YPF Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

YPF Bundle

Unlock the full strategic blueprint behind YPF's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

YPF actively engages in joint ventures with other energy firms, notably within the Vaca Muerta shale play. These collaborations are crucial for distributing the substantial capital outlays and specialized knowledge needed for developing unconventional reserves, thereby speeding up output increases.

Key partners in these ventures include established players like Pan American Energy, Vista, Shell, and Chevron. For instance, YPF partnered with these companies on significant infrastructure development such as the Vaca Muerta Sur pipeline, a testament to shared investment in critical energy transport.

YPF actively forms technology and digital transformation alliances to drive efficiency and innovation. Partnerships with leading tech firms, such as Globant, are instrumental in YPF's digital journey, focusing on areas like Artificial Intelligence and AI Agents.

These collaborations are designed to streamline operations, particularly in supply chain management, and reduce friction across the business. This strategic focus directly supports YPF's overarching 'Plan 4x4,' which aims to significantly enhance operational efficiency throughout its diverse business segments.

Developing massive energy projects like pipelines and LNG facilities typically requires forming strategic alliances. YPF is actively looking for partners for its Vaca Muerta Sur oil pipeline and its LNG export initiatives to help fund these ventures and spread the significant costs involved.

These collaborations are crucial for increasing YPF's ability to export more product and effectively turn Argentina's oil and gas reserves into revenue. For instance, securing partners for the Vaca Muerta Sur pipeline, a project estimated to cost billions, is essential for YPF to move forward and unlock the full potential of the Vaca Muerta formation.

Government and Regulatory Bodies

As a state-owned entity, YPF's relationship with the Argentine government and its regulatory bodies is foundational to its business model. This partnership is crucial for obtaining exploration and production concessions, ensuring compliance with domestic market regulations, and navigating environmental policies. For instance, in 2024, YPF continued to operate under frameworks influenced by government incentives aimed at boosting natural gas production, a key component of Argentina's energy strategy.

The government's influence extends to economic policies that directly affect YPF's financial performance. Fluctuations in exchange rates and the implementation of specific energy sector programs, such as those designed to attract investment in Vaca Muerta, are critical factors YPF must manage. These governmental actions shape YPF's operational costs, revenue streams, and overall profitability, making government relations a vital aspect of its strategic planning.

- Regulatory Compliance: YPF must adhere to all national and provincial laws governing the energy sector, including environmental protection and safety standards.

- Concession Agreements: The government grants YPF the rights to explore for and produce hydrocarbons, often through specific concession agreements that dictate terms and durations.

- Policy Influence: Government policies on natural gas prices, export regulations, and investment incentives directly impact YPF's operational decisions and financial outcomes.

- State Ownership: As a majority state-owned company, YPF's strategic direction and major capital allocation decisions are often aligned with national energy objectives.

Local Suppliers and Service Providers

YPF’s operational backbone is built upon a robust network of local suppliers and service providers. These partners are crucial for everything from specialized drilling services to essential logistics and ongoing maintenance across YPF's vast operations. Strong, collaborative relationships with these entities ensure uninterrupted business flow and operational efficiency.

Recognizing the importance of these partnerships, YPF actively fosters these connections, even highlighting outstanding suppliers. This focus is vital for effectively managing YPF's extensive supply chain, which encompasses around 5,000 suppliers and a staggering catalog of over 100,000 distinct products and services. This intricate web of relationships is fundamental to YPF's ability to execute its energy production and distribution strategies.

- Operational Continuity: YPF’s reliance on local suppliers ensures timely access to critical goods and services, minimizing operational disruptions.

- Efficiency Gains: Strong supplier relationships can lead to better pricing, improved service quality, and streamlined processes, boosting overall efficiency.

- Supply Chain Management: With approximately 5,000 suppliers and over 100,000 products/services, managing these local partnerships is key to supply chain resilience.

- Supplier Recognition: YPF’s practice of recognizing outstanding suppliers incentivizes performance and strengthens these vital business relationships.

YPF's key partnerships extend to joint ventures with major energy companies like Pan American Energy, Vista, Shell, and Chevron, particularly in the Vaca Muerta region. These collaborations are vital for sharing the immense capital and expertise required for developing unconventional reserves, accelerating production growth.

Furthermore, YPF collaborates with technology firms such as Globant to enhance its digital transformation efforts, focusing on AI and AI agents to streamline operations and supply chain management, supporting its 'Plan 4x4' efficiency goals.

The company also relies on a network of approximately 5,000 local suppliers and service providers for critical operations, from drilling to logistics, ensuring business continuity and efficiency.

YPF actively seeks partners for large-scale infrastructure projects like the Vaca Muerta Sur pipeline and LNG export facilities, essential for increasing export capacity and monetizing Argentina's hydrocarbon resources.

What is included in the product

A comprehensive, pre-written business model tailored to YPF's strategy, covering customer segments, channels, and value propositions in full detail.

Organized into 9 classic BMC blocks with full narrative and insights, reflecting YPF's real-world operations and plans.

The YPF Business Model Canvas offers a structured approach to identifying and addressing critical business challenges, streamlining strategic planning.

It provides a clear, visual representation of YPF's operations, enabling teams to pinpoint and resolve inefficiencies or market gaps effectively.

Activities

YPF's core operations revolve around the exploration and development of oil and gas reserves, with a strategic emphasis on unconventional resources, particularly the Vaca Muerta shale formation in Argentina. This involves extensive geological surveying, seismic data analysis, and the drilling of new wells to identify and access hydrocarbon deposits.

The company actively pursues the appraisal and development of these discovered reserves, employing advanced extraction technologies such as hydraulic fracturing and horizontal drilling to maximize recovery rates. YPF's 2024 plans include a significant acceleration of oil production from Vaca Muerta, aiming to solidify its position as a key player in global energy markets and a major exporter by 2030.

In 2023, YPF reported a substantial increase in its oil production, with unconventional sources contributing significantly to this growth. The company's investments in Vaca Muerta are designed to expand its proven reserves and ensure a sustainable, long-term supply of energy resources.

YPF's core activities revolve around the production and extraction of hydrocarbons, which includes obtaining crude oil and natural gas from both traditional and newer, unconventional wells. This forms the bedrock of their energy supply chain.

As Argentina's leading energy company, YPF plays a dominant role in the nation's energy landscape. In 2024, the company was responsible for approximately 36% of the country's total oil production and around 29% of its natural gas output, highlighting its significant contribution to national energy security.

Strategically, YPF is focusing its efforts on expanding its non-conventional hydrocarbon operations. This involves a deliberate divestment from older, less productive assets, signaling a clear shift towards higher-yield reserves and future growth potential.

YPF's core operations involve refining crude oil into a wide array of petroleum products, including gasoline, diesel, and lubricants. This refining process is crucial for transforming raw hydrocarbons into usable energy sources.

Following refinement, YPF actively markets and distributes these petroleum products. In 2024, YPF maintained a dominant position in Argentina's fuel market, supplying approximately 56% of the total demand. This is supported by an extensive network of over 1,600 service stations strategically located across the country, ensuring broad accessibility for consumers.

Petrochemical Production and Electricity Generation

YPF's engagement in petrochemical production is crucial, transforming hydrocarbons into valuable materials used across diverse sectors like plastics, textiles, and agriculture. This diversification moves YPF beyond fuel sales, adding significant value to its resource extraction.

The company's role in electricity generation is also substantial, encompassing both traditional thermal power plants and a growing portfolio of renewable energy projects. By contributing to Argentina's energy mix, YPF supports national infrastructure and economic activity.

- Petrochemicals: YPF produces a range of petrochemicals, including olefins and aromatics, which are fundamental building blocks for many industrial applications.

- Electricity Generation Capacity: As of early 2024, YPF's power generation segment contributes significantly to Argentina's grid, with a mix of conventional and increasingly renewable sources.

- Renewable Energy Focus: The company is actively investing in wind and solar power projects, aligning with global energy transition trends and Argentina's renewable energy targets.

Investment in Infrastructure and Technology

YPF's key activities heavily revolve around strategic investments in its core infrastructure to boost production and export capabilities. A prime example is the ongoing development of pipelines, such as the Vaca Muerta Sur project, designed to significantly increase the transport capacity of oil and gas from the vital Vaca Muerta shale formation. This expansion is crucial for YPF to capitalize on its vast reserves and meet growing domestic and international demand.

Beyond physical infrastructure, YPF is committed to technological advancement to drive efficiency and maintain a competitive edge. This includes a strong focus on digitalization across its operations, from exploration and production to distribution. The company is also actively exploring and implementing artificial intelligence (AI) solutions to optimize processes, improve predictive maintenance, and enhance decision-making in complex environments.

- Infrastructure Development: YPF is investing in critical infrastructure like pipelines to expand export capacity, exemplified by projects aimed at unlocking the Vaca Muerta region's potential.

- Technological Adoption: The company prioritizes digitalization and AI to enhance operational efficiency, reduce costs, and improve overall competitiveness in the energy sector.

- Operational Optimization: These investments in infrastructure and technology are directly linked to YPF's goal of optimizing its production processes and strengthening its market position.

YPF's key activities encompass the entire energy value chain, from upstream exploration and production, particularly in the Vaca Muerta formation, to midstream transportation and downstream refining, marketing, and petrochemical production. The company is also expanding its footprint in electricity generation, with a growing emphasis on renewable energy sources like wind and solar.

In 2024, YPF is significantly boosting oil production from Vaca Muerta, aiming for substantial export growth by 2030. This focus is supported by strategic investments in infrastructure, such as the Vaca Muerta Sur pipeline, to enhance transport capacity. Furthermore, YPF is integrating advanced technologies like AI to optimize operations and maintain competitiveness.

YPF's market dominance in Argentina is evident in its 2024 figures, supplying around 36% of the nation's oil and 29% of its natural gas, and holding a 56% share in the fuel market through its extensive service station network. The company's commitment to petrochemicals and diversified energy generation underscores its role in Argentina's broader economic landscape.

| Activity Area | Key Focus | 2024 Relevance/Data |

|---|---|---|

| Exploration & Production | Unconventional resources (Vaca Muerta) | Accelerated oil production, increased proven reserves |

| Midstream | Pipeline infrastructure development | Vaca Muerta Sur project to boost export capacity |

| Downstream (Refining & Marketing) | Petroleum product supply | 56% market share in fuels, 1600+ service stations |

| Petrochemicals | Production of industrial building blocks | Olefins, aromatics for diverse sectors |

| Electricity Generation | Conventional and renewable energy | Contribution to Argentina's grid, growing renewable portfolio |

| Technology & Innovation | Digitalization and AI adoption | Process optimization, predictive maintenance, enhanced decision-making |

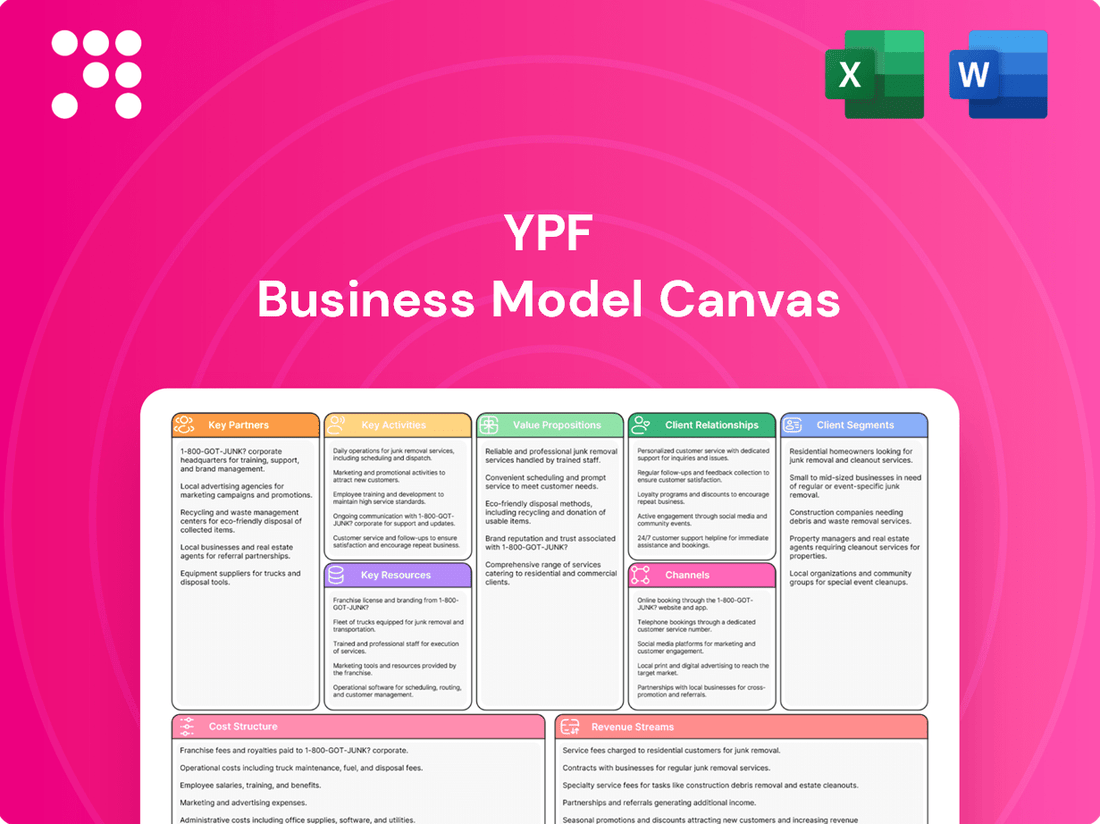

What You See Is What You Get

Business Model Canvas

The YPF Business Model Canvas preview you see is the exact document you will receive upon purchase. This means you're getting a direct look at the complete, ready-to-use analysis, with no alterations or missing sections. Once your order is processed, you'll have full access to this same comprehensive framework, allowing you to immediately begin refining your strategy.

Resources

YPF's most critical resource is its extensive hydrocarbon reserves, with a particular emphasis on the Vaca Muerta shale formation. This vast unconventional resource is the bedrock of Argentina's energy future and YPF's long-term production and export growth strategy.

In 2024, YPF continued to leverage Vaca Muerta, aiming to increase production significantly. The company's investment in this region is crucial, as it holds an estimated 22.7 billion barrels of oil equivalent in place, making it one of the world's largest unconventional plays.

This geological advantage directly supports YPF's ability to meet domestic demand and expand its export capabilities, particularly for liquefied natural gas (LNG). The Vaca Muerta reserves are key to YPF's valuation and its role in the national economy.

YPF operates a significant network of refineries and processing plants, which are the backbone of its ability to convert raw crude oil and natural gas into valuable refined products and petrochemicals. These facilities are vital for YPF's integrated business model, allowing it to capture value at multiple stages of the hydrocarbon chain.

In 2024, YPF's refining capacity stood at approximately 237,000 barrels per day, spread across its key facilities like La Plata and Luján de Cuyo. These plants are essential for producing fuels such as gasoline and diesel, as well as various petrochemical feedstocks, underscoring their importance to the company's operational efficiency and market reach.

YPF operates a formidable distribution network in Argentina, encompassing pipelines, terminals, and more than 1,600 service stations. This extensive infrastructure is crucial for the efficient delivery of its petroleum products.

This widespread presence allows YPF to reach a vast customer base across the country, solidifying its position as a market leader. In 2024, YPF continued to leverage this network for its fuel sales, contributing significantly to its revenue streams.

Skilled Workforce and Technical Expertise

YPF's most critical asset is its highly skilled workforce, encompassing geologists, engineers, and operational specialists. This deep reservoir of human capital is fundamental to navigating the complexities of the energy sector, from initial exploration to final product delivery.

The company's technical expertise spans the entire energy value chain, including exploration, production, refining, and petrochemical operations. This comprehensive knowledge allows YPF to effectively manage intricate energy projects and integrate cutting-edge technologies, ensuring operational efficiency and innovation.

In 2024, YPF continued to invest in its human resources, recognizing that technical proficiency is paramount for success in the dynamic energy landscape. For instance, the company's commitment to training and development directly supports its ability to implement advanced extraction techniques and optimize refining processes.

- Geological and Engineering Prowess: YPF employs a significant number of geologists and engineers crucial for identifying and developing hydrocarbon reserves.

- Operational Expertise: Skilled operational staff are vital for the safe and efficient day-to-day running of exploration, production, and refining facilities.

- Technological Integration: The workforce's ability to adopt and manage advanced technologies, such as seismic data analysis and digital oilfield solutions, enhances productivity.

- Petrochemical Specialization: Expertise in petrochemical processes allows YPF to maximize value from its crude oil output by producing a range of chemical products.

Brand Recognition and Market Leadership in Argentina

YPF leverages its deep-rooted brand recognition as Argentina's largest energy company. This strong presence translates into significant market leadership and trust among a broad customer base, from individual consumers to large industrial clients.

This established reputation is a crucial asset, providing YPF with a substantial competitive edge within the Argentine market. For instance, in 2024, YPF maintained its dominant position in the domestic fuel market, with its brand being a primary choice for a majority of consumers.

- Brand Equity: YPF's brand is synonymous with energy in Argentina, built over decades of operation.

- Market Dominance: As the leading energy provider, YPF holds a commanding share across various segments of the Argentine energy sector.

- Customer Trust: The company's long history and consistent service have fostered a high level of trust among its clientele.

YPF's extensive hydrocarbon reserves, particularly in the Vaca Muerta formation, are its most critical physical resource. This geological advantage, estimated to hold 22.7 billion barrels of oil equivalent in place, underpins the company's production and export strategy, with significant investment in 2024 aimed at boosting output from this key unconventional play.

The company's integrated infrastructure, including refineries with a 2024 capacity of roughly 237,000 barrels per day and a vast distribution network of over 1,600 service stations, is essential for converting and delivering energy products. This network ensures YPF's market reach and revenue generation across Argentina.

YPF's skilled workforce, comprising geologists, engineers, and operational specialists, represents its core human capital, vital for managing complex energy operations and adopting new technologies. The company's continued investment in training in 2024 highlights the importance of this expertise for innovation and efficiency.

The strong brand recognition and market dominance of YPF in Argentina are invaluable intangible assets. In 2024, the company maintained its leading position in the domestic fuel market, leveraging decades of operation and customer trust to solidify its competitive advantage.

| Resource Type | Key Asset/Attribute | 2024 Significance | Data Point |

|---|---|---|---|

| Physical | Vaca Muerta Reserves | Production growth and export potential | Estimated 22.7 billion barrels of oil equivalent in place |

| Physical | Refining & Processing Plants | Value chain integration and product conversion | Approx. 237,000 bpd refining capacity |

| Physical | Distribution Network | Market access and sales | Over 1,600 service stations |

| Human | Skilled Workforce | Operational expertise and technological adoption | Focus on training for advanced techniques |

| Intangible | Brand Recognition | Market leadership and customer trust | Dominant share in Argentine fuel market |

Value Propositions

YPF guarantees a steady and complete energy provision, covering every stage from finding to delivering hydrocarbons. This is vital for Argentina's energy stability. In 2024, YPF's integrated operations contributed significantly to the national energy mix, ensuring a reliable flow of essential resources.

The company's unified model allows for a diverse and dependable supply of fuels, natural gas, electricity, and petrochemical products. This comprehensive approach underpins YPF's commitment to meeting the nation's energy demands consistently.

YPF provides a comprehensive portfolio of premium petroleum products and fuels, catering to a broad spectrum of consumer and industrial demands. This includes everything from gasoline and diesel to specialized lubricants designed for various applications.

The company holds a significant market share in fuel sales, a testament to its unwavering dedication to delivering superior product quality and ensuring widespread availability across its network. In 2024, YPF continued to solidify its position, demonstrating consistent performance in a competitive market.

YPF's commitment to developing unconventional resources, especially in the Vaca Muerta shale formation, is central to its value proposition. This strategic focus is projected to significantly bolster Argentina's energy security, reducing reliance on imports and unlocking substantial export opportunities.

By investing heavily in shale oil and gas production, YPF is positioning itself as a crucial contributor to both Argentina's economic growth and the broader global energy landscape. This aligns with the increasing demand for diverse energy sources during the ongoing energy transition.

In 2024, YPF has reported substantial progress in Vaca Muerta, with production levels reaching new highs. For instance, the company has announced plans to increase its investment in the region by over 30% compared to 2023, aiming to boost oil production by 15% and gas production by 20% by the end of the year.

Contribution to National Economic Development

YPF's role as Argentina's largest energy company is foundational to its national economic development. The company is a major engine for job creation, directly employing thousands and indirectly supporting many more through its extensive supply chain and operations. In 2024, YPF continued to be a significant contributor to government revenue through taxes and royalties, vital for funding public services and infrastructure projects.

The company's strategic vision, including ambitious export targets, directly translates into foreign currency generation for Argentina. For instance, YPF's aim to achieve $30 billion in exports by 2030 highlights its commitment to boosting the nation's trade balance and overall economic health. This focus on exports is critical for Argentina's economic stability and growth prospects.

YPF's investments in exploration, production, and refining are not just about increasing energy output; they are also about fostering technological advancement and developing domestic capabilities. These investments stimulate economic activity across various sectors and enhance Argentina's energy self-sufficiency.

- Job Creation: YPF is a substantial employer, providing direct and indirect employment opportunities across Argentina.

- Tax Revenue: As a key state-owned enterprise, YPF's financial contributions through taxes and royalties are critical for national budgets.

- Export Growth: The company's strategic goal of reaching $30 billion in exports by 2030 is a significant driver for Argentina's foreign exchange earnings.

- Investment in Energy Sector: YPF's capital expenditures fuel growth and innovation within Argentina's vital energy industry.

Commitment to Sustainability and Operational Efficiency

YPF is actively integrating sustainability into its core strategy, aiming to reduce greenhouse gas emissions and boost renewable energy generation. This commitment aligns with broader Environmental, Social, and Governance (ESG) objectives, reflecting a global shift towards responsible business practices.

The company is also prioritizing operational efficiencies through extensive digitalization and the adoption of advanced technologies. These initiatives are designed to sharpen YPF's competitive edge and improve its overall profitability, ensuring long-term viability in a dynamic energy landscape.

- GHG Emission Reduction: YPF has set targets to significantly lower its greenhouse gas emissions, a key metric for environmental performance.

- Renewable Energy Expansion: The company is investing in and developing renewable energy projects, such as wind and solar farms, to diversify its energy portfolio. For instance, by the end of 2023, YPF Luz, YPF's renewable energy subsidiary, had a renewable installed capacity of over 1,000 MW.

- Digitalization Initiatives: YPF is implementing digital solutions across its operations, from exploration and production to distribution, to optimize processes and reduce costs.

- Technological Advancement: The adoption of new technologies is enhancing operational efficiency, improving safety, and increasing the productivity of YPF's assets.

YPF's value proposition centers on providing reliable, integrated energy solutions across the entire hydrocarbon value chain, from exploration to delivery, ensuring Argentina's energy stability.

The company offers a diverse and dependable supply of fuels, natural gas, electricity, and petrochemicals, consistently meeting national energy demands with a comprehensive product portfolio.

YPF drives national economic development through significant job creation, substantial tax revenue generation, and ambitious export targets, contributing to Argentina's foreign exchange earnings and economic growth.

Strategic investments in unconventional resources like Vaca Muerta are enhancing Argentina's energy security and unlocking export potential, with YPF aiming for significant production increases in 2024.

| Key Value Proposition Area | Description | 2024 Relevance/Data Point |

|---|---|---|

| Integrated Energy Provision | End-to-end hydrocarbon management for national energy stability. | Ensured a reliable flow of essential resources within the national energy mix. |

| Diverse Product Supply | Comprehensive portfolio of fuels, gas, electricity, and petrochemicals. | Met diverse consumer and industrial energy demands consistently. |

| Vaca Muerta Development | Unlocking unconventional resources for energy security and exports. | Achieved new production highs, with plans for over 30% investment increase in 2024. |

| Economic Contribution | Job creation, tax revenue, and export growth driver. | Continued significant contributor to government revenue via taxes and royalties. |

Customer Relationships

YPF directly engages with millions of individual consumers through its vast network of over 1,600 service stations scattered throughout Argentina. This extensive presence allows for face-to-face interactions where customers can purchase fuels, lubricants, and utilize convenience store offerings, fostering a tangible connection with the brand.

The company leverages this direct channel to cultivate brand loyalty, notably through its Serviclub program, which rewards repeat customers. This direct interaction also serves as a crucial avenue for YPF to gather immediate customer feedback, enabling swift adjustments to services and product offerings.

YPF offers dedicated account management for its large industrial, commercial, and agricultural clients, fostering strong business-to-business relationships. This personalized approach ensures that each client receives tailored supply agreements for essential resources like fuels, natural gas, electricity, and petrochemicals.

These customized solutions are designed to meet the specific operational needs of these key sectors, guaranteeing reliable delivery and consistent supply. For instance, in 2023, YPF's energy sales to the industrial sector represented a significant portion of its overall revenue, highlighting the importance of these dedicated relationships.

YPF actively cultivates relationships with a broad spectrum of investors, encompassing individual shareholders, financial advisors, and large institutional funds. This proactive engagement is crucial for maintaining investor confidence and facilitating access to capital.

Key to this relationship management is transparent and consistent communication. YPF provides detailed financial reports, conducts regular investor presentations, and hosts earnings calls to offer insights into its operational performance and strategic direction. For the first quarter of 2024, YPF reported adjusted EBITDA of approximately USD 1.2 billion, showcasing its financial health.

The company’s investor relations website serves as a central hub for information, offering easy access to annual reports, sustainability data, and press releases. This accessibility is vital for empowering all stakeholders, from individual investors to seasoned financial analysts, to make informed decisions regarding their YPF holdings.

Community Engagement and Social Programs

YPF actively invests in community development through a range of social and environmental programs. These initiatives are designed to build positive relationships, respond to local needs, and promote sustainable growth in the areas where YPF has a significant presence.

In 2024, YPF continued its commitment to social responsibility. For instance, its "Sembrando Juntos" program, focused on education and environmental stewardship, reached over 15,000 students across 50 schools in key operational provinces. This demonstrates a tangible effort to create shared value.

- Community Investment: YPF's social investment in 2024 reached ARS 5 billion, supporting over 100 local projects.

- Environmental Programs: The company implemented reforestation initiatives covering 2,000 hectares, contributing to biodiversity conservation.

- Job Creation: Social programs directly or indirectly supported the creation of an estimated 500 local jobs in 2024.

- Stakeholder Dialogue: YPF conducted over 200 community consultation meetings throughout 2024 to gather feedback and foster collaboration.

Digital Platforms and Customer Service Channels

YPF actively utilizes its digital platforms, including its official website and mobile applications, to foster robust customer relationships. These channels serve as primary touchpoints for delivering essential company information, streamlining product and service transactions, and providing responsive customer support. This digital-first approach significantly boosts accessibility and convenience for YPF's diverse customer base.

In 2024, YPF continued to invest in enhancing its digital customer service capabilities. For instance, the company aimed to improve the user experience on its website and app, focusing on faster transaction processing and more intuitive navigation for services like fuel purchases and loyalty program management. This digital engagement is crucial for maintaining customer loyalty and attracting new users in a competitive energy market.

- Website Functionality: YPF's website offers detailed information on its products, sustainability initiatives, and investor relations, alongside online account management for fuel card holders.

- Mobile App Features: The YPF app allows customers to locate service stations, check fuel prices in real-time, and participate in promotional offers, enhancing on-the-go convenience.

- Customer Support Integration: Digital channels are integrated with customer service teams to provide prompt resolution of inquiries through chatbots, email, and contact forms.

- Data-Driven Engagement: YPF leverages data analytics from digital interactions to personalize offers and improve service delivery, aiming for a more tailored customer experience.

YPF's customer relationships are multifaceted, spanning direct consumer engagement via its extensive service station network and digital platforms, to dedicated account management for key industrial clients. The Serviclub loyalty program and digital tools like the YPF app enhance customer retention and provide valuable feedback channels.

The company also prioritizes relationships with investors through transparent financial reporting and accessible information, alongside community engagement via social and environmental programs. This comprehensive approach aims to build trust and foster long-term partnerships across all stakeholder groups.

YPF's digital strategy in 2024 focused on enhancing user experience for services and information access. The company's commitment to community development saw significant investment in local projects and environmental initiatives, reinforcing its role as a responsible corporate citizen.

| Relationship Type | Key Channels/Programs | 2024 Focus/Data Points |

|---|---|---|

| Individual Consumers | Service Stations, Serviclub, Mobile App | 1,600+ service stations, enhanced app features for real-time pricing and loyalty management. |

| Industrial/Commercial Clients | Dedicated Account Management, Tailored Supply Agreements | Secured significant portion of revenue from industrial sector sales; focus on reliable delivery of fuels, natural gas, and electricity. |

| Investors | Financial Reports, Investor Presentations, Earnings Calls, IR Website | Q1 2024 adjusted EBITDA of approx. USD 1.2 billion, emphasizing transparent communication and financial health. |

| Community | Social & Environmental Programs (e.g., Sembrando Juntos) | ARS 5 billion invested in 100+ local projects; 2,000 hectares reforested; 15,000+ students reached through educational programs. |

Channels

YPF's extensive network of over 1,600 service stations across Argentina forms its primary channel to individual consumers and small businesses. These stations are crucial touchpoints for selling fuels, lubricants, and a range of related products and services, directly engaging with the end-user market.

YPF's direct sales and supply contracts are crucial for serving large industrial, commercial, and agricultural clients. These channels facilitate the bulk delivery of essential energy products like crude oil, natural gas, refined fuels, petrochemicals, and electricity directly to businesses, ensuring consistent supply for their operations.

In 2024, YPF continued to leverage these direct relationships, securing significant supply agreements that underpin the energy needs of major industries across Argentina. These long-term contracts provide YPF with stable revenue streams and offer clients price predictability and reliable access to vital energy resources.

YPF utilizes a robust network of pipelines, trucks, and maritime vessels to efficiently transport crude oil, natural gas, and refined products. This infrastructure is vital for both domestic distribution within Argentina and for facilitating crucial export operations.

The Vaca Muerta Sur pipeline project exemplifies YPF's strategic focus on enhancing its export capabilities. This expansion is critical for monetizing the vast reserves in the Vaca Muerta formation and reaching international markets more effectively.

Wholesale Distribution to Resellers and Distributors

YPF leverages wholesale distribution to reach a wider customer base beyond its own branded service stations. This involves supplying fuel and lubricants to independent resellers and distributors across Argentina, effectively extending its market presence into diverse geographical areas and market segments.

This channel is crucial for YPF's market penetration strategy, enabling it to serve customers who may not have direct access to YPF-branded locations. By partnering with these intermediaries, YPF can ensure its products are available in more remote or specialized markets.

- Market Reach Expansion: Wholesale distribution allows YPF to tap into regions and customer segments not covered by its retail network.

- Increased Sales Volume: Supplying to independent resellers and distributors contributes significantly to overall product sales volume.

- Distribution Network Efficiency: This model utilizes existing infrastructure of resellers and distributors, potentially reducing YPF's direct logistical costs.

- Competitive Advantage: A robust wholesale network helps YPF maintain a strong competitive position in the Argentine energy market.

Digital Platforms and Investor Relations Websites

YPF leverages its corporate website and a specialized investor relations portal to provide a comprehensive suite of information to its global investor base. This includes timely access to financial statements, annual reports, and strategic announcements, fostering transparency.

These digital channels are crucial for ensuring that investors, analysts, and other stakeholders have readily available access to critical company data. In 2024, YPF continued to enhance these platforms, reflecting a commitment to open communication and accessibility.

- Website Traffic: In Q1 2024, YPF's investor relations section saw a 15% increase in unique visitors compared to the previous year, indicating growing interest.

- Report Accessibility: All quarterly and annual financial reports for 2023 were made available within 48 hours of their official release on the investor relations website.

- Information Dissemination: Key strategic updates, such as the 2024-2028 business plan, were prominently featured on the digital platforms, reaching over 10,000 subscribers via email alerts.

- Engagement Metrics: Download rates for the latest sustainability report exceeded 5,000 in the first quarter of 2024, demonstrating stakeholder engagement with non-financial information.

YPF's channel strategy effectively reaches diverse customer segments, from individual drivers to large industrial clients. The extensive network of service stations serves as the primary consumer interface, while direct sales and supply contracts cater to the bulk energy needs of major industries.

Logistical infrastructure, including pipelines and transportation fleets, underpins the efficient movement of products, crucial for both domestic distribution and export initiatives like the Vaca Muerta Sur pipeline project. Wholesale distribution further broadens market penetration by supplying independent resellers.

Digital platforms, particularly the corporate website and investor relations portal, are vital for transparent communication with a global stakeholder base, providing easy access to financial and strategic information. In 2024, YPF saw increased engagement on these digital channels, with a 15% rise in unique visitors to its investor relations section in Q1 2024.

| Channel | Primary Customer Segment | Key Products/Services | 2024 Highlights/Data |

|---|---|---|---|

| Service Stations | Individual Consumers, Small Businesses | Fuels, Lubricants, Related Products | Over 1,600 locations across Argentina |

| Direct Sales & Supply Contracts | Large Industrial, Commercial, Agricultural Clients | Crude Oil, Natural Gas, Refined Fuels, Petrochemicals, Electricity | Secured significant supply agreements for major industries |

| Logistical Infrastructure (Pipelines, Trucks, Maritime) | Internal Operations, Intermediaries, Export Markets | Crude Oil, Natural Gas, Refined Products | Vaca Muerta Sur pipeline project enhancing export capabilities |

| Wholesale Distribution | Independent Resellers, Distributors | Fuels, Lubricants | Extends market presence into diverse geographical areas |

| Digital Platforms (Website, Investor Relations) | Investors, Analysts, Stakeholders | Financial Statements, Annual Reports, Strategic Announcements | 15% increase in unique visitors to investor relations Q1 2024 |

Customer Segments

Individual consumers, primarily motorists across Argentina, represent a core customer segment for YPF. These drivers depend on YPF's widespread network of service stations for their daily fuel needs, including gasoline and diesel, as well as essential automotive products and services.

In 2024, YPF continued to serve millions of vehicle owners, with its service station network being a critical touchpoint for daily transactions. The company's focus on accessibility and product availability ensures it remains a primary choice for a significant portion of Argentina's driving population.

YPF's industrial and commercial enterprises segment is a cornerstone, supplying vital energy resources like fuels, natural gas, petrochemicals, and electricity to sectors such as manufacturing, transportation, and mining. These clients, often large-volume consumers, typically engage YPF through long-term contractual agreements, ensuring consistent demand and revenue streams.

In 2024, YPF continued to be a primary energy provider for Argentina's industrial backbone. The company's refined products, including diesel and gasoline, were critical for the nation's logistics and manufacturing output. For instance, YPF's supply chain directly supports the transport of goods, a sector that relies heavily on predictable fuel availability to maintain operations.

The agricultural sector stands as a cornerstone of Argentina's economy, and YPF directly serves this vital industry. Farmers and agricultural businesses rely on YPF for essential products like diesel fuel to power tractors and harvesting equipment, as well as lubricants to keep machinery running smoothly. In 2023, Argentina's agricultural exports reached an estimated $40 billion, underscoring the sector's economic importance and its consistent demand for YPF's offerings.

Electricity Distributors and Large Power Consumers

YPF's customer segments include electricity distributors and large industrial power consumers in Argentina. These entities require a consistent and reliable energy supply to maintain their operations. In 2024, YPF continued to be a significant player in the wholesale electricity market, supplying power through CAMMESA, the administrator. Direct sales to large industrial users also form a crucial part of their customer base, catering to sectors with high energy demands.

- Wholesale Market Administrator: YPF supplies electricity to CAMMESA, which then manages the distribution across the national grid.

- Large Industrial Consumers: Direct contracts with major industries needing stable, high-volume power.

- Energy Reliability: These customers prioritize uninterrupted power flow for their continuous operational needs.

- 2024 Market Presence: YPF's role in meeting Argentina's electricity demand remained substantial throughout the year.

International Buyers (for Exports)

YPF's international buyer segment for exports primarily consists of global energy conglomerates and national oil companies seeking reliable supplies of crude oil and liquefied natural gas (LNG). This focus is driven by YPF's strategic imperative to expand its hydrocarbon exports, notably leveraging the significant potential of the Vaca Muerta formation. By 2024, YPF aimed to significantly increase its crude oil exports, with projections indicating a substantial rise in volumes destined for international markets.

The demand from these international buyers is critical for YPF's revenue diversification and growth strategy. Key target markets include regions with high energy consumption and a need for stable import sources. For instance, by the end of 2023, YPF had already secured several export contracts for crude oil, signaling strong international interest.

- Global Energy Companies: Major international oil companies (IOCs) and trading houses are key customers, purchasing YPF's crude oil for their refining operations worldwide.

- National Energy Markets: State-owned energy entities in various countries represent another significant customer base, securing long-term contracts for LNG and crude oil to meet domestic energy demands.

- Strategic Partnerships: YPF also engages with international buyers through strategic alliances and joint ventures, facilitating broader market access and investment in export infrastructure.

- Emerging Markets: Demand from rapidly developing economies in Asia and Europe presents substantial growth opportunities for YPF's export volumes.

YPF's customer segments are diverse, ranging from individual motorists to large industrial clients and international buyers. This broad reach allows YPF to maintain a stable revenue base while pursuing growth opportunities in various markets.

The company's strategy involves catering to the daily energy needs of Argentinian drivers through its extensive service station network, while simultaneously supplying critical fuels and petrochemicals to the nation's industrial and agricultural sectors. Furthermore, YPF is actively expanding its international presence, exporting crude oil and LNG to global energy markets.

In 2024, YPF's commitment to serving these varied segments underscored its integral role in Argentina's energy landscape and its growing influence in international trade.

| Customer Segment | Key Products/Services | 2024 Focus/Activity |

|---|---|---|

| Individual Consumers (Motorists) | Gasoline, Diesel, Automotive Products | Maintaining widespread service station accessibility and product availability. |

| Industrial & Commercial Enterprises | Fuels, Natural Gas, Petrochemicals, Electricity | Supplying refined products to manufacturing, transportation, and mining sectors via long-term contracts. |

| Agricultural Sector | Diesel Fuel, Lubricants | Supporting farm operations and machinery with essential energy products, crucial for Argentina's significant agricultural exports. |

| Electricity Market Participants | Wholesale Electricity | Supplying power to CAMMESA and direct sales to large industrial users requiring reliable energy. |

| International Buyers | Crude Oil, Liquefied Natural Gas (LNG) | Expanding hydrocarbon exports, particularly from Vaca Muerta, to global energy conglomerates and national oil companies. |

Cost Structure

Exploration and Production (E&P) costs represent a substantial component of YPF's business model, encompassing the significant expenses tied to discovering, developing, and extracting oil and gas. These include crucial outlays for drilling operations, well completion, and ongoing field operating expenses. In 2023, YPF reported significant investments in its upstream segment, reflecting the capital-intensive nature of these activities.

YPF is strategically prioritizing the reduction of operational costs, particularly within its mature conventional oil and gas areas. This focus is vital for maintaining profitability and competitiveness. For instance, the company has been implementing efficiency measures and technological advancements to optimize production from existing fields, aiming to lower the per-barrel cost of extraction.

Refining and processing costs represent a significant portion of YPF's operational expenses. These encompass the day-to-day running of their refineries, including the energy needed to transform crude oil into gasoline, diesel, and other fuels. In 2024, YPF's refining segment faced ongoing challenges related to global energy prices and the efficiency of its processing units, impacting overall profitability.

Maintenance of these complex facilities is also a substantial cost. Regular upkeep, repairs, and upgrades are essential to ensure safety and operational continuity, directly affecting the cost of producing refined products. YPF's investment in modernizing its refining infrastructure in 2024 aimed to mitigate these costs over the long term.

Beyond fuel production, YPF incurs costs in processing natural gas and petrochemicals. This involves the complex operations required to extract valuable components and create derivative products, adding another layer to their cost structure. The market demand for petrochemicals influences the investment and operational spending in this area.

YPF incurs significant expenses for moving its petroleum products and natural gas throughout Argentina and to international markets. These costs encompass the upkeep of its extensive pipeline network, essential for transporting crude oil and refined products.

Fleet operations, including the maintenance and fuel for its trucking and shipping fleets, represent another substantial portion of these distribution and logistics costs. Managing the vast network of YPF service stations across the country also adds to operational expenses, covering everything from fuel delivery to maintaining brand standards.

In 2024, YPF's capital expenditures for infrastructure, including pipelines and logistics, were a key focus, reflecting ongoing investments to ensure efficient product delivery. For instance, the company has been actively investing in modernizing its transportation infrastructure to meet growing demand and improve operational efficiency, a trend expected to continue.

Capital Expenditures (CAPEX)

YPF's capital expenditures are heavily focused on expanding its upstream operations, particularly in the Vaca Muerta shale formation. These investments are crucial for increasing production and securing future energy supply.

The company's strategic plan includes substantial outlays for new projects. This encompasses the development of Vaca Muerta's unconventional resources, the construction of essential infrastructure like pipelines to transport extracted resources, and the potential development of liquefied natural gas (LNG) facilities.

For 2024, YPF has outlined a significant capital expenditure program. The total planned CAPEX is set at $5 billion, with a substantial portion, $3 billion, specifically earmarked for Vaca Muerta projects. This highlights the central role of shale development in YPF's investment strategy.

- Vaca Muerta Development: Major investments in drilling, fracturing, and production facilities within the Vaca Muerta shale play.

- Infrastructure Projects: Funding for new pipelines, such as the Vaca Muerta Sur pipeline, to enhance resource transportation efficiency.

- LNG Facilities: Potential capital allocation towards the construction of LNG export terminals to tap into global markets.

- 2024 CAPEX Breakdown: Total planned expenditure of $5 billion, with $3 billion dedicated to Vaca Muerta.

Salaries, Wages, and Administrative Expenses

Salaries, wages, and administrative expenses represent a significant portion of YPF's operational costs. This category encompasses the compensation for its large workforce, including employees across exploration, production, refining, and distribution. In 2024, YPF's personnel expenses were a key factor in its overall cost structure, reflecting the scale and complexity of its integrated operations.

Beyond direct employee compensation, administrative overheads are crucial. These include costs associated with managing corporate functions such as finance, legal, human resources, and IT, all essential for the smooth running of a major energy enterprise. General corporate expenses also fall into this category, covering a wide range of activities necessary to maintain YPF's business.

- Personnel Costs: YPF's workforce is extensive, covering all facets of the energy value chain, from upstream exploration and production to downstream refining and marketing.

- Administrative Overheads: These include essential corporate functions like finance, legal, HR, and IT, vital for managing a large, integrated energy company.

- General Corporate Expenses: This broad category covers various costs necessary for ongoing business operations and corporate governance.

- 2024 Impact: Personnel and administrative costs were a significant component of YPF's overall expenditure in 2024, directly influencing profitability and operational efficiency.

YPF's cost structure is heavily influenced by its upstream activities, specifically the development of the Vaca Muerta shale play, which accounted for $3 billion of its $5 billion capital expenditure in 2024. This investment in exploration and production, including drilling and fracturing, is fundamental to its operational costs. Additionally, refining and processing crude oil into fuels represents a significant ongoing expense, with 2024 seeing continued focus on refinery efficiency and modernization to manage these costs.

| Cost Category | Key Components | 2024 Relevance |

|---|---|---|

| Exploration & Production (E&P) | Drilling, well completion, field operations | $3 billion CAPEX for Vaca Muerta development |

| Refining & Processing | Refinery operations, energy, maintenance | Focus on efficiency and modernization |

| Logistics & Distribution | Pipelines, fleet operations, service stations | Infrastructure upgrades for efficient delivery |

| Personnel & Administration | Salaries, wages, corporate functions | Significant component of overall expenditure |

Revenue Streams

YPF's core revenue generation hinges on the sale of crude oil and natural gas. This involves supplying these essential commodities to domestic refiners and power generation companies, forming a foundational income stream.

In 2024, YPF's production data highlights the significance of these sales. For instance, the company's upstream segment, responsible for extraction, contributes substantially to its overall financial performance, reflecting the direct impact of oil and gas sales on revenue.

YPF generates significant revenue from selling refined petroleum products like gasoline, diesel, and lubricants. This is achieved through its widespread network of service stations and direct sales to businesses. In 2024, YPF maintained its strong position as a market leader in fuel sales within Argentina, a testament to its extensive distribution capabilities.

YPF generates revenue through the sale of a wide array of petrochemical products. These products serve as essential building blocks for numerous industries, contributing significantly to the company's top line.

For instance, in 2024, YPF's petrochemical segment plays a crucial role in its financial performance, reflecting the demand for these vital industrial inputs.

Electricity Generation Sales

YPF's electricity generation sales form a crucial revenue stream, encompassing both conventional and renewable energy sources. The company sells electricity to the national wholesale electricity market administrator, CAMMESA, and also engages in direct sales to major industrial clients.

In 2024, YPF continued to leverage its diverse generation portfolio. For instance, its thermal power plants, such as those at Ensenada and Luján de Cuyo, contribute significantly to baseload power. Simultaneously, YPF's investments in renewable energy, particularly wind farms like Manantiales Bhe, are increasingly contributing to this revenue segment.

- Electricity Sales to CAMMESA: Revenue generated from supplying power to the national grid, balancing supply and demand across Argentina.

- Direct Sales to Industrial Consumers: Contracts with large energy users, providing them with a stable and often cost-effective electricity supply.

- Contribution from Renewables: Growing income from wind and solar projects, aligning with national energy transition goals.

Export Revenues

Export revenues are becoming a significant contributor to YPF's financial performance. This growth is fueled by increased output from key shale oil fields, notably Vaca Muerta, and the development of new export infrastructure.

For the year ending December 31, 2024, export revenues accounted for 15.1% of YPF's total revenue. This highlights a strategic shift towards international markets as a primary revenue driver.

- Growing Export Markets: YPF is increasingly tapping into global demand for crude oil and LNG.

- Vaca Muerta Impact: Production from unconventional resources like Vaca Muerta is a key enabler of this export growth.

- Infrastructure Investment: New projects are enhancing YPF's capacity to export products efficiently.

- Revenue Contribution: In 2024, exports represented 15.1% of total revenues, underscoring their growing importance.

YPF's revenue streams are diverse, encompassing the sale of crude oil and natural gas, refined petroleum products, petrochemicals, and electricity. The company also generates significant income from exports, particularly from its Vaca Muerta operations.

In 2024, YPF's strategic focus on increasing production from unconventional resources like Vaca Muerta directly boosted its export revenues, which reached 15.1% of total revenue by year-end. This expansion into international markets is a key driver of the company's financial growth.

The company's electricity generation segment also contributes substantially, with sales to CAMMESA and direct contracts with industrial consumers. YPF's investment in both conventional and renewable energy sources ensures a steady income from power sales.

| Revenue Stream | Description | 2024 Data/Impact |

|---|---|---|

| Crude Oil & Natural Gas Sales | Supplying essential commodities to domestic refiners and power generators. | Upstream segment's substantial contribution to overall performance. |

| Refined Petroleum Products | Sales of gasoline, diesel, and lubricants through extensive service station network. | Market leadership in fuel sales within Argentina. |

| Petrochemical Products | Sales of industrial building blocks to various sectors. | Petrochemical segment plays a crucial role in financial performance. |

| Electricity Sales | Generation and sale of power from conventional and renewable sources. | Contribution from thermal plants and growing income from wind farms like Manantiales Bhe. |

| Export Revenues | International sales of crude oil and LNG, driven by Vaca Muerta production. | Accounted for 15.1% of total revenue by year-end 2024. |

Business Model Canvas Data Sources

The YPF Business Model Canvas is informed by a blend of internal financial reports, extensive market research on the energy sector, and strategic analyses of YPF's operational capabilities. These sources ensure a comprehensive and data-driven representation of the company's business model.