Plastipak Holdings Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Plastipak Holdings Bundle

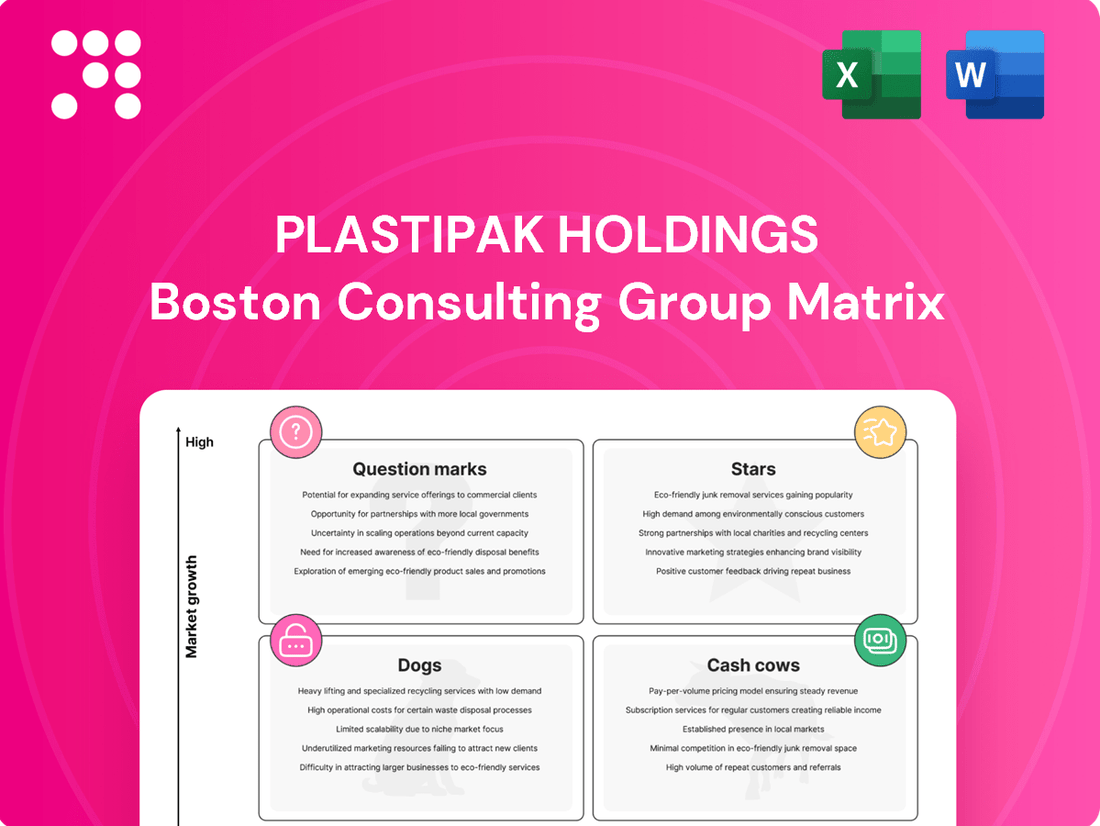

Curious about Plastipak Holdings' strategic product positioning? Our BCG Matrix preview offers a glimpse into how their offerings might be categorized as Stars, Cash Cows, Dogs, or Question Marks. Understand the foundational elements of their portfolio and begin to strategize.

Don't stop at the surface! Purchase the full Plastipak Holdings BCG Matrix for a comprehensive breakdown of each product's quadrant placement, supported by data-driven insights and actionable recommendations. Equip yourself with the knowledge to make informed decisions about resource allocation and future growth.

Stars

Plastipak's advanced rPET solutions, particularly their work with Kraft Heinz on 100% recycled PET containers, place them firmly in the Stars category of the BCG Matrix. This segment is experiencing robust growth due to escalating consumer demand for sustainable packaging and stricter environmental regulations worldwide.

The company's commitment to sustainability is underscored by its integrated recycling infrastructure, exemplified by its facility in Toledo, Spain. This strategic advantage allows Plastipak to capture a significant share of the rapidly expanding market for eco-friendly packaging solutions.

Plastipak's PPKNatura, the first PET resin derived from captured carbon emissions through a partnership with LanzaTech, is a groundbreaking development. This innovation directly addresses the growing demand for packaging with a lower carbon footprint, a sector experiencing rapid expansion. By 2024, the global sustainable packaging market was valued at over $250 billion, highlighting the significant opportunity for PPKNatura.

Plastipak's investment in lightweight packaging technologies positions it well within the growing rigid plastic packaging market, projected to expand at a 4-6.4% CAGR between 2024 and 2034. This focus addresses key industry demands for material reduction and cost savings.

High-Performance Aerosol Packaging (SprayPET Revolution)

The SprayPET Revolution represents a significant advancement in aerosol packaging, offering a 100% polymer, metal-free, and fully recyclable alternative. This innovation targets a high-growth niche within personal care and household products, directly addressing consumer and regulatory demand for sustainable solutions.

This unique packaging system is designed to prevent contamination in PET recycling streams, a critical issue for the circular economy. Furthermore, its production boasts a lower carbon footprint compared to traditional aluminum aerosols, positioning it favorably as environmental regulations tighten globally.

- Market Potential: The global aerosol market was valued at approximately $80 billion in 2023 and is projected to grow, with sustainable packaging being a key driver.

- Sustainability Advantage: SprayPET's polymer composition and recyclability align with increasing consumer preference for eco-friendly products, which saw a 20% rise in demand for sustainable options in 2024.

- Competitive Edge: By eliminating metal components, SprayPET simplifies the recycling process and reduces the environmental impact, offering a distinct advantage over legacy aerosol technologies.

Packaging for E-commerce and On-the-Go Products

The rigid plastic packaging market, particularly for food and beverages, is booming thanks to the rise of e-commerce and the demand for convenient, on-the-go products. This trend is directly benefiting companies like Plastipak, which specialize in bottles, jars, and other containers for these fast-moving consumer goods.

Plastipak's established position and ongoing product development in this area are key to their success. They're capturing a substantial piece of this expanding market, which is being reshaped by how consumers live and shop today.

- Market Growth: The global rigid plastic packaging market for food and beverages reached an estimated USD 195.5 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 4.2% from 2024 to 2030.

- E-commerce Impact: E-commerce sales of packaged food and beverages saw a significant increase in 2024, with specialized packaging solutions becoming crucial for product integrity and consumer appeal during transit.

- Consumer Lifestyles: The demand for single-serving, portable, and easy-to-open packaging continues to drive innovation, directly aligning with Plastipak's product portfolio.

- Plastipak's Position: Plastipak Holdings holds a strong market share in the rigid plastic packaging sector, bolstered by its diverse range of innovative solutions catering to these evolving consumer preferences.

Plastipak's innovative solutions, like their advanced rPET containers and the carbon-capture derived PPKNatura resin, position them as leaders in the high-growth sustainable packaging market. Their SprayPET Revolution also addresses a significant demand for eco-friendly aerosol alternatives.

These developments are driven by increasing consumer demand for sustainability and stricter environmental regulations, making Plastipak's investments in these areas strong contenders for continued market share expansion.

The company's focus on lightweighting and its strong presence in the booming rigid plastic packaging sector, particularly for food and beverages, further solidifies its Star status.

Plastipak's strategic investments in sustainable and advanced packaging technologies, such as their work with Kraft Heinz on 100% recycled PET and the development of PPKNatura, place them squarely in the Stars category of the BCG Matrix.

| Category | Key Products/Initiatives | Market Growth Driver | 2024 Market Data Point | Plastipak's Advantage |

| Stars | rPET Solutions, PPKNatura, SprayPET Revolution | Consumer demand for sustainability, regulatory pressure | Global sustainable packaging market > $250 billion (2024) | Integrated recycling, carbon-capture resin, metal-free aerosols |

| Stars | Lightweight Rigid Plastic Packaging | E-commerce growth, demand for convenience | Rigid plastic packaging market CAGR 4-6.4% (2024-2034) | Focus on material reduction and cost savings |

What is included in the product

Plastipak Holdings' BCG Matrix offers a tailored analysis of its product portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs.

This framework highlights which units to invest in, hold, or divest, guiding strategic resource allocation.

The Plastipak Holdings BCG Matrix provides a clear, one-page overview of its business units, alleviating the pain point of deciphering complex portfolios.

Cash Cows

Plastipak's extensive experience and deep partnerships with giants like PepsiCo and Dr Pepper Snapple Group solidify its position in the standard PET beverage bottle market. This segment represents a mature, high-volume business for the company.

Despite potentially slower growth in the traditional beverage sector, Plastipak's operational efficiencies and entrenched market share translate into reliable and significant cash generation. In 2024, the global PET bottle market was valued at approximately $120 billion, demonstrating the sheer scale of this segment.

Plastipak's food packaging containers, encompassing jars, tubs, and pots, represent a mature segment where the company commands a substantial market presence. This steady demand, fueled by established client relationships and efficient production, translates into consistent revenue streams with minimal need for aggressive marketing spend, a hallmark of a cash cow.

Plastipak’s personal care and household chemical packaging segment is a significant cash cow. This area benefits from steady, recurring demand for essential goods, ensuring consistent revenue streams for the company.

With a strong market share in rigid plastic containers for these sectors, Plastipak capitalizes on its operational efficiencies to generate robust profit margins. For instance, the global rigid plastic packaging market, which includes these segments, was valued at approximately $250 billion in 2023 and is projected to grow at a CAGR of around 4% through 2030, indicating sustained demand.

Integrated Recycling Services

Plastipak's integrated recycling services, particularly their significant post-consumer recycled resin production, function as a cash cow within their BCG matrix. This division provides a stable, cost-effective supply of essential raw materials for Plastipak's own sustainable product lines, reducing their dependence on fluctuating virgin plastic markets.

The demand for recycled content is robust and growing, positioning these recycling operations as a consistent revenue generator. For instance, the global recycled plastics market was valued at approximately $45.5 billion in 2023 and is projected to reach over $70 billion by 2030, indicating strong and sustained demand for Plastipak's output.

- Vertical Integration: Plastipak's recycling operations reduce the need for external resin purchases, leading to cost savings and greater control over their supply chain.

- Market Demand: The increasing consumer and regulatory pressure for sustainable packaging fuels demand for recycled content, ensuring a steady market for their recycled resins.

- Cost Stability: By processing recycled materials, Plastipak can achieve more predictable input costs compared to relying solely on virgin petrochemicals.

- Revenue Stream: Beyond internal use, Plastipak can also sell its recycled resin to other manufacturers, creating an additional revenue stream from its recycling segment.

Automotive and Industrial Product Bottles

Plastipak's automotive and industrial product bottles are a prime example of a Cash Cow within its portfolio. This segment, while perhaps less visible than consumer-facing products, boasts a strong market share in mature industrial sectors, ensuring consistent revenue generation.

These rigid plastic containers are essential for a variety of automotive fluids and industrial chemicals, creating a predictable and high-volume demand. The stability of these markets means Plastipak can rely on this segment for a significant and steady contribution to its overall cash flow.

- High Market Share: Dominant position in the mature automotive and industrial fluid packaging markets.

- Stable Demand: Essential products with consistent, predictable consumption patterns.

- Reliable Cash Flow: Generates substantial and dependable profits for Plastipak.

- Mature Market: Operates in established sectors with limited disruptive growth potential but high stability.

Plastipak's established PET beverage bottle business, serving major clients like PepsiCo, represents a significant cash cow. This mature, high-volume segment benefits from operational efficiencies and deep market penetration, ensuring reliable cash generation despite slower growth in the traditional beverage sector. The global PET bottle market's substantial size, valued around $120 billion in 2024, underscores the consistent revenue potential.

What You’re Viewing Is Included

Plastipak Holdings BCG Matrix

The preview of the Plastipak Holdings BCG Matrix you are currently viewing is the complete and final document you will receive upon purchase. This means no watermarks, no placeholder text, and no altered content; you get the exact, professionally formatted report ready for immediate strategic application. The detailed analysis and visual representation of Plastipak's product portfolio within the BCG framework are precisely as they will be delivered. This ensures you are making your purchase based on the actual insights and clarity the full document provides.

Dogs

Plastipak's legacy multi-layered packaging solutions, often featuring non-recyclable plastic combinations, are facing obsolescence. This is driven by tightening environmental regulations and a strong consumer push for mono-material and sustainable alternatives. In 2024, the global market for sustainable packaging is projected to reach over $300 billion, highlighting the shift away from older technologies.

If Plastipak continues to hold a substantial inventory of these outdated products without a clear pivot strategy, they would likely be categorized as Dogs in the BCG Matrix. This means they represent low market share in a low-growth segment. For instance, the European Union's Single-Use Plastics Directive has significantly impacted the market for multi-layer flexible packaging not designed for easy recycling.

These products can become cash traps, consuming valuable capital and operational resources without offering meaningful future growth prospects or substantial returns. Companies that fail to adapt to the increasing demand for circular economy solutions, such as those utilizing recycled content or designed for recyclability, risk being left behind in a rapidly evolving market landscape.

Niche plastic packaging with limited recyclability, such as certain multi-layer films or complex composite materials, are considered dogs in Plastipak Holdings' BCG Matrix. These products struggle to integrate into current recycling infrastructure, facing declining market demand as the industry prioritizes circular economy principles. For instance, while the global plastic recycling rate hovered around 9% in 2023, specialized packaging often falls outside these established streams.

High-cost, low-volume specialty packaging solutions at Plastipak Holdings, particularly those serving niche markets with minimal growth, are likely candidates for the dog quadrant. These products, often custom-designed for specific, small-scale applications, struggle to achieve production efficiencies due to their limited order sizes. For instance, a specialized rigid plastic container for a rare medical device, with an annual market demand of only a few thousand units, would exemplify this category.

Such offerings typically face high per-unit manufacturing costs, making it difficult to generate attractive profit margins. The lack of significant market expansion means these products offer little potential for future revenue growth. In 2024, companies with similar product lines often saw their contribution margins shrink due to rising raw material costs and energy prices, further pressuring profitability for low-volume items.

Legacy Products in Declining Markets

Plastipak Holdings might classify certain legacy rigid plastic packaging products as dogs if they cater to industries experiencing a sustained downturn. For instance, packaging for specific industrial chemicals that are being replaced by newer, more environmentally friendly alternatives would fit this category. These products would likely hold a minimal share of a contracting market, diminishing their strategic importance.

These "dog" products are characterized by their low growth potential and weak competitive position. They consume resources without generating significant returns, potentially hindering investment in more promising areas of the business. Identifying and managing these legacy assets is crucial for optimizing Plastipak's overall portfolio.

- Declining Market Share: Products tied to industries like traditional media packaging or specific single-use plastics facing regulatory pressure would see their market share erode.

- Low Growth Prospects: Packaging for products that are being phased out due to technological advancements or changing consumer preferences offers little opportunity for expansion.

- Resource Drain: Maintaining production and marketing for these low-performing items diverts capital and management attention from more lucrative ventures.

Packaging with High Virgin Plastic Content for Price-Sensitive Markets

In highly price-sensitive markets, Plastipak products that heavily rely on virgin plastic without strong design or performance advantages, and aren't shifting to recycled content, are likely considered dogs. These offerings face intense competition from lower-cost options and increasingly popular sustainable alternatives. For instance, in 2024, the global rigid plastic packaging market, while growing, saw significant pressure on margins in segments where virgin material costs were a primary driver, especially in regions with less stringent environmental regulations but high consumer price sensitivity.

These products operate in a mature, low-growth environment with thin profit margins. Their inability to command premium pricing or capture significant market share makes them a drag on overall company performance.

- Low Market Share: Products with high virgin plastic content in price-sensitive markets struggle to gain traction against cheaper alternatives.

- Low Growth: These segments are often mature with limited expansion opportunities.

- Low Profitability: Intense price competition erodes margins, making these offerings unprofitable.

- Risk of Obsolescence: A lack of focus on recycled content or sustainable innovation makes them vulnerable to changing market demands and regulations.

Products classified as Dogs within Plastipak Holdings' portfolio represent niche plastic packaging solutions with limited recyclability or those serving industries in decline. These items struggle to integrate into modern recycling streams, facing diminished demand as the market prioritizes circular economy principles. For example, while global plastic recycling rates remain modest, specialized packaging often falls outside established collection and processing channels.

These "dog" products are characterized by low market share in low-growth segments, often burdened by high production costs and minimal profit margins. Their inability to expand or adapt to evolving environmental standards makes them a drain on resources, hindering investment in more promising areas. Companies failing to embrace sustainable alternatives risk obsolescence in this dynamic sector.

Plastipak's legacy multi-layered packaging, particularly those not designed for easy recycling, are prime examples of potential Dogs. Driven by regulations like the EU's Single-Use Plastics Directive and consumer demand for mono-material solutions, these products face obsolescence. The global sustainable packaging market is projected to exceed $300 billion in 2024, underscoring the shift away from older, less sustainable technologies.

High-cost, low-volume specialty packaging for niche markets with minimal growth potential also falls into the Dog category. These products, often custom-made for small applications, lack production efficiencies and struggle with profitability, especially with rising raw material and energy costs observed in 2024.

| Product Category | BCG Matrix Classification | Reasoning | Market Trend Example (2024) | Plastipak Implication |

| Legacy Multi-Layered Packaging (Non-Recyclable) | Dog | Low market share in a low-growth, declining segment due to environmental regulations and consumer preference for sustainable alternatives. | Global sustainable packaging market projected over $300 billion, highlighting shift away from older technologies. | Cash drain, risk of obsolescence. |

| Niche Specialty Packaging (Low Volume, High Cost) | Dog | Minimal market growth, high per-unit manufacturing costs, and difficulty achieving economies of scale. | Specialized rigid container for a rare medical device with annual demand of only a few thousand units. | Low profitability, diverts resources. |

| Packaging for Declining Industries | Dog | Serving industries experiencing sustained downturns, leading to minimal market share in a contracting segment. | Packaging for specific industrial chemicals being replaced by eco-friendly alternatives. | Diminished strategic importance, potential write-offs. |

| Virgin Plastic Packaging (Price-Sensitive Markets) | Dog | High reliance on virgin plastic without sustainability advantages, facing intense competition and eroding margins. | Rigid plastic packaging segments with high virgin material costs facing margin pressure. | Low profitability, vulnerability to market shifts. |

Question Marks

Advanced bio-based plastic packaging represents a potential question mark for Plastipak, even with their strong standing in recycled PET (rPET). While the market for plastics derived from sources like corn starch and sugarcane is experiencing rapid growth, Plastipak's current penetration and breadth of offerings in this specific niche may still be developing.

The high-growth nature of bio-based plastics necessitates substantial investment for Plastipak to build a significant market share against established specialized bioplastic manufacturers. For instance, the global bioplastics market was valued at approximately USD 12.5 billion in 2023 and is projected to reach over USD 30 billion by 2028, indicating a substantial opportunity but also the scale of investment required.

Plastipak's strategic focus on geographic expansion, particularly within the Asia Pacific (APAC) region, positions its new market entries as potential Stars or Question Marks in its BCG Matrix. These high-growth markets, such as Southeast Asia and India, present significant opportunities for rigid plastic packaging demand. For instance, the APAC rigid plastic packaging market was valued at approximately USD 120 billion in 2023 and is projected to grow at a CAGR of over 5% through 2030, according to industry reports.

However, establishing a presence in these diverse and often developing markets requires substantial upfront investment. This includes building local manufacturing capabilities, developing robust distribution networks, and implementing targeted marketing campaigns to gain market share. Consequently, while the long-term potential is high, the initial market share in newly entered APAC sub-regions might be relatively low, reflecting the typical characteristics of a Question Mark, demanding careful resource allocation and strategic planning to transition into a Star.

The integration of smart packaging technologies, like IoT sensors and track-and-trace capabilities, into rigid plastic containers represents a burgeoning sector with significant growth potential. Plastipak's involvement in this advanced segment is likely in its initial phases, with a relatively small market share currently.

This positions smart packaging as a question mark within Plastipak's BCG Matrix. Significant investment in research and development, or strategic collaborations, will be crucial for Plastipak to elevate this segment from a question mark to a star performer in the competitive packaging landscape.

Chemical Recycling Innovations Beyond PET

While Plastipak excels in mechanical recycling of PET, the burgeoning field of chemical recycling for other plastics like polypropylene (PP) and polyethylene (PE) presents a significant growth opportunity. These advanced recycling technologies, which break down plastics into their molecular building blocks, are still in their nascent stages but hold immense potential to expand the circular economy for plastics beyond PET.

Investments in these chemical recycling innovations for non-PET plastics would likely be categorized as question marks within Plastipak's BCG Matrix. This is due to their high-risk, high-reward nature, characterized by substantial upfront investment, technological uncertainties, and currently limited market penetration compared to established PET recycling methods.

- Market Growth Potential: The global chemical recycling market is projected to grow significantly, with some estimates suggesting a compound annual growth rate (CAGR) of over 15% in the coming years, driven by increasing demand for sustainable materials and stricter regulations.

- Technological Hurdles: Developing efficient and cost-effective chemical recycling processes for diverse plastic streams like PP and PE, which are more complex than PET, still faces technological challenges and requires substantial R&D.

- Investment Landscape: Major chemical companies and startups are pouring billions into developing and scaling chemical recycling technologies, indicating a strong industry belief in its future, but also highlighting the competitive and capital-intensive nature of this sector.

- Regulatory Tailwinds: Evolving environmental regulations and corporate sustainability commitments are creating a favorable environment for advanced recycling solutions, potentially accelerating their adoption and market share.

Packaging for Emerging Consumer Segments (e.g., nutraceuticals, specialized health products)

Packaging for emerging consumer segments like nutraceuticals and specialized health products represents a significant growth opportunity for Plastipak. These markets are expanding rapidly, driven by increasing consumer focus on wellness and personalized health solutions.

While Plastipak holds a strong position in high-volume sectors such as beverages and food, its market share in these newer, specialized niches might be lower. This suggests these segments could be considered 'question marks' in a BCG matrix, requiring strategic investment to capture their potential.

- Growth Potential: The global nutraceutical market was valued at approximately $230 billion in 2023 and is projected to grow at a CAGR of around 8% through 2030.

- Market Share: Plastipak's share in these specialized packaging segments is likely developing, necessitating focused R&D and market penetration strategies.

- Investment Needs: Capital investment will be crucial for developing innovative packaging solutions that meet the stringent requirements of health and wellness products, such as enhanced barrier properties and tamper-evident features.

- Strategic Focus: Plastipak needs to identify key players within these emerging segments and tailor its offerings to their specific needs to build a competitive advantage.

Advanced bio-based plastic packaging, while a high-growth area, represents a question mark for Plastipak. The company's current penetration and specific product breadth in this niche are likely still developing, requiring significant investment to build market share against specialized competitors. The global bioplastics market was valued at approximately USD 12.5 billion in 2023 and is expected to exceed USD 30 billion by 2028, highlighting the substantial investment needed.

BCG Matrix Data Sources

Our Plastipak Holdings BCG Matrix leverages comprehensive data from financial reports, internal sales figures, and market research to accurately assess product performance and market share.