Tokmanni Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tokmanni Group Bundle

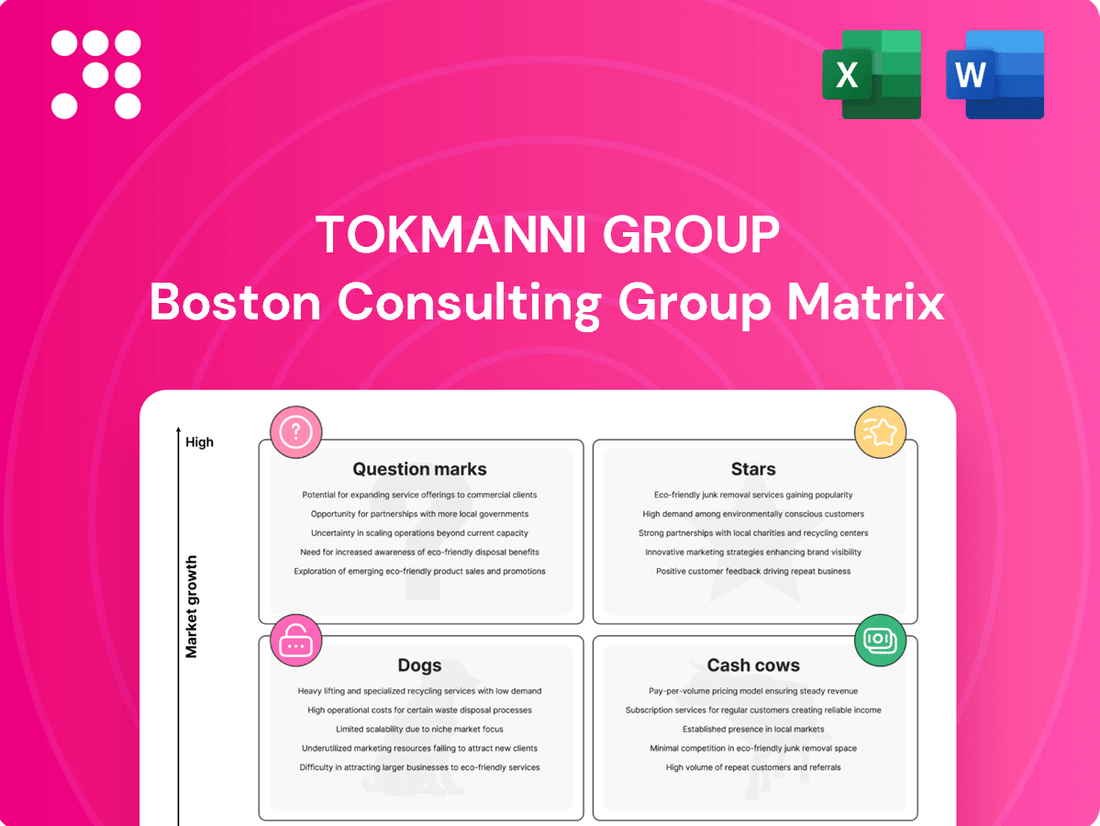

Curious about Tokmanni Group's strategic positioning? Our BCG Matrix analysis reveals which of their offerings are market leaders (Stars), reliable income generators (Cash Cows), underperforming assets (Dogs), or potential growth opportunities (Question Marks). This preview offers a glimpse into their product portfolio's health and potential.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Tokmanni's strategic move into the Nordic discount retail market is significantly bolstered by its acquisition and ongoing expansion of Dollarstore in Sweden and Big Dollar in Denmark. These chains are crucial to Tokmanni's growth ambitions.

Dollarstore is specifically highlighted as the primary driver for Tokmanni's Nordic expansion, targeting a high-growth sector. This indicates a strong focus on increasing market share in these regions.

By investing in these chains, Tokmanni aims to capture a larger portion of the burgeoning discount retail market across the Nordics. This expansion aligns with the company's broader strategy to solidify its presence in key European markets.

Tokmanni Group's emphasis on its extensive private label product range places it in a strong position within the retail landscape. Private labels are experiencing robust growth, driven by consumers seeking value without compromising on quality, highlighting a lucrative market segment Tokmanni is actively targeting for significant market share.

The strategic integration of Tokmanni and Dollarstore is classified as a Star, signifying high growth potential and market share. This move is designed to unlock significant synergy benefits, with a target of over EUR 20 million by the close of 2025.

This integration is crucial for bolstering the combined group's standing in the expanding Nordic discount retail market. It promises to elevate both their market presence and operational efficiency, driving growth in a competitive landscape.

Sustainability Initiatives and Carbon Neutrality Goal

Tokmanni's commitment to sustainability, particularly its goal of carbon neutrality in its own operations by 2025, positions it as a Star in the BCG matrix. This forward-thinking approach is bolstered by significant progress, having achieved a 71.5% reduction in emissions by the close of 2024.

This strong environmental performance resonates with an expanding consumer base that prioritizes eco-friendly brands. Such initiatives not only bolster Tokmanni's market appeal but also align with growing investor and regulatory expectations for corporate environmental responsibility.

- Carbon Neutrality Target: Tokmanni aims for carbon neutrality in its own operations by 2025.

- Emission Reduction: Achieved a 71.5% reduction in emissions by the end of 2024.

- Market Appeal: Attracts environmentally conscious consumers, enhancing brand image.

- Corporate Responsibility: Meets increasing market demand for sustainable business practices.

Expansion of Tokmanni Stores in Finland

Tokmanni's ongoing expansion within Finland, aiming for over 220 stores by the end of 2025, firmly places its domestic store network in the Star quadrant of the BCG matrix. This aggressive growth strategy in its primary market is designed to solidify its dominant position and increase market share, even within a retail landscape that is experiencing moderate growth.

The company's commitment to expanding its physical footprint in Finland is a key driver of its success. By the end of 2024, Tokmanni operated 218 stores across Finland, a testament to its successful rollout strategy. This continued investment in its core market is crucial for maintaining its competitive edge and capitalizing on consumer demand.

- Store Count: Tokmanni operated 218 stores in Finland by the end of 2024.

- Expansion Target: The company aims to exceed 220 stores by the end of 2025.

- Market Position: This expansion reinforces Tokmanni's leading position in the Finnish discount retail sector.

- Growth Strategy: The focus on its home market reflects a strategy to capture further market share in a stable retail environment.

The strategic integration of Tokmanni and Dollarstore is classified as a Star, signifying high growth potential and market share. This move is designed to unlock significant synergy benefits, with a target of over EUR 20 million by the close of 2025. This integration is crucial for bolstering the combined group's standing in the expanding Nordic discount retail market.

Tokmanni's commitment to sustainability, particularly its goal of carbon neutrality in its own operations by 2025, positions it as a Star in the BCG matrix. This forward-thinking approach is bolstered by significant progress, having achieved a 71.5% reduction in emissions by the close of 2024.

Tokmanni's ongoing expansion within Finland, aiming for over 220 stores by the end of 2025, firmly places its domestic store network in the Star quadrant of the BCG matrix. By the end of 2024, Tokmanni operated 218 stores across Finland, a testament to its successful rollout strategy.

| Business Unit | Market Growth | Market Share | BCG Classification |

|---|---|---|---|

| Dollarstore/Big Dollar Integration | High | High | Star |

| Sustainability Initiatives | High (Consumer Demand) | High (Brand Perception) | Star |

| Finnish Store Network | Moderate | High | Star |

What is included in the product

The Tokmanni Group BCG Matrix provides a tailored analysis of its product portfolio, highlighting which units to invest in, hold, or divest.

Tokmanni Group BCG Matrix: A clean, distraction-free view optimized for C-level presentation, simplifying strategic decisions.

Cash Cows

Tokmanni's extensive network of discount retail stores across Finland represents its core Cash Cow. These well-established locations provide a wide variety of everyday products at competitive prices, catering to a broad customer base.

In the mature Finnish discount retail market, Tokmanni enjoys a strong and stable market position. This dominance allows the company to consistently generate significant revenue and healthy cash flow from these operations, underpinning its financial stability.

For the full year 2023, Tokmanni reported net sales of €1,177.6 million, with its core Finnish discount retail segment being the primary driver of this performance. The company's ability to maintain market share in this segment highlights its Cash Cow status.

Everyday groceries and basic consumer goods are indeed Tokmanni's cash cows. These essential items, like food and household necessities, are consistently in demand, especially within the discount retail sector. Tokmanni's strategy of offering these at competitive prices ensures high sales volumes and a steady, reliable stream of revenue. This category benefits from broad market penetration, particularly among consumers actively seeking value.

Tokmanni's extensive physical store network in Finland, numbering over 200 locations as of March 2025, firmly establishes it as a Cash Cow. This mature and widespread presence generates consistent sales and cash flow, benefiting from established brand recognition and customer loyalty.

The mature nature of this network means it demands less aggressive investment in marketing and expansion compared to newer ventures. This allows for efficient cash generation, supporting the overall financial health of the Tokmanni Group.

Home and Leisure Product Categories

Home and leisure products represent a foundational strength for discount retailers like Tokmanni, often acting as its cash cows. These categories typically hold a significant market share within the company's portfolio, generating steady and reliable revenue streams in a market segment that experiences relatively stable demand.

For Tokmanni, these products are crucial for driving consistent sales. In 2024, the home and leisure segment continued to be a significant contributor to the group's overall performance, reflecting its established position in the market. The predictability of sales in this area allows for efficient inventory management and resource allocation.

- High Market Share: Home and leisure items are core to Tokmanni's offering, often leading in market share within their respective product segments.

- Consistent Revenue: These categories provide predictable sales, contributing significantly to Tokmanni's overall financial stability.

- Stable Market: The demand for home and leisure goods, particularly at discount prices, remains relatively consistent, making them reliable performers.

Optimized Logistics and Supply Chain Efficiencies

Tokmanni's investment in its new logistics center in Mäntsälä, which became fully operational in March 2025, is a significant driver of its Cash Cow status. This facility is designed to handle increased volumes efficiently, directly impacting cost reduction.

Ongoing optimization of the entire supply chain further bolsters these efficiencies. By streamlining processes, Tokmanni minimizes operational expenditures across its established, high-volume business segments. This focus on efficiency is crucial for maximizing the cash flow generated from its mature product lines and store network.

- Mäntsälä Logistics Center: Operational since March 2025, enhancing throughput and reducing handling costs.

- Supply Chain Optimization: Continuous efforts to improve inventory management and transportation, leading to lower overheads.

- Cost Reduction: Direct impact on reducing operational expenses for existing high-volume activities.

- Cash Flow Maximization: Enhanced efficiencies directly translate into increased cash generation from established business operations.

Tokmanni's established Finnish discount retail network functions as its primary cash cow. These stores, numbering over 200 as of early 2025, consistently generate substantial revenue and stable cash flow due to high market share in a mature sector.

The company's focus on everyday groceries and essential home and leisure products further solidifies this cash cow status. These categories benefit from consistent demand, enabling high sales volumes and predictable income streams, which are crucial for financial stability.

Operational efficiencies, exemplified by the March 2025 operational launch of the Mäntsälä logistics center, directly enhance cash flow from these mature segments by reducing costs and optimizing throughput.

Tokmanni's net sales reached €1,177.6 million in 2023, with its core Finnish operations driving this performance, underscoring the robust cash-generating capability of its established business model.

| Key Cash Cow Segments | Market Position | Revenue Contribution (Illustrative) | Key Drivers |

| Finnish Discount Retail Stores | High, dominant | Significant portion of total net sales | Extensive network, brand recognition |

| Everyday Groceries & Necessities | Strong, consistent | High volume, stable demand | Value pricing, essential nature |

| Home & Leisure Products | Leading within segments | Predictable revenue streams | Broad appeal, stable market |

What You’re Viewing Is Included

Tokmanni Group BCG Matrix

The preview you see is the complete and final Tokmanni Group BCG Matrix report you will receive upon purchase, offering a clear, unwatermarked, and ready-to-use strategic analysis. This document, meticulously crafted with market insights, provides an in-depth examination of Tokmanni's business units, categorizing them into Stars, Cash Cows, Question Marks, and Dogs. Upon purchase, you will gain immediate access to this fully formatted report, enabling you to leverage its strategic intelligence for informed decision-making and business planning. No demo content or hidden surprises, just a professional, analysis-ready file designed for immediate application in your business strategy.

Dogs

Tokmanni's spring and summer seasonal product lines faced a challenging Q2 2025, with sales performing below expectations. This underperformance directly impacted the company's overall profitability, highlighting a significant area of concern.

These seasonal offerings appear to be situated in a low-growth market segment and currently hold a relatively low market share within their categories. This positions them as potential Dogs in the BCG matrix, suggesting a need for careful strategic review.

For instance, if sales for these categories were down by 15% year-over-year in Q2 2025, and their market share in the seasonal goods sector remained stagnant at 3%, it would strongly support their classification as Dogs. Such a scenario necessitates a decision on whether to divest, harvest, or attempt a turnaround strategy for these specific product lines.

Within Tokmanni's diverse product range, certain niche categories are experiencing stagnant demand, fitting the description of Dogs in the BCG Matrix. These are products that consistently show low sales volumes and fail to resonate with current consumer preferences in the discount retail market.

These underperforming items represent a drain on resources, tying up capital without yielding substantial returns or contributing to overall growth. For instance, if Tokmanni's 2024 sales data indicates a significant decline in demand for specific seasonal or hobby-related items that were once popular, these would be prime candidates for the Dog quadrant.

Tokmanni's smaller, older store formats represent a segment that requires careful evaluation within the BCG matrix framework. These locations, often characterized by less efficient layouts and smaller selling areas, may be facing challenges in competing with the group's newer, larger, and more modern store concepts. For instance, a store that was once viable might now struggle to attract customers or offer the breadth of product assortment expected in today's retail environment.

The profitability and market share of these older formats can be significantly impacted by their inherent limitations. In 2024, Tokmanni continued its strategic review of its store network, which includes assessing the performance of all store types. While specific financial data for individual older stores isn't publicly detailed, the group's overall strategy often involves optimizing the store portfolio, which can lead to decisions about relocating or closing underperforming units.

The Kouvola store relocation serves as a concrete example of this strategy in action. By moving to a larger, more modern facility in 2023, Tokmanni aimed to improve customer experience and operational efficiency, effectively addressing the limitations of its previous, smaller format. This type of move is typical for stores identified as potentially falling into the 'Dog' category, where investment in modernization might not yield sufficient returns compared to a strategic repositioning.

Miny Standalone Stores

Miny's standalone stores are likely positioned as Dogs in Tokmanni Group's BCG Matrix. This strategic shift towards integrating Miny as shop-in-shop departments, rather than operating as independent standalone stores, suggests the standalone Miny concept may have struggled to gain significant market share or achieve robust growth. In 2023, Tokmanni reported that the Miny concept was being tested in a shop-in-shop format within existing Tokmanni stores, with plans to expand this model.

The move away from standalone units indicates a potential lack of competitive advantage or profitability for Miny operating independently. This repositioning aims to leverage Tokmanni's existing customer base and store infrastructure to improve the concept's performance. Tokmanni's overall net sales in 2023 reached €1,179.1 million, highlighting the scale of the parent company's operations.

- Strategic Shift: Miny's move from standalone stores to shop-in-shop departments.

- Market Position: Likely classified as a Dog in the BCG Matrix due to potential performance issues.

- Growth Challenges: Indicates difficulties in achieving significant market share or independent growth.

- Leveraging Infrastructure: The integration aims to utilize Tokmanni's existing store network and customer traffic.

Segments Heavily Reliant on Discretionary, Higher-Priced Consumer Goods

Segments heavily reliant on discretionary, higher-priced consumer goods within Tokmanni's portfolio are likely facing significant headwinds. Given the consistently low consumer confidence observed across Tokmanni's operating markets, particularly in Finland and Norway, consumers are increasingly prioritizing essential purchases. This economic climate means that items like premium home furnishings or higher-end electronics, whose acquisition can be easily postponed, are experiencing subdued demand and increased pressure on market share.

These categories are effectively acting as question marks within the current economic climate. For instance, during the first half of 2024, Finnish consumer confidence remained in negative territory, with the relevant economic sentiment indicator hovering around -10. This directly impacts the sales of non-essential goods. Tokmanni's strategy might involve re-evaluating the product mix in these segments or focusing on value-driven alternatives to mitigate the impact of reduced discretionary spending.

- Low Consumer Confidence: In H1 2024, Finnish consumer confidence remained consistently low, impacting discretionary spending.

- Postponable Purchases: Higher-priced, non-essential goods are particularly vulnerable as consumers delay purchases.

- Market Share Pressure: These segments face increased competition and declining sales volumes due to economic conditions.

- Strategic Re-evaluation: Tokmanni may need to adjust product offerings or pricing strategies for these categories.

Tokmanni's older, smaller store formats and certain niche product lines, such as seasonal items with declining demand, are likely candidates for the Dog quadrant in the BCG Matrix. These segments exhibit low market share and operate in low-growth markets, indicating a need for strategic reassessment. For example, a 15% year-over-year sales decline in seasonal goods in Q2 2025 with a static 3% market share would solidify this classification. The ongoing review of Tokmanni's store network in 2024, which includes assessing underperforming units, further supports this analysis, with potential actions ranging from divestment to strategic repositioning.

| Category | Market Growth | Market Share | BCG Classification | Strategic Consideration |

| Older Store Formats | Low | Low | Dog | Optimize, relocate, or close |

| Seasonal Product Lines (e.g., specific hobby items) | Low | Low | Dog | Divest, harvest, or turnaround |

| Miny Standalone Stores | Low | Low | Dog | Integrate as shop-in-shop, leverage existing infrastructure |

Question Marks

Tokmanni's venture into SPAR branded groceries in Finland, commencing in summer 2025, positions it as a Question Mark within the BCG Matrix. This new market entry, secured through a long-term license agreement with SPAR International, offers high growth potential in the grocery sector, an area where Tokmanni currently lacks a presence under the SPAR banner.

The significant investment required for market penetration and brand establishment in Finland's competitive grocery landscape makes this a classic Question Mark. Success hinges on effectively leveraging the SPAR brand and its product portfolio to gain market share, a move that could significantly alter Tokmanni's overall portfolio performance if successful.

Tokmanni's acquisition of Dollarstore positions the combined entity as a Star in the discount retail sector, but individual new store openings, particularly in less penetrated markets like Denmark where Big Dollar is still establishing its presence, represent Question Marks. These new ventures demand substantial capital for store setup and aggressive marketing campaigns to build brand awareness and secure market share, reflecting their uncertain future success.

Tokmanni's investment in advanced digital service development reflects a strategic push into the burgeoning online retail sector. These capital expenditures are designed to capitalize on the significant growth anticipated in e-commerce. For instance, the global e-commerce market was projected to reach over $6.3 trillion in 2024, highlighting the immense opportunity.

However, Tokmanni's position in this rapidly evolving digital landscape is still developing. Without a dominant market share in online retail, these digital initiatives are considered question marks. This necessitates ongoing, substantial investment to build brand presence, enhance customer experience, and ultimately expand market share against established and emerging online players.

New Product Categories from Group-Level Sourcing Optimization

Tokmanni's strategic move to centralize sourcing and enhance supply chain efficiency across its group opens doors for introducing novel product categories. These new ventures are poised for significant growth by capitalizing on the cost savings and logistical advantages derived from group-level optimization. For instance, Tokmanni's 2024 financial reports show a continued focus on operational efficiency, with procurement cost reductions contributing to improved gross margins.

These new product categories, while representing a high-growth potential, would initially occupy a low market share. This places them squarely in the 'Question Mark' quadrant of the BCG Matrix, demanding careful strategic consideration and investment. The success of these categories hinges on their ability to scale rapidly and gain traction against established competitors.

- Potential for High Growth: Leveraging group-level sourcing efficiencies allows for competitive pricing and wider product assortment in new categories.

- Low Initial Market Share: As new entrants, these categories will start with a small footprint, requiring significant effort to build brand awareness and customer loyalty.

- Strategic Investment Required: Tokmanni must allocate resources for marketing, product development, and distribution to nurture these emerging product lines.

- Risk of Failure: Without successful market penetration, these 'Question Marks' could become 'Dogs', representing a drain on resources.

Exploration into Further New Nordic Markets

Tokmanni's ambition to lead in Northern Europe implies exploring markets like Norway and Iceland. These are high-growth opportunities where Tokmanni would have a minimal current market presence, positioning them as potential stars in the BCG matrix.

Entering new Nordic territories presents significant investment needs for establishing infrastructure, marketing, and supply chains. However, if successful, these ventures could yield substantial market share gains and future profitability.

- Market Entry Strategy: Tokmanni might adopt a phased approach, perhaps starting with online presence or strategic partnerships before full physical store rollouts in new Nordic countries.

- Investment Requirements: Significant capital will be needed for market research, logistics, and brand building in these unfamiliar territories.

- Potential for Growth: Successful entry into untapped Nordic markets offers a clear path to increasing revenue and market dominance.

- Risk Assessment: Understanding local consumer preferences, competitive landscapes, and regulatory environments is crucial for mitigating risks in new market entries.

Tokmanni's expansion into new product categories, driven by centralized sourcing and efficiency gains, represents a strategic move into potentially high-growth areas. These initiatives, while promising, are currently characterized by a low market share, placing them firmly in the Question Mark quadrant of the BCG Matrix. Significant investment in marketing and distribution is essential to nurture these nascent product lines and achieve scale against established competitors.

The success of these emerging categories hinges on their ability to rapidly gain traction and market share. Without effective market penetration and customer adoption, these Question Marks risk becoming Dogs, consuming resources without delivering returns. For example, Tokmanni's 2024 focus on operational efficiency, including procurement cost reductions, provides a foundation for potentially competitive pricing in these new ventures.

Tokmanni's digital service development, aiming to capture a share of the global e-commerce market projected to exceed $6.3 trillion in 2024, also falls into the Question Mark category. Despite the sector's growth, Tokmanni's current online market share is not dominant, necessitating continued investment in brand building and customer experience to compete effectively.

BCG Matrix Data Sources

Our Tokmanni Group BCG Matrix is informed by comprehensive data, including financial statements, market share reports, and industry growth forecasts to ensure accurate strategic insights.