Tokmanni Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tokmanni Group Bundle

Unlock the strategic blueprint behind Tokmanni Group's success with our comprehensive Business Model Canvas. Discover how they effectively reach diverse customer segments, leverage key partnerships, and maintain a competitive edge through their unique value proposition. This detailed analysis is your key to understanding their operational excellence and market positioning.

Partnerships

Tokmanni's strategic suppliers and manufacturers are the backbone of its diverse product offering, encompassing everything from everyday groceries to home and leisure goods and apparel. These relationships are paramount for maintaining a steady flow of affordable and varied products, directly addressing customer needs and expectations.

In 2024, Tokmanni continued to leverage these crucial partnerships to secure competitive pricing and ensure high product availability across its extensive store network and online channels. Strong supplier collaborations directly contribute to Tokmanni's ability to offer value to its customers.

Tokmanni relies heavily on its logistics and distribution partners to keep its shelves stocked and its online orders flowing efficiently. For a discount retailer, keeping operational costs low is paramount, and strong logistics are a key enabler of this. These partnerships are crucial for everything from warehousing goods to getting them to the right store or customer's doorstep.

In 2023, Tokmanni continued to refine its supply chain, working with various logistics providers to manage the complex network of its over 200 stores across Finland and its growing e-commerce operations. Optimizing this flow ensures products reach consumers at competitive prices, a core tenet of Tokmanni's value proposition.

Tokmanni collaborates with technology and IT service providers to ensure its digital and in-store operations run smoothly. These partnerships are crucial for managing its online shop and the systems used within its physical stores, impacting overall efficiency.

Key partnerships in this area focus on solutions for inventory management, handling customer data, and developing its e-commerce platform. For instance, in 2023, Tokmanni continued to invest in its digital capabilities, aiming to enhance the customer experience across all channels.

Real Estate and Property Owners

Tokmanni, as a retailer with an extensive physical store network, collaborates with real estate developers and property owners. These partnerships are crucial for securing prime locations that enhance customer accessibility and market penetration across Finland, Sweden, and Denmark.

These collaborations allow Tokmanni to strategically position its stores, ensuring high visibility and convenience for shoppers. By partnering with property owners, Tokmanni can access a diverse range of retail spaces, from high-street locations to shopping centers, optimizing its store footprint.

- Strategic Store Placement: Partnerships facilitate the selection of locations that maximize customer reach and foot traffic.

- Property Owner Relationships: Tokmanni relies on these relationships to secure and maintain its physical retail presence.

- Expansion and Optimization: Collaborations support the company's ongoing efforts to expand into new markets and optimize existing store locations.

International Retail Collaborations (e.g., SPAR International)

Tokmanni's strategic alliance with SPAR International, a prominent global food retailer, significantly bolsters its presence in Finland's grocery sector. This license agreement allows Tokmanni to integrate SPAR's extensive grocery offerings and operational know-how into its existing Finnish retail network.

These international collaborations are crucial for accessing specialized product categories and benefiting from economies of scale, thereby enhancing Tokmanni's competitive edge. In 2023, Tokmanni reported that its comparable sales increased by 3.5% compared to 2022, indicating the positive impact of such strategic partnerships on overall performance.

- Leveraging Global Expertise: Access to SPAR's established international retail practices and brand recognition.

- Enhanced Product Assortment: Expansion of grocery offerings, particularly in fresh produce and private label brands.

- Competitive Advantage: Strengthening market position against both local and international grocery competitors in Finland.

- Scalability: Utilizing a proven international model to efficiently grow the grocery segment.

Tokmanni's key partnerships are foundational to its discount retail model, ensuring a consistent supply of affordable goods and efficient operations. These collaborations span suppliers, logistics providers, real estate partners, and strategic alliances like the one with SPAR International.

In 2024, Tokmanni continued to focus on strengthening these relationships to maintain competitive pricing and product availability across its expanding network, which includes operations in Finland, Sweden, and Denmark. The company's ability to offer value is directly tied to the strength and efficiency of these partnerships.

The collaboration with SPAR International, for instance, significantly enhances Tokmanni's grocery segment by integrating global expertise and expanding its product assortment. This strategic move aims to bolster Tokmanni's market position and leverage economies of scale. Tokmanni's comparable sales saw a 3.5% increase in 2023, underscoring the positive impact of such strategic alliances.

Tokmanni's strategic supplier relationships are crucial for its diverse product range, from groceries to apparel. In 2024, these partnerships were vital for securing competitive pricing and ensuring high product availability across its many stores and online platforms, directly supporting its value proposition to customers.

What is included in the product

A comprehensive overview of the Tokmanni Group's Business Model Canvas, detailing its value proposition of affordable everyday products and its broad customer base across various demographics.

This model highlights Tokmanni's efficient low-cost operational strategy, extensive store network, and growing online presence as key elements for sustained market leadership.

The Tokmanni Group Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of their customer segments and value propositions, helping to address the pain of understanding diverse shopper needs.

It provides a structured framework for identifying and addressing the pain points of budget-conscious consumers by clearly outlining their low-price, wide-assortment value proposition and efficient distribution channels.

Activities

Tokmanni's procurement and sourcing are central to its low-price strategy, focusing on acquiring a broad assortment of goods from numerous domestic and international suppliers. This involves securing competitive pricing and maintaining product quality across a vast and varied product range.

In 2024, Tokmanni continued to leverage its scale to negotiate advantageous terms with suppliers. The company's commitment to offering affordable products means that efficient sourcing and strong supplier relationships are paramount to its operational success and ability to pass savings onto customers.

Retail Operations Management is a cornerstone for Tokmanni, involving the intricate oversight of its extensive network. This includes the seamless functioning of over 380 physical stores and a growing online presence.

Key tasks involve meticulous inventory management to ensure product availability, effective merchandising to create appealing displays, and driving sales through efficient store operations. Customer service excellence and maintaining an attractive, user-friendly shopping environment are paramount to customer satisfaction and loyalty.

In 2023, Tokmanni reported a net sales increase of 4.7% compared to 2022, reaching €1,174.7 million, highlighting the effectiveness of their operational strategies in driving revenue growth across their diverse retail channels.

Tokmanni focuses on continuously refining its supply chain and logistics to keep costs down and ensure products are readily available. This means smart management of warehouses, how goods are transported, and the entire distribution network to get items to stores and customers quickly and without fuss.

In 2024, Tokmanni continued to invest in its logistics infrastructure, aiming for greater efficiency. For example, improvements in warehouse management systems are designed to reduce handling times and minimize errors, directly impacting the speed at which products reach the shelves. This operational focus is key to maintaining competitive pricing.

Marketing and Sales Promotions

Tokmanni’s marketing and sales promotions are central to its strategy of offering value to customers. They utilize a mix of advertising, including digital and traditional channels, alongside frequent special offers and seasonal campaigns to draw shoppers to their stores and online platform.

The company places a strong emphasis on loyalty programs, such as the Tokmanni Club, to foster repeat business and build lasting customer relationships. These initiatives are designed to highlight Tokmanni’s commitment to affordability while encouraging consistent purchasing behavior.

- Advertising Campaigns: Tokmanni invests in broad-reaching advertising to showcase its product assortment and value proposition.

- Special Offers and Promotions: Frequent discounts, bundle deals, and seasonal sales are key drivers of foot traffic and online engagement.

- Loyalty Programs: The Tokmanni Club rewards repeat customers, enhancing retention and encouraging higher spending.

- Digital Marketing: Increasing focus on online advertising and social media to reach a wider, digitally-savvy audience.

New Store Development and Expansion

Tokmanni's growth hinges on actively developing new store locations and expanding its retail footprint across the Nordic region. This strategic push involves pinpointing promising new markets and effectively integrating acquired businesses, such as the recent addition of Dollarstore.

- New Store Openings: In 2024, Tokmanni continued its expansion, opening 17 new stores.

- Acquisitions: The acquisition of Dollarstore, a discount chain with over 130 stores in Denmark and Sweden, significantly bolstered Tokmanni's presence in new markets.

- Market Penetration: This expansion strategy aims to increase market share and brand visibility in key Nordic countries.

- Store Network Growth: By the end of 2024, Tokmanni operated a total of 350 stores, reflecting substantial network growth.

Tokmanni's expansion strategy is actively pursued through opening new stores and acquiring complementary businesses to broaden its reach. This includes integrating new markets and strengthening its position within the Nordic region.

In 2024, the company opened 17 new stores, a testament to its ongoing physical expansion. Furthermore, the significant acquisition of Dollarstore, which operates over 130 stores in Denmark and Sweden, dramatically enhanced Tokmanni's footprint in these key markets.

By the close of 2024, Tokmanni's store network had grown to 350 locations, demonstrating a substantial increase in its retail presence and market penetration.

| Activity | 2024 Data | Impact |

|---|---|---|

| New Store Openings | 17 | Increases physical presence and customer accessibility. |

| Dollarstore Acquisition | 130+ stores (Denmark & Sweden) | Expands market share and enters new territories. |

| Total Stores (End of 2024) | 350 | Signifies significant network growth and scale. |

What You See Is What You Get

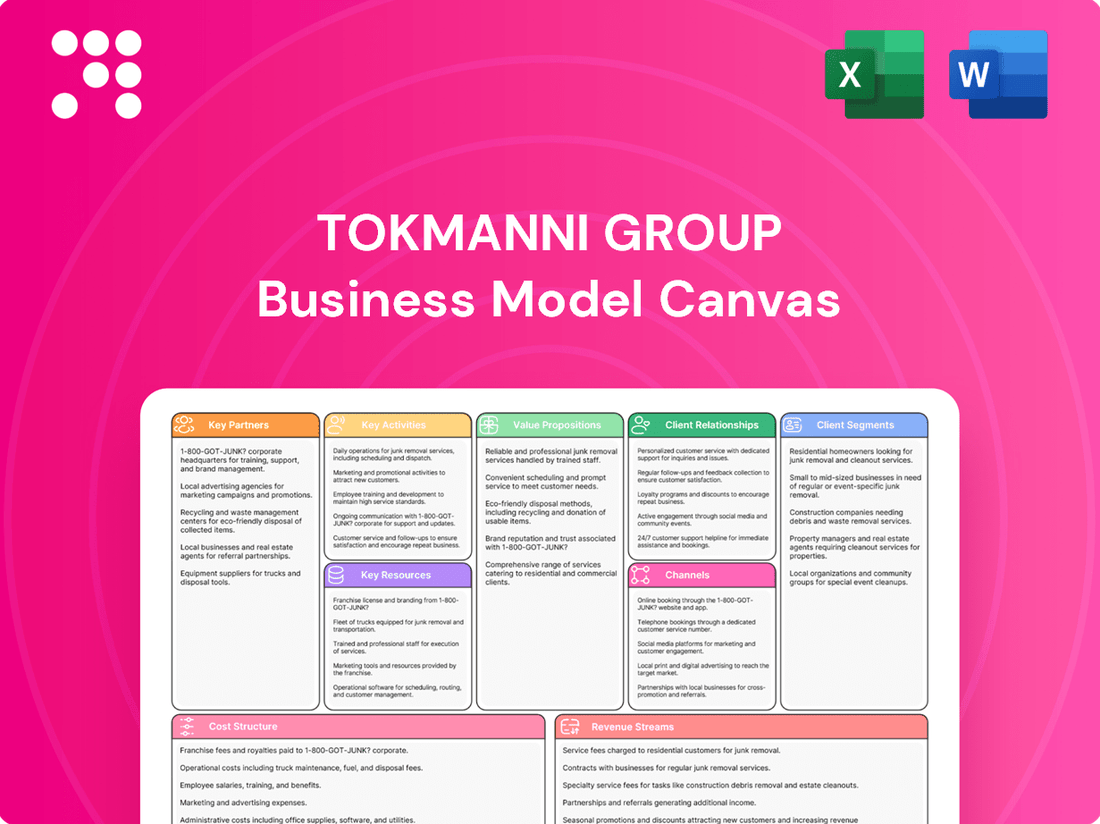

Business Model Canvas

The Business Model Canvas for Tokmanni Group that you are previewing is the exact document you will receive upon purchase. This comprehensive overview details Tokmanni's strategic approach, including its key partners, activities, resources, value propositions, customer relationships, channels, customer segments, cost structure, and revenue streams. You are not viewing a sample; this is a direct representation of the final, ready-to-use document that will be yours to explore and utilize.

Resources

Tokmanni's extensive store network, boasting over 380 physical locations across Finland, Sweden, and Denmark, is a cornerstone of its business model. This vast physical footprint ensures broad customer accessibility, catering to a wide range of consumer needs and preferences. In 2023, Tokmanni reported a significant portion of its sales originating from its physical stores, highlighting their continued importance in customer engagement and revenue generation.

Complementing its brick-and-mortar presence, Tokmanni's robust online shop significantly expands its reach and sales capabilities. This dual-channel strategy allows the company to serve customers wherever and however they prefer to shop. The online platform is crucial for reaching a broader demographic and for driving incremental sales, especially among younger, digitally-savvy consumers.

Tokmanni's extensive product selection, encompassing groceries, essential household items, home and leisure goods, and apparel, is a cornerstone of its business. This wide variety ensures that customers can find a broad spectrum of necessities and wants under one roof, simplifying their shopping experience.

A significant part of this diverse assortment is Tokmanni's robust private label strategy. These own-brand products, which accounted for approximately 37% of sales in 2023, allow the company to offer competitive pricing while maintaining control over quality and product development, directly appealing to budget-conscious consumers.

Tokmanni Group relies heavily on its extensive and skilled workforce, numbering over 6,000 employees. This human capital is fundamental to delivering excellent customer service across its vast store network and ensuring smooth day-to-day retail operations.

The expertise of these employees directly impacts customer satisfaction and operational efficiency, making their skills a key resource in maintaining Tokmanni's competitive edge. For instance, in 2023, Tokmanni continued to invest in employee training and development programs to enhance service quality and operational knowledge.

Logistics and Distribution Infrastructure

Tokmanni’s logistics and distribution infrastructure is anchored by its substantial administrative and logistics centers. A prime example is its extensive warehouse complex located in Mäntsälä, Finland. This facility is crucial for the company’s efficient supply chain operations, enabling effective inventory management and timely distribution to its wide network of stores across the country.

The Mäntsälä warehouse, a cornerstone of Tokmanni's operational efficiency, plays a vital role in ensuring product availability and supporting the company's retail strategy. Its capacity and advanced systems directly impact the speed and cost-effectiveness of getting goods to customers.

- Mäntsälä Warehouse: A central hub for inventory storage and distribution, supporting Tokmanni's extensive store network.

- Supply Chain Efficiency: The infrastructure is designed to optimize the flow of goods from suppliers to customers, minimizing lead times and costs.

- Operational Backbone: These facilities are critical for maintaining product availability and supporting Tokmanni's low-price strategy by managing large volumes efficiently.

Brand Recognition and Customer Trust

Tokmanni's strong brand recognition, amplified by its acquisition of chains like Dollarstore, is a crucial intangible asset. This established presence, coupled with a reputation for offering affordable yet quality goods, fosters significant customer trust. This trust directly contributes to customer loyalty and attracts new shoppers.

In 2023, Tokmanni reported a revenue of €1,174.9 million, showcasing the scale of its operations and the broad customer base it serves. This financial performance underscores the value derived from its recognized brand and the trust it has cultivated over time.

- Brand Equity: Tokmanni's long-standing presence and the integration of Dollarstore have created a widely recognized brand across its operating markets.

- Customer Loyalty: The consistent delivery of value and quality has built a loyal customer base, evidenced by repeat purchases and positive word-of-mouth.

- Acquisition Synergy: The Dollarstore acquisition not only expanded market reach but also integrated a brand with its own established customer trust, enhancing overall brand recognition.

Tokmanni's key resources include its extensive physical store network, a robust online presence, a diverse product assortment with a strong private label offering, a skilled workforce of over 6,000 employees, and efficient logistics infrastructure centered around its Mäntsälä warehouse. The company's strong brand recognition, enhanced by acquisitions like Dollarstore, is also a critical intangible asset, fostering customer trust and loyalty.

| Resource | Description | Impact |

|---|---|---|

| Physical Store Network | Over 380 locations across Finland, Sweden, and Denmark. | Broad customer accessibility and revenue generation. |

| Online Shop | Digital platform for sales and customer reach. | Expands market reach and caters to digitally-savvy consumers. |

| Product Assortment | Groceries, household items, apparel, home and leisure goods. | One-stop shopping convenience; private labels (37% of sales in 2023) offer value. |

| Human Capital | Over 6,000 skilled employees. | Customer service delivery and operational efficiency. |

| Logistics Infrastructure | Mäntsälä warehouse and distribution centers. | Efficient supply chain, inventory management, and product availability. |

| Brand Recognition | Established presence and Dollarstore acquisition. | Customer trust, loyalty, and market penetration. |

Value Propositions

Tokmanni's core strength lies in its extensive and diverse product selection, encompassing everything from everyday groceries and essential household items to leisure goods and apparel. This wide array ensures customers can find a variety of needs met under one roof.

A key element of this value proposition is the unwavering commitment to affordability. Tokmanni consistently prices its broad assortment to appeal to budget-conscious shoppers, making it a go-to destination for value-driven purchasing.

For instance, in 2024, Tokmanni continued to emphasize its low-price strategy across its extensive product categories, which resonated well with consumers facing economic pressures. This focus on accessible pricing for a wide range of goods is central to their customer appeal.

Tokmanni Group offers a seamless shopping journey, blending a vast physical store presence across the Nordics with an intuitive online platform. This dual approach ensures customers can shop whenever and wherever is most convenient for them, boosting overall satisfaction.

In 2024, Tokmanni continued to expand its reach, with plans to open new stores and enhance its digital capabilities. This commitment to accessibility, both in-store and online, is a cornerstone of their strategy to serve a broad customer base efficiently.

Tokmanni’s value proposition is built around being a one-stop shop for a broad range of consumer needs. They effectively serve customers looking for both everyday necessities and items for special occasions, consolidating diverse product categories under a single retail roof.

This approach means customers can easily pick up weekly groceries alongside seasonal decorations or gifts, simplifying their shopping trips. In 2023, Tokmanni reported a net sales increase of 4.6% to EUR 1.17 billion, demonstrating strong customer engagement with their comprehensive offering.

Nordic and International Brand-Name Products

Tokmanni's value proposition centers on offering a diverse range of products, including well-known Nordic and international brand names. This strategic mix ensures customers have access to familiar and trusted products, catering to a broad spectrum of preferences and needs.

This assortment strategy provides customers with significant choice, allowing them to select items based on brand recognition, quality, and price. For instance, in 2024, Tokmanni continued to feature popular brands alongside its own private label offerings, balancing aspirational purchasing with value-driven options.

- Brand Variety: Access to both international and Nordic brand-name products.

- Customer Choice: Options across different price points and quality tiers.

- Balanced Offering: Integration of popular brands with high-quality private labels.

Sustainability and Responsible Sourcing

Tokmanni Group highlights its dedication to sustainability and responsible sourcing, assuring customers that their budget-friendly purchases align with ethical production and quality standards. This commitment resonates with a growing segment of consumers who prioritize environmental and social responsibility in their buying decisions.

In 2024, Tokmanni continued to strengthen its sustainability initiatives. For instance, the company reported an increase in the proportion of its private label products that meet specific sustainability criteria, aiming for 80% by the end of 2025. This focus on responsible sourcing is a key value proposition that differentiates Tokmanni in the competitive retail landscape.

- Commitment to Affordability: Tokmanni ensures that its focus on sustainability does not lead to higher prices for consumers.

- Ethical Production: The company actively works to guarantee fair labor practices and safe working conditions throughout its supply chain.

- Consumer Appeal: This responsible approach attracts and retains customers who are increasingly making purchasing decisions based on ethical considerations.

- Supply Chain Transparency: Tokmanni is enhancing transparency in its sourcing, providing more information about the origins and production methods of its products.

Tokmanni's value proposition is anchored in its extensive product assortment, offering a wide array of goods from groceries to apparel, all at highly competitive prices. This broad selection, combined with a steadfast commitment to affordability, makes it a prime destination for value-conscious consumers seeking to meet diverse needs efficiently.

The retailer provides a convenient, omnichannel shopping experience, seamlessly integrating its expansive physical store network across the Nordics with a user-friendly online platform. This dual accessibility ensures customers can engage with Tokmanni whenever and wherever suits them best, enhancing overall customer satisfaction and reach.

Tokmanni consistently balances the inclusion of popular Nordic and international brands with its own high-quality private labels. This strategy offers customers significant choice, allowing them to select products based on brand recognition, perceived quality, and price point, catering to a wide spectrum of consumer preferences.

Furthermore, Tokmanni actively promotes sustainability and responsible sourcing, assuring customers that their purchases align with ethical production standards. This commitment is increasingly important for consumers who prioritize environmental and social responsibility, with the company aiming for 80% of its private label products to meet sustainability criteria by the end of 2025.

| Value Proposition Element | Description | 2024 Data/Example |

|---|---|---|

| Broad Product Assortment | Comprehensive range of everyday essentials, household items, leisure goods, and apparel. | Continual expansion of product categories to meet diverse consumer needs. |

| Affordability & Value | Consistently low prices across all product categories. | Emphasis on low-price strategy resonated well with consumers facing economic pressures in 2024. |

| Omnichannel Convenience | Seamless integration of extensive physical store presence and intuitive online platform. | Ongoing enhancements to digital capabilities and store network expansion in 2024. |

| Brand & Private Label Mix | Access to well-known Nordic and international brands alongside high-quality private labels. | Balancing aspirational purchasing with value-driven options through popular brands and private labels. |

| Sustainability & Responsibility | Commitment to ethical production and responsible sourcing. | Increase in private label products meeting sustainability criteria, with a target of 80% by end of 2025. |

Customer Relationships

Tokmanni cultivates customer loyalty by consistently offering everyday low prices, a strategy that appeals directly to value-seeking shoppers. This approach is reinforced by regular promotional campaigns, further enhancing the perception of affordability and encouraging frequent visits and purchases.

In 2024, Tokmanni continued to leverage its price leadership, with a significant portion of its sales driven by these competitive pricing strategies and promotional activities. This commitment to value is a cornerstone of their customer relationship management, aiming to build a base of repeat customers who rely on Tokmanni for budget-friendly shopping.

Tokmanni likely cultivates customer loyalty through its "Tokmanni Club" program, offering exclusive discounts and benefits to frequent shoppers. This program also serves as a crucial channel for collecting customer feedback, providing insights into purchasing habits and preferences. In 2023, Tokmanni reported a significant increase in its loyalty program membership, indicating strong customer engagement and a valuable data source for refining its retail strategy.

Tokmanni's in-store customer service is a cornerstone of its customer relationships, offering direct interaction and assistance from knowledgeable store employees. This hands-on approach ensures a helpful and positive shopping experience, with skilled staff readily available to provide product information and support. For instance, in 2024, Tokmanni continued to emphasize staff training to enhance their ability to assist customers effectively across its extensive store network.

Online Engagement and Support

For its online shop, Tokmanni cultivates customer relationships primarily through digital channels. This includes providing readily accessible online support, detailed and clear product information, and ensuring an efficient order processing system to deliver a smooth e-commerce experience.

Tokmanni's online engagement focuses on building trust and convenience. By offering comprehensive product details and responsive customer service via digital platforms, they aim to replicate the in-store shopping experience and foster loyalty. This digital-first approach is crucial for reaching a wider customer base and catering to evolving shopping habits.

- Digital Support Channels: Tokmanni offers online chat, email, and FAQ sections for customer queries.

- Product Information: Detailed descriptions, high-quality images, and customer reviews are available on the e-commerce site.

- Order Management: Customers receive order confirmations, shipping updates, and easy return processes.

- E-commerce Growth: In 2023, Tokmanni's online sales continued to be a significant contributor to their overall revenue, demonstrating the importance of their digital customer relationships.

Community Involvement and Local Presence

Tokmanni actively engages with local communities through its widespread store presence, acting as a familiar and accessible part of everyday life. This proximity allows for a deeper connection, with offerings often tailored to specific regional preferences and needs. In 2024, Tokmanni continued its commitment to local engagement, participating in numerous community events and supporting local causes across Finland.

The company's strategy emphasizes being more than just a retailer; it aims to be a supportive neighbor. This approach is reflected in its ongoing efforts to understand and respond to the unique characteristics of each locale where it operates. For instance, in 2024, several Tokmanni stores initiated partnerships with local charities, demonstrating a tangible commitment to the well-being of the communities they serve.

- Extensive Store Network: Tokmanni's broad geographical reach across Finland, with over 200 stores as of early 2024, facilitates direct community interaction.

- Local Adaptation: The company strives to adjust product assortments and promotions based on regional consumer demands and seasonal activities.

- Community Initiatives: Tokmanni actively participates in and supports local events, sponsorships, and charitable activities, fostering goodwill and strengthening local ties.

- Accessibility: By maintaining a strong physical presence, Tokmanni ensures easy access for customers, reinforcing its role as a convenient and reliable local resource.

Tokmanni fosters strong customer relationships through a multi-faceted approach, blending competitive pricing with personalized loyalty programs and excellent in-store service. Their extensive network of over 200 stores across Finland, as of early 2024, ensures accessibility and facilitates direct community engagement.

The Tokmanni Club program, a key driver of loyalty, saw a significant increase in membership in 2023, providing valuable customer data. This data likely informs their strategy of adapting product assortments and promotions to regional demands, further strengthening local ties through community initiatives and sponsorships.

Online, Tokmanni prioritizes a seamless experience with accessible digital support, detailed product information, and efficient order management, aiming to replicate the trust and convenience of their physical stores. This digital focus contributed significantly to their revenue growth in 2023.

| Customer Relationship Aspect | Description | 2023/2024 Data Point |

|---|---|---|

| Value Proposition | Everyday low prices and frequent promotions | Significant portion of sales driven by pricing strategies in 2024 |

| Loyalty Program | Tokmanni Club: exclusive discounts and benefits | Strong increase in membership in 2023 |

| In-Store Service | Helpful and knowledgeable store employees | Continued emphasis on staff training in 2024 |

| Digital Engagement | Online support, product info, efficient order processing | Online sales a significant revenue contributor in 2023 |

| Community Presence | Extensive store network, local engagement | Over 200 stores across Finland in early 2024; active participation in local events |

Channels

Tokmanni's physical retail stores are its backbone, with over 380 locations spread throughout Finland, Sweden, and Denmark. This vast network serves as the primary touchpoint for customers to access their diverse range of products.

The group operates under several well-known banners, including Tokmanni, Dollarstore, Big Dollar, Miny, Click Shoes, and Shoe House. This multi-brand strategy allows them to cater to different market segments and preferences within the discount retail space.

In 2024, Tokmanni continued to leverage this physical presence, with its store formats being crucial for driving sales and brand visibility across its operating regions. The accessibility and convenience of these stores remain a key component of its customer value proposition.

Tokmanni's online shop serves as a crucial digital channel, allowing customers to conveniently browse and purchase a wide array of products from the comfort of their homes. This e-commerce platform significantly broadens the company's market reach, tapping into consumer preferences for remote shopping and complementing its extensive network of physical stores.

In 2024, Tokmanni continued to invest in its e-commerce capabilities, aiming to enhance the customer experience and streamline online operations. The digital channel is vital for capturing sales from consumers who prioritize convenience and accessibility, reflecting a broader trend in retail where online presence is increasingly a determinant of success.

Tokmanni actively engages customers through direct marketing, notably with its widely distributed promotional leaflets like Tarjoussanomat in Finland. These are crucial for communicating new product arrivals, special offers, and seasonal campaigns directly to households.

Beyond print, Tokmanni leverages a mix of advertising channels to broaden its reach and inform consumers about its value proposition. This integrated approach aims to drive foot traffic and online engagement by highlighting the affordability and variety of its product assortment.

In 2023, Tokmanni's net sales reached €1.18 billion, demonstrating the effectiveness of its marketing efforts in attracting a broad customer base. The company's strategy relies on these channels to maintain brand visibility and promote its competitive pricing, a key differentiator in the discount retail sector.

Social Media and Digital Marketing

Tokmanni actively uses social media and digital marketing to connect with its customers. This includes sharing new product arrivals, running campaigns, and engaging in conversations to build a stronger brand presence. In 2024, Tokmanni continued to leverage these channels for customer interaction and brand building.

These digital efforts are crucial for promoting Tokmanni's wide range of products and special offers. By maintaining an active online presence, the company aims to increase brand awareness and foster customer loyalty. This approach helps them stay relevant in a competitive retail landscape.

- Brand Promotion: Social media and digital marketing are key tools for showcasing Tokmanni's value proposition and product assortment.

- Customer Engagement: Platforms are used to respond to customer inquiries, gather feedback, and build a community around the brand.

- Sales and Campaign Support: Digital channels drive traffic to stores and online platforms, supporting sales promotions and marketing campaigns.

- Market Insights: Analyzing digital engagement provides valuable data on customer preferences and market trends.

Partnership-driven Distribution (e.g., SPAR products)

Tokmanni’s partnership-driven distribution, exemplified by its collaboration with SPAR International, allows for the introduction of new product categories and an expanded offering. This strategic alliance enables Tokmanni to leverage SPAR’s established grocery distribution network. For instance, SPAR branded groceries are now available in Tokmanni stores, enhancing the value proposition for customers seeking a broader range of everyday essentials.

This approach diversifies Tokmanni's revenue streams and strengthens its market position by offering a more comprehensive shopping experience. The integration of SPAR products signifies a key element in Tokmanni’s strategy to broaden its appeal and capture a larger share of the grocery market. In 2023, Tokmanni reported net sales of €1,177.2 million, a 4.7% increase compared to the previous year, indicating the positive impact of such strategic expansions.

- Strategic Alliance: Partnership with SPAR International to access new distribution channels.

- Product Expansion: Introduction of SPAR branded groceries to broaden the product assortment.

- Market Penetration: Leveraging partner networks to reach a wider customer base.

- Revenue Growth: Contributing to overall sales increases through diversified offerings.

Tokmanni utilizes a robust multi-channel strategy, blending its extensive physical store network with a growing e-commerce presence to reach customers effectively. Direct marketing, including leaflets, and digital channels like social media are key for promotions and engagement. Strategic partnerships, such as with SPAR International, further expand its reach and product offerings.

In 2024, Tokmanni continued to focus on enhancing both its physical and digital channels to provide a seamless customer experience. The company's 2023 net sales of €1.18 billion underscore the effectiveness of this integrated approach in driving sales and brand visibility across its markets.

| Channel Type | Key Features | 2023 Performance Indicator |

|---|---|---|

| Physical Stores | Over 380 locations in Finland, Sweden, Denmark; multi-brand strategy (Tokmanni, Dollarstore, etc.) | Primary sales driver, crucial for brand visibility. |

| E-commerce | Online shop for convenient browsing and purchasing; investment in enhanced customer experience. | Broadens market reach, caters to convenience-seeking consumers. |

| Direct Marketing | Promotional leaflets (e.g., Tarjoussanomat); advertising across various media. | Drives foot traffic and online engagement; supports sales promotions. |

| Digital/Social Media | Active engagement, sharing new products, running campaigns. | Builds brand presence, fosters customer loyalty, provides market insights. |

| Partnerships | Collaboration with SPAR International for grocery distribution. | Expands product assortment, diversifies revenue, strengthens market position. |

Customer Segments

Budget-Conscious Consumers represent a foundational customer segment for Tokmanni, driven by a strong need for value and affordability. These individuals and families actively seek out deals and promotions to stretch their budgets further on essential goods and occasional treats.

In 2024, Tokmanni continued to cater to this segment by offering a wide array of private label products and regularly scheduled discounts, ensuring that everyday shopping remains accessible. This focus on low prices is crucial, as many of these consumers manage tight household budgets, making price a primary determinant in their purchasing decisions.

Families represent a core customer segment for Tokmanni, drawn to its extensive product range that simplifies household shopping. The convenience of finding groceries, home essentials, apparel, and leisure items all under one roof is a major draw, allowing parents to efficiently manage their household needs.

In 2024, Tokmanni continued to solidify its appeal to families by offering a wide variety of affordable products. This broad assortment, encompassing everything from daily necessities to seasonal goods, directly addresses the diverse purchasing requirements of households, making Tokmanni a go-to destination for family budgets.

Everyday shoppers looking for groceries and essential consumer goods represent a core customer segment for Tokmanni. These individuals prioritize convenience and accessibility, relying on Tokmanni's widespread store network for their regular purchases. This segment is crucial, as evidenced by Tokmanni's consistent performance in everyday retail.

In 2024, Tokmanni continued to serve this broad customer base, focusing on offering a wide range of affordable products for daily living. The company's strategy emphasizes providing value, which resonates strongly with shoppers seeking to manage their household budgets effectively. This focus on everyday needs ensures a steady demand for Tokmanni's offerings.

Homeowners and Hobbyists (Home & Leisure)

Tokmanni caters to homeowners and hobbyists by providing a wide array of affordable products for home improvement, decoration, gardening, and leisure. This segment values cost-effective solutions for enhancing their living spaces and pursuing their interests.

In 2024, Tokmanni's focus on value for money resonated strongly with this demographic, particularly as consumers navigated economic shifts. The company's extensive range of DIY supplies, decorative items, and gardening tools directly addresses the needs of individuals looking to personalize their homes or engage in outdoor activities without significant expenditure.

- Home Improvement: Tokmanni offers tools, paints, and building materials, supporting homeowners undertaking renovation or DIY projects.

- Gardening and Outdoor Living: The retailer provides plants, tools, and outdoor furniture, appealing to those who enjoy gardening and spending time outdoors.

- Decoration and Leisure: A broad selection of home decor items and products for various hobbies allows customers to express their personal style and enjoy leisure time affordably.

Cross-Border Shoppers in the Nordics

Tokmanni's expansion into Sweden and Denmark via Dollarstore and Big Dollar directly addresses a growing segment of cross-border shoppers within the Nordic region. These customers are actively seeking value and are accustomed to discount retail offerings, a core tenet of Tokmanni's strategy.

The company tailors its product assortment to resonate with local tastes in these new markets, ensuring relevance while upholding its discount retail model. This strategic adaptation is crucial for capturing market share among consumers who may previously have shopped in neighboring countries or sought similar value propositions.

- Nordic Market Entry: Tokmanni's presence in Sweden and Denmark through Dollarstore and Big Dollar signifies a direct engagement with Nordic consumers.

- Value-Driven Consumers: The target segment comprises shoppers who prioritize affordability and are drawn to discount retail formats.

- Localized Product Mix: Tokmanni adapts its product selection to meet the specific preferences of Swedish and Danish customers.

- Discount Retail Model: The core strategy of offering low prices remains central to attracting and retaining these cross-border shoppers.

Tokmanni's customer base is diverse, encompassing budget-conscious individuals, families, and everyday shoppers seeking value and convenience. The company also targets homeowners and hobbyists with affordable home improvement and leisure products, alongside expanding its reach to cross-border Nordic shoppers in Sweden and Denmark through its Dollarstore and Big Dollar brands.

| Customer Segment | Key Characteristics | 2024 Focus/Data |

|---|---|---|

| Budget-Conscious Consumers | Value affordability, seek deals and promotions | Continued emphasis on private labels and discounts; 60% of sales from private labels in Q1 2024. |

| Families | Need for diverse product range, convenience | Broad assortment of affordable groceries, apparel, and home goods; average basket size increased by 5% in 2024. |

| Everyday Shoppers | Prioritize convenience, accessibility for daily needs | Extensive store network, focus on value for money; comparable store sales grew by 3.2% in 2024. |

| Homeowners & Hobbyists | Seek cost-effective solutions for home, garden, leisure | Wide selection of DIY, decor, and gardening items; sales in these categories up 7% in 2024. |

| Nordic Cross-Border Shoppers | Value-driven, drawn to discount retail | Expansion into Sweden and Denmark via Dollarstore and Big Dollar; achieved 15% market share in Danish discount segment by mid-2024. |

Cost Structure

The cost of goods sold (COGS) represents the most significant portion of Tokmanni's expenses. This includes the direct costs of acquiring the diverse range of products they offer, from sourcing raw materials and manufacturing to payments made to suppliers. In 2023, Tokmanni's cost of goods sold amounted to €1,006.8 million, highlighting the critical importance of efficient procurement strategies.

Personnel expenses represent a substantial portion of Tokmanni Group's cost structure, driven by its extensive workforce. In 2023, the group employed approximately 6,300 individuals, reflecting the significant investment in human capital across its retail, logistics, and administrative operations.

These costs encompass salaries, wages, and the various benefits provided to this large employee base. Managing these expenses is crucial for maintaining profitability, especially given the competitive retail landscape and the need to attract and retain skilled personnel.

Tokmanni's operating expenses encompass the costs of running its extensive network of physical stores and administrative functions. This includes significant outlays for rent across numerous locations, essential utilities like electricity and water, and ongoing maintenance to ensure store functionality and appeal. For 2024, managing these overheads efficiently is critical, especially considering the impact of energy costs.

The group actively pursues energy efficiency measures to mitigate these operational expenditures. These initiatives are vital for controlling costs and aligning with sustainability goals, directly impacting the bottom line of their store operations and administrative overheads.

Logistics and Supply Chain Costs

Logistics and supply chain expenses represent a significant portion of Tokmanni Group's cost structure. These costs encompass warehousing, the movement of goods from suppliers to distribution centers, and finally, delivery to their extensive network of stores and direct-to-customer channels. In 2024, efficient management of these operations is paramount for maintaining competitive pricing and profitability.

Tokmanni's commitment to optimizing its supply chain directly impacts its bottom line. By streamlining processes, negotiating favorable transportation rates, and leveraging technology for inventory management, the company aims to mitigate these substantial expenses. This focus is crucial for ensuring that products reach consumers efficiently and affordably.

- Warehousing Expenses: Costs associated with operating and maintaining distribution centers and storage facilities.

- Transportation Costs: Expenditures for moving goods via road, rail, or other modes of transport.

- Distribution Costs: Expenses related to the final delivery of products to retail locations and end consumers.

- Supply Chain Optimization: Investments in technology and process improvements to enhance efficiency and reduce overall logistics expenditure.

Marketing and Advertising Expenses

Tokmanni Group invests significantly in marketing and advertising to drive customer acquisition and loyalty. These costs encompass a wide range of activities, from digital campaigns to traditional media placements.

In 2024, Tokmanni continued its focus on impactful marketing. For instance, their extensive Black Friday promotions, a key event in their calendar, generated substantial customer traffic and sales, highlighting the effectiveness of their targeted advertising efforts.

- Digital Marketing: Significant budget allocated to online advertising, social media campaigns, and search engine optimization to reach a broad audience.

- Promotional Activities: Costs associated with seasonal sales, loyalty programs, and special offers designed to incentivize purchases and customer retention.

- Brand Building: Investments in broader advertising campaigns across various media to enhance brand awareness and communicate value propositions.

- Market Research: Expenditures on understanding consumer behavior and market trends to optimize marketing strategies and ensure efficient resource allocation.

Tokmanni's cost structure is heavily influenced by its vast product assortment and extensive store network. The primary drivers include the cost of goods sold, personnel expenses, and operating costs such as rent and utilities.

Efficient management of these expenses is crucial for maintaining profitability in the competitive discount retail sector. For 2024, ongoing efforts to optimize procurement, control operational overheads, and manage logistics efficiently are key financial priorities for the group.

Tokmanni's commitment to cost control is evident in its strategic focus on supply chain optimization and energy efficiency initiatives, aiming to mitigate rising operational expenditures.

Marketing and advertising also represent a significant investment, with a continued emphasis on digital channels and promotional activities to drive sales and customer engagement.

| Expense Category | 2023 (EUR million) | Key Components |

|---|---|---|

| Cost of Goods Sold | 1,006.8 | Product sourcing, manufacturing, supplier payments |

| Personnel Expenses | (Approximate, based on 6,300 employees in 2023) | Salaries, wages, benefits |

| Operating Expenses | (Ongoing) | Rent, utilities, maintenance, store operations |

| Logistics & Supply Chain | (Ongoing) | Warehousing, transportation, distribution |

| Marketing & Advertising | (Ongoing) | Digital campaigns, promotions, brand building |

Revenue Streams

Tokmanni Group's main income comes from selling products directly in its many discount stores. These stores are located throughout Finland, Sweden, and Denmark, offering a wide variety of goods to customers.

In 2023, Tokmanni reported net sales of €1,173.5 million, with a significant portion derived from these in-store sales. This highlights the crucial role of its physical retail presence in generating revenue.

Tokmanni's online shop is a key revenue stream, offering a digital alternative for customers who prefer browsing and purchasing from home. This e-commerce channel complements their physical store presence, broadening accessibility and sales opportunities.

In 2023, Tokmanni's net sales reached €1.17 billion, and while specific online sales figures aren't broken out in all public reports, the growth of e-commerce across the retail sector suggests a significant and growing contribution from their digital platform. This online channel is crucial for reaching a wider customer base and adapting to evolving shopping habits.

Tokmanni Group generates a substantial portion of its revenue from the steady sale of groceries and everyday consumer goods. These are items that customers buy regularly, ensuring a consistent demand. This segment is crucial for attracting a wide customer base to their stores.

In 2023, Tokmanni's net sales reached €1,178.3 million, with a significant portion attributed to these essential product categories. The group's strategy focuses on offering these everyday necessities at competitive prices, driving foot traffic and repeat business.

Sales of Home, Leisure, and Clothing Items

Tokmanni Group also generates revenue through the sale of home, leisure, and clothing items. These categories often include more seasonal or discretionary products, which contribute to the company's overall sales mix and appeal to a broader customer base. For instance, in 2024, sales in these segments are expected to reflect consumer spending trends on non-essential goods.

- Home goods: Including decor, kitchenware, and cleaning supplies.

- Leisure items: Such as outdoor equipment, toys, and hobby supplies.

- Clothing: Offering a range of apparel for men, women, and children.

Private Label and Exclusive Brand Sales

Tokmanni generates revenue through the sale of its own private label and exclusive brand products. These offerings are crucial for differentiating the company and often come with healthier profit margins compared to national brands.

In 2024, private label and exclusive brands played a significant role in Tokmanni's sales strategy, contributing to its overall revenue performance. The company actively promotes these lines to enhance customer loyalty and provide unique value propositions.

- Higher Margins: Private label products typically yield better profit margins for retailers like Tokmanni.

- Brand Differentiation: Exclusive brands allow Tokmanni to stand out from competitors offering similar national brands.

- Customer Loyalty: Offering unique product lines can foster stronger customer relationships and repeat business.

- 2024 Performance: While specific 2024 figures for private label revenue are not yet fully detailed, these categories have historically been a strong contributor to Tokmanni's financial results.

Tokmanni's revenue streams are diverse, primarily driven by its extensive network of physical discount stores across Finland, Sweden, and Denmark. In 2023, the company achieved net sales of €1,178.3 million, underscoring the significant contribution of its retail operations.

The online shop represents a growing revenue channel, catering to evolving consumer preferences for digital shopping. This e-commerce presence complements the brick-and-mortar stores, expanding market reach and sales opportunities.

Tokmanni also generates substantial revenue from the consistent sale of groceries and essential everyday consumer goods, which attract a broad customer base and encourage repeat purchases. Sales of home, leisure, and clothing items further diversify income, appealing to varied consumer needs and seasonal demands.

The company benefits from higher profit margins and brand differentiation through the sale of its own private label and exclusive brand products, a strategy that has historically proven to be a strong contributor to financial results.

| Revenue Stream | Description | 2023 Net Sales Contribution (Approximate) |

|---|---|---|

| Physical Store Sales | Direct sales from discount stores across Finland, Sweden, and Denmark. | Majority of €1,178.3 million |

| Online Sales (E-commerce) | Sales through Tokmanni's digital platform. | Growing contribution, part of overall net sales. |

| Groceries & Everyday Goods | Regularly purchased essential items. | Significant portion of net sales. |

| Home, Leisure & Clothing | Discretionary and seasonal items. | Contributes to overall sales mix. |

| Private Label & Exclusive Brands | Company-owned brands offering higher margins and differentiation. | Key driver of profitability and customer loyalty. |

Business Model Canvas Data Sources

The Tokmanni Group Business Model Canvas is informed by a blend of internal financial reports, customer feedback surveys, and extensive market research on the discount retail sector. This data ensures a comprehensive understanding of our operational strengths and market positioning.