Sterling Infrastructure Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sterling Infrastructure Bundle

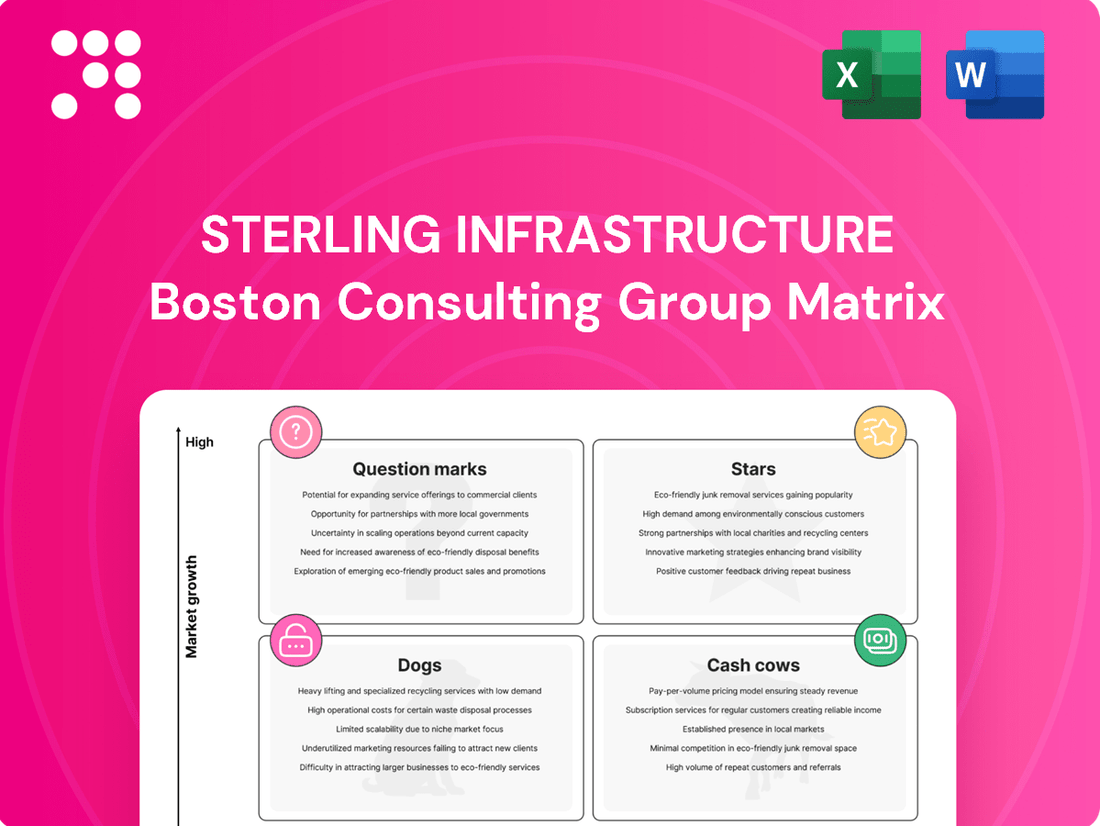

Uncover Sterling Infrastructure's strategic positioning with our exclusive BCG Matrix preview. See which segments are driving growth and which require careful consideration. Ready to transform this insight into action?

Purchase the full Sterling Infrastructure BCG Matrix to gain a comprehensive understanding of their product portfolio's market share and growth potential. This detailed analysis will equip you with the data-driven insights needed to make informed investment decisions and optimize resource allocation for maximum impact.

Stars

Sterling Infrastructure's E-Infrastructure Solutions segment, specifically its hyperscale data center construction, is a prime example of a Star in the BCG matrix. This segment is experiencing substantial growth, driven by the ever-increasing demand for artificial intelligence, cloud services, and broader digital transformation initiatives. The market for data center construction is anticipated to see considerable expansion between 2025 and 2030.

Sterling reported an impressive 18% revenue increase in this segment during the first quarter of 2025. Furthermore, data centers now represent over 65% of its E-Infrastructure backlog, a clear indicator of Sterling's strong market standing and the high demand for its services. The company's proven capability to successfully manage and deliver large, critical projects for leading technology firms further cements its significant market share in this rapidly expanding industry.

Sterling Infrastructure is making significant strides in constructing infrastructure for advanced manufacturing, particularly for semiconductor and biopharma facilities. This surge is fueled by the U.S. push for re-industrialization and strengthening supply chains. For instance, the CHIPS and Science Act, passed in 2022, allocated billions to boost domestic semiconductor manufacturing, creating a robust demand for specialized construction services like those Sterling offers.

Sterling's expertise in site development for these complex, high-tech plants is becoming increasingly valuable. The company is well-positioned to capture a larger share of this expanding market, which is crucial for national economic and technological security. The demand for such specialized infrastructure is projected to continue its upward trajectory through 2024 and beyond, as more companies look to bring critical manufacturing back to the United States.

Sterling Infrastructure is strategically prioritizing high-margin E-Infrastructure projects, including data centers and manufacturing facilities. This focus is driving significant operating income growth and margin expansion.

By concentrating on these large, mission-critical projects, Sterling is capturing a greater share of the most profitable work in a rapidly expanding market. This approach differentiates them from competitors and ensures consistent profitability.

The company's strong margin profile is a direct result of their superior execution capabilities and a proven track record of success in delivering complex projects. For example, in the first quarter of 2024, Sterling reported a 28% increase in revenue for their E-Infrastructure segment, alongside notable margin improvements.

Strategic E-Infrastructure Backlog Growth

Sterling Infrastructure's E-Infrastructure Solutions segment is a clear Star in its BCG matrix, evidenced by its robust backlog growth. By late 2024, this backlog surpassed $1 billion, marking a significant 27% increase from the previous year. This upward trajectory continued into the first quarter of 2025, showcasing sustained momentum.

This substantial backlog, combined with a promising pipeline of future projects, offers exceptional revenue visibility. It highlights the segment's dominant position in capturing high-growth opportunities within the e-infrastructure market.

- E-Infrastructure Backlog Value: Exceeded $1 billion by late 2024.

- Year-over-Year Growth: Achieved 27% growth in backlog by late 2024.

- Future Revenue Visibility: Strong visibility due to backlog and high-probability pipeline.

- Margin Improvement: Increasing backlog volume is accompanied by improved margins, reinforcing its Star status.

Geographic Concentration in High-Growth E-Infrastructure Markets

Sterling Infrastructure's strategic focus on high-growth E-Infrastructure markets within the U.S., particularly in regions like the Sun Belt, solidifies its Star position in the BCG Matrix. These areas, including Texas and Arizona, are experiencing substantial investment in data centers and advanced manufacturing, creating a fertile ground for Sterling's services.

By concentrating its efforts and resources in these geographies, Sterling is well-positioned to capitalize on robust demand and favorable business conditions. This targeted approach enhances its ability to secure significant market share in these rapidly expanding sectors, driving substantial growth.

- Geographic Focus: Sun Belt states like Texas and Arizona are key hubs for E-Infrastructure development, attracting significant capital.

- Market Drivers: Increased demand for data centers and reshoring of manufacturing operations fuel growth in these targeted regions.

- Sterling's Advantage: Strategic concentration allows for efficient resource allocation and a stronger competitive edge in high-demand E-Infrastructure markets.

- 2024 Data Insight: Texas alone saw over $10 billion in new semiconductor manufacturing announcements in early 2024, indicating substantial E-Infrastructure needs.

Sterling Infrastructure's E-Infrastructure Solutions segment is a definitive Star within its BCG matrix, characterized by high market growth and a strong competitive position. This segment, particularly its data center construction, is experiencing robust demand driven by AI and cloud computing growth. The company's strategic focus on high-margin projects like data centers and advanced manufacturing facilities, fueled by initiatives like the CHIPS Act, further solidifies its Star status. Sterling's significant backlog growth, exceeding $1 billion by late 2024, and expansion into high-growth regions like the Sun Belt underscore its market leadership and future potential.

| Segment | BCG Classification | Key Growth Drivers | 2024/2025 Performance Indicators |

|---|---|---|---|

| E-Infrastructure Solutions (Data Centers & Advanced Manufacturing) | Star | AI/Cloud Demand, U.S. Re-industrialization (CHIPS Act) | 18% Q1 2025 Revenue Growth, >65% E-Infrastructure Backlog for Data Centers, $1B+ Backlog (late 2024) |

What is included in the product

Sterling Infrastructure's BCG Matrix highlights which business units to invest in, hold, or divest based on market growth and share.

Quickly identify Sterling Infrastructure's Stars, Cash Cows, Question Marks, and Dogs for strategic resource allocation.

Cash Cows

Sterling Infrastructure's deep roots in core transportation infrastructure, particularly highways and bridges, firmly establish this segment as a Cash Cow within its portfolio. This mature market benefits from sustained government investment, exemplified by the Bipartisan Infrastructure Law, which guarantees consistent demand and solidifies Sterling's substantial market share.

These essential infrastructure projects are characterized by stable profit margins and generate robust cash flow, requiring comparatively modest reinvestment to maintain their position. For instance, in 2024, federal highway spending is projected to remain strong, supporting the predictable revenue streams Sterling derives from these long-standing projects.

Sterling Infrastructure's airport and port infrastructure segment operates as a Cash Cow. These projects, vital for national commerce and travel, represent a mature market with consistent demand for upgrades and maintenance. Sterling's deep experience and strong industry connections allow them to maintain a significant market share, translating into predictable and reliable cash flow.

Sterling Infrastructure's Public Sector Transportation Contracts are a prime example of a Cash Cow within its BCG matrix. A significant portion of its Transportation Solutions revenue, approximately 40% in 2024, stems from these stable, recurring agreements with government entities.

These contracts, often awarded through competitive bidding where Sterling's established reputation and extensive project history are significant differentiators, offer a predictable stream of future work. This consistent demand from public sector clients underpins the steady cash flow and robust profitability characteristic of a Cash Cow business.

Maintenance and Rehabilitation Services

Sterling Infrastructure's maintenance and rehabilitation services operate as a Cash Cow within its portfolio. This segment focuses on the upkeep of existing transportation infrastructure, a market characterized by steady demand and predictable revenue streams. Unlike new construction projects which can be more volatile, maintenance work offers a more stable and consistent cash flow, benefiting from the ongoing need to preserve and extend the life of public assets.

This business line typically demands less capital expenditure compared to large-scale new builds. Sterling leverages its established operational expertise and existing equipment, leading to higher profit margins. The recurring nature of maintenance contracts, often multi-year agreements, solidifies its position as a reliable generator of cash for the company. For instance, in 2024, the infrastructure maintenance sector is projected to see continued growth, driven by aging infrastructure across the United States requiring substantial investment.

- Stable Revenue: The continuous need for infrastructure upkeep ensures a predictable and consistent income stream.

- High Margins: Lower capital investment and utilization of existing capabilities contribute to strong profitability.

- Mature Market: This segment operates in a well-established market with consistent demand for services.

- Cash Flow Generation: It serves as a reliable source of cash, supporting other areas of Sterling's business.

Shift to Higher-Margin Transportation Projects

Sterling Infrastructure is strategically pivoting its Transportation Solutions segment. The focus is shifting from traditional, low-bid heavy highway projects to more profitable alternative delivery and design-build contracts. This move is designed to boost operating margins and overall profitability in the long run.

While this strategic shift might lead to a temporary dip in revenue or backlog, it's a calculated move to improve the segment's financial performance. By concentrating on these higher-margin opportunities, Sterling aims to ensure this segment remains a robust cash generator.

- Focus on Alternative Delivery and Design-Build Projects

- Aim for Enhanced Operating Margins

- Prioritize Long-Term Profitability Over Short-Term Revenue

- Maintain Strong Cash Generation within the Transportation Segment

Sterling Infrastructure's established presence in airport and port infrastructure solidifies this area as a Cash Cow. These segments benefit from consistent demand for upgrades and maintenance, reflecting their role in national commerce and travel. Sterling's deep industry expertise and strong relationships ensure a significant market share, translating into predictable and reliable cash flow generation.

The company's public sector transportation contracts are a clear Cash Cow, representing a substantial portion of its Transportation Solutions revenue, around 40% in 2024. These recurring agreements with government entities provide a stable, predictable stream of work, underpinned by Sterling's strong reputation and project history, leading to robust profitability.

Maintenance and rehabilitation services also function as a Cash Cow, focusing on the essential upkeep of existing transportation infrastructure. This market offers steady demand and predictable revenue, with lower capital expenditure compared to new builds. The recurring nature of these contracts, often multi-year, ensures a reliable cash flow, supported by the projected growth in infrastructure maintenance needs in 2024.

| Segment | BCG Classification | Key Characteristics | 2024 Relevance |

| Highway & Bridge Construction | Cash Cow | Mature market, stable government investment, consistent demand | Strong revenue from ongoing projects, supported by infrastructure spending |

| Airport & Port Infrastructure | Cash Cow | Vital for commerce, consistent upgrade/maintenance needs, high market share | Reliable cash flow from essential services |

| Public Sector Transportation Contracts | Cash Cow | Stable, recurring revenue, predictable work, strong client relationships | Approximately 40% of Transportation Solutions revenue |

| Maintenance & Rehabilitation Services | Cash Cow | Steady demand, predictable revenue, lower capex, high margins | Growth driven by aging infrastructure needs |

What You See Is What You Get

Sterling Infrastructure BCG Matrix

The Sterling Infrastructure BCG Matrix you are currently previewing is the exact, fully formatted document you will receive upon purchase. This comprehensive analysis, designed for strategic clarity, contains no watermarks or demo content, ensuring you get a professional and ready-to-use report. You can confidently download this file knowing it's the final version, immediately applicable to your business planning and competitive analysis.

Dogs

Sterling Infrastructure's Building Solutions segment, particularly its focus on residential foundations, falls into the Dogs category of the BCG Matrix. This is largely due to the highly cyclical nature of residential construction, especially in markets like Dallas-Fort Worth which have seen a cooling trend. Affordability issues and elevated interest rates have directly impacted demand, leading to low growth prospects for this specific business area.

In 2023, the U.S. housing market experienced a slowdown, with new housing starts declining compared to previous years, reflecting the challenges faced by residential foundation providers. Despite Sterling's strategic acquisitions aimed at bolstering its presence in this segment, the prevailing market conditions, characterized by fluctuating demand and limited growth, position it as a challenging area within the company's portfolio.

Legacy Low-Margin Building Solutions Projects in Sterling Infrastructure's portfolio likely represent smaller, less strategic ventures that don't align with the company's focus on large-scale infrastructure. These projects typically operate with thin profit margins, often due to intense local competition and limited opportunities for expansion, hindering their scalability and overall contribution to growth.

Underperforming regional operations or older equipment fleets within Sterling Infrastructure's Building Solutions or less strategic Transportation segments could be classified as Dogs in the BCG Matrix. For instance, if a specific regional construction unit consistently misses profit targets or if an aging fleet of specialized equipment requires excessive upkeep without yielding strong returns, these assets represent potential Dogs. In 2023, Sterling Infrastructure reported that its Building Solutions segment revenue grew by 14.4% year-over-year, reaching $1.3 billion, but this growth may mask pockets of underperformance.

Niche Building Projects with Limited Strategic Value

Certain niche building projects, particularly those with limited scope or highly specialized functions, may represent Dogs within Sterling Infrastructure's portfolio. These ventures, while potentially generating modest profits, often fail to contribute to economies of scale or establish broader market leadership for the company. For instance, a small-scale, highly localized specialized construction project, like a single, unique architectural feature for a private client, might fall into this category if it doesn't offer replicable expertise or significant revenue potential.

These projects can inadvertently divert valuable resources, including capital and management attention, away from Sterling's more promising Star or Cash Cow segments. In 2024, Sterling Infrastructure's focus remained on large-scale transportation and water infrastructure projects, which typically offer greater growth prospects and strategic alignment. Projects that do not enhance Sterling's core competencies or contribute to its overall market position are candidates for the Dog quadrant.

- Limited Scalability: Projects serving very specific, small markets or requiring highly bespoke solutions may not offer opportunities for expansion or replication.

- Resource Drain: Niche projects can consume management bandwidth and capital that could be more effectively deployed in segments with higher growth potential.

- Lack of Strategic Leverage: Without contributing to Sterling's overall market share or competitive advantage, these projects offer minimal strategic benefit.

- Individual Profitability vs. Portfolio Value: While a niche project might be profitable on its own, its contribution to Sterling's long-term strategic goals and overall portfolio value may be negligible.

Segments Impacted by Unfavorable Local Market Dynamics

Certain segments within Sterling Infrastructure’s Building Solutions or even specific areas of their Transportation business might exhibit Dog characteristics. This often occurs when operations are confined to local markets facing significant headwinds, such as aggressive price wars, persistent labor scarcity, or burdensome regulatory landscapes that stifle both profitability and expansion.

For example, Sterling's strategic move to reduce its exposure to low-bid heavy highway projects in Texas highlights a conscious effort to divest from a "Dog" segment within its transportation portfolio. This pivot is designed to improve overall profit margins by focusing on more lucrative opportunities.

- Intense Price Competition: Operating in markets where the lowest bid dictates contract awards can severely depress profit margins, making growth difficult.

- Labor Shortages: A lack of skilled labor in specific regions can increase operating costs and limit the ability to take on new projects, hindering expansion.

- Adverse Regulatory Environments: Unfavorable zoning laws, environmental regulations, or permitting processes can create significant barriers to entry and slow down project execution, impacting profitability.

- Strategic Divestment: Sterling's decision to exit certain low-margin, high-competition areas, like specific Texas highway work, is a classic strategy to shed "Dog" assets and reallocate resources to more promising ventures.

Sterling Infrastructure's "Dogs" are business units with low market share and low growth prospects, often characterized by low profitability and limited strategic value. These might include legacy projects or specific regional operations facing intense competition or unfavorable market conditions, such as the residential foundation business in cooling markets. The company's strategic divestment from low-bid heavy highway projects in Texas exemplifies shedding such Dog assets.

In 2023, while Sterling Infrastructure's Building Solutions segment saw revenue growth, certain niche or underperforming areas within this or the Transportation segment could still be classified as Dogs. These segments may suffer from limited scalability, resource drain, or a lack of strategic leverage, hindering their overall contribution to the company's portfolio value despite individual profitability.

Sterling's focus on large-scale transportation and water infrastructure projects in 2024 indicates a strategic shift away from areas with limited growth. Projects that do not enhance core competencies or market position, such as those with intense price competition or adverse regulatory environments, are prime candidates for the Dog quadrant, requiring careful management or divestment.

The company's decision to exit certain low-margin, high-competition areas, like specific Texas highway work, highlights a strategy to shed "Dog" assets and reallocate resources to more promising ventures, aiming to improve overall profit margins.

| Segment/Area | BCG Category | Key Characteristics | 2023/2024 Relevance |

|---|---|---|---|

| Residential Foundations (Dallas-Fort Worth) | Dog | Low market growth due to affordability issues and high interest rates; cyclical demand. | Continued market headwinds impacting growth prospects. |

| Legacy Low-Margin Building Solutions Projects | Dog | Limited scalability, thin profit margins due to competition, minimal strategic expansion opportunities. | Potential resource drain if not managed or divested. |

| Underperforming Regional Operations (e.g., specific Transportation units) | Dog | Consistently misses profit targets, aging equipment, high upkeep costs without strong returns. | May exist within broader segments like Transportation or Building Solutions. |

| Certain Niche Building Projects | Dog | Highly specialized, limited scope, don't contribute to economies of scale or market leadership. | May divert resources from higher-growth segments. |

| Low-Bid Heavy Highway Projects (Exited Texas) | Divested Dog | Intense price competition, low profit margins, strategic decision to exit. | Sterling's proactive move to improve overall profit margins. |

Question Marks

Emerging digital infrastructure, like smart city projects and advanced broadband expansion, presents a compelling "Question Mark" for Sterling Infrastructure. These areas offer substantial growth potential, but Sterling's current market share is likely limited, necessitating significant new investments in specialized skills and strategic alliances.

For instance, the global smart city market was projected to reach $2.5 trillion by 2026, indicating a massive opportunity. Sterling's involvement in these nascent sectors, such as deploying fiber optic networks for smart city applications or building specialized telecom infrastructure for 5G rollout in rural areas, would require developing new expertise and forging partnerships to capture a meaningful share of this expanding market.

Expanding into new U.S. geographic regions with limited current market share but high potential for E-Infrastructure or specialized Transportation projects represents a classic Question Mark for Sterling Infrastructure. These markets, such as the burgeoning semiconductor manufacturing hubs in the Southwest or the renewable energy infrastructure development in the Midwest, offer significant growth runways. For example, the U.S. Department of Transportation projected over $1 trillion in infrastructure needs through 2029, with a substantial portion dedicated to grid modernization and EV charging networks, areas where Sterling could leverage its expertise.

Sterling Infrastructure's heavy investment in advanced construction technologies, like AI for project management and robotics, positions these initiatives as Question Marks within its BCG Matrix. These technologies offer substantial future growth potential and efficiency gains, crucial for staying competitive. For instance, AI-powered project management tools can optimize scheduling and resource allocation, potentially reducing project timelines by up to 15% based on industry benchmarks, a key driver for future market share expansion.

Specialized Energy Transition Infrastructure

Sterling Infrastructure's venture into specialized civil infrastructure for the energy transition, beyond its existing data center focus, could be classified as a Question Mark in the BCG Matrix. This segment, encompassing grid modernization, large-scale battery storage, and offshore wind support, represents a high-growth area. For example, the global grid modernization market was projected to reach $150 billion by 2025, with significant investments flowing into renewable energy integration.

While the market potential is substantial, Sterling may currently hold a low market share in these specific niches. This necessitates strategic investment to cultivate expertise and establish a competitive edge. The demand for such infrastructure is driven by ambitious renewable energy targets; for instance, the U.S. aims for 100% clean electricity by 2035, requiring massive upgrades to transmission and storage capabilities.

- High Growth Potential: The global energy transition infrastructure market is expanding rapidly, driven by decarbonization efforts and the integration of renewable energy sources.

- Market Share Challenge: Sterling may face established players or require significant investment to gain traction in specialized sub-segments like offshore wind foundations or advanced battery storage facilities.

- Strategic Investment Needed: Building capabilities in areas such as advanced engineering for offshore wind or specialized construction for large-scale battery systems will be crucial for success.

- Future Potential: Successfully navigating these specialized niches could position Sterling as a key player in a critical future industry, offering substantial long-term returns.

Diversification into Complex Environmental Infrastructure

Diversifying into complex environmental infrastructure, like advanced water treatment plants or major climate resilience initiatives, represents a potential Question Mark for Sterling Infrastructure. These sectors are experiencing significant growth, driven by stricter environmental mandates and the escalating impacts of climate change.

Sterling would likely enter these markets with a modest market share, necessitating the acquisition of specialized expertise and relevant certifications to establish a competitive foothold. For instance, the global water and wastewater treatment market was valued at approximately $630 billion in 2023 and is projected to grow significantly, offering substantial opportunities but also demanding high technical proficiency.

- Market Opportunity: Growing demand for advanced water treatment and climate resilience projects.

- Challenges: Requires specialized expertise and certifications to compete.

- Potential Investment: Significant R&D or acquisition costs to build capability.

- Strategic Consideration: Balancing market growth with internal capacity development.

Sterling Infrastructure's expansion into new geographic markets with high growth potential but currently low market share, such as emerging tech hubs or renewable energy development zones, fits the Question Mark category. These ventures require significant investment to build brand recognition and operational capacity.

For example, the U.S. infrastructure spending outlook remains strong, with the Biden administration's Bipartisan Infrastructure Law allocating substantial funds through 2026, creating opportunities in underserved regions where Sterling may need to establish a stronger presence.

| Initiative | Market Growth Potential | Current Market Share | Investment Required | Strategic Focus |

| New Geographic Expansion (e.g., Southwest Semiconductor Hubs) | High | Low | High | Market Penetration, Local Partnerships |

| Advanced Digital Infrastructure (e.g., 5G Rural Expansion) | High | Low | High | Technology Acquisition, Skill Development |

| Energy Transition Infrastructure (e.g., Grid Modernization) | High | Low | High | Specialized Expertise, Project Execution |

BCG Matrix Data Sources

Our Sterling Infrastructure BCG Matrix is powered by comprehensive data, including financial disclosures, project performance metrics, and industry growth forecasts, ensuring accurate strategic positioning.