Plastipak Holdings SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Plastipak Holdings Bundle

Plastipak Holdings demonstrates strong operational efficiencies and a commitment to sustainability, key strengths in the competitive packaging market. However, potential threats from fluctuating raw material costs and evolving regulatory landscapes require careful navigation.

Want the full story behind Plastipak's market advantages, potential vulnerabilities, and strategic opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Plastipak Holdings, Inc. stands as a global frontrunner in rigid plastic packaging, boasting over 60 facilities worldwide. This extensive footprint solidifies its position as a world leader in the design, manufacture, and marketing of these essential products.

In the United States, Plastipak holds a substantial market share in plastic bottle manufacturing, a testament to its strong competitive standing within the industry.

The company's integrated operations, encompassing the entire packaging lifecycle from initial design through to recycling, offer a distinct competitive edge. This end-to-end control ensures consistent quality and operational efficiency.

Plastipak is a leader in sustainability, particularly in plastic recycling, processing billions of bottles each year. This focus on circularity is a significant strength, aligning with growing consumer and regulatory demand for environmentally responsible products.

The company's commitment is further validated by the Science Based Targets initiative (SBTi) approving its near-term emissions reduction targets, demonstrating a concrete plan for environmental stewardship.

Plastipak is also at the forefront of technological innovation, developing groundbreaking materials like PPKNatura, the first PET resin derived from captured carbon emissions. This, coupled with their adoption of renewable energy across facilities, positions them as an innovator in sustainable manufacturing.

Plastipak Holdings boasts a diverse product portfolio, manufacturing containers and preforms for a wide range of consumer goods. This includes everything from beverages and food to personal care items, household chemicals, and even industrial and automotive fluids. This broad reach across multiple end-use sectors significantly diversifies their revenue streams and reduces reliance on any single market segment.

Proprietary Technology and Custom Design Capabilities

Plastipak Holdings boasts significant strengths in its proprietary technology and custom design capabilities. The company utilizes a diverse array of in-house technologies, including those for aerosol, barrier, hotfill, and virgin resin production. This technological foundation is further amplified by its Creative Package Studio, allowing for the development of highly tailored packaging solutions.

These integrated capabilities translate into innovative packaging that directly addresses specific client needs. Plastipak's technological prowess helps ensure superior product protection, extended shelf life, and improved aesthetic appeal for the goods it packages, thereby delivering tangible value to its customers.

For instance, in 2024, the demand for advanced barrier technologies in food and beverage packaging continued to rise, a segment where Plastipak's proprietary solutions are well-positioned. The company's ability to customize designs also allows it to capture niche markets and build strong client relationships, differentiating it from competitors who offer more standardized products.

- Proprietary Technologies: Expertise in aerosol, barrier, hotfill, and virgin resin manufacturing.

- Custom Design: Creative Package Studio facilitates unique client-specific packaging solutions.

- Value Proposition: Enhanced product protection, extended shelf life, and improved visual appeal.

- Market Responsiveness: Ability to adapt to evolving market demands for specialized packaging.

Strong Focus on Post-Consumer Recycled (PCR) Content

Plastipak Holdings demonstrates a robust commitment to incorporating post-consumer recycled (PCR) materials, particularly HDPE and PET, into its product lines. This strategic focus directly addresses escalating consumer demand and increasing regulatory mandates pushing for circular economy principles.

By prioritizing PCR content, Plastipak not only minimizes its environmental impact but also strategically positions itself as a key partner for brands aiming to achieve their own ambitious sustainability objectives. This commitment is further bolstered by their acquisition of Evolve Polymers, significantly enhancing their capabilities in transforming recycled PET bottles into premium-grade materials.

- Commitment to PCR: Increasing use of recycled HDPE and PET in products.

- Market Alignment: Meets growing demand for sustainable packaging solutions.

- Brand Preference: Positions Plastipak as a preferred supplier for eco-conscious brands.

- Enhanced Capacity: Evolve Polymers acquisition strengthens recycled PET processing capabilities.

Plastipak's extensive global manufacturing footprint, with over 60 facilities, provides a significant competitive advantage, ensuring localized production and supply chain efficiencies. Their substantial market share in the US plastic bottle manufacturing sector further underscores their strong industry position.

The company's integrated approach, managing the entire packaging lifecycle from design to recycling, offers superior quality control and operational synergy. This end-to-end capability is a key differentiator in the market.

Plastipak's leadership in plastic recycling, processing billions of bottles annually, and its Science Based Targets initiative (SBTi) approval for emissions reduction targets highlight a deep commitment to sustainability. This focus aligns perfectly with increasing market and regulatory demands for eco-friendly packaging solutions.

The company's innovative material development, such as PPKNatura derived from captured carbon emissions, and its adoption of renewable energy showcase a forward-thinking approach to sustainable manufacturing.

What is included in the product

Delivers a strategic overview of Plastipak Holdings’s internal and external business factors, highlighting its market strengths, operational gaps, and potential threats.

Offers a clear, actionable roadmap by highlighting key opportunities and mitigating potential threats for Plastipak Holdings.

Weaknesses

Plastipak's fundamental reliance on rigid plastic packaging places it directly in the crosshairs of growing environmental concerns. This material is increasingly facing public criticism and stricter regulations worldwide, creating a significant vulnerability for the company.

This deep dependence on plastic exposes Plastipak to reputational risks and the potential for negative public perception. As discussions around plastic pollution intensify, there's a tangible risk of diminished demand for their conventional packaging offerings.

Plastipak's profitability is sensitive to the cost of virgin plastic resins, a key input. For instance, in early 2024, polyethylene terephthalate (PET) resin prices saw fluctuations driven by global supply and demand dynamics, impacting manufacturing expenses.

The growing demand for recycled content, while beneficial for sustainability, can also lead to price volatility. When demand for recycled plastics exceeds available supply, as observed in certain periods of 2024, procurement costs for Plastipak can increase, potentially affecting margins.

These raw material price swings directly influence production costs. Any significant upward movement in resin prices, whether virgin or recycled, can compress Plastipak's profit margins if these increases cannot be fully passed on to customers.

The rigid plastic packaging market is intensely competitive, with a multitude of domestic and international companies vying for market share. Key players such as Dart Container, Graham Packaging, and Berry Global Inc. present significant competitive challenges, often leading to price wars and impacting profit margins.

This fierce competition demands continuous investment in research and development to drive innovation and maintain a competitive edge. For instance, in 2024, the global rigid plastic packaging market was valued at approximately $250 billion, with growth expected to be around 4.5% annually, highlighting the need for sustained innovation to capture this expanding market.

High Investment Required for Advanced Sustainability Initiatives

Plastipak's dedication to sustainability, while commendable, presents a significant hurdle in the form of high upfront costs for advanced initiatives. Implementing cutting-edge solutions like chemical recycling or widespread use of bio-based plastics demands considerable financial outlay for research, development, and scaling.

These substantial investments can strain Plastipak's financial resources, creating a delicate balancing act between pursuing ambitious sustainability goals and maintaining profitability. For instance, the capital expenditure for a new chemical recycling facility could run into hundreds of millions of dollars, impacting short-term financial performance.

- Significant Capital Outlay: Advanced sustainability projects, such as chemical recycling plants, require substantial upfront investment, potentially exceeding hundreds of millions of dollars.

- R&D and Scaling Costs: Developing and scaling new bio-based materials or recycling technologies involves considerable research and development expenses.

- Financial Strain: High investment needs could strain Plastipak's financial capacity, potentially impacting other strategic investments or operational flexibility.

- Profitability Challenge: Balancing the significant costs of these initiatives with the need to meet profitability targets presents an ongoing challenge for the company.

Potential for Supply Chain Disruptions

Plastipak, like many in the packaging sector, faces ongoing supply chain challenges. These include the risk of raw material shortages, such as resin availability, and persistent logistical hurdles. For instance, in early 2024, the global shipping industry continued to experience elevated costs and extended transit times due to various factors, impacting material import and finished goods export for companies like Plastipak.

These disruptions can directly hinder Plastipak's operational efficiency. Delays in receiving necessary materials or shipping finished products can lead to increased manufacturing costs and potentially affect customer delivery schedules. This was evident in late 2023 and early 2024, where certain petrochemical feedstocks experienced price volatility and supply constraints, directly impacting plastic resin costs for packaging manufacturers.

- Raw Material Volatility: Fluctuations in the price and availability of key resins like PET and HDPE can impact production costs and output.

- Logistical Bottlenecks: Port congestion and trucking shortages, which persisted into 2024, can delay inbound materials and outbound finished goods.

- Geopolitical Instability: Global conflicts and trade tensions can further disrupt international supply chains, affecting both sourcing and distribution.

Plastipak's heavy reliance on rigid plastic packaging makes it vulnerable to increasing environmental scrutiny and regulatory pressures. This dependence exposes the company to reputational damage and potential shifts in consumer preference away from traditional plastic products.

The company's profitability is closely tied to the volatile pricing of virgin plastic resins. For example, in early 2024, PET resin prices experienced significant swings due to global supply and demand imbalances, directly impacting Plastipak's manufacturing costs.

Intense competition within the rigid plastic packaging sector, with major players like Berry Global and Graham Packaging, often leads to price pressures that can compress profit margins.

Plastipak faces substantial upfront costs for implementing advanced sustainability initiatives, such as chemical recycling technologies. These investments, potentially running into hundreds of millions of dollars for new facilities, can strain financial resources and impact short-term profitability.

| Weakness | Description | Impact Example (2024 Data) |

|---|---|---|

| Reliance on Rigid Plastic | Vulnerability to environmental concerns and regulations targeting plastic. | Increased scrutiny on single-use plastics; potential for new taxes or bans. |

| Raw Material Price Volatility | Sensitivity to fluctuations in virgin plastic resin costs. | PET resin prices saw notable volatility in early 2024, impacting manufacturing expenses. |

| Intense Market Competition | Pressure from established competitors affecting pricing and market share. | Companies like Berry Global and Graham Packaging exert competitive pressure, potentially limiting pricing power. |

| High Sustainability Investment Costs | Significant capital required for advanced eco-friendly solutions. | Developing chemical recycling facilities can cost hundreds of millions, impacting short-term financial performance. |

What You See Is What You Get

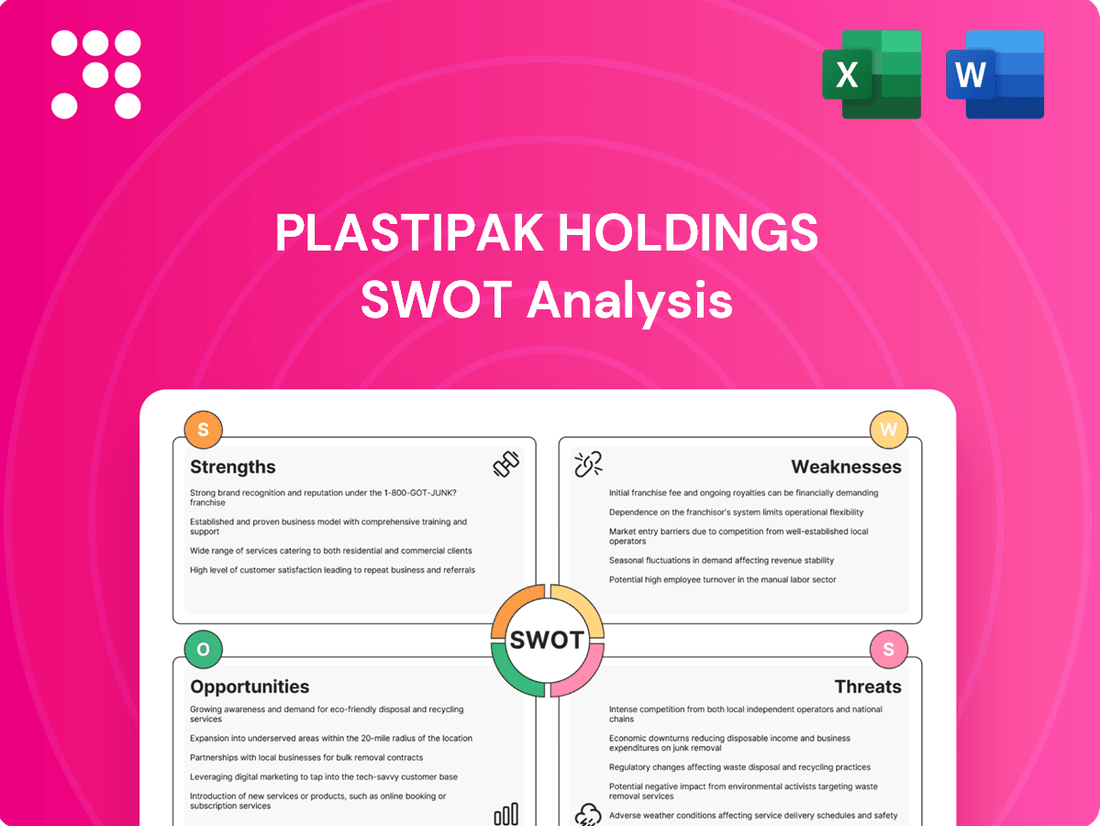

Plastipak Holdings SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. It offers a concise overview of Plastipak Holdings' Strengths, Weaknesses, Opportunities, and Threats, providing a solid foundation for strategic planning.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase to gain a comprehensive understanding of Plastipak Holdings' competitive landscape and internal capabilities.

Opportunities

The global market for sustainable packaging is booming, with projections showing substantial growth. For instance, the recycled plastic packaging market alone was valued at approximately USD 47.5 billion in 2023 and is expected to reach over USD 75 billion by 2030, growing at a CAGR of around 6.8%. This surge is fueled by increasing consumer demand for eco-friendly options and stricter government regulations worldwide, pushing brands to adopt more sustainable materials.

Plastipak is well-positioned to leverage this trend. Their deep expertise in recycling technologies and a demonstrated commitment to integrating post-consumer recycled (PCR) content into their products, such as their PET bottles, directly addresses this growing market need. This focus allows them to offer solutions that align with the environmental goals of their clients.

This presents a significant opportunity for Plastipak to expand its market share and drive revenue growth. By continuing to innovate in sustainable packaging solutions and increasing the use of recycled materials, the company can capture a larger portion of this expanding market, reinforcing its competitive advantage.

Emerging economies, particularly in Asia-Pacific, are seeing robust industrialization and urbanization, driving up demand for rigid plastic packaging. This trend offers Plastipak a prime chance to grow its manufacturing and sales operations.

By expanding into these dynamic markets, Plastipak can tap into new revenue sources and boost its global market standing. For instance, the rigid plastic packaging market in Asia-Pacific was projected to reach over $150 billion by 2025, showcasing substantial growth potential.

The packaging sector is seeing significant progress in alternative materials, such as biodegradable and compostable plastics, alongside chemical recycling that handles more plastic types. For instance, by 2024, the global bioplastics market is projected to reach $11.7 billion, showcasing strong growth potential.

Plastipak has a prime opportunity to invest more in these advanced technologies. This move would broaden its material options and help it align with increasingly stringent environmental regulations, which are becoming a key differentiator for consumers and businesses alike.

By developing and bringing these innovative solutions to market, Plastipak can tap into new customer bases and bolster its range of environmentally friendly products. Companies that prioritize sustainability are often rewarded with greater market share and improved brand reputation.

Strategic Partnerships and Acquisitions to Enhance Capabilities

Plastipak's strategic engagement with companies like LanzaTech, focusing on carbon-captured PET resin, exemplifies a key opportunity. This collaboration not only bolsters their technological edge in sustainable materials but also aligns with growing consumer demand for eco-friendly packaging.

Acquisitions, such as that of Evolve Polymers, are crucial for expanding Plastipak's recycling infrastructure. This move directly addresses the increasing need for advanced recycling capabilities and helps secure a more robust supply chain for recycled content. By consolidating recycling assets, Plastipak can achieve greater operational efficiencies and solidify its market leadership in the circular economy for plastics.

These strategic initiatives offer several benefits:

- Enhanced Technological Prowess: Access to innovative recycling technologies and sustainable material science.

- Expanded Recycling Infrastructure: Increased capacity and geographical reach for processing recycled materials.

- Market Consolidation: Strengthening Plastipak's position as an industry leader in sustainable packaging.

- Innovation and Market Reach: Fostering new product development and broadening market penetration through partnerships.

Capitalizing on E-commerce Sector Growth

The global e-commerce market is experiencing significant expansion, creating a surge in demand for robust and efficient packaging. In 2024, global e-commerce sales were projected to reach over $6.3 trillion, a figure expected to continue its upward trajectory, highlighting a substantial opportunity for packaging providers. Plastipak's proficiency in rigid plastic packaging positions it well to capture this growth by offering specialized solutions designed for the rigors of online retail and food delivery services.

Plastipak can capitalize on this trend by innovating packaging that prioritizes product safety and integrity during transit, a critical factor for customer satisfaction in e-commerce. For instance, the company could develop packaging with enhanced shock absorption and tamper-evident features. The rise of quick commerce and the increasing volume of food deliveries, particularly in 2024 and 2025, further underscore the need for packaging that maintains food quality and prevents leaks, directly aligning with Plastipak's core capabilities.

Key opportunities include:

- Developing lightweight yet durable containers to reduce shipping costs and environmental impact for online retailers.

- Creating innovative closure systems that ensure product freshness and prevent contamination in the food delivery sector.

- Designing user-friendly packaging that enhances the unboxing experience for consumers, a growing differentiator in online sales.

- Offering sustainable packaging options that align with e-commerce companies' environmental goals, a trend gaining momentum in 2024.

The increasing global focus on sustainability presents a significant opportunity for Plastipak. The recycled plastic packaging market is projected to grow substantially, reaching over USD 75 billion by 2030. Plastipak's expertise in recycling technologies and use of post-consumer recycled (PCR) content directly addresses this demand, allowing them to expand market share and revenue.

Emerging economies, particularly in Asia-Pacific, are experiencing robust growth in rigid plastic packaging demand, driven by industrialization. This offers Plastipak a prime chance to expand its manufacturing and sales operations, tapping into new revenue streams and enhancing its global standing. The rigid plastic packaging market in Asia-Pacific was projected to exceed $150 billion by 2025.

Advancements in alternative materials like bioplastics and chemical recycling also create opportunities. The bioplastics market is expected to reach $11.7 billion by 2024. Plastipak can invest in these technologies to broaden its material options and align with evolving environmental regulations, attracting environmentally conscious customers.

The booming e-commerce sector, with global sales projected to surpass $6.3 trillion in 2024, presents another avenue for growth. Plastipak can develop specialized, durable packaging solutions for online retail and food delivery, enhancing product safety and customer experience, which are critical in this expanding market.

Threats

Governments globally are tightening environmental rules, with many introducing bans on single-use plastics and requiring higher percentages of recycled content in packaging. For instance, the European Union's Single-Use Plastics Directive continues to influence packaging design and material sourcing, while various US states are also enacting similar legislation. These measures directly impact companies like Plastipak by increasing the complexity and cost of compliance, potentially restricting the use of conventional plastic materials and necessitating significant investment in alternative solutions or advanced recycling technologies.

Growing consumer awareness about environmental impact is a significant threat, pushing demand towards non-plastic packaging alternatives like paper, glass, and fiber-based materials. This trend is particularly strong in the food and beverage industry, directly impacting the market for rigid plastic packaging. For example, a 2024 survey indicated that 65% of consumers are actively seeking products with minimal plastic packaging.

Plastipak faces the challenge of adapting to this evolving consumer preference. The company needs to innovate and effectively communicate the recyclability and sustainability features of its plastic products to maintain market share. Failure to address this shift could lead to a decline in demand for their core offerings.

The growing emphasis on sustainability has fueled the rise of new companies focused on eco-friendly packaging, alongside established players enhancing their green product lines. This intensified competition means Plastipak must consistently innovate and differentiate its sustainable plastic offerings to maintain its market position.

For instance, in 2024, the global sustainable packaging market was valued at an estimated $315 billion, with projections to reach over $480 billion by 2029, indicating a significant influx of both new entrants and expanded capabilities from existing competitors. Plastipak faces the challenge of not only meeting but exceeding these evolving sustainability standards to avoid market share erosion.

Volatility in Energy and Operating Costs

Plastipak's manufacturing of rigid plastic packaging is heavily reliant on energy, exposing the company to risks from fluctuating energy prices. For instance, the average industrial electricity price in the US saw an increase of approximately 5% in early 2024 compared to the previous year, impacting production costs.

Beyond energy, broader economic pressures like inflation and rising labor expenses are also contributing to increased operating costs. In 2024, inflation continued to be a concern, with the Consumer Price Index (CPI) showing persistent upward trends in various sectors, directly affecting raw material and labor expenses for manufacturers.

While Plastipak is actively pursuing investments in renewable energy sources to mitigate some of these costs, prolonged periods of high operational expenses could still challenge its profitability and market competitiveness if not effectively managed.

- Energy Intensity: Manufacturing rigid plastic packaging is an energy-intensive process.

- Cost Volatility: Susceptible to fluctuations in energy prices and broader economic factors like inflation and labor costs.

- Renewable Energy Investment: Ongoing efforts to offset costs through renewable energy initiatives.

- Profitability Impact: Sustained high operational costs can affect profitability and competitiveness.

Brand Reputation Risk from Plastic Pollution Concerns

Despite Plastipak's substantial investments in recycling technologies and sustainable packaging solutions, the persistent global concern over plastic waste and pollution presents a significant threat. The company, like others in the industry, faces the ongoing risk of negative publicity and heightened scrutiny regarding the environmental footprint of plastic materials. This scrutiny could potentially damage its brand image and strain relationships with increasingly environmentally conscious customers and consumers. For instance, in 2024, consumer advocacy groups continued to highlight the challenges of plastic recycling, even for companies with advanced programs, putting pressure on the entire sector.

This environmental spotlight can translate into tangible business risks. Companies perceived as contributing to plastic pollution, regardless of their mitigation efforts, may see a decline in consumer preference. This is particularly relevant as many of Plastipak's clients are major consumer packaged goods (CPG) companies that are themselves under pressure to demonstrate strong environmental credentials. A 2025 survey indicated that over 60% of consumers consider a company's sustainability practices when making purchasing decisions.

- Negative Publicity: Continued media focus on plastic pollution issues could lead to reputational damage for Plastipak, impacting its market perception.

- Customer Relations: Environmentally sensitive clients may re-evaluate partnerships if Plastipak is perceived as not adequately addressing plastic waste concerns, despite its sustainability initiatives.

- Consumer Sentiment: Growing consumer awareness and demand for eco-friendly alternatives could shift market share away from companies perceived as lagging in environmental responsibility.

The increasing global focus on plastic waste and pollution continues to be a significant threat. Negative publicity surrounding plastic's environmental impact can damage Plastipak's brand image and strain relationships with environmentally conscious customers. For example, a 2024 report highlighted ongoing challenges in plastic recycling infrastructure, affecting even companies with advanced programs.

This environmental scrutiny can lead to tangible business risks, potentially causing a decline in consumer preference for companies perceived as contributing to pollution. As many of Plastipak's clients are major consumer packaged goods (CPG) companies facing pressure to demonstrate strong environmental credentials, this trend directly impacts their partnerships. A 2025 survey indicated that over 60% of consumers consider a company's sustainability practices when making purchasing decisions.

Intensified competition from new eco-friendly packaging companies and established players expanding their green product lines poses another threat. Plastipak must consistently innovate and differentiate its sustainable plastic offerings to maintain its market position. The global sustainable packaging market, valued at approximately $315 billion in 2024 and projected to exceed $480 billion by 2029, signifies this competitive landscape.

SWOT Analysis Data Sources

This Plastipak Holdings SWOT analysis is built upon a foundation of verified financial statements, comprehensive market intelligence, and expert industry commentary. These reliable data sources ensure an accurate and insightful assessment of the company's strategic position.