YPF Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

YPF Bundle

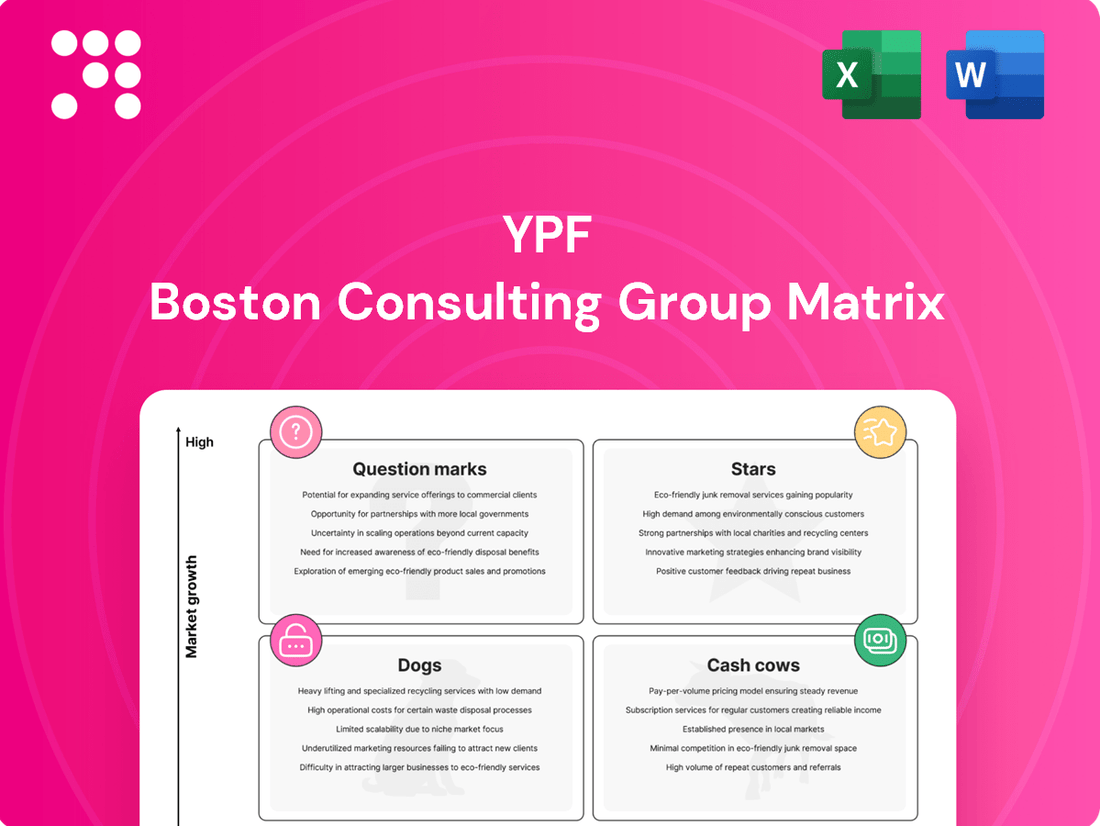

Unlock the strategic potential of your business with a clear understanding of the YPF BCG Matrix. This powerful tool categorizes products into Stars, Cash Cows, Dogs, and Question Marks, offering a visual roadmap for resource allocation. Discover which of YPF's offerings are driving growth and which require careful consideration.

Don't miss out on the complete YPF BCG Matrix analysis, which provides detailed insights into market share and growth rates for each product. Purchase the full report to gain actionable strategies for optimizing your portfolio and making informed investment decisions that will propel your business forward.

Stars

YPF's Vaca Muerta shale oil production is a cornerstone of its growth strategy, with projections indicating a substantial 30-40% increase in output for 2025. This segment is critical, currently accounting for 55% of YPF's total oil production and demonstrating a robust upward trend.

Vaca Muerta's shale gas development is a significant growth engine. In 2023, natural gas production from this region saw a robust 4% quarter-over-quarter increase and surpassed 7% year-over-year growth.

YPF is a dominant force in Vaca Muerta, a formation boasting the world's second-largest shale gas reserves. This positions Vaca Muerta as a high-potential asset within YPF's portfolio, necessitating ongoing investment to capitalize on its substantial growth prospects.

YPF commands roughly 50% of the Vaca Muerta formation's acreage, making it the foremost operator in this key unconventional resource area outside the United States.

This substantial landholding grants YPF a significant competitive edge in a market experiencing rapid growth, enabling the company to bolster its reserves and production capabilities.

Oil Export Infrastructure Expansion

YPF's strategic focus on oil export infrastructure expansion positions it favorably within the BCG matrix, likely as a Star or a potential Cash Cow depending on market conditions and YPF's market share in exports. Investments in critical infrastructure, such as the Vaca Muerta Sur oil pipeline and the expansion of the Oldelval pipeline, are actively underway. These projects are designed to significantly boost Argentina's crude export capacity, directly supporting the monetization of its burgeoning shale oil production.

These infrastructure developments are pivotal for transforming Argentina into a major crude exporter, signaling substantial growth in export volumes. For instance, the Vaca Muerta Sur pipeline aims to transport up to 110,000 barrels per day of crude oil, a substantial increase in capacity. The Oldelval pipeline expansion is also critical, with plans to increase its capacity by 30% to around 300,000 barrels per day by late 2024, facilitating the movement of oil from Neuquén to the port of Bahía Blanca.

- Vaca Muerta Sur Pipeline: Targeting 110,000 bpd capacity to boost crude exports.

- Oldelval Pipeline Expansion: Aiming for a 30% capacity increase to approximately 300,000 bpd by late 2024.

- Strategic Importance: Crucial for monetizing increased shale oil output and establishing Argentina as a key crude exporter.

Strategic Capital Allocation to Unconventionals

YPF is prioritizing unconventional resources, channeling a significant portion of its capital into these high-potential areas. This strategic allocation is key to driving future growth and solidifying its position in the energy market.

In 2024, YPF planned to invest $5.041 billion, with a substantial 63.5% earmarked for unconventional projects. This focus is primarily on the Vaca Muerta formation, a globally recognized shale play.

- Capital Allocation: 63.5% of YPF's $5.041 billion 2024 investment is directed towards unconventional projects.

- Primary Focus: The majority of this capital is allocated to the Vaca Muerta shale play.

- Strategic Rationale: This approach aims to accelerate growth and maintain market leadership in the burgeoning shale sector.

YPF's Vaca Muerta operations are clearly positioned as Stars in the BCG matrix. The significant investment in these unconventional resources, with 63.5% of its $5.041 billion 2024 capital expenditure directed towards them, highlights their high growth potential. This focus is driving substantial production increases, with oil output projected to rise 30-40% in 2025. The expansion of export infrastructure, like the Vaca Muerta Sur pipeline, further solidifies Vaca Muerta's status as a high-growth, high-market-share segment for YPF.

| Segment | Market Growth | Relative Market Share | BCG Classification |

|---|---|---|---|

| Vaca Muerta Oil Production | High (30-40% projected 2025 growth) | High (55% of YPF's total oil production) | Star |

| Vaca Muerta Gas Production | High (4% QoQ and 7% YoY growth in 2023) | High (Dominant operator in a key shale play) | Star |

What is included in the product

The YPF BCG Matrix analyzes YPF's business units by market share and growth rate.

It guides strategic decisions on investment, divestment, and resource allocation.

YPF BCG Matrix: Clear visualization of business unit performance, easing strategic decision-making.

Cash Cows

YPF's downstream operations, including refining and marketing, are a significant cash generator for the company. In the first quarter of 2025, the company achieved a robust refinery utilization rate of 94%, demonstrating efficient operations.

This segment consistently delivers strong adjusted EBITDA, bolstered by supportive local fuel pricing. These factors contribute to a reliable and steady stream of cash flow, characteristic of a cash cow.

YPF's domestic fuel sales have remained a cornerstone of its business, demonstrating resilience even with minor shifts in local consumption. The company's ability to not only hold but expand its market share in Argentina underscores the strength of its established distribution channels and brand recognition.

In 2024, YPF continued to be a dominant player in Argentina's fuel market. For instance, during the first half of 2024, YPF maintained its leading position, capturing approximately 57% of the total gasoline market and a similar share in diesel sales, reflecting consistent consumer reliance on its widespread network of service stations.

YPF's established conventional oil production, while seeing strategic divestments in some mature fields, still generates consistent output and cash flow. These assets, though in a mature market, maintain a notable market share, offering YPF a dependable operational base.

In 2024, YPF's conventional oil production remained a significant contributor, even as the company focused on optimizing its portfolio. The company's strategy involves divesting from less efficient mature assets while retaining and maximizing the value of its core conventional reserves.

Conventional Natural Gas Production

YPF's conventional natural gas production, alongside its oil operations, is a cornerstone of Argentina's energy landscape, consistently generating revenue. Despite modest growth prospects, its entrenched market presence guarantees a reliable cash flow for the company.

In 2024, YPF continued to leverage its conventional natural gas assets. For instance, the company reported significant production figures from its mature fields, contributing substantially to Argentina's domestic supply. This segment, while not experiencing rapid expansion, remains a dependable generator of profits due to established infrastructure and demand.

- Stable Revenue Stream: Conventional natural gas production provides a predictable income, essential for funding other YPF initiatives.

- Market Dominance: YPF holds a significant share in Argentina's natural gas market, ensuring consistent demand for its output.

- Contribution to National Energy: These operations are vital for meeting Argentina's energy needs, underscoring their strategic importance.

Existing Petrochemical Operations

YPF's existing petrochemical operations are a cornerstone of its integrated business model, transforming byproducts from its oil and gas extraction into valuable chemical compounds. This segment typically operates in a mature market, characterized by established demand and relatively stable pricing, allowing for consistent revenue generation. The company's long-standing presence and infrastructure in this area suggest a strong, albeit not rapidly growing, market share.

These petrochemical activities are a prime example of a cash cow within YPF's portfolio. They generate substantial and predictable cash flows with limited need for significant capital reinvestment, as the core infrastructure is already in place and the market is well-understood. For instance, in 2023, YPF reported its petrochemical division contributed significantly to its overall earnings, underscoring its role as a reliable cash generator.

- Stable Revenue Streams: Petrochemical products like polymers and fertilizers have consistent demand, providing YPF with a predictable income.

- Low Investment Needs: Existing facilities require maintenance and operational efficiency upgrades rather than large-scale expansion, maximizing cash generation.

- Contribution to Overall Profitability: In 2023, YPF's petrochemical segment played a crucial role in the company's financial performance, highlighting its importance as a cash cow.

YPF's downstream refining and marketing operations, alongside its established conventional oil and gas production, represent key cash cows. These segments benefit from consistent demand within Argentina, supported by YPF's dominant market share and extensive infrastructure. For example, in the first half of 2024, YPF held approximately 57% of the gasoline market, ensuring a steady revenue stream.

The petrochemical division also functions as a cash cow, transforming byproducts into valuable chemicals with stable market demand. In 2023, this segment significantly contributed to YPF's overall earnings, demonstrating its reliable profitability with limited reinvestment needs. These operations are crucial for YPF's consistent cash generation, funding strategic growth initiatives.

| Segment | Key Characteristics | 2024/2023 Data Point |

|---|---|---|

| Downstream (Refining & Marketing) | High refinery utilization, strong EBITDA, supportive pricing | 94% refinery utilization (Q1 2025), 57% gasoline market share (H1 2024) |

| Conventional Oil Production | Consistent output, mature asset optimization | Significant contribution to domestic supply, strategic divestments in less efficient fields |

| Conventional Natural Gas Production | Reliable cash flow, established infrastructure | Substantial production figures from mature fields, dependable profit generator |

| Petrochemicals | Stable demand, low investment needs, significant profitability | Crucial contributor to 2023 earnings, consistent revenue from polymers and fertilizers |

What You’re Viewing Is Included

YPF BCG Matrix

The preview you see is the definitive YPF BCG Matrix document you will receive upon purchase, offering a complete and unwatermarked strategic analysis. This comprehensive report, meticulously crafted for clarity and actionable insights, will be immediately available for your download, ready to inform your business planning. You're not looking at a sample; this is the actual, professionally formatted YPF BCG Matrix file, designed to empower your decision-making processes. Once acquired, this document is yours to edit, present, or integrate into your strategic frameworks without any limitations or further modifications needed.

Dogs

YPF is divesting around 55 mature conventional oil and gas blocks, a clear indication they are considered Dogs in the BCG matrix. These blocks typically exhibit low production growth rates, making them less attractive for continued investment.

The decision to divest these mature assets, which represent a portion of YPF's historical production base, is driven by a strategy to streamline operations and improve capital efficiency. This move allows YPF to focus resources on areas with higher potential returns.

In 2023, Argentina's oil production from conventional fields saw a slight decline, underscoring the challenges faced by mature assets. YPF's divestment aligns with this trend, aiming to shed assets that no longer contribute significantly to growth or profitability.

YPF's strategy often involves divesting lower-yielding assets with elevated operating costs. These are frequently conventional fields that have passed their peak production, making them less efficient to maintain. For instance, as of the first quarter of 2024, YPF continued to assess its portfolio, with a focus on optimizing resource allocation.

These 'cash traps' represent a significant financial drain due to ongoing expenses like labor, maintenance, and energy, often outweighing the revenue they generate. Divesting these assets allows YPF to reallocate capital towards more promising ventures, thereby enhancing overall operational efficiency and profitability.

YPF's conventional oil production has seen a noticeable decline, pushing the company to re-evaluate its investment in these mature assets. This trend is reflected in the broader Argentine energy sector, where output from older fields is naturally decreasing. For instance, by the end of 2023, conventional oil production in Argentina had been on a downward trajectory for several years, with YPF's contribution mirroring this pattern.

Assets Under 'Plan Andes' Divestment Program

YPF's 'Plan Andes' represents a strategic divestment program targeting mature oil and gas fields. This initiative is designed to optimize the company's portfolio by shedding underperforming assets, thereby improving overall operational efficiency and focus.

In 2024, the 'Plan Andes' program had a notable financial impact, amounting to $300 million. This figure reflects the economic consequences of returning these mature fields, underscoring the program's role in reshaping YPF's asset structure.

- Divestment Focus: 'Plan Andes' targets mature fields, aiming to streamline YPF's asset base.

- 2024 Financial Impact: The program resulted in a $300 million impact in 2024 due to asset returns.

- Strategic Goal: The initiative seeks to eliminate underperforming segments and enhance operational focus.

Legacy Assets with Limited Future Potential

Legacy Assets with Limited Future Potential represent YPF's conventional oil and gas fields. While these assets have been foundational, their contribution to future growth is constrained as the industry shifts towards more dynamic unconventional resources. YPF's strategic pivot aims to divest from these mature, low-growth segments.

The company's objective is to streamline operations and concentrate on high-potential shale plays, effectively transforming into a 'pure shale company.' This strategic repositioning is crucial for adapting to evolving market demands and maximizing long-term shareholder value. For instance, in 2023, YPF's conventional production saw a modest increase, but its share of total production continued to decline as unconventional output surged.

- Declining Contribution: Conventional assets represent a decreasing percentage of YPF's overall production and reserves.

- Strategic Divestment: YPF is actively reducing its footprint in these mature, low-return areas.

- Focus on Shale: The company is prioritizing investment and development in its promising shale oil and gas resources.

- Efficiency Gains: Streamlining operations by shedding legacy assets is expected to improve overall capital efficiency.

YPF's mature conventional oil and gas blocks are classified as Dogs in the BCG matrix due to their low production growth and limited future potential. The company's strategic divestment program, 'Plan Andes,' specifically targets these underperforming assets, aiming to optimize its portfolio and reallocate capital towards more promising ventures, particularly shale plays.

This strategic shift is crucial for YPF to improve its capital efficiency and adapt to evolving market demands, shedding assets that are often characterized as cash traps with elevated operating costs. The divestment of these legacy assets underscores a broader trend in the Argentine energy sector, where output from older fields is naturally decreasing, impacting overall production trajectories.

In 2023, Argentina's conventional oil production experienced a slight decline, a trend mirrored by YPF's contribution from these mature fields. The company's focus is increasingly on its high-potential shale resources, aiming to transform into a more focused and efficient energy producer.

The 'Plan Andes' program had a significant financial impact, amounting to $300 million in 2024, reflecting the economic realities of divesting these mature fields and reshaping YPF's asset structure for future growth.

| BCG Category | YPF Asset Type | Characteristics | Strategic Action | 2024 Data/Impact |

|---|---|---|---|---|

| Dogs | Mature Conventional Oil & Gas Blocks | Low market share, low growth rate, high operating costs, declining production | Divestment (Plan Andes) | $300 million impact from asset returns |

| Legacy Assets | Limited future potential, decreasing contribution to overall production | Streamlining operations, focusing on shale | Conventional production share declining |

Question Marks

The Argentina LNG Export Project represents a potential 'Star' for YPF in the BCG Matrix. This ambitious initiative, aiming to position Argentina as a significant global LNG exporter by 2030-2032, promises high growth. YPF's commitment to a $10 billion plan underscores the scale of this future opportunity.

YPF Luz is making significant strides in Argentina's burgeoning renewable energy sector by developing new solar and wind farms. A prime example is the 'El Quemado 1' Photovoltaic Solar Park, showcasing YPF's commitment to this high-growth area. This expansion aligns with the rapid expansion of renewable energy sources in Argentina, a market experiencing substantial development.

These renewable energy initiatives by YPF Luz represent a strategic move into a high-potential, rapidly expanding market. While YPF's current market share in renewables is still in its formative stages, the substantial investments being made indicate a clear ambition to establish a dominant position. The ongoing construction of projects like El Quemado 1 underscores this strategy, positioning YPF Luz to capitalize on the increasing demand for clean energy in Argentina.

YPF's potential new petrochemical expansions into advanced or specialized products would likely position them as a Star in the BCG matrix. This assumes these segments represent high-growth markets, a common characteristic of advanced materials. For instance, the global advanced petrochemicals market was valued at approximately $200 billion in 2023 and is projected to grow at a CAGR of over 5% through 2030, driven by demand in automotive, electronics, and healthcare sectors.

Low-Carbon Hydrogen Initiatives

YPF's low-carbon hydrogen initiatives are positioned as potential Stars or Question Marks within the BCG matrix, reflecting their high-growth potential but also their current developmental stage. These projects align with the global shift towards decarbonization, a trend that is accelerating significantly. For instance, by 2024, the International Energy Agency (IEA) projected that global clean hydrogen production capacity could reach over 100 million tonnes annually by 2030, driven by government policies and private investment.

The exploration and development of these projects are forward-looking, tapping into a market that is expected to expand rapidly. However, establishing a strong market position requires considerable research and development, alongside substantial capital infusion. This investment is crucial for overcoming technological hurdles and building the necessary infrastructure to make low-carbon hydrogen economically viable and competitive.

- Market Potential: The global hydrogen market is projected to grow substantially, with low-carbon hydrogen expected to capture a significant share as energy transition policies gain momentum.

- Investment Needs: Significant upfront capital is required for R&D, pilot projects, and infrastructure development to commercialize low-carbon hydrogen production.

- Technological Advancement: Continuous innovation in electrolysis and carbon capture technologies is key to reducing production costs and improving efficiency.

- Policy Support: Government incentives, regulatory frameworks, and international collaborations are vital for de-risking investments and accelerating market adoption.

Digital Transformation and Real Time Intelligence Centers (RTIC)

YPF's investment in Real Time Intelligence Centers (RTIC) falls into the question mark category of the BCG matrix. These centers are crucial for digital transformation, aiming to boost efficiency throughout YPF's operations, from upstream exploration to downstream distribution.

While RTICs represent a high-growth area for technological advancement and are vital for future competitiveness, the initial investment is substantial, and the immediate return on investment may be lower compared to established, high-performing business units. For instance, similar investments in advanced analytics for the energy sector in 2024 have shown significant upfront costs for data infrastructure and specialized personnel, with tangible efficiency gains often materializing over a 2-3 year period.

- RTICs are strategic bets on future operational excellence.

- Initial investment in RTICs is high, with potentially lower immediate returns.

- These investments are critical for YPF's long-term digital transformation.

- The energy sector saw a 15% increase in spending on AI and data analytics in 2024, highlighting the trend.

YPF's low-carbon hydrogen initiatives are considered Question Marks due to their high growth potential and current developmental stage. These projects align with global decarbonization trends, with the IEA projecting over 100 million tonnes of annual clean hydrogen production capacity by 2030. Significant R&D and capital are needed to overcome technological hurdles and build competitive infrastructure for these ventures.

BCG Matrix Data Sources

Our YPF BCG Matrix leverages robust data from financial statements, market research reports, and industry performance metrics to accurately position each business unit.