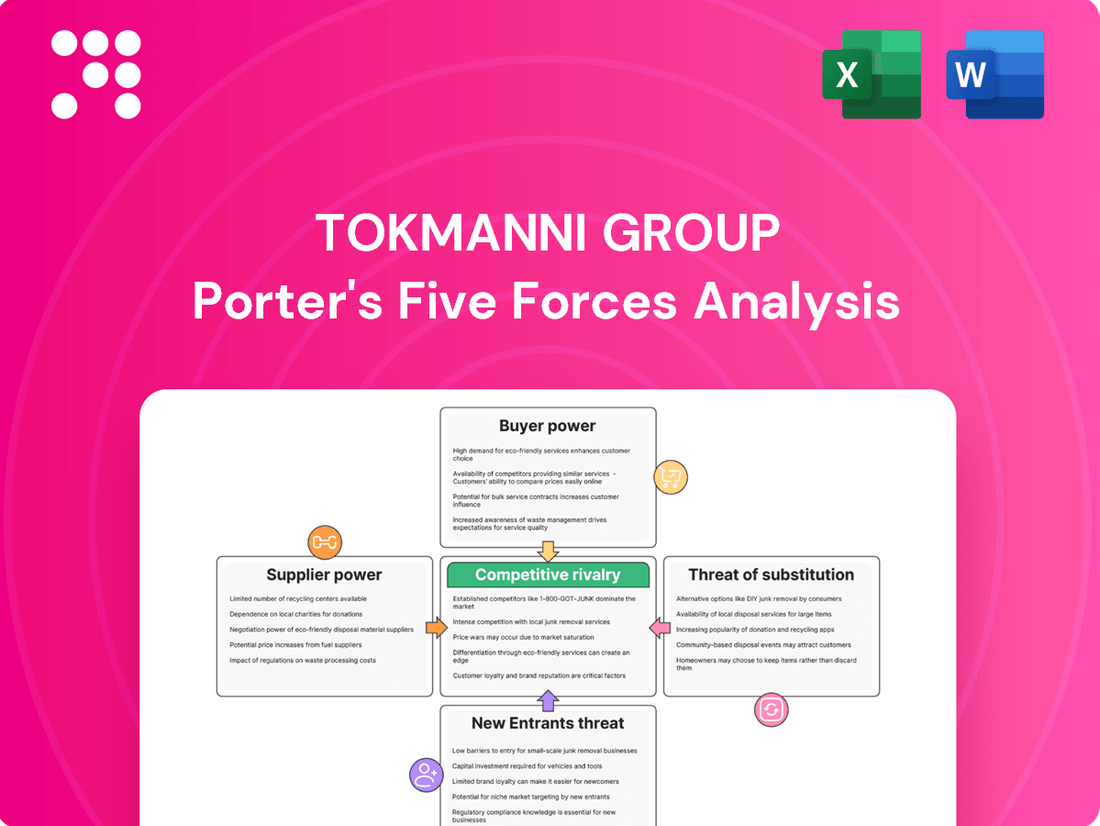

Tokmanni Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tokmanni Group Bundle

Tokmanni Group operates in a retail landscape influenced by intense rivalry, moderate buyer power, and the ever-present threat of substitutes. Understanding these dynamics is crucial for navigating its competitive environment.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Tokmanni Group’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Tokmanni, a major retailer, procures a vast array of goods. When a particular product segment is controlled by a small number of suppliers, their leverage escalates. This scenario is especially pertinent for niche items or highly sought-after brands where substitute options are scarce, potentially driving up Tokmanni's procurement expenses.

The criticality of a supplier's product to Tokmanni's core offering significantly influences supplier power. If a supplier provides essential, high-demand items like groceries, Tokmanni faces greater pressure to retain that supplier, as switching could lead to customer dissatisfaction and lost sales. For example, a significant portion of Tokmanni's revenue comes from everyday necessities, making those suppliers' products vital.

If switching from one supplier to another involves significant costs for Tokmanni, such as retooling logistics, renegotiating contracts, or altering product displays, suppliers gain more power. These costs act as a barrier to switching, making Tokmanni more reliant on existing relationships even if prices increase slightly. For example, in 2023, Tokmanni's cost of goods sold was €1.07 billion, indicating the scale of its supplier relationships and the potential impact of switching costs.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into retail operations poses a challenge to Tokmanni. This means suppliers could potentially bypass Tokmanni and sell directly to consumers, thereby cutting out the middleman and directly competing. This is particularly relevant for suppliers with strong brand recognition who may see an opportunity in direct-to-consumer (DTC) sales.

For Tokmanni, this forward integration by suppliers can diminish its bargaining power. If a supplier can reach customers directly, they have less need to rely on Tokmanni's distribution network and customer base. This could lead to less favorable terms for Tokmanni in future negotiations.

While not all suppliers have the capability or desire to integrate forward, those who manufacture well-known brands are more likely to consider this strategy. For instance, a popular clothing manufacturer could launch its own online store or physical outlets, directly vying for Tokmanni's customer segment.

In 2023, the global e-commerce market saw continued growth, with DTC sales becoming increasingly prevalent across various sectors. This trend highlights the ongoing viability of forward integration as a strategy for suppliers seeking greater control over their brand and customer relationships.

Tokmanni's Ability to Backward Integrate or Source Directly

Tokmanni's strategic move to develop its own private label products and directly import goods, especially from Asian manufacturers, significantly curtails the bargaining power of its suppliers. This direct sourcing approach bypasses traditional intermediaries, granting Tokmanni enhanced control over both its procurement costs and its overall supply chain efficiency. For instance, in 2024, a substantial portion of Tokmanni's product assortment comprised private label items, a testament to its successful backward integration strategy.

This direct engagement with manufacturers allows Tokmanni to negotiate more favorable terms, thereby diminishing the leverage that independent suppliers might otherwise wield. By controlling more of the value chain, Tokmanni can absorb or mitigate price increases that might be imposed by external suppliers, insulating its profit margins.

- Private Label Growth: Tokmanni's investment in developing and expanding its private label offerings directly challenges supplier dominance.

- Direct Import Strategy: Sourcing directly from manufacturers, particularly in Asia, reduces reliance on traditional distribution networks and their associated markups.

- Cost Control: By cutting out middlemen, Tokmanni gains greater visibility and control over product costs, enhancing its competitive pricing.

- Supply Chain Resilience: Direct sourcing can also lead to a more robust and responsive supply chain, less susceptible to disruptions from powerful intermediaries.

Tokmanni's bargaining power with suppliers is influenced by the concentration of suppliers in specific product categories. When few suppliers dominate a market segment, their ability to dictate terms increases, potentially raising Tokmanni's costs for those items.

The essential nature of a supplier's product to Tokmanni's business operations is a key factor. If a supplier provides critical goods that are difficult to substitute, Tokmanni has less leverage. For instance, in 2023, Tokmanni's cost of goods sold was €1.07 billion, highlighting the significant volume of its supplier relationships.

Switching costs for Tokmanni, such as those related to logistics or contract renegotiations, can empower suppliers. High switching costs make Tokmanni more inclined to maintain existing supplier relationships, even if prices rise. This is particularly relevant given the scale of its procurement activities.

Tokmanni's strategy of developing private labels and sourcing directly, especially from Asia, significantly reduces supplier bargaining power. This approach, evident in 2024 with a substantial private label product mix, allows Tokmanni to negotiate better terms and control costs more effectively.

| Factor | Impact on Tokmanni | Example/Data Point |

|---|---|---|

| Supplier Concentration | Increases supplier power if few suppliers dominate | Relevant for niche or highly branded products. |

| Product Differentiation/Essentiality | Increases supplier power if products are critical and unique | Everyday necessities are vital to Tokmanni's revenue. |

| Switching Costs | Increases supplier power if costs to switch are high | €1.07 billion cost of goods sold in 2023 indicates significant supplier relationships. |

| Tokmanni's Backward Integration (Private Labels, Direct Sourcing) | Decreases supplier power | Substantial private label share in 2024, direct sourcing from Asia. |

What is included in the product

Tokmanni Group's Porter's Five Forces analysis reveals the competitive intensity, buyer and supplier power, threat of new entrants, and substitute products impacting its discount retail operations.

Instantly visualize Tokmanni's competitive landscape with a clear, one-sheet summary of all five forces—perfect for quick, data-driven strategic decision-making.

Customers Bargaining Power

Tokmanni's position as a discount retailer means its customers are inherently sensitive to price. This sensitivity is amplified in environments with lower consumer confidence, such as the economic conditions observed in early 2024, where discretionary spending is curtailed.

When consumers are more cautious about their spending, especially on non-essential items, they actively seek out the best value. This behavior makes them highly likely to switch to competitors if a better price is offered, directly impacting Tokmanni's customer loyalty and market share.

The bargaining power of Tokmanni's customers is significantly influenced by the availability of substitute products and retailers. Customers can easily find similar discount goods at competitors like Lidl and Rusta, as well as from larger grocery chains such as S Group and K Group. This wide array of choices, including online retailers, allows consumers to readily compare prices and product offerings.

This ease of comparison directly translates into increased customer bargaining power. For instance, in 2024, the discount retail sector in Finland, where Tokmanni primarily operates, saw intense price competition. Reports indicated that consumers were actively seeking out the best value, often switching between retailers based on promotions and everyday pricing. This environment means Tokmanni must remain highly competitive on price to retain its customer base.

For customers of the Tokmanni Group, the cost of switching to a competitor is typically very low. This means consumers can easily move between different discount retailers or online marketplaces without facing significant financial penalties or time commitments. For instance, in 2024, the average consumer in Finland, Tokmanni's primary market, reported visiting multiple retail locations or online stores weekly to compare prices and product availability.

Customer Information and Transparency

Customers today are incredibly well-informed. With the internet, price comparison sites, and social media, they can easily see what Tokmanni is charging compared to competitors. This transparency means they know if they're getting a good deal, which naturally pushes Tokmanni to keep its prices competitive.

This heightened customer awareness directly impacts Tokmanni's pricing strategies. For instance, in 2024, the average consumer spent an estimated 2.5 hours per week researching purchases online, a significant increase from previous years, highlighting the depth of their information gathering.

- Informed Purchasing Decisions: Customers leverage online resources and comparison tools to identify the best prices and promotions available, directly influencing their buying behavior.

- Pressure for Competitive Pricing: The ease of price comparison forces retailers like Tokmanni to maintain aggressive pricing to attract and retain customers.

- Impact on Profit Margins: Increased price transparency can lead to tighter profit margins for retailers as they compete more intensely on price.

- Customer Loyalty Factors: Beyond price, customers now consider value, convenience, and brand reputation, all influenced by readily accessible online information.

Volume of Purchases by Individual Customers

The bargaining power of individual customers for Tokmanni Group is generally low due to the fragmented nature of its customer base. No single customer or a small group of customers represents a substantial portion of Tokmanni's overall sales volume. This means individual buyers cannot exert significant influence over pricing or dictate specific terms of sale.

While individual customers hold little direct power, their collective price sensitivity is a crucial factor. As a discount retailer, Tokmanni's business model relies on attracting a large volume of customers who are actively seeking value. This widespread price consciousness means that while they can't negotiate individually, widespread dissatisfaction with pricing could lead to shifts in purchasing behavior across the customer base.

- Low individual customer concentration: Tokmanni's vast customer base means no single buyer has significant leverage.

- Limited individual negotiation power: Customers cannot typically negotiate prices or demand special terms.

- High collective price sensitivity: The discount model means customers are generally very responsive to price changes.

- Impact of collective behavior: While individual power is minimal, widespread price dissatisfaction can influence sales volume.

Tokmanni's customers possess significant bargaining power, primarily driven by their price sensitivity and the ease of switching between numerous competitors. The discount retail sector thrives on volume, making customers highly attuned to price differences. In 2024, Finnish consumers actively compared prices across retailers like Lidl, Rusta, and even larger grocery chains such as S Group and K Group, both in-store and online. This widespread price consciousness, fueled by readily available information, compels Tokmanni to maintain competitive pricing to retain its customer base.

| Factor | Impact on Tokmanni | Evidence (2024) |

| Price Sensitivity | High | Consumers actively sought best value due to economic caution. |

| Availability of Substitutes | High | Numerous discount retailers and online options available. |

| Switching Costs | Low | Minimal financial or time commitment to change retailers. |

| Information Availability | High | Consumers spent approx. 2.5 hours/week researching purchases online. |

Preview Before You Purchase

Tokmanni Group Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The Tokmanni Group Porter's Five Forces Analysis you see here details the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within its market. This comprehensive analysis is ready for your immediate use.

Rivalry Among Competitors

The Finnish retail market, especially in discount and grocery segments, features a crowded field of competitors. Tokmanni faces strong competition from major grocery players like S Group and K Group, which dominate market share. Additionally, other discount retailers such as Lidl and Rusta, alongside numerous smaller, specialized stores, intensify the rivalry.

Tokmanni’s expansion into Sweden and Denmark through the Dollarstore acquisition has introduced new competitive dynamics. This move brings in more players in these markets, requiring Tokmanni to navigate different competitive landscapes and consumer preferences.

The Finnish retail market has seen only modest growth recently, with consumer confidence being quite low, particularly in Finland and Sweden. This sluggish economic environment means that companies are fiercely competing for customers, as there isn't much new business to go around.

While discount stores are likely to hold their ground, this low-growth scenario really heats up the competition. Every company is trying to grab a bigger piece of the pie in a market that isn't expanding much, making rivalry even more intense.

Tokmanni's strategy hinges on a broad assortment of affordable goods, significantly bolstered by its private label brands. This approach aims to capture value-conscious consumers. However, in the discount retail landscape, achieving deep product differentiation is inherently difficult, as many items are essentially commodities readily available from numerous sources.

The competitive intensity is further amplified by rivals who also leverage private labels and extensive product selections. This necessitates continuous innovation from Tokmanni and a persistent emphasis on its core value proposition to stand out. For instance, in 2023, Tokmanni reported that its private label products accounted for a substantial portion of its sales, underscoring their importance in its differentiation strategy.

Exit Barriers for Competitors

Tokmanni Group faces intensified competition due to high exit barriers for its rivals. Significant investments in physical retail infrastructure, including numerous stores and extensive logistics networks, represent substantial fixed assets. These assets make it financially challenging for competitors to simply shut down operations, even when unprofitable. For instance, many retailers operate under long-term lease agreements, further locking them into existing locations and increasing the cost of exiting the market.

These elevated exit barriers can trap underperforming competitors, prolonging their presence and thereby intensifying rivalry within the discount retail sector. This situation often leads to aggressive pricing strategies, commonly known as price wars, as these companies strive to retain market share rather than incur the substantial costs associated with exiting. Consequently, this can depress overall profitability for all participants in the market.

In 2023, Tokmanni Group operated over 200 stores across Finland, demonstrating the significant capital commitment expected within the sector. Competitors with similar or extensive store portfolios face comparable challenges in divesting or closing down operations, contributing to a competitive landscape where market share defense often takes precedence over strategic withdrawal.

- High Fixed Assets: Competitors often possess substantial investments in physical store locations and distribution centers, making closure costly.

- Long-Term Leases: Binding lease agreements for retail spaces create financial obligations that hinder quick exits.

- Market Share Defense: The presence of unprofitable but entrenched competitors can trigger price wars as they fight to maintain their customer base.

- Profitability Squeeze: Persistent rivalry driven by high exit barriers can lead to reduced profit margins for all players in the discount retail segment.

Strategic Alliances and Acquisitions

Tokmanni's strategic alliances and acquisitions significantly alter the competitive rivalry. The acquisition of Dollarstore in 2023, for instance, solidified its position as a major discount retailer across the Nordic region, directly challenging existing players. This move, along with a 2024 licensing agreement with SPAR International to bolster its Finnish grocery segment, increases Tokmanni's scale and competitive edge, likely spurring similar consolidation or partnership efforts among its rivals to maintain market share.

These strategic maneuvers have tangible impacts on the market. By integrating Dollarstore, Tokmanni expanded its store network and customer base, enhancing its purchasing power and operational efficiencies. This creates a more formidable competitor, forcing others to re-evaluate their own growth strategies and potentially leading to increased price competition or further M&A activity within the discount retail sector.

- Acquisition of Dollarstore (2023): Significantly expanded Tokmanni's Nordic footprint and market share in the discount retail segment.

- SPAR International Licensing Agreement (2024): Aimed at strengthening Tokmanni's grocery assortment in Finland, a key competitive area.

- Increased Scale and Competitiveness: These actions enhance Tokmanni's ability to compete on price, product range, and operational efficiency.

- Industry Response: Competitors are likely to respond with their own strategic initiatives to counter Tokmanni's growing influence.

Tokmanni operates in a highly competitive Finnish retail market, facing strong pressure from major grocery chains like S Group and K Group, as well as other discount retailers such as Lidl. The recent acquisition of Dollarstore in 2023 and a 2024 licensing agreement with SPAR International have intensified this rivalry, expanding Tokmanni's reach and forcing competitors to adapt. This heightened competition is particularly acute in a low-growth economic environment, where companies are aggressively vying for market share.

The discount retail sector is characterized by a difficulty in achieving deep product differentiation, as many offerings are commoditized. Tokmanni's reliance on private labels, which represented a significant portion of its sales in 2023, is a key strategy to stand out, but rivals also employ similar tactics. High exit barriers, such as substantial investments in physical stores and long-term leases, keep competitors in the market even when unprofitable, leading to price wars and squeezing profit margins for all players.

| Competitor | Market Segment | Key Strategy | 2023 Market Share (Finland - Est.) |

|---|---|---|---|

| S Group | Grocery, Retail | Broad assortment, loyalty programs | ~35% |

| K Group | Grocery, Retail | Diverse store formats, private labels | ~25% |

| Lidl | Discount Grocery | Aggressive pricing, private labels | ~10% |

| Rusta | Home & Garden Discount | Value-for-money, seasonal products | N/A (Private) |

SSubstitutes Threaten

Consumers have numerous alternative retail formats available, presenting a significant threat of substitutes for Tokmanni. These include hypermarkets and supermarkets, which often carry a wider range of groceries alongside non-food items, directly competing with Tokmanni's value-oriented general merchandise. For instance, in 2024, the Finnish grocery sector, which overlaps with Tokmanni's offerings, saw continued strong performance from major players like S Group and Kesko, indicating robust competition from these larger format retailers.

The increasing prevalence of online retailers and e-commerce platforms poses a substantial threat to traditional brick-and-mortar discount stores like those operated by Tokmanni. Customers increasingly value the convenience of browsing and purchasing goods from the comfort of their homes, often finding more competitive pricing and readily available home delivery options through online channels. For instance, in 2024, e-commerce sales in Finland continued their upward trajectory, capturing a larger share of the retail market, which directly impacts the foot traffic and sales of physical stores.

The rise of do-it-yourself (DIY) projects and the burgeoning second-hand market presents a significant threat of substitution for Tokmanni. For categories like home decor, basic apparel, and certain leisure goods, consumers increasingly choose to create their own items or purchase pre-owned ones. This trend is fueled by a desire for cost savings and a growing commitment to sustainable consumption practices, directly impacting demand for new products.

In 2023, the global second-hand apparel market was valued at over $100 billion and is projected to grow significantly, indicating a strong consumer shift towards pre-owned goods. Similarly, DIY home improvement projects have seen a surge, with consumers investing in materials and tools to personalize their living spaces rather than buying ready-made solutions. This growing preference for repair, repurposing, and reuse directly diverts potential sales away from retailers like Tokmanni.

Direct-to-Consumer (D2C) Brands

The rise of direct-to-consumer (D2C) brands presents a significant threat of substitutes for traditional retailers like Tokmanni. Many brands are now bypassing intermediaries and selling directly to customers via their own online platforms, offering a more personalized and potentially cost-effective shopping experience.

This shift can diminish Tokmanni's attractiveness as customers may seek out specific brands directly for exclusive product lines or more competitive pricing. For instance, the global D2C e-commerce market was projected to reach over $323 billion in 2023, indicating a substantial and growing alternative sales channel.

- D2C Growth: The D2C market continues its rapid expansion, offering consumers direct access to a wider array of brands and products.

- Customer Loyalty Shift: Brands engaging directly with consumers can foster stronger loyalty, potentially diverting customers from multi-brand retailers.

- Price and Exclusivity: D2C channels often allow brands to offer better pricing or exclusive products, creating a compelling substitute for traditional retail purchases.

- Digital Convenience: The ease of online purchasing through D2C websites caters to consumer demand for convenience, further challenging brick-and-mortar retailers.

Shifting Consumer Preferences and Lifestyle Changes

Shifting consumer preferences represent a significant threat of substitutes for Tokmanni. As consumers increasingly value sustainability, premium quality, or specialized niche products, the appeal of general discount retail can diminish. For instance, a growing segment of shoppers might opt for ethically sourced clothing or organic groceries, bypassing the broader, more affordable selections typically found at Tokmanni.

This trend can lead to a decline in demand for Tokmanni's core offerings if consumers pivot towards alternative purchasing behaviors. If the market sees a substantial move towards curated, high-end, or ethically produced goods, Tokmanni's value proposition as an affordable general retailer could be challenged. This necessitates a keen understanding of evolving consumer desires to counter the threat of substitutes.

- Growing Demand for Sustainable Products: In 2024, the global market for sustainable goods continued its upward trajectory, with consumers showing a greater willingness to pay a premium for environmentally friendly products.

- Rise of Niche Retailers: The proliferation of specialized online and brick-and-mortar stores focusing on specific categories like artisanal foods or vintage fashion offers direct substitutes for consumers seeking unique or high-quality items.

- Premiumization Trend: Consumer spending data from late 2023 and early 2024 indicated a segment of the market actively seeking out premium brands and experiences, potentially diverting spending away from discount channels.

The threat of substitutes for Tokmanni is substantial, stemming from various retail channels and evolving consumer habits. Hypermarkets and supermarkets, like S Group and Kesko in Finland, offer a broader grocery selection alongside general merchandise, directly competing with Tokmanni's value proposition. The convenience and competitive pricing of online retailers continue to draw customers away from physical stores, a trend amplified by the ongoing growth of e-commerce in Finland throughout 2024.

Furthermore, the increasing popularity of DIY projects and the thriving second-hand market provide alternative consumption patterns. Consumers opting for pre-owned goods or creating items themselves, driven by cost savings and sustainability, divert spending from new product purchases. For instance, the global second-hand apparel market, valued over $100 billion in 2023, highlights this shift.

Direct-to-consumer (D2C) brands also pose a significant threat, offering personalized experiences and potentially better pricing through their own online platforms, a market projected to exceed $323 billion in 2023. Finally, changing consumer preferences towards sustainability, premium quality, or niche products can erode the appeal of general discount retail. Data from late 2023 and early 2024 indicates a segment of consumers actively seeking premium brands, impacting discount retailers.

| Substitute Channel | Key Characteristics | Impact on Tokmanni | 2023/2024 Data Point |

| Hypermarkets/Supermarkets | Wider grocery range, one-stop shopping | Direct competition on general merchandise | Finnish grocery sector saw strong performance from major players in 2024 |

| Online Retailers (E-commerce) | Convenience, competitive pricing, home delivery | Diverts foot traffic and sales from physical stores | E-commerce sales in Finland continued upward trajectory in 2024 |

| Second-hand Market | Cost savings, sustainability focus | Reduces demand for new apparel, home goods, leisure items | Global second-hand apparel market exceeded $100 billion in 2023 |

| Direct-to-Consumer (D2C) Brands | Personalization, exclusive lines, direct pricing | Potential customer loyalty shift, bypasses traditional retail | Global D2C e-commerce market projected over $323 billion in 2023 |

| Niche/Premium Retailers | Specialized products, higher quality, ethical sourcing | Challenges value proposition for price-sensitive consumers | Consumer spending in late 2023/early 2024 showed a segment seeking premium brands |

Entrants Threaten

Entering the discount retail sector, particularly with a physical store presence akin to Tokmanni's, demands considerable upfront capital. This includes significant outlays for securing prime retail locations, stocking vast amounts of inventory, establishing efficient logistics and supply chains, and investing in necessary technology infrastructure.

Tokmanni's established network, boasting over 370 stores across Finland and its substantial logistics hub, presents a formidable barrier. The sheer scale of these operations means new entrants would need to commit massive financial resources to even approach a comparable market presence, making it difficult to compete effectively from the outset.

Tokmanni Group benefits significantly from economies of scale in purchasing, distribution, and marketing. The recent acquisition of Dollarstore, for instance, is projected to yield substantial annual synergies, reinforcing Tokmanni's cost advantages. New entrants would find it exceedingly difficult to replicate these efficiencies without rapidly achieving a comparable scale, placing them at a considerable cost disadvantage from the outset.

Building strong supplier relationships and securing reliable distribution channels is a significant hurdle for new entrants. Tokmanni has cultivated these over years, making it challenging for newcomers to match their breadth of affordable offerings. For instance, in 2023, Tokmanni reported a net sales of €1,166.9 million, demonstrating the scale of operations supported by its established supply chain.

Brand Loyalty and Customer Switching Costs

While the discount retail sector often sees price-sensitive consumers, Tokmanni has cultivated significant brand recognition and a loyal following, particularly in Finland. New entrants face the challenge of overcoming this established loyalty, requiring substantial investment in marketing and aggressive pricing to lure customers. Although switching costs for consumers are generally low in this market, making initial experimentation easy, building sustained customer allegiance against a strong incumbent like Tokmanni is a considerable hurdle.

Tokmanni’s brand loyalty acts as a significant barrier. For instance, in 2023, Tokmanni reported a net sales increase of 4.4% to €1,177.5 million, indicating continued customer engagement. New entrants must not only match price points but also invest in building a comparable brand presence to attract and retain customers.

- Brand Recognition: Tokmanni has a strong, recognizable brand in its core markets.

- Marketing Investment: New entrants need substantial marketing budgets to build awareness.

- Customer Loyalty: Established loyalty makes it difficult for new players to gain market share.

- Price Sensitivity vs. Loyalty: While customers are price-aware, brand preference can override minor price differences.

Regulatory Hurdles and Local Market Knowledge

Navigating the complex regulatory landscape and securing the necessary permits in new markets presents a significant barrier for potential entrants. This process can be lengthy and costly, requiring substantial investment in legal and compliance expertise. Furthermore, understanding nuanced local consumer preferences and intricate market dynamics is crucial for success, a knowledge base that takes years to build.

Tokmanni's established presence and deep understanding of the Finnish market, coupled with its recent strategic expansion into Sweden and Denmark, provide a distinct advantage. This existing local market knowledge, honed over years of operation, and well-defined operational processes are difficult for newcomers to replicate swiftly. For instance, Tokmanni's 2023 annual report highlighted a revenue of €1,172.8 million, demonstrating its scale and operational efficiency within its existing markets, which would be a considerable hurdle for any new competitor to overcome.

- Regulatory Complexity: New entrants face significant challenges in understanding and complying with diverse national and regional regulations, including product safety standards, import duties, and retail licensing.

- Permit Acquisition: Obtaining the requisite permits and licenses for retail operations can be a time-consuming and capital-intensive process, often involving multiple government agencies and lengthy approval cycles.

- Local Market Nuances: Success hinges on a deep comprehension of local consumer behavior, purchasing habits, and cultural sensitivities, which are difficult for external companies to acquire quickly.

- Established Retailer Advantage: Tokmanni's long-standing presence and operational expertise in its core markets, along with its recent international expansion, create a formidable barrier to entry due to its established brand recognition and supply chain efficiencies.

The threat of new entrants for Tokmanni Group is moderate, primarily due to high capital requirements for establishing a physical retail presence and the need for extensive supply chain infrastructure. Tokmanni's established scale, economies of scale, and strong brand recognition in Finland create significant barriers for newcomers. For instance, in 2023, Tokmanni's net sales reached €1,166.9 million, underscoring its substantial market penetration.

New entrants face considerable challenges in matching Tokmanni's purchasing power and distribution efficiencies, which are bolstered by its extensive store network of over 370 locations. The recent acquisition of Dollarstore is expected to generate significant annual synergies, further solidifying Tokmanni's cost advantages. Overcoming Tokmanni's established brand loyalty and marketing investment requires substantial resources, making it difficult for new players to gain immediate traction.

Navigating complex regulations and securing necessary permits in new markets adds another layer of difficulty for potential entrants. Tokmanni’s deep understanding of local market nuances, cultivated over years, and its recent expansion into Sweden and Denmark, present a formidable competitive advantage that new entrants would struggle to replicate quickly.

| Factor | Impact on New Entrants | Tokmanni's Advantage |

|---|---|---|

| Capital Requirements | High (stores, inventory, logistics) | Established infrastructure, economies of scale |

| Brand Recognition & Loyalty | Challenging to build | Strong in Finland, significant marketing investment |

| Economies of Scale | Difficult to achieve | Purchasing power, distribution efficiency (e.g., Dollarstore synergies) |

| Supplier Relationships & Distribution | Requires time and investment | Long-standing, extensive network |

| Regulatory & Market Knowledge | Complex and time-consuming | Deep local expertise, international expansion experience |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Tokmanni Group is built upon a foundation of publicly available financial statements, annual reports, and investor presentations. We supplement this with data from industry-specific market research reports and relevant trade publications to capture a comprehensive view of the competitive landscape.