Sterling Infrastructure Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sterling Infrastructure Bundle

Sterling Infrastructure operates in a dynamic environment shaped by intense competition and the significant bargaining power of its clients. Understanding these forces is crucial for any stakeholder looking to grasp the company's strategic positioning.

The complete report reveals the real forces shaping Sterling Infrastructure’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Supplier concentration in the civil construction sector, which Sterling Infrastructure operates in, varies. While basic materials like concrete and steel might have numerous providers, specialized components for E-Infrastructure projects, such as advanced cooling systems for data centers, can originate from a more limited pool of suppliers. This concentration grants these specialized suppliers greater bargaining power.

The reliance on specific, often imported, materials for complex projects means Sterling Infrastructure could face increased costs if these key suppliers consolidate or face production disruptions. For example, the global shortage of semiconductors in 2022-2023 impacted various industries, and similar supply chain vulnerabilities for specialized construction equipment or materials could emerge in 2024-2025, amplifying supplier leverage.

Switching costs for Sterling Infrastructure's inputs are not uniform. For common construction materials, the ease of finding alternative suppliers means lower switching costs, thus limiting supplier leverage. However, in specialized sectors like E-Infrastructure, where Sterling builds data centers, the cost of changing suppliers for critical components, such as advanced cooling systems, can be substantial. This can involve significant expenses for retooling manufacturing processes or obtaining new certifications, directly enhancing supplier power.

Suppliers offering highly specialized inputs or technologies, particularly those essential for advanced data centers or intricate transportation projects, wield significant bargaining power. This stems directly from the unique nature of their products or services, making them difficult to substitute.

The escalating demand for AI computing power and the continued expansion of data center infrastructure are notably impacting the supply chains for critical components like power and cooling solutions. This surge in demand is leading to constrained supplier capacity, a situation that directly translates into potentially higher costs for companies like Sterling Infrastructure.

Threat of Forward Integration

The threat of forward integration by suppliers, while not a primary concern for Sterling Infrastructure, presents a nuanced challenge. Large material suppliers could, in theory, move into basic construction services, but the substantial capital investment and the highly project-specific nature of civil infrastructure work create significant barriers to entry for them. This makes widespread forward integration by these entities unlikely to directly threaten Sterling's core operations.

A more tangible, though still indirect, threat comes from specialized equipment manufacturers or technology providers. These companies might develop and offer integrated solutions that bundle equipment, software, and even basic installation services. This could potentially reduce Sterling's need for certain standalone services, thereby increasing the suppliers' leverage by offering a more complete package to clients.

- Limited Direct Threat: The capital intensity and project-specific demands of civil construction make it difficult for material suppliers to effectively integrate forward into Sterling's core business.

- Indirect Influence: Specialized equipment and technology providers pose a greater indirect threat by offering integrated solutions that may reduce the demand for certain Sterling services.

- Lower Overall Risk: Compared to other forces within the supplier bargaining power framework, the threat of forward integration is generally considered a lower risk for Sterling Infrastructure.

Importance of Supplier's Input to Sterling's Cost Structure

The cost of materials and labor represents a substantial segment of Sterling Infrastructure's overall project expenses. For instance, in 2024, the construction sector experienced ongoing volatility in raw material prices, with key inputs like steel and concrete seeing upward pressure due to supply chain disruptions and increased global demand.

These cost pressures directly influence Sterling's profitability, as elevated material expenses and persistent shortages of skilled labor, a trend expected to continue through 2025, can significantly increase the bargaining power of suppliers. This dynamic means suppliers can often dictate terms and pricing, impacting Sterling's margins.

- Material Costs: In 2024, the Producer Price Index for construction materials saw an average increase of 5.2% year-over-year, impacting Sterling's procurement expenses.

- Labor Shortages: The U.S. Bureau of Labor Statistics reported a deficit of over 400,000 skilled construction workers in early 2024, exacerbating wage pressures.

- Supplier Leverage: The combination of material price hikes and labor scarcity grants suppliers greater leverage in negotiating contract terms and pricing with infrastructure firms like Sterling.

- Profitability Impact: These factors directly squeeze Sterling's profit margins, especially on fixed-price contracts, highlighting the critical nature of supplier relationships.

The bargaining power of suppliers for Sterling Infrastructure is elevated when dealing with specialized components crucial for E-Infrastructure projects, such as advanced cooling systems for data centers. These specialized suppliers, often with limited competition, can command higher prices and dictate terms, especially given the increasing demand for AI computing power which strains supplier capacity.

Switching costs for these specialized inputs are substantial for Sterling, involving significant expenses for retooling or obtaining new certifications, thereby reinforcing supplier leverage. While common material suppliers have less power due to lower switching costs, the overall trend of rising material and labor costs in 2024, with construction materials up 5.2% year-over-year and a skilled labor deficit of over 400,000 workers, amplifies supplier influence across the board.

| Factor | Impact on Sterling Infrastructure | 2024 Data/Trend |

| Supplier Concentration (Specialized Inputs) | Increased pricing power and leverage | High demand for data center components |

| Switching Costs (Specialized Inputs) | Higher costs to change suppliers, reinforcing leverage | Significant investment required for alternatives |

| Material Cost Volatility | Directly impacts project expenses and profitability | 5.2% YoY increase in construction material prices |

| Skilled Labor Shortages | Drives up labor costs and supplier negotiation power | Over 400,000 skilled construction worker deficit |

What is included in the product

This analysis meticulously examines the five competitive forces impacting Sterling Infrastructure, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on its market position.

Instantly identify and quantify the strategic impact of each Porter's Five Forces on Sterling Infrastructure, enabling targeted mitigation of competitive pressures.

Customers Bargaining Power

Sterling Infrastructure's customer base is diverse, encompassing both public and private sectors. This duality significantly impacts customer bargaining power, particularly concerning concentration and size.

In the public sector, government agencies responsible for large infrastructure projects like highways and bridges often represent a concentrated group of buyers. These entities typically engage in rigorous competitive bidding, granting them considerable leverage over pricing and contract terms. For instance, in 2024, major transportation infrastructure projects often saw bids from multiple qualified contractors, intensifying price competition.

Similarly, Sterling's private sector clients, especially those in high-demand areas like data center construction or large-scale commercial development, are frequently large, sophisticated organizations. Their substantial project volumes and potential to award significant future work enable them to negotiate favorable pricing and contract conditions, directly influencing Sterling's profit margins.

Customer switching costs are a significant factor influencing the bargaining power of customers for civil construction companies like Sterling Infrastructure. For ongoing projects, the expense and disruption associated with switching contractors, such as re-bidding, potential project delays, and the inherent risk of engaging an unproven entity, can be substantial. This makes it difficult for customers to switch mid-project, thereby strengthening Sterling's position.

For instance, a major infrastructure project, like a highway or bridge construction, involves intricate planning and specialized equipment. A change in contractor mid-way can lead to significant cost overruns and schedule slippage, which customers are keen to avoid. This inherent stickiness in ongoing projects limits the immediate bargaining power of customers.

However, this dynamic shifts during the initial bidding phase for new projects. Customers can readily compare proposals from various civil construction firms, including Sterling, making it easier to switch to a competitor if pricing or proposed solutions are more attractive. In 2024, the competitive bidding landscape in the infrastructure sector remains robust, with numerous companies vying for contracts, giving customers considerable leverage at this stage.

Customer price sensitivity is a significant factor for Sterling Infrastructure. Both public sector entities, which are accountable for taxpayer funds, and private sector companies undertaking substantial capital projects exhibit a strong inclination towards cost-effectiveness. This is a direct consequence of the competitive nature of infrastructure project bidding, where the lowest responsible bid often secures the contract.

For instance, in 2023, the average bid-to-award ratio for many public works projects remained highly competitive, reflecting this price sensitivity. Companies like Sterling must meticulously manage their costs to remain attractive to these clients. This pressure can translate into demands for lower pricing, directly influencing Sterling's profit margins on awarded projects.

Threat of Backward Integration

The threat of customers integrating backward into Sterling Infrastructure's operations is generally low. Most clients do not possess the specialized expertise, heavy equipment, or the necessary scale to undertake complex civil construction projects independently.

While large private sector clients, such as major technology firms developing data centers, might maintain internal teams for project management or smaller site preparation tasks, they typically outsource the core, large-scale design, build, and maintenance functions. For the highly specialized and extensive services Sterling provides, backward integration by customers is not a substantial concern.

For instance, in 2024, the average cost of heavy construction equipment, like excavators and cranes, can run into hundreds of thousands or even millions of dollars, a significant barrier to entry for most clients. Furthermore, the specialized knowledge required for complex engineering and construction management is not readily available in-house for the majority of Sterling's clientele.

- Limited Client Expertise: Most customers lack the technical skills for complex civil construction.

- High Capital Investment: The cost of specialized equipment is prohibitive for clients.

- Scale Requirements: Clients typically do not have the operational scale for in-house construction.

- Outsourcing Core Competencies: Large clients often prefer to outsource specialized construction needs.

Availability of Information

The availability of information significantly bolsters customer bargaining power in the infrastructure sector. Clients, especially in the public realm, can readily access data on project expenses, industry standards, and competitor pricing. This is often facilitated through public tender documents, industry reports, and historical project records, providing a clear view of market value.

This transparency allows customers to negotiate more assertively, armed with knowledge of prevailing rates and the array of available service providers. For instance, in 2024, many government procurement portals offer detailed breakdowns of awarded contracts, enabling private sector clients to benchmark costs effectively. This informed position directly translates to stronger negotiation leverage for customers seeking infrastructure services.

- Informed Negotiations: Customers can leverage readily available data on project costs and industry benchmarks to negotiate more favorable terms.

- Benchmarking Capabilities: Access to past project data and competitor pricing allows clients to accurately assess fair market value.

- Increased Transparency: Public tenders and industry reports foster an environment where pricing and project details are more visible, empowering buyers.

Customers wield significant bargaining power due to the concentrated nature of large public sector projects and the substantial volume capabilities of major private sector clients. This leverage is amplified by the ease with which customers can compare bids during the initial project phase, especially in 2024's competitive bidding environment, where price sensitivity remains a key driver for cost-conscious public entities and large private developers.

Switching costs for ongoing projects offer Sterling some protection, but the transparency of information readily available through public tenders and industry reports in 2024 empowers customers to negotiate assertively. The threat of backward integration by customers is minimal, as most lack the specialized expertise and capital investment required for complex civil construction.

| Factor | Impact on Sterling Infrastructure | Supporting Data/Context (2024) |

| Customer Concentration & Size | High Bargaining Power | Major infrastructure projects often involve a few large public or private entities, enabling them to negotiate aggressively on price and terms. |

| Switching Costs (Mid-Project) | Low Bargaining Power for Customers | High costs and delays associated with changing contractors mid-project limit customer flexibility. |

| Switching Costs (Pre-Project) | High Bargaining Power for Customers | Easy comparison of bids in the competitive 2024 market gives customers significant leverage before project commencement. |

| Price Sensitivity | High Bargaining Power | Accountability for taxpayer funds (public) and focus on capital efficiency (private) drives demand for cost-effectiveness. |

| Threat of Backward Integration | Low Bargaining Power | Lack of specialized expertise and high capital investment for heavy equipment deters most clients from self-performing construction. |

| Information Availability | High Bargaining Power | Publicly accessible tender data and industry reports in 2024 allow clients to benchmark costs and negotiate from an informed position. |

What You See Is What You Get

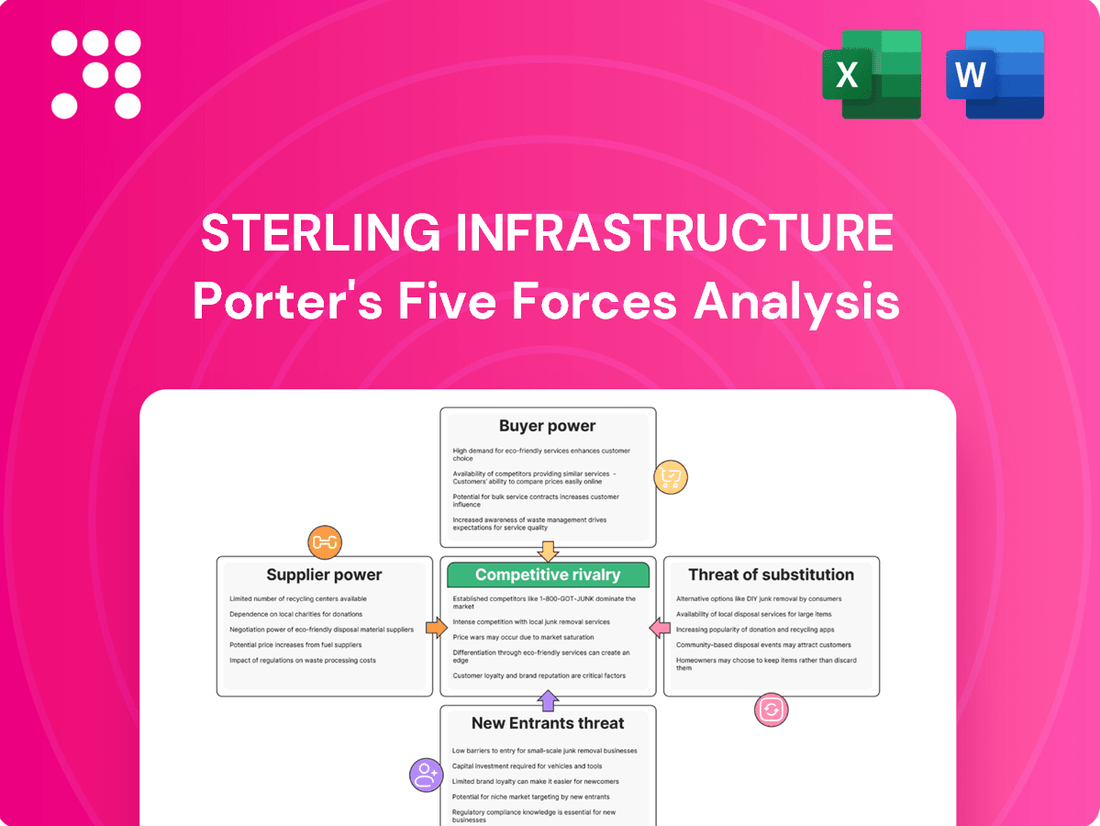

Sterling Infrastructure Porter's Five Forces Analysis

This preview shows the exact Sterling Infrastructure Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. It details the industry's competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing firms. This comprehensive analysis is professionally formatted and ready for your immediate use.

Rivalry Among Competitors

The U.S. civil construction landscape is quite fragmented, featuring a multitude of companies operating at local, regional, and national levels. Sterling Infrastructure navigates this environment by competing against a broad spectrum of entities, from niche, specialized outfits to massive, diversified construction giants. This sheer volume of players fuels a highly competitive atmosphere.

This intense competition is particularly evident in segments that require less specialized expertise, such as residential foundation work. In these areas, the high number of available contractors often leads to significant price pressures, impacting profit margins for all involved.

The U.S. civil construction sector is projected for moderate growth in 2025, fueled by significant government infrastructure spending, including the Bipartisan Infrastructure Law, and robust demand in areas such as data centers and manufacturing facilities. This anticipated expansion, however, intensifies competitive pressures as more firms enter the market and existing players seek to capitalize on increased opportunities.

Sterling Infrastructure distinguishes itself by focusing on specialized sectors like E-Infrastructure (data centers), transportation, and building solutions. This specialization, coupled with their proven track record on complex, large-scale projects, sets them apart from competitors who might offer more generalized civil construction services.

While the broader civil construction market can be highly competitive and prone to commoditization, Sterling's niche expertise, particularly in areas demanding significant capital investment and advanced technical capabilities, creates a degree of differentiation. This can lessen direct competitive pressure within these specialized segments.

Exit Barriers

Exit barriers in the civil construction sector, where Sterling Infrastructure operates, are notably high. This is largely due to the substantial capital tied up in specialized heavy machinery, such as excavators, cranes, and paving equipment, which have limited alternative uses. For instance, the cost of a single large-scale excavator can easily exceed $500,000.

Furthermore, companies often engage in long-term contracts, sometimes spanning several years, making it difficult and costly to exit mid-project without incurring significant penalties. The need for specialized labor, including skilled engineers, project managers, and equipment operators, also contributes to these barriers, as this expertise is not easily transferable to other industries.

- High Capital Investment: Significant upfront costs for specialized heavy equipment, often running into millions of dollars per company.

- Long-Term Contracts: Commitment to multi-year projects creates financial and operational obligations that are difficult to abandon.

- Specialized Labor Force: Reliance on skilled personnel whose expertise is industry-specific, hindering easy redeployment.

- Asset Specificity: Construction equipment is highly specialized and lacks broad resale value or alternative applications.

Intensity of Bidding and Pricing Pressure

Competitive bidding is fundamental in the civil construction sector, especially for government contracts. This dynamic inherently creates substantial pricing pressure, compelling firms such as Sterling Infrastructure to optimize their operations and bid aggressively to secure work.

The constant pursuit of projects, particularly those of significant scale, fuels a high level of rivalry within the industry. For instance, in 2024, the infrastructure sector saw robust competition for major transportation and utility projects, with numerous bids submitted for each opportunity.

- Bid intensity for public works projects directly impacts Sterling Infrastructure's pricing strategy.

- The need for efficiency to remain competitive on bids is a key operational driver.

- High rivalry is sustained by the ongoing competition for large-scale infrastructure contracts.

- In 2024, the market experienced intense bidding for transportation projects, reflecting this competitive pressure.

Competitive rivalry within the U.S. civil construction sector is intense, driven by a fragmented market and significant government infrastructure spending, such as the Bipartisan Infrastructure Law. Sterling Infrastructure competes against numerous firms, from specialized players to large diversified companies, particularly in less specialized areas where price pressure is high. This rivalry is further fueled by the constant bidding for large-scale projects, a trend clearly observed in 2024 with robust competition for transportation and utility contracts.

| Metric | Value | Year | Source/Notes |

|---|---|---|---|

| Number of U.S. Civil Engineering Firms | Over 100,000 | 2023 | U.S. Bureau of Labor Statistics (estimated) |

| Infrastructure Spending (Federal) | $130 Billion (approx.) | 2024 | Bipartisan Infrastructure Law allocation |

| Average Bid Competition Rate (Major Projects) | 5-10 Bidders | 2024 | Industry reports |

SSubstitutes Threaten

While traditional civil construction methods still dominate large-scale infrastructure projects, alternative methods like modular construction and prefabrication are gaining traction. These technologies can offer faster build times and potentially lower costs, particularly in sectors like residential and some commercial developments. For example, the global modular construction market was valued at approximately $76 billion in 2023 and is projected to grow significantly in the coming years, indicating a growing acceptance of these substitutes.

For less complex or smaller projects, major clients might explore bringing certain tasks in-house, particularly if they possess internal engineering or construction capabilities. However, the highly specialized nature of Sterling Infrastructure's large-scale infrastructure and E-Infrastructure projects demands significant expertise, specialized equipment, and a substantial operational scale that makes complete client insourcing a minimal threat.

Customers facing economic headwinds might choose to extend the lifespan of current infrastructure through maintenance rather than investing in new builds or major rehabilitation. This trend acts as a substitute threat, potentially dampening demand for Sterling Infrastructure's new project services. For instance, the foundation repair market is experiencing robust growth, with reports indicating a significant increase in demand as aging infrastructure necessitates more extensive upkeep.

Shifting Investment Priorities

Clients, especially government entities, may redirect their capital from traditional civil projects to other sectors. For instance, in 2024, there was a notable increase in government spending allocated towards digital infrastructure and social welfare programs, potentially diverting funds that might have otherwise gone to road or bridge construction. This shift represents a threat because it reduces the overall market size for Sterling's core services.

This reallocation of public funds acts as a substitute at a macro level. Instead of investing in physical infrastructure, governments might prioritize investments in areas like renewable energy grid upgrades or broadband expansion. For example, the Infrastructure Investment and Jobs Act in the US, while supporting traditional infrastructure, also earmarks significant funds for broadband deployment and clean energy initiatives, indicating a diversifying investment landscape.

The consequence for Sterling Infrastructure is a potential contraction in demand for its primary offerings. If public sector clients, a significant portion of Sterling's business, decide that technology or social services offer a better return on investment or address more pressing societal needs, Sterling's project pipeline could be negatively impacted.

- Public Sector Investment Diversification: Governments are increasingly allocating funds to non-traditional infrastructure areas such as digital connectivity and social programs, impacting demand for civil engineering services.

- Macro-Level Substitution: Investments in technology upgrades or social initiatives can serve as substitutes for traditional physical infrastructure projects, reducing the overall market for Sterling's core business.

- Impact on Demand: A shift in client priorities away from traditional civil infrastructure projects directly reduces the potential for Sterling Infrastructure to secure new contracts and maintain revenue streams.

Non-Consumption/Delayed Projects

Economic headwinds, such as elevated interest rates and potential regulatory shifts, can prompt clients to postpone or entirely cancel upcoming construction projects. This inaction acts as a powerful substitute for engaging Sterling Infrastructure's services.

This threat is particularly pronounced in the construction sector. For instance, data from early 2024 indicated a more cautious approach to capital expenditure on new construction machinery by many firms, reflecting broader economic anxieties. Furthermore, reports throughout 2024 and into 2025 highlighted a noticeable slowdown in new commercial construction starts in several key markets, underscoring the impact of delayed project decisions.

- Economic Downturns: Clients may halt or defer projects due to reduced profitability or access to capital.

- High Interest Rates: Increased borrowing costs make new construction projects less financially viable, leading to delays.

- Regulatory Uncertainty: Unclear or changing regulations can create a pause in investment decisions.

- Industry Impact: Slowing commercial construction spending in 2024 demonstrates the tangible effect of these substituting factors.

While traditional civil construction methods still dominate large-scale infrastructure projects, alternative methods like modular construction and prefabrication are gaining traction, offering faster build times and potentially lower costs. For instance, the global modular construction market was valued at approximately $76 billion in 2023 and is projected to grow significantly, indicating a growing acceptance of these substitutes.

Customers facing economic headwinds might choose to extend the lifespan of current infrastructure through maintenance rather than investing in new builds, acting as a substitute threat. For example, the foundation repair market is experiencing robust growth, with reports indicating a significant increase in demand as aging infrastructure necessitates more extensive upkeep.

Clients, particularly government entities, may redirect capital from traditional civil projects to other sectors. In 2024, there was a notable increase in government spending allocated towards digital infrastructure and social welfare programs, potentially diverting funds from road or bridge construction, thus reducing the market size for Sterling's core services.

Economic headwinds, such as elevated interest rates, can prompt clients to postpone or cancel upcoming construction projects, acting as a powerful substitute for engaging Sterling Infrastructure's services. Data from early 2024 indicated a more cautious approach to capital expenditure on new construction machinery by many firms, reflecting broader economic anxieties.

| Substitute Area | Description | Impact on Sterling Infrastructure | Supporting Data (2023-2024) |

|---|---|---|---|

| Alternative Construction Methods | Modular construction, prefabrication | Potential reduction in demand for traditional methods, faster project lifecycles | Global modular construction market ~$76 billion (2023), projected growth |

| Infrastructure Maintenance & Repair | Extending lifespan of existing infrastructure | Dampens demand for new construction and rehabilitation projects | Robust growth in foundation repair market |

| Public Sector Investment Diversification | Shifting funds to digital, social, or green initiatives | Reduced capital available for traditional civil projects | Increased 2024 government spending on digital infrastructure and social programs |

| Economic Slowdown & Project Deferral | Postponement or cancellation of projects due to economic uncertainty | Direct loss of potential contracts and revenue | Cautious capital expenditure on construction machinery (early 2024); slowdown in commercial construction starts (2024-2025) |

Entrants Threaten

Entering the civil construction sector, particularly for significant infrastructure undertakings, necessitates immense capital. This includes outlays for heavy machinery, specialized equipment, and a skilled workforce, creating a formidable barrier for prospective competitors.

Established players like Sterling Infrastructure leverage significant economies of scale in areas such as bulk material procurement, efficient project management software, and optimized equipment utilization. This scale allows them to negotiate better prices and streamline operations, creating a substantial cost advantage over newcomers.

New entrants would find it incredibly difficult to match Sterling's established operational efficiencies and would lack the deep industry experience and proven track record required to secure the large, complex public and private sector contracts that are the lifeblood of the infrastructure industry. For instance, in 2024, major infrastructure projects often require pre-qualification based on years of successful project completion and demonstrated financial stability.

The civil construction sector faces substantial regulatory barriers, demanding numerous licenses and permits. Sterling Infrastructure, like its peers, must navigate complex safety and environmental compliance, which are costly and time-consuming for newcomers. For instance, in 2024, the average time to obtain major construction permits in the US could extend several months, adding significant upfront investment and delaying project commencement for any new entrant.

Access to Distribution Channels/Client Relationships

Winning significant civil construction projects, the core business for companies like Sterling Infrastructure, heavily relies on deep-seated relationships with public sector entities, private developers, and a demonstrated history of success in competitive bidding. Newcomers face a steep climb in cultivating this trust and securing access to these vital client networks.

The barriers are substantial; a new entrant would struggle to replicate the years of experience and established rapport that incumbents possess. For instance, in 2024, major infrastructure tenders often require pre-qualification based on past project performance and existing client satisfaction metrics, making it difficult for unproven entities to even enter the bidding arena.

- Established Relationships: Incumbents like Sterling Infrastructure have cultivated long-term partnerships with key governmental bodies and private developers, essential for securing large-scale projects.

- Proven Track Record: A history of successful project completion and client satisfaction is a critical prerequisite, often demonstrated through extensive project portfolios and positive performance reviews.

- Competitive Bidding Nuances: Navigating the complexities of competitive bidding processes, which often favor established players with a known capacity and reliability, presents a significant hurdle for new entrants.

Specialized Expertise and Talent Shortages

Sterling Infrastructure's focus on E-Infrastructure, like data centers, and intricate transportation projects demands very specific engineering and construction skills. This specialization acts as a significant barrier for potential new companies looking to enter the market.

The construction sector, particularly for advanced technological projects, is grappling with ongoing shortages of skilled labor. For instance, the U.S. Bureau of Labor Statistics projected a need for 500,000 additional construction workers annually over the next decade, a figure that highlights the depth of the talent gap.

- Specialized Skill Sets: New entrants would need to attract and retain engineers with expertise in areas like high-voltage electrical systems for data centers or advanced structural design for complex bridges, which are not readily available.

- Talent Acquisition Challenges: The existing shortage means that new companies would face intense competition for a limited pool of qualified professionals, driving up labor costs and project timelines.

- High Training Investment: Developing the necessary in-house expertise through training programs represents a substantial upfront investment for any new player, further deterring entry.

The threat of new entrants in the civil infrastructure sector, where Sterling Infrastructure operates, is considerably low due to several formidable barriers. These include the immense capital required for heavy machinery and skilled labor, as well as the significant regulatory hurdles involving licenses and permits, which can take months to acquire in 2024. Furthermore, established players benefit from economies of scale in procurement and operations, creating a cost advantage that is difficult for newcomers to overcome.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High upfront investment for machinery, equipment, and skilled workforce. | Significant financial barrier, requiring substantial funding. |

| Economies of Scale | Cost advantages from bulk purchasing and optimized operations. | New entrants struggle to match cost efficiencies, impacting pricing. |

| Regulatory Hurdles | Complex licensing, permits, safety, and environmental compliance. | Lengthy and costly processes, delaying project entry. |

| Established Relationships & Track Record | Deep-seated trust with public sector, private developers, and proven success. | New entrants lack credibility and access to key contracts. |

| Specialized Skills & Talent Shortage | Need for specific engineering expertise and competition for limited skilled labor. | High labor costs and recruitment challenges for new firms. |

Porter's Five Forces Analysis Data Sources

Our Sterling Infrastructure Porter's Five Forces analysis leverages data from annual reports, SEC filings, and industry-specific market research reports. We also incorporate insights from trade publications and economic databases to provide a comprehensive view of the competitive landscape.