Tokmanni Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tokmanni Group Bundle

Tokmanni Group leverages its strong brand recognition and extensive store network as key strengths, but faces challenges from intense competition and evolving consumer preferences. Understanding these dynamics is crucial for navigating the retail landscape.

Want the full story behind Tokmanni's market position, including a deep dive into its opportunities and potential threats? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Tokmanni Group stands as a dominant force in Finnish discount retail, boasting significant brand recognition and a loyal customer base. This established strength is amplified by its strategic expansion into the broader Nordic region, notably through the acquisition of Dollarstore. This move solidifies its standing as a key player in the discount retail landscape across multiple countries.

Tokmanni Group's diverse product assortment, spanning groceries, everyday essentials, home goods, and apparel, effectively caters to a wide array of consumer needs. This comprehensive offering is a significant strength, ensuring broad market appeal.

The company's commitment to affordable pricing further enhances its attractiveness, particularly resonating with budget-conscious consumers. In 2023, Tokmanni reported net sales of €1,178.1 million, demonstrating the broad reach of its value-driven strategy.

Tokmanni's strategic acquisition of the Swedish discount chain Dollarstore in August 2023 marked a significant step in its Nordic expansion. This move propelled Tokmanni beyond its Finnish base, positioning it as a major player in the broader Nordic discount retail market.

The company's growth trajectory is further underscored by its ambitious target to operate over 360 stores across the Nordics by the close of 2025. This expansion plan highlights a deliberate strategy to leverage its market presence and achieve substantial scale in new territories.

Commitment to Sustainability and ESG Initiatives

Tokmanni Group has embedded sustainability into its core strategy, a move that resonates well with increasingly environmentally conscious consumers and investors. This commitment is not just aspirational; it's backed by tangible progress. For instance, by the close of 2024, the Tokmanni segment had achieved an impressive 71.5% reduction in emissions stemming from its own operations when measured against a 2015 baseline. Furthermore, the company has actively invested in renewable energy, installing solar power plants at 70 of its locations. This focus on environmental responsibility is set to continue, with plans to establish new group-level climate targets validated by the Science Based Target initiative (SBTi) in 2025, demonstrating a forward-looking approach to climate action.

Synergy Benefits from Integrations and Partnerships

Tokmanni is realizing substantial synergy benefits from its integration of Dollarstore. By the close of December 2024, these annual synergies amounted to EUR 13.3 million, with an ambitious target exceeding EUR 15 million set for the end of 2025. This demonstrates a clear and quantifiable positive impact from strategic acquisitions.

Further bolstering its market position, Tokmanni entered a long-term license agreement with SPAR International in January 2025. This partnership grants Tokmanni exclusive rights to sell SPAR products and operate the SPAR brand within Finland. The move is strategically designed to significantly enhance Tokmanni's competitiveness, particularly within the grocery retail sector.

- Dollarstore integration synergies: EUR 13.3 million achieved by end of 2024, targeting over EUR 15 million by end of 2025.

- SPAR International partnership: Exclusive rights for SPAR products and brand operation in Finland secured January 2025.

- Strategic impact: Enhanced competitiveness in grocery retailing through brand expansion and product offering.

Tokmanni's strong brand recognition and loyal customer base in Finland provide a solid foundation. The acquisition of Dollarstore in August 2023 significantly expands its Nordic presence, with a target of over 360 stores across the region by the end of 2025. This expansion is supported by substantial synergy benefits from the Dollarstore integration, reaching EUR 13.3 million by the end of 2024 and projected to exceed EUR 15 million by the end of 2025. Furthermore, the January 2025 license agreement with SPAR International enhances its grocery offering and competitiveness in Finland.

| Strength | Description | Supporting Data |

|---|---|---|

| Market Dominance & Expansion | Strong position in Finnish discount retail and growing Nordic presence. | Acquisition of Dollarstore (Aug 2023); Target of >360 Nordic stores by end of 2025. |

| Synergy Realization | Quantifiable financial benefits from strategic acquisitions. | EUR 13.3 million in synergies from Dollarstore integration by end of 2024; Target >EUR 15 million by end of 2025. |

| Strategic Partnerships | Enhancement of product offering and market competitiveness. | Long-term license agreement with SPAR International (Jan 2025) for Finland. |

| Diverse Product Assortment | Catering to a broad range of consumer needs. | Includes groceries, everyday essentials, home goods, and apparel. |

What is included in the product

Tokmanni Group's SWOT analysis highlights its strong market position and cost-leadership strategy, while also identifying potential weaknesses in brand perception and opportunities for digital expansion and international growth, alongside threats from intense competition and changing consumer preferences.

Offers a clear breakdown of Tokmanni's internal and external factors, simplifying complex strategic challenges for actionable insights.

Weaknesses

Tokmanni Group's performance is closely tied to how consumers feel and how much they spend. When people are less confident about the economy, they tend to hold back on buying, especially for non-essential items.

This sensitivity was evident in the first half of 2025. Declining consumer confidence in key markets like Finland and Sweden directly impacted Tokmanni. Consumers became more hesitant, particularly when it came to purchasing pricier goods, forcing the company to adjust its revenue and profit forecasts downwards for the entire year.

Tokmanni's sales are heavily influenced by the seasons, with the first quarter typically being the weakest and the fourth quarter, driven by Christmas, the strongest. This cyclical pattern directly impacts revenue, profitability, and cash flow throughout the year.

A particularly challenging spring or early summer can significantly hurt annual profits, especially for seasonal items. For instance, a cold Q2 2025 in Finland, as reported, negatively affected the performance of seasonal goods, demonstrating the vulnerability of the business model to weather-dependent demand.

While the Dollarstore acquisition presented a strategic avenue for expansion, its recent performance has been a notable weakness for the Tokmanni Group. The segment's results have experienced a decline, coupled with difficulties in optimizing its product assortment and achieving desired profitability levels. This underperformance directly impacts the group's overall financial health.

Further exacerbating these challenges are the clearance campaigns initiated due to shifts in Dollarstore's product offerings. These promotional activities, alongside aggressive pricing strategies, have put significant pressure on the gross margin. For instance, in the first quarter of 2024, Tokmanni reported a decrease in comparable sales, partly attributed to these factors within the Dollarstore segment, leading to a weakened gross margin compared to previous periods.

Cost Pressures and Impact on Profitability

Tokmanni Group has grappled with escalating operating expenses, encompassing personnel, marketing, and real estate, which have outpaced revenue growth. This surge in costs, coupled with a greater emphasis on promotional items and clearance events, has consequently squeezed the company's comparable gross margin.

The financial year 2023 highlighted these pressures. For instance, Tokmanni reported that while net sales increased, the cost of goods sold and other operating expenses also saw significant rises, impacting the overall profitability before tax. This trend suggests a persistent challenge in translating sales volume into proportional profit gains.

- Rising Operating Expenses: Personnel, marketing, and real estate costs have outpaced revenue growth.

- Margin Compression: Increased sales of promotional and clearance items have negatively impacted the comparable gross margin.

- 2023 Financial Impact: While net sales grew, higher operating costs led to pressure on profitability.

Dependence on Finnish and Nordic Market Conditions

Tokmanni's significant reliance on the Finnish and broader Nordic markets presents a key weakness. Economic downturns or shifts in consumer spending within these regions can disproportionately affect its revenue and profitability. For instance, if Finland experiences a recession, a substantial portion of Tokmanni's sales could be impacted.

The competitive landscape in the Nordic discount retail sector is also intense. Tokmanni faces pressure from both local and international players, which can limit its pricing power and market share growth. This dependence means that factors outside of Tokmanni's direct control, such as regional economic health, are critical to its success.

As of the first quarter of 2024, Tokmanni reported that Finland still constituted the vast majority of its sales. While the company is expanding into Estonia, its core market remains highly concentrated.

- Geographic Concentration: Over 90% of Tokmanni's revenue is generated in Finland, making it highly susceptible to Finnish economic conditions.

- Nordic Market Sensitivity: Broader Nordic economic trends, including inflation and consumer confidence, directly influence purchasing behavior at Tokmanni.

- Competitive Pressures: The discount retail sector in the Nordics is crowded, with established players and new entrants vying for market share.

- Economic Vulnerability: Any slowdown in consumer spending in Finland or the Nordics can significantly dampen Tokmanni's sales performance.

Tokmanni's substantial reliance on the Finnish market, which accounted for over 90% of its sales in Q1 2024, presents a significant weakness. This geographic concentration makes the company highly vulnerable to economic downturns or shifts in consumer spending within Finland. The intense competition in the Nordic discount retail sector further limits pricing power and market share expansion.

The performance of the Dollarstore acquisition has been a notable drag, with declining segment results and challenges in optimizing product assortment and profitability. This underperformance directly impacts the group's overall financial health, exacerbated by clearance campaigns and aggressive pricing that pressure gross margins, as seen in Q1 2024 where comparable sales decreased partly due to these factors.

Escalating operating expenses, including personnel, marketing, and real estate costs, have outpaced revenue growth. This cost pressure, combined with a greater emphasis on promotional items, has squeezed the company's comparable gross margin. For instance, in FY 2023, while net sales increased, operating expenses also rose significantly, impacting profitability before tax.

| Weakness | Description | Impact | Data Point |

|---|---|---|---|

| Geographic Concentration | Heavy reliance on the Finnish market. | Vulnerability to Finnish economic conditions. | Over 90% of sales in Finland (Q1 2024). |

| Dollarstore Performance | Underperformance and margin pressure. | Negative impact on group financials and profitability. | Declining segment results and optimization challenges. |

| Rising Operating Expenses | Costs outpacing revenue growth. | Margin compression and reduced profitability. | Personnel, marketing, and real estate costs increased in FY 2023. |

| Competitive Landscape | Intense competition in Nordic discount retail. | Limited pricing power and market share growth. | Pressure from established and new players. |

Full Version Awaits

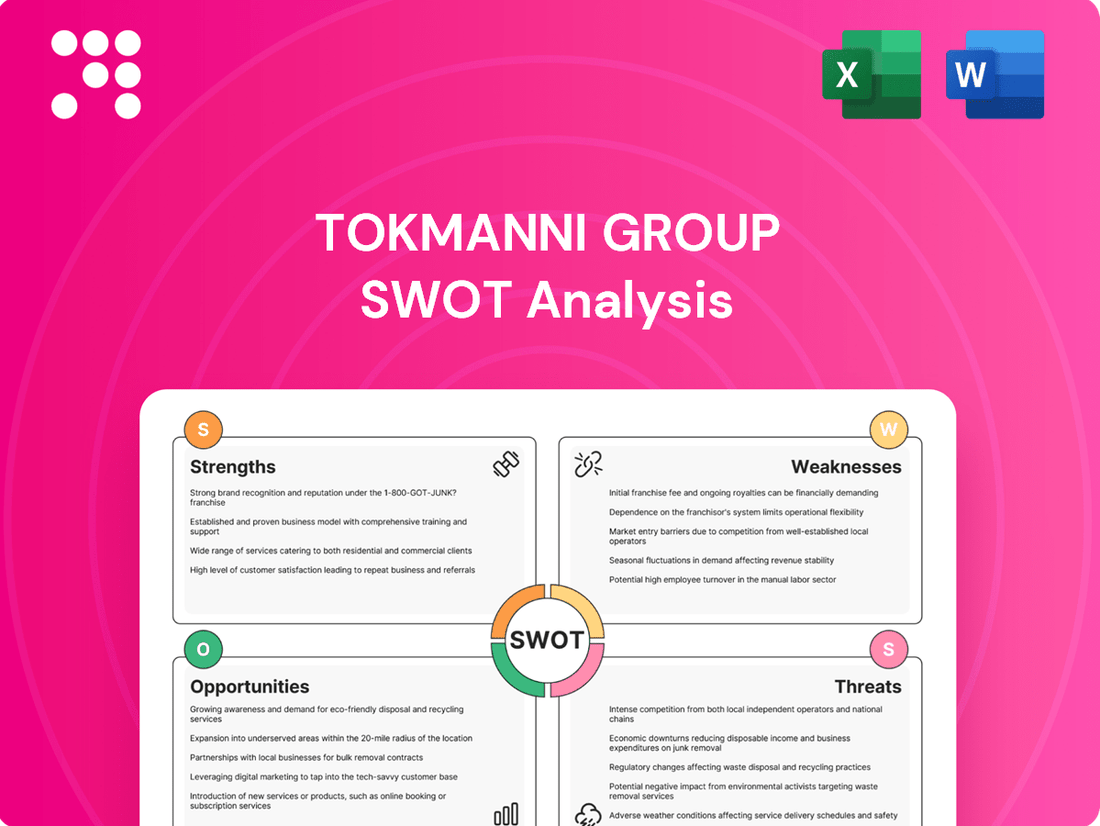

Tokmanni Group SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality, offering a comprehensive look at Tokmanni Group's internal strengths and weaknesses, as well as external opportunities and threats.

The preview below is taken directly from the full SWOT report you'll get, detailing key strategic considerations for Tokmanni Group.

Purchase unlocks the entire in-depth version, providing actionable insights derived from this thorough analysis.

Opportunities

Tokmanni Group's ambition to be the premier discount retailer across Northern Europe fuels its drive for expansion. The company actively explores new markets beyond its existing presence in Finland, Sweden, and Denmark, aiming to replicate its successful model in untapped territories.

This strategic push into new geographical areas represents a substantial avenue for growth. For instance, by the end of Q1 2024, Tokmanni had already established its presence with 206 stores in Finland, alongside operations in Sweden and Denmark, signaling a solid foundation for further international ventures.

The burgeoning e-commerce sector in Finland, projected to grow significantly in the coming years, offers a prime opportunity for Tokmanni. Consumer demand for seamless digital integration and flexible shopping methods, such as click-and-collect, is on the rise. Tokmanni can capitalize on this by further refining its online platform and investing in technologies that bridge the gap between online and in-store experiences.

Further enhancing digital capabilities, including investments in property automation and supply chain optimization, can lead to substantial operational efficiencies. For instance, improved inventory management through automation can reduce stockouts and enhance customer satisfaction. By embracing these technological advancements, Tokmanni can streamline its operations and better meet the evolving expectations of its customer base in the dynamic retail landscape.

Tokmanni's exclusive license agreement with SPAR International, commencing in 2025, presents a significant avenue for expanding its grocery offerings. This partnership allows Tokmanni to leverage SPAR's established global scale and deep expertise in the grocery sector, a move that could substantially bolster its competitiveness in the Finnish market.

By integrating SPAR's brand and operational know-how, Tokmanni is poised to enhance its grocery assortment, potentially attracting a wider customer base and increasing market share. This strategic alignment is expected to strengthen Tokmanni's position in the increasingly competitive grocery retail landscape.

Optimizing Assortment and Private Label Strategy

Tokmanni has a significant opportunity to boost its appeal and profitability by refining its product selection. This involves not only increasing joint purchasing power to secure better terms but also strategically expanding its own private label brands. These private labels often carry higher gross margins than national brands, offering a direct path to improved profitability.

The company can further solidify its market position by identifying and strengthening 'destination categories' – those product areas that consistently draw shoppers into its stores. By focusing on these key categories and driving like-for-like sales growth, Tokmanni can achieve more robust organic revenue increases. For instance, in 2023, Tokmanni reported a net sales increase of 5.1% to €1,176.3 million, demonstrating the potential of a well-managed assortment strategy.

- Expand Private Label Penetration: Increasing the share of private label products in the overall assortment can lead to improved gross margins.

- Focus on Destination Categories: Identifying and investing in categories that act as key traffic drivers can enhance customer visits and overall sales.

- Leverage Joint Purchases: Collaborating on purchasing for a wider range of products can unlock cost efficiencies and better supplier terms.

- Drive Like-for-Like Sales: A consistent focus on improving sales from existing stores is crucial for sustainable organic growth.

Strengthening Sustainability Leadership and Consumer Trust

Tokmanni's robust sustainability initiatives, such as its commitment to significant emission reductions and expanded solar power capacity, are key opportunities to deepen consumer trust. As Finnish consumers increasingly favor eco-conscious brands, Tokmanni can leverage these efforts to build stronger loyalty.

Setting new, ambitious climate targets in 2025 will further solidify Tokmanni's position as a leader in sustainability within the retail sector. This proactive approach can attract environmentally aware customers and enhance brand reputation.

- Emission Reduction: Tokmanni aims for a 30% reduction in Scope 1 and 2 emissions by 2025 compared to 2020.

- Solar Power: The company has installed solar panels on over 20 stores, with plans for further expansion.

- Consumer Preference: A 2024 survey indicated that 65% of Finnish consumers consider sustainability when making purchasing decisions.

Tokmanni can expand its reach by entering new Northern European markets, building on its existing success in Finland, Sweden, and Denmark. The growing e-commerce sector in Finland presents a significant opportunity for enhanced digital offerings and seamless online-to-offline experiences. Furthermore, the exclusive license agreement with SPAR International, starting in 2025, is set to bolster Tokmanni's grocery assortment and competitiveness.

By focusing on private label expansion and strengthening key 'destination categories,' Tokmanni can improve profitability and drive like-for-like sales growth. For instance, in 2023, net sales increased by 5.1% to €1,176.3 million, illustrating the effectiveness of strategic assortment management.

Tokmanni's commitment to sustainability, including emission reduction targets and solar power expansion, resonates with increasingly eco-conscious Finnish consumers, fostering brand loyalty and trust. Setting new climate targets in 2025 will further cement its leadership in responsible retail practices.

| Opportunity Area | Key Actions | Potential Impact |

|---|---|---|

| Market Expansion | Enter new Northern European markets | Increased revenue and market share |

| E-commerce Growth | Enhance digital platform and omni-channel capabilities | Improved customer experience and sales conversion |

| SPAR Partnership | Leverage SPAR's expertise for grocery expansion | Wider product selection and enhanced market position |

| Assortment Strategy | Increase private labels and focus on destination categories | Higher margins and improved like-for-like sales |

| Sustainability Initiatives | Promote emission reductions and solar power expansion | Enhanced brand reputation and customer loyalty |

Threats

The Finnish and broader Nordic retail landscapes are characterized by fierce competition, with both established domestic giants and aggressive international entrants actively seeking to capture market share. This competitive pressure can easily trigger price wars, directly affecting Tokmanni's profit margins and demanding constant vigilance to uphold its core promise of affordability.

In 2024, the discount retail sector, where Tokmanni operates, saw continued expansion from both existing players and new entrants, intensifying the battle for price-sensitive consumers. For instance, competitor actions in late 2024 and early 2025 have shown a willingness to engage in promotional pricing, directly challenging Tokmanni's value proposition.

A challenging economic climate, marked by persistent inflation and a general decline in consumer confidence, poses a significant threat to Tokmanni. This environment often leads to reduced discretionary spending, directly impacting sales of non-essential items. For instance, if inflation remains elevated throughout 2024 and into 2025, consumers may prioritize essential goods, cutting back on purchases from Tokmanni's broader product categories.

Tokmanni faces the threat of rising operational costs, with potential increases in rents, wages, and energy prices directly impacting its profitability. For instance, in the first quarter of 2024, Finland's inflation rate saw fluctuations, impacting household spending power and potentially increasing input costs for retailers.

Furthermore, global supply chain disruptions remain a significant concern. Any further bottlenecks or increased raw material costs could hinder Tokmanni's ability to maintain its competitive pricing strategy and ensure consistent product availability for its customers, especially for essential goods.

Evolving Consumer Preferences and Digital Disruption

The shift towards online shopping presents a significant challenge. For instance, in 2024, the global e-commerce market was projected to reach over $6.3 trillion, underscoring the scale of this trend. Tokmanni must actively enhance its digital presence and online customer experience to remain competitive against agile online retailers.

Consumers increasingly demand sustainable and ethically sourced products, a preference that can quickly become a threat if not met. By early 2025, reports indicate that over 60% of consumers consider sustainability when making purchasing decisions. Tokmanni's ability to integrate and promote eco-friendly options will be crucial for retaining and attracting environmentally conscious shoppers.

- Evolving Consumer Preferences: A growing demand for online convenience and personalized shopping experiences.

- Digital Disruption: Increased competition from pure-play e-commerce businesses and digitally native brands.

- Sustainability Imperative: Pressure to offer and clearly communicate sustainable product choices, with a significant portion of consumers prioritizing this factor.

- Pace of Innovation: The risk of falling behind if digital transformation and adaptation of product assortments are not continuous.

Integration Risks of Acquisitions and Expansion

Tokmanni's acquisition of Dollarstore in early 2024, a deal valued at approximately €140 million, presents significant integration risks. Successfully merging operations, harmonizing product assortments, and realizing the projected synergy benefits will be critical. Failure to manage these complexities could hinder the anticipated growth from this expansion.

Expanding into new geographical markets, as Tokmanni has done, introduces further challenges. Understanding and adapting to local market nuances, consumer preferences, and the specific competitive landscapes in each new territory requires careful strategic planning and execution. This can strain resources and management bandwidth.

- Operational Alignment: Integrating diverse IT systems, supply chains, and store management practices from acquired entities like Dollarstore can be a complex and costly undertaking.

- Assortment Harmonization: Reconciling differing product ranges and supplier relationships to create a cohesive and appealing offering across all stores requires meticulous planning to avoid cannibalization or customer dissatisfaction.

- Synergy Realization: Achieving projected cost savings and revenue enhancements from acquisitions is often contingent on effective integration; delays or unforeseen issues can significantly impact the financial benefits.

Intensified competition, particularly in the discount retail sector, remains a primary threat, with rivals actively engaging in price promotions throughout 2024 and into early 2025. This environment necessitates continuous vigilance to maintain Tokmanni's affordability promise. Furthermore, a challenging economic climate, characterized by persistent inflation and declining consumer confidence, could curb discretionary spending, impacting sales of non-essential items. Rising operational costs, including potential increases in rents, wages, and energy prices, also pose a direct threat to profitability, as evidenced by fluctuating inflation rates in Finland during early 2024.

Global supply chain disruptions continue to be a concern, potentially affecting product availability and pricing strategies. The rapid growth of e-commerce, with the global market projected to exceed $6.3 trillion in 2024, presents a challenge for brick-and-mortar focused retailers like Tokmanni, demanding enhanced digital presence. Additionally, growing consumer demand for sustainability, with over 60% of consumers considering it by early 2025, requires proactive integration and communication of eco-friendly options.

The integration of Dollarstore, acquired in early 2024 for approximately €140 million, introduces significant operational risks, including IT system alignment and assortment harmonization. Successfully realizing synergy benefits from such acquisitions is crucial, as delays can impact financial outcomes. Expanding into new geographical markets also presents challenges in adapting to local consumer preferences and competitive landscapes, potentially straining resources.

| Threat Category | Specific Threat | Impact on Tokmanni | 2024/2025 Data Point |

|---|---|---|---|

| Competition | Price Wars & New Entrants | Erosion of profit margins, pressure on value proposition | Discount retail sector saw continued expansion of players in 2024. |

| Economic Climate | Inflation & Reduced Consumer Confidence | Decreased discretionary spending, lower sales of non-essentials | Finnish inflation rates fluctuated in Q1 2024, impacting purchasing power. |

| Operational Costs | Rising Rents, Wages, Energy | Direct impact on profitability | Energy prices remained a key cost consideration for retailers throughout 2024. |

| Supply Chain | Disruptions & Raw Material Costs | Hindered ability to maintain pricing and product availability | Global shipping costs saw volatility in late 2024, affecting import expenses. |

| Digital Shift | E-commerce Growth | Need to enhance online presence against agile competitors | Global e-commerce market projected to exceed $6.3 trillion in 2024. |

| Consumer Preferences | Demand for Sustainability | Risk of losing environmentally conscious shoppers | Over 60% of consumers consider sustainability in purchasing decisions by early 2025. |

| Acquisition Integration | Dollarstore Integration | Risks in operational alignment, assortment harmonization, synergy realization | Dollarstore acquisition valued at approx. €140 million in early 2024. |

| Market Expansion | Entering New Geographies | Strain on resources and management bandwidth | Increased focus on cross-border retail trends noted in late 2024. |

SWOT Analysis Data Sources

This Tokmanni Group SWOT analysis is built upon a foundation of verified financial statements, comprehensive market research, and expert industry commentary to provide a robust and accurate strategic overview.