Tokmanni Group Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tokmanni Group Bundle

Tokmanni Group masterfully navigates the retail landscape by offering a diverse product range at accessible price points, strategically placed in convenient locations. Their promotional efforts effectively communicate value, creating a compelling customer proposition.

Go beyond this snapshot and unlock the full potential of Tokmanni Group's marketing strategy. Our comprehensive 4Ps analysis provides actionable insights into their product assortment, pricing architecture, distribution network, and promotional campaigns, empowering your own business decisions.

Product

Tokmanni Group's diverse assortment is a cornerstone of its strategy, offering a wide array of products from groceries and everyday essentials to home goods, leisure items, and apparel. This comprehensive selection caters to a broad spectrum of customer needs, positioning Tokmanni as a one-stop shop for many households.

The company actively manages its product mix, focusing on strengthening existing popular categories and introducing new ones to enhance customer appeal. For instance, the expansion of the Miny concept, which offers trendy and affordable home decor and lifestyle products, exemplifies this approach.

In 2023, Tokmanni reported that its product assortment strategy contributed to a net sales increase of 10.3% compared to the previous year, reaching €1,146.9 million. This growth underscores the effectiveness of offering a varied and relevant product range to drive sales and customer engagement.

Tokmanni's product strategy heavily features a mix of its own private labels, alongside non-branded and established national/international brands. This approach ensures a broad appeal and caters to diverse customer needs and price sensitivities.

The company is consistently expanding its private label portfolio, recently introducing ranges such as Pisara, Parco, Arki 360°, Catmandoo, and 2Moons. This focus on developing proprietary brands allows Tokmanni to differentiate itself in the market and offer unique value propositions.

By offering a wide spectrum of private label products, Tokmanni aims to provide both value for money and an extensive variety, strengthening its market position and customer loyalty. For instance, in 2023, private label products represented a significant portion of their sales, demonstrating the success of this strategy.

Tokmanni's strategic expansion into grocery retailing is significantly bolstered by its 2025 long-term license agreement with SPAR International. This partnership grants Tokmanni exclusive rights to sell SPAR products and operate the SPAR brand within Finland, a move expected to dramatically broaden its grocery offerings.

By summer 2025, customers can anticipate a wider selection of SPAR-branded groceries across all Tokmanni locations. This initiative is designed to sharpen Tokmanni Group's competitive edge in the Finnish grocery market, leveraging SPAR's established international presence and product range.

Focus on Safety and Quality

Tokmanni places a strong emphasis on ensuring the safety and quality of its product offerings, a core component of its marketing strategy. This commitment is underscored by its performance in 2024, where the company reported no significant product safety issues across the items it sold. This dedication to safety is paramount for building customer trust and maintaining a positive brand reputation.

Furthermore, Tokmanni actively works to minimize customer dissatisfaction with its private label products. In 2024, the company achieved a commendable goal of keeping complaints related to these own-brand items below the 3% threshold. This focus on quality assurance and customer feedback is integral to their product development cycle, ensuring that customers receive reliable and satisfactory goods.

- Product Safety: Tokmanni reported zero serious product safety flaws in 2024.

- Private Label Quality: Complaints for private label products were less than 3% in 2024.

- Customer Satisfaction: Quality assurance and customer feedback are central to product development.

Commitment to Responsible Sourcing

Tokmanni Group's commitment to responsible sourcing is a cornerstone of its marketing strategy, reflecting a deep understanding of evolving consumer and stakeholder expectations. The company has established group-level guidelines for responsible purchasing, with a clear roadmap for their ongoing implementation through 2025. This proactive approach ensures that ethical and sustainable practices are integrated across its supply chain.

A key objective in this area is to have 80% of its suppliers, measured by spend, achieve science-based targets by 2025. By the close of 2024, Tokmanni had already made significant progress, with 47.6% of its suppliers meeting this crucial benchmark. These figures highlight a tangible dedication to environmental responsibility and long-term sustainability within its sourcing operations.

These initiatives underscore Tokmanni's commitment to ethical and sustainable product sourcing, a critical element of its 4P's analysis, particularly within the Product and Promotion aspects.

- Responsible Purchasing Guidelines: Approved group-level guidelines are being implemented through 2025.

- Supplier Science-Based Targets: Aiming for 80% of suppliers (by spend) to achieve these targets by 2025.

- Progress Update (End of 2024): 47.6% of suppliers by spend had achieved science-based targets.

- Ethical Sourcing Commitment: Demonstrates a strong dedication to sustainability in product acquisition.

Tokmanni's product strategy centers on a broad and varied assortment, from groceries to apparel, positioning it as a one-stop shop. The expansion of concepts like Miny and the strategic grocery partnership with SPAR International by summer 2025 are key to this approach. The company also emphasizes its own private labels, which contributed significantly to sales in 2023, alongside a strong commitment to product safety and quality assurance, evidenced by zero serious safety flaws reported in 2024 and private label complaints below 3%.

| Product Strategy Element | Key Details | Impact/Data Point |

| Assortment Breadth | Groceries, home goods, apparel, leisure | One-stop shop appeal |

| Private Labels | Pisara, Parco, Arki 360°, etc. | Significant sales contribution (2023); < 3% complaint rate (2024) |

| Grocery Expansion | SPAR International license agreement (by summer 2025) | Broaden grocery offerings |

| Quality & Safety | Zero serious safety flaws (2024) | Builds customer trust |

What is included in the product

This analysis provides a comprehensive breakdown of Tokmanni Group's marketing mix, detailing their product assortment, pricing strategies, distribution channels, and promotional activities.

It's designed for professionals seeking to understand Tokmanni's market positioning and competitive advantages through a data-driven examination of their 4P's.

Offers a clear, concise overview of Tokmanni's 4Ps marketing strategy, alleviating the pain of complex market analysis for busy executives.

Simplifies the understanding of Tokmanni's product, price, place, and promotion strategies, making it easier to identify and address market challenges.

Place

Tokmanni Group boasts an extensive retail store network, a critical component of its marketing mix. As of early 2024, the group operates over 380 stores spanning Finland, Sweden, and Denmark, strategically positioned for customer convenience. This broad physical footprint is key to their accessibility strategy.

The network encompasses a diverse range of store formats, including the flagship Tokmanni stores, alongside concepts like Dollarstore, Big Dollar, Click Shoes, Shoe House, and Miny. This multi-format approach caters to different customer needs and market segments, enhancing their reach and market penetration.

Tokmanni's online shop is a key component of its strategy, complementing its extensive network of physical stores. This digital channel offers customers the flexibility to shop at their convenience, anytime and anywhere, significantly broadening the company's market reach. In 2023, Tokmanni reported that its online sales continued to grow, contributing a notable percentage to the group's overall revenue, though specific figures for the online share are often integrated into broader sales reports.

Tokmanni Group's strategic store network expansion is a cornerstone of its growth strategy. The company aims to operate over 360 Tokmanni, Dollarstore, and Big Dollar stores across the Nordics by the close of 2025, directly impacting revenue and profit. This expansion is crucial for increasing market penetration and accessibility for its value-oriented retail offerings.

In 2024, the group's expansion efforts included opening four new Tokmanni stores in Finland, six Dollarstore locations in Sweden, and four Big Dollar stores in Denmark. These openings are designed to capture market share and drive top-line growth in key Nordic markets. The focus remains on establishing a strong physical presence to complement its digital initiatives.

Looking ahead, Tokmanni has already announced plans for further expansion in 2026, with new Tokmanni stores slated for Ähtäri and Ivalo in Finland. These future openings underscore a sustained commitment to network development, ensuring continued reach and customer engagement across its operating regions.

Efficient Logistics and Supply Chain

Tokmanni Group's commitment to efficient logistics and supply chain management is a cornerstone of its operational strategy. This focus allows for the swift establishment and launch of new stores, ensuring a consistent and reliable supply of goods across its diverse network. The company actively seeks to minimize its environmental impact, as demonstrated by its use of Ecodelivery services for shipments from Asia to Finland, a move designed to cut upstream logistics emissions.

This operational agility is further evidenced by Tokmanni's capacity to thrive in retail spaces of varying sizes, from compact 200 sqm locations to expansive 10,000 sqm stores. This flexibility underscores a highly optimized supply chain that can adapt to different store formats and customer demands efficiently. For instance, in 2023, Tokmanni continued its store network expansion, opening several new stores and renovating existing ones, all while maintaining efficient inventory management and delivery processes.

- Optimized Store Launches: Streamlined processes for opening new retail locations, supported by robust logistics.

- Emission Reduction Initiatives: Utilization of Ecodelivery for Asian shipments to lower upstream logistics emissions.

- Flexible Retail Footprint: Profitable operation across a wide range of store sizes, from 200 to 10,000 sqm, showcasing supply chain adaptability.

- 2023 Network Growth: Continued expansion and renovation of stores, demonstrating ongoing logistical efficiency in supporting growth.

Integration of Acquired Store Chains

The integration of acquired store chains, such as Dollarstore, Click Shoes, and Shoe House, into the Tokmanni Group has been a strategic move to bolster its market presence. This process involves harmonizing key operational areas, including purchasing power and supply chain logistics, to unlock economies of scale. By centralizing these functions, Tokmanni aims to reduce costs and improve overall efficiency across its expanded retail footprint.

Furthermore, the integration extends to a renewal of store concepts, a crucial element in the Product aspect of the marketing mix. This initiative seeks to create a more cohesive brand experience for customers across all acquired banners. For instance, Dollarstore's integration into Tokmanni's network in early 2024 is expected to yield significant synergy benefits, with initial projections pointing towards a positive impact on profitability.

- Strengthened Market Position: Acquired chains like Dollarstore (integrated early 2024) enhance Tokmanni's reach and customer base.

- Operational Synergies: Alignment of purchasing and supply chain functions aims for cost efficiencies and improved buying power.

- Store Concept Renewal: Modernizing store formats across the group to create a unified brand experience.

- Synergy Realization: Maximizing benefits from the combined network is a key objective for enhancing profitability.

Tokmanni Group's Place strategy centers on extensive physical store reach and a growing online presence. By early 2024, the group operated over 380 stores across Finland, Sweden, and Denmark, with plans to reach over 360 Tokmanni, Dollarstore, and Big Dollar stores by the end of 2025. This dual approach ensures broad customer accessibility, catering to both in-person shoppers and those preferring digital convenience. The group's efficient logistics support this expansive network, enabling profitable operations across diverse store sizes.

| Metric | 2023 (Approx.) | 2024 (Target/Actual) | 2025 (Target) |

|---|---|---|---|

| Total Stores (Group) | 380+ | ~400+ | 360+ (Tokmanni, Dollarstore, Big Dollar) |

| New Tokmanni Stores (Finland) | N/A | 4 | N/A |

| New Dollarstore Stores (Sweden) | N/A | 6 | N/A |

| New Big Dollar Stores (Denmark) | N/A | 4 | N/A |

| Online Sales Contribution | Growing | Growing | Growing |

Preview the Actual Deliverable

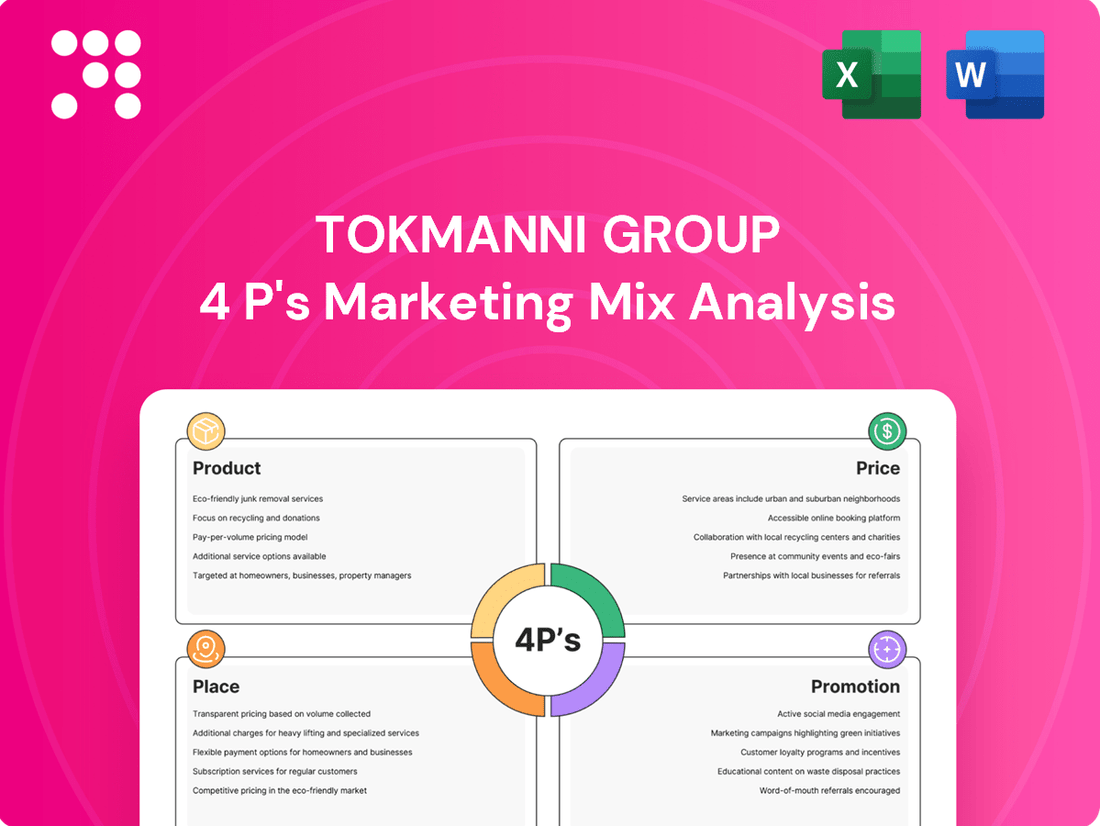

Tokmanni Group 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of the Tokmanni Group's 4P's Marketing Mix is fully complete and ready for your immediate use, offering an in-depth look at their strategies.

Promotion

Tokmanni's promotional strategy consistently highlights its commitment to affordability, a cornerstone of its brand identity as a discount retailer. This focus on low prices is central to attracting and retaining value-conscious consumers. For instance, in 2023, Tokmanni reported a net sales increase of 4.1% to €1,176.7 million, demonstrating the effectiveness of their price-focused communication in driving revenue.

Tokmanni Group is leveraging AI-powered marketing automation for its in-store promotions, a significant advancement in their marketing strategy. This system automates the creation of audio advertisements, streamlining the process from marketing plans to ready-to-play in-store content.

The AI component handles crucial tasks like scriptwriting and voiceover production, ensuring consistent and timely delivery of marketing messages across all Tokmanni locations. This innovation aims to enhance the in-store customer experience by providing dynamic and relevant audio advertising.

Tokmanni Group actively employs targeted sales promotions and campaigns to boost brand visibility and encourage customer purchases. These initiatives are strategically crafted to emphasize product advantages and unique selling points, particularly for discounted items and budget-friendly products, a crucial approach given the current climate of cautious consumer spending.

In 2023, Tokmanni reported a net sales increase of 4.2% to €1,110.6 million, with comparable store sales growing by 3.1%. This growth demonstrates the effectiveness of their promotional strategies in driving traffic and sales, especially during economic uncertainty where value-focused offerings resonate strongly with consumers.

Digital Transformation in Marketing

Tokmanni Group is heavily investing in digital transformation, which significantly impacts its marketing strategies. This focus signals a clear intent to enhance online presence and leverage digital channels for promotions. The group views marketing effectiveness as an ongoing process, with digital evolution being a key component of future growth.

While Tokmanni's digital marketing campaigns are not always explicitly detailed, the strategic emphasis on digital development points to increased investment in online advertising and customer engagement platforms. This proactive approach aims to adapt to evolving consumer behaviors and maintain a competitive edge in the retail landscape.

- Digital Investment: Tokmanni's commitment to digital transformation suggests a growing allocation of resources towards online marketing initiatives, reflecting a strategic shift in promotional activities.

- Marketing Effectiveness: The continuous improvement of marketing effectiveness is a core objective, with digital channels playing an increasingly vital role in achieving this goal.

- Future Prospects: The group's future success is intrinsically linked to its ability to navigate and capitalize on digital advancements in marketing, enhancing customer reach and engagement.

Public Relations and Investor Communications

Tokmanni Group places significant emphasis on public relations and investor communications as a core component of its marketing strategy. The company consistently disseminates financial reports, comprehensive business reviews, and detailed sustainability statements to keep its stakeholders informed. For instance, in their 2023 annual report, Tokmanni highlighted strong revenue growth and a commitment to ESG principles, demonstrating their proactive approach to transparency.

These communications are crucial for building and maintaining trust within the investment community and the broader public. Through regular engagement via earnings calls, press releases, and investor presentations, Tokmanni effectively communicates its financial performance, outlines strategic objectives, and underscores its dedication to sustainable business practices. This consistent dialogue is vital for managing brand reputation and fostering long-term stakeholder relationships.

- Financial Reporting: Tokmanni regularly publishes quarterly and annual financial reports, detailing revenue, profitability, and key performance indicators. For example, their Q1 2024 report showed a revenue increase of 5.2% year-on-year.

- Investor Relations Activities: The company conducts earnings calls and investor meetings to discuss financial results and future outlook, ensuring open communication with shareholders and analysts.

- Sustainability Communications: Tokmanni actively reports on its environmental, social, and governance (ESG) initiatives, including progress on carbon footprint reduction and ethical sourcing, as seen in their 2023 Sustainability Report.

Tokmanni's promotional efforts are deeply rooted in its discount retailer identity, consistently emphasizing affordability to attract value-conscious shoppers. This strategy is evident in their sales performance, with net sales reaching €1,176.7 million in 2023, a 4.1% increase, underscoring the effectiveness of their price-focused messaging.

The group is enhancing in-store promotions through AI-powered automation, which generates audio advertisements, streamlining content creation for all its locations. This innovation aims to improve the customer experience by delivering dynamic and relevant audio marketing. Furthermore, Tokmanni actively uses targeted sales campaigns to highlight product benefits and value, particularly important given cautious consumer spending. Their 2023 net sales grew by 4.2% to €1,110.6 million, with comparable store sales up 3.1%, demonstrating the success of these promotional activities.

Tokmanni is also significantly investing in digital transformation to bolster its online presence and leverage digital channels for promotions. This strategic focus on digital evolution is seen as key to future growth and maintaining a competitive edge by adapting to changing consumer behaviors.

Public relations and investor communications are central to Tokmanni's marketing, with regular dissemination of financial reports and sustainability statements. Their 2023 annual report, for instance, showcased strong revenue growth and a commitment to ESG principles, reinforcing transparency and stakeholder trust. This ongoing dialogue through earnings calls and press releases helps manage brand reputation and foster long-term relationships.

| Metric | 2023 Value (€ million) | 2024 Q1 Value (€ million) | Change (YoY) |

|---|---|---|---|

| Net Sales | 1,176.7 | N/A | +4.1% (2023 vs 2022) |

| Comparable Store Sales | N/A | N/A | +3.1% (2023 vs 2022) |

| Revenue (Q1) | N/A | 1,110.6 | +5.2% (Q1 2024 vs Q1 2023) |

Price

Tokmanni Group anchors its market presence as a premier variety discount retailer across the Nordic region, a position that fundamentally shapes its pricing approach. This strategic placement necessitates a commitment to consistently accessible price points, reinforcing its brand promise of affordability.

The company’s brand identity is intrinsically linked to providing products at perpetually low prices, a cornerstone of its value proposition. This unwavering focus on affordability directly informs every pricing decision, ensuring Tokmanni remains highly competitive within the discount retail landscape.

For instance, in the first quarter of 2024, Tokmanni reported a comparable sales growth of 3.5%, indicating strong customer response to its value-driven offerings. This growth underscores the effectiveness of their pricing strategy in attracting and retaining a broad customer base, even amidst economic fluctuations.

Tokmanni implements a competitive pricing strategy across its product tiers, ensuring broad market appeal. This approach is designed to attract a diverse customer base by offering options that align with different budget needs and value perceptions.

The company's pricing structure emphasizes the 'best price' for essential, entry-level items, making everyday necessities accessible. This segment is crucial for driving foot traffic and ensuring consistent sales volume, particularly in the current economic climate where consumers are highly price-sensitive.

Tokmanni further enhances its value proposition through its private label brands, offering 'best value' by combining quality with affordability. These own-brand products often provide higher profit margins for the retailer and are key in building customer loyalty, as seen in the strong performance of private labels in the discount retail sector during 2024.

Finally, the 'best deals' on both international and domestic A-brands cater to customers seeking premium products at discounted prices. This strategy not only attracts brand-conscious shoppers but also positions Tokmanni as a destination for significant savings on popular items, contributing to its overall market competitiveness.

The integration of Dollarstore and other strategic acquisitions is a key driver for Tokmanni's competitive pricing strategy. By the end of March 2025, these integrations are projected to yield EUR 16.2 million in annual synergy benefits, a figure expected to surpass EUR 20 million by the close of 2025.

These substantial synergy gains directly empower Tokmanni to maintain low prices for its customer base. Simultaneously, these cost efficiencies contribute to an improved profitability profile for the entire Group, demonstrating a successful balance between value offering and financial health.

Responsive to Consumer Purchasing Power

Tokmanni's pricing strategy directly addresses consumer purchasing power, adapting to economic shifts. When consumer confidence dips, they see a noticeable move away from pricier items towards discounted groceries and promotional offers, a trend that helps sustain sales even in tougher economic climates.

This adaptability is crucial for maintaining market share. For instance, during periods of economic uncertainty, Tokmanni's focus on value ensures they remain a go-to retailer for essential goods. Their ability to pivot pricing and promotions based on consumer sentiment is a key element of their market responsiveness.

- Price Sensitivity: Tokmanni's pricing is highly attuned to consumer confidence and economic conditions.

- Demand Shift: In weaker economic periods, demand gravitates towards promotional and lower-priced grocery items.

- Sales Maintenance: This responsiveness allows Tokmanni to preserve sales volumes during economic downturns.

Strategic Pricing to Drive Sales and Profitability

Tokmanni is strategically pricing its products to navigate a challenging consumer environment in early 2025. Despite economic headwinds, the company is focusing on competitive pricing to stimulate sales volume and enhance overall profitability. This approach is underpinned by a commitment to offering value to its customer base.

To support this pricing strategy, Tokmanni is implementing rigorous cost control measures and optimizing its supply chain. These operational efficiencies are crucial for maintaining competitive price points without compromising margins. For instance, in Q1 2025, the company reported a net sales increase of 4.4% to €297.0 million, demonstrating the effectiveness of its commercial initiatives even amidst weak consumer confidence.

The pricing strategy aims to strike a delicate balance: ensuring affordability for price-sensitive consumers while simultaneously driving sustainable business performance. This involves careful product assortment and promotional activities tailored to market demand.

- Competitive Pricing: Tokmanni aims to offer attractive price points to drive sales volume.

- Cost Efficiency: Strict cost control and supply chain optimization support competitive pricing.

- Profitability Focus: The strategy seeks to balance affordability with sustainable business performance.

- Sales Growth: In Q1 2025, net sales reached €297.0 million, a 4.4% increase year-on-year.

Tokmanni's pricing strategy is fundamentally built on affordability, a core element of its discount retailer identity. This is evident in their consistent focus on offering low prices across a wide product range, including private labels and popular A-brands. The company actively leverages cost efficiencies, such as those derived from acquisitions like Dollarstore, to maintain these competitive price points. For example, synergy benefits from Dollarstore were projected to reach EUR 16.2 million by the end of March 2025, directly supporting their low-price commitment.

Tokmanni's approach is highly responsive to consumer economic sentiment. During periods of economic uncertainty in early 2025, they observed a shift towards discounted groceries and promotional items, a trend their pricing strategy is designed to capitalize on. This adaptability helps maintain sales volume even when consumer confidence is low. The company's net sales increased by 4.4% to €297.0 million in Q1 2025, reflecting the success of their value-driven offerings in a challenging market.

| Metric | Value | Period | Significance |

|---|---|---|---|

| Comparable Sales Growth | 3.5% | Q1 2024 | Indicates strong customer response to value offerings. |

| Dollarstore Synergy Benefits (Projected) | EUR 16.2 million | End of March 2025 | Supports maintaining low prices through cost efficiencies. |

| Net Sales | €297.0 million | Q1 2025 | 4.4% increase, demonstrating effectiveness of commercial initiatives. |

4P's Marketing Mix Analysis Data Sources

Our Tokmanni Group 4P's Marketing Mix Analysis is grounded in a comprehensive review of official company disclosures, including annual reports and investor presentations, alongside data from their e-commerce platforms and public announcements. This ensures our insights into their product offerings, pricing strategies, distribution network, and promotional activities are accurate and current.