Plastipak Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Plastipak Holdings Bundle

Unlock the secrets to Plastipak Holdings's strategic positioning with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors influencing their operations. Download the full report to gain actionable insights and refine your own market approach.

Political factors

Government regulations are a major force shaping the rigid plastic packaging sector. Laws focused on reducing plastic waste and fostering a circular economy are becoming increasingly strict worldwide. For instance, the EU's Packaging and Packaging Waste Regulation (PPWR) and the Single-Use Plastics Directive (SUPD), with key deadlines in 2025, are setting mandatory recycled content levels and limiting certain disposable plastic items.

These policies also hold producers financially responsible for waste management. This means companies like Plastipak must adjust their packaging designs and how they source materials to meet these new requirements and avoid fines. The drive for sustainability is directly influencing product development and operational strategies within the industry.

Extended Producer Responsibility (EPR) schemes are increasingly shaping the landscape for packaging producers like Plastipak Holdings. These regulations, particularly prominent in the US and Europe, are transferring the burden of packaging waste management from local governments to the companies that create the products.

Several US states have enacted EPR legislation, with Oregon, Colorado, California, Maine, and Minnesota among them. Compliance and fee structures are set to commence in 2025, meaning companies must accurately track their packaging volumes, report this data, and financially support the development of recycling infrastructure. This will directly influence operational expenses and necessitate strategic planning around product design and end-of-life management.

Global trade policies and tariffs significantly influence Plastipak's operational costs and product availability. For example, the US imposition of tariffs on certain imported materials in 2024 has increased raw material expenses for North American manufacturers, pushing them to explore new sourcing options or regionalize their production facilities.

These trade dynamics directly affect supply chain robustness and purchasing strategies, making it imperative for Plastipak to closely track evolving international trade agreements and potential disputes. The company's ability to adapt procurement to these shifts is key to maintaining competitive pricing and ensuring consistent product flow.

Political Stability and Geopolitical Events

Political stability in Plastipak's key operating regions, such as North America and Europe, is crucial for uninterrupted operations and investment. Geopolitical events, like the ongoing trade tensions and regional conflicts, can significantly impact global supply chains, affecting raw material availability and costs for packaging manufacturers. For instance, disruptions in energy markets, often linked to geopolitical instability, directly influence the cost of plastic resins, a primary input for Plastipak.

The packaging industry, including companies like Plastipak, is sensitive to shifts in government priorities and regulatory landscapes, which can be influenced by political stability. For example, changes in environmental policies or trade agreements stemming from political realignments can necessitate costly adjustments in manufacturing processes or market access. The potential for market volatility due to unforeseen political developments requires businesses to maintain operational flexibility and robust risk management strategies.

- Supply Chain Vulnerability: Global geopolitical events, such as the Russia-Ukraine conflict, have demonstrated the fragility of supply chains, impacting energy prices and the availability of key petrochemical feedstocks used in plastic production.

- Regulatory Uncertainty: Evolving trade policies and environmental regulations, often driven by political shifts, can create uncertainty for international businesses like Plastipak, potentially affecting market access and operational costs.

- Consumer Confidence: Political instability can dampen consumer confidence, leading to reduced spending on packaged goods, thereby impacting demand for Plastipak's products.

Government Incentives for Sustainable Practices

Governments worldwide are actively encouraging sustainable business operations through various incentives. For instance, in 2024, the European Union continued to push for circular economy principles, with member states offering subsidies and tax credits for companies incorporating recycled plastics into their packaging. Plastipak, by focusing on recycled content, can leverage these programs.

These incentives are designed to lower the financial burden of adopting greener technologies and materials. In the United States, the Inflation Reduction Act of 2022, with its ongoing provisions into 2024 and beyond, offers tax credits for manufacturing clean energy technologies and sustainable materials, which could indirectly benefit Plastipak’s material sourcing and production processes.

Companies that proactively integrate sustainable practices, such as developing advanced reusable packaging systems, can benefit from these political tailwinds. This alignment not only enhances corporate social responsibility but also provides a tangible competitive edge through reduced operational costs and improved market access, especially in regions with stringent environmental regulations and preferential procurement policies for sustainable goods.

- European Union's Circular Economy Action Plan: Continued emphasis in 2024 on increasing recycled content in packaging, with member states providing financial support.

- US Inflation Reduction Act (2022-2024): Tax credits available for clean energy and sustainable material manufacturing, potentially impacting Plastipak's supply chain.

- Preferential Procurement: Governments increasingly favor suppliers with demonstrable sustainable practices, creating market opportunities for companies like Plastipak.

Government mandates for recycled content are significantly impacting the rigid plastic packaging industry. For example, the EU's Packaging and Packaging Waste Regulation (PPWR) is setting ambitious targets for recycled content in plastic packaging, with key deadlines approaching in 2025. These regulations, alongside Extended Producer Responsibility (EPR) schemes now active in several US states like California and Oregon starting in 2025, are shifting the financial responsibility for waste management onto producers, directly influencing operational costs and strategic material sourcing for companies like Plastipak.

What is included in the product

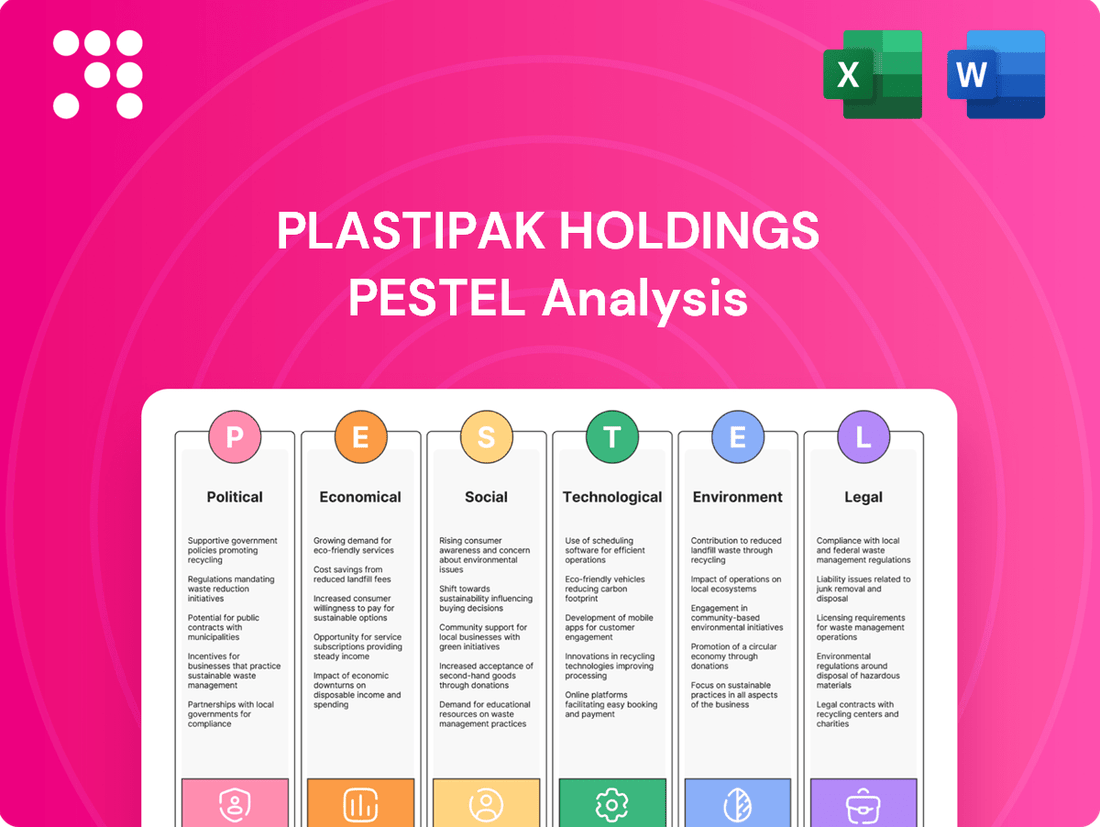

This PESTLE analysis of Plastipak Holdings examines how political, economic, social, technological, environmental, and legal forces shape its operational landscape and strategic decision-making.

It provides a comprehensive understanding of the external environment, highlighting key trends and potential impacts on Plastipak's business strategy and market position.

A concise PESTLE analysis for Plastipak Holdings, providing a clear overview of external factors impacting the business, which simplifies strategic discussions and risk assessment.

Economic factors

The global rigid plastic packaging market is on a solid growth trajectory, expected to hit around $238.46 billion by 2025. This upward trend is fueled by a compound annual growth rate of 4.1% from 2024, indicating a robust expansion in demand.

Key drivers for this market expansion include the rising needs of sectors such as food and beverages, personal care, and healthcare. Emerging economies, in particular, are showing increased consumption, boosting overall market size.

This expanding market presents a clear opportunity for companies like Plastipak. It provides a fertile ground to capture a larger share of the market and enhance overall revenue streams.

Plastipak's profitability is heavily influenced by the cost of its primary raw materials, including polyethylene (PE), polypropylene (PP), and polyethylene terephthalate (PET). These costs are directly tied to global crude oil prices, which saw significant fluctuations in the 2024-2025 period. For instance, Brent crude oil prices, a key benchmark, experienced periods of volatility, impacting resin prices. A barrel of Brent crude traded between $75 and $90 for much of late 2024 and early 2025, creating uncertainty for Plastipak's input costs.

Supply chain disruptions, exacerbated by geopolitical events and shipping challenges throughout 2024 and into 2025, further amplified the volatility in plastic resin markets. This made consistent and predictable procurement difficult. For example, disruptions in key petrochemical production regions led to temporary shortages and price spikes for PET resins, impacting manufacturers like Plastipak. Managing these input cost risks is crucial for maintaining profit margins.

To mitigate the impact of raw material price volatility, Plastipak strategically employs various approaches. These include negotiating long-term supply contracts to lock in prices, optimizing procurement processes for efficiency, and increasing the utilization of recycled plastic content. The increasing global focus on sustainability and circular economy initiatives in 2024-2025 also presented opportunities to leverage recycled PET (rPET), which can offer a more stable cost base compared to virgin resins, though its availability and price also fluctuate.

Inflationary pressures in 2024 and early 2025 are significantly impacting Plastipak's operating environment. Rising material and energy costs directly affect production expenses. For instance, the Producer Price Index (PPI) for chemicals and plastics saw a notable uptick in late 2024, indicating higher input costs for packaging manufacturers.

While consumers express a growing preference for sustainable packaging, their ability to absorb higher prices is constrained by inflation. Surveys from early 2025 suggest that despite a willingness to pay a premium for eco-friendly options, a substantial portion of consumers remain price-sensitive, especially for everyday goods. This creates a delicate balancing act for Plastipak.

Plastipak must strategically navigate this landscape by optimizing cost efficiencies without compromising on its sustainability commitments. The challenge lies in developing innovative packaging solutions that are both environmentally responsible and affordable to maintain consumer purchasing power and market share amidst persistent inflation.

E-commerce Growth and Demand for Durable Packaging

The relentless growth of e-commerce, projected to reach over $8 trillion globally by 2026, directly translates into a heightened demand for robust packaging. Consumers expect their purchases to arrive intact, driving the need for materials that offer superior protection during transit. Rigid plastics, a core offering for companies like Plastipak, are well-suited to meet these requirements due to their durability and protective qualities.

This trend creates a significant opportunity for packaging manufacturers. The ability to provide lightweight yet strong solutions that minimize damage and product loss throughout the supply chain is a key differentiator. For instance, reports from late 2024 indicated a 15% year-over-year increase in damaged goods reported by online shoppers, underscoring the critical role of effective packaging.

- E-commerce sales are expected to surpass $8.1 trillion by 2026, increasing the need for protective packaging.

- Rigid plastics offer durability and protection essential for shipping fragile goods.

- Consumer demand for undamaged products in online orders is a key driver for advanced packaging solutions.

- Packaging innovation in lightweight yet strong materials is crucial for cost-effective and sustainable e-commerce fulfillment.

Investment in Circular Economy and Recycling Infrastructure

Global investment in circular economy initiatives, particularly for plastics, is surging. For instance, the Ellen MacArthur Foundation reported that by 2024, over $10 billion was committed to scaling up recycling and reuse infrastructure. This economic pivot creates robust new markets for recycled plastics and related services.

Companies like Plastipak are strategically positioned to capitalize on this trend. Their existing investments in recycling services and the utilization of recycled content directly address the growing demand driven by this economic evolution. For example, in 2024, Plastipak announced plans to expand its use of post-consumer recycled (PCR) PET by 50% across its European operations by 2027.

- Growing Market Demand: The global market for recycled plastics is projected to reach over $70 billion by 2027, according to various market research reports from 2024.

- Technological Advancements: Significant capital is flowing into advanced recycling technologies, such as chemical recycling, which can process a wider range of plastic waste.

- Policy and Regulatory Support: Many governments are implementing policies and offering incentives to encourage investment in circular economy solutions, further stimulating economic growth in this sector.

Economic factors significantly shape Plastipak's operational landscape. Fluctuations in crude oil prices directly impact the cost of key raw materials like PET and PE, with Brent crude trading between $75 and $90 in late 2024 and early 2025, affecting input expenses.

Inflationary pressures in 2024-2025 increased production costs, with the Producer Price Index for chemicals and plastics showing an uptick. While consumers favor sustainable packaging, inflation limits their willingness to pay higher prices, creating a need for cost-efficient, eco-friendly solutions.

The burgeoning e-commerce sector, projected to exceed $8 trillion by 2026, drives demand for durable packaging. This trend, coupled with a 15% year-over-year increase in damaged goods reported by online shoppers in late 2024, highlights the need for robust, protective rigid plastic solutions.

Global investment in circular economy initiatives is substantial, with over $10 billion committed by 2024 to recycling infrastructure. This economic shift fuels the market for recycled plastics, expected to reach over $70 billion by 2027, aligning with Plastipak's strategy to increase its use of post-consumer recycled PET.

What You See Is What You Get

Plastipak Holdings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Plastipak Holdings delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a deep dive into the external forces shaping Plastipak's strategic landscape.

Sociological factors

Consumers are increasingly prioritizing sustainability, with a notable 87% indicating a willingness to purchase more eco-friendly products when readily available. Furthermore, 74% of consumers are prepared to pay extra for these sustainable options, highlighting a significant market shift.

This growing demand for packaging made from recyclable, compostable, or reusable materials directly shapes consumer choices and fosters brand allegiance. Plastipak's strategic emphasis on sustainability and the incorporation of recycled content aligns perfectly with this powerful consumer trend.

Public sentiment towards plastics is increasingly negative, with a significant portion of consumers, nearly 60%, indicating they are less inclined to purchase products packaged in materials perceived as harmful. This shift is largely fueled by growing awareness and concern regarding plastic waste and its detrimental environmental consequences.

Companies within the plastic packaging sector, like Plastipak Holdings, must actively address this public perception. Demonstrating tangible sustainability initiatives and clearly communicating the advantages of responsible plastic usage are crucial for maintaining consumer trust and market share in 2024 and beyond.

Growing consumer vigilance surrounding food contact materials, especially concerning chemicals like BPA, is a significant sociological force. This heightened awareness is directly impacting regulatory landscapes and driving consumer purchasing decisions toward safer alternatives.

New European Union regulations, such as Regulation (EU) 2025/351, are set to implement more rigorous purity requirements for plastic food contact materials. For instance, by January 1, 2025, these new standards will necessitate advanced testing and material validation for all food-grade plastics.

Plastipak must proactively adapt its product lines to comply with these increasingly stringent safety mandates. Maintaining consumer confidence in the safety and integrity of its packaging for food and beverage products is paramount for continued market acceptance and brand loyalty.

Shift Towards Reusable and Refillable Solutions

Consumers are increasingly demanding sustainable packaging options, driving a significant shift towards reusable and refillable solutions. This growing awareness of single-use plastic waste is prompting both individuals and regulatory bodies to advocate for alternatives. For instance, a 2024 NielsenIQ report indicated that 73% of consumers globally are willing to change their purchasing habits to reduce environmental impact, with packaging being a key area of concern.

While rigid plastics have historically been associated with single-use applications, there's a burgeoning effort to reimagine their lifecycle. Companies are exploring innovative designs that enable multiple uses or facilitate integration into robust refill systems. This evolution necessitates a commitment to circular economy principles, requiring substantial investment in product development and supply chain adaptation. By 2025, the global market for reusable packaging is projected to reach over $17 billion, highlighting the economic viability of this trend.

- Growing Consumer Demand: Over 70% of consumers are willing to alter purchasing habits for environmental reasons.

- Regulatory Push: Increasing pressure from governments to reduce single-use plastic waste.

- Market Growth: The reusable packaging market is expected to exceed $17 billion by 2025.

- Innovation Focus: Designing rigid plastics for multiple uses and refillable systems is a key industry driver.

Demand for Transparency and Eco-Labeling

Consumers today are increasingly demanding to know the story behind their products, from where the materials come from to how they're disposed of. This desire for transparency often translates into actively seeking out products with eco-labels that signal responsible practices. For instance, a 2024 survey revealed that 65% of consumers are more likely to purchase products with recognized sustainability certifications.

Companies are now expected to go beyond mere claims and provide concrete details about their sustainability efforts. This includes specifying material sourcing, detailing recycling initiatives, and openly reporting on their environmental impact. Plastipak, by clearly communicating its commitment to recycling and the use of recycled content, can significantly build consumer trust.

- Growing Consumer Demand: A significant majority of consumers, around 70% in recent studies, express a preference for brands that demonstrate strong environmental responsibility.

- Impact of Eco-Labels: Products featuring credible eco-labels can see a sales uplift of up to 15% compared to unlabelled alternatives.

- Plastipak's Opportunity: Clear communication on recycled content, such as highlighting that its products utilize up to 100% recycled PET in certain applications, directly addresses this consumer need.

- Building Trust: Transparency in reporting, like detailing the percentage of post-consumer recycled material used, fosters brand loyalty and differentiates Plastipak in a competitive market.

Sociological factors significantly influence consumer preferences and market dynamics for packaging solutions. A growing segment of consumers, estimated at over 70% in recent surveys, actively seeks out brands demonstrating environmental responsibility, with a particular emphasis on sustainable packaging materials.

This trend is amplified by a demand for transparency, where consumers expect detailed information about material sourcing and recycling processes, with 65% of consumers favoring products with recognized sustainability certifications. Plastipak's commitment to using recycled content, including up to 100% recycled PET in specific product lines, directly addresses this need for accountability and eco-conscious choices.

The market is also seeing a surge in demand for reusable and refillable packaging systems, with the global market projected to surpass $17 billion by 2025, indicating a substantial shift away from single-use plastics driven by consumer awareness of environmental impact.

Consumer perception of plastics is also evolving, with nearly 60% of consumers expressing a reduced likelihood to purchase products packaged in materials they perceive as harmful, underscoring the need for companies like Plastipak to actively communicate their sustainability initiatives and the benefits of responsible plastic use.

Technological factors

Technological leaps in plastic recycling, especially chemical recycling methods like pyrolysis and depolymerization, are transforming waste into valuable resources. These advanced techniques can handle complex plastics previously destined for landfills, producing materials akin to virgin-quality plastic. This is vital for companies like Plastipak to boost their recycled content and comply with growing environmental regulations.

Technological advancements are driving significant progress in lightweighting plastic packaging. Companies like Plastipak are heavily invested in reducing the amount of plastic used in their products. This not only lowers material costs but also decreases shipping expenses and the environmental impact, as lighter packages require less fuel to transport. For instance, by 2024, the industry has seen a noticeable reduction in PET bottle weights, with some achieving weights as low as 8 grams for a 500ml container, down from previous averages of 10-12 grams.

Innovations in material science and packaging design are key to this lightweighting trend. Manufacturers are developing thinner plastic films and containers that maintain their structural integrity and barrier properties. This means consumers still get a durable product, but with less material overall. This continuous evolution in rigid plastic packaging is crucial for staying competitive and meeting sustainability goals.

Research into bio-based and lower-impact materials like plant-based plastics (PLA, PHA) and mycelium foams is accelerating, aiming to decrease dependence on fossil fuels. This trend is a significant technological factor as the industry explores these alternatives.

While Plastipak's core business remains in conventional rigid plastics, the expanding development of these sustainable materials presents a potential shift in future material sourcing and product design for the packaging sector.

Automation and AI Integration in Manufacturing and Sorting

Automation and artificial intelligence (AI) are transforming plastic manufacturing and recycling. These technologies are boosting efficiency, accuracy, and the overall quality of output. For instance, AI-powered sorting systems are becoming crucial in recycling, enabling more precise identification of different plastic types and contamination levels, which directly improves the quality of recycled materials. This advancement is vital for companies like Plastipak, aiming to optimize their production lines and enhance their recycling operations.

The integration of AI and automation offers significant advantages for Plastipak. In manufacturing, these technologies can streamline processes, reduce waste, and ensure consistent product quality. In the recycling sector, AI's ability to differentiate plastics more effectively means higher purity rates for recycled content. This directly supports Plastipak's commitment to sustainability and its ability to provide high-quality recycled materials for new products. The global market for AI in manufacturing is projected to reach over $20 billion by 2026, highlighting the significant investment and growth in this area.

- Enhanced Sorting Accuracy: AI-powered optical sorters can identify over 50 different polymer types, significantly improving the purity of recycled plastics compared to traditional methods.

- Production Efficiency Gains: Automation in manufacturing can lead to a 15-25% increase in production line efficiency, reducing downtime and labor costs.

- Quality Control Improvements: AI vision systems can detect defects in plastic products with up to 99% accuracy, ensuring higher quality standards.

- Sustainability Impact: By improving recycling rates and material purity, these technologies support a more circular economy for plastics, aligning with growing environmental regulations and consumer demand.

Smart Packaging Innovations

Smart packaging, integrating sensors and indicators, is a growing technological trend. These advancements aim to monitor product freshness, a critical factor in reducing food waste, which cost the global economy an estimated $940 billion in 2024. Furthermore, smart packaging can provide consumers with valuable data on sustainability metrics and recycling guidelines, enhancing brand transparency.

While these technologies are still developing, they present potential new avenues for Plastipak. For instance, smart labels that track temperature could extend the shelf life of beverages, a key market for Plastipak. The market for smart packaging is projected to reach $60.4 billion by 2030, indicating significant future growth potential.

- Smart Packaging Market Growth: Projected to reach $60.4 billion by 2030.

- Food Waste Reduction: Smart packaging can help mitigate the estimated $940 billion global cost of food waste in 2024.

- Consumer Transparency: Enhanced information on sustainability and recycling.

- New Functionalities: Potential for temperature monitoring and other value-added features for Plastipak's offerings.

Technological advancements in chemical recycling are enabling the transformation of complex plastic waste into high-quality materials, crucial for companies like Plastipak to increase recycled content and meet regulatory demands. Innovations in lightweighting plastic packaging, with some PET bottles weighing as little as 8 grams for a 500ml container by 2024, are reducing material usage, costs, and environmental impact.

Automation and AI are significantly boosting efficiency and accuracy in plastic manufacturing and recycling, with AI-powered sorting systems improving the purity of recycled materials. The global market for AI in manufacturing is expected to exceed $20 billion by 2026, underscoring the widespread adoption of these transformative technologies.

Smart packaging, which can monitor product freshness and provide consumer data, is a growing trend with the market projected to reach $60.4 billion by 2030, offering new functionalities and transparency for companies like Plastipak.

| Technological Factor | Description | Impact on Plastipak | Relevant Data/Projections |

| Chemical Recycling | Advanced methods like pyrolysis and depolymerization convert waste plastics into virgin-quality materials. | Increases recycled content, aids regulatory compliance. | Transforms difficult-to-recycle plastics. |

| Lightweighting | Reducing the amount of plastic in packaging while maintaining integrity. | Lowers material and shipping costs, reduces environmental footprint. | PET bottles for 500ml containers down to 8 grams by 2024. |

| Automation & AI | Implementing automated systems and artificial intelligence in manufacturing and recycling processes. | Boosts efficiency, accuracy, quality control, and recycling purity. | AI in manufacturing market projected over $20 billion by 2026. |

| Smart Packaging | Integrating sensors and indicators for freshness monitoring and consumer data. | Enhances product shelf-life, offers consumer transparency, potential new functionalities. | Smart packaging market projected to reach $60.4 billion by 2030. |

Legal factors

Extended Producer Responsibility (EPR) laws are a major legal development, especially in the US and Europe. These laws shift the responsibility for managing packaging waste, both financially and operationally, onto the companies that produce the packaging. This means Plastipak faces new obligations and costs related to the end-of-life management of its products.

Several US states are already implementing EPR legislation. For instance, Oregon, Colorado, and California have active EPR laws with significant compliance and reporting deadlines approaching in 2025. These regulations typically require producers like Plastipak to register their products and pay fees, often calculated based on the volume and recyclability of the packaging they introduce into the market.

Navigating these diverse state-level EPR regulations presents a complex challenge for Plastipak. Each state's law can have different requirements, fee structures, and reporting timelines. This fragmentation directly impacts Plastipak's operational costs and necessitates robust compliance strategies to meet varying legal mandates across different jurisdictions.

Regulations like the EU's Single-Use Plastics Directive and the upcoming Packaging and Packaging Waste Regulation are pushing for higher recycled content. For instance, targets for PET bottles include a minimum of 25% recycled content by 2025.

Across the US, several states are also enacting similar legislation, creating a patchwork of legal requirements that Plastipak must navigate. These mandates directly influence the company's operational choices.

These evolving legal frameworks compel Plastipak to significantly increase its utilization of post-consumer recycled (PCR) materials in its packaging solutions. This is a direct response to the growing legal pressure to incorporate recycled content.

Global regulations for plastic food contact materials (FCMs) are tightening, with the EU's Regulation (EU) 2025/351, effective March 2025, setting a precedent. This regulation mandates higher purity standards and addresses non-intentionally added substances, including a ban on Bisphenol A (BPA) in FCMs by 2025.

Plastipak must navigate these evolving health and safety mandates, particularly concerning its food and beverage packaging. Compliance ensures market access and consumer trust in an increasingly regulated environment.

Restrictions on Single-Use Plastics

Governments globally are increasingly enacting bans and restrictions on single-use plastic items like straws, cutlery, and certain food packaging, actively encouraging the adoption of reusable options. This trend, even for companies like Plastipak primarily focused on rigid packaging, shapes the broader market demand for plastics and spurs innovation in sustainable packaging solutions.

These legislative actions directly impact the market dynamics for plastic packaging manufacturers. For instance, the European Union's Single-Use Plastics Directive, implemented in stages since 2021, aims to reduce plastic waste by targeting specific items and promoting circular economy principles. By 2023, member states reported significant progress in reducing the consumption of targeted items.

- Regulatory Pressure: Bans on specific single-use plastics are becoming more prevalent, influencing product development and material choices.

- Market Shift: The push for reusable alternatives impacts the overall demand for virgin plastics in certain packaging segments.

- Innovation Driver: These restrictions encourage investment in and adoption of more sustainable and recyclable packaging materials and designs.

- Global Trend: Over 100 countries had implemented some form of plastic regulation by the end of 2023, indicating a widespread, systemic shift.

Labeling and Transparency Requirements

New legal mandates are increasingly requiring packaging to feature clearer, more informative labeling. This includes detailed instructions for disposal, precise material identification, and substantiated sustainability claims. For instance, the EU's proposed Ecodesign for Sustainable Products Regulation (ESPR) aims to expand labeling requirements to cover product durability, repairability, and recyclability by 2025, impacting global supply chains.

Failure to adhere to these evolving standards, particularly regarding environmental claims, can result in significant financial penalties. The US Federal Trade Commission (FTC) continues to enforce its Green Guides, with fines for deceptive advertising potentially reaching tens of thousands of dollars per violation. Plastipak must therefore ensure its product labeling is not only accurate and transparent but also fully compliant with these increasingly stringent global regulations to preserve consumer confidence and avert legal liabilities.

Key considerations for Plastipak include:

- Material Identification: Ensuring all packaging materials are clearly and accurately labeled for recycling purposes, aligning with regional waste management infrastructure.

- Disposal Instructions: Providing unambiguous guidance on how consumers should properly dispose of or recycle packaging components.

- Sustainability Claims: Substantiating all environmental claims with verifiable data to avoid accusations of greenwashing, a growing area of regulatory scrutiny.

- Compliance Monitoring: Continuously tracking and adapting to new labeling legislation across key markets, such as the UK's Plastic Packaging Tax which came into effect in April 2022, impacting the cost and material choices for packaging.

Extended Producer Responsibility (EPR) laws are increasingly prevalent, with states like Oregon, Colorado, and California implementing them, requiring Plastipak to manage packaging waste. The EU's targets for 2025 mandate 25% recycled content in PET bottles, pushing Plastipak to increase its use of post-consumer recycled materials.

Global regulations for food contact materials are tightening, with the EU's Regulation (EU) 2025/352 banning BPA by 2025, impacting Plastipak's beverage packaging. Bans on single-use plastics are also widespread, with over 100 countries having regulations by the end of 2023, influencing market demand and driving innovation in sustainable packaging.

Labeling requirements are becoming more stringent, with the EU's proposed Ecodesign for Sustainable Products Regulation (ESPR) expanding these by 2025. Failure to comply with environmental claims can lead to significant penalties, as enforced by the FTC's Green Guides, making accurate labeling crucial for Plastipak.

| Legal Factor | Impact on Plastipak | Key Dates/Data |

| Extended Producer Responsibility (EPR) | Increased operational costs and compliance burdens for packaging waste management. | Oregon, Colorado, California active laws; compliance deadlines approaching in 2025. |

| Recycled Content Mandates | Requirement to incorporate higher percentages of post-consumer recycled (PCR) materials. | EU target: 25% recycled content in PET bottles by 2025. |

| Food Contact Material (FCM) Regulations | Stricter purity standards and potential bans on certain chemicals like BPA. | EU Regulation (EU) 2025/352 bans BPA in FCMs by 2025. |

| Single-Use Plastic Bans | Shifts market demand and encourages development of alternative packaging solutions. | Over 100 countries had plastic regulations by end of 2023. |

| Labeling and Claims Regulation | Need for accurate, substantiated environmental claims and clear disposal instructions. | FTC Green Guides enforcement; EU ESPR expanding labeling by 2025. |

Environmental factors

Growing global concern over plastic pollution is fueling aggressive waste reduction targets. For instance, the United Nations Environment Programme (UNEP) is spearheading efforts to establish a legally binding global treaty on plastic pollution, with significant progress expected by late 2024 or early 2025. This push aims to curb plastic leakage and reduce overall plastic waste generation worldwide.

Plastipak, as a significant player in the plastic packaging industry, faces direct pressure from these environmental mandates. The company must adapt its operations to minimize its ecological impact and actively contribute to achieving these ambitious waste reduction goals. This includes exploring innovative materials and recycling technologies.

The global push towards a circular economy for plastics is a significant environmental trend, focusing on extending material lifecycles via reuse, recycling, and composting. Many jurisdictions and industry agreements have established 2025 benchmarks, requiring plastic packaging to be entirely reusable, recyclable, or compostable, alongside ambitious recycling rate goals.

For instance, the Ellen MacArthur Foundation's New Plastics Economy Global Commitment, signed by numerous major brands and governments, aims for 100% of plastic packaging to be reusable, recyclable, or compostable by 2025. Additionally, the European Union's Plastics Strategy sets targets for all plastic packaging placed on the EU market to be reusable or economically and technically recyclable by 2030.

Plastipak's business model, which encompasses product design, manufacturing, and recycling operations, is strategically aligned to capitalize on and support this transition. Their focus on creating recyclable packaging and investing in recycling infrastructure positions them favorably as regulatory pressures and consumer demand for sustainable solutions intensify.

Environmental regulations and consumer preferences are pushing for more recycled content in plastic packaging. For instance, by 2025, several regions are expected to mandate higher percentages of post-consumer recycled (PCR) materials in beverage bottles. Plastipak's ability to source and incorporate this PCR content, alongside designing packaging for easier recycling, directly impacts its market position and compliance.

The demand for enhanced recyclability, often achieved through mono-material designs, is a critical factor. This trend aims to simplify the recycling process and increase the quality of recycled plastics. Plastipak's investment in technologies that enable the use of mono-materials, like PET for bottles, is essential to meet these evolving environmental standards and capture market share in a sustainability-conscious landscape.

Carbon Footprint Reduction and Energy Efficiency

Growing global awareness of climate change is compelling industries, including packaging, to actively shrink their carbon footprints. This translates to a significant push for reducing emissions stemming from manufacturing operations and the extensive transportation networks involved in product delivery. For instance, the global average CO2 emissions from manufacturing are under intense scrutiny, with many nations setting ambitious reduction targets for the coming years.

Consequently, there's a heightened emphasis on adopting more energy-efficient production techniques and developing lighter-weight packaging alternatives. These innovations aim to directly lower the energy required for manufacturing and decrease fuel consumption during the logistics phase. Reports from 2024 indicate a substantial investment in energy-saving technologies across the manufacturing sector, with a particular focus on renewable energy integration.

Plastipak Holdings can bolster its environmental standing and operational efficiency by prioritizing the optimization of its manufacturing processes for reduced energy consumption. Furthermore, developing and promoting packaging solutions that are lighter in weight can contribute to lower transportation-related emissions. By 2025, the demand for sustainable packaging solutions, particularly those that reduce transport emissions, is projected to see continued strong growth.

- Focus on energy-efficient manufacturing: Implementing advanced technologies to lower electricity and fuel usage in production facilities.

- Develop lightweight packaging: Innovating materials and designs that reduce the overall weight of products, thereby cutting transport emissions.

- Invest in renewable energy sources: Transitioning towards solar, wind, or other sustainable energy for operational power.

- Supply chain optimization: Streamlining logistics to minimize travel distances and improve fuel efficiency.

Water Usage and Resource Depletion

Plastipak Holdings, like many in the packaging sector, faces increasing scrutiny over its water usage. The environmental impact of manufacturing processes, particularly those involving plastics, often carries a significant water footprint. Globally, industries are being pushed to adopt more sustainable practices to address concerns about resource depletion.

The broader issue of water scarcity and the need for efficient resource management directly impacts packaging companies. For instance, the UN estimates that by 2050, over 5 billion people could suffer from water shortages. This reality pressures companies like Plastipak to innovate in water conservation.

- Water Consumption in Plastic Manufacturing: Processes like cooling, washing, and material processing can be water-intensive.

- Resource Depletion Concerns: Growing global populations and industrial activity exacerbate the strain on freshwater resources.

- Sustainable Manufacturing Imperative: Minimizing water use and maximizing recycling are key environmental management goals.

- Lifecycle Approach: Environmental considerations must span from raw material sourcing to end-of-life product management.

The global drive for sustainability is intensifying, with a strong focus on reducing plastic waste and promoting a circular economy. By 2025, many regions aim for all plastic packaging to be reusable, recyclable, or compostable, with ambitious recycling rate targets. Plastipak's investments in recyclable packaging and recycling infrastructure position it well to meet these evolving environmental demands.

There's a significant push for increased recycled content in plastic packaging, with mandates for post-consumer recycled (PCR) materials in beverage bottles expected in several regions by 2025. Plastipak's ability to source and integrate PCR, alongside designing for recyclability, is crucial for market competitiveness and compliance.

The industry is also concentrating on reducing its carbon footprint through energy-efficient manufacturing and lightweight packaging. Reports from 2024 highlight substantial investments in energy-saving technologies and renewable energy integration across manufacturing sectors.

Water conservation is another key environmental concern, with industries pressured to minimize water usage in manufacturing processes. The UN projects that by 2050, over 5 billion people could face water shortages, underscoring the need for efficient resource management.

PESTLE Analysis Data Sources

Our Plastipak Holdings PESTLE analysis is built on a robust foundation of data from official government publications, reputable financial institutions, and leading market research firms. We meticulously gather insights on political stability, economic forecasts, technological advancements, and environmental regulations to ensure comprehensive and accurate assessments.