YPF SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

YPF Bundle

YPF's market position is shaped by significant strengths like its integrated operations and established infrastructure, but also faces challenges in its operating environment and capital intensity. Understanding these dynamics is crucial for navigating the energy sector.

Want to uncover the full strategic picture of YPF's opportunities and threats? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

YPF commands a dominant market position within Argentina's energy sector, holding significant sway over oil, natural gas, and fuel distribution. As of 2024, the company's production accounted for 36% of Argentina's total oil output and 29% of its natural gas. Furthermore, YPF's extensive network of over 1,600 service stations ensures it supplies a substantial 56% of the national fuel market.

YPF holds a significant advantage with its extensive involvement in the Vaca Muerta shale formation, recognized as one of the globe's most substantial shale reserves. This strategic asset is fundamental to YPF's operational blueprint.

The company has earmarked considerable investments, aiming to elevate its unconventional oil output by an impressive 30-40% throughout 2025. This aggressive production ramp-up underscores the critical role Vaca Muerta plays in YPF's growth trajectory.

With vast proven reserves within the Vaca Muerta formation, YPF is strategically positioned for considerable future production expansion and increased export capabilities, solidifying its market standing.

YPF's vertically integrated business model is a significant strength, encompassing the entire hydrocarbon value chain. This includes everything from finding oil and gas (exploration and production) to processing it (refining), selling it (marketing and distribution), and even venturing into petrochemicals and electricity generation.

This comprehensive approach offers substantial operational efficiencies and allows YPF to maintain greater control over its supply chains. For instance, in 2023, YPF reported that its integrated operations contributed to a robust EBITDA of approximately USD 4.2 billion, showcasing the financial benefits of managing multiple stages of the energy business.

Furthermore, this integration diversifies YPF's revenue streams. By not relying solely on upstream production, the company is better positioned to weather fluctuations in commodity prices, as profits can be generated across refining, marketing, and other downstream activities.

Strategic Importance and Government Support

YPF's strategic importance is amplified by the Argentine government's 51.5% controlling stake, signaling a strong national commitment to its operations. This significant government backing translates into crucial support for major infrastructure investments, such as the expansion of pipeline networks vital for developing the Vaca Muerta shale formation and boosting energy exports. The government's direct involvement ensures a degree of stability and facilitates access to resources for projects critical to Argentina's energy security and economic growth.

Commitment to Infrastructure Development

YPF's commitment to infrastructure development is a significant strength, directly addressing key operational bottlenecks. The company is actively investing in projects like the Vaca Muerta Sur pipeline, crucial for boosting crude oil export capacity.

This strategic pipeline is slated for an initial capacity of 180,000 barrels per day by 2026, with plans for future expansion. Such investments are vital for unlocking the full potential of the Vaca Muerta region.

- Vaca Muerta Sur Pipeline: Initial capacity of 180,000 bpd by 2026, with expansion potential.

- Export Capacity Enhancement: Directly tackles export limitations, a critical factor for Vaca Muerta's growth.

- Strategic Investment: Focuses on essential infrastructure to support increased hydrocarbon production and sales.

YPF's dominant market share in Argentina, controlling 56% of the fuel market and significant portions of oil and gas production, provides a stable revenue base. Its strategic position in the Vaca Muerta shale formation, one of the world's largest, offers immense potential for future production growth and exports. The company's vertically integrated model, from exploration to refining and marketing, enhances efficiency and diversifies income streams, as evidenced by its USD 4.2 billion EBITDA in 2023 from integrated operations.

| Metric | 2023 Data | 2024 Target/Projection | 2025 Projection |

|---|---|---|---|

| Total Oil Production Share (Argentina) | 36% | ~37% | ~38-40% |

| Total Natural Gas Production Share (Argentina) | 29% | ~30% | ~31-33% |

| Fuel Market Share (Argentina) | 56% | ~56% | ~57% |

| Unconventional Oil Output Growth | N/A | ~30-40% | ~30-40% |

| Vaca Muerta Sur Pipeline Initial Capacity | N/A | N/A | 180,000 bpd by 2026 |

What is included in the product

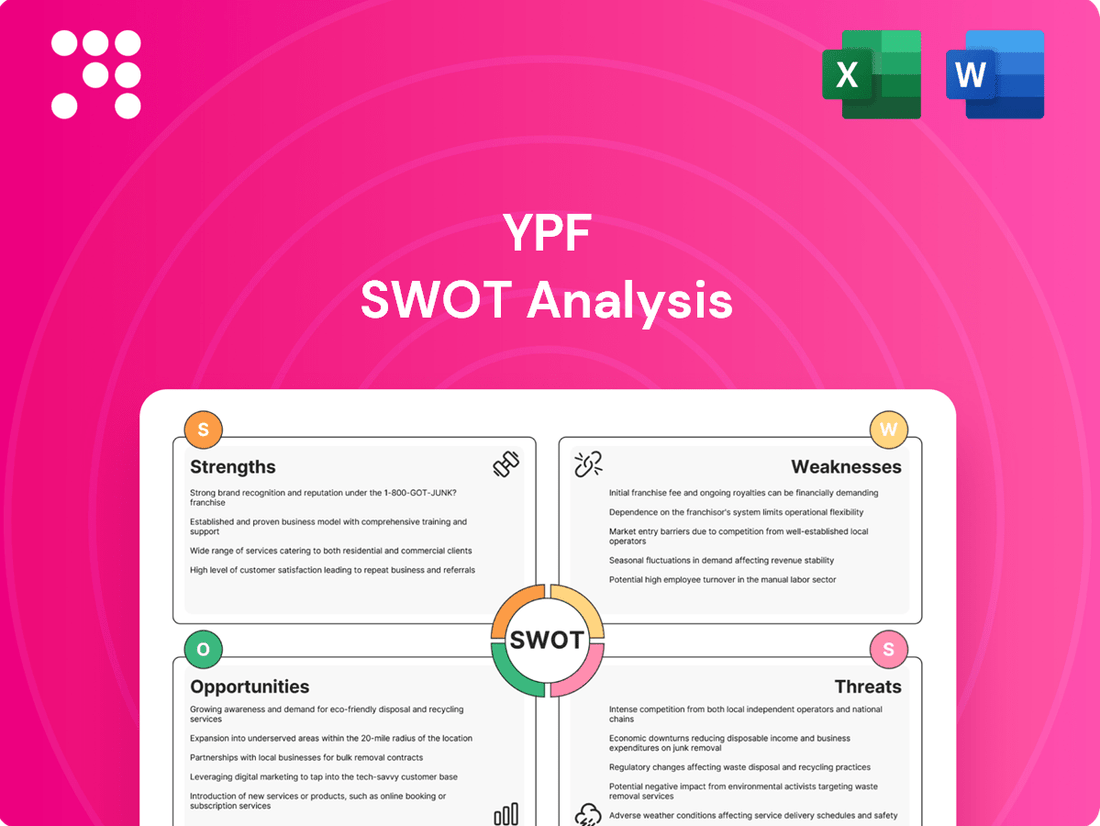

Delivers a strategic overview of YPF’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Helps identify and mitigate YPF's internal weaknesses and external threats, transforming potential risks into actionable strategies.

Weaknesses

YPF's operations are deeply intertwined with Argentina's volatile economic landscape, characterized by persistent high inflation and significant currency fluctuations. This inherent instability directly impacts the company's financial performance, making forecasting and strategic planning exceptionally challenging.

The company's financial statements reflect this vulnerability. For instance, YPF reported a net loss of ARS 150 billion in the first quarter of 2025, a figure heavily influenced by currency revaluation adjustments. Similarly, the annual net loss for 2024 stood at ARS 400 billion, underscoring the substantial impact of macroeconomic factors and government fiscal policies on its bottom line.

YPF faces significant challenges with its substantial debt burden and persistent negative free cash flow. As of the first quarter of 2025, the company's net debt climbed by 16% year-over-year to $8.34 billion, a figure that underscores financial strain.

While a recent $1.1 billion debt issuance provided a temporary liquidity boost, the ongoing negative free cash flow remains a critical concern. This trend can impede YPF's ability to fund essential future investments and maintain operational flexibility, potentially impacting its long-term solvency.

YPF's state ownership, while potentially beneficial for government support, inherently carries the risk of political interference. This can manifest as regulatory shifts, such as imposed fuel price caps that can squeeze profit margins, or restrictions on the company's ability to distribute dividends or access foreign currency, impacting financial flexibility and investor returns.

Recent legal entanglements, like the U.S. court order concerning Argentina's controlling stake in YPF, underscore the vulnerability to political and legal challenges. Such events can create significant operational disruptions and erode investor confidence, directly impacting YPF's valuation and strategic planning capabilities.

Higher Development Costs in Vaca Muerta

While Vaca Muerta holds significant promise, YPF faces challenges with higher development costs per well compared to established shale plays like the Permian Basin. Despite ongoing efforts to optimize operations and reduce expenses, these costs remain a key weakness. For instance, in 2023, YPF reported development costs for new wells in Vaca Muerta were still higher on a per-barrel equivalent basis than those achieved by leading US operators.

This cost disparity directly impacts YPF's international competitiveness and can strain profitability, particularly when global energy prices fluctuate. The higher initial investment required for Vaca Muerta development means YPF must achieve greater operational efficiencies and secure favorable market conditions to ensure strong returns.

- Higher Development Costs: YPF's well development expenses in Vaca Muerta, though trending downwards, continue to exceed those in major US shale basins.

- Competitiveness Impact: This cost differential can hinder YPF's ability to compete effectively on a global scale for investment capital.

- Profitability Pressure: Volatile energy markets exacerbate the pressure on YPF's margins due to these elevated upfront development expenditures.

Reliance on Hydrocarbons Amid Energy Transition

YPF's core business heavily relies on oil and gas extraction, presenting a significant long-term vulnerability as the world pivots towards cleaner energy sources. This dependence creates a substantial risk profile in an era defined by the global energy transition.

While Argentina's energy landscape remains hydrocarbon-centric, the nation is actively expanding its renewable energy capacity. For instance, by the end of 2023, renewable sources accounted for approximately 20% of Argentina's electricity generation, a figure expected to grow. YPF's current decarbonization initiatives, though present, may prove insufficient to adequately address the escalating risks associated with the ongoing energy transition.

- Hydrocarbon Dependency: YPF's primary revenue streams are derived from oil and gas, a sector facing increasing regulatory and market pressure due to climate change concerns.

- Pace of Transition: While YPF is investing in renewables, the pace of its transition may lag behind global trends and national policy shifts, potentially impacting its competitive position and asset valuation.

- Argentina's Energy Mix: Despite progress in renewables, hydrocarbons still constitute a substantial portion of Argentina's energy consumption, creating a complex environment for YPF to navigate.

YPF's significant debt, reaching $8.34 billion in net debt by Q1 2025, coupled with persistent negative free cash flow, limits its capacity for crucial investments and operational agility. This financial strain, despite a recent $1.1 billion debt issuance, raises concerns about long-term solvency and future growth prospects.

The company's operations are heavily influenced by Argentina's volatile economy, marked by high inflation and currency swings. This instability, evidenced by a net loss of ARS 150 billion in Q1 2025 and ARS 400 billion for the full year 2024, directly impacts financial performance and strategic planning.

Political interference due to state ownership poses a significant risk, potentially leading to unfavorable regulatory changes like fuel price caps or restrictions on foreign currency access, which can hinder financial flexibility and investor returns.

YPF's reliance on hydrocarbons presents a long-term vulnerability as the global energy sector shifts towards renewables. While Argentina is increasing renewable energy capacity, YPF's decarbonization efforts might not be sufficient to counter the risks associated with this energy transition.

Full Version Awaits

YPF SWOT Analysis

This is the same YPF SWOT analysis document included in your download. The full content is unlocked after payment.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real YPF SWOT analysis you'll download post-purchase, in full detail.

Opportunities

Vaca Muerta's immense shale potential offers YPF a prime chance to ramp up oil and gas output and establish itself as a key energy exporter. The company plans to invest $3.3 billion in Vaca Muerta during 2025, with a strong emphasis on developing oil wells to significantly increase shale oil production.

This increased production is crucial for unlocking substantial export opportunities for YPF. The company is actively pursuing infrastructure development, including new pipelines and exploring the feasibility of LNG plants, to facilitate these exports and capitalize on global energy demand.

Argentina's energy consumption is on an upward trajectory, and YPF, being the nation's primary integrated energy company, is strategically positioned to capitalize on this growth. The company's extensive infrastructure and operational capabilities allow it to efficiently supply the increasing domestic energy needs.

The burgeoning production from the Vaca Muerta shale formation presents a significant opportunity for YPF to expand its market presence beyond Argentina. Increased output can facilitate greater piped exports of natural gas to neighboring countries, such as Chile, thereby broadening YPF's regional footprint and revenue streams.

YPF is actively pursuing opportunities in the burgeoning renewable energy sector through its subsidiary YPF Luz. The company is investing in wind and solar projects and participating in energy storage tenders, reflecting a strategic diversification beyond its core hydrocarbon business. This move is well-aligned with Argentina's national commitment to increasing renewable energy generation, which saw significant growth in 2024, with renewables accounting for approximately 25% of the country's electricity mix by the end of the year.

Strategic Partnerships and Investment Incentives

YPF is actively pursuing strategic alliances with global energy giants to co-develop significant projects, notably liquefied natural gas (LNG) facilities. This collaborative approach aims to leverage external expertise and capital, crucial for the success of capital-intensive ventures.

The Argentine government's recent introduction of the Large Investment Incentives Regime (RIGI) is a key driver, attracting considerable investor attention. This policy framework is designed to de-risk large-scale projects and offer attractive fiscal benefits, thereby stimulating foreign direct investment in the energy sector.

These strategic partnerships and government incentives are vital for YPF's growth, as they can unlock substantial funding and technical know-how. Such collaborations are expected to accelerate the development of YPF's key projects, enhancing its capacity for production and export, particularly in the burgeoning LNG market.

- Strategic Alliances: YPF is targeting partnerships with major oil companies for LNG plant development.

- Government Support: The Argentine government's Large Investment Incentives Regime (RIGI) is boosting investor confidence.

- Funding and Expertise: Partnerships and incentives provide essential capital and technical knowledge for large projects.

- Export Growth: These factors are crucial for accelerating YPF's production and export capabilities, especially in LNG.

Divestment of Non-Core Assets

YPF's strategic divestment of non-core assets, particularly mature conventional fields, is a key opportunity. This move, central to their 'Plan Andes,' aims to sharpen focus on the highly prospective Vaca Muerta shale play.

By shedding lower-yielding assets, YPF can reallocate capital more effectively towards its high-growth unconventional operations. This streamlining is projected to boost overall profitability and position the company as a specialized shale producer by 2030.

- Portfolio Optimization: Divesting mature, less profitable conventional assets allows YPF to concentrate resources on Vaca Muerta's unconventional potential.

- Capital Reallocation: Freeing up capital from non-core operations enables increased investment in high-yield shale projects, enhancing future returns.

- Strategic Focus: This pivot supports YPF's ambition to become a dedicated 'pure shale company' by 2030, simplifying its operational structure and market perception.

- Enhanced Profitability: By concentrating on its most promising ventures, YPF aims to improve its overall financial performance and shareholder value.

YPF's strategic focus on Vaca Muerta, with a planned 2025 investment of $3.3 billion primarily in oil wells, positions it to significantly boost shale oil production and capitalize on export markets. The company is also expanding its reach through increased natural gas exports to neighboring countries, leveraging its extensive infrastructure. YPF Luz's investments in renewables, aligning with Argentina's goal for renewables to constitute 25% of the energy mix by end-2024, further diversify its portfolio and tap into a growing sector.

| Opportunity Area | Key Action/Factor | Impact |

|---|---|---|

| Vaca Muerta Development | $3.3B investment in 2025, focus on oil wells | Increased shale oil output, enhanced export potential |

| Regional Exports | Expanding piped natural gas exports to Chile | Broader market presence, diversified revenue streams |

| Renewable Energy | Investment in wind and solar projects via YPF Luz | Portfolio diversification, alignment with national green energy goals |

| Strategic Partnerships & Incentives | Alliances for LNG, RIGI regime support | Access to capital, expertise, de-risked large-scale projects |

Threats

Fluctuations in global oil and gas prices directly impact YPF's revenue and profitability. For instance, Brent crude oil prices experienced significant volatility in 2023, trading in a range from approximately $70 to over $90 per barrel, and early 2024 trends suggest continued price sensitivity to geopolitical events and supply-demand dynamics.

While YPF's Vaca Muerta operations are designed to be cost-competitive, even at lower crude prices, sustained periods of low prices or sharp price swings can still strain the company's financial performance and its ability to fund ambitious investment plans, particularly as its export reliance grows.

Argentina's persistent economic instability, marked by soaring inflation and stringent currency controls, presents a considerable threat to YPF. For instance, the country's inflation rate remained exceptionally high, reaching an estimated 211.4% year-on-year in December 2023, impacting operational costs and consumer purchasing power.

The volatile political climate further exacerbates these challenges. Shifts in government policy, such as potential changes to energy regulations or export restrictions, create an unpredictable operating environment. This instability can also deter crucial foreign investment needed for large-scale energy projects.

The ongoing legal battle stemming from Argentina's 2012 nationalization of YPF continues to pose a significant threat. A substantial multi-billion dollar judgment against the country underscores the financial exposure.

Recent judicial actions, including a U.S. judge's order for Argentina to potentially cede its controlling stake in YPF, amplify the risk of losing strategic assets. This situation could lead to further legal entanglements and financial instability for the company.

Infrastructure Bottlenecks and Development Delays

YPF faces significant threats from infrastructure bottlenecks and development delays, particularly concerning the Vaca Muerta shale formation. Despite substantial investment, challenges in completing crucial projects like pipelines could impede the full realization of Vaca Muerta's vast potential and constrain export capabilities. These delays directly impact YPF's ability to meet ambitious production targets and efficiently monetize its extensive reserves, ultimately affecting revenue generation and market competitiveness.

Specifically, the timely completion of projects like the Néstor Kirchner gas pipeline, which began operations in mid-2023, is critical. However, further expansions and the development of oil pipelines are essential to transport increased production. For instance, if oil pipeline capacity doesn't keep pace with Vaca Muerta's output growth, YPF could be forced to curtail production or sell at a discount, impacting profitability. The company's 2024-2028 strategic plan anticipates significant production increases, making infrastructure development a paramount concern.

- Pipeline Capacity Constraints: Delays in oil and gas pipeline construction can limit the volume of Vaca Muerta's output that can reach domestic refineries or export terminals.

- Export Market Access: Insufficient export infrastructure, such as port facilities or specialized tankers, could prevent YPF from capitalizing on international demand for its hydrocarbons.

- Project Execution Risks: Unforeseen geological challenges, regulatory hurdles, or supply chain disruptions can lead to cost overruns and extended timelines for critical infrastructure projects.

- Impact on Monetization: Bottlenecks directly affect YPF's ability to convert its substantial Vaca Muerta reserves into revenue, potentially delaying the return on investment for upstream activities.

Increased Competition and Shifting Energy Landscape

YPF confronts a heightened competitive environment as Argentina's energy sector diversifies. New entrants, both domestic and international, are increasingly active, especially in the burgeoning unconventional oil and gas sector and as the nation champions renewable energy expansion. This evolving landscape challenges YPF's established market position.

The global imperative for decarbonization and the accelerating adoption of alternative energy sources present a significant long-term threat to YPF's traditional hydrocarbon-focused business model. For instance, by the end of 2023, Argentina saw a notable increase in renewable energy capacity, with solar and wind power contributing more substantially to the national grid, a trend expected to continue and potentially impact demand for fossil fuels.

- Increased Competition: YPF faces growing rivalry from both domestic and international energy firms, particularly in the development of Vaca Muerta's unconventional resources.

- Renewable Energy Push: Argentina's government actively promotes renewable energy, potentially diverting investment and market share away from traditional hydrocarbon projects.

- Decarbonization Trends: Global shifts towards cleaner energy sources threaten the long-term viability of YPF's core oil and gas operations.

- Shifting Energy Mix: By early 2024, renewable sources accounted for a growing percentage of Argentina's energy generation, signaling a structural change in the market.

YPF operates in a volatile global energy market, where fluctuating oil and gas prices, exemplified by Brent crude's trading range in 2023 and early 2024, directly impact its revenue and ability to fund investments, especially as its export reliance grows.

Argentina's persistent economic instability, with inflation reaching an estimated 211.4% year-on-year in December 2023, coupled with a volatile political climate and potential policy shifts, creates an unpredictable operating environment and deters foreign investment.

Significant threats also stem from infrastructure bottlenecks, particularly for Vaca Muerta's development, as delays in pipeline construction can limit output realization and export capabilities, directly affecting YPF's ability to monetize its reserves efficiently.

Furthermore, YPF faces increased competition from new energy entrants and the global push for decarbonization, which challenges its hydrocarbon-focused business model as renewable energy sources, like solar and wind, gain traction in Argentina's energy mix.

SWOT Analysis Data Sources

This YPF SWOT analysis is built upon a robust foundation of verified financial reports, comprehensive market intelligence, and expert industry evaluations to provide accurate and actionable strategic insights.