YPF Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

YPF Bundle

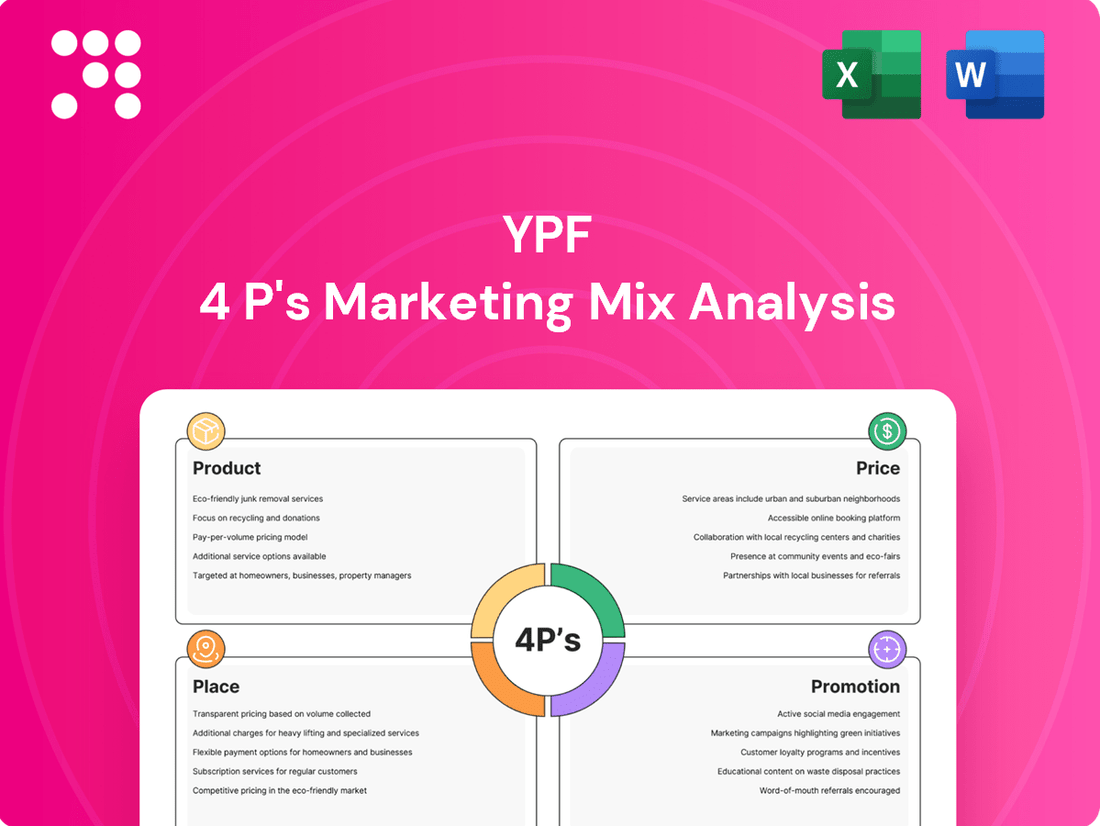

Discover how YPF leverages its Product, Price, Place, and Promotion strategies to dominate the energy market. This analysis reveals the intricate interplay of their offerings, pricing models, distribution networks, and communication efforts.

Go beyond this snapshot and gain access to an in-depth, ready-made Marketing Mix Analysis covering YPF's complete Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants seeking strategic insights.

Save hours of research and analysis. This pre-written Marketing Mix report provides actionable insights, examples, and structured thinking—perfect for reports, benchmarking, or business planning.

Product

YPF's integrated energy portfolio is built upon its end-to-end hydrocarbon operations, encompassing exploration, development, and production of crude oil and natural gas. These upstream activities are the bedrock for its extensive downstream product offerings, demonstrating a strong vertical integration.

As Argentina's leading energy company, YPF's portfolio is crucial for the nation's energy security, supplying a wide array of products across the entire hydrocarbon value chain. In 2024, YPF reported significant production figures, with crude oil output reaching approximately 200,000 barrels per day and natural gas production averaging around 60 million cubic meters daily, highlighting its substantial contribution to national supply.

YPF's refined petroleum products form the bedrock of its offerings, providing essential gasoline, diesel, and other fuels crucial for both personal transportation and industrial operations. This diverse range caters to a wide spectrum of market needs.

In 2024, YPF's refining capacity remained a key asset, with ongoing investments in modernization. The company actively adjusts its fuel prices to reflect international market trends and to manage the effects of currency fluctuations, a critical strategy in the Argentine economic landscape.

YPF's product strategy extends beyond fuels to encompass a robust petrochemical and lubricants division. Petrochemicals are foundational materials for a vast array of industries, from plastics to textiles, underscoring YPF's role as a key supplier. In 2024, the petrochemical segment continued to be a significant contributor to YPF's revenue streams, though specific segment data for 2024 is still being finalized, with 2023 figures showing strong performance.

The company also offers a diverse portfolio of lubricants, notably the Elaion Auro premium line. These products are engineered for a wide spectrum of uses, serving the automotive, industrial, and agricultural markets. YPF's lubricant sales in 2024 demonstrated steady demand, particularly in the premium and specialized product categories, reflecting a strategic focus on higher-margin offerings.

Electricity Generation and Renewables

YPF has strategically expanded its operations into electricity generation, emphasizing a significant shift towards renewable energy sources. This diversification is primarily managed through its subsidiary, YPF Luz, which is actively contributing to Argentina's energy infrastructure by supplying both conventional and renewable power.

YPF Luz is at the forefront of Argentina's energy transition, operating a portfolio of wind and solar farms. The company has set ambitious targets to substantially increase its renewable installed capacity, aiming for significant growth by 2025 and further expansion by 2030, aligning with national decarbonization goals.

- Renewable Capacity Growth: YPF Luz aims to reach 2,000 MW of renewable installed capacity by 2025, a substantial increase from its current operational capacity.

- Diversified Portfolio: The company operates both wind farms (e.g., Manantiales, Los Teros) and solar farms (e.g., Zonda), contributing to a cleaner energy mix.

- Market Position: YPF Luz is a key player in Argentina's electricity market, contributing a significant portion of the country's renewable energy generation.

- Investment Focus: By 2025, YPF plans to have invested over $1.5 billion in renewable energy projects through YPF Luz, underscoring its commitment to this sector.

s for Agriculture and Specialized Industries

YPF's product strategy extends beyond traditional fuels, with a significant focus on specialized sectors. For agriculture, YPF offers tailored solutions designed to enhance efficiency and productivity. This includes lubricants, fuels, and potentially specialized chemicals that meet the unique demands of farming operations.

The company's reach into specialized industries is extensive, catering to critical sectors like aviation, mining, and naval operations. These industries require high-performance products that adhere to stringent safety and operational standards. For instance, YPF supplies aviation fuels that meet rigorous international specifications, ensuring the safety and reliability of air travel.

In 2024, YPF's industrial and agricultural segments likely contributed a notable portion to its overall revenue, reflecting the company's diversified business model. While specific segment breakdowns for 2024 are still emerging, YPF's historical performance indicates a strong presence in these B2B markets. For example, in 2023, YPF's total revenue was approximately ARS 15.7 trillion, with its industrial and agricultural segments playing a crucial role in this figure.

Key product and service offerings for these specialized markets include:

- Aviation Fuels: Supplying Jet A-1 and other aviation-grade fuels to domestic and international airlines.

- Industrial Lubricants: Providing a range of lubricants for heavy machinery used in mining, construction, and manufacturing.

- Naval Fuels: Offering marine fuels and lubricants that comply with environmental regulations for shipping and maritime activities.

- Agricultural Inputs: Delivering specialized fuels and potentially other agrochemicals to support the farming sector.

YPF's product strategy centers on its integrated hydrocarbon value chain, offering a comprehensive suite of refined fuels like gasoline and diesel, alongside petrochemicals and specialized lubricants such as the Elaion Auro line. This diverse product portfolio serves both individual consumers and critical industrial sectors including automotive, agriculture, and manufacturing.

Beyond traditional energy, YPF, through YPF Luz, is actively expanding into electricity generation with a strong emphasis on renewables. By 2025, YPF Luz aims to reach 2,000 MW of renewable installed capacity, marking a significant investment in wind and solar energy to support Argentina's clean energy transition.

The company also caters to specialized markets, supplying aviation fuels, industrial lubricants for mining and construction, and naval fuels, all while adhering to strict industry standards. These B2B offerings are vital for Argentina's key economic sectors, with YPF's industrial and agricultural segments contributing significantly to its overall revenue, as evidenced by its 2023 revenue of approximately ARS 15.7 trillion.

| Product Category | Key Offerings | Target Markets | 2024/2025 Data/Outlook |

|---|---|---|---|

| Refined Fuels | Gasoline, Diesel, Jet Fuel | Automotive, Aviation, Industrial | Continued supply to meet national demand; price adjustments based on market and currency trends. |

| Petrochemicals | Base materials for plastics, textiles | Manufacturing, Industrial | Strong revenue contributor, with ongoing performance analysis from 2023 data. |

| Lubricants | Elaion Auro premium line, industrial lubricants | Automotive, Industrial, Agricultural | Steady demand, with focus on higher-margin premium and specialized products in 2024. |

| Renewable Energy | Wind and Solar Power | National Grid, Industrial Users | YPF Luz targeting 2,000 MW renewable capacity by 2025; over $1.5 billion investment planned. |

| Specialized Industrial Products | Aviation fuels, mining lubricants, naval fuels | Aviation, Mining, Maritime, Agriculture | Supplying high-performance products meeting stringent sector-specific standards. |

What is included in the product

This YPF 4P's Marketing Mix Analysis offers a comprehensive examination of their Product, Price, Place, and Promotion strategies, grounded in real-world practices and competitive context.

It's designed for professionals seeking a deep dive into YPF's marketing positioning, providing a structured and data-rich foundation for strategic decision-making and benchmarking.

Streamlines complex YPF marketing strategies into a clear, actionable 4Ps framework, alleviating the pain of strategic ambiguity.

Provides a concise overview of YPF's 4Ps, simplifying the understanding of their market approach and easing the burden of in-depth analysis.

Place

YPF commands Argentina's largest service station network, a formidable asset with over 1600 locations nationwide. This vast physical footprint is a cornerstone of its marketing strategy, ensuring unparalleled accessibility for customers seeking fuel and convenience items.

This extensive reach directly translates into market dominance, allowing YPF to maintain a significant share of the domestic fuel retail market. By being present in virtually every corner of Argentina, YPF solidifies its brand visibility and customer loyalty.

YPF's 'place' strategy is anchored in its robust, vertically integrated hydrocarbon value chain across Argentina. This integration spans from upstream exploration and production to midstream refining and downstream distribution, creating a cohesive and efficient operational network.

This comprehensive control ensures YPF's products reach consumers through a vast network of service stations and industrial clients. For instance, YPF operated approximately 1,500 service stations across Argentina as of early 2024, a significant portion of the national market, demonstrating its extensive physical presence.

YPF employs direct sales and tailored distribution networks to serve its industrial and commercial clientele. This approach ensures efficient delivery of fuels, lubricants, and petrochemicals to key sectors such as aviation, transportation, mining, and agriculture. YPF Negocios, a dedicated business unit, spearheads these specialized supply chains.

Pipeline Infrastructure and Export Capabilities

YPF's commitment to its pipeline infrastructure is a cornerstone of its export strategy, especially for the vast resources in Vaca Muerta. This extensive network is designed to efficiently move crude oil and natural gas from production hubs to key export points, thereby enhancing YPF's global market reach.

The Vaca Muerta Sur Oil Pipeline (VMOS) exemplifies this focus. This critical project is instrumental in boosting crude oil evacuation capacity, directly linking Vaca Muerta's output to export terminals. This connectivity is vital for accessing international markets, including potential trade with countries like Chile, and maximizing the value of its hydrocarbon reserves.

YPF's ongoing investments in pipeline expansion and modernization are directly tied to its ability to capitalize on export opportunities. These infrastructure developments are not just about transportation; they are about unlocking the full potential of Argentina's unconventional resources and solidifying YPF's position as a significant energy exporter.

- Vaca Muerta Production Growth: YPF aims to increase Vaca Muerta crude oil production to over 300,000 barrels per day by 2025, necessitating robust pipeline infrastructure.

- VMOS Capacity: The Vaca Muerta Sur Oil Pipeline is designed to transport approximately 110,000 barrels per day of crude oil, with potential for expansion.

- Export Market Access: Enhanced pipeline capacity directly supports YPF's strategy to increase its crude oil exports, targeting markets in South America and beyond.

- Investment in Infrastructure: YPF has allocated significant capital, estimated in the billions of dollars, towards developing and expanding its midstream infrastructure, including pipelines.

Digital Platforms and Mobile Applications

YPF leverages digital channels, including its YPF App and YPF Serviclub platform, to streamline customer interaction and distribution. These digital touchpoints offer real-time information on fuel prices and station locations, enhancing convenience and accessibility. The YPF App, for instance, provides users with loyalty program details and exclusive offers, fostering repeat business and customer engagement. This digital strategy aligns with broader industry trends prioritizing online accessibility and personalized customer experiences.

The YPF App and Serviclub program are central to YPF's digital distribution strategy, aiming to boost customer loyalty and streamline transactions. In 2024, YPF reported a significant increase in digital engagement, with millions of active users on its mobile platforms, indicating a strong preference for these convenient services. These applications provide direct access to loyalty points, special promotions, and station finders, making it easier for consumers to interact with the YPF brand. This digital push is crucial for maintaining competitiveness and meeting evolving consumer expectations for seamless service delivery.

- YPF App Usage: Millions of active users in 2024, demonstrating strong adoption of mobile services.

- Serviclub Integration: Digital platform for loyalty program management, enhancing customer retention.

- Information Accessibility: Real-time data on fuel prices and station locations via mobile applications.

- Customer Engagement: Digital channels facilitate personalized offers and direct communication, boosting brand loyalty.

YPF's extensive physical presence, boasting over 1,600 service stations across Argentina by early 2024, is a critical component of its market strategy. This vast network ensures widespread accessibility and reinforces brand dominance in the fuel retail sector. The company's vertically integrated operations, from exploration to distribution, enable efficient product delivery to these numerous outlets and industrial clients.

Beyond its retail network, YPF leverages digital platforms like the YPF App and Serviclub to enhance customer engagement and streamline access to services and loyalty programs. Millions of active users in 2024 highlight the success of this digital strategy in meeting modern consumer expectations for convenience and personalized interaction.

YPF's commitment to midstream infrastructure, particularly pipelines like the Vaca Muerta Sur Oil Pipeline (VMOS), is vital for its export ambitions. These investments, amounting to billions of dollars, are designed to increase crude oil and natural gas evacuation capacity, facilitating access to international markets and maximizing the value of resources from Vaca Muerta, with production targets aiming for over 300,000 barrels per day by 2025.

| Infrastructure Component | Capacity/Scale | Strategic Importance |

|---|---|---|

| Service Station Network | Over 1,600 locations (early 2024) | Market dominance, customer accessibility |

| Vaca Muerta Production Target | > 300,000 bpd by 2025 | Resource monetization, export potential |

| VMOS Pipeline Capacity | ~110,000 bpd (with expansion potential) | Crude oil evacuation, export market access |

| Digital Platforms (YPF App/Serviclub) | Millions of active users (2024) | Customer loyalty, streamlined transactions |

What You See Is What You Get

YPF 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive YPF 4P's Marketing Mix Analysis is fully complete and ready for your immediate use. You're viewing the exact version of the analysis you'll receive, ensuring you get exactly what you expect.

Promotion

YPF's brand leadership in Argentina is undeniable, as the nation's largest energy company. This translates to a dominant market share in fuel sales, with recent data indicating YPF holds approximately 60% of the domestic fuel market. Their extensive national presence, with thousands of service stations across the country, further solidifies this position.

The company's historical significance and deep roots within Argentina foster a high degree of brand awareness and consumer trust. This long-standing relationship is a key asset, allowing YPF to maintain a strong connection with its customer base, a crucial element in its marketing mix.

YPF's advertising and marketing efforts are a key component of its strategy to connect with consumers and build brand loyalty. The company utilizes a multi-channel approach, ensuring its message reaches a broad audience. This includes digital platforms, traditional media, and sponsorships, all designed to enhance product and service awareness.

A notable aspect of YPF's promotional activities is its substantial investment in official advertising, particularly evident in the first quarter of 2025. This strategic allocation of resources, amounting to approximately ARS 15 billion in Q1 2025 for marketing and advertising, underscores the company's commitment to boosting brand visibility and driving customer acquisition in a competitive market.

YPF's Serviclub loyalty program is a cornerstone of its promotional strategy, actively driving customer engagement and retention. This program incentivizes repeat business by offering tangible benefits and discounts across YPF's vast network of service stations, thereby increasing customer lifetime value and solidifying brand loyalty.

In 2024, YPF reported that its Serviclub program boasted over 5 million active members, a significant portion of its customer base. These members are more likely to choose YPF stations for fuel and convenience store purchases, contributing to an estimated 15% higher transaction frequency compared to non-members.

Public Relations and Corporate Social Responsibility (CSR)

YPF actively manages its public image and societal impact through strategic public relations and corporate social responsibility (CSR) programs. These initiatives are crucial for building trust and demonstrating the company's value beyond its core energy operations.

A cornerstone of YPF's CSR is Fundación YPF, which focuses on key areas vital for Argentina's future. In 2024, the foundation continued its commitment to advancing education, particularly in STEM fields, and promoting the development of renewable energy sources. These efforts are designed to foster long-term societal benefits and align YPF with national development goals.

These CSR activities directly support YPF's reputation by showcasing tangible contributions to local communities and national progress. By investing in education and sustainable energy projects, YPF aims to cultivate a positive brand perception and strengthen stakeholder relationships. For instance, YPF's investments in renewable energy projects are part of a broader strategy to contribute to Argentina's energy transition, a key theme in 2024 and projected for 2025.

- Reputation Enhancement: YPF's PR and CSR efforts are geared towards building a positive corporate image.

- Community Investment: Fundación YPF directs resources towards education and renewable energy initiatives.

- Societal Contribution: The company communicates its role in local development and the energy transition.

- Stakeholder Engagement: These activities foster goodwill and strengthen relationships with various stakeholders.

Strategic Investor Communications and Industry Events

YPF prioritizes clear communication with investors, detailing its strategic vision and financial health. This is achieved through comprehensive annual reports, engaging investor presentations, and active participation in key industry gatherings. For instance, YPF's presence at events like Investor Day at the NYSE underscores its commitment to transparency and showcasing future growth, especially in the burgeoning unconventional oil and gas sector.

This proactive engagement is crucial for attracting capital and building confidence. YPF's strategy focuses on highlighting its potential in areas like Vaca Muerta, a significant shale play. The company aims to demonstrate its robust operational capabilities and long-term value proposition to a global investor base.

- Strategic Outreach: YPF utilizes annual reports and investor presentations to convey its strategic direction and financial performance.

- Industry Presence: Participation in events like Investor Day at the NYSE is key to engaging with the financial community.

- Growth Focus: Communications emphasize YPF's expansion plans, particularly in unconventional oil and gas resources.

- Transparency Goal: The aim is to attract investment by openly sharing the company's growth trajectory and operational successes.

YPF's promotional strategy centers on building brand loyalty and increasing customer engagement. Their advertising efforts, including a substantial ARS 15 billion investment in Q1 2025, aim to enhance product awareness across various media channels. The Serviclub loyalty program is a key driver, boasting over 5 million active members in 2024, who exhibit a 15% higher transaction frequency.

Beyond direct marketing, YPF leverages public relations and corporate social responsibility (CSR) to cultivate a positive image. Fundación YPF's focus on education and renewable energy in 2024 and 2025 demonstrates a commitment to societal development and aligns the company with national progress, strengthening stakeholder relationships.

Investor communication is also a vital promotional pillar, with YPF actively engaging the financial community through reports and events like NYSE Investor Day. This outreach highlights their strategic vision and growth potential, particularly in areas like Vaca Muerta, to attract capital and build confidence.

| Promotional Tactic | Key Metrics/Data | Objective |

|---|---|---|

| Advertising & Media | ARS 15 billion spent in Q1 2025 | Brand visibility, customer acquisition |

| Serviclub Loyalty Program | 5 million+ active members (2024) | Customer retention, increased transaction frequency (+15%) |

| Corporate Social Responsibility (CSR) | Focus on STEM education and renewables (2024-2025) | Reputation enhancement, stakeholder engagement |

| Investor Relations | NYSE Investor Day participation | Attract capital, build investor confidence |

Price

YPF employs a dynamic pricing strategy for its petroleum products, particularly fuels, closely mirroring international crude oil benchmarks such as Brent. This approach ensures domestic prices remain aligned with global market fluctuations, fostering competitiveness. For instance, as of mid-2024, Brent crude prices have been trading in the range of $75-$85 per barrel, a key determinant for YPF's retail fuel pricing in Argentina.

YPF navigates the Argentine fuel market with a competitive pricing strategy, even while its prices often mirror international benchmarks. This approach is crucial for maintaining its significant market share.

The company actively manages its pricing to ensure it remains an attractive option for consumers compared to other fuel providers. This balancing act between profitability and market leadership is key to YPF's domestic strategy.

For instance, in early 2024, YPF's gasoline prices were competitive within Argentina, with premium gasoline averaging around ARS 1,100 per liter, reflecting a careful calibration against local competitors and global trends.

YPF employs a differentiated pricing strategy, recognizing that different customer groups have unique needs and purchasing power. This approach allows them to maximize revenue by offering tailored price points and incentives.

For instance, corporate clients and fleet operators often benefit from volume-based discounts and customized long-term contracts, reflecting their significant fuel consumption. In 2023, YPF reported a substantial portion of its revenue derived from its business-to-business segment, indicating the importance of these tailored pricing structures.

Individual consumers, on the other hand, may be targeted with loyalty programs and promotional offers, encouraging repeat business and brand loyalty. These programs can include points systems or discounts on specific fuel types, designed to appeal to the everyday driver and contribute to YPF's retail market share, which remained robust through the first half of 2024.

Adaptable Pricing Model Responding to Economic Conditions

YPF's pricing strategy is a crucial element in navigating Argentina's often turbulent economic landscape, characterized by high inflation and currency fluctuations. The company employs an adaptable pricing model, making frequent adjustments to its product prices to keep pace with these rapid economic shifts. This approach is designed to recover any price gaps that emerge due to inflation and to cushion the blow of economic instability, all while striving to maintain its customer base and market share.

These adjustments are often implemented on a quarterly basis, allowing YPF to react to changing economic conditions more effectively. For instance, in early 2024, YPF, like other energy providers in Argentina, implemented price increases to align with government directives and to reflect the ongoing inflationary pressures. These adjustments are a direct response to macroeconomic factors, aiming for a delicate balance between cost recovery and market competitiveness.

- Quarterly Adjustments: YPF frequently revises its prices, often on a quarterly basis, to counter inflation and currency devaluation.

- Economic Volatility Response: The pricing model is designed to be flexible, directly responding to Argentina's dynamic economic conditions.

- Market Share Preservation: Despite necessary price hikes, YPF aims to mitigate the impact on its market share by balancing adjustments with competitive strategies.

- Inflationary Impact Mitigation: Pricing strategies are geared towards recovering costs associated with high inflation and preserving the company's financial health.

Governmental Regulations and Subsidies Impact

YPF's pricing strategy for natural gas and LPG is significantly shaped by government regulations and subsidy programs designed to maintain domestic supply and affordability. These regulations often establish reference prices, influencing the cost structure for consumers and producers alike.

While certain producer compensation schemes have been phased out, the regulatory landscape continues to impact market availability and pricing benchmarks. For instance, in 2024, the Argentine government has been actively adjusting energy policies, with potential implications for natural gas tariffs that could affect YPF's revenue streams and pricing flexibility.

Key aspects include:

- Reference Pricing: Government-set reference prices for natural gas and LPG directly influence YPF's wholesale and retail pricing, aiming for consumer protection.

- Market Availability Mandates: Regulations often require producers like YPF to ensure a certain level of domestic supply, which can impact export decisions and domestic pricing.

- Subsidy Adjustments: Changes in government subsidies or compensation programs for energy producers can directly alter YPF's cost base and, consequently, its pricing decisions for regulated products.

- Policy Shifts: Ongoing reviews and potential reforms of Argentina's energy sector policies in 2024 and 2025 are critical factors that YPF must monitor to adapt its pricing strategies.

YPF's pricing strategy is multifaceted, balancing global benchmarks with domestic economic realities and regulatory frameworks. For fuels, this means aligning with international crude oil prices, such as Brent crude trading between $75-$85 per barrel in mid-2024, while also offering competitive retail prices in Argentina, with gasoline around ARS 1,100 per liter in early 2024.

The company employs differentiated pricing, offering volume discounts to corporate clients and loyalty programs for individual consumers to maintain market share and revenue. This adaptability is crucial in Argentina's volatile economy, prompting frequent price adjustments, often quarterly, to counter inflation and currency fluctuations.

For natural gas and LPG, YPF's pricing is heavily influenced by government regulations and subsidies. These policies establish reference prices and can mandate domestic supply, directly impacting YPF's cost structure and pricing flexibility, especially as energy policies are reviewed in 2024-2025.

| Product Category | Pricing Strategy Element | Key Influences | Example Data (Mid-2024/Early 2024) |

|---|---|---|---|

| Petroleum Fuels | Global Benchmark Alignment & Competitive Retail | International Crude Oil Prices (Brent), Domestic Competition | Brent Crude: $75-$85/barrel; Gasoline: ~ARS 1,100/liter |

| Petroleum Fuels | Differentiated Pricing | Customer Segment (Corporate vs. Individual), Volume Discounts, Loyalty Programs | Significant B2B revenue (2023), Robust retail market share (H1 2024) |

| Natural Gas & LPG | Regulatory & Subsidy Driven | Government Regulations, Reference Prices, Subsidy Programs | Ongoing energy policy adjustments in Argentina (2024-2025) |

4P's Marketing Mix Analysis Data Sources

Our YPF 4P's Marketing Mix Analysis is grounded in comprehensive data, including YPF's official financial reports, investor relations materials, and publicly available operational data. We also incorporate insights from industry publications, market research reports, and competitor analysis to ensure a holistic view of their strategies.