Petrobras SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Petrobras Bundle

Petrobras, a titan of the energy sector, navigates a complex landscape of strengths like its vast offshore reserves and significant market share, alongside weaknesses such as historical governance issues and high debt levels. Understanding these internal dynamics is crucial for any stakeholder. The full SWOT analysis delves deeper, revealing external opportunities like the global energy transition and threats from fluctuating oil prices and regulatory changes.

Want the full story behind Petrobras's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Petrobras holds substantial pre-salt oil and gas reserves, notable for their high-quality light crude and remarkably low extraction costs. This provides a significant competitive edge, enhancing the company's global position and bolstering its production goals. In 2024, Petrobras' own pre-salt production hit a record 2.2 million barrels of oil equivalent per day (boed), and 3.2 million boed when including partners, accounting for 81% of its total output.

Petrobras's integrated operations span the entire oil and gas value chain, from exploration and production to refining, transportation, and marketing. This end-to-end control fosters significant operational efficiencies and builds resilience against market volatility. For instance, in 2023, Petrobras reported a net production of 2.7 million barrels of oil equivalent per day (boed), showcasing its vast operational scale.

The company's strategic diversification into low-carbon sectors, including petrochemicals and biofuels, further strengthens its business model. This move not only broadens its revenue streams but also positions Petrobras to capitalize on the global energy transition, aligning with sustainability goals and future market demands. In 2023, the company invested R$4.2 billion in exploration and production, with a growing allocation towards lower-carbon initiatives.

Petrobras is demonstrating a strong commitment to its future through substantial investment in key projects. The company's 2024-2028 Strategic Plan alone earmarks US$102 billion for investments, a notable 31% increase compared to its predecessor. This significant capital allocation is primarily directed towards profitable exploration and production (E&P) assets, especially in the promising pre-salt fields, aiming to secure future production growth and ensure robust reserve replacement.

Looking ahead, Petrobras's 2025-2029 Strategic Plan continues this aggressive investment trajectory, projecting a further US$111 billion in capital expenditures. This ongoing financial commitment underscores the company's strategic focus on expanding its operational footprint and diversifying its energy portfolio, positioning it for sustained growth and market leadership in the coming years.

Commitment to Decarbonization and Sustainability

Petrobras demonstrates a strong commitment to decarbonization, setting ambitious targets like achieving net-zero operational emissions by 2050 and a 30% reduction in absolute operational emissions by 2030. This strategic focus is backed by substantial investments in low-carbon technologies.

The company is channeling significant capital into areas such as biorefining, renewable energy sources like wind and solar, carbon capture, utilization, and storage (CCUS), and the development of hydrogen technologies. These initiatives position Petrobras to align with evolving global energy transition trends and improve its environmental standing.

- Net-zero operational emissions by 2050.

- 30% reduction in absolute operational emissions by 2030.

- Investments in biorefining, wind, solar, CCUS, and hydrogen.

Strong Financial Performance and Cash Generation

Petrobras continues to exhibit robust financial health, consistently delivering strong performance and significant free cash flow even amidst market fluctuations. This resilience is a key strength, underpinning its strategic initiatives and shareholder value.

In the third quarter of 2024, Petrobras achieved a notable net profit of R$32.6 billion. Furthermore, the company successfully reduced its financial debt to approximately US$25.8 billion, marking its lowest debt level since 2008. This financial discipline highlights the company's operational efficiency and prudent debt management.

- Strong Profitability: Q3 2024 net profit reached R$32.6 billion.

- Debt Reduction: Financial debt lowered to approximately US$25.8 billion, a multi-year low.

- Cash Generation: Consistent generation of substantial free cash flow.

- Investment Capacity: Financial strength supports ambitious investment plans and shareholder returns.

Petrobras's extensive pre-salt reserves are a significant advantage, characterized by high-quality light crude and low extraction costs, contributing to its strong global standing. In 2024, its pre-salt production alone reached 2.2 million barrels of oil equivalent per day (boed), representing 81% of total output.

The company's integrated business model, covering the entire oil and gas value chain, drives operational efficiencies and market resilience. This scale was evident in its 2023 net production of 2.7 million boed.

Petrobras's strategic pivot towards low-carbon sectors, including biofuels and petrochemicals, diversifies revenue and aligns with the energy transition. Investments in these areas, such as R$4.2 billion in exploration and production in 2023, underscore this commitment.

The company's financial strength is a key asset, demonstrated by a Q3 2024 net profit of R$32.6 billion and a reduction in financial debt to roughly US$25.8 billion, its lowest since 2008. This robust financial position supports its substantial investment plans.

| Metric | 2023 (Approx.) | Q3 2024 (Approx.) | Significance |

|---|---|---|---|

| Net Production (boed) | 2.7 million | N/A | Demonstrates operational scale |

| Pre-salt Production (boed) | N/A | 2.2 million | Highlights key reserve advantage |

| Net Profit (R$ billion) | N/A | 32.6 | Indicates strong profitability |

| Financial Debt (US$ billion) | N/A | 25.8 | Shows effective debt management |

What is included in the product

Delivers a strategic overview of Petrobras’s internal and external business factors, highlighting its strong position in pre-salt oil exploration and the challenges of political interference and operational efficiency.

Uncovers critical external threats and internal weaknesses, enabling proactive mitigation for Petrobras's strategic planning.

Weaknesses

Petrobras has grappled with a legacy of substantial corruption scandals, notably Operation Car Wash, which severely tarnished its reputation and resulted in billions in fines and legal settlements. For instance, by the end of 2023, the company had paid out over R$2.7 billion (approximately $540 million USD) in settlements related to these investigations.

Being a state-controlled enterprise, Petrobras continues to face the risk of political interference. This can manifest in decisions regarding fuel pricing, investment strategies, and even executive appointments, creating an environment of uncertainty that can negatively affect investor confidence and the company's stock performance.

While Petrobras has focused on reducing its debt, it continues to carry significant financial obligations. As of the third quarter of 2024, the company reported gross debt of US$59.1 billion, a figure that, while managed within its targets, still presents potential vulnerabilities.

These substantial debt levels can heighten the company's exposure to financial risks. Specifically, Petrobras remains susceptible to the impact of market downturns and fluctuations in interest rates, which could increase borrowing costs and strain its financial performance.

Petrobras' profitability is intrinsically linked to the volatile global oil market. A significant downturn in oil prices, such as the 11.3% revenue drop observed in Q1 2025 compared to the previous year due to lower international Brent crude prices, directly erodes its earnings.

This dependence means that substantial and sustained dips in crude oil prices can severely compress Petrobras' profit margins, impacting its ability to invest in future projects and return value to shareholders.

Reliance on Mature Fields and Production Decline

Petrobras continues to grapple with the natural decline in output from its established oil fields. Despite substantial investments in new platforms and pre-salt exploration, these mature assets require ongoing capital expenditure to sustain production. For instance, while the company is pushing forward with projects like FPSO Almirante Tamandaré, the inherent depletion of older reserves remains a significant operational hurdle.

This reliance on mature fields means Petrobras must consistently pour resources into both new developments and revitalization programs for existing ones. This continuous investment is crucial to counteract production drops and maintain overall output levels. The company's strategy hinges on successfully bringing new, high-potential projects online to compensate for the inevitable decline in its legacy fields.

- Production Decline in Mature Fields: Petrobras faces a natural decrease in output from its older, established oil and gas fields.

- Need for Continuous Investment: Significant capital is required for both new exploration and the revitalization of existing mature fields to offset declining production.

- Balancing New Projects with Legacy Assets: The company must effectively manage its portfolio, ensuring new projects, such as those in the pre-salt region, can compensate for the depletion of mature reserves.

Environmental Concerns and Regulatory Compliance Costs

Petrobras faces significant environmental challenges, especially from its exploration and production activities. These operations are under intense scrutiny from regulators, and keeping up with new environmental rules adds to expenses. For instance, the company anticipated a 5% increase in regulatory compliance costs for 2024.

The risk of environmental incidents, such as oil spills, poses a major threat. Such events can result in substantial financial penalties, costly cleanup operations, and severe damage to Petrobras' public image. These liabilities can significantly impact profitability and shareholder value.

- Environmental Risks: Exploration and production activities carry inherent risks of spills and habitat disruption.

- Regulatory Burden: Adhering to evolving environmental laws and standards requires continuous investment and adaptation.

- Compliance Costs: Petrobras projected a 5% rise in regulatory compliance expenses for 2024.

- Reputational Damage: Environmental incidents can lead to negative publicity and loss of public trust, impacting operations and market standing.

Petrobras' legacy of corruption, exemplified by Operation Car Wash, has significantly damaged its reputation, leading to substantial fines and settlements, with over R$2.7 billion paid by late 2023. As a state-controlled entity, it remains vulnerable to political interference, impacting pricing, investment, and leadership decisions, which can erode investor confidence. Despite efforts to manage its debt, Petrobras still carries significant financial obligations, with gross debt at US$59.1 billion as of Q3 2024, making it susceptible to market downturns and interest rate fluctuations.

| Weakness | Description | Impact | Supporting Data (as of latest available) |

|---|---|---|---|

| Corruption Legacy | Past corruption scandals have tarnished reputation and led to financial penalties. | Reduced investor trust, potential legal liabilities. | Over R$2.7 billion in settlements paid by end of 2023. |

| Political Interference Risk | State control creates vulnerability to government decisions on operations and strategy. | Uncertainty in strategic direction, potential impact on stock performance. | Ongoing influence on pricing and investment decisions. |

| High Debt Levels | Significant financial obligations remain a concern. | Increased exposure to financial risks, higher borrowing costs. | US$59.1 billion gross debt as of Q3 2024. |

Full Version Awaits

Petrobras SWOT Analysis

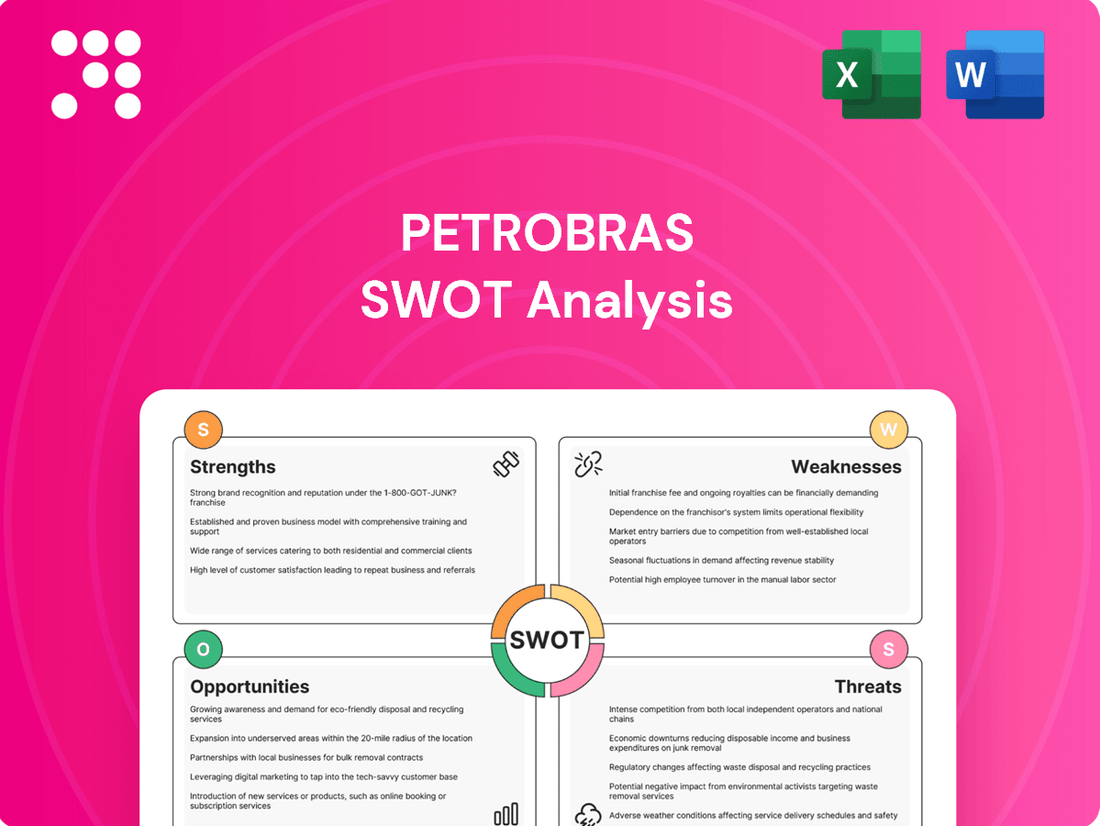

This is the actual Petrobras SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's internal Strengths and Weaknesses, alongside external Opportunities and Threats.

The preview below is taken directly from the full Petrobras SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing key strategic considerations for Petrobras.

This preview reflects the real Petrobras SWOT analysis document you'll receive—professional, structured, and ready to use for strategic planning.

Opportunities

Brazil's pre-salt fields hold immense, high-quality oil and gas reserves, presenting a prime opportunity for Petrobras to significantly boost its exploration and production. The company's strategic focus on these deepwater assets is poised to drive substantial production increases.

Petrobras is set to deploy 14 new Floating Production, Storage, and Offloading (FPSO) units between 2024 and 2028, a move that will directly support the expansion of its pre-salt operations. This investment in advanced technology and infrastructure is designed to enhance efficiency and solidify Petrobras's market leadership.

The global shift towards cleaner energy sources offers Petrobras a significant avenue for growth. The company's strategic focus includes expanding into wind and solar power, alongside advancements in biorefining, which encompasses renewable diesel and aviation biokerosene.

Petrobras is also making strides in emerging low-carbon sectors such as green hydrogen and carbon capture technologies. The company has earmarked a considerable US$16.3 billion for these low-carbon initiatives within its 2025-2029 strategic plan, signaling a strong commitment to diversification and a reduced dependence on traditional fossil fuels.

Petrobras' deepwater and ultra-deepwater drilling expertise is a significant advantage, allowing them to maximize recovery from complex offshore fields. This technological prowess is crucial for accessing and efficiently extracting resources from challenging environments.

Continued investment in innovation can further boost operational efficiency and reduce costs for Petrobras. For instance, advancements in seismic imaging and artificial lift systems can unlock previously uneconomical reserves, particularly in the pre-salt region, which holds vast potential.

In 2024, Petrobras continued to highlight its commitment to technological development, aiming to enhance recovery rates in its pre-salt fields. The company's focus on digitalization and automation is projected to contribute to a more streamlined and cost-effective production process throughout 2025.

Strategic Partnerships and Joint Ventures

Strategic partnerships and joint ventures offer Petrobras a pathway to shared risk and enhanced expertise, particularly for capital-intensive ventures. This strategy allows for more efficient market entry and technology adoption. For instance, in 2024, Petrobras has been actively seeking collaborations for its offshore wind projects, aiming to tap into specialized knowledge and reduce upfront investment burdens.

These alliances are crucial for navigating the complexities of large-scale renewable energy development and exploring frontier exploration areas. By pooling resources and capabilities, Petrobras can accelerate its transition into new energy sectors.

- Risk Sharing: Partnerships distribute the financial and operational risks associated with high-cost projects, such as deepwater exploration or massive renewable energy installations.

- Expertise Leverage: Collaborating with companies possessing specialized technological or market knowledge can bolster Petrobras's capabilities in areas like offshore wind or advanced exploration techniques.

- Market Expansion: Joint ventures can facilitate entry into new geographical markets or technological domains by leveraging the partner's established presence and networks.

- Capital Efficiency: Sharing investment costs for major projects improves capital allocation and allows for a broader portfolio of development initiatives.

Infrastructure Expansion and Gas Market Development

Petrobras' strategic infrastructure expansion, particularly in natural gas processing and transportation, presents a significant opportunity. The company is set to boost its domestic market share and capitalize on increasing energy consumption through these investments.

The newly operational Natural Gas Processing Unit in Itaboraí, which commenced operations in November 2024, is a key development. This facility is designed to handle 10.5 million cubic meters of natural gas daily, enhancing Petrobras' capacity to serve the growing demand for natural gas.

Further expansion plans include the development of new natural gas processing units and an extensive pipeline network. These initiatives are crucial for strengthening Petrobras' position in the domestic energy market and meeting Brazil's evolving energy needs.

The company's focus on gas market development aligns with national energy security goals and offers avenues for increased revenue generation. This strategic push into gas infrastructure is poised to be a major growth driver for Petrobras in the coming years.

Petrobras's significant investments in its 2025-2029 strategic plan, including US$16.3 billion allocated to low-carbon initiatives, highlight a strong commitment to diversifying its energy portfolio beyond traditional oil and gas. This strategic pivot includes expanding into renewable energy sources like wind and solar, alongside advancements in biorefining technologies for renewable diesel and aviation biokerosene.

The company's expertise in deepwater and ultra-deepwater drilling, particularly in Brazil's pre-salt fields, remains a core strength, enabling efficient extraction from complex environments. Continued innovation in areas like seismic imaging and artificial lift systems is expected to further unlock reserves and improve production efficiency, with a focus on digitalization and automation projected to streamline operations in 2025.

Strategic partnerships and joint ventures are crucial for Petrobras, offering shared risk, leveraged expertise, and capital efficiency for capital-intensive projects, especially in offshore wind development and frontier exploration. These collaborations are vital for accelerating the company's transition into new energy sectors and expanding its market reach.

Petrobras's expansion of natural gas processing and transportation infrastructure, exemplified by the November 2024 Itaboraí unit processing 10.5 million cubic meters daily, strengthens its domestic market position and capitalizes on increasing energy demand, aligning with national energy security objectives.

| Initiative | 2025-2029 Investment (USD Billions) | Key Focus | Projected Impact |

|---|---|---|---|

| Low-Carbon Initiatives | 16.3 | Green hydrogen, carbon capture, biorefining | Diversification, reduced carbon footprint |

| Pre-Salt Exploration & Production | Significant portion of capital expenditure | Deployment of 14 new FPSOs (2024-2028) | Increased oil and gas production, market leadership |

| Natural Gas Infrastructure | Ongoing investment | New processing units, pipeline network expansion | Enhanced domestic market share, revenue growth |

Threats

The accelerating global transition towards renewable energy sources presents a significant long-term threat to Petrobras. As nations increasingly prioritize decarbonization, demand for oil and gas is expected to decline, potentially impacting the company's core revenue streams.

This shift could lead to a devaluation of Petrobras's extensive fossil fuel assets, commonly referred to as stranded assets. For instance, by 2023, global renewable energy capacity additions reached a record high, signaling a sustained move away from traditional energy sources.

Petrobras's ability to adapt its business model and diversify into renewable energy will be crucial for its long-term viability. Failure to do so could result in a substantial decline in its market position and financial performance as the energy landscape evolves.

Petrobras is exposed to evolving regulatory landscapes in Brazil and globally, particularly concerning environmental standards and the push for decarbonization. These shifts, exemplified by Brazil's Future Fuels Law, could significantly increase compliance expenses and impose operational limitations, impacting profitability.

The company must navigate the risk of legal actions and reputational harm stemming from environmental mishaps. For instance, increased scrutiny on offshore operations and potential spills could trigger substantial fines and damage public trust, affecting future investment and operational permits.

As a company with significant state control, Petrobras is particularly vulnerable to Brazil's economic ups and downs and political shifts. For instance, Brazil's GDP growth forecast for 2024 stands at a modest 2.3%, highlighting potential economic headwinds that could affect demand and profitability.

Government interference in key areas like fuel pricing, major investment projects, and overall strategic direction can directly impact Petrobras' operational flexibility and financial results. This political influence can create uncertainty, deterring investors who prioritize predictable business environments.

Broader macroeconomic challenges within Brazil, such as inflation rates which averaged around 4.62% in 2023, can further complicate Petrobras' financial planning and operational costs, potentially eroding investor confidence and impacting its stock performance.

Geopolitical Risks and Trade Tensions

Global geopolitical events and escalating trade tensions pose a significant threat to Petrobras. Disruptions in major oil-producing regions or key shipping lanes can directly impact oil prices and Petrobras' operational stability. For instance, ongoing conflicts in Eastern Europe and the Middle East have historically led to increased oil price volatility, affecting Petrobras' revenue streams and capital expenditure plans.

Trade disputes, such as those involving major economies, can indirectly dampen global economic growth, thereby reducing overall oil demand. This slowdown could negatively affect Petrobras' export volumes and pricing power. For example, a significant slowdown in Chinese economic activity, potentially exacerbated by trade friction, could reduce demand for Brazilian crude exports.

- Impact on Oil Prices: Geopolitical instability can cause sharp price fluctuations, making financial planning more challenging for Petrobras. Brent crude oil futures, for example, saw significant spikes in 2022 due to geopolitical events, impacting global energy markets.

- Supply Chain Disruptions: Tensions can disrupt the flow of essential goods and equipment needed for oil exploration and production, increasing operational costs and project timelines.

- Market Access: Trade barriers or sanctions against key trading partners could limit Petrobras' ability to access certain markets for its oil and refined products.

Intensifying Competition in the Energy Sector

Petrobras is navigating an increasingly competitive landscape. Both established national and international oil and gas giants, alongside agile new entrants in renewable energy, are intensifying their presence. This surge in competition directly impacts Petrobras's ability to maintain market share and exert pricing power across its diverse portfolio.

The pressure is palpable, potentially squeezing profit margins as companies vie for dominance. For instance, in the pre-salt exploration, Petrobras faces rivals like Shell and ExxonMobil, who are also making significant investments. Furthermore, the global push towards decarbonization means Petrobras must contend with renewable energy developers, who are capturing market share in power generation and alternative fuels, a segment where Petrobras is also expanding.

- Increased Competition: Petrobras faces pressure from global oil majors and emerging renewable energy firms.

- Market Share Erosion: Competitors are actively seeking to capture segments of Petrobras's traditional and growing markets.

- Pricing Pressures: The heightened competitive environment can lead to reduced pricing power for Petrobras's products and services.

- Profitability Impact: These competitive dynamics directly affect Petrobras's financial performance and profitability across its operations.

The global energy transition poses a significant threat, with renewable energy capacity additions reaching a record high in 2023, signaling a sustained move away from fossil fuels. This shift could devalue Petrobras's vast oil and gas assets, commonly known as stranded assets, and necessitate a costly business model adaptation to avoid market share erosion.

Petrobras faces heightened competition from both established oil giants and emerging renewable energy firms, intensifying pressure on market share and pricing power. For instance, in the pre-salt region, rivals like Shell and ExxonMobil are making substantial investments, while renewable developers are capturing market share in power generation.

Geopolitical instability and trade tensions can disrupt supply chains and impact oil prices, as seen with significant spikes in Brent crude futures in 2022 due to global conflicts. Such volatility complicates financial planning and can limit market access for Petrobras's products.

Brazil's economic and political landscape presents inherent risks, with projected GDP growth of 2.3% for 2024 and inflation averaging 4.62% in 2023. Government intervention in pricing and strategic decisions can create uncertainty, potentially deterring investors seeking stable environments.

SWOT Analysis Data Sources

This Petrobras SWOT analysis is informed by a comprehensive review of official financial statements, robust market research reports, and expert industry commentary. These sources provide a solid foundation for understanding the company's internal capabilities and external environment.