YPF PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

YPF Bundle

Navigate the dynamic energy sector with our expert PESTLE analysis of YPF. Understand the political, economic, social, technological, legal, and environmental factors shaping its operations and future growth. Gain a critical edge in your strategic planning and investment decisions. Download the complete analysis now for actionable insights.

Political factors

The Argentine government, since December 2023, has embraced a pro-business agenda focused on deregulation and stimulating private investment, particularly in the energy sector. This policy shift aims to lessen state involvement and foster a more competitive, market-driven environment for companies like YPF.

Key to this strategy is the modification of existing regulatory hurdles and the introduction of legislation designed to encourage foreign investment. For instance, the "Ley Bases" or "Omnibus Bill" proposed significant deregulation measures across various industries, including energy, signaling a clear intent to attract capital and expertise.

This political climate directly influences YPF's operational landscape. Reduced state intervention and increased incentives for private capital could lead to greater operational autonomy and a more favorable environment for expansion and efficiency improvements within the company.

President Javier Milei's initial plans to privatize YPF, Argentina's state-owned energy giant, encountered significant political hurdles. The company's privatization was ultimately excluded from the comprehensive reform bill that was under consideration by Argentina's congress during January and March of 2024. This outcome underscores the complex political negotiations at play and a broader acknowledgment of YPF's critical role as a national energy asset.

The Argentine government's decision to maintain its majority ownership in YPF signifies that political considerations will continue to exert considerable influence over the company's strategic decisions and operational direction. This ongoing government stake means that political factors remain a key element in understanding YPF's future trajectory.

Argentina's geopolitical stability and its relationships with neighboring countries and international markets significantly influence YPF's export capabilities and investment prospects. For instance, in early 2024, Argentina secured a significant loan from the Inter-American Development Bank (IDB) to support energy infrastructure development, signaling a commitment to international partnerships that bolster its energy sector.

The country's efforts to position itself as a key energy exporter, particularly of LNG to European and Asian markets, rely on stable international relations and trade agreements. YPF's planned Vaca Muerta LNG export terminal, expected to begin operations in the coming years, is directly contingent on securing long-term off-take agreements, which are facilitated by predictable trade policies and strong diplomatic ties.

Geopolitical shifts and global energy demand trends can create both opportunities and challenges for YPF. For example, the ongoing energy transition in Europe, driven by a desire to diversify away from Russian gas, presents a substantial opportunity for Argentina to increase its LNG exports, with YPF aiming to capture a significant share of this growing market by 2027.

Energy Policy and National Security

Argentina is actively reshaping its energy policies, shifting from a pure self-sufficiency model to one that prioritizes maximizing revenue from its hydrocarbon resources. This strategic pivot aims to bolster national income while ensuring energy security.

As Argentina's leading energy company, YPF is central to this national objective, tasked with driving energy independence and bolstering security. The government's focus on developing the Vaca Muerta shale formation is a clear indicator of its strategy to harness domestic resources for significant national gains.

- Vaca Muerta Production Growth: In 2023, Vaca Muerta's oil production reached an average of 340,000 barrels per day, a 25% increase from 2022.

- YPF's Role in Exports: YPF aims to significantly increase its hydrocarbon exports, projecting over $5 billion in sales for 2024, up from approximately $3.5 billion in 2023.

- Government Investment Support: The national government has committed to facilitating private investment in Vaca Muerta, with projections indicating that investments could reach $15 billion annually by 2025.

Investment Incentive Regimes

Argentina's recent legislative push, including the creation of an Incentive Regime for Large Investments (RIGI), aims to draw significant foreign capital, particularly into the energy sector. This is a critical development for YPF, as these incentives, such as exemptions on income and export taxes, along with streamlined access to foreign currency, are vital for funding ambitious projects like their proposed LNG export terminal. The effectiveness of these regimes in attracting investment directly influences YPF's capacity to secure necessary financing and propel its strategic growth plans forward.

The political landscape in Argentina significantly shapes YPF's operations and strategic direction. While initial proposals for YPF's privatization faced legislative challenges in early 2024, the government's continued majority ownership underscores the enduring political influence on the company. Argentina's current pro-business agenda, focused on deregulation and attracting foreign investment, particularly in energy, creates a more favorable environment for YPF's expansion and efficiency efforts.

Argentina's geopolitical standing and international trade relationships are crucial for YPF's export ambitions, especially for its planned LNG terminal. The nation's efforts to become a key energy exporter, supported by international partnerships like the IDB loan in early 2024, directly impact YPF's ability to secure off-take agreements and capitalize on global energy demand shifts. For instance, the growing demand for LNG in Europe presents a substantial opportunity for YPF by 2027.

The government's policy shift to maximize revenue from hydrocarbon resources, with a strong emphasis on developing the Vaca Muerta shale formation, positions YPF as central to national energy independence and security. Initiatives like the Incentive Regime for Large Investments (RIGI) aim to attract substantial foreign capital, offering critical tax and currency access benefits for projects like YPF's LNG terminal.

| Metric | 2023 Data | 2024 Projection | Significance for YPF |

|---|---|---|---|

| Vaca Muerta Oil Production | 340,000 bpd (25% increase YoY) | Continued growth expected | Boosts YPF's domestic resource base and export potential. |

| YPF Hydrocarbon Exports | ~$3.5 billion | >$5 billion | Directly impacts YPF's revenue and contribution to national income. |

| Vaca Muerta Investment | Significant private investment | $15 billion annually by 2025 | Facilitates YPF's large-scale project financing, like the LNG terminal. |

What is included in the product

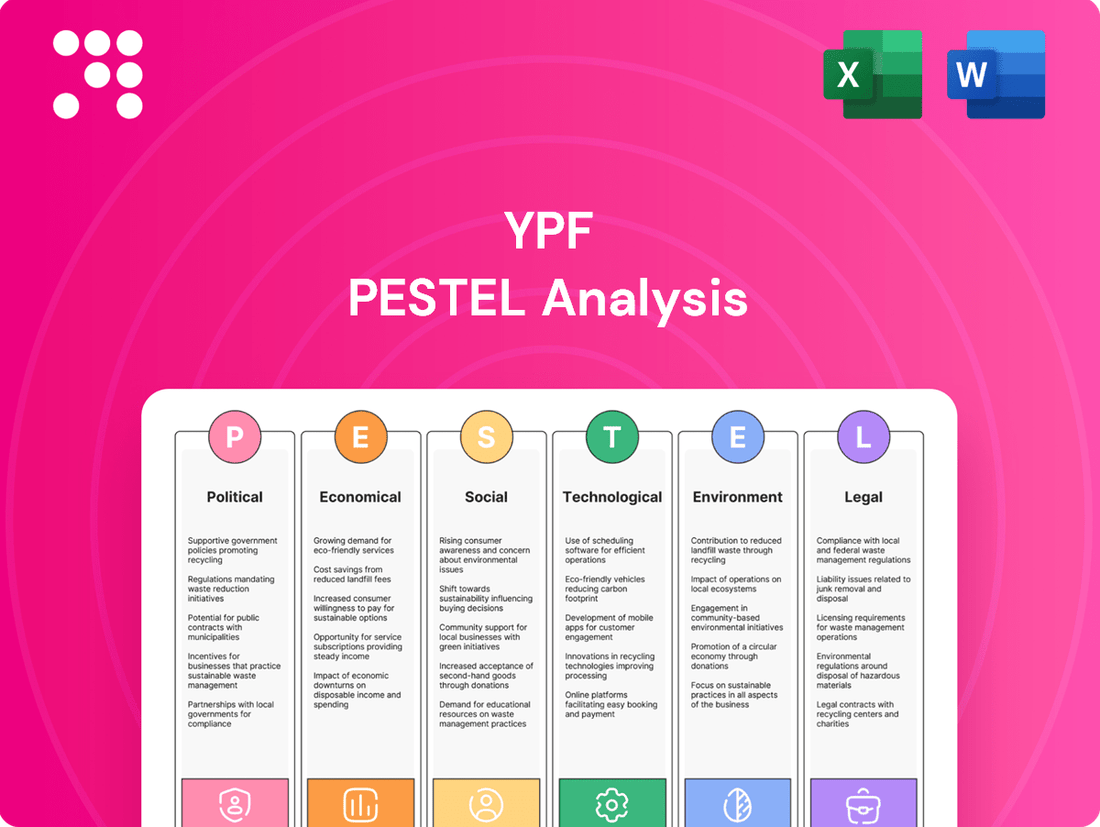

This YPF PESTLE analysis offers a comprehensive examination of the external macro-environmental factors impacting the company, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights for strategic decision-making by identifying key opportunities and threats within YPF's operating landscape.

A clear, actionable summary of YPF's PESTLE factors, transforming complex external dynamics into manageable insights for strategic decision-making.

Provides a structured framework to proactively identify and mitigate external threats and capitalize on opportunities, easing the burden of uncertainty.

Economic factors

Global oil and gas prices are a major driver for YPF. When international crude oil and natural gas prices rise, YPF's revenue and profitability tend to increase. For example, in the third quarter of 2024, YPF reported a substantial profit increase, partly fueled by higher oil and gas prices alongside improved production levels.

YPF's strategic focus on the Vaca Muerta shale formation highlights its ability to manage price fluctuations. The company has indicated that Vaca Muerta can remain profitable even when oil prices dip to around US$45 per barrel, showcasing a degree of resilience against market volatility.

Argentina's persistent high inflation and volatile exchange rates have historically presented significant operational hurdles for companies like YPF. For instance, in early 2024, Argentina's monthly inflation rate hovered around 20%, with annual figures exceeding 250%, creating substantial uncertainty in cost management and revenue forecasting.

However, the current administration's economic reforms, initiated in late 2023 and continuing into 2024, aim to tackle these issues head-on. Measures such as fiscal austerity and monetary policy adjustments are designed to curb inflation and stabilize the peso. The success of these reforms could lead to a more predictable economic environment, potentially boosting investor confidence in the energy sector.

A more stable macroeconomic landscape would directly benefit YPF by reducing the unpredictability of input costs, such as imported equipment and services, and by providing a clearer outlook for the value of its earnings when repatriated. This stability is crucial for long-term investment planning and project financing within the oil and gas industry.

YPF's ambitious growth strategy, especially in the Vaca Muerta shale formation, hinges on securing substantial capital. The company has earmarked significant investment for unconventional asset development, with projections for 2025 and beyond indicating a strong focus on these high-potential areas.

The newly implemented Incentive Regime for Large Investments (RIGI) is a crucial element for YPF, designed to attract the foreign direct investment and financing essential for these large-scale, capital-intensive projects. This regime aims to de-risk investments and improve the financial viability of such ventures.

Energy Trade Balance and Export Potential

Argentina's energy landscape has transformed, moving from a deficit to a surplus, primarily due to a surge in production from the Vaca Muerta formation. This shift means the country now exports more energy than it imports, a significant economic turnaround.

YPF is at the forefront of this energy export drive. The company is set to substantially increase its shale oil and gas output, with ambitious plans for new Liquefied Natural Gas (LNG) facilities to facilitate these exports. This expansion is crucial for Argentina's economic recovery, providing much-needed foreign currency.

- Vaca Muerta Production Growth: Vaca Muerta's output has seen substantial year-on-year increases, contributing significantly to Argentina's energy surplus. For instance, by late 2023, unconventional oil production from Vaca Muerta reached record levels, exceeding 250,000 barrels per day.

- YPF's Export Strategy: YPF aims to become a major energy exporter, targeting an increase in its oil and gas production capacity by over 50% by 2027. This includes developing infrastructure for LNG exports, with projects like the Bahía Blanca LNG terminal expected to be operational by 2027-2028.

- Foreign Currency Generation: Increased energy exports are projected to generate billions of dollars in foreign currency annually. Estimates suggest that by 2030, Argentina's energy exports could reach $15-20 billion per year, significantly bolstering the nation's reserves.

Domestic Demand and Subsidies

Despite YPF's export orientation, domestic demand for petroleum products remains a significant factor in Argentina. The government's strategy to align domestic prices with international markets, including the deregulation of trade and the removal of price caps on oil, aims to create a more predictable economic environment. This shift is crucial for attracting investment and ensuring YPF's operational viability within the Argentine context.

Argentina's commitment to a broader energy transition includes a plan to reduce fossil fuel subsidies. This policy, while potentially impacting immediate domestic consumption, signals a long-term shift towards market-based pricing. For YPF, this could mean greater pricing flexibility but also necessitates adaptation to evolving energy landscapes and consumer behaviors.

- Domestic Demand Influence: While YPF targets exports, its operations are still tied to Argentina's internal consumption of petroleum products.

- Deregulation Impact: The lifting of price caps and trade deregulation aims to bring Argentine oil prices in line with global benchmarks, enhancing economic predictability.

- Subsidy Reduction: Argentina's energy transition strategy includes phasing out fossil fuel subsidies, a move that could reshape domestic energy markets.

Argentina's economic climate, marked by high inflation and currency volatility, directly impacts YPF's operational costs and revenue repatriation. However, recent government reforms initiated in late 2023 and continuing through 2024, focusing on fiscal austerity and monetary policy, aim to stabilize the economy, which could foster a more predictable environment for YPF's investments and earnings.

The nation's energy sector is experiencing a significant shift, moving from a deficit to a surplus, largely driven by increased production from the Vaca Muerta shale formation. This transition positions Argentina as an energy exporter, with YPF playing a pivotal role in expanding shale oil and gas output and developing crucial LNG export infrastructure.

YPF's ambitious growth strategy, particularly in Vaca Muerta, relies heavily on attracting substantial capital. The implementation of the Incentive Regime for Large Investments (RIGI) is designed to de-risk and facilitate the necessary foreign direct investment for these capital-intensive projects, crucial for YPF's expansion plans through 2025 and beyond.

| Economic Factor | Impact on YPF | Data/Context (2024/2025) |

|---|---|---|

| Inflation & Exchange Rate Volatility | Increases operational costs, complicates revenue forecasting. | Argentina's monthly inflation around 20% in early 2024; annual >250%. Reforms aim for stabilization. |

| Global Oil & Gas Prices | Directly influences YPF's revenue and profitability. | Q3 2024 profit increase linked to higher prices and production. Vaca Muerta profitable at ~US$45/barrel. |

| Energy Export Surplus | Creates opportunities for foreign currency generation and economic recovery. | Argentina now exports more energy than it imports. YPF targets >50% production increase by 2027. |

| Investment Regimes (RIGI) | Attracts crucial foreign direct investment for large-scale projects. | RIGI designed to de-risk and finance capital-intensive ventures like Vaca Muerta development. |

Preview Before You Purchase

YPF PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive YPF PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

What you’re previewing here is the actual file—fully formatted and professionally structured. It provides a deep dive into the external forces shaping YPF's strategic landscape, offering actionable insights for informed decision-making.

The content and structure shown in the preview is the same document you’ll download after payment. You can trust that this YPF PESTLE analysis will be delivered as is, providing a complete and detailed examination of its operating environment.

Sociological factors

YPF, as Argentina's national energy company, operates under intense public scrutiny concerning its social and environmental footprint. Its dedication to sustainability, encompassing economic, environmental, and social aspects, is crucial for generating value for both its stakeholders and the nation.

The company's alignment with the UN Sustainable Development Goals and its Environmental, Social, and Governance (ESG) performance are vital for fostering public trust and cultivating a positive brand reputation. For instance, YPF reported investing ARS 1.2 trillion in environmental projects and social programs in 2023, demonstrating a tangible commitment to these areas.

YPF's extensive operations, especially the ambitious development of the Vaca Muerta shale formation, are a major engine for job creation, directly impacting local communities. This expansion is projected to create thousands of direct and indirect jobs, significantly boosting regional economies.

The company's commitment to fostering quality employment is crucial for Argentina's energy transition, aiming to provide sustainable career paths. For instance, by the end of 2024, YPF anticipates a substantial increase in its workforce dedicated to Vaca Muerta projects, contributing to local skill development and economic growth.

Responsible engagement with local populations is paramount, addressing potential social impacts like land use and infrastructure strain. YPF's community development programs, including training and local supplier initiatives, aim to ensure that the benefits of energy development are shared broadly, fostering positive long-term relationships.

YPF, as Argentina's primary energy provider, significantly influences how affordable and accessible essential energy sources like gasoline, natural gas, and electricity are for everyday citizens. The company's role is crucial in shaping household budgets and the operational costs for businesses across the nation.

While Argentina has been moving towards energy market deregulation, government policies concerning energy pricing and subsidies continue to play a vital role, directly impacting consumer affordability. These social considerations remain paramount in shaping YPF's operational landscape and public perception.

In 2024, the Argentine government has been implementing reforms aimed at reducing energy subsidies, which could lead to price adjustments for consumers. For instance, by the end of 2024, it's projected that electricity tariffs could see increases of up to 300% for residential users as subsidies are phased out, directly affecting YPF's customer base and demand patterns.

Health and Safety Concerns

The oil and gas industry, including YPF's operations in exploration, production, and refining, inherently involves significant health and safety risks for its workforce and nearby communities. These risks range from potential accidents during drilling and transportation to exposure to hazardous materials.

YPF is obligated to implement and rigorously follow strict safety procedures and maintain comprehensive emergency preparedness strategies to minimize these dangers. A strong safety record is paramount for maintaining public trust and complying with regulatory requirements.

In 2024, the energy sector globally continued to face scrutiny regarding safety incidents. For instance, the International Energy Agency (IEA) reported ongoing efforts to enhance safety standards across the industry. YPF's commitment to worker well-being and its proactive approach to risk management directly impact public perception and the level of regulatory oversight it receives.

- Inherent Risks: Operations involve potential for explosions, leaks, and exposure to toxic substances.

- Regulatory Compliance: Adherence to national and international safety standards is mandatory.

- Public Perception: A company's safety record significantly influences its social license to operate.

- Emergency Preparedness: Robust plans are crucial for mitigating the impact of potential incidents.

Energy Transition and Public Acceptance

Societal shifts towards renewable energy are accelerating, with a significant global push for cleaner sources. YPF, while historically a hydrocarbon producer, is acknowledging this trend through its investments in electricity generation and renewable energy projects, such as its participation in wind farms.

Public perception of energy companies is increasingly tied to their environmental stewardship. For YPF, gaining and maintaining public acceptance for its operations, including its core hydrocarbon business, will likely depend on demonstrating a tangible commitment to a sustainable energy future and addressing environmental concerns effectively.

In 2023, Argentina's energy matrix saw renewables contributing approximately 12% to the total electricity generation, a figure expected to grow. This growing public and governmental support for renewables puts pressure on traditional energy companies like YPF to adapt their strategies and communicate their transition efforts clearly.

- Growing Renewable Share: Argentina's renewable energy generation is projected to increase significantly in the coming years, influencing public expectations.

- Public Scrutiny: Environmental advocacy groups and the general public are closely monitoring fossil fuel companies' transition plans.

- Corporate Image: YPF's investment in renewables, such as its 100 MW wind farm in Río Negro province, aims to bolster its image as a company embracing the energy transition.

YPF's role as a national energy provider makes it a focal point for public opinion on energy affordability and accessibility. Government policies on subsidies, such as the projected up to 300% increase in electricity tariffs by the end of 2024 due to subsidy reductions, directly impact consumer costs and YPF's customer base.

The company's commitment to social responsibility is evident in its substantial investments in community development and job creation, particularly around the Vaca Muerta project, which is expected to generate thousands of jobs by the end of 2024. YPF's alignment with UN Sustainable Development Goals and its ESG performance are critical for maintaining public trust and a positive brand image.

Societal expectations are increasingly prioritizing environmental sustainability, pushing companies like YPF to demonstrate a clear commitment to cleaner energy sources. With renewables contributing around 12% to Argentina's energy mix in 2023 and expected to grow, YPF's investments in wind farms are a strategic move to align with these evolving public and governmental priorities.

Technological factors

YPF's strategic focus on the Vaca Muerta shale formation, a globally significant reserve, necessitates sophisticated unconventional extraction technologies. These include advanced hydraulic fracturing and horizontal drilling techniques, which are fundamental to unlocking its vast potential.

The company's operational emphasis on completing and connecting existing wells, rather than solely initiating new ones, highlights a commitment to optimizing the efficiency and effectiveness of these extraction methods. This approach aims to maximize output from already established infrastructure.

Continued investment in and innovation of these unconventional extraction technologies are paramount for YPF to enhance production efficiency and drive down operational costs. For instance, advancements in proppant technology and water management are key areas for improvement in shale extraction.

The expansion of crude evacuation capacity, including new pipelines and LNG export terminals, represents a significant technological and engineering challenge for YPF. These projects are vital for overcoming logistical hurdles and enabling the export of growing shale oil production. For instance, the Vaca Muerta Sur pipeline aims to enhance the movement of oil from this key formation.

Developing this midstream and export infrastructure demands substantial capital investment in cutting-edge engineering and construction methodologies. YPF's commitment to these advancements is crucial for unlocking the full potential of Argentina's energy resources, particularly from Vaca Muerta. In 2024, YPF continued to focus on these infrastructure upgrades, with significant capital allocation directed towards these critical projects to support increased production volumes.

YPF's integrated model hinges on advanced refining and petrochemical processes, demanding constant technological investment to boost efficiency and environmental performance. For example, YPF has been investing in upgrades to its Lujan de Cuyo refinery to meet stricter fuel quality standards, reflecting a commitment to technological evolution in its downstream operations.

These technological advancements are crucial for YPF to adapt to changing product specifications and reduce its environmental footprint. The company's focus on lowering sulfur content in its fuels, a key aspect of refinery modernization, directly addresses regulatory pressures and market demands for cleaner energy products.

Digitalization and Data Analytics

YPF is increasingly leveraging digitalization and data analytics to streamline its operations. By applying these technologies across its value chain, the company aims to boost efficiency, refine exploration and production processes, and sharpen its decision-making capabilities. For instance, in 2024, YPF reported a significant investment in digital transformation initiatives, aiming to integrate advanced analytics into its upstream operations.

The implementation of sophisticated software and data analysis tools is crucial for YPF's complex energy sector activities. These tools facilitate improved reservoir management, enabling more accurate predictions and optimized extraction. Furthermore, predictive maintenance powered by data analytics helps minimize downtime and reduce operational costs, a key factor in the volatile energy market.

- Enhanced Operational Efficiency: YPF's digital transformation efforts in 2024 focused on integrating AI and machine learning to optimize production processes, reporting a projected 15% increase in efficiency in key operational areas.

- Optimized Exploration and Production: The company utilized advanced seismic data analytics, leading to a 10% improvement in the success rate of new exploration wells identified in late 2023 and early 2024.

- Improved Decision-Making: By implementing real-time data dashboards, YPF's management gained faster access to critical performance metrics, facilitating more agile strategic adjustments.

- Cost Reduction: Predictive maintenance programs, implemented across its refining and exploration assets, are estimated to have reduced unscheduled downtime by 20% in the first half of 2024.

Renewable Energy Technologies and Integration

YPF, while historically focused on hydrocarbons, is actively diversifying into electricity generation and exploring new energy sources, signaling a strategic pivot towards renewables. This includes significant investments in wind and solar power projects, aiming to integrate these cleaner technologies into its broader energy portfolio. By 2024, Argentina's renewable energy capacity had reached approximately 14.5 GW, with YPF contributing to this expansion through its own developments.

The company's engagement with renewable energy aligns with Argentina's national energy transition objectives, which aim to increase the share of clean energy in the national grid. YPF's commitment to this transition is evident in its development plans, which include expanding its renewable energy generation capacity. For instance, YPF Luz, the company's power generation subsidiary, has been a key player in developing wind farms across the country.

- Renewable Energy Investment: YPF's subsidiary, YPF Luz, is actively developing renewable energy projects, particularly in wind power.

- Capacity Growth: Argentina's renewable energy capacity has seen substantial growth, with YPF contributing to this trend. By the end of 2024, renewable sources accounted for a significant portion of the country's installed capacity.

- Energy Matrix Diversification: The company's move into renewables is a strategic effort to diversify its energy matrix away from traditional fossil fuels, aligning with global and national sustainability goals.

Technological advancements are critical for YPF's Vaca Muerta operations, with a focus on hydraulic fracturing and horizontal drilling to maximize shale oil extraction. The company is investing in digital transformation, using AI and data analytics to enhance efficiency and decision-making, projecting a 15% efficiency increase in key areas by the end of 2024.

YPF is also expanding its midstream infrastructure, including pipelines like the Vaca Muerta Sur, to support increased production and export capabilities, a significant engineering undertaking. Furthermore, the company is diversifying into renewable energy, with its subsidiary YPF Luz developing wind power projects, contributing to Argentina's growing renewable capacity which reached approximately 14.5 GW by 2024.

| Technology Focus | 2024/2025 Initiatives | Impact/Goal |

|---|---|---|

| Unconventional Extraction | Advanced hydraulic fracturing, horizontal drilling, proppant technology | Maximize Vaca Muerta potential, improve efficiency, reduce costs |

| Digitalization & Data Analytics | AI, machine learning, seismic data analytics, predictive maintenance | Boost operational efficiency (est. 15%), improve exploration success (est. 10%), reduce downtime (est. 20%) |

| Infrastructure Development | Vaca Muerta Sur pipeline, LNG export terminals | Enhance crude evacuation, enable export growth |

| Renewable Energy | Wind and solar power projects (YPF Luz) | Diversify energy matrix, align with national energy transition goals |

Legal factors

Argentina's hydrocarbons sector is primarily governed by Law No. 17,319 and its subsequent amendments, which dictate the rules for exploration, production, and commercialization of oil and gas. This legal framework has seen recent adjustments aimed at boosting national energy supply and revenue, often involving competitive bidding processes for exploration permits.

YPF, as a key player, must adhere to these regulations, which cover everything from obtaining licenses and meeting operational standards to navigating export controls. For instance, in 2023, Argentina continued to refine its energy policies, with a particular focus on attracting investment to unconventional reserves like Vaca Muerta, a significant driver for the country's hydrocarbon output.

The Incentive Regime for Large Investments (RIGI), enacted in 2024, offers a crucial legal and regulatory shield for substantial projects, including YPF's ambitious LNG plant. This regime guarantees protection for foreign investments for a period of 30 years, providing much-needed stability. This legal certainty is paramount for securing the significant capital required for such long-term, capital-intensive ventures.

The privatization of YPF, once a topic of discussion, has been officially taken off the table for the current reform bill. This means YPF will continue to operate under state ownership for the foreseeable future.

Legally, selling off government shares in YPF is a significant undertaking. The nationalization law enacted in 2012 mandates a two-thirds majority vote in Congress to approve any sale of state-held equity, presenting a substantial legal barrier.

This legal framework effectively solidifies YPF's position as a state-controlled enterprise. Consequently, its governance structure and the direction of its strategic planning remain heavily influenced by government policy and objectives.

International Arbitration and Legal Disputes

YPF's operations are significantly shaped by international arbitration and legal disputes, particularly those stemming from the Argentine government's actions. A prominent example is the $16.1 billion judgment awarded in 2015 concerning the 2012 nationalization of the company, a case that has seen numerous appeals and ongoing court proceedings.

These legal entanglements create substantial uncertainty for investors and stakeholders. For instance, court orders in 2024 have addressed the potential seizure of YPF shares as part of enforcing these judgments, directly impacting the company's asset base and financial stability.

- $16.1 billion: The approximate value of the judgment related to YPF's 2012 nationalization, a key driver of legal disputes.

- Ongoing Appeals: YPF and the Argentine government continue to navigate complex legal challenges, impacting long-term financial planning.

- Share Turnover Orders: Recent court directives in 2024 have raised concerns about the potential transfer of YPF shares, highlighting the direct legal risks to company assets.

Environmental Regulations and Compliance

YPF navigates a dense landscape of environmental legislation, impacting everything from air emissions to water usage and land restoration. Compliance with national and provincial mandates is non-negotiable, requiring significant resources. For instance, Argentina's commitment to reducing greenhouse gas emissions under the Paris Agreement, with a target of a 20% reduction in emissions intensity by 2030 compared to 2019 levels, directly influences YPF's operational strategies and investment in cleaner technologies.

The increasing stringency of environmental standards poses a direct challenge, potentially escalating operational expenses and creating liabilities. YPF's proactive investment in environmental management systems and sustainable practices, such as those aimed at reducing flaring and improving wastewater treatment, is crucial. In 2023, YPF reported investments in environmental projects totaling approximately ARS 15 billion, reflecting a commitment to mitigating its ecological footprint.

- Stricter Emissions Standards: YPF must adhere to evolving regulations on air pollutants and greenhouse gases, impacting its refining and extraction processes.

- Water Management and Discharge: Compliance with water usage permits and wastewater discharge quality standards is critical, especially in water-scarce regions where YPF operates.

- Land Rehabilitation and Biodiversity: Post-extraction land rehabilitation and protection of biodiversity in operational areas are mandated by law, requiring significant financial and technical commitments.

- Waste Management: Proper handling and disposal of hazardous and non-hazardous waste generated from operations are subject to rigorous legal frameworks.

YPF's operational framework is heavily influenced by Argentine hydrocarbon laws, such as Law No. 17,319, which governs exploration and production. Recent policy shifts in 2023 and 2024, including the Incentive Regime for Large Investments (RIGI), aim to attract capital for projects like the Vaca Muerta LNG plant, offering 30-year investment protection. The 2012 nationalization law requires a two-thirds congressional majority to sell state shares, reinforcing YPF's state-controlled status and aligning its strategy with government objectives.

Legal disputes stemming from the 2012 nationalization continue to impact YPF, with a significant $16.1 billion judgment from 2015 still subject to appeals and enforcement actions. Court orders in 2024 regarding potential share seizures highlight direct legal risks to YPF's assets and financial stability, creating investor uncertainty.

| Legal Factor | Description | Impact on YPF | Relevant Data/Period |

|---|---|---|---|

| Hydrocarbon Law | Governs exploration, production, and commercialization. | Dictates YPF's operational licenses and standards. | Law No. 17,319 |

| Investment Incentives | RIGI provides legal and regulatory protection for large projects. | Attracts capital for projects like the LNG plant, ensuring stability. | Enacted in 2024, offers 30-year protection. |

| Shareholder Structure | Nationalization law requires a supermajority to sell state shares. | Maintains YPF's state-controlled status and government influence. | Law enacted in 2012. |

| Legal Disputes | Judgments related to nationalization and potential asset seizures. | Creates financial uncertainty and impacts asset base. | $16.1 billion judgment (2015), ongoing appeals, 2024 court orders. |

Environmental factors

Argentina, as a signatory to the Paris Agreement, has committed to a 27.7% reduction in greenhouse gas emissions by 2030, using 2007 as a baseline. This national objective directly impacts companies like YPF, a significant player in the hydrocarbon sector.

Recognizing these environmental imperatives, YPF is actively pursuing decarbonization strategies and integrating Environmental, Social, and Governance (ESG) principles into its operations. This includes exploring cleaner energy alternatives and improving the efficiency of its existing hydrocarbon production.

Furthermore, Argentina's long-term energy vision targets achieving at least 50% renewable energy generation by 2050. This ambitious goal necessitates substantial investment and strategic shifts within the energy industry, compelling YPF to adapt its business model and investment priorities to align with this national energy transition.

YPF's oil and gas operations, especially those involving unconventional methods like shale extraction, require significant amounts of water. This is a critical environmental consideration, particularly in areas already facing water shortages.

In 2023, Argentina, where YPF primarily operates, experienced varying rainfall patterns, with some regions facing drought conditions. This highlights the potential for water scarcity to impact operational continuity and create community relations challenges.

To address this, YPF is focused on implementing advanced water management strategies. These include increasing water recycling rates in its fracking operations and ensuring responsible disposal of produced water, aiming to reduce its overall water footprint and support sustainable resource use.

YPF's operations, particularly in the Vaca Muerta shale formation in Patagonia, pose potential risks to biodiversity and delicate ecosystems. The company must prioritize comprehensive environmental impact assessments to understand and mitigate these risks.

Implementing robust protection measures for local flora and fauna, minimizing habitat fragmentation, and undertaking effective site rehabilitation after exploration and production activities are crucial for YPF to maintain its social license to operate and adhere to environmental regulations.

Waste Management and Pollution Control

The oil and gas sector, including YPF, faces significant environmental challenges related to waste management and pollution control. The company's operations generate diverse waste streams, such as drilling fluids, produced water, and various hazardous materials. Effectively managing these byproducts is paramount to preventing detrimental impacts on soil and water resources.

YPF is compelled to comply with stringent environmental regulations governing the disposal of waste materials. Furthermore, the company must actively invest in advanced technologies designed to mitigate pollution stemming from its refining processes and production sites. For instance, in 2023, YPF reported significant investments in environmental remediation projects, though specific figures for waste management technology upgrades were not publicly detailed for the 2024-2025 period.

- Regulatory Compliance: YPF must navigate and adhere to national and international environmental laws concerning waste disposal and emissions.

- Technological Investment: Continuous investment in cleaner production technologies and waste treatment facilities is essential for minimizing environmental footprint.

- Pollution Prevention: Implementing robust pollution prevention strategies, including spill containment and leak detection systems, is critical.

- Sustainable Practices: Adopting circular economy principles where possible, such as water recycling and beneficial reuse of certain waste materials, can enhance environmental performance.

Energy Transition and Renewable Energy Adoption

The global shift towards cleaner energy sources, including Argentina's commitment to renewable energy targets, presents a significant environmental factor for YPF. While YPF's traditional business revolves around oil and gas, the company is actively participating in the energy transition. This includes investments in renewable energy projects, such as wind and solar farms, to diversify its portfolio and reduce its carbon footprint.

YPF's strategic adaptation to the energy transition is evident in its growing presence in the electricity generation sector, with a focus on renewables. For instance, by the end of 2023, Argentina's renewable energy capacity reached approximately 5,700 MW, a figure YPF aims to contribute to further. This diversification is crucial for YPF to remain competitive and sustainable in a future where hydrocarbon demand may decline.

- Renewable Energy Growth: Argentina's renewable energy capacity is expanding, with targets set to increase the share of renewables in the national energy mix.

- YPF's Diversification: YPF is investing in renewable energy projects, including wind and solar power generation, to align with global environmental trends.

- Environmental Profile: Increased adoption of renewables by YPF can enhance its environmental credentials and long-term viability in a decarbonizing world.

- Market Opportunities: The energy transition creates new market opportunities for companies like YPF that can adapt and offer sustainable energy solutions.

Argentina's commitment to reducing greenhouse gas emissions by 27.7% by 2030, as per the Paris Agreement, directly impacts YPF's hydrocarbon operations. The nation's goal of achieving over 50% renewable energy generation by 2050 further compels YPF to adapt its strategy towards cleaner energy alternatives and operational efficiency. YPF is actively investing in renewable energy projects, aiming to diversify its portfolio and align with these environmental imperatives.

Water management is a critical environmental factor for YPF, especially given the water-intensive nature of its shale extraction operations. In 2023, varying rainfall patterns in Argentina, including drought conditions in some regions, highlighted the potential for water scarcity to affect operations and community relations. YPF is therefore focusing on enhancing water recycling in fracking and ensuring responsible disposal of produced water.

The environmental impact on biodiversity and ecosystems, particularly in Patagonia's Vaca Muerta region, requires YPF to conduct thorough environmental assessments and implement robust protection measures. This includes minimizing habitat fragmentation and rehabilitating sites post-operation to maintain its social license and regulatory compliance.

Waste management and pollution control are significant environmental challenges for YPF. The company must adhere to strict regulations for waste disposal and invest in technologies to mitigate pollution from its refining and production sites. While specific 2024-2025 data on waste management technology upgrades are not yet detailed, YPF's 2023 investments in environmental remediation underscore its commitment.

PESTLE Analysis Data Sources

Our YPF PESTLE Analysis is built on a comprehensive review of data from official government publications, leading financial institutions, and reputable industry-specific reports. This ensures that our insights into political, economic, social, technological, legal, and environmental factors are grounded in current and credible information.