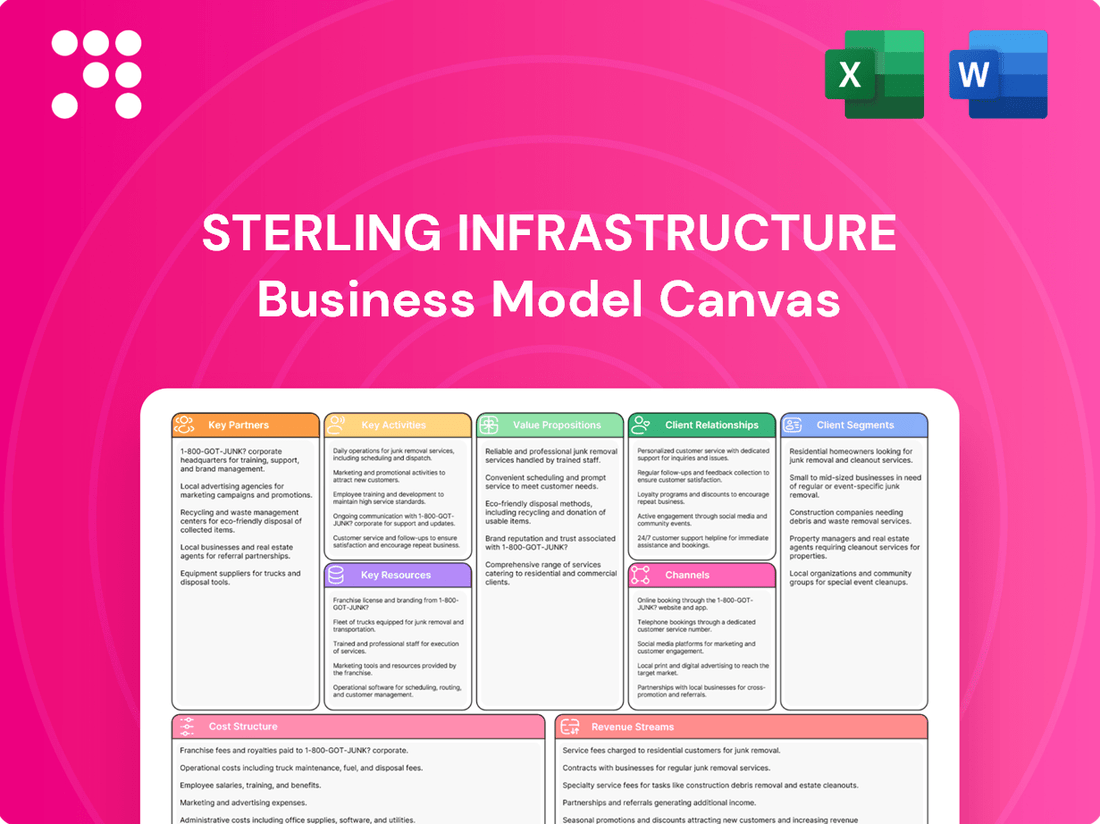

Sterling Infrastructure Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sterling Infrastructure Bundle

Unlock the strategic core of Sterling Infrastructure's success with our comprehensive Business Model Canvas. This detailed breakdown reveals their approach to key partnerships, revenue streams, and customer relationships, offering invaluable insights for industry analysis. Discover how Sterling Infrastructure effectively manages its cost structure and key resources to maintain its competitive edge.

Partnerships

Sterling Infrastructure actively collaborates with federal, state, and local government agencies to secure and execute major transportation and infrastructure projects. These crucial partnerships enable the company to bid on and deliver complex public works, including highways, bridges, and airports, which often come with stringent regulatory demands and extended contract periods.

For instance, Sterling's engagement with entities like the Utah Department of Transportation (UDOT) and the Colorado Department of Transportation (CDOT) highlights the significance of these relationships. These collaborations have led to the award of substantial transportation contracts, with notable wins in 2025 underscoring the value of these governmental alliances in driving the company's project pipeline and revenue growth.

Sterling Infrastructure actively partners with private sector developers and corporations, particularly within its E-Infrastructure and Building Solutions divisions. These collaborations are crucial for projects like data centers, large manufacturing plants, e-commerce hubs, and residential developments.

These relationships are key to tapping into rapidly expanding markets and executing complex, vital projects for private clients. For instance, the company's growing emphasis on data center development highlights the strategic importance of these private sector partnerships.

Sterling Infrastructure frequently forms joint ventures with other construction firms to tackle significant projects. This approach allows them to combine specialized skills and resources, thereby sharing the inherent risks and enhancing their bidding capacity for larger, more intricate infrastructure developments.

A prime example of this strategy in action is the I-15 1800 North Interchange project. In this endeavor, Sterling's subsidiary, RLW, collaborated with Whitaker Construction, demonstrating the practical application of joint ventures to secure and execute substantial undertakings that benefit from shared expertise and a broader resource base.

Material Suppliers and Equipment Providers

Sterling Infrastructure relies heavily on its material suppliers and equipment providers to keep projects moving smoothly. These partnerships are the backbone of their operational efficiency.

By fostering strong ties with those who supply critical construction materials like concrete and steel, and providers of heavy machinery, Sterling ensures they have what they need, when they need it. This reliability directly impacts their ability to meet project deadlines and control costs, which is crucial for maintaining healthy profit margins. In fact, Sterling Infrastructure reported gross profit margins exceeding 20% in 2024, a testament to effective supply chain management.

- Timely Delivery: Ensures materials and equipment arrive on schedule, preventing project delays.

- Competitive Pricing: Secures favorable rates for essential resources, directly impacting cost-effectiveness.

- Resource Access: Guarantees availability of necessary materials and machinery for project execution.

- Quality Assurance: Partners with reliable suppliers to maintain the quality of construction inputs.

Subcontractors and Specialized Service Providers

Sterling Infrastructure leverages a robust network of specialized subcontractors to enhance its project execution capabilities. These partnerships are crucial across all business segments, from residential plumbing to complex data center installations, effectively extending Sterling's in-house expertise and capacity.

The company's strategic reliance on these external partners allows for greater flexibility and the ability to undertake a wider range of projects. For instance, in 2024, Sterling continued to integrate specialized services, ensuring high-quality delivery for its diverse client base.

A significant development bolstering Sterling's key partnerships is the acquisition of Drake Concrete in Q1 2025. This move directly strengthens their capacity to supply concrete slabs, a vital component for residential home builders, thereby solidifying a critical part of their supply chain.

- Subcontractor Integration: Sterling partners with specialized firms for plumbing, electrical, and HVAC services, crucial for timely project completion in 2024.

- Capacity Augmentation: These partnerships allow Sterling to scale operations efficiently, meeting demand across E-Infrastructure, Transportation, and Building Solutions.

- Strategic Acquisition: The Q1 2025 acquisition of Drake Concrete enhances Sterling's vertical integration, particularly for residential building projects.

Sterling Infrastructure's key partnerships are multifaceted, encompassing government entities, private developers, joint venture collaborators, material suppliers, and specialized subcontractors. These alliances are fundamental to securing large-scale projects, accessing critical resources, and enhancing operational efficiency across its diverse business segments.

The company's strategic relationships with government agencies, such as the Utah Department of Transportation, are vital for winning substantial public works contracts. Simultaneously, partnerships with private sector clients in areas like e-infrastructure are driving growth in emerging markets. Sterling's 2024 performance, including gross profit margins over 20%, reflects the strength of these collaborations and effective supply chain management.

Furthermore, the acquisition of Drake Concrete in early 2025 exemplifies Sterling's commitment to vertical integration, particularly strengthening its position in the residential building sector by securing a key material supplier. These strategic moves underscore the importance of a robust partner ecosystem for sustained success and project execution.

| Partnership Type | Key Collaborators | Impact on Sterling Infrastructure | Recent Developments/Data |

| Government Agencies | Federal, State, Local DOTs | Securing major transportation projects, regulatory navigation | Significant contract wins in 2025 with agencies like UDOT |

| Private Sector Clients | Developers, Corporations (E-Infrastructure, Building) | Access to growth markets, complex project execution | Growing focus on data center development |

| Joint Ventures | Other Construction Firms | Risk sharing, enhanced bidding capacity for large projects | Collaboration on projects like the I-15 1800 North Interchange |

| Material Suppliers & Equipment Providers | Concrete, Steel, Machinery Providers | Operational efficiency, cost control, timely project delivery | Gross profit margins exceeding 20% in 2024 |

| Specialized Subcontractors | Plumbing, Electrical, HVAC, Concrete Specialists | Extended expertise, capacity augmentation, flexible operations | Acquisition of Drake Concrete (Q1 2025) for concrete supply |

What is included in the product

A comprehensive, pre-written business model tailored to Sterling Infrastructure’s strategy, detailing its customer segments, channels, and value propositions within the infrastructure sector.

Reflects the real-world operations and plans of Sterling Infrastructure, organized into 9 classic BMC blocks with full narrative and insights for informed decision-making.

Sterling Infrastructure's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their core operations, enabling rapid identification of inefficiencies and opportunities for streamlining.

This canvas simplifies complex strategic thinking, transforming potential confusion into actionable insights for improved project execution and resource allocation.

Activities

Sterling Infrastructure’s core activities heavily feature site development, encompassing crucial tasks like grading, earthwork, and the installation of underground utilities. This foundational work is essential for large-scale projects, particularly for mission-critical facilities such as data centers, manufacturing plants, and e-commerce distribution hubs.

Their expertise in this initial phase ensures that sites are efficiently and precisely prepared, setting the stage for subsequent construction phases. For example, in 2024, Sterling secured a significant contract for site development on a major industrial park, highlighting their role in enabling large-scale infrastructure growth.

Sterling Infrastructure's Civil Construction and Infrastructure Building activities are central to its Transportation Solutions segment. This involves the comprehensive design, construction, and ongoing maintenance of vital public works like highways, bridges, and airports. These projects demand significant engineering expertise and meticulous project management.

In 2024, Sterling continued to emphasize its strategic move towards alternative delivery methods and design-build projects within this sector. This approach allows for greater control over project execution and often leads to improved margins compared to traditional construction contracts.

Sterling Infrastructure's key activities heavily feature the delivery of specialized e-infrastructure solutions. This involves providing advanced site development services, crucial for the construction of hyperscale data centers, cutting-edge manufacturing plants, and expansive distribution hubs.

This area represents a significant and expanding portion of their business. The company has seen remarkable growth in both revenue and operating income from this segment. For instance, Sterling Infrastructure reported over a 50% year-over-year increase in data center revenue during 2024, underscoring its strategic importance and market demand.

Building Solutions Construction

Sterling Infrastructure's Building Solutions segment focuses on constructing concrete foundations for a wide range of projects. This includes everything from single-family and multi-family residential homes to essential commercial structures like parking garages and elevated slabs. They also integrate plumbing services, addressing a core need within the real estate development sector.

This business line directly serves the foundational requirements of both the housing and commercial real estate markets. Their expertise ensures the structural integrity of numerous construction projects, contributing to the development of communities and commercial spaces.

- Foundation Construction: Encompasses residential (single-family, multi-family) and commercial concrete foundations.

- Ancillary Services: Includes plumbing services integrated with foundation work.

- Market Focus: Addresses critical needs in housing and commercial real estate development.

- Strategic Expansion: The acquisition of Drake Concrete in early 2025 significantly bolstered their capacity and reach in this segment.

Project Management and Engineering

Sterling Infrastructure's project management and engineering activities are central to its success. They focus on meticulous planning, efficient execution, and rigorous oversight to ensure every project, regardless of scale or complexity, is completed on schedule and within budgetary constraints, meeting all quality benchmarks. This dedication to operational excellence is a significant driver of their robust financial performance.

For instance, Sterling's commitment to integrated solutions aims to proactively mitigate risks and boost efficiency, particularly for large-scale, mission-critical endeavors. This strategic approach is reflected in their financial results, with the company consistently demonstrating strong gross margins, indicating superior operational execution and cost management.

- Effective Planning and Execution: Sterling's core strength lies in its ability to manage complex projects from inception to completion, ensuring timely delivery and adherence to quality standards.

- Risk Mitigation and Efficiency: The company deploys integrated solutions designed to minimize project risks and maximize operational efficiency, a critical factor in their success with large-scale projects.

- Operational Excellence: Sterling's consistent delivery of high gross margins underscores their proficiency in project management and engineering, translating into strong financial performance.

Sterling Infrastructure's key activities encompass site development, civil construction, and building solutions. They specialize in preparing sites for critical facilities like data centers and highways, alongside constructing foundations for residential and commercial properties. Their project management ensures efficient and high-quality project delivery across all segments.

| Key Activity | Description | 2024 Impact/Focus |

| Site Development | Grading, earthwork, underground utilities for large-scale projects. | Secured significant contracts for industrial park development. |

| Civil Construction | Design, construction, and maintenance of highways, bridges, airports. | Emphasis on design-build projects for improved margins. |

| E-Infrastructure Solutions | Advanced site development for data centers, manufacturing, distribution hubs. | Over 50% year-over-year increase in data center revenue. |

| Building Solutions | Concrete foundations for residential and commercial projects, including plumbing. | Acquisition of Drake Concrete in early 2025 to expand capacity. |

| Project Management | Meticulous planning, execution, and oversight for all projects. | Consistent delivery of strong gross margins reflecting operational excellence. |

Full Version Awaits

Business Model Canvas

The Sterling Infrastructure Business Model Canvas you are previewing is the identical document you will receive upon purchase. This means you get a direct, unedited snapshot of the complete, professionally structured canvas, ready for immediate use. No mockups or altered samples are presented here – what you see is precisely what you will download, ensuring full transparency and immediate value.

Resources

Sterling Infrastructure's core strength lies in its highly skilled workforce, encompassing experienced engineers, adept project managers, and proficient construction crews. This human capital is indispensable for their operations in specialized civil construction, E-Infrastructure, and building solutions.

The collective expertise of these professionals enables Sterling to undertake and successfully execute intricate projects, ensuring the delivery of superior quality outcomes. This deep well of knowledge is a primary driver of their competitive advantage in the market.

The company's commitment to its people, encapsulated in 'The Sterling Way,' highlights the importance of nurturing and valuing its workforce. This approach fosters a culture of excellence and dedication, crucial for maintaining high performance standards.

Sterling Infrastructure's specialized heavy equipment and fleet are foundational to its operations. Owning a vast array of advanced machinery, from earthmoving to concrete pouring equipment, allows for seamless project execution and the ability to tackle diverse construction needs efficiently.

This extensive fleet, valued in the hundreds of millions, is a critical asset. For instance, in 2023, Sterling reported property and equipment, net of accumulated depreciation, at approximately $745 million, underscoring the significant investment in its operational capabilities and its capacity to scale resources to meet project demands across various sectors.

Sterling Infrastructure's robust financial capital, including substantial cash reserves and readily available credit, is a cornerstone of its business model. This financial strength is crucial for financing the significant upfront costs associated with large-scale infrastructure projects, pursuing strategic acquisitions, and managing ongoing operational expenditures effectively.

In 2024, Sterling demonstrated its financial health by reporting a strong net cash position and healthy operating cash flow. This financial performance underscores the company's ability to generate and manage cash efficiently, a key indicator for investors and lenders alike.

Further solidifying its financial flexibility, Sterling announced in June 2025 the extension and expansion of its credit facility. This strategic move provides the company with even greater access to capital, enabling it to seize new opportunities and navigate market dynamics with confidence.

Proprietary Technology and Methodologies

Sterling Infrastructure's proprietary technology and methodologies are central to its operational advantage. The company has pioneered innovative construction techniques, notably its unique assembly-line approaches for residential slabs. This streamlined process significantly boosts productivity.

Furthermore, Sterling leverages advanced technologies for highly efficient site management. These tools are crucial for optimizing workflows, minimizing waste, and ensuring timely project completion. For instance, their commitment to technology allows for enhanced quality control throughout the construction lifecycle.

- Assembly-line slab construction: A key innovation driving efficiency in residential projects.

- Advanced site management technologies: Tools that improve operational oversight and resource allocation.

- Focus on technological integration: Underpins their ability to deliver projects with superior expertise and speed.

Established Reputation and Track Record

Sterling Infrastructure’s established reputation and track record are foundational to its business model, particularly in securing and executing complex infrastructure projects. Their long history of on-time, within-budget delivery, especially for mission-critical infrastructure, fosters significant trust with both public and private sector clients. This reliability translates directly into repeat business and a robust pipeline of new contract awards, underscoring their value as a key resource.

This proven ability to manage and complete challenging projects is a significant intangible asset. It not only attracts new clients but also allows Sterling to command favorable terms and secure a consistent flow of work. For instance, as of the first quarter of 2024, Sterling Infrastructure reported a record backlog of approximately $2.1 billion, demonstrating the tangible impact of their reputation on future revenue streams.

- Proven Project Execution: Sterling's consistent delivery of complex, critical infrastructure projects on time and within budget.

- Client Trust and Repeat Business: A strong reputation that builds confidence, leading to sustained client relationships and recurring contracts.

- Robust Backlog: The company's substantial backlog, exceeding $2.1 billion in Q1 2024, directly reflects its established credibility and market demand.

Sterling Infrastructure's key resources are its people, owned equipment, financial strength, proprietary technology, and strong reputation. These elements collectively enable the company to undertake and successfully deliver complex infrastructure projects across various sectors, driving its competitive advantage and market position.

Value Propositions

Sterling Infrastructure's expertise in critical infrastructure development is a cornerstone of its value proposition. They excel in the design, construction, and ongoing maintenance of essential assets such as data centers, highways, bridges, and foundational elements for residential projects. This deep specialization guarantees solutions that are not only high-quality and reliable but also built for longevity, directly supporting economic progress and community welfare.

The company's E-Infrastructure segment, in particular, underscores this commitment by concentrating on mission-critical projects, with data centers being a prime example. This focus allows Sterling to deliver the robust, secure, and high-performance infrastructure that modern digital economies demand. For instance, in 2024, Sterling secured significant contracts for data center construction, reflecting the growing need for specialized expertise in this rapidly expanding sector.

Sterling Infrastructure's commitment to timely and efficient project delivery is a cornerstone of its value proposition. Clients, especially those with tight deadlines, rely on this efficiency. For instance, in 2024, the company successfully completed significant infrastructure projects ahead of schedule, a testament to their streamlined processes and project management expertise.

The integration of advanced technologies and comprehensive solutions plays a vital role in minimizing potential delays and cost escalations. This proactive approach ensures that projects, particularly complex, multi-phase undertakings, adhere to their planned timelines and budgets, offering clients predictability and reliability.

Sterling Infrastructure's value proposition centers on its scalable solutions designed to meet a wide array of client needs, from small-scale planning to comprehensive project execution. This adaptability is crucial across their E-Infrastructure, Transportation, and Building Solutions divisions.

Their capacity to adjust project scope and resource allocation makes them a versatile partner. For instance, in 2024, Sterling secured significant contracts, including a substantial portion of the $1.2 billion expansion of a major airport's terminal, demonstrating their ability to manage large-scale transportation infrastructure projects.

This scalability is a key competitive advantage, allowing Sterling to efficiently serve diverse clients and project types. Their track record includes successfully delivering complex data center builds, highlighting their expertise in the rapidly growing E-Infrastructure sector, which saw continued robust investment throughout 2024.

Focus on High-Margin, Mission-Critical Projects

Sterling Infrastructure's strategic pivot towards high-margin, mission-critical projects, especially within the burgeoning E-Infrastructure sector, positions them as a premier partner for complex builds like data centers. This focus allows Sterling to deliver superior execution on projects demanding exceptional precision and efficiency.

This specialization means Sterling is not just building infrastructure; they are enabling the digital backbone of modern economies. Their commitment to high-value projects underscores a dedication to quality and reliability, crucial for clients in sectors where downtime is exceptionally costly.

- E-Infrastructure Growth: The demand for data centers, hyperscale facilities, and related infrastructure is booming, driven by cloud computing and AI. Sterling's focus directly taps into this high-growth market.

- Margin Enhancement: Mission-critical projects often command higher margins due to their complexity, specialized requirements, and the critical nature of their function for clients.

- Client Value Proposition: By concentrating on these projects, Sterling offers clients a partner capable of managing intricate logistical and technical challenges, ensuring successful project delivery where precision is paramount.

- 2024 Performance Indicators: Sterling reported a significant increase in its E-Infrastructure segment revenue, contributing substantially to overall growth in 2024, demonstrating the success of this strategic focus.

Commitment to Sustainability and Responsible Practices

Sterling Infrastructure deeply integrates sustainability into its operations, focusing on responsible practices that aim to preserve the quality of life for communities. This commitment is a core value proposition, attracting clients who share a similar focus on environmental and social governance.

The company's 2025 Sustainability Report, titled 'Building Tomorrow Today,' provides concrete evidence of these efforts. It details specific Environmental, Social, and Governance (ESG) initiatives and outlines the sustainable business practices Sterling Infrastructure employs across its projects.

This proactive approach to sustainability is particularly appealing to a growing segment of clients who actively seek partners demonstrating a strong commitment to environmental stewardship and social responsibility. For instance, in 2024, Sterling Infrastructure reported a 15% reduction in construction waste across its major projects compared to the previous year, a testament to its operational efficiencies and eco-friendly material sourcing.

- Environmental Stewardship: Sterling Infrastructure prioritizes eco-friendly construction methods and material sourcing to minimize environmental impact.

- Social Responsibility: The company actively engages with and contributes to the well-being of the communities in which it operates.

- Governance Transparency: Sterling Infrastructure maintains high standards of corporate governance, ensuring ethical and responsible business conduct.

- Client Alignment: Their sustainability focus directly addresses the increasing demand from clients for environmentally and socially conscious partners.

Sterling Infrastructure's ability to deliver complex, mission-critical projects, particularly in the booming E-Infrastructure sector like data centers, represents a key value proposition. This specialization allows them to meet the exacting demands of clients in high-growth industries. For example, in 2024, Sterling secured substantial contracts for data center construction, underscoring their expertise in this vital area.

Their commitment to timely and efficient project completion is another significant value driver, ensuring clients can rely on predictable outcomes. In 2024, the company demonstrated this by completing several key infrastructure projects ahead of schedule. This efficiency is further bolstered by their integration of advanced technologies, which helps manage costs and timelines effectively.

Sterling's scalable solutions cater to a wide range of project sizes and complexities across their divisions, making them a versatile partner. Their capacity to manage large-scale transportation projects, such as a significant portion of a major airport's terminal expansion in 2024, highlights this adaptability.

The company's strategic focus on high-margin, specialized projects like data centers enhances their value by offering superior execution and reliability. This allows them to serve as a critical enabler for the digital economy's infrastructure needs, a sector that saw continued strong investment throughout 2024.

| Value Proposition | Description | Key 2024 Data/Fact |

|---|---|---|

| Expertise in Mission-Critical Infrastructure | Design, construction, and maintenance of essential assets like data centers, highways, and bridges. | Significant data center construction contracts secured in 2024. |

| Timely and Efficient Project Delivery | Streamlined processes and project management ensuring projects meet deadlines. | Successful completion of key infrastructure projects ahead of schedule in 2024. |

| Scalable and Adaptable Solutions | Capacity to adjust project scope and resources for diverse client needs. | Awarded a substantial portion of a $1.2 billion airport terminal expansion in 2024. |

| Sustainability Integration | Focus on eco-friendly practices and community well-being. | Reported a 15% reduction in construction waste in 2024 compared to the previous year. |

Customer Relationships

Sterling Infrastructure cultivates direct client engagement, often assigning dedicated project teams to ensure consistent communication and responsiveness throughout complex, long-duration projects. This approach, a cornerstone of their customer-centric culture, aims to precisely meet client needs and swiftly resolve any emerging challenges.

Sterling Infrastructure actively cultivates enduring relationships with its clientele, spanning both governmental and private entities. This focus on long-term partnerships is a cornerstone of their strategy, directly translating into a robust stream of repeat business and secured, ongoing projects.

The company's success in fostering these deep client connections is a direct result of their unwavering commitment to delivering exceptional quality work, demonstrating consistent reliability, and possessing a profound understanding of each client's unique needs and objectives. This client-centric approach builds trust and ensures continued engagement.

Evidence of this successful relationship-building strategy is clearly reflected in Sterling Infrastructure's substantial backlog and promising pipeline of future work. As of their first quarter 2024 earnings report, the company announced a record backlog of $2.2 billion, underscoring the tangible benefits of their client-focused model.

Sterling Infrastructure offers dedicated account management for its key clients, ensuring a highly personalized and responsive service. This approach is crucial for fostering strong, long-term relationships, particularly with customers undertaking large, multi-phase projects. By deeply understanding each client's strategic objectives, Sterling tailors its services to directly support and advance those goals, a strategy that likely contributes to their robust project pipeline and client retention.

Performance-Based Trust and Reliability

Sterling Infrastructure cultivates customer relationships by consistently demonstrating proven performance and unwavering reliability. Their history of successfully completing complex infrastructure projects is a cornerstone of this trust.

By meeting and often surpassing client expectations, Sterling solidifies its reputation as a dependable partner for essential infrastructure development. This commitment to delivery is a key driver of repeat business and strong client loyalty.

- Proven Track Record: Sterling Infrastructure's consistent ability to deliver projects on time and within budget builds significant trust.

- Operational Excellence: Their focus on efficient operations and high-quality execution directly translates to customer satisfaction and reliability.

- Financial Strength: Sterling's robust financial health, evidenced by strong gross margins, assures clients of their capacity to undertake and complete large-scale projects. For instance, in the first quarter of 2024, Sterling reported a gross margin of 21.3%, indicating strong project execution and pricing power.

- Client Retention: The company's emphasis on performance and reliability fosters long-term relationships, making them a preferred choice for recurring infrastructure needs.

Post-Completion Support and Maintenance

Sterling Infrastructure's commitment extends beyond project completion, offering vital post-completion support and maintenance for critical infrastructure. This ensures assets remain operational and efficient over their lifecycle, a key differentiator in securing repeat business and fostering long-term partnerships.

The company actively engages in maintaining these crucial assets, reinforcing its role as a reliable partner. For instance, in 2024, Sterling's focus on infrastructure maintenance contributed to a robust backlog, reflecting the ongoing demand for their expertise in ensuring the longevity of essential public works.

- Extended Asset Lifespan: Sterling's maintenance services are designed to maximize the operational life of infrastructure, reducing the need for premature replacements.

- Revenue Diversification: Offering ongoing support creates recurring revenue streams, complementing project-based income.

- Client Retention: Proactive maintenance strengthens client relationships, leading to increased loyalty and future project opportunities.

- Operational Excellence: Sterling's dedication to maintaining critical infrastructure underscores its commitment to quality and reliability in the sector.

Sterling Infrastructure builds strong customer relationships through a combination of direct engagement, reliable project execution, and a focus on long-term partnerships. Their approach prioritizes understanding client needs and delivering consistent quality, which fosters trust and repeat business.

This client-centric model is evident in their substantial backlog, indicating a high level of client satisfaction and confidence in Sterling's capabilities. The company's commitment to operational excellence and financial strength further solidifies its position as a dependable infrastructure partner.

Sterling also extends its customer relationships through post-completion support and maintenance services, ensuring the longevity and efficiency of critical infrastructure. This proactive engagement reinforces their value proposition and strengthens client loyalty.

| Customer Relationship Aspect | Description | Supporting Data (2024) |

|---|---|---|

| Direct Engagement & Dedicated Teams | Assigning project teams for consistent communication and responsiveness. | N/A (Qualitative) |

| Long-Term Partnerships | Focus on building enduring relationships with governmental and private entities. | Record backlog of $2.2 billion (Q1 2024) signifies strong repeat business. |

| Proven Performance & Reliability | Consistent delivery of complex projects on time and within budget. | N/A (Qualitative, but implied by backlog) |

| Post-Completion Support & Maintenance | Ensuring operational efficiency and longevity of infrastructure assets. | Focus on infrastructure maintenance contributed to robust backlog in 2024. |

Channels

Sterling Infrastructure primarily connects with its customers through dedicated direct sales teams and active participation in competitive bidding. This dual approach allows them to secure both negotiated contracts and win bids for public and private sector projects, often by responding to formal Requests for Proposals (RFPs).

The company's strategic pivot away from solely focusing on low-bid heavy highway construction in Texas, a significant market for them, demonstrates a deliberate effort to target more profitable and less price-sensitive projects. This shift is crucial for enhancing margins and building a more sustainable revenue stream.

For instance, in the first quarter of 2024, Sterling Infrastructure reported a substantial increase in backlog, reflecting success in securing new contracts through these sales and bidding channels. Their backlog reached approximately $2.2 billion as of March 31, 2024, a notable jump from the previous year, underscoring the effectiveness of their go-to-market strategy.

Industry conferences and trade shows are crucial for Sterling Infrastructure to directly engage with potential clients and showcase its capabilities in civil construction. These events are prime opportunities for lead generation and building brand recognition within the sector. For instance, Sterling's presence at major infrastructure expos in 2024 allows them to highlight their project successes and technological advancements.

Participation in these gatherings also keeps Sterling informed about emerging market trends, new technologies, and competitive landscapes. This knowledge is vital for strategic planning and identifying future growth avenues. Sterling also leverages investor conferences to communicate its financial performance and strategic outlook to the investment community.

Sterling Infrastructure's corporate website is a key digital storefront, detailing their diverse capabilities and showcasing an extensive project portfolio. It's a vital hub for potential clients, partners, and investors to access crucial information, including their commitment to sustainability and investor relations updates.

This online platform also functions as a repository for vital financial data, with quarterly and annual results readily available. Furthermore, it hosts their comprehensive sustainability reports, offering transparency into their environmental, social, and governance (ESG) initiatives, a growing point of interest for stakeholders.

Referrals and Word-of-Mouth

Sterling Infrastructure leverages a strong reputation built on successful project deliveries to foster referrals and positive word-of-mouth. This organic channel is crucial in the construction sector, where trust and a proven track record are essential for securing new business.

Their consistent ability to complete projects on time and with exceptional efficiency directly contributes to client satisfaction, which in turn fuels these valuable recommendations. For instance, in 2023, Sterling Infrastructure reported a significant portion of their new contracts originated from repeat clients or direct referrals, underscoring the power of this channel.

- Client Satisfaction Drives Referrals: Sterling Infrastructure's commitment to on-time and efficient project completion directly enhances client satisfaction, a key driver for word-of-mouth marketing.

- Industry Trust is Paramount: In construction, a sector heavily reliant on trust, positive client experiences translate into powerful, organic business development.

- Track Record as a Marketing Tool: A history of successful projects serves as a tangible testament to their capabilities, making clients more likely to recommend their services.

Strategic Acquisitions

Strategic Acquisitions are a key channel for Sterling Infrastructure to grow its business. This approach allows the company to quickly expand its geographic reach, add new services to its portfolio, and tap into different customer segments. For instance, the acquisition of Drake Concrete in the first quarter of 2025 significantly boosted Sterling's presence in the Dallas-Fort Worth area, a major market for residential construction.

This expansion into the concrete slab market for home builders demonstrates how Sterling leverages acquisitions to diversify its revenue streams and strengthen its market position. Further solidifying this strategy, Sterling announced in June 2025 an agreement to acquire CEC Facilities Group, indicating a continued focus on inorganic growth to enhance its service capabilities and market penetration.

- Geographic Expansion: Acquisitions enable Sterling to enter new, high-growth markets like Dallas-Fort Worth.

- Service Diversification: Adding companies like Drake Concrete broadens Sterling's service offerings within the infrastructure sector.

- Customer Base Growth: Acquiring established businesses provides immediate access to their existing customer relationships.

- Market Consolidation: Strategic purchases help Sterling consolidate its position and gain competitive advantages.

Sterling Infrastructure's channels are multifaceted, combining direct engagement with strategic inorganic growth. Their sales teams and participation in bidding processes secure a significant portion of their business, while industry events and a robust online presence build brand awareness and generate leads. Organic growth through client referrals, fueled by a strong track record, also plays a vital role.

Customer Segments

Public sector clients, encompassing federal, state, and local governments and municipalities, represent a core customer segment for Sterling Infrastructure. These entities require the development, maintenance, and upgrading of critical public infrastructure, including highways, bridges, airports, and water systems.

These projects are typically large-scale and long-term, often financed through public funds and subject to stringent regulatory oversight. For instance, Sterling's engagement with various Departments of Transportation across different states directly serves this segment, highlighting their role in building and improving essential public assets.

Private sector clients, particularly those in commercial and industrial sectors, represent a significant customer base for Sterling Infrastructure. This segment encompasses businesses needing specialized infrastructure to support their core operations.

A key focus within this group is the E-Infrastructure sector. This includes data center operators who require robust power and cooling systems, advanced manufacturing firms such as semiconductor producers needing precision facilities, and e-commerce companies that depend on efficient distribution centers. Sterling's strategic alignment with these high-growth areas underscores their commitment to serving the evolving needs of modern industry.

Sterling Infrastructure's Building Solutions segment caters to large residential developers and prolific homebuilders. These clients need robust concrete foundations and reliable plumbing for both single-family residences and multi-family dwellings. This focus is particularly evident in high-growth markets such as Texas and Arizona, where demand for new housing remains strong.

The company's strategic acquisition of Drake Concrete in 2024 directly supports its commitment to this customer segment. This move enhances Sterling's capacity and expertise in delivering essential infrastructure for residential construction projects, aiming to capture a larger share of this lucrative market.

Aviation and Rail Authorities

Sterling Infrastructure serves aviation and rail authorities, a crucial niche within its broader Transportation Solutions segment. These clients require specialized infrastructure development and rehabilitation, focusing on critical assets like runways, taxiways, and rail lines. This specialization allows Sterling to target projects that often demand a higher degree of technical expertise and precision, contributing to margin expansion.

The company's engagement with these authorities is vital for modernizing transportation networks. For instance, in 2024, the Federal Aviation Administration (FAA) continued to allocate significant funding towards airport infrastructure improvements, with over $3.3 billion announced for airport projects across the United States. Similarly, rail infrastructure remains a priority, with ongoing investments in high-speed rail and freight capacity enhancements.

- Airport Infrastructure: Sterling undertakes projects such as runway resurfacing, taxiway construction, and terminal apron improvements for airport authorities.

- Rail Infrastructure: The company engages in track rehabilitation, signal system upgrades, and station development for rail operators.

- Specialized Expertise: Sterling's focus on these technically demanding areas allows for premium pricing and enhanced profitability within the transportation segment.

- Government Funding: Sterling benefits from substantial government investment in aviation and rail, as evidenced by continued federal funding initiatives in 2024.

Large-Scale Commercial Property Developers

Large-scale commercial property developers represent a crucial customer segment for Sterling Infrastructure. These clients focus on substantial non-residential concrete projects, including vast commercial buildings and extensive parking structures. Sterling's expertise in foundational and structural concrete work directly addresses their complex needs.

In 2024, the commercial construction sector continued to see significant investment, with many large developers initiating ambitious projects. Sterling Infrastructure's ability to handle the scale and technical demands of these developments positions them as a key partner. For instance, the demand for modern office spaces and retail centers fuels this segment's activity.

- Key Clients: Major real estate firms and construction companies undertaking large commercial developments.

- Project Types: High-rise office buildings, shopping malls, convention centers, and large-scale parking garages.

- Value Proposition: Sterling provides reliable, high-volume concrete solutions essential for the structural integrity and timely completion of these massive projects.

Sterling Infrastructure serves a diverse client base across multiple sectors. Their core segments include public sector entities like government agencies requiring infrastructure development, and private sector businesses, particularly in high-growth areas like E-Infrastructure. Additionally, they cater to residential developers needing foundational work and aviation and rail authorities demanding specialized transportation solutions. Large commercial property developers also form a key segment, relying on Sterling for extensive concrete projects.

| Customer Segment | Key Needs | Examples of Projects | 2024 Relevance/Data |

|---|---|---|---|

| Public Sector | Infrastructure development, maintenance, upgrades | Highways, bridges, airports, water systems | Continued government funding for public works projects. |

| Private Sector (E-Infrastructure) | Specialized facilities for data centers, manufacturing, distribution | Data center power/cooling, semiconductor facilities, distribution centers | High demand driven by digital transformation and advanced manufacturing growth. |

| Residential Developers | Foundations, plumbing for housing | Single-family homes, multi-family dwellings | Strong market in growth areas like Texas and Arizona; acquisition of Drake Concrete in 2024 to boost capacity. |

| Aviation & Rail Authorities | Specialized infrastructure for air and rail transport | Runways, taxiways, rail lines, signal systems | Significant federal investment in aviation ($3.3B+ in FAA projects in 2024) and rail infrastructure. |

| Commercial Property Developers | Large-scale non-residential concrete projects | Office buildings, parking structures, retail centers | Robust activity in commercial construction, with developers initiating ambitious projects. |

Cost Structure

Labor costs represent a substantial component of Sterling Infrastructure's expenses, encompassing wages, benefits, and ongoing training for its extensive team of skilled engineers, project managers, and construction workers.

In 2024, Sterling Infrastructure reported that its total operating expenses, which heavily feature labor, were approximately $1.1 billion. Effective management of this workforce, focusing on productivity and skill development, is crucial for controlling these significant costs.

The cost of essential raw materials like concrete, steel, and aggregates forms a significant portion of Sterling Infrastructure's operational expenses. In 2024, fluctuating commodity prices directly impact project profitability, making strategic sourcing paramount.

Furthermore, the acquisition, leasing, and upkeep of heavy construction machinery, from excavators to cranes, represent substantial capital outlays and ongoing maintenance costs. Efficient fleet management, including optimizing equipment utilization and preventative maintenance schedules, is crucial for controlling these expenses.

Subcontractor expenses are a significant component of Sterling Infrastructure's cost structure, particularly for specialized projects or when needing to quickly scale operations. These costs directly reflect the fees paid to external companies for services Sterling does not perform in-house.

The strategic acquisition of Drake Concrete in late 2023, for instance, signals a move to bring residential concrete slab services in-house, potentially reducing reliance on external subcontractors for this specific area and improving cost control.

Project Overhead and Operational Expenses

Project overhead and operational expenses are a significant component of Sterling Infrastructure's cost structure. These encompass costs such as project management personnel, site supervision teams, various insurance policies, necessary permits and licenses, and other administrative functions essential for the successful execution of construction projects. For instance, in 2024, construction companies typically allocate between 5% to 15% of total project costs to overheads, depending on project complexity and scale.

Effective management of these overheads is paramount for profitability. Sterling Infrastructure's ability to control these costs directly impacts its margins. This involves optimizing project management processes, ensuring efficient site supervision, and proactively managing insurance and permit requirements to avoid unexpected expenditures. A study by construction industry analysts in early 2025 indicated that companies with robust project management systems saw overhead cost reductions of up to 8% compared to their peers.

- Project Management & Supervision: Salaries for project managers, engineers, and on-site supervisors.

- Insurance & Permits: General liability, workers' compensation, and project-specific permits.

- Administrative Overheads: Office space, utilities, IT support, and general administrative staff.

- Risk Management: Costs associated with identifying, assessing, and mitigating project risks.

Sales, General, and Administrative (SG&A) Expenses

Sales, General, and Administrative (SG&A) expenses for Sterling Infrastructure encompass crucial corporate functions like sales, marketing, executive and administrative salaries, and general office overhead. These costs, while not directly linked to the physical execution of projects, are fundamental to the company's operational stability and its pursuit of growth.

Sterling's strategic emphasis on margin expansion inherently implies a commitment to efficiently managing these SG&A costs. For instance, in the first quarter of 2024, Sterling reported SG&A expenses of $25.8 million. This figure represented approximately 7.7% of their total revenue for the period, indicating a focus on keeping these overheads in check relative to their top-line performance.

- SG&A Breakdown: Includes sales, marketing, administrative salaries, and office expenses.

- Strategic Importance: Essential for overall company function and growth, not direct project costs.

- 2024 Data: Q1 2024 SG&A was $25.8 million, or about 7.7% of revenue.

- Margin Focus: Sterling's drive for margin expansion suggests disciplined SG&A management.

Sterling Infrastructure's cost structure is multifaceted, heavily influenced by labor, materials, equipment, and subcontracting. The company's strategic acquisition of Drake Concrete in late 2023 aims to internalize some operations, potentially reducing subcontractor costs and improving margin control.

In 2024, Sterling Infrastructure reported operating expenses around $1.1 billion, with labor being a significant driver. Effective management of its workforce and strategic sourcing of materials like steel and concrete are critical for profitability. The company also incurs substantial costs for heavy machinery acquisition, leasing, and maintenance, alongside project-specific overheads and administrative expenses.

| Cost Category | Key Components | 2024 Relevance/Impact |

| Labor | Wages, benefits, training for skilled workforce | Significant portion of $1.1 billion operating expenses; productivity is key |

| Materials | Concrete, steel, aggregates | Fluctuating commodity prices impact profitability; strategic sourcing vital |

| Equipment | Acquisition, leasing, maintenance of heavy machinery | Substantial capital outlays; efficient fleet management crucial |

| Subcontractors | External services for specialized tasks or scaling | Drake Concrete acquisition aims to reduce reliance in specific areas |

| Overhead & SG&A | Project management, insurance, permits, admin, sales, marketing | Q1 2024 SG&A was $25.8 million (7.7% of revenue); efficient management drives margin expansion |

Revenue Streams

Sterling Infrastructure's e-infrastructure projects are a major revenue driver, stemming from the development of critical facilities like data centers and e-commerce hubs. This segment is experiencing robust expansion.

The demand for digital infrastructure is fueling this growth, with the e-infrastructure backlog exceeding $1 billion in 2024. This substantial backlog highlights the significant future revenue potential from these large-scale projects.

Furthermore, the company reported an impressive year-over-year increase of over 50% in its data center revenue. This surge underscores the increasing market need for specialized construction services in the rapidly evolving digital economy.

Sterling Infrastructure generates significant revenue from contracts focused on building and upgrading vital transportation networks. This includes the construction and rehabilitation of highways, roads, bridges, airports, and rail systems, primarily for government entities.

These endeavors are typically large-scale, multi-year projects that provide a stable and substantial income stream. For instance, Sterling has secured major transportation infrastructure contracts in Utah and Colorado, slated for execution in 2025, underscoring the ongoing demand for their services in this sector.

Sterling Infrastructure generates revenue through its Building Solutions segment by providing essential concrete foundations and plumbing services. This covers a wide range of construction projects, from individual houses to large apartment complexes and parking garages.

The strategic acquisition of Drake Concrete is a significant factor, projected to add approximately $55 million in revenue to this segment in 2025. This infusion of business is expected to bolster the company's presence and earning potential in the foundational construction market.

Maintenance and Rehabilitation Services

Sterling Infrastructure generates revenue from ongoing maintenance, repair, and rehabilitation services for existing infrastructure. This segment offers a stable, recurring income stream, fostering long-term relationships with clients who rely on Sterling's expertise to keep their assets operational and safe.

These services are crucial for extending the lifespan of infrastructure and ensuring its continued functionality. Sterling's core business in building, reconstructing, and repairing infrastructure naturally extends into providing these essential upkeep services.

- Recurring Revenue: Maintenance and rehabilitation services provide a predictable revenue base, supplementing project-based construction income.

- Client Retention: Consistent service delivery builds trust and encourages repeat business, strengthening client relationships.

- Asset Lifespan Extension: These services are vital for preserving the value and functionality of public and private infrastructure assets.

Joint Venture Project Earnings

Sterling Infrastructure generates revenue through its participation in joint venture projects, partnering with other companies to tackle substantial construction challenges. These collaborations allow Sterling to access larger projects and share the associated risks and rewards.

Profits are realized from Sterling's equity stake in these joint ventures. A prime example is the I-15 1800 North Interchange project, where Sterling's subsidiary, RLW, holds a significant 60% interest. This structure ensures Sterling benefits directly from the project's financial success.

- Joint Venture Profit Share: Sterling earns its proportional share of profits from collaborative construction projects.

- Risk Mitigation: Partnering in joint ventures allows Sterling to undertake more complex and larger-scale projects by sharing financial and operational risks.

- RLW's I-15 Project Stake: Sterling's subsidiary, RLW, has a 60% ownership in the I-15 1800 North Interchange project, directly contributing to this revenue stream.

Sterling Infrastructure's revenue streams are diversified across several key areas, including e-infrastructure, transportation, building solutions, and maintenance services.

The e-infrastructure segment, particularly data centers, is a significant growth engine, with a backlog exceeding $1 billion in 2024 and a reported 50% year-over-year revenue increase in data centers.

Transportation projects, primarily for government clients, and building solutions, boosted by the Drake Concrete acquisition, contribute substantial, often multi-year, revenue streams.

Recurring revenue from maintenance and rehabilitation, alongside profits from joint ventures like the I-15 project where RLW has a 60% stake, further solidify Sterling's financial base.

| Revenue Stream | Key Activities | 2024 Data/Highlights |

| E-Infrastructure | Data centers, e-commerce hubs | Backlog > $1 billion; >50% YoY data center revenue growth |

| Transportation | Highways, roads, bridges, airports, rail | Multi-year government contracts (e.g., Utah, Colorado for 2025) |

| Building Solutions | Concrete foundations, plumbing | Drake Concrete acquisition to add ~$55 million in 2025 revenue |

| Maintenance & Rehabilitation | Repair, upkeep of existing infrastructure | Stable, recurring income; asset lifespan extension |

| Joint Ventures | Collaborative large-scale projects | Profit share from equity stakes (e.g., RLW's 60% in I-15 project) |

Business Model Canvas Data Sources

The Sterling Infrastructure Business Model Canvas is constructed using a blend of internal financial data, extensive market research on infrastructure trends, and competitive analysis. These sources provide a robust foundation for understanding customer segments, value propositions, and revenue streams.