Westlake Chemical Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Westlake Chemical Bundle

Westlake Chemical strategically leverages its diverse product portfolio, from essential building materials to specialized chemicals, to meet varied market needs.

Discover how their pricing strategies balance cost-effectiveness with market value, and explore their extensive distribution networks that ensure product availability across industries.

Unlock the full picture of Westlake Chemical's promotional efforts and how they build brand loyalty and market share.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Westlake Corporation boasts a diverse chemical and polymer portfolio, crucial for many industries. Their offerings span basic chemicals, vinyls, and polymers, acting as building blocks for countless products.

The company organizes its extensive product line into two main segments: Performance and Essential Materials (PEM) and Housing and Infrastructure (HIP). This structure reflects their commitment to serving a wide spectrum of customer requirements across various market sectors.

As of the first quarter of 2024, Westlake reported net sales of $2.8 billion, with their diverse product mix contributing significantly to this revenue. This broad portfolio enables them to meet varied customer needs, from industrial applications to consumer goods.

Westlake's chemical products are fundamental across a broad spectrum of industries. In 2024, their ethylene and polyethylene, for example, are vital components in durable food packaging and essential automotive parts, underpinning consumer goods and transportation sectors.

The company's polyvinyl chloride (PVC) is a cornerstone of the construction industry, utilized in everything from weather-resistant siding and roofing systems to critical water and sewage piping, demonstrating its importance in infrastructure development.

Furthermore, Westlake's materials also find significant application in healthcare, contributing to medical devices and packaging, and in the packaging sector for a vast array of consumer and industrial goods, highlighting their pervasive presence in modern life.

Westlake Chemical is prioritizing sustainable innovations, a key element in their product strategy. They are actively developing and promoting greener product solutions to meet increasing environmental demands. For instance, their GreenVin® PVC is manufactured using renewable energy sources, and Pivotal PVC integrates post-industrial recycled content.

This commitment extends to their specialty products as well. In 2025, Westlake Epoxy introduced its EpoVIVE™ line, featuring sustainable epoxy products. This move underscores their dedication to offering materials with a lower carbon intensity, aligning with market trends towards eco-conscious manufacturing.

Specialty and Differentiated s

Westlake Chemical's strategy heavily relies on its specialty and differentiated products within the Performance and Essential Materials segment. These offerings are designed to meet stringent technical demands across key industries such as housing, aerospace, and automotive.

This focus on high-value, specialized materials provides Westlake with a competitive edge, enabling them to deliver superior value to their customers. For instance, their expansion into molecular-oriented PVC for municipal pipe applications highlights a commitment to innovation and sustainability, offering products with a reduced environmental impact.

- Focus on High-Performance Materials: Westlake targets sectors with increasing technical specifications, such as aerospace and automotive, with its specialized product lines.

- Value Proposition: Differentiated products allow Westlake to command premium pricing and maintain a strategic advantage in its served markets.

- Sustainability Initiatives: Expansion in molecular-oriented PVC for municipal pipes demonstrates a commitment to environmentally friendlier solutions.

Development and Enhancement

Westlake Chemical demonstrates a strong focus on development and enhancement, consistently investing in new product offerings and improvements. For instance, Westlake Royal Building Products introduced new color options for roof tiles and expanded their single-width slate colors in 2024, directly responding to aesthetic trends and customer preferences in the building materials market.

Their innovation isn't limited to traditional sectors; Westlake is actively developing advanced composite solutions. These advancements are targeted at high-growth areas like wind turbines and hydrogen storage, aiming to boost efficiency, safety, and overall material performance. This forward-thinking approach ensures their product portfolio remains competitive and aligned with future market needs.

- Product Innovation: Introduction of new color palettes for roofing products by Westlake Royal Building Products in 2024.

- Advanced Materials: Development of composite solutions for wind energy and hydrogen storage applications.

- Market Responsiveness: Continuous investment to keep products relevant to evolving industry demands and technological advancements.

Westlake's product strategy centers on a broad chemical and polymer portfolio, serving diverse industries. Their offerings range from basic chemicals and vinyls to specialized polymers, forming the backbone of numerous everyday items and industrial applications. This extensive product mix is a key driver of their market presence and revenue generation.

The company's commitment to sustainability is evident in its product development, with initiatives like GreenVin® PVC and Pivotal PVC incorporating renewable energy and recycled content. Furthermore, their 2025 introduction of the EpoVIVE™ line by Westlake Epoxy highlights a focus on lower carbon intensity materials, aligning with growing environmental consciousness.

Westlake actively innovates across its product lines, responding to market trends and technological advancements. Examples include new color options for Westlake Royal Building Products' roof tiles in 2024 and the development of advanced composite solutions for sectors like wind energy and hydrogen storage, ensuring their portfolio remains competitive and future-ready.

| Product Category | Key Applications | 2024/2025 Highlights |

|---|---|---|

| Basic Chemicals & Polymers | Food packaging, automotive parts, consumer goods | Ethylene and polyethylene vital components; Net sales of $2.8 billion in Q1 2024 driven by diverse product mix. |

| Vinyls (PVC) | Construction (siding, roofing, piping), healthcare, packaging | Cornerstone of construction; Molecular-oriented PVC for municipal pipes focusing on sustainability. |

| Specialty Products | Aerospace, automotive, wind turbines, hydrogen storage | EpoVIVE™ sustainable epoxy line (2025); Advanced composite solutions for high-growth areas. |

What is included in the product

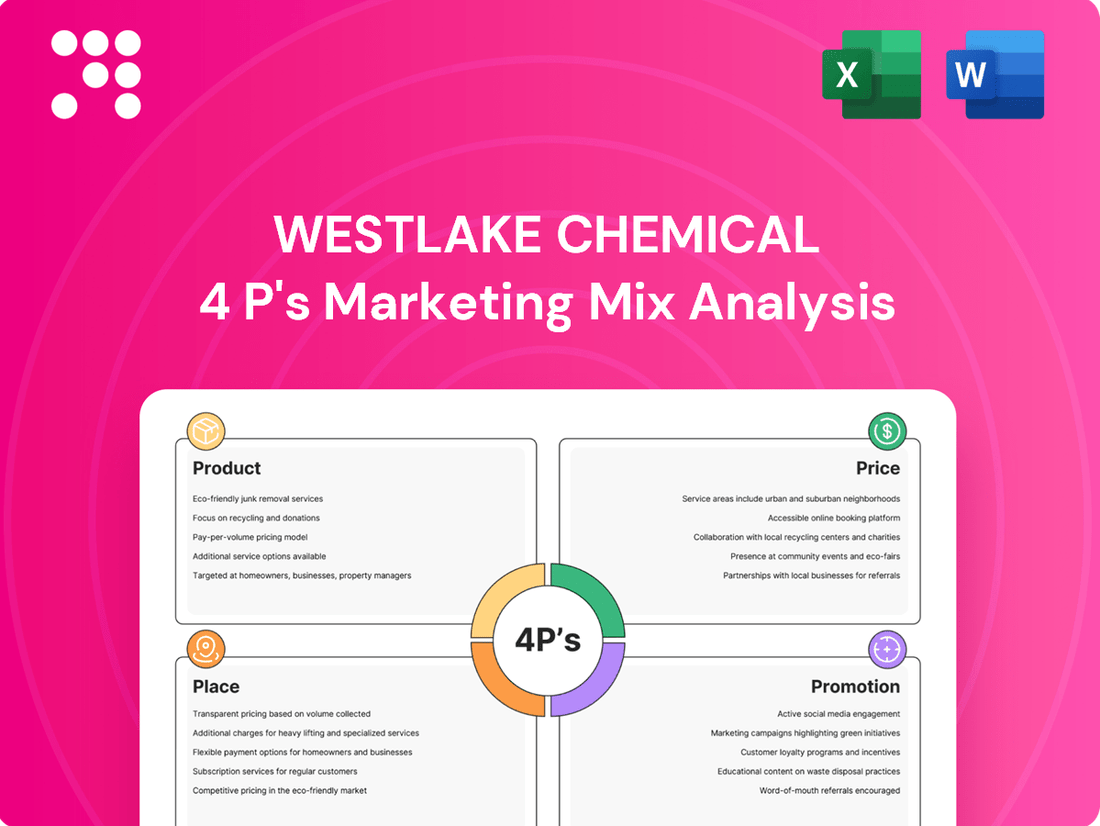

This analysis provides a comprehensive overview of Westlake Chemical's marketing strategies, detailing their approach to Product, Price, Place, and Promotion with real-world examples and strategic implications.

Simplifies the complex Westlake Chemical 4P's analysis into actionable insights, alleviating the pain of information overload for strategic decision-making.

Place

Westlake Corporation's manufacturing footprint is truly global, with production facilities strategically located across Asia, Europe, and North America. This international network, which includes numerous chemical and building product plants, allows them to efficiently serve a wide array of customers worldwide. For instance, in 2023, Westlake reported significant capital expenditures on expanding and optimizing its manufacturing capabilities, underscoring its commitment to a robust global supply chain.

Westlake Chemical primarily utilizes a direct business-to-business (B2B) distribution model for its foundational chemicals, vinyls, and polymers. This strategy focuses on building robust relationships with industrial customers, ensuring efficient logistics for bulk material delivery. For instance, in 2023, Westlake's Olefins segment, a key area for basic chemicals, generated substantial revenue, underscoring the importance of these direct industrial sales.

Westlake Chemical strategically utilizes its extensive logistics network, particularly in key U.S. hubs like Louisiana and Texas, to efficiently deliver its diverse product portfolio. This robust infrastructure supports significant domestic sales and facilitates crucial export operations, ensuring products reach customers promptly and reliably.

The company's distribution capabilities are designed to maximize customer convenience and operational efficiency, critical for managing the complex and often large-scale shipments characteristic of the chemical and polymer industries. For instance, Westlake's access to rail, barge, and pipeline networks allows for cost-effective transportation, a key factor in maintaining competitive pricing and timely delivery, especially as global demand for petrochemicals continues to grow. In 2024, Westlake reported substantial capital expenditures aimed at further enhancing its logistical infrastructure, reflecting a commitment to supply chain resilience and market responsiveness.

Vertical Integration Advantage

Westlake's significant vertical integration acts as a powerful advantage within its marketing mix, particularly concerning its distribution strategy. This integration ensures a consistent and dependable flow of essential raw materials, like ethylene and chlorine, directly into their downstream production of PVC and other building products. This control over the supply chain is crucial for maintaining product availability and managing costs effectively.

This upstream control translates directly into reliable value delivery for Westlake's customers. By streamlining the entire production process from basic chemicals to finished goods, the company can potentially shorten lead times and ensure product quality remains consistent. This operational efficiency supports their ability to offer differentiated products, such as specialized PVC compounds for various applications, with greater confidence and cost-effectiveness.

- Supply Chain Control: Westlake's ownership of upstream facilities, including cracker plants, provides a buffer against raw material price volatility and supply disruptions, a critical factor in the volatile petrochemical market.

- Cost Efficiency: By capturing margins at multiple stages of the value chain, vertical integration can lead to lower overall production costs, enhancing price competitiveness.

- Product Quality Consistency: Direct oversight of raw material production and processing allows for tighter quality control, ensuring the final products meet stringent customer specifications.

- Market Responsiveness: A more integrated supply chain can allow Westlake to adapt more quickly to shifts in demand for its downstream products.

Market Penetration in Construction and Infrastructure

Westlake Chemical's Housing and Infrastructure Products segment demonstrates significant market penetration across North America, positioning itself as a key supplier to major national homebuilders. This strategic focus ensures their diverse range of building materials, including PVC pipes, fittings, siding, and roofing solutions, are integral to both residential construction and vital infrastructure development projects. The company's approach is designed to capitalize on the sustained demand and growth within these critical economic sectors.

This targeted penetration allows Westlake to effectively serve a wide customer base, from large-scale developers to municipal projects. For instance, in 2024, the construction industry, particularly in North America, continued to see robust activity, with infrastructure spending projected to rise. Westlake's product portfolio directly addresses these needs, supporting the build-out of essential services and housing. Their commitment to being a primary source for these materials underscores their strategy to embed their offerings within the foundational elements of the built environment.

- Geographic Reach: Extensive presence across North America, targeting key construction markets.

- Key Customer Focus: Leading supplier to national homebuilders, ensuring broad adoption of products.

- Product Integration: PVC pipes, fittings, siding, and roofing are essential components in residential and infrastructure projects.

- Growth Strategy: Aims to capture market share by meeting the demand in growing housing and infrastructure sectors.

Westlake's place strategy leverages its extensive global manufacturing footprint, with facilities across Asia, Europe, and North America, ensuring efficient service to a diverse customer base. This global presence is supported by strategic investments in logistics, including rail, barge, and pipeline access, particularly in key U.S. hubs like Louisiana and Texas. This infrastructure facilitates both domestic sales and crucial export operations, underscoring their commitment to supply chain resilience and market responsiveness.

The company's direct B2B distribution model for foundational chemicals and polymers emphasizes strong customer relationships and efficient bulk material delivery. Furthermore, Westlake's significant vertical integration, from raw material production to finished goods, provides a distinct advantage. This integration ensures a consistent supply of materials like ethylene and chlorine, allowing for tighter quality control and cost efficiencies, which translates into reliable value delivery for their customers.

Westlake's Housing and Infrastructure Products segment showcases strong market penetration in North America, serving as a primary supplier to major homebuilders and infrastructure projects. This focus capitalizes on sustained demand in these sectors, with their product portfolio, including PVC pipes and siding, being integral to residential construction and essential infrastructure development.

In 2023, Westlake continued to invest in optimizing its manufacturing and logistical capabilities, reflecting a dedication to maintaining a robust global supply chain and meeting market demands. For instance, their Olefins segment performance in 2023 highlights the importance of their basic chemical sales, driven by this efficient distribution network.

Full Version Awaits

Westlake Chemical 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Westlake Chemical 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion in detail. You'll gain immediate access to a fully prepared document ready for your strategic review.

Promotion

Westlake Chemical's promotional strategy heavily targets other businesses, focusing on direct conversations and involvement in industry gatherings. They actively participate in trade shows, like JEC World 2025, to unveil new sustainable epoxy solutions, demonstrating their commitment to innovation.

This approach allows Westlake to directly communicate the technical advantages of their products and build strong connections with crucial industry stakeholders. Their presence at events such as the American Chemistry Council's Annual Meeting in 2024 further solidifies their industry engagement.

Westlake Chemical prioritizes transparent communication with its financial stakeholders through robust investor relations. This includes regular quarterly earnings calls, detailed annual reports, and informative investor presentations, all designed to keep investors and analysts well-informed about the company's performance and strategic initiatives.

In 2024, Westlake continued this commitment, with its Q3 2024 earnings call highlighting strong performance in its Olefins segment, driven by favorable market conditions and operational efficiencies. The company's investor presentations consistently showcase advancements in its Specialty Products segment, particularly in PVC and Chlor-alkali, reinforcing its strategic focus on innovation and market leadership.

Westlake Chemical actively showcases its dedication to sustainability through its annual ESG reports, detailing progress in eco-friendly products and community engagement. These reports highlight tangible achievements, such as the development of recycled PVC compounds and investments in solar power, which resonate with stakeholders valuing environmental responsibility.

Brand Consolidation and Product Storytelling

Westlake Chemical has been actively consolidating its brand under a unified 'One Westlake' identity. This strategic move aims to present a cohesive image across its varied product lines, simplifying market perception and emphasizing the breadth of its solutions. For instance, in 2024, the company continued to integrate its acquisitions, such as the Euclid Chemical Company, under this umbrella, streamlining customer engagement.

This brand consolidation is supported by compelling product storytelling, illustrating how Westlake's materials contribute to everyday life. By highlighting applications ranging from building and construction to automotive and consumer goods, Westlake effectively communicates the value and ubiquity of its chemical products. This approach resonates with a broad audience, reinforcing the company's market position.

- Brand Consolidation: Transitioning to a 'One Westlake' identity to unify diverse product segments.

- Market Simplification: Presenting a singular, clear image to customers and stakeholders.

- Product Storytelling: Emphasizing everyday applications and the positive impact of Westlake's materials.

- Strategic Integration: Incorporating acquisitions into the unified brand narrative to leverage synergies.

Community Involvement and Corporate Citizenship

Westlake Chemical actively participates in corporate citizenship, notably through its scholarship programs for employees' children. This initiative not only supports educational advancement but also cultivates a positive public perception of the company.

These community-focused actions, while not directly tied to product sales, foster goodwill and highlight Westlake's dedication to the areas where it operates. Such engagement can bolster brand reputation and aid in attracting skilled employees.

For instance, in 2023, Westlake continued its commitment to community development, investing in various local programs. While specific scholarship numbers for 2024 are still being compiled, the company's historical allocation demonstrates a consistent focus on social impact.

- Employee Scholarship Programs: Westlake's commitment to education through scholarships for employees' children.

- Community Goodwill: Building positive relationships and demonstrating corporate responsibility.

- Talent Attraction: Enhancing brand image to attract and retain valuable employees.

- Social Impact Investment: Ongoing support for local community initiatives.

Westlake Chemical's promotional efforts focus on industry engagement and transparent financial communication. Their participation in events like JEC World 2025 showcases new sustainable products, while investor relations activities, including Q3 2024 earnings calls, highlight segment performance and strategic advancements.

The company also emphasizes its commitment to sustainability through ESG reports, detailing achievements in recycled materials and renewable energy investments. This is complemented by a unified 'One Westlake' brand identity, integrating acquisitions like Euclid Chemical Company, and product storytelling that connects materials to everyday life.

Furthermore, Westlake fosters goodwill through corporate citizenship, such as its scholarship programs for employees' children, reinforcing its positive brand image and commitment to social impact.

Price

Westlake Chemical's pricing strategy for its diverse chemical, vinyl, and polymer products is intrinsically tied to the ebb and flow of market dynamics. Factors such as the cost of raw materials, the delicate balance between supply and demand, and broader global economic trends all play a significant role in shaping their pricing decisions.

The company demonstrated this adaptability in 2024, where its Performance & Essential Materials segment experienced reduced product pricing and narrower margins. This was a direct consequence of prevailing challenging global industrial conditions, highlighting Westlake's need to adjust its pricing in response to external economic pressures.

Westlake Chemical's pricing strategies are distinctly tailored to its two primary business segments. The Performance and Essential Materials segment has experienced price erosion, a common trend in commodity-driven markets, impacting average selling prices.

Conversely, the Housing and Infrastructure Products segment has demonstrated resilience, with strong demand often leading to higher sales volumes that compensate for any potential dips in average selling prices. This divergence highlights Westlake's ability to navigate varied market dynamics by adjusting its approach to pricing across different product portfolios. For instance, in Q1 2024, Westlake reported that while its Performance and Essential Materials segment saw lower average selling prices, its Housing and Infrastructure Products segment benefited from strong demand, contributing to overall financial performance.

Westlake Chemical is prioritizing cost efficiencies and operational reliability to boost earnings and navigate pricing pressures. For instance, in Q1 2024, the company reported a net income of $184 million, demonstrating their ongoing efforts to manage expenses effectively.

The company has actively pursued cost-saving initiatives, aiming to enhance the value proposition for its customers. This strategy is designed to support pricing stability or allow for more competitive pricing in the market.

Effective management of input costs remains a cornerstone for maintaining robust margins, particularly within the fluctuating market conditions experienced throughout 2024 and into 2025. This focus is crucial for sustained profitability.

Strategic Adjustments

Westlake Corporation actively manages its pricing strategy to align with evolving market conditions. This proactive approach ensures the company remains competitive and profitable. For example, Westlake announced a price increase for its Pels® and Pels® Plus Caustic Soda Beads in October 2024. This move directly addressed dynamic shifts within the chemical industry, aiming to offset rising operational expenses and maintain healthy margins.

These strategic price adjustments are crucial for Westlake's financial health. By responding to market signals, the company can better manage its cost structure and ensure continued investment in product development and operational efficiency. The chemical market in 2024 and into 2025 has seen fluctuations in raw material costs and energy prices, making such tactical pricing decisions essential for sustained performance.

- October 2024 Price Adjustment: Westlake increased prices on Pels® and Pels® Plus Caustic Soda Beads.

- Market Responsiveness: Adjustments reflect ongoing changes and volatility in the chemical market.

- Profitability Maintenance: Pricing strategies are designed to cover increasing operational costs and ensure profitability.

- Competitive Positioning: Strategic pricing helps Westlake maintain its market position amidst industry shifts.

Contractual Pricing and Volatility Mitigation

Westlake Chemical's strategy for certain products, such as ethylene sold through Westlake Chemical Partners, heavily relies on fixed-margin agreements. This contractual approach significantly shields the company from the unpredictable swings in market prices.

This contractual stability translates into more reliable revenue streams, providing a buffer against market volatility and ensuring consistent distributions for unitholders. For instance, in Q1 2024, Westlake Chemical Partners reported that approximately 80% of its ethylene sales were under fixed-margin agreements, highlighting the impact of this pricing strategy.

- Fixed-Margin Agreements: Secures predictable revenue for products like ethylene, insulating against price volatility.

- Revenue Stability: Supports consistent distributions to unitholders despite market fluctuations.

- Risk Management: This contractual pricing is a key tool for managing financial risk in specific product lines.

- Cash Flow Predictability: Ensures more stable and foreseeable cash flows for these business segments.

Westlake Chemical's pricing reflects a dual approach, balancing market-driven adjustments with contractual stability. For commodity chemicals, pricing closely tracks raw material costs and supply-demand dynamics, as seen with the Q1 2024 price erosion in the Performance & Essential Materials segment. Conversely, strategies like fixed-margin agreements for ethylene, with approximately 80% of sales under such contracts in Q1 2024, provide a predictable revenue stream, insulating against market volatility.

| Segment | Pricing Driver | 2024/2025 Trend Example |

|---|---|---|

| Performance & Essential Materials | Market Supply/Demand, Raw Material Costs | Reduced pricing and narrower margins in challenging global industrial conditions (Q1 2024) |

| Housing & Infrastructure Products | Strong Demand, Volume | Resilient pricing, strong sales volumes offsetting potential average selling price dips (Q1 2024) |

| Ethylene (via Westlake Chemical Partners) | Fixed-Margin Agreements | ~80% of sales under fixed-margin contracts (Q1 2024), providing revenue stability |

4P's Marketing Mix Analysis Data Sources

Our Westlake Chemical 4P's Marketing Mix Analysis is built on a foundation of verified, up-to-date information, including SEC filings, investor presentations, and official company reports. We also leverage industry analysis and competitive benchmarks to ensure accuracy.