YPF Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

YPF Bundle

YPF navigates a complex energy landscape where supplier power can significantly impact costs, and the threat of substitutes looms large in the transition to renewables. Understanding these dynamics is crucial for any stakeholder.

The complete report reveals the real forces shaping YPF’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

YPF's growing investment in unconventional resources, particularly the Vaca Muerta shale formation, necessitates specialized drilling and hydraulic fracturing equipment. This reliance on advanced technology and the service providers who operate it significantly boosts supplier bargaining power. For example, companies offering proprietary fracking techniques or highly specialized drilling rigs command higher prices due to their unique capabilities and limited competition.

The development of critical infrastructure, like YPF's Vaca Muerta Sur pipeline, significantly amplifies supplier bargaining power. This is due to the highly specialized engineering, construction, and material requirements.

In Argentina, the scarcity of firms possessing the expertise for such massive and intricate projects grants these suppliers considerable leverage. They can dictate terms on pricing, contract specifics, and crucial project schedules, impacting YPF's operational efficiency and costs.

Suppliers of capital, such as banks and institutional investors, wield considerable influence, particularly for YPF's large-scale undertakings like LNG facilities. YPF's reliance on partnerships and external funding for its major projects means these capital providers can often set the terms of financing, influenced by prevailing market rates and YPF's financial standing.

In 2023, YPF secured significant financing, including a $500 million bond issuance with a 7.5% coupon, demonstrating the cost of capital. The company's credit rating, which influences borrowing costs, is a key factor in these negotiations, highlighting the power of financial institutions to dictate terms based on risk assessments.

Labor and Specialized Workforce

The energy sector, especially unconventional oil and gas, relies on a specialized workforce. This includes geologists, engineers, and technicians with unique skill sets. The availability of this talent in Argentina directly affects YPF's operational costs and project execution.

A scarcity of this specialized talent can significantly increase labor costs. This situation grants unions or individual highly skilled experts greater leverage, potentially impacting YPF's budget and project schedules. For instance, in 2023, the average salary for a petroleum engineer in Argentina could range significantly based on experience and location, reflecting this specialized demand.

- Specialized Skill Demand: The need for geologists, reservoir engineers, and drilling specialists is critical for YPF's operations.

- Talent Scarcity Impact: Limited availability of these professionals can drive up wages and increase the bargaining power of labor.

- Union Influence: Strong unions in the energy sector can negotiate favorable terms, affecting YPF's labor expenses.

- Project Timelines: Delays in securing specialized personnel can directly impact the commencement and progress of exploration and production projects.

Government Regulations and Local Content Requirements

Government regulations significantly impact YPF's supplier dynamics, even as a state-controlled entity. Policies mandating local content, for instance, can compel YPF to source materials or services from domestic providers, potentially at higher costs than international alternatives.

These regulations are designed to foster national industries and employment. For example, in 2024, Argentina continued to emphasize local sourcing in its energy sector, with specific directives aimed at increasing the participation of Argentine companies in oil and gas projects. This can limit YPF's ability to negotiate the best prices or access the most advanced technologies from global suppliers.

- Local Content Mandates: Government policies can force YPF to prioritize domestic suppliers, potentially increasing procurement costs.

- Reduced Supplier Choice: Restrictions on international sourcing limit YPF's flexibility and bargaining power with global providers.

- Impact on Efficiency: Sourcing from less efficient local suppliers due to regulations can affect operational costs and project timelines.

YPF's reliance on specialized equipment for unconventional resource development, like Vaca Muerta shale, grants significant leverage to suppliers of proprietary technology and advanced drilling services. The scarcity of firms possessing these unique capabilities allows them to command premium pricing and favorable contract terms.

Furthermore, the construction of critical infrastructure for projects such as the Vaca Muerta Sur pipeline requires highly specialized engineering and materials, concentrating power in the hands of a few experienced contractors. This limited pool of expertise enables suppliers to dictate terms, impacting YPF's project costs and timelines.

The availability of specialized labor, including geologists and engineers, is another key factor. A shortage of these skilled professionals in Argentina can drive up wages and empower labor unions, influencing YPF's operational expenses and project execution schedules.

Government regulations, such as local content mandates, also strengthen supplier bargaining power by limiting YPF's options for sourcing materials and services. In 2024, Argentina's continued emphasis on local participation in energy projects means YPF may face higher costs and reduced access to advanced global technologies.

| Factor | Impact on YPF | Supplier Leverage |

|---|---|---|

| Specialized Technology for Vaca Muerta | Increased reliance on specific equipment providers | High |

| Infrastructure Development Expertise | Need for specialized engineering and construction firms | High |

| Scarcity of Skilled Energy Professionals | Potential for higher labor costs and project delays | Moderate to High |

| Local Content Regulations (2024) | Mandated sourcing from domestic suppliers | Moderate |

What is included in the product

This analysis unpacks the competitive forces shaping YPF's energy market, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the industry.

Instantly identify and address competitive threats with a dynamic, interactive YPF Porter's Five Forces model, allowing for rapid strategic adjustments.

Customers Bargaining Power

YPF's commanding presence in Argentina's domestic fuel market, where it supplies around 56% of all fuel, significantly curtails the bargaining power of individual retail customers. This dominance means consumers have fewer readily available alternatives, making them less likely to exert pressure on pricing or terms.

In Argentina, YPF's pricing power is significantly curtailed by government regulations, particularly for energy products consumed domestically. This regulatory environment effectively amplifies the bargaining power of consumers, as the government often acts as their proxy in price negotiations. For instance, in 2024, fuel prices in Argentina remained a sensitive issue, with the government frequently intervening to manage inflation and ensure affordability for the general population, thereby limiting YPF's pricing autonomy.

YPF is strategically broadening its reach by increasing crude oil exports and developing liquefied natural gas (LNG) export capabilities. This move significantly expands its customer base beyond Argentina's borders, lessening the sway of any single buyer.

By cultivating a more diverse international clientele, YPF aims to dilute the bargaining power of individual customers. This diversification creates alternative revenue avenues, making the company less dependent on the demands of its domestic market alone.

Industrial and Commercial Customers

Large industrial and commercial clients, especially those needing significant energy or petrochemical volumes, wield considerable bargaining power. Their sheer scale allows them to negotiate favorable terms or even switch suppliers, a factor YPF must contend with. This is particularly true for YPF's electricity generation segment, where large industrial users are key customers.

For instance, in 2023, YPF's revenue from its energy segment, which includes electricity generation and distribution, was a significant portion of its overall income. Major industrial consumers, representing a substantial portion of this revenue, can leverage their demand to secure better pricing or service level agreements. Their ability to explore alternative energy sources or suppliers further amplifies their influence.

- Customer Concentration: YPF's industrial and commercial customer base may exhibit concentration, meaning a few large clients account for a significant percentage of sales, increasing their leverage.

- Switching Costs: While switching suppliers can involve costs, large industrial users may have the resources and foresight to minimize these, thereby enhancing their bargaining position.

- Price Sensitivity: Industrial customers, particularly those in competitive markets, are often highly price-sensitive, making them more inclined to negotiate aggressively on energy and petrochemical costs.

Impact of Macroeconomic Conditions

Argentina's economic landscape, marked by significant inflation and currency fluctuations, directly shapes consumer spending capacity. For instance, Argentina's inflation rate hovered around 250% year-on-year in early 2024, a figure that drastically erodes purchasing power.

This economic volatility can translate into reduced demand for YPF's offerings, such as fuel and other petroleum products. Furthermore, it often prompts government intervention or public pressure for price caps, which, in turn, amplifies customer price sensitivity and strengthens their collective bargaining power against YPF.

- Inflationary Pressures: Argentina's high inflation in 2024 significantly reduced consumers' ability to afford YPF's products.

- Currency Devaluation: A weaker peso made imported components for YPF's operations more expensive, potentially leading to price increases that customers resist.

- Government Intervention: The economic climate increases the likelihood of government-imposed price controls on energy, directly impacting YPF's pricing flexibility and customer leverage.

YPF's significant market share in Argentina, around 56% of domestic fuel supply, limits individual customer bargaining power due to fewer alternatives. However, government regulations, especially concerning price controls amid high inflation, effectively enhance consumer leverage. For instance, Argentina's inflation reached approximately 250% year-on-year in early 2024, increasing public pressure for price stability.

YPF's strategy to increase crude oil and LNG exports diversifies its customer base internationally, thereby reducing reliance on any single buyer and diluting domestic customer influence. Large industrial and commercial clients, particularly in the electricity generation sector, possess substantial bargaining power due to their volume of consumption and ability to explore alternative suppliers.

| Customer Type | Bargaining Power Factors | Impact on YPF |

|---|---|---|

| Retail Consumers | Limited alternatives, High price sensitivity due to inflation (approx. 250% YoY in early 2024) | Low individual power, but collective power amplified by government price interventions. |

| Industrial/Commercial Clients | High volume demand, potential for switching suppliers, price sensitivity | Significant leverage, especially for large energy consumers; can negotiate favorable terms. |

| International Buyers | Diversified customer base, growing export markets (oil, LNG) | Reduced reliance on domestic market, dilutes power of individual international buyers. |

Preview the Actual Deliverable

YPF Porter's Five Forces Analysis

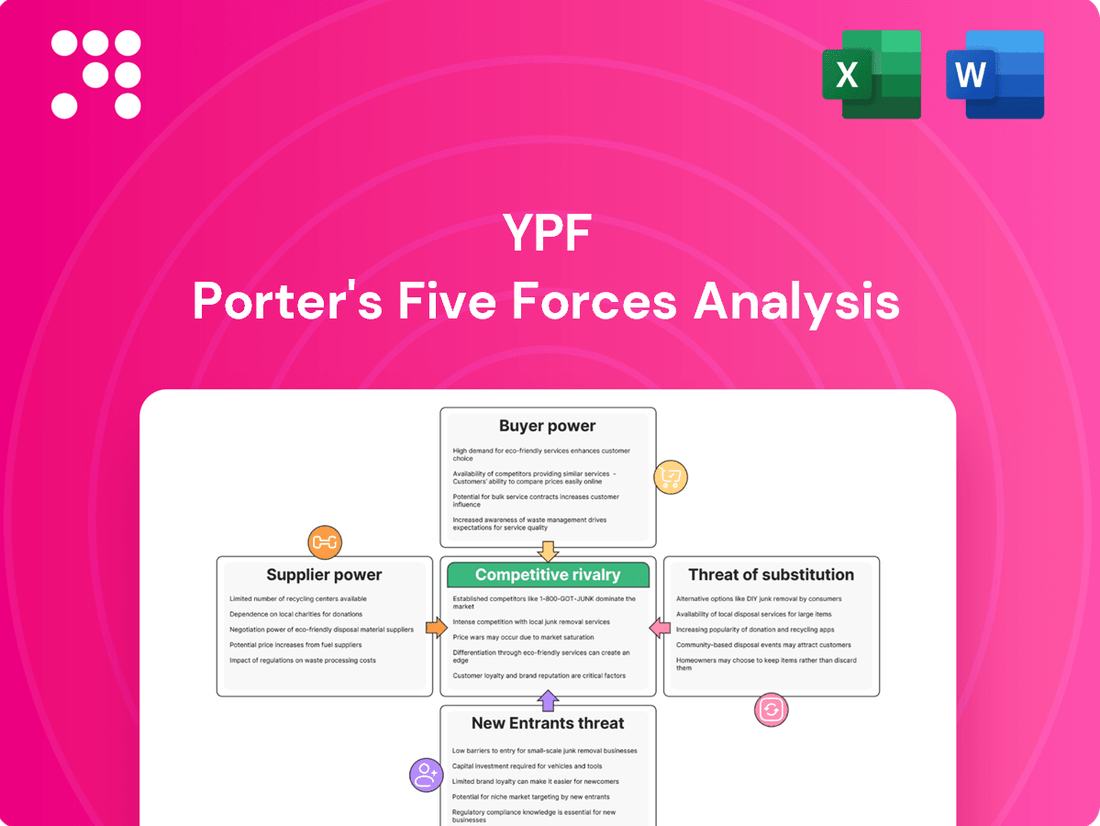

The document you see here is the complete, ready-to-use YPF Porter's Five Forces Analysis. What you're previewing is precisely what you'll receive after purchase, offering a thorough examination of competitive forces within YPF's industry. This includes detailed insights into buyer power, supplier power, threat of new entrants, threat of substitutes, and the intensity of rivalry, all formatted professionally for your immediate use.

Rivalry Among Competitors

While YPF stands as Argentina's largest energy firm, its competitive landscape is shaped by robust players like Pampa Energia. These companies are actively developing Argentina's rich Vaca Muerta shale formation, a key area for future production growth.

Pampa Energia, for instance, has been a significant investor in Vaca Muerta, aiming to boost its hydrocarbon output. This intensified focus by major competitors on a critical resource naturally escalates the rivalry within the Argentine oil and gas sector.

YPF's strategic move to divest mature conventional oil and gas fields, a trend observed throughout 2024, opens doors for smaller, specialized energy companies. This divestment strategy can lead to a more fragmented competitive environment in specific segments, potentially increasing rivalry for particular resource types or within regional markets as new players enter.

YPF's strategic emphasis on the Vaca Muerta shale formation intensifies competitive rivalry. This focus means YPF and other energy giants are locked in a battle for the most promising land parcels, essential resources, and crucial infrastructure needed for extraction and transportation.

The concentration of investment and production efforts in Vaca Muerta fuels a fierce competition for market share within the unconventional hydrocarbon sector. In 2023, Argentina's oil production from Vaca Muerta reached approximately 370,000 barrels per day, a significant portion of the country's total output, highlighting the high stakes involved for all players.

Government Policies and Incentives

Government policies, like Argentina's Large Investment Incentives Regime (RIGI), are designed to boost investment in the energy sector. For instance, RIGI offers tax stability and customs benefits for projects exceeding USD 100 million, aiming to attract significant capital. This can lead to increased competition as new entrants leverage these incentives.

These initiatives, while promoting overall sector growth, can inadvertently lower entry barriers. Consequently, this can intensify rivalry among established companies like YPF and emerging players vying for market share and resources. The influx of new investment, facilitated by government support, directly impacts the competitive landscape.

- Government Initiatives: RIGI aims to attract substantial investment into Argentina's energy sector by offering incentives.

- Impact on Competition: These policies can lower entry barriers, increasing rivalry among existing and new players.

- Example Incentive: RIGI provides tax stability and customs benefits for projects over USD 100 million, fostering new investment.

Integrated Value Chain and Market Leadership

YPF's integrated value chain, from upstream exploration and production to downstream refining and distribution, provides a significant competitive advantage. This integration allows for greater control over costs and supply, bolstering its market position. However, intense rivalry persists across all segments of the hydrocarbon industry.

The fuel retail market, in particular, is a battleground where YPF holds a dominant, yet frequently challenged, market share. In 2024, YPF continued to lead Argentine fuel sales, but competitors like Shell, Puma Energy, and Axion Energy actively vied for market share through aggressive pricing and loyalty programs.

- Dominant Market Share: YPF maintained its leading position in Argentina's fuel market in 2024, though facing increasing competition.

- Integrated Operations: YPF's control over exploration, production, refining, and distribution offers a strategic advantage.

- Intense Retail Competition: The fuel retail segment is highly competitive, with significant market share contested by major international and domestic players.

- Strategic Pricing and Loyalty: Competitors actively use pricing strategies and customer loyalty initiatives to chip away at YPF's dominance.

The competitive rivalry for YPF is intense, particularly with major players like Pampa Energia actively developing the Vaca Muerta shale formation, a critical growth area. This shared focus on a high-potential resource naturally escalates competition for land, resources, and infrastructure.

YPF's strategy to divest mature fields in 2024 can fragment competition, potentially increasing rivalry in specific market segments as new, specialized companies enter. The fuel retail market is a prime example, with competitors like Shell, Puma, and Axion aggressively contesting YPF's dominant market share through pricing and loyalty programs.

Government incentives, such as the Large Investment Incentives Regime (RIGI), which offers tax stability and customs benefits for projects over USD 100 million, can lower entry barriers. This influx of potential new investment, facilitated by these policies, further intensifies the competitive landscape for all participants in Argentina's energy sector.

| Competitor | Focus Area | Competitive Action |

| Pampa Energia | Vaca Muerta Shale Development | Increased investment and production efforts |

| Shell, Puma Energy, Axion Energy | Fuel Retail Market | Aggressive pricing and loyalty programs |

| Emerging Energy Companies | Divested Mature Fields | Entry into specific segments and regional markets |

SSubstitutes Threaten

Argentina's commitment to renewable energy is a significant threat of substitutes for YPF. The nation aims to boost renewables' contribution to its energy mix, with substantial growth in installed capacity for wind and solar power. For instance, by the end of 2023, Argentina had reached over 3 GW of installed wind power capacity and was rapidly expanding its solar energy projects.

These expanding renewable energy sources directly compete with YPF's core business of fossil fuels. As more wind and solar farms come online, they reduce the demand for traditional energy sources, impacting YPF's market share and revenue potential in the long run. Favorable government policies continue to incentivize this shift, making renewables an increasingly viable and attractive alternative.

The Argentine government's ongoing commitment to renewable energy, evidenced by policies like the RenovAr program, significantly influences the threat of substitutes for YPF. These initiatives, coupled with international climate accords, directly encourage investment in and adoption of alternative energy sources, potentially impacting YPF's core business.

In 2024, Argentina continued to advance its renewable energy targets, aiming to increase the share of renewables in its energy matrix. This proactive regulatory environment, including potential tax incentives and financing mechanisms for solar and wind projects, makes these substitutes more competitive and accessible, thereby posing a growing threat to YPF's traditional hydrocarbon sales.

Technological advancements in renewable energy are significantly increasing their efficiency and lowering costs, directly impacting traditional energy sources. For instance, the global average cost of electricity from solar photovoltaics (PV) fell by 89% between 2010 and 2022, making it increasingly competitive with fossil fuels. This trend is particularly evident in electricity generation, where renewables are rapidly gaining market share.

As solar and wind power become more economically viable, they present a substantial threat to the demand for oil and gas, especially in sectors like power generation. By 2024, renewable energy sources are projected to account for over 30% of global electricity generation. This shift directly substitutes demand for fuels previously used in power plants, impacting companies like YPF.

Energy Efficiency Initiatives

The increasing emphasis on energy efficiency presents a significant threat of substitutes for YPF. Initiatives aimed at reducing energy consumption across industries, businesses, and homes directly lessen the demand for traditional energy sources like oil and gas, which are YPF's core products. For instance, in 2024, global investments in energy efficiency technologies were projected to reach over $600 billion, signaling a strong market shift.

This trend is amplified by government policies and growing consumer awareness. These factors encourage the adoption of more efficient appliances, building insulation, and smarter energy management systems. For example, the International Energy Agency reported that energy efficiency measures saved the equivalent of the European Union's total energy consumption in 2023, highlighting its substantial impact.

- Reduced Demand: Energy efficiency efforts directly decrease the need for fossil fuels, impacting YPF's sales volume.

- Government Support: Policies promoting efficiency, such as tax credits for energy-efficient retrofits, further incentivize the shift away from high energy consumption.

- Technological Advancements: Innovations in areas like LED lighting, smart thermostats, and electric vehicle technology offer viable alternatives that reduce reliance on traditional fuels.

- Consumer Behavior: A growing segment of consumers prioritizes sustainability and cost savings, actively seeking out and adopting energy-efficient solutions.

YPF's Own Renewable Energy Ventures

YPF, through its subsidiary YPF Luz, is actively investing in and operating renewable energy projects. This strategic move demonstrates YPF's recognition of the increasing importance and competitive threat posed by alternative energy sources to its traditional fossil fuel business. For instance, by 2024, YPF Luz had a significant installed capacity in wind power, directly competing with YPF's oil and gas operations.

The company’s own ventures into renewables, such as wind farms in Argentina, highlight the growing viability of these alternatives. This internal development serves as a direct acknowledgment of the threat substitutes represent, as YPF is essentially hedging its bets and participating in the market segment that could potentially erode its core revenue streams from hydrocarbons.

- YPF Luz's installed capacity in wind energy reached over 500 MW by early 2024.

- This diversification strategy positions YPF as both a producer of traditional fuels and a participant in the growing renewable energy market.

- The success of YPF's own renewable projects underscores the competitive pressure from substitute energy sources on its oil and gas portfolio.

The increasing adoption of electric vehicles (EVs) presents a significant substitute threat to YPF's gasoline and diesel sales. As EV technology advances and charging infrastructure expands, consumer preference is shifting away from internal combustion engine vehicles. By early 2024, global EV sales were projected to exceed 15 million units for the year, a substantial increase from previous years.

This transition directly reduces demand for refined petroleum products. Government incentives, such as subsidies for EV purchases and tax breaks for charging infrastructure, further accelerate this substitution trend. Argentina itself has been exploring policies to encourage EV adoption, which would directly impact YPF's downstream operations.

Furthermore, advancements in battery technology are making EVs more affordable and practical. The declining cost of lithium-ion batteries, for instance, has been a key driver in making EVs competitive with traditional vehicles. This technological progress, combined with supportive policies, solidifies EVs as a potent substitute for YPF's core products.

| Metric | 2023 (Estimate) | 2024 (Projection) | Impact on YPF |

|---|---|---|---|

| Global EV Sales (Millions) | 14.7 | 15.7 | Decreased demand for gasoline/diesel |

| Average EV Battery Cost Reduction (Since 2018) | ~50% | ~55% | Increased EV affordability, higher substitution risk |

| YPF's Gasoline/Diesel Sales Volume | Declining trend | Continued decline expected | Reduced revenue from fuel sales |

Entrants Threaten

The oil and gas sector, particularly for integrated players like YPF, demands massive upfront capital for exploration, drilling, refining facilities, and transportation networks. For instance, developing a new offshore oil field can easily cost billions of dollars. This enormous financial hurdle significantly deters potential new entrants from establishing a competitive foothold.

Argentina's energy sector, where YPF operates, is characterized by an extensive regulatory framework and significant government influence. As a state-controlled entity, YPF's operations are deeply intertwined with national policies and directives. This governmental oversight creates substantial barriers for potential new entrants who must navigate complex legal structures, secure numerous permits, and adapt to potential policy changes that can impact profitability and operational feasibility.

Control over proven oil and gas reserves, especially in high-yield regions like Vaca Muerta, presents a significant hurdle for potential competitors. YPF's substantial holdings in these areas mean new entrants must secure their own, often costly, exploration rights.

Access to essential transportation and processing infrastructure, including pipelines and refineries, is equally vital. YPF's existing network and ongoing investments in expanding this infrastructure create a substantial barrier, as new players would need to build or lease their own, adding considerable capital expenditure.

In 2024, YPF continued to focus on developing its Vaca Muerta assets, aiming to boost production significantly. The company's investments in pipeline capacity are designed to handle this increased output, further solidifying its infrastructure advantage against potential new entrants who would face the challenge of securing such critical logistical support.

Brand Loyalty and Established Distribution Networks

YPF benefits from deeply ingrained brand loyalty in Argentina, a significant barrier for newcomers. Its established network of over 1,500 service stations across the country, as of early 2024, represents a substantial physical presence that new entrants would struggle to replicate quickly or affordably.

This extensive distribution infrastructure, built over decades, provides YPF with a competitive advantage in reaching customers efficiently. Any new player would face immense challenges in matching YPF's market penetration and logistical capabilities, requiring substantial capital and time investment to build comparable reach.

- Brand Recognition: YPF's long-standing presence has fostered strong brand recall and trust among Argentine consumers.

- Distribution Network: An expansive network of over 1,500 service stations provides unparalleled market access.

- Capital Investment: Replicating YPF's distribution and brand equity would demand significant financial resources and time.

- Market Penetration: New entrants would face considerable hurdles in achieving YPF's current level of market saturation.

Strategic Divestment and New Investment Incentives

While YPF is divesting some mature oil fields, these are generally less profitable assets and may not attract significant new entrants looking for high returns. Acquisitions of these fields by smaller, specialized companies are possible, but their scale might limit their impact on the overall market structure.

Argentina's Large Investment Incentives Regime (RIGI), enacted in 2024, aims to bolster foreign direct investment by offering tax benefits and streamlined regulations. This could potentially lower some barriers for large, well-capitalized new entrants, particularly in the energy sector, by reducing upfront costs and regulatory hurdles. However, the substantial capital and long-term commitment required for major energy projects remain significant deterrents for many potential new players.

- Divestment of Mature Fields: YPF's strategy involves selling off less productive assets, which are unlikely to attract major new competitors.

- RIGI's Impact: The 2024 RIGI aims to attract substantial foreign investment, potentially easing entry for large, financially robust companies.

- Barriers Remain: Despite incentives, the high capital expenditure and long payback periods in the energy sector continue to be significant barriers to entry.

The threat of new entrants for YPF remains relatively low due to substantial capital requirements, estimated in the billions for new exploration and infrastructure. Argentina's complex regulatory environment, heavily influenced by government policy, further deters new players. YPF's control over prime reserves like Vaca Muerta and its extensive distribution network, including over 1,500 service stations as of early 2024, create significant competitive advantages that are difficult and costly to overcome.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | Billions of dollars for exploration, drilling, and infrastructure. | Very High |

| Regulatory Environment | Complex, government-influenced policies and permits. | High |

| Resource Control | YPF's dominance in key reserves like Vaca Muerta. | High |

| Infrastructure Access | YPF's established pipelines and refining capacity. | High |

| Brand Loyalty & Distribution | Over 1,500 service stations nationwide, strong brand recognition. | Very High |

Porter's Five Forces Analysis Data Sources

Our YPF Porter's Five Forces analysis is built upon a foundation of diverse and reliable data sources. We utilize annual reports and financial statements from YPF and its competitors, alongside industry-specific market research reports from firms like Wood Mackenzie and Rystad Energy. Additionally, we incorporate data from regulatory filings and macroeconomic indicators to provide a comprehensive view of the competitive landscape.