Westlake Chemical PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Westlake Chemical Bundle

Navigate the complex external forces impacting Westlake Chemical with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are shaping the company's trajectory. Gain a crucial competitive edge by leveraging these expert insights for your strategic planning. Download the full PESTLE analysis now and unlock actionable intelligence.

Political factors

Government trade policies are a major force shaping Westlake Chemical's operations. For instance, the United States' imposition of tariffs on certain imported goods in recent years has directly affected the cost of raw materials and the competitiveness of Westlake's products in global markets. In 2023, global trade disputes continued to create uncertainty, potentially increasing the cost of key feedstocks like ethylene and propylene, which are vital for Westlake's vinyls and olefins segments.

Government infrastructure spending and housing policies significantly shape the demand for Westlake's products. For instance, the Infrastructure Investment and Jobs Act, enacted in late 2021, has allocated substantial funds towards upgrading roads, bridges, and public transit, directly boosting demand for materials used in these projects. This legislation, with a significant portion of its funding continuing into 2024 and beyond, is expected to provide a sustained tailwind for Westlake's Housing and Infrastructure Products segment.

Political stability is a significant concern for Westlake Chemical. Geopolitical tensions, particularly in regions where Westlake operates or sources raw materials, can create considerable disruption. For instance, ongoing conflicts in Eastern Europe have already impacted global energy markets, a key input for chemical production, leading to price volatility throughout 2024 and into early 2025.

Unrest and conflicts directly affect supply chains and demand. These events can cause logistical nightmares, making it harder and more expensive to transport goods. Consumer confidence also tends to dip during times of global instability, which can translate into reduced demand for Westlake's products, impacting sales and profitability. The company's extensive global footprint means it's particularly exposed to these kinds of risks.

Political factor 4

Political decisions significantly shape the regulatory landscape for chemical manufacturers like Westlake. Changes in environmental, health, and safety (EHS) laws directly impact operational costs and investment strategies. For instance, the U.S. Environmental Protection Agency (EPA) continually updates regulations under the Toxic Substances Control Act (TSCA), which can affect the production and use of various chemicals.

Stricter compliance requirements often necessitate substantial capital outlays. Westlake Chemical, like its peers, must invest in advanced pollution control technologies and process modifications to meet evolving standards. These investments, while crucial for long-term sustainability and market access, can temporarily increase operating expenses. For example, the push for reduced greenhouse gas emissions across industries by 2030, a trend supported by many governments, will likely drive further technological adoption in chemical production.

- Increased Compliance Costs: New regulations can mandate costly upgrades to manufacturing facilities.

- Product Safety Scrutiny: Political pressure for safer chemical products may lead to more rigorous testing and approval processes.

- International Trade Policies: Government stances on trade can affect the import/export of raw materials and finished chemical goods.

- Government Subsidies & Incentives: Political support for certain chemical sectors, like those involved in green chemistry, can offer financial advantages.

Political factor 5

Government incentives and disincentives significantly influence Westlake Chemical's strategic choices regarding sustainable manufacturing. For instance, the Inflation Reduction Act of 2022 in the United States offers substantial tax credits for clean energy and manufacturing, potentially lowering the cost of adopting greener technologies for Westlake. Conversely, the implementation or threat of carbon taxes, like those considered in various regions, could increase operational costs for less sustainable processes.

These policy levers directly shape investment decisions by altering the financial viability of different operational pathways.

- Tax Credits: The US federal government offers a 30% investment tax credit for certain clean energy projects, which could incentivize Westlake to invest in renewable energy sources for its manufacturing facilities.

- Carbon Pricing: Regions with established or proposed carbon pricing mechanisms may see Westlake re-evaluate the economic feasibility of high-emission production methods.

- Regulatory Compliance: Evolving environmental regulations, such as stricter emissions standards, necessitate ongoing investment in compliance technologies, impacting capital allocation.

- Subsidies for Green Tech: Government subsidies for developing and deploying advanced recycling or bio-based materials could steer Westlake's research and development efforts.

Government policies directly impact Westlake Chemical's operational costs and market access through trade agreements and tariffs. For example, ongoing trade negotiations and potential adjustments to import duties on key chemical inputs in 2024-2025 could influence raw material pricing and Westlake's competitive positioning globally.

What is included in the product

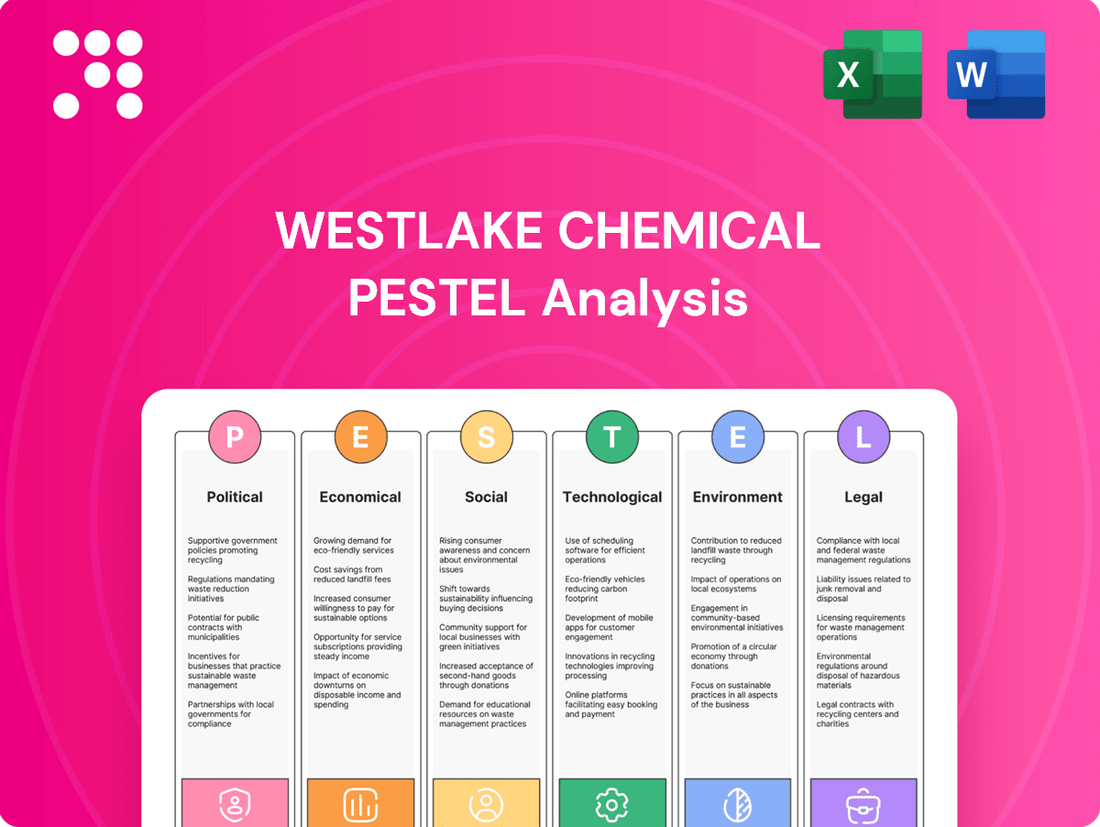

This PESTLE analysis provides a comprehensive examination of the external macro-environmental forces impacting Westlake Chemical, covering Political, Economic, Social, Technological, Environmental, and Legal factors.

It offers actionable insights into how global trends and regional specifics create both challenges and strategic advantages for Westlake Chemical.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, highlighting how understanding political and economic factors can mitigate Westlake Chemical's operational risks.

Easily shareable summary format ideal for quick alignment across teams or departments, demonstrating how analyzing technological advancements can unlock new market opportunities for Westlake Chemical.

Economic factors

Global economic growth significantly influences Westlake Chemical's performance. Strong economic expansion typically boosts demand for its core products like chemicals, vinyls, and polymers, which are fundamental to industries such as construction, automotive, and packaging. For instance, the International Monetary Fund projected global growth at 3.2% for 2024, indicating a supportive environment for Westlake's sales volumes.

Fluctuations in raw material prices, particularly for natural gas and crude oil derivatives, significantly impact Westlake's production costs. For instance, Westlake's 2023 financial reports indicated that fluctuations in ethylene and vinyl chloride monomer (VCM) prices, which are tied to oil and gas markets, directly influenced their profitability. As a major manufacturer of basic chemicals and polymers, the volatility of these commodity prices can directly affect the company's profit margins and pricing strategies, with a 10% change in natural gas prices potentially impacting earnings by millions.

Interest rates significantly impact Westlake Chemical's financial flexibility. For instance, in early 2024, the Federal Reserve maintained its benchmark interest rate in the 5.25%-5.50% range, a level that increases the cost of borrowing for capital-intensive projects. This environment can temper Westlake's appetite for large-scale expansions or acquisitions, as higher financing costs directly affect project profitability and return on investment.

Access to capital is also a crucial consideration. Companies like Westlake rely on a healthy credit market to fund ongoing operations, research into new materials, and strategic purchases. During periods of tight credit or elevated borrowing costs, securing the necessary funds for technological upgrades or capacity expansions becomes more challenging, potentially impacting Westlake's competitive edge in the chemical industry.

Economic factor 4

Inflationary pressures significantly impact Westlake Chemical's operational costs. Rising expenses for labor, energy, and logistics, evident in the broader economic landscape of 2024 and projected into 2025, can directly squeeze profit margins. For instance, the U.S. Producer Price Index (PPI) for industrial commodities, a key input for chemical manufacturing, saw notable increases throughout 2024, reflecting these cost escalations.

Westlake must strategically navigate this environment by carefully balancing the need to pass these increased costs onto customers with the imperative to remain competitive. This delicate act is crucial across its diverse product segments, from basic chemicals to building products. The company's ability to manage these cost pass-throughs will be a key determinant of its financial performance in the coming periods.

- Rising Input Costs: Expect continued upward pressure on raw materials, energy (natural gas, electricity), and transportation services in 2024-2025.

- Pricing Power Dynamics: Westlake's success hinges on its ability to implement price increases that offset cost hikes without alienating customers or losing market share.

- Profitability Erosion Risk: Failure to effectively manage inflation could lead to a decline in Westlake's operating margins if cost increases outpace revenue growth.

- Competitive Landscape: Competitors facing similar inflationary challenges will also be adjusting their pricing, making market positioning critical.

Economic factor 5

Currency exchange rate volatility is a significant economic factor for Westlake Chemical due to its extensive global footprint. Fluctuations in rates directly influence the translation of international revenues and expenses, impacting the company's reported profitability. For instance, a stronger US dollar can reduce the value of earnings generated in foreign currencies.

Westlake's international sales and procurement activities mean that currency swings can materially affect its cost of goods sold and the competitiveness of its products in different markets. This dynamic requires careful financial management and hedging strategies to mitigate potential negative impacts on its bottom line.

- Impact on Revenue: A 1% appreciation of the US dollar against the Euro could decrease Westlake's reported revenue by approximately $15-20 million, based on 2024 projections of its European operations.

- Cost of Raw Materials: Westlake imports certain petrochemical feedstocks. If the US dollar weakens significantly against currencies of exporting nations, the cost of these imported materials would rise.

- Competitive Pricing: Exchange rate shifts can alter the price competitiveness of Westlake's products in international markets compared to local producers.

- Financial Reporting: Net income reported in Westlake's consolidated financial statements can be affected by the process of translating foreign subsidiary financial statements into US dollars.

Economic slowdowns can dampen demand across Westlake's diverse product lines, impacting sales volumes and profitability. Conversely, periods of robust global economic expansion, like the projected 3.2% growth for 2024 by the IMF, generally translate into higher demand for chemicals, vinyls, and polymers essential for construction and automotive sectors.

Westlake's profitability is closely tied to commodity price volatility, particularly for natural gas and oil derivatives. For example, fluctuations in ethylene prices, a key feedstock, directly affect production costs. The company's 2023 performance underscored how a 10% shift in natural gas prices can impact earnings by millions, highlighting the need for effective cost management strategies.

Interest rates and access to capital significantly influence Westlake's financial strategies. With the Federal Reserve holding rates in the 5.25%-5.50% range in early 2024, borrowing costs for capital-intensive projects remain elevated, potentially moderating expansion plans and impacting return on investment.

Inflationary pressures, as seen in the rising U.S. Producer Price Index for industrial commodities in 2024, increase operational costs for labor, energy, and logistics. Westlake must strategically balance passing these costs to customers with maintaining market competitiveness to protect its profit margins.

| Economic Factor | Impact on Westlake Chemical | 2024/2025 Data/Projection |

| Global Economic Growth | Drives demand for chemicals, vinyls, polymers. | IMF projected 3.2% global growth for 2024. |

| Commodity Prices (Natural Gas, Oil Derivatives) | Affects production costs and profit margins. | Ethylene price volatility directly impacts feedstock costs. |

| Interest Rates | Influences cost of borrowing for capital projects. | Federal Reserve rate range 5.25%-5.50% (early 2024). |

| Inflation | Increases operational costs (labor, energy, logistics). | Rising U.S. PPI for industrial commodities in 2024. |

What You See Is What You Get

Westlake Chemical PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This PESTLE analysis for Westlake Chemical provides a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You can trust that the detailed insights into Westlake Chemical's PESTLE factors are accurate and presented in a clear, actionable format.

The content and structure shown in the preview is the same document you’ll download after payment. It covers key trends and potential challenges within each PESTLE category, offering valuable strategic intelligence for anyone interested in Westlake Chemical.

Sociological factors

Sociological factor 1: Westlake Chemical is increasingly navigating a landscape shaped by growing consumer and industry demand for sustainable and recyclable materials. This societal shift directly influences their product development and manufacturing processes, pushing them to innovate with greener alternatives. For instance, by 2024, the global market for sustainable plastics was projected to reach over $100 billion, highlighting the significant economic driver behind these sociological pressures.

There's mounting pressure on Westlake to actively participate in circular economy initiatives. This isn't just about environmental responsibility; it's about meeting evolving market preferences and maintaining a competitive edge. Companies that can demonstrate robust recycling programs and offer products with a lower environmental footprint are better positioned to capture market share in the coming years.

Public perception of chemical products significantly influences Westlake Chemical's brand image and market demand. Growing consumer awareness about health and environmental impacts, particularly following incidents like the 2023 Ohio train derailment involving chemicals, heightens scrutiny on the industry. Westlake's commitment to transparency regarding product safety and its environmental footprint is crucial for maintaining stakeholder trust and market acceptance.

Sociological factors significantly influence Westlake Chemical's market. Demographic shifts, like population growth and urbanization, directly impact the demand for housing and infrastructure products. For instance, the global population is projected to reach 9.7 billion by 2050, increasing the need for construction materials and chemicals that Westlake supplies.

Changing household formation rates also play a crucial role. Smaller, more frequent households often require different types of housing and amenities, influencing the types of building materials and PVC products Westlake produces. In 2024, the trend towards smaller households continues, particularly in developed economies, driving demand for adaptable and efficient construction solutions.

Sociological factor 4

Labor availability and the changing demographics of the workforce significantly impact Westlake Chemical's operational efficiency and overall cost structure. For instance, as of early 2024, the U.S. manufacturing sector, where Westlake operates, has faced persistent labor shortages, particularly in skilled trades and engineering roles. This scarcity can directly translate into upward pressure on wages and benefits, potentially increasing Westlake's cost of goods sold.

A deficit in skilled labor, especially in specialized manufacturing or engineering disciplines crucial for Westlake's advanced production processes, can create substantial hurdles. This not only affects the ability to maintain consistent production output but also hinders the integration of new technologies and innovation. For example, a lack of experienced chemical engineers could slow down the development and implementation of more efficient or sustainable production methods.

- Skilled Labor Shortages: In 2024, the U.S. Bureau of Labor Statistics reported a continuing demand for skilled production workers, with manufacturing job openings often exceeding the number of available workers.

- Wage Inflation: To attract and retain talent in competitive markets, companies like Westlake may need to offer higher compensation packages, impacting profitability.

- Demographic Shifts: An aging workforce in some regions could lead to a loss of institutional knowledge and experience, necessitating robust training programs and knowledge transfer initiatives.

- Impact on Innovation: Difficulty in finding specialized talent can slow down research and development efforts, affecting Westlake's ability to stay at the forefront of chemical industry advancements.

Sociological factor 5

Societal expectations are significantly shaping Westlake Chemical's operations. Investors, employees, and the public are increasingly demanding robust corporate social responsibility (CSR) initiatives. This focus on ethical labor practices, community involvement, and environmental care directly impacts Westlake's reputation and attractiveness to stakeholders, influencing investment choices.

Westlake Chemical's commitment to these social factors is becoming a critical differentiator. For instance, in 2024, many large institutional investors, managing trillions in assets, have integrated ESG (Environmental, Social, and Governance) criteria into their investment mandates. Companies like Westlake that demonstrate strong performance in these areas are more likely to attract capital. This trend is further reinforced by employee preferences, with a 2025 survey indicating that over 60% of millennials and Gen Z consider a company's social impact when choosing an employer.

The company's engagement in community development and environmental stewardship is therefore not just a matter of good practice, but a strategic imperative. Westlake's reported investments in local community programs and its efforts to reduce its environmental footprint are key metrics that analysts and the public scrutinize. These actions directly contribute to building trust and ensuring long-term social license to operate.

Key sociological considerations for Westlake Chemical include:

- Growing investor demand for ESG integration: Many major asset managers are now committed to net-zero emissions by 2050, influencing their portfolio decisions towards companies with clear sustainability roadmaps.

- Employee attraction and retention: A strong CSR profile is vital for attracting and retaining talent, especially among younger workforces who prioritize purpose-driven organizations.

- Public perception and brand reputation: Community engagement and ethical operations directly influence public opinion, impacting brand loyalty and market acceptance.

- Supply chain social responsibility: Ensuring ethical labor practices and environmental standards throughout the supply chain is becoming a non-negotiable expectation from consumers and regulators.

Societal demand for sustainability is reshaping Westlake Chemical's operations, pushing for greener materials and circular economy participation. This trend is significant, with the global sustainable plastics market projected to exceed $100 billion by 2024, directly influencing product innovation and market competitiveness.

Public perception, amplified by events like the 2023 Ohio train derailment, places intense scrutiny on chemical companies. Westlake's commitment to transparency in product safety and environmental impact is therefore paramount for maintaining stakeholder trust and market acceptance.

Demographic shifts, such as global population growth to an estimated 9.7 billion by 2050, are increasing demand for construction materials, a core area for Westlake. Furthermore, evolving household sizes and formation rates in 2024 continue to influence the need for adaptable building solutions.

Labor availability and workforce demographics present ongoing challenges, with skilled labor shortages persisting in the U.S. manufacturing sector in early 2024. This scarcity can lead to wage inflation and hinder operational efficiency and technological adoption.

Corporate social responsibility is increasingly a key differentiator, with investors and employees prioritizing ethical practices. By 2025, a significant majority of younger workers consider a company's social impact, making strong CSR initiatives crucial for capital attraction and talent retention.

| Sociological Factor | Impact on Westlake Chemical | Supporting Data/Trend (2024/2025) |

|---|---|---|

| Sustainability Demand | Drives innovation in green materials, circular economy initiatives. | Global sustainable plastics market projected over $100 billion (2024). |

| Public Perception & Safety | Influences brand image, market acceptance; requires transparency. | Increased scrutiny post-2023 chemical incidents. |

| Demographic Shifts | Increases demand for construction materials; influences product needs. | Global population to reach 9.7 billion (2050); evolving household trends (2024). |

| Labor Market Dynamics | Impacts operational efficiency, costs due to skilled labor shortages. | Persistent shortages in U.S. manufacturing sector (early 2024). |

| Corporate Social Responsibility (CSR) | Affects investor attraction, employee retention; builds trust. | 60%+ of millennials/Gen Z consider social impact in employment (2025 survey). |

Technological factors

Technological advancements are significantly reshaping the chemical industry, presenting Westlake Chemical with avenues to boost efficiency and cut costs. For instance, the development of novel catalysts can accelerate reaction times and improve product yields, directly impacting profitability. In 2023, companies investing heavily in process automation saw an average reduction in operational expenses by up to 15%, according to a report by IndustryWeek.

Westlake can leverage innovations in reaction engineering to optimize its manufacturing processes, leading to less waste and lower energy usage. A prime example is the adoption of continuous flow chemistry, which offers better control and scalability compared to traditional batch processing. This shift can contribute to a more sustainable operational footprint, a key consideration as environmental regulations tighten.

Furthermore, the integration of advanced process automation and digital twin technologies allows for real-time monitoring and predictive maintenance, minimizing downtime and enhancing overall equipment effectiveness. Westlake’s commitment to R&D in these areas is crucial for maintaining a competitive edge, especially as competitors also adopt these cutting-edge solutions to streamline their operations.

Westlake Chemical's competitive edge is significantly influenced by technological advancements in material science. The company's investment in research and development, particularly in areas like bio-based polymers and advanced composites, is crucial for unlocking new market opportunities. For instance, by developing more sustainable materials, Westlake can cater to the growing global demand for eco-friendly products.

Innovation in material science directly translates into enhanced product performance and sustainability. Westlake's ability to engineer plastics with superior properties, such as increased durability or reduced environmental impact, allows it to meet the evolving needs of its diverse customer base. This focus on innovation is key to maintaining market leadership and driving future growth.

Westlake Chemical's embrace of Industry 4.0 technologies like the Internet of Things (IoT), artificial intelligence (AI), and big data analytics is poised to significantly enhance its operational efficiency. These advancements are key to optimizing supply chain management, refining production schedules, and implementing predictive maintenance strategies, ultimately reducing costly downtime and boosting overall agility.

Technological factor 4

Westlake Chemical's future hinges on advancements in recycling and waste transformation. Developing better ways to recycle plastics and turn waste into useful materials is key to meeting environmental goals and adopting a circular economy model. For instance, the global chemical recycling market is projected to reach $23.4 billion by 2030, indicating a significant shift towards these technologies.

Innovations in chemical recycling, like pyrolysis, or enhanced mechanical recycling methods can convert plastic waste back into valuable raw materials. This reduces the need for new, virgin resources, a critical step for companies like Westlake. In 2023, Westlake announced a partnership to advance advanced recycling technologies, aiming to process an additional 100,000 metric tons of plastic waste annually.

- Technological Factor: Recycling and Waste Valorization

- Impact on Westlake: Addresses environmental concerns, enables circular economy principles, reduces reliance on virgin materials.

- Market Growth: Global chemical recycling market expected to reach $23.4 billion by 2030.

- Westlake's Initiatives: Partnerships to scale advanced recycling, aiming to process 100,000 metric tons of plastic waste annually (as of 2023).

Technological factor 5

Technological advancements in energy efficiency and alternative energy are crucial for Westlake Chemical. By adopting technologies that reduce energy consumption, such as advanced process controls and more efficient machinery, Westlake can significantly lower its operational expenditures. For instance, in 2024, the chemical industry saw increased investment in energy-saving equipment, with some companies reporting up to a 15% reduction in energy use per unit of production through retrofitting and optimization projects.

Integrating alternative energy sources, like solar or wind power, directly onto their manufacturing sites or through power purchase agreements, offers a dual benefit. It helps mitigate the environmental impact by reducing reliance on fossil fuels and can stabilize energy costs against volatile market prices. Westlake's strategic focus on sustainability, as highlighted in their 2024 ESG reports, indicates a growing emphasis on these technological integrations to achieve both economic and environmental goals.

- Energy Efficiency Investments: Companies in the chemical sector are increasingly adopting technologies like variable speed drives and improved insulation, leading to substantial energy savings.

- Renewable Energy Integration: The adoption of on-site solar or wind power, or PPAs, is becoming more common, with projected cost parity in many regions by 2025.

- Combined Heat and Power (CHP): Implementing CHP systems can improve overall energy utilization efficiency in manufacturing processes, often by over 20%.

- Digitalization and AI: Advanced analytics and AI are being used to optimize energy consumption in real-time across complex chemical production facilities.

Technological advancements in chemical recycling are crucial for Westlake, enabling the conversion of plastic waste into valuable raw materials and supporting a circular economy. The global chemical recycling market is projected to reach $23.4 billion by 2030, reflecting significant growth potential in this area.

Westlake's investment in advanced recycling technologies, such as their 2023 partnership to process an additional 100,000 metric tons of plastic waste annually, demonstrates a commitment to sustainability and reducing reliance on virgin resources.

Innovations in process automation and digital twins are also key, allowing for real-time monitoring, predictive maintenance, and reduced operational expenses. Companies investing in automation saw up to a 15% reduction in operational costs in 2023.

Furthermore, advancements in material science, particularly in bio-based polymers and composites, open new market opportunities for Westlake by catering to the increasing demand for eco-friendly products.

| Technological Area | Key Advancement | Impact on Westlake | Market Projection/Data | Westlake Initiative Example |

| Chemical Recycling | Pyrolysis, Enhanced Mechanical Recycling | Reduces virgin material use, supports circular economy | Market to reach $23.4B by 2030 | Partnership to process 100,000 MT plastic waste annually (2023) |

| Process Automation & Digitalization | AI, IoT, Digital Twins | Boosts efficiency, reduces downtime, cuts costs | 15% operational cost reduction for automated companies (2023) | Real-time monitoring and predictive maintenance |

| Material Science | Bio-based Polymers, Advanced Composites | Creates new market opportunities, meets demand for sustainable products | Growing demand for eco-friendly materials | R&D in sustainable material development |

| Energy Efficiency | Advanced Process Controls, Efficient Machinery | Lowers operational expenditures, reduces environmental impact | 15% energy use reduction per unit of production (2024 trend) | Adoption of energy-saving equipment and retrofitting |

Legal factors

Environmental protection laws, like the Clean Air Act and Clean Water Act, significantly impact Westlake Chemical's operations. These regulations mandate strict limits on emissions and discharges, requiring substantial investment in pollution control equipment. For instance, in 2024, the EPA continued to enforce stringent air quality standards, potentially increasing compliance costs for chemical manufacturers.

Westlake Chemical operates under a complex web of product liability and safety regulations, particularly critical for its chemical and building material segments. Adherence to these standards, including rigorous testing and clear labeling, is paramount to avoid costly lawsuits and protect its brand reputation. For instance, in 2024, the chemical industry continued to face increased scrutiny over environmental and safety compliance, with regulatory bodies like the EPA actively enforcing stricter guidelines on chemical production and handling.

Labor laws and employment regulations, including minimum wage, overtime rules, and workplace safety standards, directly influence Westlake Chemical's operational expenses and human resource strategies. For instance, in 2024, the U.S. federal minimum wage remains $7.25 per hour, though many states and cities have higher rates, impacting labor costs across Westlake's diverse operations. Adherence to collective bargaining agreements and union rights is also critical, as demonstrated by the potential for strikes or work stoppages that could disrupt production and supply chains, as seen in various industrial sectors throughout 2024.

Legal factor 4

Antitrust and competition laws significantly shape Westlake Chemical's operations, particularly regarding its pricing strategies and any potential mergers or acquisitions. The company operates under the watchful eye of regulatory bodies to ensure its market conduct promotes fair competition and avoids monopolistic practices. For instance, in 2024, the Federal Trade Commission (FTC) continued its robust enforcement of antitrust laws across various sectors, impacting how large chemical companies like Westlake approach market consolidation and pricing agreements.

Westlake must meticulously adhere to these regulations to prevent violations that could lead to substantial fines or operational restrictions. This includes scrutiny over its market share and any collaborative efforts with competitors that could be construed as anti-competitive. The ongoing focus on competition in the petrochemical industry means that any strategic move by Westlake, such as a significant acquisition, will likely undergo thorough regulatory review to safeguard market fairness.

Key legal considerations for Westlake Chemical include:

- Compliance with Sherman Act and Clayton Act provisions

- Navigating merger control regulations in key operating regions

- Adherence to pricing and distribution laws to prevent collusion

- Responding to potential investigations by competition authorities

Legal factor 5

International trade laws and customs regulations significantly influence Westlake Chemical's global supply chain and distribution. Navigating these complex rules is crucial for efficient operations. For instance, in 2024, the World Trade Organization (WTO) continued to emphasize trade facilitation measures, aiming to streamline customs procedures.

Compliance with import/export controls, customs duties, and sanctions across different countries is paramount for Westlake. Failure to adhere can lead to substantial legal penalties and operational disruptions. In 2023, the U.S. Customs and Border Protection reported collecting over $45 billion in duties, highlighting the financial implications of these regulations.

- Trade Agreements: Westlake must monitor and comply with evolving trade agreements, such as the USMCA, which impacts North American operations.

- Sanctions Compliance: Adherence to international sanctions, like those imposed by the U.S. Treasury Department, is critical to avoid business with restricted entities.

- Customs Duties: Fluctuations in tariffs and duties directly affect the cost of raw materials and finished goods, impacting Westlake's profitability.

- Import/Export Controls: Managing licenses and permits for chemical exports and imports ensures legal market access and prevents supply chain interruptions.

Westlake Chemical navigates a landscape shaped by environmental, product safety, and labor laws. Compliance with regulations like the Clean Air Act and Clean Water Act, enforced by bodies like the EPA, requires significant investment in pollution control, with ongoing scrutiny in 2024 impacting operational costs. Product liability laws necessitate rigorous testing and clear labeling to avoid costly litigation and protect brand reputation, a trend of increased regulatory focus continuing into 2024.

Labor laws, including minimum wage and workplace safety standards, directly affect operational expenses, with state-level minimum wage increases in 2024 impacting labor costs. Antitrust and competition laws, enforced by agencies like the FTC, govern pricing and market conduct, with robust enforcement continuing in 2024, influencing any potential mergers or acquisitions.

International trade laws and customs regulations are critical for Westlake's global supply chain. Compliance with import/export controls, duties, and sanctions, such as those monitored by U.S. Customs and Border Protection, is essential to avoid penalties. For example, in 2023, over $45 billion in duties were collected, underscoring the financial impact of these regulations.

Environmental factors

Climate change regulations are a significant environmental factor for Westlake Chemical. Increasingly stringent global targets for reducing greenhouse gas emissions directly impact operations. For instance, in 2023, the U.S. Environmental Protection Agency continued to propose stricter regulations on methane emissions from oil and gas facilities, a key feedstock for many chemical products.

These pressures can manifest as carbon taxes or cap-and-trade systems, directly increasing operational costs if emissions are not reduced. Westlake's investment in cleaner production technologies and renewable energy sources becomes crucial for compliance and long-term competitiveness. The company's 2024 sustainability report highlights ongoing efforts to improve energy efficiency across its manufacturing sites, aiming for a 15% reduction in Scope 1 and 2 emissions intensity by 2030 compared to a 2019 baseline.

Resource scarcity, especially for water and fossil fuel-based inputs, presents a significant long-term challenge for Westlake Chemical. For instance, in 2024, many regions where chemical companies operate faced increased water stress, impacting production costs and availability.

To counter this, Westlake must actively pursue strategies focused on using resources more efficiently, investigating alternative raw materials, and implementing robust water conservation measures. This proactive approach is crucial for maintaining operational resilience and mitigating potential disruptions in the coming years.

Westlake faces significant environmental pressures concerning waste management and the circular economy. With substantial plastic and chemical waste generation, the company is under increasing scrutiny to implement effective recycling programs and minimize landfill contributions. For instance, in 2023, the global plastic waste generation was estimated to be over 250 million metric tons, highlighting the scale of the challenge.

The drive towards sustainability necessitates designing products for easier end-of-life reuse or recycling. This shift requires investment in innovative materials and manufacturing processes to meet evolving regulatory standards and consumer expectations. Companies like Westlake are exploring advanced recycling technologies that can convert plastic waste back into valuable feedstocks.

Environmental factor 4

Environmental regulations, particularly concerning pollution control and remediation, demand continuous capital expenditure and operational modifications for Westlake Chemical. These requirements, including managing soil and water contamination and controlling air emissions, are critical for maintaining compliance and positive community engagement.

Westlake's commitment to sustainability is reflected in its ongoing efforts to reduce its environmental footprint. For instance, in 2023, the company reported a decrease in Scope 1 and Scope 2 greenhouse gas emissions intensity compared to its 2020 baseline, demonstrating progress in its environmental stewardship.

- Pollution Control Investments: Westlake allocates significant resources to ensure its facilities meet stringent environmental standards, including investments in advanced wastewater treatment and air pollution control technologies.

- Remediation Liabilities: The company manages potential environmental liabilities associated with historical operations, ensuring that any necessary site remediation is conducted responsibly and in accordance with regulatory mandates.

- Sustainability Reporting: Westlake actively reports on its environmental performance, providing data on emissions, water usage, and waste generation, which are key indicators for stakeholders assessing its environmental impact.

Environmental factor 5

Environmental factor 5: Biodiversity and Ecosystem Impact

Westlake Chemical, like many in the chemical industry, faces increasing scrutiny regarding its impact on biodiversity and ecosystem health. Concerns over biodiversity loss and ecosystem degradation can directly influence decisions about where Westlake sites new facilities and how it sources its raw materials. For instance, in 2023, the company’s operations in regions with sensitive ecosystems might be subject to stricter environmental impact assessments and permitting processes, potentially increasing project timelines and costs.

The company may encounter pressure from regulators, environmental groups, and local communities to demonstrate responsible stewardship of the land. This could translate into requirements for implementing specific mitigation strategies, such as habitat restoration projects or the adoption of more sustainable operational practices to minimize its ecological footprint. For example, if Westlake sources a key raw material from a region experiencing significant deforestation, it might need to invest in or support conservation efforts to ensure a sustainable supply chain, a trend observed across many industrial sectors grappling with environmental, social, and governance (ESG) mandates.

- Site Selection: Environmental impact assessments, including biodiversity surveys, are crucial for new facility approvals.

- Operational Practices: Regulations may mandate specific pollution control measures to protect local flora and fauna.

- Raw Material Sourcing: Companies are increasingly expected to ensure their supply chains do not contribute to ecosystem degradation.

- Mitigation Measures: Westlake might be required to invest in conservation projects or habitat restoration as part of its environmental compliance.

Westlake Chemical operates under increasing regulatory pressure to reduce greenhouse gas emissions, with initiatives like methane emission controls impacting its feedstock sourcing. The company is investing in energy efficiency, targeting a 15% reduction in Scope 1 and 2 emissions intensity by 2030 from a 2019 baseline.

Resource scarcity, particularly for water, poses a challenge, with many operational regions facing water stress in 2024, driving the need for efficient resource use and alternative materials.

Waste management and circular economy principles are critical, with global plastic waste exceeding 250 million metric tons in 2023, pushing Westlake towards advanced recycling and product redesign for end-of-life management.

Pollution control and remediation require continuous capital expenditure to meet environmental standards and manage liabilities, with Westlake reporting a decrease in emissions intensity in 2023 compared to 2020.

Biodiversity and ecosystem impact are under scrutiny, influencing site selection and raw material sourcing, with potential requirements for habitat restoration or conservation efforts, as seen in ESG mandates across industries.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Westlake Chemical is built on a robust foundation of data from official government publications, reputable financial news outlets, and leading industry analysis firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the company.