Plastipak Holdings Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Plastipak Holdings Bundle

Plastipak Holdings operates in a dynamic packaging industry where buyer power can be significant, and the threat of substitutes is always present. Understanding these pressures is crucial for navigating the competitive landscape.

The complete report reveals the real forces shaping Plastipak Holdings’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The rigid plastic packaging sector, including companies like Plastipak, is highly dependent on essential raw materials such as PET, HDPE, and PP resins. When the number of suppliers for these crucial inputs is limited, or when their offerings are significantly differentiated, such as specialized resin grades for specific packaging needs, these suppliers gain considerable leverage over Plastipak.

The global PET resin market, a key input for many rigid plastic packaging applications, is expected to see continued growth. Major players like Indorama Ventures and SABIC are significant contributors to this market, suggesting a degree of supplier concentration that could influence pricing and availability for Plastipak.

Plastipak's ability to switch between raw material suppliers significantly influences the bargaining power of those suppliers. If the cost and time associated with changing suppliers, including retooling or new qualification processes, are substantial, Plastipak's leverage diminishes.

The push for incorporating recycled content, a growing trend in the packaging industry, can introduce new supplier relationships and associated complexities. For instance, securing a consistent supply of high-quality recycled PET (rPET) might involve fewer readily available sources compared to virgin materials, potentially increasing supplier power.

Suppliers of raw plastic resins, such as polyethylene terephthalate (PET), possess the potential to integrate forward into packaging manufacturing. This move would position them as direct competitors to Plastipak Holdings, potentially diminishing Plastipak's bargaining power.

While forward integration demands significant capital, the mere threat can influence pricing and terms in Plastipak's favor during negotiations. The global PET resin market, valued at approximately $70 billion in 2023 and projected to grow, presents an attractive avenue for major resin producers to explore further vertical integration.

Importance of Raw Material to Plastipak's Cost Structure

The cost of raw plastic resins is a substantial component of Plastipak's total production expenses. For instance, in 2023, resin costs represented roughly 50-60% of the manufacturing cost for many plastic packaging producers, a figure likely consistent for Plastipak.

Global oil prices and the intricate dance of supply and demand significantly sway these resin prices, directly impacting Plastipak's bottom line. A sharp rise in crude oil, for example, can quickly translate into higher resin input costs, squeezing profit margins if not passed on to customers.

Furthermore, the pricing of recycled resins, a growing area for sustainability-conscious companies like Plastipak, introduces its own layer of cost uncertainty. Factors such as import tariffs on recycled materials can create volatility, making long-term cost projections more challenging.

- Resin costs are a major driver of Plastipak's production expenses.

- Global oil prices and market dynamics heavily influence resin pricing.

- Tariffs on recycled resins add another layer of cost variability.

Availability of Substitutes for Raw Materials

The availability of substitutes for raw materials can significantly influence the bargaining power of suppliers. As alternative, more sustainable materials like bio-based plastics or PET derived from captured carbon emerge, Plastipak gains more leverage. For instance, the increasing adoption of recycled content in packaging, driven by both consumer demand and regulatory pressures, offers an alternative to virgin resins.

Plastipak's own material innovations, such as their PPKNatura product which utilizes captured carbon emissions, directly address this by potentially lessening their dependence on traditional virgin resin suppliers. This proactive approach to material sourcing and development is key to managing supplier power. The global market for recycled plastics, for example, was valued at approximately $45.5 billion in 2023 and is projected to grow, indicating a strengthening alternative supply base.

- Emerging sustainable materials offer Plastipak more sourcing options.

- Innovations like PPKNatura reduce reliance on traditional virgin resin.

- The growing recycled plastics market provides a viable alternative supply.

- Increased material options can dilute individual supplier bargaining strength.

The bargaining power of suppliers for Plastipak Holdings is significantly influenced by the concentration of resin producers and the availability of substitutes. With resin costs representing a substantial portion of manufacturing expenses, typically 50-60% in 2023, fluctuations in oil prices and supply dynamics directly impact Plastipak's profitability.

The growing market for recycled plastics, valued at approximately $45.5 billion in 2023, offers Plastipak alternative sourcing options, thereby potentially mitigating the power of virgin resin suppliers. Innovations in materials, such as Plastipak's PPKNatura product utilizing captured carbon emissions, further reduce dependence on traditional suppliers.

| Factor | Impact on Plastipak | Supporting Data (2023/2024 Estimates) |

|---|---|---|

| Supplier Concentration (PET, HDPE, PP) | High potential leverage for limited suppliers | Global PET resin market valued at ~$70 billion; key players like Indorama Ventures, SABIC |

| Switching Costs | High costs reduce Plastipak's leverage | Costs include retooling and qualification processes |

| Availability of Substitutes (Recycled Content, Bio-plastics) | Increases Plastipak's leverage | Recycled plastics market valued at ~$45.5 billion; growing adoption driven by sustainability |

| Raw Material Cost Component | Significant impact on profitability | Resin costs represented ~50-60% of manufacturing costs for packaging producers |

What is included in the product

This analysis of Plastipak Holdings reveals the intensity of rivalry within the rigid plastic packaging industry, the significant bargaining power of its large customers, and the low threat of new entrants due to capital requirements and established relationships.

Effortlessly assess competitive intensity and identify strategic vulnerabilities within the rigid packaging industry.

Customers Bargaining Power

Plastipak Holdings' customer base is heavily concentrated within major consumer product companies across food, beverage, personal care, and household chemicals. This concentration means that if a few key clients represent a large chunk of Plastipak's revenue, those customers gain significant leverage. For instance, a major beverage producer could demand price concessions or more favorable contract terms, knowing their substantial order volume is critical to Plastipak's financial health.

Customer switching costs can significantly influence the bargaining power of buyers. For Plastipak, these costs often involve more than just finding a lower price. Clients might face expenses associated with redesigning packaging, undergoing new validation processes, and the potential for disruptions on their own production lines when changing suppliers.

These switching costs create a degree of customer loyalty, particularly for businesses using Plastipak's custom-designed containers. For instance, a beverage company that has invested in molds and testing for a unique bottle shape will likely hesitate to switch to a new supplier who cannot immediately replicate that exact design without incurring substantial upfront investment and time delays.

Large beverage and food manufacturers, as Plastipak's key customers, possess significant bargaining power, partly due to the threat of backward integration. This means they could potentially bring rigid plastic packaging production in-house.

While establishing their own packaging facilities requires substantial capital investment, this potential capability grants these customers considerable leverage. It encourages Plastipak to offer competitive pricing and superior service to retain their business.

For example, a major soft drink company might evaluate the cost savings and control gained from internal production versus the benefits of relying on specialized suppliers like Plastipak, influencing contract negotiations.

Price Sensitivity of Customers

Customers in the consumer goods sector, a key market for Plastipak, often face tight profit margins. This makes them acutely aware of packaging expenses, as these costs directly influence their product's retail price and market standing. For instance, in 2024, the average gross profit margin for consumer packaged goods companies hovered around 30-35%, meaning even small increases in packaging costs can significantly erode profitability.

This intense price sensitivity compels Plastipak to prioritize cost-effective manufacturing and maintain highly competitive pricing strategies. Failure to do so risks losing business to rivals who can offer more attractive terms. The global rigid plastic packaging market, valued at approximately $240 billion in 2023, is highly competitive, with customer price expectations being a primary driver of supplier selection.

- Price Sensitivity Impact: Direct correlation between packaging costs and final product pricing for consumer goods manufacturers.

- Margin Pressure: Thin margins in the consumer goods sector amplify customer focus on packaging cost reduction.

- Competitive Landscape: The vast size of the rigid plastic packaging market in 2023 underscores the importance of competitive pricing to secure contracts.

Product Differentiation and Importance to Customer's Product

Plastipak's capacity to deliver novel packaging designs, lighter-weight alternatives, and eco-conscious choices, such as incorporating recycled content or carbon-captured PET, significantly distinguishes its products in the market. This focus on innovation and sustainability provides tangible benefits to customers, helping them enhance their brand image and meet environmental targets.

By offering packaging that actively contributes to a client's brand appeal and sustainability objectives, Plastipak diminishes the bargaining power of its customers. When clients value these unique attributes, they become less inclined to switch suppliers solely based on price, as the added value of Plastipak's differentiated offerings outweighs potential cost savings elsewhere.

- Innovation in Design: Plastipak's commitment to unique bottle shapes and functionalities can make its packaging a key element of a customer's product identity.

- Lightweighting Solutions: Offering lighter packaging reduces shipping costs and environmental impact for customers, a critical differentiator.

- Sustainability Focus: The use of recycled PET (rPET) and other sustainable materials aligns with growing consumer demand and corporate ESG goals, making Plastipak a preferred partner. For instance, in 2024, the global recycled plastics market was valued significantly and continues to grow, highlighting the importance of these offerings.

- Brand Enhancement: Packaging that improves shelf presence and communicates brand values directly translates into sales for the customer, solidifying Plastipak's position.

Plastipak's customers, particularly large consumer product companies, wield considerable bargaining power due to their significant order volumes and the potential for backward integration. This leverage is amplified by the tight profit margins within the consumer goods sector, making packaging costs a critical factor in profitability.

The global rigid plastic packaging market, valued at approximately $240 billion in 2023, is highly competitive, forcing suppliers like Plastipak to offer competitive pricing. Customers' price sensitivity is a primary driver in supplier selection, as even minor cost increases can impact their product's retail price and market position.

However, Plastipak mitigates this power through innovation and sustainability. Offering unique designs, lightweighting solutions, and the incorporation of recycled content, such as rPET, provides added value. This differentiation makes customers less likely to switch solely based on price, as these features enhance brand image and meet environmental goals, critical considerations in 2024's market.

| Factor | Impact on Plastipak | Customer Leverage | Mitigation Strategy |

| Customer Concentration | High reliance on key clients | Significant | Value-added services, innovation |

| Switching Costs | Moderate to high for custom solutions | Moderate | Proprietary designs, integration support |

| Backward Integration Threat | Potential loss of business | High | Competitive pricing, superior service |

| Price Sensitivity | Direct impact on margins | High | Cost-efficient production, sustainable offerings |

What You See Is What You Get

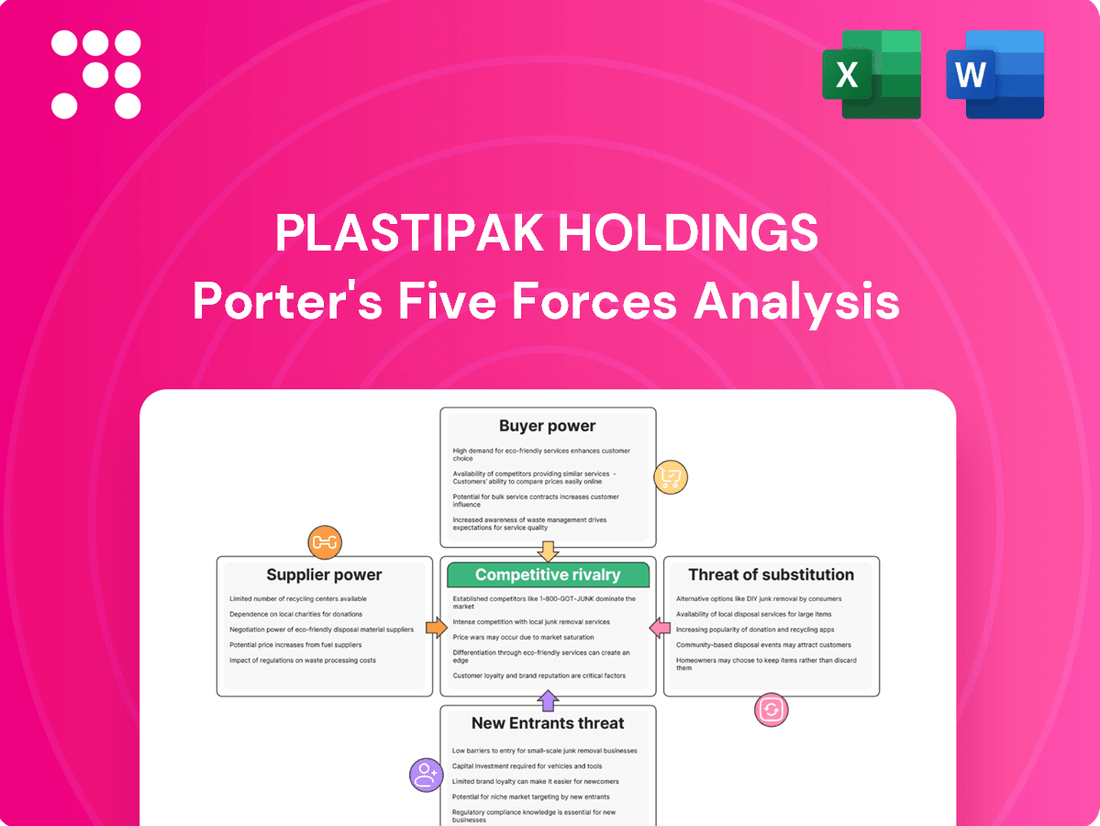

Plastipak Holdings Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis for Plastipak Holdings, presenting a thorough examination of the competitive landscape. You'll receive this exact, professionally written document immediately after purchase, offering actionable insights into industry rivalry, buyer and supplier power, threat of new entrants, and substitute products. This detailed analysis is ready for your immediate use, providing a comprehensive understanding of Plastipak's strategic positioning.

Rivalry Among Competitors

The rigid plastic packaging sector features prominent global entities such as Amcor, Berry Global, and Graham Packaging, alongside numerous regional and niche manufacturers. This diverse competitive landscape, with its mix of large-scale operators and smaller, specialized companies, fuels intense rivalry as each player strives to capture market share and customer loyalty.

The global rigid plastic packaging market is expected to see consistent growth, with projections indicating a compound annual growth rate (CAGR) of around 3.5% through 2028. This expansion is largely driven by increasing demand from the food and beverage sector, as well as the burgeoning e-commerce industry which relies heavily on robust packaging solutions.

While a growing market can often temper intense price competition by creating more opportunities for all participants, the packaging industry is experiencing a significant shift due to sustainability trends. This evolving landscape means that even with market expansion, competitive rivalry remains a key consideration.

Companies are increasingly focusing on developing and adopting recyclable and biodegradable packaging alternatives. This focus on sustainability, coupled with evolving consumer preferences and regulatory pressures, is reshaping how competitors differentiate themselves and manage pricing strategies within the rigid plastic packaging sector.

Plastipak actively combats commoditization by investing heavily in product differentiation. Their focus on advanced barrier technologies, lightweighting solutions, and proprietary designs like SprayPET Revolution sets them apart from basic plastic container manufacturers, reducing the intensity of price-based rivalry.

This commitment to innovation is underscored by substantial investments in recycled content and emerging carbon capture technologies. For instance, by mid-2024, Plastipak was a significant player in incorporating post-consumer recycled (PCR) resin into its packaging, with targets to increase PCR content across its product lines, aiming for a substantial percentage by 2025.

Exit Barriers

The rigid plastic packaging sector, where Plastipak Holdings operates, is characterized by significant exit barriers. The sheer scale of investment needed for state-of-the-art manufacturing facilities, specialized machinery, and advanced processing technologies means that exiting the market is a costly and complex undertaking. This capital intensity discourages companies from leaving, even when facing challenging economic conditions, thereby fostering sustained and often intense competition among remaining players.

These high exit barriers contribute directly to fierce competitive rivalry. Companies are compelled to remain operational and continue competing, even if profitability is squeezed. This dynamic is particularly evident in periods of economic slowdown, where the cost of shutting down operations often outweighs the potential losses from continued, albeit reduced, production. For instance, the global rigid plastic packaging market, valued at approximately $280 billion in 2023, saw continued investment in capacity, suggesting a commitment from major players to stay engaged.

- High Capital Investment: The rigid plastic packaging industry demands substantial upfront capital for machinery, plants, and technology, making it difficult and expensive for firms to exit.

- Operational Commitments: Long-term leases, supplier contracts, and specialized workforce requirements further anchor companies to the industry, increasing exit costs.

- Intensified Rivalry: The inability or unwillingness of firms to exit during downturns leads to prolonged periods of heightened competition as companies fight for market share.

- Industry Resilience: Despite economic fluctuations, the essential nature of many plastic packaging products ensures continued demand, encouraging companies to weather storms rather than abandon the market.

Sustainability Initiatives and Regulations

The drive for sustainability is intensifying competitive rivalry within the packaging sector. Increasing regulatory pressure, such as mandates for higher recycled content and improved recyclability, is forcing companies to innovate. For instance, the European Union's Single-Use Plastics Directive, implemented in stages, sets ambitious targets for recycled PET in beverage bottles, directly impacting manufacturers like Plastipak.

Consumer demand for eco-friendly packaging further fuels this competition. Companies that proactively invest in recycling infrastructure and develop novel sustainable materials, like Plastipak's advancements in PET recycling technology, can carve out a significant market advantage. However, this leadership often comes with substantial capital expenditures for research, development, and operational upgrades.

Key competitive dynamics include:

- Regulatory Compliance: Meeting evolving standards for recycled content and recyclability is becoming a baseline requirement, not a differentiator.

- Material Innovation: Developing and scaling new sustainable materials and packaging designs offers a competitive edge.

- Investment in Recycling: Companies with integrated recycling capabilities or strong partnerships can secure recycled feedstock and reduce reliance on virgin materials.

- Brand Reputation: Demonstrating a commitment to sustainability resonates with consumers and can influence purchasing decisions.

The rigid plastic packaging industry is highly competitive, featuring numerous global and regional players like Amcor and Berry Global. This intense rivalry is further amplified by high capital investment requirements and significant exit barriers, forcing companies to remain engaged and compete vigorously even during economic downturns. For example, the global rigid plastic packaging market was valued at approximately $280 billion in 2023, with continued investment in capacity by major players.

Sustainability trends are a major driver of competitive dynamics, pushing companies to innovate in recyclable and biodegradable materials. Regulatory mandates, such as the EU's Single-Use Plastics Directive, require higher recycled content, compelling manufacturers like Plastipak to invest in advanced recycling technologies and sustainable solutions to maintain a competitive edge and meet consumer demand.

| Competitive Factor | Description | Impact on Rivalry |

| Industry Concentration | Presence of large global players and numerous smaller firms. | Intensifies rivalry as companies vie for market share. |

| Exit Barriers | High capital investment in machinery and technology. | Companies remain in the market, sustaining competition. |

| Sustainability Push | Demand for recycled and biodegradable packaging. | Drives innovation and investment, creating competitive advantages. |

| Product Differentiation | Focus on advanced technologies and proprietary designs. | Helps mitigate price-based competition. |

SSubstitutes Threaten

The threat of substitutes for Plastipak Holdings' rigid plastic packaging primarily stems from alternative materials like glass, metal cans, and paper-based solutions such as cartons and flexible pouches. These substitutes present varied characteristics regarding weight, recyclability, barrier properties, and consumer perception.

For instance, the growing consumer and regulatory emphasis on sustainability has boosted the appeal of paperboard and aluminum. In 2024, the global recycled aluminum market was projected to reach over $35 billion, reflecting a significant shift towards this material. Similarly, the paper and pulp packaging market is expected to continue its upward trajectory, driven by environmental consciousness.

While plastic packaging, like that produced by Plastipak Holdings, is often lauded for its cost-effectiveness and design adaptability, shifts in the market are making substitutes more attractive. The price of recycled plastic content, a key component for many plastic manufacturers, has seen volatility. For instance, in early 2024, virgin PET resin prices, which influence recycled PET costs, fluctuated significantly due to global supply chain dynamics and energy prices, potentially narrowing the cost advantage of plastic in some segments.

The beverage packaging sector, a major area for plastic, is also witnessing a rise in alternative materials. While plastic bottles still hold a dominant market share, glass and aluminum are gaining traction, particularly for premium beverages and in regions with strong recycling initiatives and consumer preference for these materials. For example, the global aluminum can market, a direct substitute for plastic bottles in many beverage applications, was projected to grow at a compound annual growth rate of over 4% through 2027, driven by sustainability trends and consumer demand.

Consumer preferences are increasingly leaning towards sustainable packaging, directly impacting demand for traditional plastic solutions. For instance, a 2024 Nielsen report indicated that 60% of consumers are willing to pay more for products with eco-friendly packaging, a significant driver pushing brands to explore alternatives to plastics.

This growing environmental consciousness translates into a tangible threat of substitution for companies like Plastipak. As brands seek to align with consumer values and regulatory pressures, they are actively researching and adopting materials such as paper-based composites, bioplastics, and aluminum, directly challenging plastic's market share in various applications.

Regulatory Pressure and Extended Producer Responsibility (EPR)

Government regulations are a significant force, pushing the packaging industry towards sustainability. For instance, many regions are implementing or strengthening Extended Producer Responsibility (EPR) schemes. These programs hold producers accountable for the end-of-life management of their products, including packaging.

Mandatory recycled content targets are becoming increasingly common. By 2025, several jurisdictions have set ambitious goals for the percentage of recycled material, particularly PET, that must be used in new packaging. This directly incentivizes the use of recycled plastics or alternative materials, potentially impacting demand for virgin plastic production.

These regulatory pressures create a clear threat of substitutes by making virgin plastic less attractive and promoting circular economy principles. Companies like Plastipak must adapt to these evolving requirements, which can lead to increased costs for compliance and investment in new technologies or materials.

- EPR Schemes: Increasing producer responsibility for waste management.

- Recycled Content Mandates: Targets for recycled material usage in packaging by 2025.

- Shift to Alternatives: Encouragement for substitutes or highly recycled plastic options.

- Impact on Business Model: Pressure to reduce reliance on virgin plastics.

Innovation in Non-Plastic Packaging

Continuous innovation in non-plastic packaging materials presents a significant threat to Plastipak. The development of bio-based plastics, advanced paper-based solutions, and the increasing adoption of reusable and refillable systems offer viable alternatives that can reduce reliance on traditional plastics.

The market for reusable packaging is experiencing robust growth. For example, it's projected to reach substantial figures, demonstrating a clear shift towards more sustainable options. This trend directly impacts the demand for single-use plastic packaging, Plastipak's core product.

- Growing Market for Reusable Packaging: The global reusable packaging market is anticipated to expand, presenting a direct challenge to single-use plastic solutions.

- Advancements in Bio-based Materials: Innovations in biodegradable and compostable packaging offer environmentally friendly alternatives.

- Rise of Paper-based Solutions: Improved paper and cardboard packaging technologies are increasingly capable of meeting performance requirements previously dominated by plastic.

- Consumer and Regulatory Pressure: Increasing consumer demand for sustainable options and stricter regulations on single-use plastics further amplify the threat of substitutes.

The threat of substitutes for Plastipak's plastic packaging is significant, driven by growing consumer demand for sustainability and increasing regulatory pressures. Alternatives like glass, metal, and paper-based packaging are becoming more attractive, especially as their environmental credentials are highlighted.

For instance, the global aluminum can market, a direct substitute for plastic bottles in beverages, was projected to grow at a compound annual growth rate of over 4% through 2027. This growth is fueled by sustainability trends and consumer preference. Furthermore, a 2024 Nielsen report indicated that 60% of consumers are willing to pay more for eco-friendly packaging, directly impacting brand choices and, consequently, Plastipak's market share.

| Substitute Material | Key Advantages | Market Trend (2024/Projected) |

| Aluminum Cans | High recyclability, perceived sustainability | Projected CAGR > 4% (through 2027) |

| Glass Bottles | Premium perception, high recyclability | Increasing adoption for premium beverages |

| Paper-based Packaging | Renewable resource, growing eco-consciousness | Continued upward trajectory, boosted by environmental concerns |

Entrants Threaten

Establishing a rigid plastic packaging manufacturing operation, like those Plastipak Holdings operates within, demands substantial capital. This includes significant investments in specialized machinery, the construction or leasing of manufacturing facilities, and the integration of advanced automation and quality control technologies. For instance, a state-of-the-art blow molding machine can cost upwards of $500,000 to over $2 million, depending on its capabilities.

The sheer scale of this initial investment acts as a formidable barrier, effectively deterring many potential new entrants from entering the market. Without access to substantial funding, it becomes exceedingly difficult for new companies to compete with established players like Plastipak, who have already amortized their initial capital expenditures over years of operation.

Established players like Plastipak Holdings benefit significantly from economies of scale, particularly in bulk raw material purchasing and optimized manufacturing processes. For instance, in 2024, major packaging manufacturers continued to leverage their size to secure lower per-unit costs for PET resin, a key input. This cost advantage makes it challenging for newcomers to achieve competitive pricing without substantial initial investment.

Plastipak's established relationships with major consumer brands and its extensive global distribution networks present a significant barrier to new entrants. These long-standing ties mean that new companies would struggle to gain access to the same crucial channels, making it difficult to reach customers effectively.

Building the necessary trust and credibility with large, demanding clients, who are accustomed to Plastipak's reliability and service, would be a considerable hurdle for any newcomer. This deep-seated customer loyalty and the sheer scale of existing distribution infrastructure create a formidable challenge for potential competitors seeking to enter the market.

Proprietary Technology and Patents

Plastipak's robust intellectual property portfolio, boasting over 420 United States patents covering package designs and manufacturing processes, acts as a formidable barrier. This extensive patent protection, particularly in advanced areas like barrier technology and sustainable materials, significantly deters new entrants by making it difficult to replicate their innovative solutions. The company's ongoing commitment to research and development ensures a continuous stream of proprietary advancements, further solidifying its competitive advantage.

- Proprietary Technology: Over 420 US patents protect Plastipak's innovations.

- Innovation Focus: Continuous development in barrier technology and sustainable materials.

- Competitive Moat: Intellectual property makes it challenging for newcomers to offer comparable products.

- Deterrent to Entry: High R&D investment and patent protection limit new competitors' ability to enter the market with similar offerings.

Regulatory Compliance and Sustainability Demands

New entrants into the rigid plastic packaging market, like Plastipak Holdings, face significant hurdles due to increasingly stringent regulatory compliance and escalating sustainability demands. These requirements, which include mandates for recycled content and recyclability standards, necessitate substantial upfront investment and ongoing operational adjustments. For example, by 2025, the European Union aims for an average of 30% recycled plastic in PET beverage bottles, a target that demands advanced processing capabilities and secure sourcing of recycled materials from day one.

Meeting these complex environmental regulations, coupled with growing consumer pressure for sustainable packaging solutions, significantly increases the complexity and cost associated with market entry. Companies must demonstrate not only adherence to current laws but also a forward-looking strategy for evolving sustainability goals. This often translates into higher capital expenditures for advanced recycling technologies and supply chain integration, creating a substantial barrier for potential new competitors aiming to challenge established players like Plastipak.

- Regulatory Hurdles: Navigating evolving environmental regulations, such as recycled content mandates and recyclability standards, presents a significant barrier to entry.

- Sustainability Costs: Meeting stringent sustainability requirements and consumer expectations adds considerable complexity and cost to new market participants.

- Investment in Technology: Compliance often requires substantial investment in advanced recycling technologies and infrastructure, increasing the capital needed to enter the market.

- Supply Chain Integration: Establishing reliable supply chains for recycled materials is crucial and can be a complex undertaking for new entrants.

The threat of new entrants into the rigid plastic packaging sector, where Plastipak Holdings operates, is generally considered moderate to low. This is primarily due to the high capital requirements for establishing manufacturing facilities, which can easily run into millions of dollars for specialized machinery alone. For instance, a single advanced blow molding machine can cost upwards of $1 million, making significant initial investment a prerequisite.

Economies of scale enjoyed by incumbents like Plastipak, particularly in raw material procurement, also present a substantial barrier. In 2024, major players continued to leverage their purchasing power to secure favorable pricing on PET resin, a key input material. Furthermore, established distribution networks and strong customer relationships, built over years of reliable service, are difficult for newcomers to replicate, creating a significant competitive moat.

Intellectual property, with Plastipak holding over 420 US patents, further deters new entrants by protecting proprietary technologies. The increasing complexity of regulatory compliance and sustainability mandates, such as those requiring higher percentages of recycled content by 2025, also necessitates significant investment in advanced technologies and supply chain integration, raising the barrier to entry.

| Barrier Type | Description | Impact on New Entrants | Example Data (2024/2025) |

|---|---|---|---|

| Capital Requirements | High investment in specialized machinery and facilities. | Significant deterrent due to substantial upfront costs. | Blow molding machine cost: $1M+ |

| Economies of Scale | Lower per-unit costs through bulk purchasing and optimized production. | New entrants struggle to match pricing without comparable scale. | Bulk PET resin pricing advantage for large manufacturers. |

| Distribution & Customer Relationships | Established networks and brand loyalty. | Difficult for new entrants to gain market access and customer trust. | Long-standing contracts with major consumer brands. |

| Intellectual Property | Patented technologies and manufacturing processes. | Limits ability of new entrants to replicate innovative solutions. | Plastipak Holdings: 420+ US patents. |

| Regulatory & Sustainability Demands | Compliance with environmental standards and recycled content mandates. | Requires investment in new technologies and supply chains. | EU PET bottle recycled content target: 30% by 2025. |

Porter's Five Forces Analysis Data Sources

Our Plastipak Holdings Porter's Five Forces analysis is built upon a foundation of comprehensive data, including annual reports, industry-specific market research from firms like IBISWorld, and financial data from sources such as S&P Capital IQ. This blend ensures a robust understanding of competitive dynamics.