Westlake Chemical SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Westlake Chemical Bundle

Westlake Chemical's robust market position is bolstered by its diversified product portfolio and strong vertical integration, creating significant competitive advantages. However, understanding the nuances of its operational efficiencies and potential market headwinds is crucial for informed decision-making.

Want the full story behind Westlake Chemical's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Westlake Corporation's strength lies in its dual-segment structure, encompassing Performance and Essential Materials (PEM) and Housing and Infrastructure Products (HIP). This diversification across chemicals, vinyls, polymers, and building materials offers a significant advantage.

This broad product range acts as a shield against downturns in any single market, smoothing out revenue streams. Furthermore, Westlake's vertically integrated business model allows it to capture value throughout the production process, particularly benefiting from its strong position in the vinyls chain.

Westlake Chemical Corporation boasts a robust financial standing, underscored by its investment-grade balance sheet and significant cash reserves. This financial strength, coupled with an absence of immediate debt maturities, provides a stable foundation for operations and strategic growth initiatives.

The company has a well-established track record of delivering consistent quarterly dividends, a testament to its dedication to returning value to shareholders. Even during periods of market volatility, Westlake has maintained this commitment, reinforcing investor confidence and highlighting its financial resilience.

Westlake Chemical's Housing and Infrastructure Products (HIP) segment demonstrates exceptional strength, consistently achieving record annual earnings for the past five years. This segment’s sales volume has outpaced the broader market, underscoring its robust demand and competitive edge.

The HIP segment benefits significantly from strong brand recognition and a comprehensive product portfolio, which are key drivers of its sustained outperformance. These factors position Westlake favorably to capitalize on ongoing long-term growth trends in both the housing and infrastructure sectors.

Globally Advantaged Feedstock and Energy Cost Position

Westlake Chemical benefits significantly from its North American location, which provides a distinct advantage in feedstock and energy costs. This is a critical factor for staying competitive in the global chemical market. This cost edge directly supports the profitability of its Performance and Essential Materials segment.

The company's access to cost-advantaged natural gas liquids (NGLs) in North America, particularly ethane, serves as a key feedstock. This allows Westlake to produce ethylene and its derivatives at a lower cost compared to many international competitors who rely on more expensive oil-based feedstocks. For instance, in 2024, the price differential between North American NGLs and global oil prices remained favorable, bolstering Westlake's cost structure.

- Feedstock Advantage: Access to abundant and cost-effective NGLs in North America.

- Energy Efficiency: Lower natural gas prices contribute to reduced operational expenses.

- Competitive Pricing: Enables Westlake to offer competitive pricing for its chemical products.

- Profitability Boost: Directly enhances margins in key business segments.

Commitment to Sustainability and Innovation

Westlake's dedication to sustainability is evident in its development of lower-carbon products. For instance, they are producing bio-attributed PVC and integrating recycled materials into their polyethylene resins, showcasing a commitment to circular economy principles. This focus is crucial as market demands and regulatory landscapes increasingly favor environmentally conscious solutions.

The company's investment in innovation, particularly in sustainable practices, positions it well for future growth. This strategic alignment with evolving market needs is a significant strength, potentially unlocking new revenue streams and enhancing brand reputation in the face of growing environmental awareness.

- Developing lower-carbon products: Westlake is actively producing bio-attributed PVC.

- Incorporating recycled materials: The company uses recycled content in its polyethylene resins.

- Aligning with market demands: Focus on sustainability meets growing consumer and regulatory pressures.

- Long-term growth potential: Innovative and sustainable practices offer a competitive advantage.

Westlake's dual-segment structure, encompassing Performance and Essential Materials (PEM) and Housing and Infrastructure Products (HIP), provides significant diversification. This broad product range, from chemicals to building materials, helps to smooth out revenue streams by mitigating risks associated with any single market downturn. The company's vertically integrated model, particularly its strong position in the vinyls chain, allows it to capture value throughout the production process.

The Housing and Infrastructure Products (HIP) segment has demonstrated exceptional strength, achieving record annual earnings for the past five years, with sales volumes consistently outperforming the broader market. This success is driven by strong brand recognition and a comprehensive product portfolio, positioning Westlake to capitalize on long-term growth trends in housing and infrastructure.

Westlake benefits from a cost advantage due to its North American location and access to cost-advantaged natural gas liquids (NGLs), such as ethane. This feedstock advantage allows for lower production costs for ethylene and its derivatives compared to competitors using oil-based feedstocks. For example, in 2024, favorable NGL price differentials in North America supported Westlake's competitive cost structure.

The company maintains a robust financial position, characterized by an investment-grade balance sheet and substantial cash reserves, with no immediate debt maturities. This financial stability supports ongoing operations and strategic growth. Westlake also has a consistent history of returning value to shareholders through quarterly dividends, even during market volatility, which reinforces investor confidence.

| Segment | 2023 Revenue (Approx.) | Key Products | Market Position |

|---|---|---|---|

| Performance and Essential Materials (PEM) | $8.5 billion | Ethylene, Polyethylene, PVC, Chlor-alkali | Leading producer in North America |

| Housing and Infrastructure Products (HIP) | $5.1 billion | Vinyl siding, trim, pipe, fittings, windows | Strong brand recognition, market outperformance |

What is included in the product

Delivers a strategic overview of Westlake Chemical’s internal and external business factors, highlighting its strengths in vertical integration and market position, while addressing potential weaknesses in commodity price volatility and opportunities in expanding product lines and geographic reach.

Offers a clear, actionable framework to identify and leverage Westlake Chemical's competitive advantages, mitigating the pain of strategic uncertainty.

Weaknesses

Westlake Chemical's Performance and Essential Materials segment, a major contributor to its revenue, faces considerable risk from unpredictable swings in North American feedstock and energy prices. This sensitivity was clearly demonstrated in the first quarter of 2025, when elevated costs directly squeezed the segment's operating income by an estimated $75 million compared to the prior year's comparable period.

Westlake's operations are susceptible to disruptions from planned plant turnarounds and unplanned outages. These events can significantly impact production volumes, leading to a decrease in output and a subsequent rise in operational costs.

These operational interruptions have directly affected Westlake's financial performance, contributing to lower earnings and EBITDA in recent quarters. For instance, the company cited turnaround activities as a factor impacting its performance in the first quarter of 2024.

Westlake Chemical faces headwinds from a softening global economic environment, which has directly impacted demand for key products like PVC resin and polyethylene. This weaker demand translates into lower sales volumes, a significant challenge for the company.

The consequence of this reduced demand is a noticeable decline in average sales prices across Westlake's product portfolio. For instance, during the first quarter of 2024, the company reported a decrease in average selling prices for polyethylene compared to the prior year, reflecting broader market pressures.

This pricing pressure, coupled with lower sales volumes, has demonstrably affected Westlake's financial performance. Specifically, the Performance and Essential Materials segment experienced a notable decrease in both net income and income from operations in recent periods, directly attributable to these market conditions.

Exposure to Cyclicality in Chemical Markets

Westlake's reliance on core chemical manufacturing segments means it's susceptible to the natural ups and downs of the chemical industry. These cycles, driven by economic conditions and supply-demand balances, can significantly impact performance.

For instance, periods of overcapacity in petrochemicals, a key area for Westlake, can lead to lower production utilization and reduced profitability. This vulnerability was evident in the broader chemical sector during 2023, where pricing pressures were a common theme.

- Vulnerability to Economic Downturns: Recessions often lead to reduced demand for chemicals used in construction, automotive, and consumer goods, directly impacting Westlake's sales volumes.

- Impact of Market Overcapacity: When supply outstrips demand, chemical prices can fall sharply, squeezing margins for producers like Westlake.

- Fluctuating Profitability: The cyclical nature can result in volatile earnings, making consistent financial forecasting more challenging.

Geopolitical and Trade Policy Uncertainties

Geopolitical and trade policy shifts, such as the imposition of tariffs or trade restrictions, create significant uncertainty for Westlake Chemical. This unpredictability can lead customers to delay purchasing decisions as they evaluate the potential impact on their own operations, directly affecting Westlake's sales volumes and the stability of its supply chains.

Furthermore, geopolitical conflicts can trigger volatility in the prices of essential raw materials. For instance, disruptions in regions crucial for petrochemical feedstocks, like the Middle East or parts of Eastern Europe, have historically led to price spikes. Westlake's reliance on these materials means such events can compress margins and impact profitability, as seen during periods of heightened global tension.

- Trade Policy Uncertainty: Tariffs and trade disputes can increase costs and disrupt international sales, potentially impacting Westlake's revenue streams.

- Geopolitical Instability: Conflicts in key regions can lead to supply chain disruptions and price volatility for raw materials, affecting production costs.

- Customer Hesitation: Uncertainty about future trade policies may cause customers to reduce orders or postpone investments, slowing down sales growth.

- Operational Risk: Geopolitical events can pose direct risks to Westlake's manufacturing facilities or logistics networks in affected areas.

Westlake Chemical's profitability is significantly exposed to fluctuations in North American feedstock and energy prices, a vulnerability that directly impacted its Performance and Essential Materials segment. For example, in Q1 2025, elevated costs reduced operating income by an estimated $75 million compared to the prior year.

The company's operations are prone to disruptions from scheduled plant turnarounds and unforeseen outages, which can lead to lower production volumes and increased operational expenses. These interruptions have demonstrably affected financial performance, contributing to reduced earnings and EBITDA, as noted by the company regarding turnaround activities in Q1 2024.

A softening global economy has weakened demand for Westlake's key products like PVC resin and polyethylene, resulting in lower sales volumes and a decline in average selling prices. This was evident in Q1 2024, where polyethylene average selling prices decreased year-over-year, impacting the Performance and Essential Materials segment's net income and operating income.

Westlake operates within the cyclical chemical industry, making it susceptible to periods of overcapacity in petrochemicals, which can lower production utilization and profitability. The broader chemical sector experienced pricing pressures in 2023, highlighting this inherent vulnerability.

| Weakness | Description | Impact Example |

| Feedstock & Energy Price Volatility | Sensitivity to unpredictable price swings in North America. | Q1 2025 operating income reduced by approx. $75 million due to elevated costs. |

| Operational Disruptions | Risk from planned and unplanned plant outages. | Contributed to lower earnings and EBITDA in recent quarters; cited in Q1 2024 performance. |

| Economic Downturns & Demand Softening | Reduced demand for key products like PVC and polyethylene. | Lower sales volumes and declining average selling prices, impacting Q1 2024 results. |

| Chemical Industry Cyclicality | Vulnerability to overcapacity and pricing pressures. | General pricing pressures observed across the chemical sector in 2023. |

What You See Is What You Get

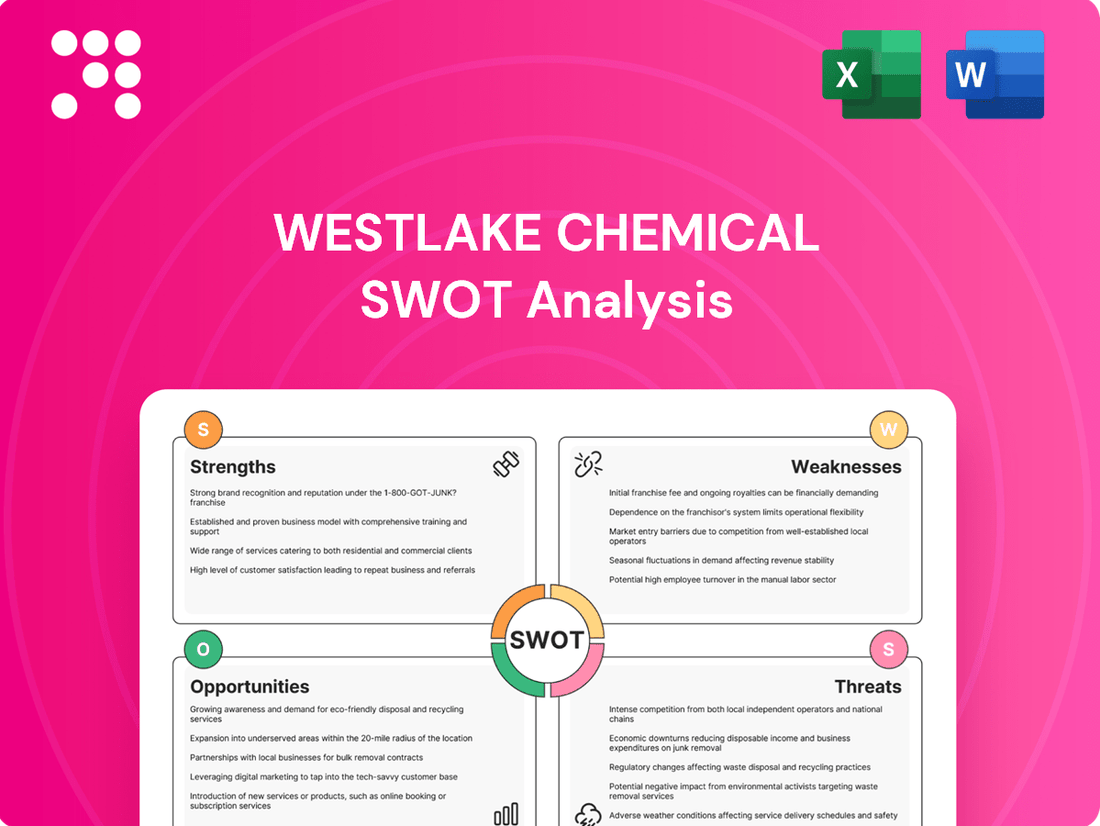

Westlake Chemical SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. It offers a clear overview of Westlake Chemical's Strengths, Weaknesses, Opportunities, and Threats. You're seeing the actual analysis, so you know exactly what you're getting.

Opportunities

The global Polyvinyl Chloride (PVC) market, a core product for Westlake, is anticipated to experience robust growth. This expansion is largely fueled by escalating demand across critical sectors such as construction, automotive manufacturing, and packaging. For instance, the global construction market alone was valued at over $13 trillion in 2023 and is expected to see continued expansion.

Westlake's Housing and Infrastructure Products segment is strategically positioned to benefit from these enduring trends. The company is set to capitalize on long-term secular tailwinds, particularly in the housing sector and the essential market for pipes and fittings infrastructure.

Westlake can capitalize on the growing global emphasis on environmental responsibility by broadening its range of sustainable and recycled products. This includes developing and marketing bio-attributed PVC, which uses renewable feedstocks, and increasing the incorporation of post-consumer recycled materials into its existing product lines. In 2024, the market for sustainable building materials, including recycled PVC, is projected to see significant growth, offering Westlake a clear avenue for expansion and differentiation.

Westlake Chemical can leverage ongoing technological advancements to boost its operational efficiency. For instance, investing in research and development for novel technologies like enzyme-based catalysis presents a significant opportunity to enhance petrochemical production processes, making them more efficient and environmentally friendly. This aligns with the company's stated focus on cost-saving plans and productivity improvements, aiming to refine its cost structure and bolster operational dependability.

Strategic Acquisitions and Partnerships

Westlake Chemical's robust financial position, evidenced by its strong balance sheet, positions it advantageously for strategic acquisitions. This financial flexibility allows the company to pursue targets that can solidify and expand its market leadership in key areas like Housing and Infrastructure Products (HIP) and Performance and Essential Materials (PEM). For instance, in 2023, Westlake completed the acquisition of Hexion's Phenoxy business, a move that bolstered its PEM segment and its global footprint in epoxy resins.

Furthermore, strategic partnerships offer avenues for innovation and market penetration. Collaborations, such as the one with Alpha Recyclage Composites to advance composites recycling, not only align with sustainability goals but also unlock new growth opportunities. These alliances can lead to the development of novel materials and processes, enhancing Westlake's competitive edge in an evolving market landscape.

- Acquisition of Hexion's Phenoxy business in 2023 strengthened the Performance and Essential Materials segment.

- Partnerships like the one with Alpha Recyclage Composites drive innovation in sustainable materials.

- Strong balance sheet provides capital for pursuing growth-oriented M&A activities.

- Expansion of leading positions in HIP and PEM segments through targeted acquisitions remains a key strategy.

Emerging Markets and Diversified Applications for PVC

The global PVC market is experiencing robust growth, with Asia-Pacific leading the charge. This region's rapid industrialization and urbanization are key drivers, fueling demand for PVC in various sectors. For instance, in 2024, Asia-Pacific accounted for over 60% of global PVC consumption, a trend expected to continue through 2025.

Westlake Chemical can capitalize on this expansion by leveraging its production capabilities. The company's strategic positioning allows it to serve these high-growth markets effectively. By 2025, it's projected that the Asia-Pacific PVC market will reach approximately $120 billion.

Beyond construction, PVC's utility is broadening significantly. Emerging applications include:

- Electrical and electronics: Increased demand for wire and cable insulation.

- Specialty chemicals: Use in various industrial processes.

- Furniture manufacturing: Growing adoption for durable and cost-effective components.

- Medical packaging: Essential for sterile and safe containment solutions.

These diversified applications present substantial opportunities for Westlake Chemical to expand its market reach and revenue streams beyond traditional construction segments.

Westlake Chemical is well-positioned to capitalize on the growing demand for sustainable and recycled materials, particularly in the building and construction sectors. The company's focus on expanding its range of bio-attributed PVC and incorporating post-consumer recycled content aligns with market trends, with the sustainable building materials market projected for significant growth in 2024. Furthermore, strategic acquisitions, like the 2023 purchase of Hexion's Phenoxy business, continue to bolster its Performance and Essential Materials segment, while partnerships foster innovation in areas like composites recycling, opening new avenues for market penetration and product development.

Threats

Westlake Chemical operates within a global petrochemical industry grappling with persistent overcapacity. This means there's more product available than the market is currently demanding, which puts downward pressure on prices and profitability. For instance, reports from early 2024 indicated that operating rates in key petrochemical segments remained subdued due to this imbalance.

New production capacity coming online, particularly in Asia and the Middle East, is further intensifying this oversupply situation. This trend is projected to persist, with analysts forecasting that the market will continue to feel the effects of this excess capacity at least through 2025. Consequently, companies like Westlake may face challenges in achieving optimal plant utilization and maintaining strong profit margins.

Westlake Chemical operates in a highly competitive global petrochemical market, facing intense pressure from both established players and emerging producers. This fierce competition, particularly in regions with significant capacity expansions, often leads to an imbalance between supply and demand, directly impacting pricing power and profit margins.

For instance, the global ethylene market, a key feedstock for many of Westlake's products, saw significant capacity additions in 2023 and is projected to continue seeing growth through 2025, particularly in North America and Asia. This oversupply environment can force producers like Westlake to lower prices to maintain market share, thereby squeezing profitability and threatening long-term financial viability.

Stricter environmental regulations, especially in Europe, are a significant hurdle, limiting the use of certain additives common in the petrochemical industry. This pressure to improve sustainability and reduce environmental impact is a growing concern.

The global consumer demand for sustainable materials is escalating, directly challenging the market position of traditional petrochemical products. For Westlake Chemical, this shift necessitates adaptation to remain competitive in a changing landscape.

Economic Slowdowns and Weak Industrial Activity

Economic slowdowns globally, marked by sluggish GDP growth and persistent uncertainties, directly dampen industrial and manufacturing output. This downturn naturally affects demand for Westlake Chemical's diverse product portfolio, from building materials to petrochemicals.

The impact is already visible, particularly in Westlake's Housing and Infrastructure Products segment. This division has seen a reduction in sales volumes, a direct consequence of the slower construction activity observed across North America during 2024.

- Global GDP Growth Concerns: Projections for 2024 and 2025 indicate a moderation in global economic expansion, raising concerns about overall industrial demand.

- North American Construction Slowdown: Data from 2024 highlighted a softening in residential and commercial construction starts in key North American markets, impacting demand for building products.

- Petrochemical Demand Sensitivity: Westlake's Olefins and Vinyls segments are highly sensitive to industrial production levels, which are expected to remain subdued in the face of economic headwinds.

Volatility in Raw Material Prices Beyond Feedstock

Beyond feedstock, Westlake Chemical, like others in the petrochemical sector, grapples with volatility in prices for other essential raw materials. These price swings can significantly affect production expenses and ultimately squeeze profit margins. For instance, disruptions in the supply of key catalysts or additives, often influenced by geopolitical events, can lead to unexpected cost increases.

Global conflicts and ongoing supply chain disruptions are primary drivers of this broader raw material price instability. These external factors create an unpredictable cost environment, making it harder for companies like Westlake to forecast expenses accurately. The impact can range from increased input costs to potential production slowdowns if certain materials become scarce or prohibitively expensive.

- Geopolitical Instability: Events like the ongoing conflict in Eastern Europe continue to disrupt global trade routes and impact the availability and cost of various industrial inputs.

- Supply Chain Bottlenecks: Persistent logistical challenges, from port congestion to labor shortages, can inflate the cost of transporting and acquiring non-feedstock raw materials.

- Commodity Market Fluctuations: Prices for metals, energy (beyond direct feedstock), and other essential industrial components can experience sharp movements due to speculation, demand shifts, and weather events.

Intensifying global competition, particularly from new capacity in Asia and the Middle East, poses a significant threat by driving down prices and impacting Westlake's market share. This oversupply situation, evident in segments like ethylene, is projected to persist through 2025, squeezing profit margins. Furthermore, growing consumer demand for sustainable materials challenges traditional petrochemical products, requiring Westlake to adapt its offerings to remain competitive.

Economic slowdowns globally, marked by sluggish GDP growth, directly dampen industrial and manufacturing output, negatively affecting demand for Westlake's diverse product portfolio. This is already impacting Westlake's Housing and Infrastructure Products segment, with reduced sales volumes observed in 2024 due to slower construction activity in North America.

Geopolitical instability and persistent supply chain disruptions contribute to volatility in raw material prices beyond direct feedstocks, increasing production expenses and impacting profitability. Events like ongoing conflicts and logistical challenges inflate costs and create an unpredictable operating environment for Westlake.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of credible data, including Westlake Chemical's official financial filings, comprehensive market research reports, and expert industry analysis. These sources provide a robust understanding of the company's operational performance and the broader economic landscape.