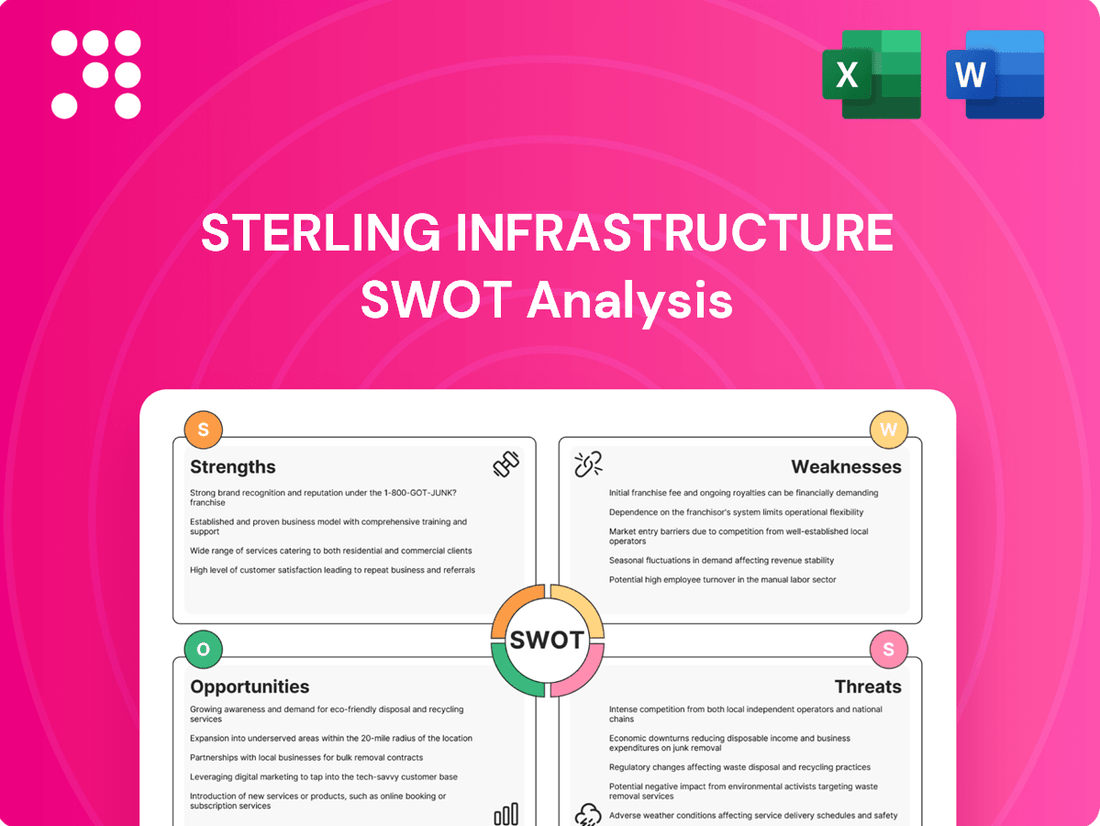

Sterling Infrastructure SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sterling Infrastructure Bundle

Sterling Infrastructure's robust backlog and strong market position in essential infrastructure sectors present significant strengths, but understanding the nuances of their competitive landscape and potential regulatory shifts is crucial for informed decision-making.

Want the full story behind Sterling Infrastructure's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Sterling Infrastructure's E-Infrastructure segment is a major growth engine, especially in building data centers. In Q3 2024, operating income for this segment jumped 89%, with data center revenues climbing 90%. This momentum continued into Q4 2024, where data center revenue saw more than a 50% increase.

The increasing importance of data centers is clear as they now represent over 60% of the segment's backlog. By Q1 2025, this figure grew to over 65% of the e-infrastructure backlog. This strong performance is driven by high demand for data centers and e-commerce logistics, placing Sterling advantageously in a fast-growing market.

Sterling Infrastructure showcased impressive financial strength in 2024, reporting a 6% increase in revenue compared to the previous year. This growth was accompanied by a significant 56% jump in net income, highlighting the company's enhanced profitability.

Further demonstrating its financial prowess, Sterling Infrastructure's adjusted net income saw a substantial 36% rise in 2024. The company consistently maintained gross margins above 20% annually, even setting a new record, driven by operational efficiencies and a strategic focus on higher-margin services.

Sterling Infrastructure boasts a robust and expanding backlog, a key strength that translates into predictable, multi-year revenue streams. This visibility is crucial for strategic planning and financial forecasting.

Specifically, the E-Infrastructure Solutions segment demonstrated impressive growth, with its backlog exceeding $1 billion by the close of 2024. This represented a significant 27% jump from the previous year, with the overall pipeline, including anticipated future phases, approaching $2 billion.

Further solidifying this strength, Sterling Infrastructure's total consolidated backlog reached $2.23 billion as of the first quarter of 2025. This figure marks a substantial 21% increase compared to the end of 2024, accompanied by a positive trend of improving gross profit margins, indicating enhanced operational efficiency.

Diversified Expertise and Strategic Project Focus

Sterling Infrastructure's strength lies in its diversified expertise across three key sectors: E-Infrastructure, Transportation, and Building Solutions. This broad specialization allows the company to generate revenue from a variety of critical infrastructure projects, mitigating risks associated with reliance on a single market. For instance, in the first quarter of 2024, Sterling reported record revenue, partly driven by strong performance in its E-Infrastructure segment, which includes data centers.

The company strategically targets higher-margin, mission-critical projects. This focus on areas like data centers and advanced manufacturing facilities plays to Sterling's strengths in large-scale execution and a proven track record. This disciplined approach to project selection is a significant advantage, as evidenced by their consistent ability to secure and successfully deliver complex projects. Their commitment to superior execution is a key differentiator in these demanding markets.

Furthermore, Sterling's strategic shift within its Transportation Solutions segment towards aviation and rail projects is enhancing profitability. These specialized areas often command higher margins due to their technical complexity and the critical nature of the infrastructure. This strategic mix has demonstrably contributed to the company's margin expansion, reflecting a successful adaptation to market demands and a focus on value-added services.

Key highlights supporting these strengths include:

- Revenue Diversification: Sterling operates across E-Infrastructure, Transportation, and Building Solutions, creating multiple revenue streams.

- Strategic Project Focus: Emphasis on high-margin, mission-critical projects like data centers and manufacturing facilities.

- Execution Excellence: A strong track record and reputation for superior execution valued by customers.

- Margin Expansion: Driven by disciplined project selection and a favorable shift in Transportation Solutions towards aviation and rail.

Effective Risk Mitigation Strategies

Sterling Infrastructure effectively navigates industry risks through strategic pricing and vendor management. A phase-by-phase pricing model, for instance, directly addresses the volatility of raw material and fuel costs, shielding the company from abrupt price hikes. This proactive stance is crucial in an environment where input costs can significantly impact project profitability.

The company's commitment to mitigating financial risk extends to its partnerships. By thoroughly vetting vendors and subcontractors for financial stability, Sterling Infrastructure reduces the likelihood of project delays or cost overruns stemming from supplier issues. This due diligence is a cornerstone of maintaining operational integrity and financial predictability.

Furthermore, Sterling Infrastructure's reliance on fixed-price contracts is a key strength in managing cost fluctuations. This contractual approach locks in project costs, thereby preserving profit margins and providing a more stable financial outlook, even when market conditions are unpredictable. For example, in the first quarter of 2024, the company reported strong revenue growth, demonstrating the effectiveness of these risk-management techniques in a dynamic economic landscape.

- Phase-by-phase pricing: Minimizes exposure to fluctuating raw material and fuel costs.

- Vendor vetting: Assesses financial stability of subcontractors to prevent disruptions.

- Fixed-price contracts: Locks in project costs, preserving profit margins and financial stability.

- Q1 2024 Performance: Sterling Infrastructure demonstrated robust revenue growth, reflecting the success of its risk mitigation strategies.

Sterling Infrastructure's E-Infrastructure segment is a significant growth driver, particularly in data center construction. This segment saw operating income surge by 89% in Q3 2024, with data center revenues climbing 90%, and continued this strong performance into Q4 2024 with over 50% revenue growth. The increasing demand for data centers is evident, as they now constitute over 65% of the E-Infrastructure backlog by Q1 2025, underscoring Sterling's advantageous position in a rapidly expanding market.

The company's financial health is robust, with 2024 revenue up 6% year-over-year and net income increasing by a substantial 56%. This growth was further bolstered by a 36% rise in adjusted net income for the year, alongside consistently strong gross margins exceeding 20%, a testament to operational efficiencies and a focus on higher-margin services.

Sterling Infrastructure possesses a strong and growing backlog, providing predictable, multi-year revenue streams essential for strategic planning. The E-Infrastructure Solutions backlog surpassed $1 billion by the end of 2024, a 27% increase year-over-year, with the total pipeline approaching $2 billion. By Q1 2025, the consolidated backlog reached $2.23 billion, a 21% increase from the end of 2024, coupled with improving gross profit margins.

| Metric | Q3 2024 | Q4 2024 | 2024 (vs 2023) | Q1 2025 |

| E-Infrastructure Op. Income Growth | 89% | N/A | N/A | N/A |

| Data Center Revenue Growth | 90% | >50% | N/A | N/A |

| Total Revenue Growth | N/A | N/A | 6% | N/A |

| Net Income Growth | N/A | N/A | 56% | N/A |

| Adjusted Net Income Growth | N/A | N/A | 36% | N/A |

| E-Infrastructure Backlog % | >60% | N/A | N/A | >65% |

| E-Infrastructure Backlog Value | N/A | >$1 Billion | N/A | N/A |

| Total Consolidated Backlog | N/A | N/A | N/A | $2.23 Billion |

| Total Consolidated Backlog Growth | N/A | N/A | N/A | 21% |

What is included in the product

Analyzes Sterling Infrastructure’s competitive position through key internal and external factors, detailing its strengths in project execution, weaknesses in diversification, opportunities in infrastructure spending, and threats from market competition.

Offers a clear, actionable framework to address Sterling Infrastructure's operational challenges and capitalize on market opportunities.

Weaknesses

Sterling Infrastructure's Building Solutions segment is experiencing headwinds from a softening residential real estate market, notably in key areas like Dallas-Fort Worth and Arizona. This softness, driven by persistent affordability challenges and elevated mortgage rates, negatively impacted the segment's operating income and revenue in late 2024.

The prolonged period of higher mortgage rates, which remained a significant factor throughout 2024, directly contributed to reduced demand in the residential sector. This external market dynamic has been a primary driver behind the decline in revenue and operating income for Sterling's Building Solutions segment, despite its importance for revenue diversification.

The construction sector, including companies like Sterling Infrastructure, faces a persistent shortage of skilled workers. Projections indicate a need for hundreds of thousands more workers by 2025 to keep pace with project pipelines.

This scarcity directly impacts operational costs, driving up wages and potentially delaying project timelines as companies compete for limited talent. Sterling must actively invest in training and offer attractive compensation to attract and retain the necessary expertise.

Sterling Infrastructure faces ongoing challenges with material cost volatility, impacting key inputs like steel, lumber, concrete, and fuel. These fluctuations, driven by inflation and supply chain issues, can squeeze profit margins if higher expenses aren't fully recoverable from clients.

Execution and Permitting Complexities

Sterling Infrastructure's focus on large, complex projects, while a strategic advantage, inherently carries significant execution risks. The sheer scale and intricate nature of these undertakings demand exceptional project management capabilities to mitigate potential cost overruns and schedule slippages. For instance, in 2023, large infrastructure projects globally experienced an average cost overrun of 20% and schedule delays of 15%, highlighting the inherent challenges.

Permitting processes represent another critical weakness, often introducing unpredictable delays that can significantly impact project timelines and profitability. Navigating the diverse and evolving regulatory landscapes across different jurisdictions requires substantial effort and can be a bottleneck. In the US, the average time for federal environmental reviews for major infrastructure projects has been reported to be between 4 to 7 years, underscoring this challenge.

- Execution Risks: Large-scale projects inherently involve higher complexity, increasing the likelihood of cost overruns and schedule delays, a common issue in the industry.

- Permitting Delays: Lengthy and unpredictable permitting processes can impede project commencement and completion, impacting revenue streams and operational efficiency.

- Resource Intensity: Effectively managing these complexities requires substantial investment in skilled personnel, advanced project management tools, and strong government relations.

Competitive Market Pressures

Sterling Infrastructure faces intense competition, particularly in lucrative sectors like data centers and transportation. This crowded market, featuring both seasoned companies and emerging players, often results in more aggressive bidding and can squeeze profit margins. For instance, the demand for data center construction, a key growth area for Sterling, saw significant investment in 2024, attracting numerous contractors vying for projects.

The pressure to maintain a competitive edge is constant. Sterling must continually innovate its construction methods, optimize operational efficiency, and nurture strong client relationships to win new contracts and safeguard its market position. This dynamic means that securing projects, especially in high-demand infrastructure segments, requires not just competitive pricing but also demonstrable expertise and reliability.

- Intensified Bidding: Increased competition leads to more aggressive pricing strategies, potentially impacting profitability on awarded projects.

- Margin Squeeze: The need to win bids in a competitive environment can force companies to accept lower profit margins.

- Innovation Imperative: Staying ahead requires continuous investment in new technologies and more efficient construction processes.

- Client Retention: Strong, long-term relationships are crucial for securing repeat business and navigating competitive landscapes.

Sterling Infrastructure's Building Solutions segment is vulnerable to downturns in the residential real estate market, as evidenced by the impact of affordability challenges and high mortgage rates on revenue and operating income in late 2024. The company also contends with a pervasive shortage of skilled labor across the construction industry, a trend projected to worsen by 2025, driving up labor costs and potentially causing project delays.

What You See Is What You Get

Sterling Infrastructure SWOT Analysis

The preview you see is the same Sterling Infrastructure SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

This is a real excerpt from the complete Sterling Infrastructure SWOT analysis. Once purchased, you’ll receive the full, editable version, providing a comprehensive understanding of the company's strategic position.

Opportunities

The data center construction market is booming, fueled by the increasing need for digital infrastructure, AI, and cloud computing. This sector is expected to grow significantly, with a projected CAGR of 6.4% to 6.8% through 2029, reaching over $340 billion in 2024.

Sterling Infrastructure's E-Infrastructure segment is perfectly positioned to benefit from this surge. Data centers already represent a substantial and expanding part of their project backlog, indicating strong future revenue potential in this high-demand area.

The Infrastructure Investment and Jobs Act (IIJA), also known as the Bipartisan Infrastructure Law (BIL), is a significant tailwind for Sterling Infrastructure. With an estimated $492 billion still slated for distribution through 2026, this legislation fuels substantial investments in critical areas like roads, bridges, public transit, and ports. These are precisely the sectors where Sterling's Transportation Solutions segment thrives, creating a robust and predictable project pipeline for the company.

Anticipated interest rate declines through late 2024 and into 2025 are poised to invigorate new construction starts. Lower borrowing costs enhance project feasibility, potentially driving greater investment in residential, commercial, and institutional building. This economic shift could significantly benefit Sterling's Building Solutions segment, which has faced headwinds from elevated mortgage rates, and generally bolster demand for infrastructure work.

Onshoring and Reshoring Trends

The growing movement to bring manufacturing back to the U.S., often called onshoring and reshoring, is a major tailwind for Sterling Infrastructure. This trend is particularly strong in critical industries like semiconductors and biopharmaceuticals, which require significant new facility construction. For instance, the CHIPS and Science Act, passed in 2022, aims to revitalize domestic semiconductor manufacturing, projecting billions in new investments and factory builds across the country.

Sterling's E-Infrastructure segment is perfectly positioned to capitalize on this demand. Their expertise in large-scale site development for manufacturing and energy projects directly addresses the needs arising from these reshoring initiatives. This presents a substantial growth opportunity, expanding Sterling's project pipeline beyond its established data center work.

- Increased demand for site development: Reshoring efforts are driving the need for new manufacturing plants and research facilities.

- Alignment with E-Infrastructure services: Sterling's core competencies in large-scale site preparation and infrastructure development are a direct match for these projects.

- Diversification of revenue streams: This trend offers Sterling opportunities in sectors beyond its traditional data center focus, reducing reliance on a single market.

- Government incentives fueling growth: Legislation like the CHIPS Act provides significant financial backing for domestic manufacturing expansion, translating into more projects for companies like Sterling.

Technological Adoption in Construction

The construction sector's growing embrace of technology offers significant avenues for Sterling Infrastructure to boost efficiency and project oversight. For instance, the global construction technology market was projected to reach $11.4 billion in 2024, indicating a strong trend towards digital solutions.

Innovations like cloud-based project management software enhance data security and collaboration, while AI analytics can proactively identify and mitigate potential project delays. Modular construction, a key technological advancement, allows for faster build times and improved quality control, potentially reducing project timelines by up to 20% in some cases.

- Enhanced Efficiency: Technologies like Building Information Modeling (BIM) streamline design and construction processes, reducing errors and waste.

- Improved Project Management: Real-time data analytics and cloud platforms offer better visibility into project progress and resource allocation.

- Risk Mitigation: AI-driven predictive analytics can forecast potential issues, such as supply chain disruptions or labor shortages, enabling proactive management.

- Competitive Advantage: Early adoption of these technologies can position Sterling Infrastructure as an industry leader, attracting talent and clients seeking modern construction solutions.

Sterling Infrastructure is well-positioned to capitalize on the increasing demand for site development driven by reshoring initiatives in critical industries like semiconductors. This trend directly aligns with their E-Infrastructure segment's expertise in large-scale site preparation, offering a significant opportunity for revenue diversification beyond data centers.

Government incentives, such as the CHIPS Act, are actively fueling domestic manufacturing expansion, creating a robust pipeline of projects that Sterling's capabilities can address. The adoption of advanced construction technologies further enhances efficiency and project management, providing a competitive edge.

The company's E-Infrastructure segment is poised to benefit from the booming data center construction market, projected to reach over $340 billion in 2024 with a healthy CAGR. This growth, coupled with the tailwinds from the Infrastructure Investment and Jobs Act and anticipated interest rate declines, creates a favorable environment for Sterling across its various segments.

Threats

While overall inflation may be easing, Sterling Infrastructure continues to grapple with elevated construction material costs. Prices for key inputs like steel and lumber, though perhaps not accelerating at the same pace as before, remain at challenging levels. For example, the Producer Price Index for construction materials saw a notable increase in late 2023 and early 2024, indicating persistent cost pressures.

These ongoing inflationary pressures directly impact project expenses, potentially squeezing profit margins for Sterling. The ability to pass these increased material and labor costs onto clients is crucial for maintaining profitability. Failure to do so could significantly impact earnings, especially on long-term contracts where price adjustments might be limited.

This economic headwind demands a proactive and vigilant approach to cost management. Sterling must employ strategic pricing models and explore innovative procurement strategies to mitigate the impact of volatile material prices and rising labor expenses throughout 2024 and into 2025.

The construction industry continues to grapple with a persistent shortage of skilled labor, a challenge that directly impacts Sterling Infrastructure. This scarcity necessitates increased investment in recruitment and training to secure the necessary workforce for ongoing and future projects.

This tight labor market is a primary driver of wage inflation. Construction firms, including Sterling Infrastructure, are experiencing rising operational costs as they compete for qualified workers, which also affects insurance premiums.

A sustained deficit in skilled construction professionals could lead to project delays and hinder Sterling Infrastructure's capacity to undertake new contracts or efficiently manage existing ones, potentially impacting revenue and profitability.

While the acute phase of pandemic-related supply chain issues has passed, Sterling Infrastructure, like others in the construction sector, continues to grapple with persistent delays in obtaining essential materials. Geopolitical tensions, such as ongoing conflicts impacting global shipping routes, and the increasing threat of cyberattacks on logistics providers, create unpredictable bottlenecks. For instance, the cost of key construction materials like lumber and steel saw significant fluctuations throughout 2024, with some reports indicating a 15-20% increase in certain categories due to these ongoing global uncertainties.

These disruptions directly translate into extended project timelines and escalating costs for Sterling Infrastructure. The need to potentially substitute materials to maintain schedules introduces risks related to quality and long-term performance. For example, a project originally slated for completion in late 2024 might now face delays into mid-2025, with cost overruns estimated between 5-10% due to these material sourcing challenges. This necessitates a proactive and resilient approach to supply chain management.

Economic Slowdown and Interest Rate Sensitivity

A general economic slowdown, potentially including a contraction in U.S. GDP, poses a significant threat by reducing overall construction demand, especially in residential and commercial sectors. For instance, if U.S. GDP growth forecasts for 2024 and 2025 are revised downward, it could directly translate to fewer infrastructure projects being initiated.

While interest rates are anticipated to ease, the persistence of higher rates or any unexpected hikes could continue to constrain construction financing and dampen market demand. This economic uncertainty directly influences clients' investment decisions, impacting the overall market for Sterling Infrastructure's services.

- Economic Slowdown Impact: A projected slowdown in U.S. GDP growth for 2024-2025 could curb overall construction spending.

- Interest Rate Sensitivity: Persistent higher interest rates or unexpected increases can hinder financing and reduce demand for construction services.

- Client Investment Uncertainty: Economic volatility makes clients more hesitant to commit to new projects, affecting Sterling's revenue pipeline.

Intensifying Competition and Market Saturation

The infrastructure sector, particularly areas like data center construction which saw significant growth in 2024, is experiencing increasing saturation as more companies enter the market. This heightened competition can force aggressive bidding, potentially squeezing profit margins for established players like Sterling Infrastructure. For instance, the demand for specialized construction services, driven by AI advancements, requires constant innovation, putting pressure on companies to invest heavily in new technologies to remain competitive.

Sterling Infrastructure faces the threat of intensifying competition as the high-growth data center market attracts new entrants. This influx of competitors can lead to more aggressive pricing strategies, potentially impacting profitability. The need for continuous innovation in areas like sustainable building practices and AI-ready infrastructure adds another layer of pressure, requiring significant investment to keep pace with evolving industry demands.

- Market Saturation: Increased investment in high-growth sectors like data centers is leading to a more crowded marketplace.

- Eroding Margins: Intensified competition may result in more aggressive bidding, potentially reducing profit margins.

- Innovation Pressure: Rapid advancements in AI and sustainability requirements necessitate continuous innovation, demanding significant R&D investment.

Persistent inflation continues to be a significant threat, with construction material costs remaining elevated. For example, while some commodity prices have stabilized, the cost of specialized components and skilled labor continues to drive up project expenses. This pressure directly impacts Sterling Infrastructure's ability to maintain healthy profit margins, especially on longer-term contracts where price adjustments are limited.

The ongoing shortage of skilled labor in the construction sector presents a critical challenge, leading to wage inflation and potential project delays. Sterling Infrastructure must invest more in recruitment and training to secure the workforce needed, which adds to operational costs. A sustained deficit in skilled professionals could hinder the company's capacity to take on new projects or efficiently manage existing ones, impacting overall revenue and profitability throughout 2024 and into 2025.

Supply chain disruptions, though less severe than during the pandemic's peak, persist due to geopolitical instability and logistical challenges. These issues can cause material delays and cost overruns, potentially extending project timelines. For instance, reports from late 2024 indicated that lead times for certain electrical components used in infrastructure projects had increased by 15-20%, impacting project schedules.

Economic uncertainty, including potential GDP slowdowns and the lingering effects of higher interest rates, poses a threat by dampening overall construction demand. Clients may become more hesitant to commit to new projects, impacting Sterling Infrastructure's future revenue pipeline. For example, revised U.S. GDP growth forecasts for 2024 and 2025, if lowered, could directly translate to fewer infrastructure projects being initiated.

Intensifying competition, particularly in high-growth sectors like data center construction, could lead to more aggressive bidding and potentially erode profit margins. The need for continuous innovation in areas like sustainable building practices and AI-ready infrastructure also demands significant investment to remain competitive, adding further pressure on Sterling Infrastructure.

SWOT Analysis Data Sources

This Sterling Infrastructure SWOT analysis is built upon a robust foundation of data, incorporating publicly available financial statements, comprehensive market research reports, and insights from industry experts to ensure a well-rounded and accurate assessment.