Sterling Infrastructure PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sterling Infrastructure Bundle

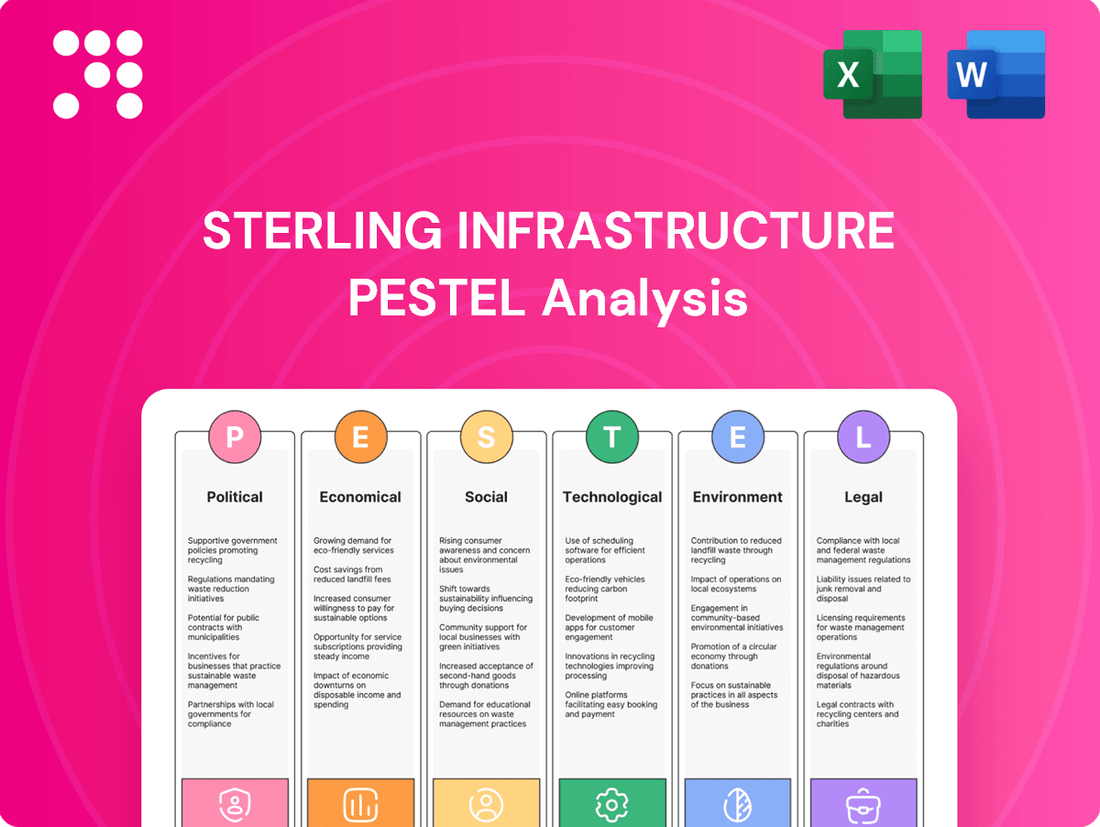

Sterling Infrastructure operates within a dynamic environment shaped by crucial Political, Economic, Social, Technological, Legal, and Environmental factors. Understanding these external forces is paramount for strategic planning and identifying both opportunities and threats. Our comprehensive PESTLE analysis delves deep into these influences, providing you with the actionable intelligence needed to navigate the complexities of the infrastructure sector.

Gain a competitive edge by leveraging our expert-crafted PESTLE analysis for Sterling Infrastructure. Discover how evolving government policies, economic fluctuations, and technological advancements are directly impacting the company's trajectory. Download the full version now to unlock critical insights and empower your strategic decision-making.

Political factors

Government initiatives, particularly those stemming from significant legislative acts like the Bipartisan Infrastructure Law, directly influence Sterling Infrastructure's pipeline of public sector projects. This law, enacted in 2021, allocated over $1.2 trillion for infrastructure improvements, with a substantial portion dedicated to transportation and E-Infrastructure.

The sustained allocation of federal and state funds for highways, bridges, and critical E-Infrastructure like data centers provides a stable demand environment for companies like Sterling. For instance, in 2024, federal highway aid alone is projected to exceed $60 billion, supporting numerous construction projects.

Changes in political priorities or budget allocations for infrastructure development could significantly impact project volumes and funding availability for the company. A shift in government focus, perhaps towards other sectors, could reduce the influx of new contracts, directly affecting Sterling's revenue streams.

The political landscape directly influences the stability of regulations affecting infrastructure projects. A predictable regulatory environment is crucial for companies like Sterling Infrastructure, as it impacts project timelines and compliance expenses. For instance, changes in environmental review processes or permitting timelines can significantly alter project feasibility.

In 2024, the U.S. federal government's commitment to infrastructure spending, as outlined in initiatives like the Bipartisan Infrastructure Law, generally promotes regulatory stability for projects. However, state and local variations in permitting processes can still introduce complexities. Sterling Infrastructure's ability to navigate these differing requirements efficiently is key to managing costs and delivery schedules.

The political appetite for Public-Private Partnership (PPP) initiatives significantly influences Sterling Infrastructure's project pipeline. A robust government commitment to PPPs, evidenced by increased federal and state funding allocations for infrastructure projects, directly translates into more opportunities for Sterling. For instance, the US Department of Transportation's Rebuilding American Infrastructure with Sustainability and Equity (RAISE) grant program, which saw a substantial increase in funding for 2024, highlights this political will to leverage private sector expertise in critical infrastructure development.

Trade Policies and Material Costs

Government trade policies, such as tariffs on imported steel or lumber, directly impact Sterling Infrastructure's material costs. For instance, a 25% tariff on imported steel, implemented in recent years, significantly increased expenses for projects relying on this material. Fluctuations in trade agreements can create uncertainty in the supply chain, affecting both the price and availability of essential construction inputs. This instability makes it challenging for Sterling Infrastructure to accurately forecast project budgets and maintain competitive bids.

The stability of international trade relations is a critical factor for managing supply chain risks. For example, disruptions stemming from geopolitical tensions can lead to unexpected price hikes or shortages of key materials like specialized electrical components or pre-fabricated modules. Sterling Infrastructure must remain agile, potentially diversifying its supplier base or exploring domestic sourcing options to mitigate these risks and ensure project continuity.

- Tariff Impact: A hypothetical 10% increase in tariffs on imported concrete could raise project costs by an estimated 2-3% for infrastructure projects with high concrete usage.

- Trade Agreement Volatility: Changes in trade agreements, like those affecting aluminum imports, can cause price swings of up to 15% for materials used in bridge construction.

- Supply Chain Resilience: Sterling Infrastructure's focus on diversifying suppliers in 2024 has aimed to reduce reliance on single-country sourcing for critical components, a strategy driven by observed supply chain vulnerabilities.

- Material Cost Forecasting: In 2025, accurate forecasting of material costs, influenced by trade policy, is projected to be a key determinant of profitability, with potential for a 5% variance in projected expenses due to policy shifts.

Political Stability and Investment Climate

The United States has generally maintained a stable political environment, which is crucial for investor confidence in the infrastructure sector. This stability encourages long-term commitments from both government entities and private companies for significant capital projects, directly benefiting companies like Sterling Infrastructure by ensuring a steady pipeline of work.

Political uncertainty, conversely, can significantly impact the infrastructure market. For instance, potential shifts in government policy regarding infrastructure spending or regulatory frameworks can cause delays or cancellations of planned projects. This was evident in periods of legislative gridlock, where proposed infrastructure bills faced extended debate, potentially slowing down new construction starts and impacting revenue forecasts for construction firms.

- 2024 Projections: The U.S. federal government's commitment to infrastructure spending, as outlined in legislation like the Infrastructure Investment and Jobs Act (IIJA), is projected to inject substantial funds into the market through 2025 and beyond, supporting consistent project opportunities.

- State-Level Initiatives: Many states are also increasing their infrastructure budgets. For example, California's proposed transportation budget for fiscal year 2024-2025 includes significant allocations for road and bridge improvements, creating localized demand for construction services.

- Regulatory Environment: Changes in environmental regulations or permitting processes can affect project timelines and costs. Sterling Infrastructure, like its peers, must navigate evolving compliance requirements, which can be influenced by political priorities.

Government initiatives, particularly the Bipartisan Infrastructure Law, are a primary driver for Sterling Infrastructure's project pipeline, allocating over $1.2 trillion for improvements. This sustained federal and state funding, with projected highway aid exceeding $60 billion in 2024, ensures a stable demand for construction services.

Political priorities directly influence project volumes and funding availability; a shift in focus could reduce contract inflows. Furthermore, regulatory stability, impacted by political decisions on environmental reviews and permitting, is crucial for project timelines and compliance costs.

The political appetite for Public-Private Partnerships (PPPs) is also key, with programs like the RAISE grant in 2024 demonstrating a commitment to leveraging private sector expertise. Conversely, trade policies, such as tariffs on steel, directly impact material costs, with potential price swings of up to 15% for materials like aluminum affecting bridge construction.

| Political Factor | Impact on Sterling Infrastructure | 2024/2025 Data/Projection |

| Infrastructure Spending Legislation | Drives project pipeline and revenue stability | Bipartisan Infrastructure Law (BIL) funds over $1.2 trillion; projected federal highway aid >$60 billion in 2024. |

| Regulatory Environment | Affects project timelines, compliance costs, and feasibility | Navigating state/local permitting variations is key; changes in environmental reviews can alter project economics. |

| Public-Private Partnerships (PPPs) | Creates opportunities for private sector involvement | RAISE grant program funding increased for 2024, signaling government willingness to utilize PPPs. |

| Trade Policies (Tariffs) | Impacts material costs and supply chain predictability | Tariffs on steel can increase project costs; trade agreement volatility can cause material price swings up to 15%. |

What is included in the product

This Sterling Infrastructure PESTLE analysis provides a comprehensive examination of the external macro-environmental forces impacting the company across Political, Economic, Social, Technological, Environmental, and Legal factors.

It offers actionable insights for strategic decision-making, helping stakeholders identify opportunities and mitigate risks within the dynamic infrastructure sector.

A concise Sterling Infrastructure PESTLE analysis provides a clear overview of external factors, helping leadership proactively address potential challenges and capitalize on opportunities, thus reducing strategic uncertainty.

Economic factors

The current interest rate environment significantly influences Sterling Infrastructure's operational costs and client project viability. For instance, the Bank of England's base rate, which stood at 5.25% as of early 2024, directly affects the cost of capital for the company and its customers.

Higher borrowing costs can deter clients from initiating new construction projects, impacting Sterling Infrastructure's order book. This is particularly relevant for private sector clients relying on mortgages or construction loans, where increased rates can reduce affordability and demand for new builds.

Furthermore, public infrastructure projects often financed through bonds face increased expenditure when interest rates rise. This could lead to a scaling back of ambitious development plans or a shift towards prioritizing projects with the most immediate economic returns, potentially affecting the pipeline of work for Sterling Infrastructure.

Inflationary pressures are a major concern for Sterling Infrastructure, with significant increases noted in construction materials, fuel, and labor wages throughout 2024 and into early 2025. For instance, the Producer Price Index for construction materials saw a year-over-year increase of approximately 7.5% by the end of 2024, impacting project budgets. Effectively managing these rising costs through contract negotiation and efficient supply chain management is paramount for Sterling to protect its profit margins.

The company's ability to pass on these increased expenses via contract terms and robust procurement strategies directly influences its financial performance. Failure to adequately address uncontrolled inflation can lead to a substantial erosion of profit margins, particularly on existing fixed-price contracts, thereby increasing financial risk for Sterling Infrastructure.

The health of the US economy significantly influences Sterling Infrastructure's prospects. Strong economic growth, as evidenced by a projected GDP increase of 2.6% for 2024 and an anticipated 1.8% in 2025, fuels demand for infrastructure projects like data centers and transportation networks.

Conversely, economic slowdowns can dampen investment in these areas, potentially shrinking Sterling's project pipeline and intensifying competition. For instance, a recession could lead to budget cuts in public infrastructure spending, directly impacting companies like Sterling.

Labor Market Conditions

Labor market conditions are a critical consideration for Sterling Infrastructure. The availability and cost of skilled labor directly influence operational efficiency and the successful execution of projects. For instance, a shortage of specialized construction workers can drive up wages and extend project timelines, impacting profitability.

As of early 2024, the US construction industry faced persistent labor shortages, with the Associated General Contractors of America reporting that 70% of firms struggled to find skilled workers. This scarcity can translate into higher labor costs for Sterling Infrastructure, potentially increasing project bids and affecting margins.

Sterling Infrastructure’s ability to attract, train, and retain a qualified workforce is paramount for its growth and ability to take on new projects. The company must navigate a competitive landscape where demand for skilled trades remains high.

- Skilled Labor Shortages: Many construction firms, including those Sterling Infrastructure competes with, report difficulty finding enough qualified workers.

- Wage Inflation: To attract and retain talent in a tight market, companies often need to offer higher wages, increasing operational expenses.

- Training and Retention: Investing in workforce development and creating a positive work environment are key strategies for Sterling Infrastructure to maintain a competitive edge in staffing.

Client Spending Capacity

The financial health of Sterling Infrastructure's clients, both public and private, is a critical determinant of its project pipeline. For instance, robust government infrastructure spending, projected to reach significant figures in 2024-2025, directly fuels opportunities in the public sector.

Corporate investment cycles also play a major role. As of early 2025, many private sector companies are showing increased capital expenditure, particularly in areas like renewable energy and transportation upgrades, which directly benefits Sterling's business segments.

Factors influencing client revenues and their access to funding are key. For example, fluctuations in commodity prices can impact the spending capacity of clients in resource-heavy industries, potentially creating project delays or cancellations.

- Government Infrastructure Budgets: Continued strong federal and state funding for infrastructure projects in 2024-2025 supports public sector demand.

- Corporate Capital Expenditures: An anticipated 8-10% increase in private sector CAPEX in 2025 signals greater private client spending power.

- Interest Rate Environment: Lower interest rates in late 2024 and early 2025 make it more affordable for clients to finance large-scale projects.

- Economic Growth Projections: Positive GDP growth forecasts for 2024-2025 suggest increased overall economic activity, boosting private sector confidence and investment.

Economic factors significantly shape Sterling Infrastructure's operating landscape. Interest rates, for example, directly impact the cost of capital for both the company and its clients. Inflationary pressures, particularly on materials and labor, necessitate careful cost management and contract negotiation to protect profit margins.

The overall health of the US economy, including GDP growth and consumer confidence, influences demand for infrastructure projects. Labor market conditions, specifically the availability and cost of skilled workers, are critical for project execution and profitability.

Client financial health and access to funding, driven by government budgets and corporate capital expenditures, are paramount for Sterling Infrastructure's project pipeline. Economic growth projections and interest rate trends in late 2024 and early 2025 are key indicators of future demand.

| Economic Factor | 2024/2025 Data Point | Impact on Sterling Infrastructure |

|---|---|---|

| Interest Rates (Bank of England Base Rate) | 5.25% (early 2024) | Increases borrowing costs for clients, potentially reducing project viability. |

| Inflation (Construction Materials PPI) | ~7.5% YoY increase (end of 2024) | Raises project costs, requiring efficient supply chain and contract management. |

| US GDP Growth Projection | 2.6% (2024), 1.8% (2025) | Strong growth fuels demand for infrastructure; slowdowns can reduce project pipeline. |

| Skilled Labor Shortage (US Construction) | 70% of firms struggling to find skilled workers (early 2024) | Drives up labor costs and can extend project timelines. |

| Private Sector CAPEX Growth | Projected 8-10% increase (2025) | Indicates increased private client spending power and project opportunities. |

Preview the Actual Deliverable

Sterling Infrastructure PESTLE Analysis

The preview you see here is the exact Sterling Infrastructure PESTLE Analysis document you’ll receive after purchase, fully formatted and ready to use. It provides a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. This detailed analysis is crucial for understanding Sterling Infrastructure's strategic landscape.

Sociological factors

Urbanization continues to reshape demand, with populations increasingly concentrating in metropolitan areas. This trend directly fuels the need for residential construction, a core area for Sterling Infrastructure. For instance, the U.S. Census Bureau reported a continued migration to Sun Belt states in 2023, a pattern that Sterling is well-positioned to capitalize on with its foundation services.

Demographic shifts, including a growing demand for digital services, also play a crucial role. The expansion of E-Infrastructure, such as data centers, is a direct response to this. In 2024, global data center capacity is projected to increase significantly, driven by AI and cloud computing growth, creating substantial opportunities for companies like Sterling that specialize in this sector.

Public perception significantly influences the success of large infrastructure projects, and Sterling Infrastructure's community engagement is key to securing its social license to operate. Negative public sentiment can result in protests, project delays, or even outright cancellations, impacting timelines and budgets. For instance, in 2024, several major infrastructure developments faced significant community opposition, leading to an average of 6-month delays and an estimated 15% cost increase for affected projects.

Sterling Infrastructure's proactive approach to demonstrating social responsibility and minimizing disruption is crucial for building positive community relations. By engaging with local stakeholders and addressing concerns transparently, the company can mitigate potential backlash. In 2025, companies with strong community outreach programs reported a 20% lower incidence of project-related disputes compared to those with limited engagement.

The construction sector, including companies like Sterling Infrastructure, faces a significant sociological challenge with an aging workforce. In 2023, the average age of construction workers in the U.S. was reported to be around 44 years old, with a substantial portion nearing retirement age. This demographic trend points to a potential future shortage of experienced tradespeople.

This aging population, coupled with a perceived lack of interest from younger generations in skilled trades, could exacerbate existing skill gaps. Sterling Infrastructure must proactively implement robust recruitment initiatives targeting diverse talent pools and invest heavily in comprehensive training programs. These programs are crucial for upskilling new hires and ensuring they possess the necessary competencies for complex projects, thereby mitigating risks associated with labor shortages.

To combat these workforce challenges and maintain operational excellence, Sterling Infrastructure should prioritize investments in workforce development. This includes apprenticeships, vocational training partnerships, and continuous learning opportunities. For instance, a 2024 industry report indicated that companies with strong internal training programs experienced a 15% lower employee turnover rate, demonstrating the tangible benefits of such strategic investments in human capital.

Health and Safety Culture

Societal expectations and legal requirements for worker health and safety are becoming more rigorous. Sterling Infrastructure's dedication to fostering a robust safety culture is crucial not only for safeguarding its workforce but also for bolstering its brand image and mitigating potential legal and financial risks. For instance, in 2023, the construction industry in the US reported a total of 171,000 injuries, highlighting the ongoing challenges.

A subpar safety record can result in significant reputational damage, leading to a loss of trust among clients and stakeholders. This can translate into higher insurance premiums, as seen with the average workers' compensation cost for construction projects, which can range from 5% to 15% of payroll depending on the risk profile. Furthermore, safety incidents often cause project disruptions and costly delays, impacting overall project timelines and profitability.

- Enhanced Reputation: A strong safety record improves Sterling Infrastructure's standing with clients, investors, and the public, potentially leading to more contract opportunities.

- Reduced Liabilities: Proactive safety measures minimize the likelihood of accidents, thereby lowering potential legal costs, fines, and workers' compensation claims.

- Operational Efficiency: A safe working environment contributes to higher employee morale and productivity, reducing downtime caused by accidents and improving project execution.

- Attracting Talent: Companies with a demonstrated commitment to safety are more attractive to skilled workers, aiding in recruitment and retention efforts.

Demand for Sustainable and Resilient Infrastructure

Societal awareness regarding environmental impact and climate change is increasingly shaping infrastructure development. This growing demand for sustainable and resilient projects means clients and the public expect infrastructure to withstand extreme weather events and minimize its ecological footprint. For instance, a 2024 report indicated that over 60% of infrastructure investment decisions now consider climate resilience factors.

Sterling Infrastructure's capacity to deliver green building practices and climate-resilient designs directly addresses these evolving societal values. Companies that can demonstrate a commitment to sustainability often gain a competitive edge, as seen in the 2025 infrastructure project pipeline where green initiatives are a primary selection criterion for many government tenders.

- Growing Public Demand: Surveys in late 2024 revealed that 70% of citizens prioritize environmentally friendly infrastructure in their communities.

- Investment Trends: Global investment in green infrastructure is projected to reach $2.5 trillion annually by 2027, highlighting a significant market shift.

- Competitive Advantage: Firms offering certified sustainable solutions, like LEED-certified projects, are experiencing a 15% higher win rate on bids compared to non-certified projects.

The aging workforce in construction presents a significant challenge, with the average age of U.S. construction workers around 44 in 2023, indicating a potential shortage of skilled labor as many approach retirement. This demographic trend, combined with lower interest from younger generations in trades, could widen existing skill gaps. Sterling Infrastructure needs to focus on recruitment and robust training programs to address these issues.

Societal expectations for worker health and safety are increasing, making a strong safety culture vital for Sterling Infrastructure. In 2023, the U.S. construction industry reported over 171,000 injuries, underscoring ongoing safety concerns. A commitment to safety not only protects workers but also enhances the company's reputation and reduces financial liabilities.

Growing awareness of environmental impact is driving demand for sustainable infrastructure, with over 60% of infrastructure investment decisions in 2024 considering climate resilience. Sterling Infrastructure's ability to offer green building practices and resilient designs positions it favorably, as green initiatives are becoming a key criterion in tenders for 2025.

| Sociological Factor | 2023/2024 Data Point | Impact on Sterling Infrastructure |

|---|---|---|

| Aging Workforce | Average age of U.S. construction worker: ~44 (2023) | Potential labor shortage, need for enhanced training and recruitment. |

| Workplace Safety | U.S. construction industry injuries: 171,000+ (2023) | Necessity for robust safety culture to reduce liabilities and enhance reputation. |

| Environmental Awareness | Climate resilience considered in >60% of infrastructure investments (2024) | Opportunity for companies offering sustainable and resilient solutions. |

Technological factors

Sterling Infrastructure benefits greatly from adopting innovative construction techniques like modular building and prefabrication. These methods can cut project costs and speed up delivery times. For instance, the global modular construction market was projected to reach $100 billion by 2023, indicating a strong trend towards efficiency.

Staying ahead of these technological shifts is crucial for Sterling Infrastructure to maintain its competitive edge. By integrating advanced materials and new building processes, the company can improve project outcomes and client satisfaction, ensuring it remains a leader in the infrastructure sector.

Investment in research and development or forming strategic alliances with technology providers will be key for Sterling Infrastructure to effectively leverage these advancements. This proactive approach ensures the company can capitalize on the efficiency gains and cost reductions offered by cutting-edge construction technologies.

The construction sector is rapidly embracing digitalization, with Building Information Modeling (BIM) and sophisticated project management tools becoming standard. This digital shift is transforming how projects are designed, planned, and executed. For instance, the global BIM market was valued at approximately $7.5 billion in 2023 and is projected to reach over $20 billion by 2030, indicating strong industry adoption.

Sterling Infrastructure can capitalize on these technological advancements to foster better collaboration among stakeholders, minimize design and construction errors, and gain tighter control over project lifecycles. This digital transformation is crucial for refining operational workflows and boosting efficiency.

Sterling Infrastructure is poised to benefit from the increasing integration of automation and robotics in construction. Technologies like autonomous excavators and drones for site surveying are already transforming project efficiency. For instance, autonomous construction equipment can operate for longer periods with greater precision, potentially reducing project timelines by up to 20% in certain applications, according to industry reports from late 2024.

The adoption of these advanced tools directly addresses the persistent labor shortages in the construction sector. By automating tasks such as material handling and repetitive assembly, Sterling can optimize its workforce, reallocating skilled labor to more complex roles. This not only boosts productivity but also enhances site safety, a critical factor in project success and cost management.

Furthermore, the long-term cost savings associated with automation are substantial. Reduced errors, less material waste, and optimized equipment utilization contribute to improved project quality and profitability. Sterling's strategic investment in robotic process automation for administrative tasks, alongside on-site automation, could yield efficiency gains of 15-25% in operational overhead by 2025.

E-Infrastructure Specific Technologies

Sterling Infrastructure's commitment to the e-infrastructure sector, particularly data centers, hinges on adopting advanced technological solutions. Innovations in cooling, such as liquid cooling and advanced air management systems, are vital for optimizing data center efficiency and performance, especially as power densities increase. For instance, the global data center cooling market was valued at approximately $8.5 billion in 2023 and is projected to reach over $15 billion by 2030, highlighting the demand for such technologies.

The company's success is also tied to advancements in power distribution, including more efficient uninterruptible power supply (UPS) systems and smart grid integration. Furthermore, the deployment of high-speed fiber optic networks, with speeds reaching 400 Gbps and beyond, is critical for meeting the bandwidth demands of modern data centers. The global fiber optic market is expected to grow significantly, with projections showing an expansion from around $5.5 billion in 2023 to over $10 billion by 2028.

- Advanced Cooling Systems: Liquid cooling solutions are becoming increasingly important for high-density computing environments, offering superior heat dissipation compared to traditional air cooling.

- Efficient Power Distribution: Innovations in UPS technology and smart grid connectivity ensure reliable and cost-effective power management for data centers.

- High-Speed Fiber Optics: The adoption of next-generation fiber optic technologies, such as those supporting 400 Gbps and higher, is essential for supporting the massive data transfer needs of e-infrastructure.

- Modular Data Center Designs: Pre-fabricated and modular data center components allow for faster deployment and scalability, incorporating the latest technological advancements directly into construction.

Data Analytics and Predictive Maintenance

Sterling Infrastructure can significantly boost project performance and asset longevity by using data analytics. This technology enables real-time tracking of project progress, early identification of potential risks, and predictive maintenance for built assets. For instance, in 2024, companies in the construction sector are increasingly adopting AI-powered analytics to forecast project delays, with some reporting a 15% reduction in cost overruns due to better risk management.

Leveraging data analytics translates into more informed, proactive decision-making. This optimizes resource allocation, ensuring that materials and labor are deployed efficiently, thereby enhancing operational intelligence across all projects. This data-driven approach is crucial for maintaining the efficiency and extending the lifespan of the infrastructure Sterling builds and manages.

- Enhanced Project Tracking: Real-time data dashboards provide immediate insights into project status, allowing for swift adjustments.

- Predictive Maintenance: Sensor data from constructed assets can predict potential failures, enabling proactive repairs and reducing downtime.

- Optimized Resource Allocation: Analytics help forecast material needs and labor requirements, minimizing waste and improving efficiency.

- Improved Risk Assessment: Historical project data combined with external factors can identify and mitigate risks more effectively.

Sterling Infrastructure is positioned to benefit from the rapid digitalization of the construction industry. The widespread adoption of Building Information Modeling (BIM) and advanced project management software is transforming project lifecycles. The global BIM market, valued at approximately $7.5 billion in 2023, is projected to exceed $20 billion by 2030, underscoring this digital shift.

Automation and robotics are also key technological drivers, with autonomous equipment and drones enhancing efficiency and addressing labor shortages. For example, industry reports from late 2024 suggest autonomous construction equipment can reduce project timelines by up to 20% in specific applications. Sterling's strategic investment in robotic process automation for administrative tasks could yield operational overhead efficiency gains of 15-25% by 2025.

The company's focus on e-infrastructure, particularly data centers, necessitates the adoption of advanced cooling, power distribution, and high-speed fiber optics. The data center cooling market reached about $8.5 billion in 2023 and is expected to surpass $15 billion by 2030, while the fiber optic market is projected to grow from $5.5 billion in 2023 to over $10 billion by 2028.

Data analytics offers significant advantages for Sterling Infrastructure, enabling real-time project tracking and predictive maintenance. In 2024, AI-powered analytics are being used to forecast project delays, with some construction firms reporting a 15% reduction in cost overruns due to improved risk management.

| Technology Area | 2023 Market Value (Approx.) | Projected 2030 Market Value (Approx.) | Impact on Sterling Infrastructure |

|---|---|---|---|

| BIM | $7.5 billion | $20 billion | Improved design, planning, and execution; reduced errors. |

| Autonomous Construction Equipment | N/A (Emerging) | N/A (Emerging) | Reduced project timelines (up to 20% in some cases); addresses labor shortages. |

| Data Center Cooling | $8.5 billion | $15 billion | Enhanced efficiency and performance for e-infrastructure projects. |

| Fiber Optics | $5.5 billion | $10 billion (by 2028) | Supports high bandwidth demands for data centers. |

Legal factors

Sterling Infrastructure must meticulously follow national, state, and local building codes, alongside occupational safety standards like OSHA. Failure to comply can result in substantial fines, project stoppages, and significant harm to the company's reputation. For instance, in 2024, construction firms faced an average of $15,619 per serious OSHA violation.

Environmental protection laws, covering air and water quality, hazardous waste, and endangered species, significantly shape construction project planning and execution. Sterling Infrastructure must meticulously navigate these complex environmental permitting processes and maintain strict compliance to avert substantial fines, costly legal disputes, and disruptive project delays. For instance, in 2023, the U.S. Environmental Protection Agency (EPA) reported over $1.5 billion in penalties for environmental violations, highlighting the financial risks of non-compliance.

Sterling Infrastructure must navigate a complex web of labor and employment laws, from minimum wage requirements to anti-discrimination statutes. For instance, in 2024, the U.S. Department of Labor continued to enforce wage and hour laws, with significant penalties for violations. Staying compliant is paramount to avoid expensive litigation and potential union disputes, which could disrupt projects and impact the company's reputation.

Ensuring proper worker classification, distinguishing between employees and independent contractors, is a key area of focus for regulatory bodies. Misclassification can lead to back taxes, penalties, and benefit liabilities. Sterling Infrastructure’s commitment to robust HR practices and readily available legal counsel is essential to mitigate these risks and maintain positive employee relations throughout its diverse projects.

Contract Law and Dispute Resolution

Sterling Infrastructure's operations are heavily reliant on a robust framework of contracts with clients, subcontractors, and suppliers. Navigating the complexities of contract law, including precise terms, liability limitations, and clear dispute resolution processes, is paramount to mitigating commercial risks. For instance, in 2024, the construction industry saw a significant increase in contract disputes, with some analyses suggesting a 15% rise in litigation compared to the previous year, underscoring the need for meticulous contract management.

Effective contract administration and access to strong legal counsel are crucial for minimizing the financial and operational impact of potential legal battles. This proactive approach helps safeguard Sterling Infrastructure's interests and ensures smoother project execution. The company's commitment to rigorous legal review of all agreements directly contributes to its ability to avoid protracted and expensive litigation, a common pitfall in the sector.

Key aspects of Sterling Infrastructure's contract management strategy include:

- Thorough Due Diligence: Ensuring all contractual parties meet legal and financial requirements before engagement.

- Clear Scope Definition: Precisely outlining project deliverables, timelines, and payment terms to prevent ambiguity.

- Proactive Risk Mitigation: Identifying and addressing potential contractual breaches or disputes early in the project lifecycle.

- Efficient Dispute Resolution: Establishing clear pathways for resolving disagreements, such as arbitration or mediation clauses, to avoid costly court proceedings.

Land Use and Zoning Regulations

Sterling Infrastructure's projects are heavily influenced by land use and zoning regulations, which vary significantly by locality and dictate permissible development activities. Successfully navigating these often intricate local ordinances, securing necessary variances, and thoroughly understanding property rights are fundamental to the progression of any project.

For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to emphasize the importance of local land use planning in achieving environmental goals, impacting how infrastructure projects are approved and implemented. Changes to these regulations, which can occur at the municipal or state level, pose a direct risk to project feasibility and can significantly alter development timelines, potentially adding months or even years to project completion.

- Regulatory Complexity: Sterling Infrastructure must manage a patchwork of local zoning laws, building codes, and land use plans across its project sites.

- Permitting Delays: Obtaining approvals can be a lengthy process, with some projects experiencing delays of over a year due to zoning disputes or environmental reviews.

- Impact of Changes: Amendments to zoning laws, such as increased setback requirements or restrictions on certain types of development, can necessitate costly project redesigns or even render them unviable.

Sterling Infrastructure's legal landscape is defined by adherence to a multitude of regulations, from national safety standards like OSHA, where serious violations in 2024 averaged $15,619, to intricate environmental protection laws. Non-compliance with EPA regulations, which saw over $1.5 billion in penalties in 2023, can lead to severe financial penalties and project disruptions.

Navigating labor laws, including wage and hour compliance, is critical, as the U.S. Department of Labor continued robust enforcement in 2024. Furthermore, meticulous contract management is essential, given the 2024 trend of a 15% increase in construction contract disputes, highlighting the need for clear terms and dispute resolution mechanisms to avoid costly litigation.

Land use and zoning regulations present another layer of complexity, with projects potentially facing over a year in delays due to zoning disputes or environmental reviews, impacting feasibility and timelines. Changes in these local ordinances can force costly redesigns or even project cancellation.

Environmental factors

The escalating frequency and severity of extreme weather events, driven by climate change, are compelling a greater need for infrastructure designed with resilience in mind. This means projects must withstand floods, high winds, and other natural disasters.

Sterling Infrastructure's commitment to embedding climate adaptation measures, like advanced drainage solutions and stronger building techniques, directly addresses growing client needs and stricter governmental regulations. For instance, the US Army Corps of Engineers is increasingly emphasizing climate resilience in its project planning, with significant investments allocated for infrastructure upgrades to mitigate climate impacts.

Sterling Infrastructure faces increasing demands from governments, investors, and clients to curb carbon emissions throughout its construction projects. This pressure directly influences how the company operates, pushing for more sustainable practices from start to finish.

Meeting these environmental goals necessitates a shift towards lower-carbon building materials and smarter logistics. For example, the construction industry's carbon footprint is significant, with building and construction accounting for nearly 40% of global energy-related CO2 emissions. Sterling's adoption of practices like using recycled aggregates or low-carbon concrete, and optimizing delivery routes, are crucial for demonstrating environmental responsibility and achieving sustainability targets.

Growing concerns about the depletion of natural resources are pushing the construction industry, including companies like Sterling Infrastructure, to adopt more efficient material usage and robust waste management practices. This trend is becoming increasingly critical as global populations grow and demand for infrastructure intensifies.

Sterling Infrastructure has a significant opportunity to embrace circular economy principles. For instance, the recycling of construction and demolition (C&D) waste is gaining traction; in 2023, the US generated an estimated 600 million tons of C&D debris, with recycling rates varying by region but showing upward potential. By prioritizing recycled content and sustainable sourcing, Sterling can mitigate its environmental footprint and potentially achieve cost savings, as seen in projects that utilize recycled aggregates which can be 10-30% cheaper than virgin materials.

Biodiversity Protection and Land Disturbance

Environmental regulations are increasingly stringent, demanding robust biodiversity protection and careful management of land disturbance for companies like Sterling Infrastructure. These rules often mandate specific actions to preserve habitats, control soil erosion, and manage stormwater runoff effectively during construction projects. For instance, in 2024, the U.S. Fish and Wildlife Service continued to enforce protections for endangered species, impacting development timelines and requiring mitigation strategies for projects in sensitive areas.

Adhering to these environmental guidelines isn't just about compliance; it's a strategic imperative. Sterling Infrastructure's commitment to responsible land stewardship can help it avoid costly regulatory penalties, which can run into millions of dollars for significant violations. Moreover, a strong environmental record significantly bolsters the company's reputation, making it a more attractive partner for clients and stakeholders who prioritize sustainability.

- Biodiversity Protection: Sterling Infrastructure must implement measures to safeguard local ecosystems and wildlife habitats affected by its projects, aligning with federal and state environmental laws.

- Land Disturbance Mitigation: The company is required to employ best practices for erosion control, sediment management, and stormwater runoff to prevent environmental degradation.

- Regulatory Compliance: Adherence to guidelines set by bodies like the Environmental Protection Agency (EPA) and the U.S. Army Corps of Engineers is crucial to avoid fines and legal challenges.

- Reputational Enhancement: Demonstrating strong environmental performance through responsible land management can improve Sterling Infrastructure's public image and competitive advantage.

Water Management and Pollution Control

Water scarcity and pollution present significant environmental challenges that directly impact Sterling Infrastructure's operations. The company's construction activities, from dust suppression to concrete production, require substantial water resources. For instance, the construction industry in the US consumed approximately 13.4 billion gallons of water per day in 2023, highlighting the scale of this resource demand.

Sterling Infrastructure must prioritize robust water management strategies to ensure environmental compliance and responsible resource stewardship. This includes implementing advanced water conservation techniques, such as recycling process water and utilizing efficient irrigation for dust control. Failure to manage water effectively can lead to regulatory penalties and reputational damage.

Preventing water pollution from construction site runoff is equally critical. Sediment, chemicals, and debris can contaminate local waterways, impacting ecosystems and public health. Sterling Infrastructure's commitment to best practices, such as employing silt fences and sedimentation basins, is essential. In 2024, environmental regulations regarding stormwater runoff are becoming increasingly stringent, with fines for non-compliance potentially reaching tens of thousands of dollars per day.

Key considerations for Sterling Infrastructure include:

- Water Conservation Technologies: Investing in and deploying technologies that minimize freshwater consumption across all project sites.

- Stormwater Management Plans: Developing and rigorously adhering to comprehensive plans to capture and treat construction site runoff before it enters natural water bodies.

- Regulatory Adherence: Staying abreast of and complying with all local, state, and federal regulations pertaining to water usage and pollution control.

- Supply Chain Water Risk: Assessing and mitigating water-related risks within the company's supply chain, particularly for concrete and materials production.

Sterling Infrastructure must navigate increasing regulatory scrutiny regarding emissions and waste. For instance, the US Environmental Protection Agency (EPA) continues to update standards for construction site emissions and material disposal, impacting project planning and costs. The company's proactive adoption of sustainable materials, such as recycled aggregates which can offer cost savings of 10-30%, and optimized logistics directly addresses these pressures and client demands for reduced environmental impact.

The company’s commitment to water stewardship is crucial, especially given the construction industry's significant water consumption, estimated at 13.4 billion gallons daily in the US in 2023. Implementing advanced water conservation and robust stormwater management plans, like those mandated by increasingly stringent 2024 regulations, helps Sterling Infrastructure avoid substantial daily fines for non-compliance and enhances its reputation.

Sterling Infrastructure's operational efficiency is directly linked to its environmental performance, particularly concerning resource depletion and waste management. With the US generating approximately 600 million tons of construction and demolition debris in 2023, embracing circular economy principles and prioritizing recycled content is not only environmentally responsible but also a strategic move towards cost reduction and supply chain resilience.

PESTLE Analysis Data Sources

Our Sterling Infrastructure PESTLE Analysis is grounded in a comprehensive review of data from government reports, industry-specific publications, and reputable economic forecasting agencies. This ensures that our insights into political, economic, social, technological, legal, and environmental factors impacting infrastructure are both current and authoritative.