Westlake Chemical Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Westlake Chemical Bundle

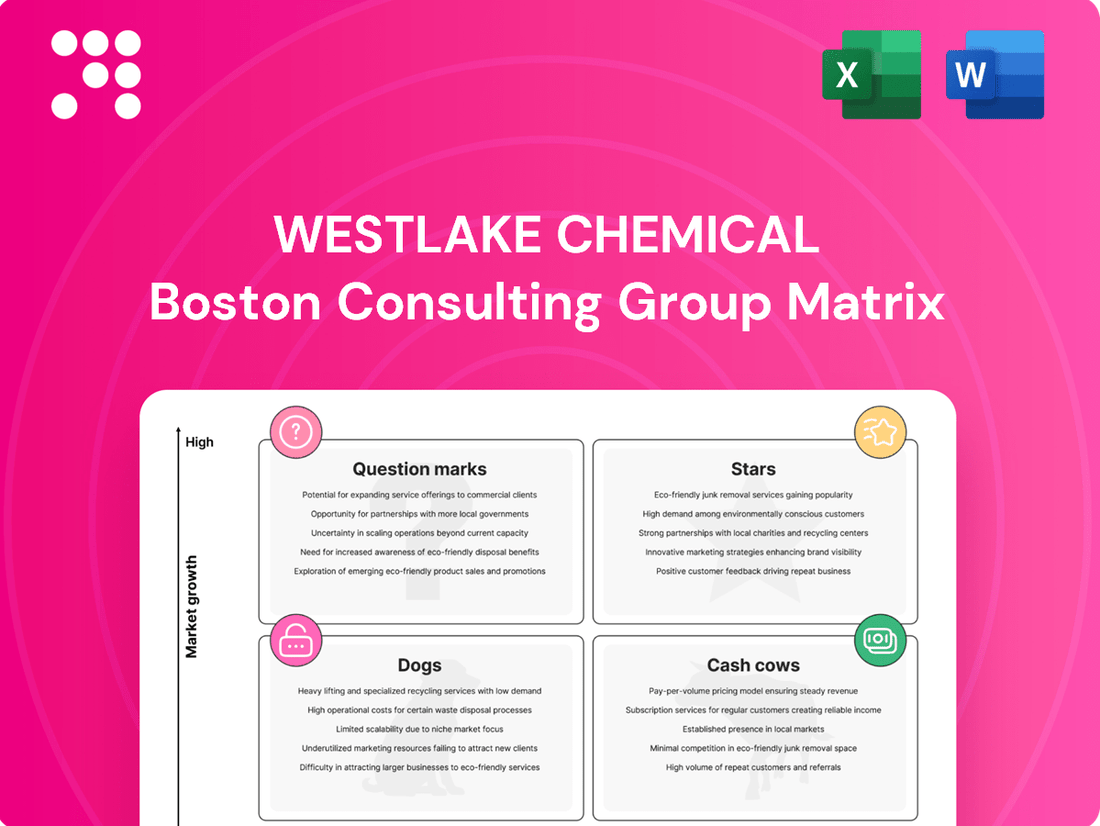

Curious about Westlake Chemical's product portfolio performance? Our BCG Matrix analysis reveals which segments are driving growth and which might be holding the company back. Understand their strategic positioning at a glance.

Ready to unlock the full potential of this analysis? Purchase the complete Westlake Chemical BCG Matrix for detailed quadrant breakdowns, actionable insights, and a clear roadmap for optimizing your investments and product strategies.

Stars

Westlake's Housing and Infrastructure Products (HIP) segment is a star performer, as evidenced by its impressive financial results. In 2024, this segment achieved a record annual income from operations of $807 million and an EBITDA of $1.1 billion.

The segment's strength is further highlighted by its consistent year-over-year sales volume growth, which has been sustained for five consecutive quarters. This consistent upward trend signals a robust market position within the expanding residential construction sector.

Westlake is strategically investing in specialty PVC, particularly molecular-oriented PVC, signaling a move towards higher-value products. A new production facility, slated for operation in 2026, will bolster output of this advanced material.

This molecular-oriented PVC boasts superior tensile strength and a lighter environmental impact. These attributes make it a prime candidate for the demanding municipal pipe market and other specialized uses, underscoring its strong growth prospects.

Westlake Chemical's EpoVIVE™ sustainable epoxy product portfolio is poised to capture significant market share. These offerings are specifically engineered for sectors like aerospace and automotive, addressing a clear demand for greener materials. The portfolio boasts advantages such as reduced carbon footprints and enhanced recyclability, key differentiators in the burgeoning eco-friendly materials market.

New Product Innovations in Building Products

Westlake Royal Building Products is actively innovating within the building products sector, particularly with its siding and trim offerings. The company is consistently launching new colors and designs that align with current housing market trends and consumer preferences. This strategic focus on aesthetics, coupled with a commitment to performance and durability, positions these products favorably in a growing market segment.

The success of these new product innovations can be seen in their ability to capture significant market share. For instance, the demand for updated exterior aesthetics in residential construction has been a strong driver. In 2024, the U.S. housing market continued to see demand for renovations and new builds, with exterior remodeling projects often prioritizing visual appeal and longevity. Westlake Royal's approach directly addresses this, suggesting their new product lines are not only meeting but exceeding market expectations, indicating a strong position within the BCG matrix as a potential star.

- New Product Focus: Introduction of on-trend colors and designs in siding and trim.

- Market Driver: Catering to consumer demand for updated housing aesthetics and performance.

- Market Position: High market share and poised for continued success in a growing segment.

- 2024 Relevance: Aligns with continued demand for exterior renovations in the U.S. housing market.

Ethylene Production (Westlake Chemical Partners LP)

Westlake Chemical Partners LP, with Westlake Corporation as a major stakeholder, is a key player in ethylene production. The partnership successfully surpassed its 2024 production targets, even with planned maintenance periods affecting short-term cash flow.

Looking ahead to 2025, Westlake Chemical Partners LP anticipates enhanced distributable cash flow, driven by favorable third-party ethylene pricing and robust margins. This performance underscores their solid standing in the market for this essential chemical commodity.

- Ethylene Production Focus: Westlake Chemical Partners LP's core business revolves around ethylene.

- 2024 Performance: Exceeded annual production plan despite planned turnarounds.

- 2025 Outlook: Expects improved cash flows due to attractive market conditions.

- Market Position: Demonstrates strength in the vital ethylene market.

Westlake's Housing and Infrastructure Products (HIP) segment, particularly its specialty PVC and innovative building products like siding and trim, are clearly positioned as stars within the BCG matrix. The segment's record $807 million income from operations and $1.1 billion EBITDA in 2024, coupled with five consecutive quarters of sales volume growth, highlight its strong market leadership and rapid expansion. Strategic investments in advanced materials like molecular-oriented PVC, designed for high-demand sectors such as municipal pipes, further solidify its high growth potential and market dominance.

| Segment | Star Characteristics | 2024 Financials/Data | Strategic Focus |

|---|---|---|---|

| Housing & Infrastructure Products (HIP) | High market share, rapid growth, strong demand for innovative products. | $807 million income from operations, $1.1 billion EBITDA, 5 consecutive quarters of sales volume growth. | Specialty PVC (molecular-oriented PVC), new siding and trim designs, sustainable epoxy products (EpoVIVE™). |

What is included in the product

This BCG Matrix overview for Westlake Chemical details its business units, classifying them as Stars, Cash Cows, Question Marks, or Dogs.

It provides strategic recommendations on investing in Stars, milking Cash Cows, developing Question Marks, and divesting Dogs.

The Westlake Chemical BCG Matrix provides a clear, actionable overview of business unit performance, relieving the pain of strategic uncertainty.

Cash Cows

Westlake Chemical is a major player in North American PVC resin production, a key material for building and industry. Despite some global demand softness, their strong market position and efficient production in North America are expected to yield steady cash generation.

Westlake's siding and trim products, a key component of its Housing Products portfolio, demonstrated robust sales volume growth throughout 2024. This performance was instrumental in the Housing Improvement Products segment achieving record financial results.

These offerings represent mature products within the residential construction market, benefiting from established brand recognition and enduring demand. This maturity translates into stable, high-profit margins for Westlake, solidifying their position as cash cows.

The Pipe & Fittings category at Westlake Chemical is a strong performer, exhibiting robust sales volume growth throughout 2024. This segment is a cornerstone of their Housing and Infrastructure Products division.

While average sales prices have seen some fluctuations, the consistent demand from infrastructure projects solidifies Pipe & Fittings as a dependable cash cow. It's a significant contributor to the segment's overall income from operations, underscoring its stable and profitable nature.

Basic Chlor-alkali & Derivatives

Westlake's basic chlor-alkali and derivatives segment, a cornerstone of its operations, functions as a classic Cash Cow within the BCG Matrix. These are fundamental chemicals, vital for numerous industrial applications, from plastics to water treatment. Despite being commodity products subject to market cycles, Westlake's strategic advantage lies in its globally competitive, low-cost production. This efficiency allows the company to maintain a substantial market share and generate steady, predictable cash flows, even in periods of slower market expansion.

The consistent profitability of this segment is a key strength for Westlake. For instance, in 2023, Westlake reported significant contributions from its Olefins and Vinyls segments, which heavily rely on chlor-alkali production, demonstrating the enduring cash-generating power of these basic chemicals. The company's focus on operational excellence and vertical integration further solidifies its cost leadership.

- High Market Share: Westlake's cost-efficiency in chlor-alkali production enables it to capture and maintain a significant portion of the global market.

- Consistent Cash Generation: Despite being a mature market, the segment reliably produces substantial cash flow for the company.

- Low Growth, High Profitability: While the overall market for basic chemicals may not experience rapid growth, Westlake's strong competitive position ensures healthy profit margins.

- Strategic Importance: This segment provides essential feedstock for other Westlake businesses and underpins its diversified chemical portfolio.

Established Polyethylene Products

Westlake Chemical's established polyethylene products are a prime example of a cash cow in their portfolio. Polyethylene, a versatile plastic, finds extensive use in packaging, automotive components, and consumer goods. Despite potential market fluctuations tied to global industrial activity, Westlake's long-standing operational expertise and efficient production processes ensure a consistent and reliable stream of cash flow from this segment.

This segment benefits from economies of scale and optimized supply chains, contributing significantly to Westlake's financial stability. For instance, in 2024, the global polyethylene market was valued at approximately $115 billion, with steady demand driven by essential industries.

- Market Position: Westlake holds a significant share in the polyethylene market, leveraging its integrated production facilities.

- Cash Generation: The mature nature of polyethylene applications allows for predictable revenue and strong cash generation.

- Operational Efficiency: Westlake's focus on cost-effective production methods enhances profitability in this segment.

Westlake's PVC resin production is a quintessential cash cow, benefiting from its substantial North American market share. This segment consistently generates strong cash flows due to efficient operations and enduring demand in construction and industrial sectors. The company's integrated model provides a cost advantage, ensuring profitability even with moderate market growth.

The Housing Products segment, particularly siding and trim, demonstrated robust sales volume growth in 2024, contributing to record financial results for housing improvement products. This indicates a stable, high-margin business driven by established brand recognition and consistent demand in the residential construction market.

Westlake's Pipe & Fittings segment is another reliable cash cow, showing strong sales volume growth in 2024. Despite price fluctuations, consistent demand from infrastructure projects underpins its stable and profitable nature, making it a significant income generator for the Housing and Infrastructure Products division.

The basic chlor-alkali and derivatives segment operates as a classic cash cow due to Westlake's globally competitive, low-cost production. This segment, vital for numerous industrial applications, maintains substantial market share and generates steady cash flows, as evidenced by its significant contributions to the Olefins and Vinyls segments in 2023.

Established polyethylene products represent a core cash cow for Westlake, with consistent demand from packaging and automotive industries. The global polyethylene market, valued around $115 billion in 2024, benefits from Westlake's operational expertise and economies of scale, ensuring predictable revenue and strong cash generation.

What You’re Viewing Is Included

Westlake Chemical BCG Matrix

The Westlake Chemical BCG Matrix preview you are viewing is the definitive report you will receive upon purchase. This means the analysis, formatting, and strategic insights are exactly as they will be delivered, ensuring no discrepancies and immediate usability for your business planning.

Rest assured, the Westlake Chemical BCG Matrix displayed here is the complete and final document you will download after completing your purchase. It is meticulously prepared, free of any demo markers or watermarks, and ready for immediate integration into your strategic decision-making processes.

What you see is the actual, unadulterated Westlake Chemical BCG Matrix file that will be yours once the purchase is finalized. This preview accurately represents the professional-grade analysis and comprehensive layout you can expect to receive, ready for immediate application.

Dogs

Westlake Chemical's decision in July 2024 to temporarily halt its allyl chloride (AC) and epichlorohydrin (ECH) production in Pernis, Netherlands, starting in 2025, signals a strategic re-evaluation. This move, which will involve mothballing costs, indicates these specific operations are likely facing market pressures, potentially in a mature or declining phase.

The temporary cessation of the AC and ECH units in Pernis, a significant European chemical hub, implies these product lines may be considered "Cash Cows" or even "Dogs" within Westlake's broader portfolio. The capital tied up in these underperforming assets, especially given the expected expenses for mothballing, suggests a need to optimize resource allocation in a market environment that isn't providing adequate returns.

Certain legacy performance materials products within Westlake Chemical's Performance and Essential Materials (PEM) segment are likely candidates for the Dogs quadrant of the BCG Matrix. The company reported lower sales prices for most PEM products in Q4 2024, which directly impacted operational results, leading to a loss in Q1 2025. This financial pressure suggests these older products may possess a low market share in markets characterized by slow growth and intense competition.

The sales volume decline of 2% in Westlake Chemical's Performance and Essential Materials segment in Q1 2025 was partly attributed to weaker global demand for PVC resin. This suggests that certain PVC products within this segment, particularly those facing significant international competition or tied to industries experiencing downturns, might be experiencing a low market share in a low-growth environment. These products could be classified as dogs in the BCG matrix.

Underperforming Product Lines impacted by High Feedstock Costs

Westlake's Performance and Essential Materials segment experienced a loss from operations in Q1 2025, directly attributed to elevated North American feedstock and energy expenses. This headwind has particularly affected product lines that struggle to absorb or pass on these increased input costs to their customer base.

These product lines, facing diminished profitability and a weaker competitive stance due to the cost pressures, could be categorized as Dogs within Westlake's BCG Matrix. For instance, while specific product lines weren't detailed, the overall segment's performance highlights the vulnerability.

- High Feedstock Costs: Q1 2025 saw significant increases in North American feedstock and energy prices, impacting operational profitability.

- Segment Performance: The Performance and Essential Materials segment reported a loss from operations in Q1 2025 due to these cost pressures.

- Underperforming Products: Product lines unable to pass on higher input costs to customers are likely suffering from reduced profitability and market competitiveness.

Segments with Persistent Negative Margins

The Performance and Essential Materials (PEM) segment experienced a substantial operating loss of $163 million in the first quarter of 2025. This marks a significant downturn from the profitability observed in the same quarter of 2024.

This persistent negative operational performance, potentially driven by market oversupply or specific product challenges, indicates that certain areas within PEM are consuming cash without yielding sufficient returns.

- Operating Loss in PEM (Q1 2025): $163 million

- Comparison to Q1 2024: Significant negative shift from profit

- Potential Causes: Market oversupply, specific product issues

- Implication: Cash consumption without adequate returns

Certain legacy performance materials products within Westlake Chemical's Performance and Essential Materials (PEM) segment are likely candidates for the Dogs quadrant of the BCG Matrix. The company reported lower sales prices for most PEM products in Q4 2024, directly impacting operational results and leading to a loss in Q1 2025. This financial pressure suggests these older products may possess a low market share in markets characterized by slow growth and intense competition.

The Performance and Essential Materials segment experienced a substantial operating loss of $163 million in the first quarter of 2025, a significant downturn from the profitability observed in the same quarter of 2024. This persistent negative operational performance, potentially driven by market oversupply or specific product challenges, indicates that certain areas within PEM are consuming cash without yielding sufficient returns.

The sales volume decline of 2% in Westlake Chemical's Performance and Essential Materials segment in Q1 2025, partly attributed to weaker global demand for PVC resin, suggests that certain PVC products within this segment, particularly those facing significant international competition or tied to industries experiencing downturns, might be experiencing a low market share in a low-growth environment.

These product lines, facing diminished profitability and a weaker competitive stance due to cost pressures such as elevated North American feedstock and energy expenses in Q1 2025, could be categorized as Dogs within Westlake's BCG Matrix.

| BCG Quadrant | Westlake Chemical Segment/Product Example | Market Growth | Market Share | Financial Performance Indication |

| Dogs | Performance & Essential Materials (Specific legacy products, some PVC resins) | Low | Low | Operating Loss ($163M in Q1 2025), declining sales prices, inability to absorb cost increases |

Question Marks

Westlake Epoxy's new recyclable rotor blade technology positions it as a potential question mark in the BCG matrix. This innovation targets the burgeoning renewable energy composites market, a sector experiencing significant growth.

While the market itself is expanding rapidly, Westlake's specific product is new to the scene. Consequently, its current market share is likely minimal, necessitating substantial investment to establish a foothold and capture market share.

Westlake Epoxy is actively developing advanced materials for hydrogen storage, a critical component of the burgeoning hydrogen economy. This sector, projected for substantial growth, presents a significant opportunity for innovation and market penetration.

Given the nascent stage of Westlake's involvement and the specialized nature of hydrogen storage solutions, these products likely fall into the Question Mark category of the BCG matrix. This classification signifies a high-growth market where the company's current market share is relatively low, necessitating strategic investment to gain traction and compete effectively.

Westlake Chemical's EpoVIVE™ products, with their enhanced bio-based content, are poised to make a significant impact in the aeronautics sector by lowering the Product Carbon Footprint (PCF) of molded parts. This innovation directly addresses the growing sustainability mandates within this high-growth industry.

As a relatively new entrant, EpoVIVE™ currently occupies a small market share. This positions it as a potential question mark within the BCG matrix, necessitating strategic investment and focused marketing efforts to drive adoption and capture a larger portion of the aerospace market, which is increasingly prioritizing eco-friendly materials.

Phenolic Fiber-Reinforced Battery Covers for Automotive

Westlake Chemical is exploring phenolic fiber-reinforced battery covers for the automotive sector, highlighting their robust mechanical properties and a novel 'snap curable' resin. This innovation targets the burgeoning electric vehicle (EV) market, a segment experiencing substantial growth and demanding advanced material solutions for critical components like battery enclosures. The global EV battery market was valued at approximately $100 billion in 2023 and is projected to reach over $500 billion by 2030, indicating a massive opportunity for material suppliers.

While the potential is immense, Westlake's current market share in this specific niche of reinforced battery covers is likely nascent. This positions the product line as a 'Question Mark' within the BCG Matrix, signifying a business unit with low market share in a high-growth industry.

- High-Growth Market: The electric vehicle market is expanding rapidly, with global EV sales projected to exceed 15 million units in 2024, creating significant demand for innovative battery components.

- Technological Innovation: Phenolic fiber-reinforced covers offer superior mechanical strength and thermal resistance compared to traditional materials, addressing key safety and performance requirements in EVs.

- Investment Required: To capitalize on this opportunity, Westlake will need to invest in scaling production, further research and development, and establishing market presence to gain traction against established competitors.

- Strategic Focus: The success of these battery covers hinges on Westlake's ability to secure partnerships with EV manufacturers and demonstrate the cost-effectiveness and performance benefits of their material solution.

Advanced Composites Recycling Initiatives

Westlake Chemical's involvement in advanced composites recycling, exemplified by its partnership with Alpha Recyclage Composites, positions this area as a strategic 'Question Mark' within its BCG Matrix.

While primarily a sustainability effort, these initiatives tap into the burgeoning circular economy for materials, a sector projected for significant growth.

Westlake's current market penetration with commercialized recycled composite products is likely minimal, reflecting the early stage of this market.

- Strategic Partnership: Collaboration with Alpha Recyclage Composites signifies a commitment to developing advanced composites recycling technologies.

- Market Potential: The circular economy for materials, particularly advanced composites, represents a high-growth potential area for future product development and market expansion.

- Nascent Stage: Westlake's current commercialization of recycled composite products is likely in its infancy, indicating a low current market share in this emerging sector.

- Future Opportunity: Despite low current market share, the initiative is a 'Question Mark' due to its significant future growth prospects and potential to create new business lines.

Westlake Chemical's focus on developing recyclable rotor blade technology for wind turbines places this initiative firmly in the Question Mark quadrant of the BCG matrix. The renewable energy sector, particularly wind power, is experiencing robust growth, with global installed wind capacity projected to reach over 1,500 GW by 2030. However, Westlake's specific recyclable composite technology is novel, meaning its current market share is likely negligible.

The company's efforts in advanced materials for hydrogen storage also represent a Question Mark. The global hydrogen market is anticipated to grow significantly, with estimates suggesting it could be worth trillions by 2050. Westlake's involvement in this nascent but high-potential market, where its market share is currently minimal, necessitates substantial investment to establish a competitive position.

Similarly, Westlake's EpoVIVE™ products, designed with enhanced bio-based content for the aeronautics industry, are positioned as Question Marks. The aerospace sector's increasing demand for sustainable materials, driven by environmental regulations and corporate goals, creates a high-growth environment. Yet, EpoVIVE™ being a newer offering, likely holds a small market share, requiring strategic marketing and development to capture a larger segment.

| Business Unit | Market Growth | Market Share | BCG Classification |

| Recyclable Rotor Blade Tech | High | Low | Question Mark |

| Hydrogen Storage Materials | High | Low | Question Mark |

| EpoVIVE™ (Aeronautics) | High | Low | Question Mark |

BCG Matrix Data Sources

Our Westlake Chemical BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable insights.