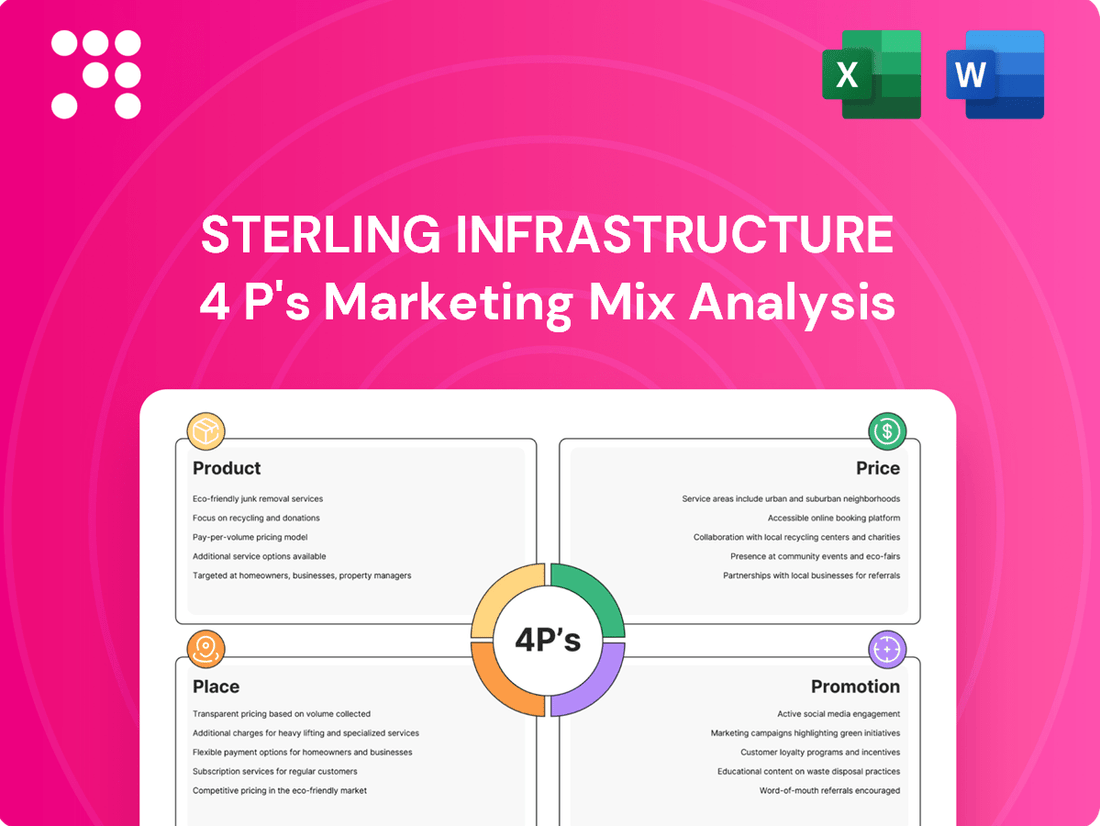

Sterling Infrastructure Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sterling Infrastructure Bundle

Discover how Sterling Infrastructure leverages its product offerings, strategic pricing, targeted distribution, and impactful promotions to dominate the infrastructure sector. This analysis goes beyond the surface, revealing the core elements of their marketing success.

Want to understand the complete picture? Get access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Sterling Infrastructure's E-Infrastructure Solutions focus on providing comprehensive, large-scale site development for critical digital facilities. This encompasses everything from data centers to semiconductor plants, ensuring the foundational groundwork for these essential operations.

The company's expertise spans the entire site development lifecycle, including initial earthmoving and the intricate installation of underground utilities. This end-to-end capability is crucial for the complex needs of modern digital infrastructure projects.

Data center-related revenue is a significant growth driver for Sterling Infrastructure, forming a substantial part of its E-Infrastructure backlog. As of the first quarter of 2024, the company reported a record backlog of $2.3 billion, with E-Infrastructure representing a significant portion, demonstrating strong demand for these specialized services.

Sterling Infrastructure's Transportation Solutions segment is a cornerstone of its operations, concentrating on the vital infrastructure and rehabilitation of highways, roads, bridges, airports, ports, rail, and storm drainage systems. The company is actively engaged in significant transportation initiatives throughout the United States, with a notable presence in the Rocky Mountain and Arizona areas, undertaking complex interchange and corridor projects.

Strategically, Sterling has pivoted from less profitable heavy highway construction in Texas. This shift is geared towards prioritizing higher-margin areas such as aviation and rail, a move designed to drive continued margin expansion, with projections indicating positive impacts into 2025. For instance, in the first quarter of 2024, the transportation segment revenue reached $159.8 million, a substantial increase from $126.4 million in the same period of 2023, reflecting this strategic focus.

Sterling Infrastructure's Building Solutions segment offers comprehensive concrete foundation services for both residential and commercial projects, including single-family and multi-family homes, parking structures, and elevated slabs. This division also encompasses essential plumbing and surveying services for new residential construction in high-growth areas such as Houston, Phoenix, and Dallas-Fort Worth.

Despite recent market fluctuations, Sterling anticipates sustained demand over the coming years. The company bolstered its residential capabilities with the strategic acquisition of Drake Concrete in early 2025, a move designed to enhance its service breadth and market penetration.

Specialized Design-Build Capabilities

Sterling Infrastructure's Specialized Design-Build Capabilities represent a key strength in their product offering. They excel at tackling complex, large-scale infrastructure projects by integrating engineering and construction expertise. This approach is particularly valuable for clients seeking a single point of accountability and a streamlined delivery process for intricate developments.

This capability allows Sterling to secure projects demanding advanced site development and integrated solutions, where precision and coordination are paramount. For instance, their involvement in projects like the $1.3 billion expansion of the Denver International Airport's Great Hall showcases their ability to manage highly complex, multi-faceted undertakings, demonstrating a strong track record in delivering on time and within scope.

Sterling's design-build expertise translates into tangible benefits for clients:

- Enhanced Project Efficiency: Combining design and construction phases under one roof minimizes delays and potential conflicts.

- Cost Predictability: A single contract often leads to more accurate cost forecasting and control.

- Innovation and Value Engineering: Early collaboration between design and construction teams fosters innovative solutions and cost savings.

- Reduced Client Risk: Sterling assumes greater responsibility for project outcomes, simplifying the client's management burden.

Maintenance and Rehabilitation Services

Sterling Infrastructure's commitment extends beyond new builds to crucial maintenance and rehabilitation services for existing infrastructure. These offerings are vital for ensuring the continued longevity and peak performance of critical assets such as highways and bridges. This focus on upkeep provides Sterling with a stable, recurring revenue stream.

These rehabilitation services are key to Sterling's strategy for building enduring client relationships. By guaranteeing the ongoing functionality and safety of their infrastructure investments, Sterling demonstrates its dedication to long-term asset value. For instance, in 2023, Sterling's Infrastructure segment, which includes these services, reported revenue of $1.1 billion, showcasing the significant contribution of maintenance and rehabilitation to their overall financial health.

- Revenue Diversification: Maintenance and rehabilitation services provide a consistent revenue stream, reducing reliance on new construction cycles.

- Client Retention: Ensuring the longevity and performance of existing assets fosters strong, long-term relationships with clients.

- Asset Lifecycle Management: Sterling actively participates in the entire lifecycle of infrastructure projects, from creation to upkeep.

- Market Position: This service offering solidifies Sterling's role as a comprehensive infrastructure solutions provider.

Sterling Infrastructure's product offering is multifaceted, encompassing E-Infrastructure, Transportation, and Building Solutions, all underpinned by specialized design-build capabilities and a commitment to maintenance and rehabilitation. The E-Infrastructure segment, particularly data center site development, is a significant growth engine, with a record backlog of $2.3 billion in Q1 2024. The Transportation segment focuses on high-margin areas like aviation and rail, showing a revenue increase to $159.8 million in Q1 2024 from $126.4 million in Q1 2023. Building Solutions, strengthened by the early 2025 acquisition of Drake Concrete, provides comprehensive foundation and plumbing services for residential and commercial projects.

| Segment | Key Offerings | 2024 Q1 Revenue | Growth Driver | Strategic Focus |

|---|---|---|---|---|

| E-Infrastructure | Data center & semiconductor site development, earthmoving, underground utilities | N/A (Part of Infrastructure Segment) | Digital infrastructure demand, record backlog of $2.3B (Q1 2024) | Large-scale digital facility groundwork |

| Transportation | Highways, roads, bridges, airports, rail, storm drainage | $159.8 million | Shift to higher-margin aviation/rail projects | Complex interchange and corridor projects |

| Building Solutions | Residential & commercial concrete foundations, plumbing, surveying | N/A (Part of Infrastructure Segment) | Acquisition of Drake Concrete (early 2025), high-growth residential markets | Enhancing service breadth in residential construction |

What is included in the product

This analysis provides a comprehensive breakdown of Sterling Infrastructure's marketing mix, detailing their strategies for Product, Price, Place, and Promotion to understand their market positioning and competitive advantages.

Streamlines Sterling Infrastructure's marketing strategy by clearly defining Product, Price, Place, and Promotion, alleviating the pain of unclear brand positioning.

Simplifies complex marketing decisions by presenting Sterling Infrastructure's 4Ps in a clear, actionable framework, reducing the burden of strategic planning.

Place

Sterling Infrastructure’s nationwide operations, with a strategic emphasis on high-growth areas like the Southern, Northeastern, Mid-Atlantic, and Rocky Mountain regions, alongside the Pacific Islands, allows it to capitalize on a broad spectrum of infrastructure projects. This expansive footprint, covering diverse economic landscapes, is a key element of its market strategy.

This broad geographic reach, as of early 2024, enables Sterling to tap into various regional development initiatives and infrastructure spending plans. For instance, the company's presence in the Southern US aligns with significant transportation and utility upgrades occurring in states like Texas and Florida.

By maintaining strong local expertise and relationships in these key areas, Sterling Infrastructure can effectively navigate regional regulatory environments and secure diverse project opportunities. This strategic diversification of its operational base helps to buffer against localized economic downturns, ensuring a more stable revenue stream.

Sterling Infrastructure's direct client engagement model is a cornerstone of its marketing strategy, particularly for its E-Infrastructure segment. The company actively pursues and cultivates relationships directly with key stakeholders in both the public and private sectors. This approach is vital for navigating the complexities of large-scale projects.

By engaging directly with entities like state Departments of Transportation and major blue-chip corporations, Sterling ensures a deep understanding of client needs and project specifications. This direct line of communication is critical for tailoring solutions and fostering the trust necessary for long-term infrastructure partnerships, a strategy that has proven effective in securing substantial contracts.

Sterling Infrastructure's project-based on-site delivery is central to its marketing mix, directly addressing the 'Place' element. Their services, particularly in heavy civil construction and infrastructure, are executed at the physical locations where these massive projects unfold. This means the 'place' is not a retail store, but a construction site, whether it's a highway, bridge, or utility network.

This on-site model demands sophisticated logistical planning and execution. Sterling must efficiently mobilize vast amounts of equipment, materials, and skilled labor to diverse and often remote locations. For instance, in their 2024 fiscal year, Sterling reported significant project activity across multiple states, highlighting the complexity of managing operations at numerous geographically dispersed sites simultaneously.

Strategic Joint Ventures and Partnerships

Sterling Infrastructure leverages strategic joint ventures and partnerships to tackle larger, more complex projects and broaden its market presence. These collaborations are crucial for accessing specialized skills and financial capacity needed for significant infrastructure development.

For instance, in 2024, Sterling participated in several large-scale transportation projects, demonstrating the power of these alliances. These ventures allow Sterling to share risks and rewards while enhancing its bidding power on major public and private sector contracts. The company’s approach to partnerships is a key driver of its ability to secure and execute high-value infrastructure work.

- Increased Capacity: Joint ventures allow Sterling to bid on and manage projects exceeding its standalone capabilities.

- Risk Mitigation: Sharing financial and operational risks with partners makes undertaking large projects more feasible.

- Expertise Sharing: Partnerships provide access to specialized knowledge and technology from other firms.

- Market Expansion: Collaborations can open doors to new geographic regions or project types.

Bid and Tender Process

Sterling Infrastructure heavily relies on formal bid and tender processes, particularly for securing public sector contracts. This competitive arena is where a substantial portion of their project pipeline is developed, showcasing their established reputation and technical prowess. The company's active engagement in these tenders acts as a primary distribution channel for new business opportunities.

In 2024, Sterling Infrastructure demonstrated its competitive edge by winning key infrastructure projects through these formal processes. For instance, the company secured a significant highway expansion project valued at over $150 million via a competitive bidding process in Texas. This win highlights their ability to effectively navigate and succeed in environments demanding rigorous technical proposals and cost-effective solutions.

- Project Acquisition Channel: Formal bid and tender processes are a critical distribution mechanism for Sterling Infrastructure, especially for public works.

- Competitive Advantage: The company leverages its strong reputation, technical expertise, and proven project delivery record to win bids.

- 2024 Successes: Sterling secured major contracts, such as a $150+ million highway project, through successful participation in competitive tender processes.

- Strategic Focus: Continued active participation in these bidding environments remains a core strategy for future project acquisition and growth.

Sterling Infrastructure's "Place" is fundamentally tied to the physical locations of its projects, emphasizing on-site execution. This means their service delivery happens directly at construction sites, from highways to utility networks, requiring extensive logistical capabilities to manage diverse and often remote operational areas.

The company's strategic geographic footprint, particularly in high-growth regions like the Southern US, allows it to align with significant infrastructure development and spending initiatives. This broad operational base, as of early 2024, enables Sterling to tap into various regional needs and secure a diverse project portfolio.

Sterling's distribution strategy heavily relies on formal bid and tender processes, acting as a primary channel for new business, especially within the public sector. Their success in winning contracts, such as a $150+ million highway project in Texas in 2024, underscores their competitive positioning and technical proficiency.

Furthermore, strategic joint ventures and partnerships expand Sterling's reach and capacity, enabling them to undertake larger, more complex projects. These collaborations are vital for accessing specialized expertise and financial resources, as seen in their participation in multiple large-scale transportation projects throughout 2024.

Same Document Delivered

Sterling Infrastructure 4P's Marketing Mix Analysis

The preview you see here is the actual Sterling Infrastructure 4P's Marketing Mix Analysis you’ll receive instantly after purchase—no surprises. This comprehensive document details Product, Price, Place, and Promotion strategies. You can be confident that the content is complete and ready for your immediate use.

Promotion

Sterling Infrastructure prioritizes clear communication with investors and the financial world. This involves regular earnings calls, investor presentations, and annual reports, all designed to showcase their financial health, strategic goals, and upcoming projects. For instance, their Q1 2024 earnings call on May 1, 2024, detailed significant backlog growth, a key indicator for future performance.

These efforts are crucial for drawing in and keeping financially savvy individuals and institutions. By providing detailed data and insights, Sterling Infrastructure ensures these stakeholders have a comprehensive understanding of the company's value proposition and future prospects, supporting informed investment decisions.

Sterling Infrastructure actively engages in key industry conferences and trade shows, a crucial element of its promotional strategy. These events serve as vital platforms for Sterling to not only display its extensive capabilities across E-Infrastructure, Transportation, and Building Solutions but also to foster valuable connections with potential clients and strategic partners.

By participating in these gatherings, Sterling Infrastructure gains direct exposure to market intelligence and emerging trends, ensuring it remains at the forefront of the civil construction sector. For instance, in 2024, Sterling's presence at events like the World of Concrete and the American Public Works Association Congress allowed them to directly engage with over 50,000 industry professionals, showcasing their project successes and technological advancements.

Sterling Infrastructure leverages public relations to broadcast major project wins, strategic acquisitions, and crucial operational achievements, aiming for favorable media attention. For instance, in early 2024, the company announced a significant contract expansion for its Infrastructure segment, contributing to a robust backlog.

Through press releases and news features, Sterling showcases its role in vital infrastructure projects, thereby boosting its brand image and recognition among industry peers and investors alike. This strategic communication reinforces its position as a key player in the sector, as evidenced by its consistent project pipeline growth throughout 2024.

Corporate Website and Digital Presence

Sterling Infrastructure’s corporate website acts as a crucial digital storefront, offering a comprehensive overview of its diverse services, completed projects, and investor relations. This platform is key to communicating the company's value proposition and showcasing its extensive portfolio. For instance, as of early 2024, the company highlighted significant projects in infrastructure development, demonstrating its capabilities to a global audience.

The company's digital presence extends beyond its website, encompassing various online channels to attract both clients and potential employees. This modern and accessible format effectively communicates Sterling's commitment to innovation and sustainability. In 2024, Sterling Infrastructure continued to emphasize its ESG (Environmental, Social, and Governance) initiatives online, aligning with investor and stakeholder expectations for responsible corporate behavior.

- Centralized Information Hub: The corporate website serves as the primary source for details on Sterling's service offerings, project successes, and financial performance, crucial for informed decision-making by investors and partners.

- Value Proposition Communication: Sterling leverages its digital presence to clearly articulate its competitive advantages and commitment to quality in the infrastructure sector.

- Talent Acquisition: A robust online presence is vital for attracting top talent by showcasing company culture, career opportunities, and recent achievements, especially in a competitive industry.

- Investor Relations Gateway: The website provides essential information for investors, including annual reports, SEC filings, and news updates, facilitating transparency and engagement.

Client Testimonials and Case Studies

Sterling Infrastructure effectively leverages client testimonials and detailed case studies as key promotional elements. These highlight successful project completions and positive client feedback, showcasing the company's ability to manage complex civil construction projects efficiently. For instance, in the fiscal year ending March 31, 2024, Sterling Infrastructure reported a significant increase in its order book, reflecting growing client confidence built on past performance.

These materials serve to build trust and credibility, crucial in the competitive civil construction sector. By demonstrating a consistent track record of delivering projects on time and within budget, Sterling Infrastructure reinforces its reputation. This approach directly addresses potential clients' concerns about reliability and execution capabilities, differentiating Sterling in a crowded market.

The company's promotional strategy emphasizes these real-world successes to attract new business. Specific examples of projects, coupled with client endorsements, provide tangible proof of Sterling's expertise. This focus on proven results is particularly impactful for securing large-scale infrastructure contracts where a history of successful delivery is paramount.

Key aspects highlighted through testimonials and case studies include:

- On-time and within-budget project delivery: Proven ability to manage complex timelines and financial constraints.

- Client satisfaction and trust: Positive feedback reinforcing strong working relationships and reliable service.

- Technical expertise and execution capability: Demonstrating proficiency in handling diverse and challenging civil engineering projects.

Sterling Infrastructure's promotional efforts center on transparent communication, industry engagement, and showcasing project success. Their Q1 2024 earnings call highlighted substantial backlog growth, demonstrating future revenue potential to investors. Participation in key 2024 industry events like World of Concrete connected them with over 50,000 professionals, enhancing visibility and networking.

Public relations efforts, including announcements of significant contract wins in early 2024, bolster Sterling's brand image. Their corporate website acts as a digital hub, detailing services and projects, with a 2024 emphasis on ESG initiatives to attract stakeholders. Client testimonials and case studies further solidify credibility, underscoring their proven ability to deliver projects on time and within budget, a critical factor in securing new contracts.

| Promotional Tactic | Key Activity/Focus | Impact/Data Point (2024/2025) |

|---|---|---|

| Investor Communications | Earnings Calls, Investor Presentations | Q1 2024 earnings call detailed significant backlog growth. |

| Industry Engagement | Conferences, Trade Shows | Presence at World of Concrete and APWA Congress engaged 50,000+ professionals. |

| Public Relations | Press Releases, News Features | Announced significant contract expansion for Infrastructure segment in early 2024. |

| Digital Presence | Corporate Website, Online Channels | Highlighted infrastructure projects; emphasized ESG initiatives in 2024. |

| Client Proof Points | Testimonials, Case Studies | Showcased successful project delivery, contributing to increased client confidence. |

Price

Sterling Infrastructure's pricing strategy is deeply rooted in competitive bidding, especially for public sector contracts where bids are often submitted on a fixed-price basis. This approach necessitates meticulous cost estimation to ensure profitability while remaining competitive. For instance, in the fiscal year 2023, the company secured a significant portion of its revenue from public infrastructure projects, highlighting the importance of their bidding acumen.

For private sector clients, Sterling employs a project-specific quoting system. This allows for a more customized pricing model, directly reflecting the unique demands of each project, from intricate design specifications to specialized material requirements. This bespoke approach ensures that clients receive pricing that accurately aligns with the scope, complexity, and resource allocation needed, fostering transparency and mutual understanding.

Sterling Infrastructure leverages value-based pricing for its high-margin E-Infrastructure services, such as data centers and semiconductor facilities. This strategy aligns pricing with the significant value clients derive from timely, mission-critical project completion. For instance, in 2024, the company's backlog in the E-Infrastructure segment reached $1.4 billion, underscoring the demand for these specialized, high-value services.

Sterling Infrastructure is strategically focusing on expanding its profit margins by prioritizing projects that yield higher returns. This means they're being more selective, steering clear of the lower-margin, heavy highway construction projects where possible.

This disciplined approach to project selection directly impacts their pricing strategy, as Sterling aims to get the most out of its invested capital. For instance, in Q1 2024, Sterling reported a gross margin of 18.6%, an increase from 17.3% in Q1 2023, demonstrating the effectiveness of this margin expansion initiative.

Consideration of Economic and Market Factors

Sterling Infrastructure's pricing strategy is a fluid response to the economic landscape and competitive environment. They actively adjust their bids and contracts based on what competitors are charging, the current demand for their services, and broader economic trends, such as the cost of materials like asphalt and concrete, and the availability of skilled labor. For instance, in 2023, the company noted that input costs for key materials had stabilized after earlier volatility, allowing for more predictable pricing.

The company's approach involves a keen eye on market trends and the strength of its project backlog. This ensures that their pricing remains competitive within the infrastructure sector while still safeguarding profitability. By understanding current industry dynamics, Sterling Infrastructure aims to capture value effectively.

- Competitor Pricing: Sterling Infrastructure actively monitors bids from other major infrastructure contractors to benchmark their own pricing.

- Market Demand: High demand for infrastructure projects, particularly in sectors like transportation and utilities, allows for more robust pricing.

- Economic Conditions: Fluctuations in fuel prices, steel costs, and labor wages directly influence the cost basis and, consequently, Sterling's pricing decisions.

- Backlog Quality: The company prioritizes securing projects with favorable contract terms and pricing structures to ensure long-term profitability.

Long-Term Contracts and Escalation Clauses

Sterling Infrastructure frequently secures long-term contracts, a key element in its pricing strategy. These agreements often incorporate escalation clauses, designed to protect against rising material and labor costs throughout the project lifecycle. This proactive approach is crucial for maintaining profitability on multi-year infrastructure developments.

These clauses provide Sterling with revenue stability, especially for large-scale projects that span several years. For instance, in 2023, the company reported that a significant portion of its backlog was secured under long-term agreements, mitigating the impact of economic volatility.

- Long-Term Contracts: Provide predictable revenue streams and reduce project-specific risk.

- Escalation Clauses: Protect profit margins by allowing for adjustments to contract prices based on inflation or material cost increases.

- Risk Management: These provisions are vital for managing financial exposure in complex, multi-year infrastructure projects.

- Profitability Assurance: Help ensure that Sterling's projects remain profitable even with fluctuating input costs.

Sterling Infrastructure's pricing is competitive, especially for public projects with fixed bids, requiring precise cost management. For private clients, they use custom quotes reflecting project specifics. For high-value E-Infrastructure, they employ value-based pricing, aligning costs with client benefits. For example, their E-Infrastructure backlog reached $1.4 billion in 2024.

The company is actively shifting focus to higher-margin projects, moving away from lower-return heavy highway construction. This strategic selection aims to maximize capital returns, evidenced by a gross margin increase to 18.6% in Q1 2024 from 17.3% in Q1 2023.

Sterling Infrastructure's pricing adapts to market dynamics, competitor pricing, and economic factors like material costs. They leverage long-term contracts with escalation clauses to manage risks and ensure profitability on multi-year projects, with a significant portion of their 2023 backlog secured under such agreements.

| Pricing Strategy Element | Description | Impact on Sterling Infrastructure | Example/Data Point |

|---|---|---|---|

| Competitive Bidding | Fixed-price bids for public contracts. | Requires tight cost control for profitability. | Significant revenue from public infrastructure in FY2023. |

| Project-Specific Quoting | Customized pricing for private sector projects. | Aligns price with unique project scope and complexity. | Ensures transparency and mutual understanding. |

| Value-Based Pricing | Pricing based on client-derived value. | Maximizes returns on high-margin services. | E-Infrastructure backlog of $1.4 billion in 2024. |

| Margin Expansion Focus | Prioritizing higher-return projects. | Improves overall profitability and capital efficiency. | Gross margin increased to 18.6% in Q1 2024. |

| Market & Economic Adaptation | Adjusting prices based on competition, demand, and costs. | Maintains competitiveness and safeguards margins. | Material costs stabilized in 2023 after volatility. |

| Long-Term Contracts with Escalation | Securing multi-year agreements with cost adjustments. | Provides revenue stability and protects against cost increases. | Significant portion of 2023 backlog under long-term agreements. |

4P's Marketing Mix Analysis Data Sources

Our Sterling Infrastructure 4P's Marketing Mix Analysis leverages a comprehensive blend of primary and secondary data sources. This includes official company filings, investor relations materials, and detailed analysis of their project portfolio and operational strategies.