Westlake Chemical Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Westlake Chemical Bundle

Westlake Chemical operates in an industry shaped by moderate buyer power and the constant threat of substitutes, particularly in its commodity chemical segments.

The complete report reveals the real forces shaping Westlake Chemical’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of suppliers significantly impacts Westlake Chemical's bargaining power. If a small number of companies supply essential raw materials like ethylene or propylene, these suppliers can dictate terms and prices, increasing costs for Westlake. For example, in 2024, the global ethylene market, a key feedstock for Westlake, is dominated by a few major producers, giving them considerable leverage.

The cost and difficulty Westlake Chemical faces when switching suppliers are crucial factors in determining supplier bargaining power. If Westlake's processes are heavily reliant on a specific supplier's unique products or require significant investment in new equipment to accommodate a different supplier, switching costs are high. This elevates the supplier's leverage.

For instance, if Westlake uses specialized catalysts or proprietary chemical formulations from a particular supplier, the expense and time involved in qualifying and integrating alternatives can be substantial. This dependency strengthens the supplier's position, potentially allowing them to dictate terms or prices.

The availability of substitute inputs significantly curtails supplier bargaining power. For Westlake Chemical, if alternative raw materials or components are easily accessible in the market, current suppliers lose leverage. For instance, in 2024, the petrochemical industry saw increased output from new ethylene crackers, potentially offering Westlake more options for key feedstocks like ethane, thereby softening the grip of any single supplier.

Importance of Westlake to Suppliers

Westlake Chemical's reliance on its suppliers significantly influences their bargaining power. If Westlake constitutes a substantial portion of a supplier's sales, that supplier might be more accommodating to Westlake's pricing and terms, as losing Westlake's business would be detrimental. For instance, in 2023, Westlake Chemical reported total cost of goods sold of $13.4 billion, indicating a considerable volume of purchases from its supply chain.

Conversely, if Westlake represents a small fraction of a supplier's overall revenue, the supplier holds greater leverage. They can more easily dictate terms or shift their focus to other, larger customers if Westlake's demands become too onerous. This dynamic is crucial for Westlake to manage to ensure competitive input costs.

The bargaining power of suppliers is also shaped by the availability of alternative suppliers and the uniqueness of the raw materials or services provided.

- Supplier Dependence: If Westlake is a major customer for a supplier, that supplier's power is diminished.

- Westlake's Customer Size: If Westlake is a minor customer for a supplier, the supplier's power increases.

- Input Cost Impact: Westlake's cost of goods sold in 2023 was $13.4 billion, highlighting the scale of its supplier relationships.

- Market Concentration: The number of alternative suppliers for Westlake's key inputs affects supplier leverage.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Westlake Chemical's operations, such as producing basic chemicals or polymers themselves, could significantly enhance their bargaining power. This would directly challenge Westlake's market position and potentially lead to less favorable pricing and supply agreements.

For instance, if a key supplier of ethylene, a crucial feedstock for Westlake, were to start producing polyethylene, they could dictate terms more aggressively. This scenario would force Westlake to either compete with its own supplier or accept higher input costs, impacting profitability. In 2024, the petrochemical industry experienced volatility in feedstock prices, making such forward integration a more attractive strategy for some suppliers seeking greater control over their value chain.

- Suppliers' forward integration capability: Suppliers could leverage their expertise and existing infrastructure to enter Westlake's production segments.

- Impact on Westlake's terms: Increased supplier power could result in higher raw material costs and less favorable contract conditions for Westlake.

- Industry context (2024): Volatile feedstock markets in 2024 made forward integration a potentially lucrative strategy for suppliers aiming for greater value capture.

The bargaining power of suppliers for Westlake Chemical is influenced by several factors, including supplier concentration and the availability of substitutes. If only a few companies supply essential raw materials, like ethylene, they gain significant leverage. For example, in 2024, the global ethylene market is characterized by a limited number of major producers, giving them considerable pricing power over Westlake.

| Factor | Impact on Westlake Chemical | 2024 Context/Data |

|---|---|---|

| Supplier Concentration | High concentration of suppliers for key feedstocks like ethylene increases their bargaining power. | Global ethylene market dominated by a few key producers in 2024. |

| Switching Costs | High switching costs for Westlake (e.g., specialized equipment, proprietary materials) empower suppliers. | Reliance on specific catalysts or proprietary formulations can make switching difficult and expensive. |

| Availability of Substitutes | Greater availability of substitute raw materials or components reduces supplier leverage. | Increased output from new ethylene crackers in 2024 offered more feedstock options, potentially softening supplier grip. |

| Supplier Dependence on Westlake | If Westlake is a large customer, supplier power is reduced; if Westlake is a small customer, supplier power increases. | Westlake's 2023 cost of goods sold was $13.4 billion, indicating significant purchasing volume. |

| Forward Integration Threat | Suppliers integrating into Westlake's business segments (e.g., producing polymers) increases their power. | Volatile feedstock markets in 2024 made forward integration an attractive strategy for suppliers seeking more control. |

What is included in the product

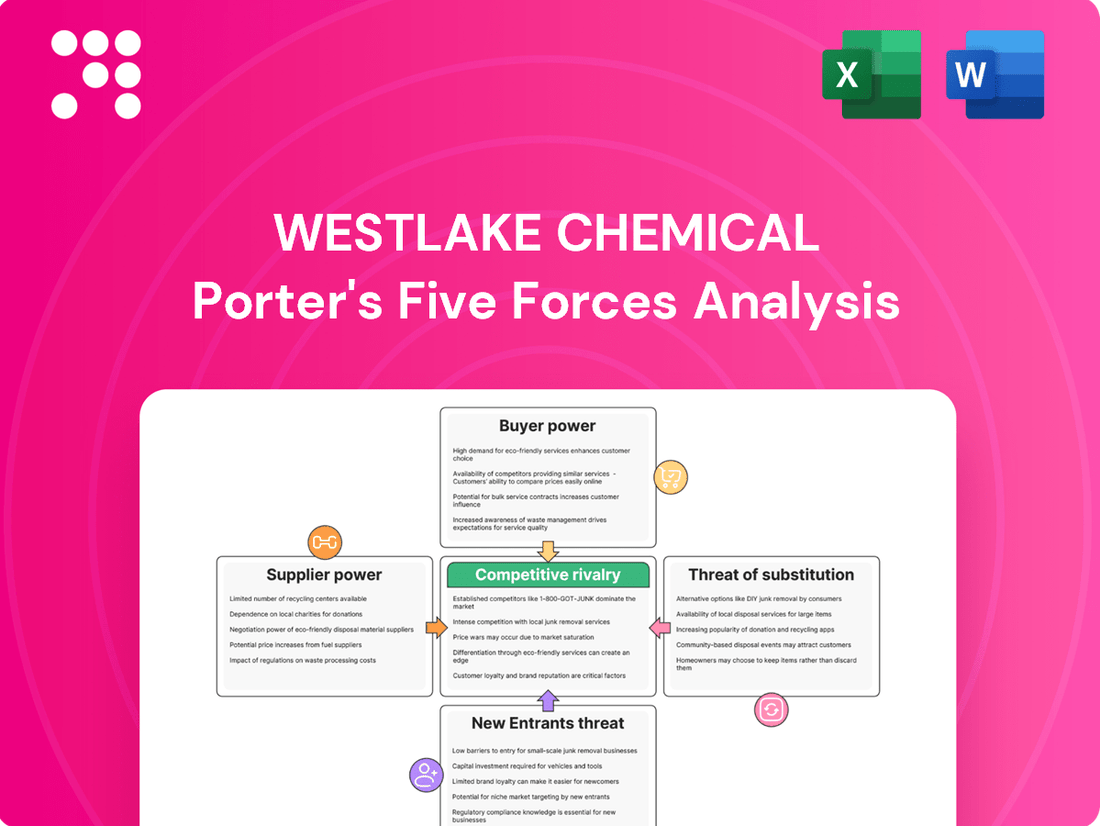

This analysis examines the competitive intensity within the petrochemical industry, evaluating the bargaining power of Westlake Chemical's suppliers and buyers, the threat of new entrants and substitutes, and the rivalry among existing players.

Quickly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces impacting Westlake Chemical.

Customers Bargaining Power

Westlake Chemical's bargaining power of customers is influenced by customer concentration. If a few large customers account for a substantial portion of Westlake's sales, these buyers can wield significant influence over pricing and contract terms. For instance, if a single customer represents over 10% of Westlake's revenue, their ability to negotiate favorable terms increases considerably.

If customers can easily switch from Westlake Chemical's products to those of rivals without incurring significant costs or effort, their bargaining power naturally grows. This is especially true if Westlake's offerings are perceived as interchangeable commodities.

For instance, in the commodity chemicals sector, where Westlake operates, switching costs are often minimal. A customer buying ethylene, a key Westlake product, can readily source it from another supplier if the price or terms are more favorable. In 2024, the global ethylene market, a significant segment for Westlake, saw prices fluctuate based on supply and demand, making price a primary driver for customer choice and highlighting the impact of low switching costs.

Customer price sensitivity significantly influences their bargaining power. When Westlake's products represent a substantial portion of a customer's overall costs, or when those customers face intense market competition, their sensitivity to price fluctuations increases dramatically, giving them more leverage.

For instance, in the construction sector, where material costs are a major factor, builders are highly attuned to price changes for products like PVC, a key Westlake offering. The average cost of PVC resin can fluctuate, impacting the final price of pipes and fittings, and thus influencing a builder's profit margins and competitiveness.

Availability of Substitute Products for Customers

The presence of readily available substitute products significantly weakens Westlake Chemical's bargaining power with its customers. When consumers can easily switch to alternative materials or technologies, they have more leverage to demand lower prices or better terms.

This dynamic is particularly relevant in the petrochemical industry, where innovation can quickly introduce new, cost-effective alternatives. For instance, the development of advanced plastics or bio-based materials could directly compete with Westlake's core product lines, forcing the company to remain competitive on pricing.

- Availability of Substitutes: Customers can choose from a wide array of materials like glass, metal, or wood, depending on the application, thereby limiting Westlake's pricing flexibility.

- Technological Advancements: Emerging technologies can create new substitute materials that offer comparable or superior performance at a lower cost, directly impacting demand for Westlake's products.

- Price Sensitivity: In 2024, many industrial sectors are experiencing heightened price sensitivity due to economic uncertainties, making customers more inclined to explore cheaper alternatives if Westlake's prices increase.

- Market Competition: The global chemical market is highly competitive, with numerous players offering similar products, further empowering customers to seek the best value proposition.

Threat of Backward Integration by Customers

The threat of backward integration by customers significantly impacts Westlake Chemical's bargaining power. If customers, particularly large industrial buyers, possess the technical expertise and financial resources to produce chemicals and polymers in-house, they gain leverage. This capability allows them to negotiate lower prices or even threaten to switch to self-production, directly pressuring Westlake's profit margins.

For instance, major automotive manufacturers or large construction material producers might explore producing certain chemical components if the cost savings and supply chain control outweigh the investment. In 2024, the increasing volatility in raw material prices and supply chain disruptions could further incentivize some of Westlake's key customers to investigate vertical integration to secure their inputs.

- Increased Customer Leverage: Customers with the ability to backward integrate can demand more favorable terms from Westlake Chemical.

- Potential Margin Erosion: The credible threat of customers producing their own chemicals can force Westlake to lower prices, impacting profitability.

- Strategic Consideration for Westlake: Westlake must continuously assess the integration capabilities of its major clients and offer competitive pricing and value-added services to mitigate this threat.

Westlake Chemical faces considerable customer bargaining power due to the commoditized nature of many of its products, particularly in the petrochemical sector. Customers often have low switching costs, meaning they can readily shift to competitors if pricing or terms are more attractive. This is evident in markets like ethylene, where price is a primary driver, as seen in the fluctuating global prices throughout 2024.

Price sensitivity among Westlake's customers is high, especially in industries like construction where materials represent a significant portion of costs. For example, builders are keenly aware of PVC resin price changes, which directly impact their profitability and competitiveness. The availability of substitutes, such as alternative plastics or bio-based materials, further amplifies this power by providing customers with more options and limiting Westlake's pricing flexibility.

The potential for backward integration by large customers also exerts pressure. If major buyers can produce key chemicals in-house, they gain leverage to negotiate better terms or threaten to switch to self-production, especially given the supply chain volatility observed in 2024. This forces Westlake to remain competitive on price and value.

| Factor | Impact on Westlake | 2024 Relevance |

| Low Switching Costs | Increases customer leverage; easy to switch to competitors. | High in commodity chemicals like ethylene; price is key. |

| Price Sensitivity | Customers demand lower prices, especially when costs are high for them. | Elevated across many sectors due to economic conditions. |

| Availability of Substitutes | Limits pricing power; customers can opt for alternatives. | Growing with advancements in materials science. |

| Backward Integration Threat | Customers may produce inputs internally, reducing reliance on Westlake. | Incentivized by 2024's raw material price volatility and supply chain issues. |

Full Version Awaits

Westlake Chemical Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details Westlake Chemical's competitive landscape through Porter's Five Forces, analyzing the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products.

Rivalry Among Competitors

The chemical industry, where Westlake Chemical operates, is characterized by a significant number of competitors, many of whom are substantial in size. This crowded landscape often fuels intense rivalry, as companies vie for market share through pricing strategies and product innovation.

Westlake's competitive set includes major players such as AdvanSix, Cabot, Celanese, DOW, Eastman Chemical, Huntsman, LyondellBasell Industries, Olin, Hawkins, and Kronos Worldwide. The presence of these large, established companies means that competitive battles can be fierce, impacting pricing power and profitability across the sector.

Slow industry growth significantly amplifies competitive rivalry. When the market isn't expanding, companies must aggressively vie for existing customers and market share, leading to more intense competition. This dynamic can manifest in price wars and increased marketing efforts as firms battle for dominance in a limited landscape.

Conversely, a rapidly growing industry offers a more favorable environment for companies. Expansion allows businesses to increase their sales and profits by capturing new demand, rather than solely by taking business away from competitors. For instance, the global chemical industry is projected to see a growth rate of approximately 3% annually in both 2025 and 2026, suggesting a moderately expanding market where growth can be achieved with less direct confrontation.

In the commodity segments of basic chemicals and polymers, Westlake Chemical faces significant competitive rivalry due to low product differentiation and minimal customer switching costs. This often translates into intense price-based competition, where products are viewed as interchangeable, making it challenging to achieve premium pricing. For instance, in 2024, the global polyethylene market, a key area for Westlake, continued to grapple with oversupply in certain grades, putting downward pressure on prices.

Westlake's strategy to counter this rivalry involves a deliberate shift towards differentiated and specialty products. By developing and marketing products with unique properties or tailored applications, the company aims to reduce its reliance on price alone. This move is supported by their investments in innovation and research and development, seeking to create value beyond basic chemical composition. For example, their focus on PVC compounds for specialized construction applications offers a distinct advantage over generic PVC resins.

Exit Barriers

Westlake Chemical, like many in the chemical sector, faces significant exit barriers. These are factors that make it difficult and costly for a company to leave an industry. High capital investments in specialized manufacturing facilities, often requiring billions of dollars, create a substantial hurdle. Once these assets are in place, they have limited alternative uses, meaning a company can't easily repurpose them if the chemical market turns unfavorable.

The sheer scale of operations and the need for continuous investment in plant and equipment mean that shutting down a facility often involves substantial decommissioning costs and potential write-offs of unamortized assets. This financial commitment can trap companies in the industry, even when facing low profitability, thereby intensifying competitive rivalry as these firms strive to maintain operations and cover their fixed costs.

- Specialized Assets: Chemical plants are highly specific and not easily transferable to other industries, increasing the cost of exiting.

- High Fixed Costs: Significant ongoing expenses for maintenance, utilities, and labor at manufacturing sites make it costly to cease operations.

- Capital Intensity: The chemical industry requires massive upfront investment in infrastructure, making divestment or closure a financially burdensome decision.

- Environmental Regulations: Decommissioning chemical facilities often involves stringent environmental cleanup requirements, adding to exit costs.

Diversity of Competitors

The competitive landscape for Westlake Chemical is intensified by a wide array of rivals, each with distinct strategies, origins, and objectives. This diversity means companies might compete through different avenues, such as cost leadership, product differentiation, or niche market focus, creating a dynamic and often unpredictable environment. For instance, while some competitors might prioritize aggressive expansion through acquisitions, others may focus on organic growth and technological innovation.

The chemical industry, including segments where Westlake operates, has been characterized by significant consolidation in recent years. This trend, driven by mergers, acquisitions, and strategic portfolio adjustments, reshapes competitive dynamics. For example, in 2023, the global chemical industry saw numerous M&A deals aimed at achieving greater scale, market access, or technological synergy. This ongoing restructuring means that Westlake must constantly adapt to evolving competitor strengths and market positions.

- Diverse Strategic Approaches: Competitors vary in their strategic priorities, ranging from cost optimization and operational efficiency to innovation and market specialization, impacting how they vie for market share.

- Unpredictable Competition: The varied goals of diverse players can lead to unexpected competitive moves, making it challenging for companies like Westlake to anticipate market shifts and rival actions.

- Consolidation Impact: Ongoing industry consolidation through M&A activity, a trend continuing into 2024, alters the competitive structure by creating larger, more integrated entities or divesting non-core assets, thereby changing the competitive intensity.

Westlake Chemical faces intense competition in its core markets, particularly in basic chemicals and polymers where product differentiation is low and switching costs are minimal. This often leads to price-driven battles, exacerbated by oversupply in certain segments, such as polyethylene in 2024, which pressures margins.

The presence of numerous large, established competitors like DOW, LyondellBasell, and Eastman Chemical means that market share gains are hard-won, often through aggressive pricing or strategic innovation. Westlake's strategy to mitigate this rivalry involves a focus on higher-value, differentiated products, such as specialized PVC compounds, to reduce reliance on commodity pricing.

High exit barriers, including substantial capital investments and specialized assets, trap firms in the industry even during periods of low profitability, further intensifying rivalry. This dynamic forces companies to continually compete for existing demand, as leaving the market is prohibitively expensive.

SSubstitutes Threaten

The threat of substitutes for Westlake Chemical's products is significant, particularly in its core markets of construction and packaging. The continuous innovation in material science is yielding viable alternatives that can potentially displace traditional materials like PVC.

In the construction sector, for example, bio-based materials such as mycelium, cork, and algae-based tiles are gaining traction as eco-friendly replacements for PVC. High-density polyethylene (HDPE) pipes are also increasingly presented as a sustainable alternative to PVC in various construction applications, reflecting a growing demand for environmentally conscious building solutions.

The attractiveness of substitutes for Westlake Chemical's products hinges significantly on their price-performance trade-off. If alternatives provide similar functionality at a lower cost, or enhanced features for a comparable price, the threat posed by these substitutes intensifies.

For instance, while PVC flooring, a key product for Westlake, offers durability and cost-effectiveness, natural linoleum presents itself as a bio-based, biodegradable, and potentially safer option. Although linoleum might carry a higher initial price point, its environmental advantages could sway consumers, especially in markets prioritizing sustainability, thereby impacting Westlake's market share.

Customer willingness to switch to alternative materials significantly impacts Westlake Chemical. For instance, a growing preference for bio-based plastics, driven by environmental concerns, could lead consumers to seek out products made from these materials rather than traditional petrochemical-based plastics offered by Westlake. This shift is amplified by increasing regulatory pressures worldwide pushing for more sustainable packaging and product components.

Factors such as the perceived performance benefits of substitutes, like lighter weight or enhanced durability, also play a role. If a competitor's product offers a more eco-friendly profile or superior material properties, customers may readily adopt it. For example, the automotive industry's ongoing quest for lighter materials to improve fuel efficiency could see a greater adoption of advanced composites or aluminum alloys over certain plastics, presenting a substitution threat to Westlake's polymer products.

Technological Advancements in Substitutes

The threat of substitutes for Westlake Chemical is amplified by ongoing technological advancements. Innovations in new materials, particularly bio-based polymers like polylactic acid (PLA), polyhydroxyalkanoates (PHA), and bio-polyethylene (bioPE) and bio-polypropylene (bioPP), present a significant challenge, especially in sectors like packaging and construction. These emerging alternatives are engineered to provide more sustainable and potentially more economical options compared to conventional petrochemical-derived products.

These advancements are not merely theoretical; the market for bioplastics is experiencing robust growth. For instance, the global bioplastics market was valued at approximately $11.5 billion in 2023 and is projected to reach over $30 billion by 2030, indicating a compound annual growth rate of around 15%. This expansion is driven by increasing consumer demand for eco-friendly products and stricter environmental regulations worldwide.

- Rising demand for sustainable materials: Consumers and businesses are increasingly prioritizing environmentally friendly options, pushing for alternatives to traditional plastics.

- Technological breakthroughs in biopolymer production: Research is yielding more efficient and cost-effective methods for producing bio-based polymers, narrowing the price gap with petrochemicals.

- Government regulations and incentives: Policies aimed at reducing plastic waste and promoting circular economy principles favor the adoption of biodegradable and compostable materials.

- Performance improvements in bio-based alternatives: New bioplastics are achieving performance characteristics comparable to or exceeding those of conventional plastics in areas like durability and barrier properties.

Regulatory and Environmental Pressures

Increasing regulatory scrutiny and a growing consumer preference for sustainability are intensifying the threat from substitute products for companies like Westlake Chemical. For instance, the U.S. Environmental Protection Agency (EPA) is actively reviewing the environmental impact of PVC plastic production, a key material for Westlake. This review could lead to stricter manufacturing standards or even limitations on PVC use, pushing industries towards alternative materials.

Furthermore, global initiatives like the European Union's Green Deal are actively promoting the development and adoption of more sustainable alternatives across various sectors. This policy direction directly encourages the use of materials that are biodegradable, recyclable with less energy, or derived from renewable resources, potentially eroding demand for Westlake's conventional product offerings.

- Regulatory Review: The EPA's ongoing assessment of PVC production highlights potential future restrictions.

- EU Green Deal Impact: This policy actively favors sustainable alternatives, posing a competitive challenge.

- Consumer Demand Shift: Growing preference for eco-friendly products accelerates the adoption of substitutes.

The threat of substitutes for Westlake Chemical is significant, driven by advancements in material science and a growing demand for sustainable options. For example, bio-based plastics are projected to grow substantially, with the global bioplastics market expected to reach over $30 billion by 2030, up from approximately $11.5 billion in 2023. This trend directly challenges Westlake's petrochemical-based products, particularly in packaging and construction where alternatives like polylactic acid (PLA) and high-density polyethylene (HDPE) pipes are gaining market share due to their eco-friendly profiles and improving performance characteristics.

| Substitute Material | Key Applications | Threat Level to Westlake | Growth Driver |

|---|---|---|---|

| Bio-based Plastics (e.g., PLA, PHA) | Packaging, Films, Consumer Goods | High | Consumer demand for sustainability, regulatory push for biodegradability |

| High-Density Polyethylene (HDPE) | Pipes, Films, Containers | Medium-High | Durability, recyclability, perceived environmental benefits over PVC in some applications |

| Natural Linoleum | Flooring | Medium | Bio-based, biodegradable, perceived as safer, though often with a higher initial cost |

| Advanced Composites & Aluminum | Automotive, Aerospace | Medium | Lightweighting for fuel efficiency, enhanced strength-to-weight ratio |

Entrants Threaten

The chemical manufacturing sector, where Westlake Chemical operates, demands enormous upfront investment. Building and maintaining state-of-the-art production facilities, along with the necessary infrastructure and specialized equipment, can easily run into hundreds of millions, if not billions, of dollars. For instance, a new ethylene cracker, a foundational component for many chemical products, can cost upwards of $1 billion to construct.

Established players like Westlake Chemical enjoy significant cost advantages due to massive economies of scale in production, raw material purchasing, and logistics. For instance, Westlake's extensive network of manufacturing facilities allows for optimized production runs, driving down per-unit costs. This scale makes it incredibly difficult for newcomers to match their operational efficiency and cost structure, creating a substantial barrier to entry.

Securing reliable distribution channels for chemicals and polymers presents a significant hurdle for potential new entrants. These channels are often extensive, requiring substantial investment and time to build, and are frequently dominated by established companies with long-standing relationships.

In 2024, the chemical industry's reliance on specialized logistics and established networks means that new players struggle to gain comparable reach. For instance, Westlake Chemical's integrated supply chain, from production to end-market delivery, exemplifies the kind of infrastructure that is difficult and costly to replicate.

Government Policy and Regulations

Government policy and regulations represent a significant threat of new entrants in the chemical industry. The sector is heavily regulated, with evolving environmental, health, and safety standards requiring substantial investment and specialized expertise to navigate. For instance, the U.S. Environmental Protection Agency (EPA) continually updates its rules, and the European Union's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation imposes stringent compliance burdens. These complex regulatory landscapes act as a considerable barrier, making it difficult and costly for new companies to establish a foothold.

The financial commitment required for compliance is a major deterrent. New entrants must invest heavily in pollution control technologies, safety protocols, and the personnel needed to manage these aspects. This can easily run into millions of dollars before a single product is manufactured. For example, the cost of complying with new emission standards or chemical registration processes can be prohibitive for smaller, less capitalized businesses looking to enter the market.

- Regulatory Hurdles: The chemical industry faces a complex web of environmental, health, and safety regulations that are constantly evolving.

- Compliance Costs: Adhering to these regulations necessitates significant capital investment in technology, safety measures, and expert personnel, creating a financial barrier for new entrants.

- Impact of New Rules: Recent regulatory changes, such as updated EPA standards in the U.S. and expanded EU regulations, further increase the complexity and cost of market entry.

Product Differentiation and Brand Loyalty

While the basic chemicals market Westlake operates in can be highly commoditized, the company's strategic emphasis on specialty products and its robust Housing and Infrastructure Products segment offers a degree of differentiation. This focus allows Westlake to cultivate brand recognition and customer loyalty, making it harder for new entrants to penetrate the market. For instance, in 2024, Westlake's performance in its Vinyls segment, which includes PVC used in construction, demonstrated the value of its integrated operations and established market presence.

New companies entering this space would need to invest significantly in research and development to create truly distinct products or build strong brand narratives to compete effectively. Overcoming the established brand loyalties and the perceived quality associated with Westlake's offerings presents a substantial hurdle. The company's commitment to innovation, as evidenced by its continued investment in new product development, further solidifies this barrier.

- Westlake's Housing and Infrastructure Products segment leverages brand equity.

- Specialty chemicals offer a path to differentiation against commoditized basic chemicals.

- New entrants must overcome established brand loyalties and invest in unique product development.

The threat of new entrants in the chemical industry, particularly for companies like Westlake Chemical, is significantly mitigated by several factors. The sheer capital required for new facilities, often exceeding $1 billion for basic components like ethylene crackers, presents a formidable financial barrier. Furthermore, established players benefit from economies of scale, robust distribution networks, and strong brand recognition, all of which are difficult and costly for newcomers to replicate.

In 2024, the chemical sector's regulatory landscape, encompassing stringent environmental and safety standards, adds another layer of complexity and cost for potential entrants. Compliance with evolving regulations, such as those from the EPA and EU REACH, demands substantial investment in technology and expertise, further solidifying the position of incumbents.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Building chemical plants and infrastructure requires billions of dollars. | Severely limits the number of potential new entrants. |

| Economies of Scale | Large-scale operations lead to lower per-unit costs. | New entrants struggle to compete on price. |

| Distribution Channels | Established networks are extensive and require significant investment to build. | New entrants face challenges in reaching customers efficiently. |

| Regulatory Compliance | Complex environmental, health, and safety regulations demand significant investment. | Increases the cost and time to market entry. |

| Brand Loyalty & Differentiation | Specialty products and established brands foster customer loyalty. | New entrants must invest heavily in R&D and marketing to differentiate. |

Porter's Five Forces Analysis Data Sources

Our Westlake Chemical Porter's Five Forces analysis is built upon a foundation of robust data, drawing from Westlake's annual reports, SEC filings, and investor presentations. We also incorporate insights from industry-specific market research reports and chemical industry trade publications to provide a comprehensive view of the competitive landscape.