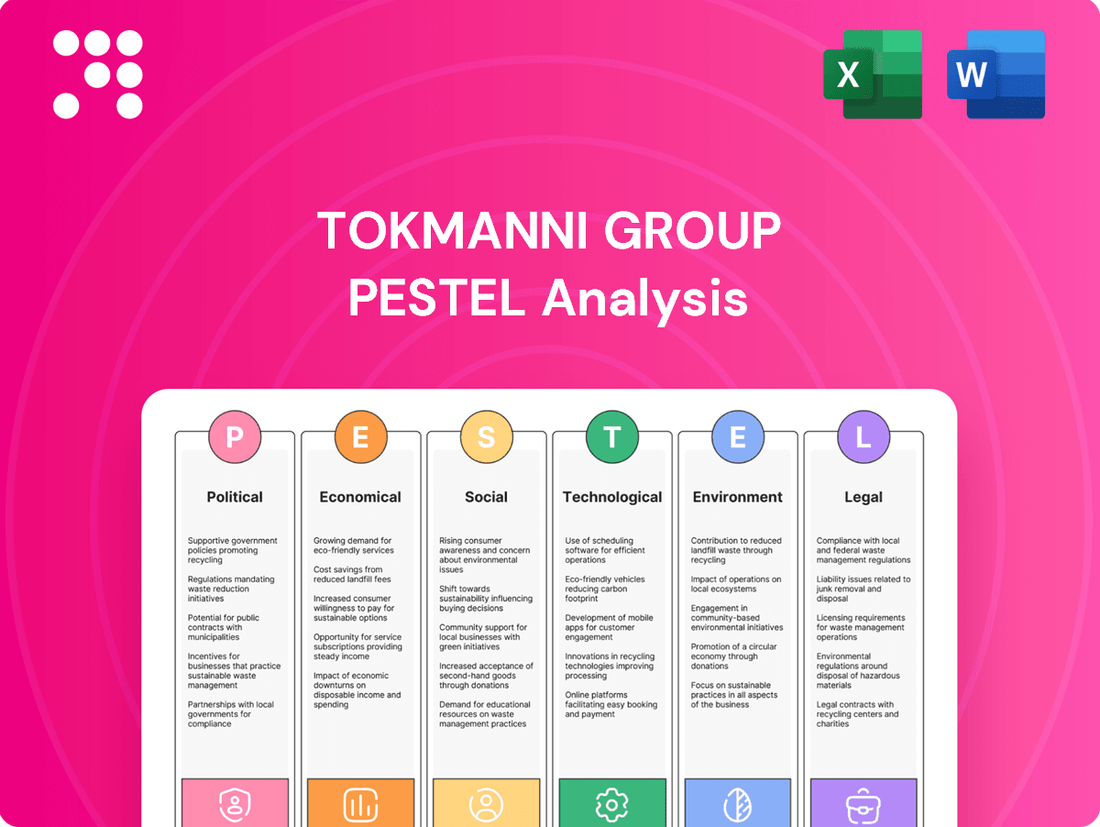

Tokmanni Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tokmanni Group Bundle

Discover the critical political, economic, social, technological, legal, and environmental factors shaping Tokmanni Group's future. Our expertly crafted PESTLE analysis provides actionable intelligence to navigate these external forces. Gain a competitive edge by understanding market dynamics and potential opportunities. Download the full PESTLE analysis now for immediate, in-depth insights.

Political factors

The Finnish government's fiscal policies and budget proposals for 2025 are centered on bolstering public finances via savings and structural reforms designed to boost employment. These measures directly impact consumer purchasing power and the broader economic landscape for retailers such as Tokmanni.

For instance, a key proposal for 2025 involves achieving approximately €3 billion in central government savings, which could indirectly affect disposable income. However, the government's stated commitment to fostering economic growth through private sector initiatives provides a potentially more stable backdrop for Tokmanni's operations.

Upcoming labor law reforms in Finland, potentially lowering the threshold for employee termination from 'substantive and weighty reason' to merely 'substantive reason,' could offer Tokmanni Group greater flexibility in managing its workforce. This shift might influence operational costs and staffing strategies, particularly in a sector with significant employment. However, unions are closely observing the implementation of these changes, especially in light of the recent retail sector collective agreement that includes wage hikes.

Government reports in 2024 highlight the critical need to bolster the retail sector's international competitiveness, with significant emphasis on Research, Development, and Innovation (RDI) policies. These initiatives aim to foster technological advancements and new business models within retail.

Policies actively encouraging digitalization are shaping how retailers operate, from e-commerce expansion to in-store technology adoption. For instance, Finland's national digitalization strategy, updated in 2023, provides a framework for such investments.

Furthermore, the push towards sustainable retail models is increasingly influencing regulatory landscapes. This includes regulations concerning waste reduction, ethical sourcing, and energy efficiency, all of which are becoming central to retail operations and consumer expectations in 2024 and beyond.

Alcohol Act Amendments

Recent amendments to Finland's Alcohol Act, particularly those allowing licensed retailers to sell fermented beverages with higher alcohol content, present a potential opportunity for Tokmanni. This shift, aligning with broader European alcohol policies, could enable Tokmanni to broaden its beverage selection in stores.

Furthermore, proposed changes that may permit home delivery of alcoholic beverages could open new sales channels for Tokmanni. In 2023, alcohol sales in Finland continued to be a significant consumer spending category, with specific segments showing growth, indicating market receptiveness to expanded availability.

- Expanded Product Range: Higher alcohol content limits for fermented beverages could allow Tokmanni to offer a wider variety of wines and ciders.

- New Sales Channels: Home delivery options, if enacted, would provide an additional avenue for alcohol sales, potentially reaching a broader customer base.

- Market Alignment: These legislative adjustments aim to harmonize Finnish alcohol regulations with those in other EU countries, fostering a more consistent market environment.

Trade Policy and International Competition

The Finnish retail landscape is increasingly shaped by international trade policies and the competitive pressures they create. A significant factor is the growing presence of foreign online retailers, particularly those based in China, which are making inroads into the Finnish market. This influx is especially impactful in the more price-sensitive segments of the market, directly challenging local players like Tokmanni.

To address this, the Finnish Commerce Federation is actively lobbying for policy changes. Their aim is to establish a more level playing field by ensuring that non-EU e-commerce platforms operate under the same regulatory framework as European businesses. This includes advocating for adherence to Finnish and EU consumer protection laws, tax regulations, and product safety standards.

- Increased Competition: The rise of foreign online retailers, especially from China, intensifies competition for Finnish retailers like Tokmanni, particularly in the budget-friendly product categories.

- Regulatory Advocacy: The Finnish Commerce Federation is pushing for regulations that require international e-commerce platforms to comply with the same rules as domestic and EU-based businesses.

- Fair Play Demands: The federation's efforts are focused on ensuring fair competition by harmonizing standards for online sales into Finland, regardless of the seller's origin.

Finnish government fiscal policies for 2025 aim for €3 billion in savings, potentially impacting consumer spending, while also supporting private sector growth. Labor law reforms could offer Tokmanni workforce flexibility, though union scrutiny and wage agreements remain factors. Government focus on RDI and digitalization policies supports retail innovation and e-commerce expansion, as seen in Finland's 2023 national digitalization strategy update.

What is included in the product

The Tokmanni Group's PESTLE analysis examines how political, economic, social, technological, environmental, and legal forces shape its operating landscape in the Nordic discount retail sector.

This comprehensive evaluation provides actionable insights into external factors, enabling strategic decision-making for navigating market complexities and capitalizing on emerging opportunities.

A PESTLE analysis for Tokmanni Group provides a clear, summarized version of external factors, acting as a pain point reliever by offering easy referencing during strategic planning and decision-making.

Economic factors

Consumer confidence in Finland has been a significant factor influencing purchasing behavior, particularly for higher-priced items. Despite some positive shifts, such as potential improvements in purchasing power stemming from lower interest rates and wage increases, consumers generally maintain a cautious approach to spending. This caution often translates into reduced expenditure on non-essential goods.

For instance, the Finnish Consumer Confidence Indicator, as reported by Statistics Finland, has hovered in negative territory for much of 2024, reflecting a general unease about the economic outlook. While specific figures fluctuate, the trend indicates that consumers are prioritizing essential purchases, which can directly impact sales volumes for retailers like Tokmanni, especially in categories beyond everyday necessities.

While Finland saw a significant drop in inflation during 2024, reaching an estimated average of 2.2% for the year according to Statistics Finland, upcoming tax increases in 2025 are projected to put upward pressure on prices. This means consumers might feel the pinch again, even as the overall inflation trend has been downward.

The recovery of household purchasing power is expected to be a gradual process. Moderate inflation, even with its recent decline, combined with anticipated modest wage growth, suggests that consumers' ability to spend freely will likely improve only slowly. For instance, wage growth in Finland averaged around 3.5% in early 2024, which may not fully offset even moderate inflation and tax changes.

The Finnish e-commerce landscape is experiencing robust growth, with online sales in 2024 showing substantial increases. This expansion is partly fueled by the increasing presence and popularity of foreign retailers offering competitive pricing and a wider selection of global brands, directly impacting domestic players like Tokmanni.

Consumer habits are evolving, with a growing preference for the convenience and accessibility of online shopping. This shift presents a significant competitive challenge for traditional brick-and-mortar retailers, as they must adapt to meet these changing demands and maintain market share against a backdrop of intensified online competition.

Retail Sector Performance and Outlook

The Finnish retail sector is projected to experience a modest recovery in sales volume during 2025, following a contraction in 2024. However, the pace of this growth is expected to be slower than pre-financial crisis levels. This outlook is supported by forecasts suggesting a stabilization of consumer spending as inflation moderates.

Several headwinds are present for retailers. Rising operational expenses, encompassing procurement, labor, and rental costs, are squeezing profit margins. For instance, the average consumer price index for goods and services in Finland saw an increase of 3.1% in 2024, impacting purchasing power and retailer costs.

Furthermore, a potential resurgence in retail bankruptcies is a concern, particularly for businesses burdened by significant debt. This risk is heightened by the ongoing economic pressures and the need for retailers to adapt to evolving consumer behaviors and digital competition.

- Projected Sales Growth: Gradual increase in retail sales volume expected in Finland for 2025.

- Cost Pressures: Retailers face increased costs for purchasing, staffing, and rent.

- Bankruptcy Risk: Potential for increased bankruptcies among retailers with problematic debt.

- Inflation Impact: Consumer price index increases in 2024 highlight ongoing cost challenges.

Company-Specific Financial Performance

Tokmanni Group experienced a net loss in the first quarter of 2025. This downturn was primarily linked to subdued sales of seasonal spring and summer items, coupled with a general dip in consumer confidence. The company has consequently revised its financial guidance downwards for the full year 2025.

In response to these challenges, Tokmanni is actively pursuing strategies aimed at revitalizing sales and enhancing its profitability. These initiatives are crucial for navigating the current economic climate and improving the company's financial standing.

- Q1 2025 Net Loss: Tokmanni reported a net loss for the first quarter of 2025, indicating immediate financial pressures.

- Lowered 2025 Guidance: The company reduced its financial outlook for the entire year 2025 due to the Q1 performance and market conditions.

- Sales Performance: Weak sales of seasonal products, particularly for spring and summer, were a key factor contributing to the financial results.

- Consumer Confidence Impact: Broader economic sentiment, reflected in weak consumer confidence, also played a significant role in the company's performance.

Economic factors present a mixed outlook for Tokmanni. While inflation eased in 2024, projected tax increases for 2025 could reignite price pressures, impacting consumer spending power. Retail sales volume is expected to see a modest recovery in 2025, but operational costs for retailers remain a concern, potentially squeezing profit margins.

| Economic Factor | 2024 Data/Projection | 2025 Projection | Impact on Tokmanni |

|---|---|---|---|

| Consumer Confidence | Negative territory for much of 2024 | Cautious improvement expected | Influences spending on non-essential items |

| Inflation | Estimated average of 2.2% in 2024 | Potential upward pressure from tax increases | Affects purchasing power and operational costs |

| Retail Sales Volume | Contraction in 2024 | Modest recovery expected | Directly impacts revenue |

| Operational Costs | CPI for goods/services increased 3.1% in 2024 | Continued pressure expected | Squeezes profit margins |

What You See Is What You Get

Tokmanni Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. It details the Tokmanni Group's PESTLE analysis, covering Political, Economic, Social, Technological, Legal, and Environmental factors impacting their operations. This comprehensive report provides actionable insights into the strategic landscape faced by the company.

Sociological factors

Finnish consumers are demonstrating a pronounced shift towards cautious spending, with a strong preference for essential goods. This trend significantly benefits discount retailers like Tokmanni, as shoppers seek value and affordability in the current economic climate. For instance, in early 2024, consumer confidence surveys indicated a heightened focus on necessities over discretionary purchases.

Furthermore, there's a discernible rise in demand for sustainable and locally sourced products within Finland. This growing consumer consciousness means that retailers must increasingly align their offerings with environmental and ethical considerations. Tokmanni's ability to integrate and promote such products will be crucial for maintaining relevance and attracting a segment of the market prioritizing these values.

The digital transformation has profoundly reshaped consumer behavior in Finland, with e-commerce experiencing significant growth. In 2023, a substantial portion of Finnish consumers, approximately 80%, engaged in online shopping, demonstrating a clear preference for digital channels.

This shift is evident across various product categories, with home electronics, cosmetics, and even pharmacy items seeing increased online demand. Furthermore, the consumer base is increasingly mobile-first, with a majority of online transactions conducted via smartphones, underscoring the need for seamless mobile shopping experiences.

Demographic shifts are reshaping consumer landscapes, with Generation Alpha, born roughly between 2010 and 2024, emerging as a significant future consumer base. Their early exposure to digital platforms and evolving expectations for personalized experiences will influence retail strategies. Tokmanni needs to consider how to engage this generation as they mature.

Furthermore, a notable trend is the increasing adoption of cosmetics and personal care products by men, a segment that has historically been underserved. This expansion of the beauty market presents new opportunities for retailers like Tokmanni to broaden their product offerings and marketing efforts to cater to this growing demographic. For instance, the global men's grooming market was valued at approximately USD 60.5 billion in 2023 and is projected to grow.

Impact of Cost of Living and Financial Strain

A significant portion of Finnish consumers are feeling the pinch financially, which naturally leads to less spending on things they don't absolutely need. This heightened financial pressure, fueled by rising energy costs, increasing food prices, and higher mortgage interest rates, is directly boosting the appeal of discount retailers like Tokmanni, as people actively seek out more affordable options.

The economic climate in Finland during 2024 and into early 2025 has seen inflation remain a key concern for households. For instance, Statistics Finland reported that in early 2024, the year-on-year increase in consumer prices was still impacting household budgets significantly, with essential goods seeing notable price hikes.

- Reduced Discretionary Spending: Consumers are cutting back on non-essential purchases to manage household budgets amidst rising living costs.

- Increased Demand for Value: The financial strain directly translates into a stronger preference for discount retailers offering affordable products.

- Impact of Inflation: Persistent inflation, particularly in food and energy sectors, erodes purchasing power and makes value-conscious shopping a necessity for many.

- Interest Rate Sensitivity: Rising mortgage interest rates further squeeze household finances, leaving less disposable income for other spending.

Sustainability Consciousness

Finnish consumers are increasingly prioritizing brands that demonstrate a commitment to societal and environmental well-being. This trend is particularly evident in their purchasing decisions, where purpose-driven innovation and eco-friendly practices are becoming key differentiators for retailers.

Tokmanni's focus on sustainability aligns with this consumer shift. For example, in 2023, Tokmanni reported that 94% of its product assortment was assessed for sustainability criteria, with a goal to reach 100% by 2025. This indicates a proactive approach to meeting consumer expectations for responsible business operations.

- Growing Demand for Eco-Friendly Products: Consumers are actively seeking out products with reduced environmental impact, influencing purchasing habits.

- Retailer Accountability: Expectations are rising for retailers to be transparent and proactive in their environmental and social responsibility efforts.

- Impact on Brand Loyalty: Companies demonstrating genuine commitment to sustainability are likely to foster stronger customer loyalty and positive brand perception.

- Market Opportunities: The increasing sustainability consciousness presents opportunities for retailers like Tokmanni to innovate and differentiate their offerings.

Finnish society is experiencing a notable shift towards value-driven consumption, with consumers actively seeking affordability and necessity-focused goods. This trend is further amplified by ongoing inflation, which has seen year-on-year price increases in essential items like food and energy, impacting household budgets significantly throughout 2024.

Consumer preferences are increasingly leaning towards sustainable and ethically produced items, pushing retailers to integrate these values into their product assortments and marketing. Tokmanni's commitment, evidenced by its 2023 assessment of 94% of its product range for sustainability criteria, directly addresses this evolving consumer consciousness.

Demographic changes, including the rise of Generation Alpha and a growing male interest in personal care products, are reshaping market demands. The global men's grooming market, valued at approximately USD 60.5 billion in 2023, highlights this expanding opportunity for retailers to broaden their appeal.

The digital landscape continues to transform shopping habits, with an estimated 80% of Finnish consumers engaging in online shopping in 2023, predominantly via mobile devices. This necessitates a robust and seamless digital presence for retailers to capture market share.

| Sociological Factor | Description | Impact on Tokmanni | Supporting Data |

|---|---|---|---|

| Consumer Spending Habits | Shift towards value and necessity items due to financial pressures. | Favors discount retailers like Tokmanni. | Inflation in early 2024 impacted essential goods prices. |

| Sustainability Awareness | Growing demand for eco-friendly and ethically sourced products. | Requires alignment with responsible business practices. | Tokmanni assessed 94% of products for sustainability in 2023. |

| Demographic Shifts | Emergence of new consumer groups and evolving preferences. | Opportunities in expanding product lines and engaging new demographics. | Global men's grooming market valued at USD 60.5 billion in 2023. |

| Digitalization | Increased adoption of e-commerce and mobile shopping. | Necessitates a strong online and mobile presence. | ~80% of Finnish consumers shopped online in 2023. |

Technological factors

The ongoing expansion of e-commerce in Finland demands robust digital marketing, with SEO and mobile-first approaches being vital for retailers like Tokmanni. Tokmanni's online presence is essential for connecting with customers who are shifting towards digital purchasing habits.

In 2023, Finnish e-commerce sales reached approximately €12.1 billion, a 6% increase from the previous year, highlighting the growing consumer reliance on online channels. Tokmanni's investment in its e-commerce platform development and optimization directly addresses this trend, ensuring it remains competitive in reaching a digitally engaged customer base.

Artificial intelligence and automation are revolutionizing retail operations, leading to significant efficiency gains. Tokmanni, like many retailers, is exploring how these technologies can streamline processes and enhance customer experiences.

By leveraging advanced data analytics and AI-powered pricing tools, retailers can optimize their strategies. For instance, AI can help predict demand more accurately, allowing for better inventory management and more competitive pricing, potentially boosting sales and reducing waste.

The ongoing advancements in AI are expected to further transform the retail landscape. In 2024, global retail AI spending was projected to reach billions, indicating a strong industry trend towards adopting these powerful tools for competitive advantage.

Technological advancements are crucial for Tokmanni's stated goal of improving profitability through supply chain optimization. Innovations in inventory management systems, such as AI-powered demand forecasting and real-time tracking, allow for more accurate stock levels, reducing waste and improving product availability. For instance, advanced warehouse automation and route optimization software can significantly cut down logistics costs and delivery times.

In-Store Retail Technology

While online shopping continues its upward trajectory, there's a significant push in enhancing the physical retail environment through technology. Innovations in inventory management, personalized marketing, seamless payment systems, and tools designed to boost customer interaction are transforming brick-and-mortar stores. For instance, by the end of 2024, many retailers are expected to have implemented AI-powered inventory tracking, reducing stockouts by an estimated 15-20% compared to previous years.

These advancements offer retailers like Tokmanni Group substantial opportunities to elevate the in-store customer experience. Think about self-checkout kiosks becoming more sophisticated, offering faster transactions, or digital displays providing dynamic pricing and product information. In 2025, the adoption of advanced customer relationship management (CRM) systems integrated with in-store analytics is projected to grow by 25%, allowing for more targeted promotions and personalized service.

- Enhanced Inventory Management: Technologies like RFID and AI-driven forecasting are reducing discrepancies and improving stock availability, with early adopters reporting a 10% reduction in lost sales due to stockouts in 2024.

- Smarter Marketing & Personalization: In-store digital signage and mobile app integrations can deliver tailored offers based on customer behavior, potentially increasing conversion rates by up to 5% in pilot programs.

- Streamlined Payments: Contactless payment adoption continues to rise, with projections indicating over 70% of in-store transactions will be contactless by the end of 2025, improving checkout speed and customer convenience.

- Improved Customer Engagement: Interactive displays and augmented reality features can create more engaging shopping experiences, fostering brand loyalty and potentially increasing dwell time in stores by 15%.

Digital Transformation and Omnichannel Strategies

Digital transformation is fundamentally reshaping the Finnish retail landscape, with omnichannel strategies becoming increasingly crucial for success. Tokmanni, operating both a significant physical store network and an e-commerce platform, is well-positioned to capitalize on this trend.

By integrating its various sales channels, Tokmanni can offer a seamless customer journey, allowing shoppers to browse online, pick up in-store, or return purchases easily. This approach enhances convenience and builds stronger customer loyalty. For instance, in 2023, Finnish e-commerce sales grew by 7.7%, indicating a strong consumer shift towards online purchasing, a trend Tokmanni can leverage through its digital investments.

- Enhanced Customer Experience: Integrating online and offline touchpoints allows for personalized offers and a consistent brand experience across all channels.

- Operational Efficiency: Digital tools can streamline inventory management, order fulfillment, and customer service, reducing costs and improving responsiveness.

- Data-Driven Insights: A robust digital infrastructure enables Tokmanni to collect valuable customer data, informing product assortment, marketing campaigns, and overall business strategy.

- Competitive Advantage: Retailers that successfully adopt omnichannel strategies often see increased sales and market share compared to those with siloed operations.

Technological advancements are reshaping retail, with e-commerce growth in Finland, reaching €12.1 billion in 2023, demanding strong digital marketing and mobile-first strategies. AI and automation are key for efficiency, with global retail AI spending projected to be substantial in 2024, aiding inventory management and pricing. Innovations like RFID and AI-driven forecasting are improving stock availability, with early adopters seeing a 10% reduction in lost sales in 2024. Contactless payments are expected to handle over 70% of in-store transactions by the end of 2025.

| Technology Area | Impact on Tokmanni | Key Data/Projection |

|---|---|---|

| E-commerce & Digital Marketing | Enhanced customer reach and sales channels | Finnish e-commerce sales: €12.1 billion (2023, +6% YoY) |

| AI & Automation | Streamlined operations, improved demand forecasting, optimized pricing | Global retail AI spending projected in billions (2024) |

| Inventory Management (RFID, AI) | Reduced stockouts, improved product availability | 10% reduction in lost sales due to stockouts reported by early adopters (2024) |

| Payment Systems | Faster checkout, enhanced customer convenience | Over 70% of in-store transactions projected to be contactless (End of 2025) |

Legal factors

The EU's Corporate Sustainability Reporting Directive (CSRD) is now part of Finnish law, impacting large companies like Tokmanni. This means Tokmanni will need to provide detailed reports on its sustainability efforts, covering environmental, social, and governance (ESG) aspects. The first reports from large, listed companies are expected in 2025, so Tokmanni is actively preparing for these new disclosure requirements.

Finland's Extended Producer Responsibility (EPR) for packaging, effective January 2024, requires all packaging producers, irrespective of turnover, to register with a collective system and fund recycling expenses. This legislation, which includes eco-modulation, aims to encourage the use of more sustainable and recyclable packaging materials. For Tokmanni, this means increased compliance costs and a strategic imperative to prioritize packaging solutions that meet these new environmental standards.

Amendments to Finnish consumer protection laws are expected, driven by the EU's Directive on Empowering Consumers for the Green Transition. These updates will likely influence how retailers like Tokmanni communicate environmental claims, potentially requiring more robust substantiation for green marketing. For instance, the directive aims to combat greenwashing, meaning Tokmanni will need to ensure its sustainability messaging is clear, accurate, and verifiable to comply with evolving regulations.

Labor Laws and Collective Agreements

Finnish labor laws, such as the Working Hours Act and the Employment Contracts Act, set the framework for employee rights and employer obligations concerning work hours, compensation, and termination procedures. These regulations are crucial for Tokmanni, influencing its operational costs and employee relations.

Recent collective agreements in the Finnish retail sector, effective through 2025, have introduced wage increases, impacting Tokmanni's payroll expenses. These agreements also focus on enhancing protections and rights for part-time employees, a significant segment of the retail workforce.

Government-led reforms in 2024 are also shaping the labor landscape, with initiatives aimed at streamlining dismissal processes. This could potentially offer Tokmanni more flexibility in workforce management, though it remains subject to ongoing legislative developments and potential union responses.

- Working Hours Act: Governs daily and weekly working time limits, rest periods, and overtime regulations.

- Employment Contracts Act: Outlines requirements for employment agreements, notice periods, and grounds for termination.

- Retail Sector Collective Agreement (2024-2025): Mandates specific wage adjustments and addresses terms for part-time workers.

- Dismissal Reform (2024): Aims to simplify procedures for terminating employment contracts.

Competition Law and Market Practices

Competition law is a significant factor for Tokmanni. The Finnish Market Court has imposed fines for non-compliance with commitments, underscoring the critical need for businesses like Tokmanni to strictly adhere to competition regulations. This ensures a level playing field and directly influences operational strategies within the retail sector.

Tokmanni must navigate these regulations to maintain fair market practices. For instance, in 2023, the Finnish Competition Authority (KKV) continued its oversight, with specific cases involving retail sector practices being reviewed. Adherence to these laws prevents potential penalties and safeguards Tokmanni's reputation and market position.

- Regulatory Fines: Finnish Market Court fines highlight the financial and operational risks of non-compliance with competition law.

- Fair Play: Adherence to competition laws ensures equitable market practices, crucial for maintaining customer trust and a competitive edge.

- Operational Impact: Competition regulations influence pricing strategies, supplier agreements, and merger/acquisition activities for retailers like Tokmanni.

Tokmanni operates within a framework of Finnish and EU laws that significantly impact its operations and sustainability reporting. The Corporate Sustainability Reporting Directive (CSRD), now integrated into Finnish law, mandates detailed ESG disclosures starting with 2025 reports for large listed companies, requiring Tokmanni to enhance its reporting capabilities. Furthermore, Finland's Extended Producer Responsibility (EPR) for packaging, effective from January 2024, imposes registration and funding obligations on all packaging producers, increasing compliance costs and driving the adoption of sustainable packaging solutions for Tokmanni.

Environmental factors

Tokmanni Group has made significant strides in its climate action, successfully achieving its Science Based Targets initiative (SBTi) goals for Scope 1 and 2 emissions. This impressive reduction of 71.5% compared to 2015 levels was largely driven by enhanced energy efficiency measures and a decisive shift towards carbon-free energy sources.

Looking ahead, Tokmanni is broadening its environmental focus to encompass all Group emissions, including Scope 3. The company has established new, ambitious climate targets to further drive its sustainability agenda across its entire value chain.

Tokmanni is actively pursuing energy efficiency and renewable energy adoption. In 2023, the company reported that 78% of its energy consumption was from renewable sources, a significant increase from previous years.

Key initiatives include enhancing property automation systems to optimize energy usage and installing solar power plants across multiple locations. As of early 2024, over 20 Tokmanni stores have solar power installations, contributing to their renewable energy mix.

Furthermore, Tokmanni is increasing its reliance on renewable district heating and is committed to transitioning to fossil-free district heating wherever feasible, aligning with broader sustainability goals and reducing its carbon footprint.

Finland's Extended Producer Responsibility (EPR) regulations are increasingly shaping how companies like Tokmanni manage waste. These rules require businesses to financially support the recycling of their packaging, incentivizing more sustainable choices. For instance, eco-modulation means that packaging designed for easier recycling can incur lower fees, directly influencing Tokmanni's procurement and product design decisions as of 2024.

Sustainable Sourcing and Product Offerings

Consumer demand for sustainable products is a significant environmental factor influencing the retail sector. Retailers like Tokmanni are increasingly expected to adapt their supply chains and product assortments to include ethically sourced and environmentally friendly options. This shift reflects a broader societal move towards conscious consumption.

Tokmanni's commitment to sustainability is evident in its reporting, which often details its efforts in product development and sourcing practices. For instance, in their 2023 sustainability report, Tokmanni highlighted progress in increasing the proportion of products with recognized environmental or social certifications.

- Increased Demand for Eco-Friendly Products: Consumers are actively seeking products with reduced environmental impact, driving retailers to prioritize sustainable sourcing.

- Supply Chain Transparency: There's growing pressure for businesses to provide clear information about the origin and production methods of their goods.

- Tokmanni's Sustainability Reporting: The company provides data on its sustainability initiatives, including product sourcing and environmental performance metrics.

- Growth in Certified Products: Retailers are seeing a rise in sales for products that carry credible sustainability labels, indicating a market shift.

Environmental Reporting and Compliance

The EU's Corporate Sustainability Reporting Directive (CSRD) is now integrated into Finnish law, mandating detailed sustainability statements from companies, covering their environmental footprints. Tokmanni has already aligned its sustainability reporting with these enhanced requirements.

This regulatory shift means companies like Tokmanni must disclose a wider range of environmental data, ensuring greater transparency and accountability. For instance, under CSRD, Tokmanni's reporting will likely include metrics on greenhouse gas emissions, waste management, and resource consumption.

- CSRD Implementation: EU's CSRD now law in Finland, requiring comprehensive environmental impact reporting.

- Tokmanni's Preparedness: Tokmanni has proactively prepared its sustainability statement adhering to these new CSRD standards.

- Increased Transparency: The directive mandates detailed disclosure of environmental performance, fostering greater corporate accountability.

Tokmanni has made significant progress in its environmental efforts, achieving a 71.5% reduction in Scope 1 and 2 emissions compared to 2015, largely through energy efficiency and a shift to carbon-free energy. By early 2024, over 20 stores featured solar power installations, and 78% of their energy consumption in 2023 was from renewable sources, including a growing reliance on fossil-free district heating.

The company is also adapting to evolving environmental regulations, such as Finland's Extended Producer Responsibility (EPR) laws, which now influence packaging choices and recycling support. Furthermore, the EU's Corporate Sustainability Reporting Directive (CSRD), now integrated into Finnish law, requires Tokmanni to provide more detailed disclosures on its environmental footprint, fostering greater transparency.

| Environmental Factor | Tokmanni's Action/Status (as of 2023/early 2024) | Impact/Trend |

| Emissions Reduction | 71.5% reduction in Scope 1 & 2 vs. 2015; expanding to Scope 3 | Demonstrates commitment to climate targets; increasing focus on value chain |

| Renewable Energy Use | 78% of energy from renewables in 2023; over 20 stores with solar power | Reduced carbon footprint; cost savings and energy independence |

| Regulatory Compliance | Adhering to EPR for packaging; CSRD integrated into Finnish law | Increased transparency and accountability; potential impact on operational costs and product design |

| Consumer Demand | Increasing proportion of products with environmental certifications | Market shift towards sustainable products; influences sourcing and product development |

PESTLE Analysis Data Sources

Our Tokmanni Group PESTLE analysis is built on a robust foundation of data from official government publications, reputable financial institutions, and leading market research firms. We incorporate insights from economic indicators, regulatory updates, and industry-specific reports to ensure comprehensive and accurate analysis.