Petrobras Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Petrobras Bundle

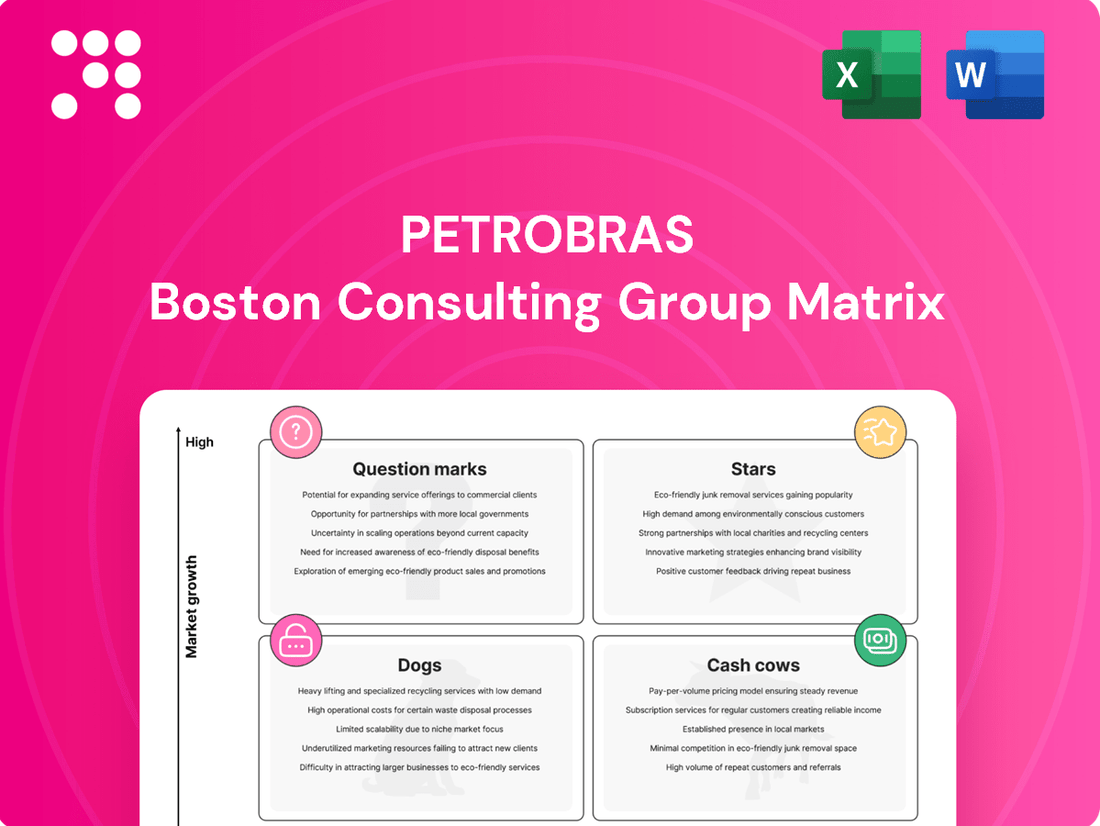

Curious about Petrobras's strategic positioning? Our BCG Matrix analysis reveals which of their ventures are market leaders, which are generating steady profits, and which require careful consideration. This preview offers a glimpse into their product portfolio's health.

To truly unlock the strategic potential and make informed decisions about Petrobras's future investments, you need the full picture. Purchase the complete BCG Matrix report for a detailed quadrant breakdown, actionable recommendations, and a clear roadmap to optimizing their business strategy.

Don't miss out on critical insights that can shape your understanding of Petrobras's market performance. Get the full BCG Matrix today and gain a competitive edge with data-driven strategic clarity.

Stars

Petrobras' pre-salt production is a significant engine for growth, with projections indicating it will account for 79% of the company's total output by 2028. This strategic focus is backed by substantial investment, including the planned deployment of 14 new Floating Production Storage and Offloading (FPSO) units from 2024 to 2028.

This aggressive expansion in the pre-salt region is designed to boost overall oil and gas equivalent production to 3.2 million barrels per day by 2028 or 2029. The company aims to solidify its market share within this burgeoning segment of the energy industry.

Petrobras is heavily investing in the Equatorial Margin, earmarking US$3.1 billion for exploration activities through 2028. This strategic focus highlights the region's potential as a significant new frontier for ultra-deepwater oil discoveries.

The company intends to drill around 16 exploratory wells in the Equatorial Margin, underscoring its commitment to unlocking substantial future production and bolstering its reserve base.

This substantial investment in a high-growth potential area positions the Equatorial Margin as a key component of Petrobras's long-term exploration and production strategy.

Petrobras is significantly bolstering its production capacity with the planned deployment of 14 new FPSO units between 2024 and 2028. This ambitious expansion is a cornerstone of their strategy to drive output growth, particularly from the highly productive pre-salt reserves.

The introduction of advanced FPSOs like the Maria Quitéria and Marechal Duque de Caxias is already contributing to increased production from key pre-salt fields such as Jubarte and Mero. This influx of new capacity is designed to maintain Petrobras' strong market position.

Carbon Capture, Utilization, and Storage (CCUS) Leadership

Petrobras stands out as a frontrunner in Carbon Capture, Utilization, and Storage (CCUS), especially within challenging ultra-deep water environments. In 2024, the company achieved a significant milestone by reinjecting a record 14.2 million tons of CO2.

This advanced CCUS strategy is cleverly combined with Enhanced Oil Recovery (EOR) techniques. This dual approach not only slashes the carbon intensity of its oil production but also boosts the amount of oil that can be recovered, giving Petrobras a distinct edge in a market that increasingly values lower-emission energy sources. The company has set an ambitious target to reinject 80 million tons of CO2 by the close of 2025.

- Global Leadership in CCUS: Petrobras is a recognized leader in CCUS technologies, particularly in ultra-deep water operations.

- 2024 CO2 Reinjection Record: Achieved a record 14.2 million tons of CO2 reinjected during 2024.

- CCUS-EOR Integration: Combines CCUS with Enhanced Oil Recovery (EOR) to reduce carbon footprint and optimize oil recovery.

- Future CCUS Targets: Aims to reinject 80 million tons of CO2 by the end of 2025.

Advanced Biorefining Initiatives

Petrobras is making significant strides in advanced biorefining, earmarking US$1.5 billion for investments through 2028. This strategic push aims to dramatically expand its biofuel production capacity, targeting a fourfold increase by 2030.

The company's focus includes scaling up its successful Diesel R5 production and establishing new facilities for aviation biokerosene (BioQAV) and 100% renewable diesel (HVO). These initiatives are designed to capture growth in the burgeoning sustainable fuels market.

- Investment: US$1.5 billion committed by 2028.

- Production Goal: Quadruple biofuel capacity by 2030.

- Key Products: Diesel R5 expansion, BioQAV, and HVO development.

- Market Focus: High-growth segments in sustainable aviation fuel and renewable diesel.

Petrobras' pre-salt operations, particularly in fields like Jubarte and Mero, are its current Stars. These high-production assets are generating substantial revenue and cash flow, fueling further investment across the company. The company’s strategic deployment of 14 new FPSOs from 2024 to 2028, primarily targeting pre-salt, reinforces the Star status of these reserves, which are projected to constitute 79% of total output by 2028.

| Asset Category | Petrobras' Position | Key Drivers | Future Outlook |

|---|---|---|---|

| Pre-salt Production | Star | High productivity, significant reserve base, deployment of new FPSOs (14 from 2024-2028) | Projected to reach 3.2 million boe/day by 2028/2029, 79% of total output by 2028 |

| Equatorial Margin Exploration | Question Mark | High potential for ultra-deepwater discoveries, US$3.1 billion investment through 2028, ~16 exploratory wells planned | Uncertainty in discovery success, but significant potential for future growth |

| CCUS Technology | Question Mark/Star (Emerging) | Global leadership in ultra-deepwater CCUS, record 14.2 million tons CO2 reinjected in 2024, CCUS-EOR integration | Target of 80 million tons CO2 reinjected by end of 2025, reducing carbon intensity and boosting recovery |

| Advanced Biorefining | Question Mark | US$1.5 billion investment through 2028, target to quadruple biofuel capacity by 2030, focus on Diesel R5, BioQAV, HVO | Growth opportunity in sustainable fuels market, but scale and market adoption are key |

What is included in the product

The Petrobras BCG Matrix offers a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide investment decisions.

A clear Petrobras BCG Matrix overview helps quickly identify underperforming units, relieving the pain of strategic indecision.

Cash Cows

Petrobras' pre-salt operations are a true cash cow, a cornerstone of its financial strength. In 2024, these fields were responsible for a remarkable 80% of the company's total oil and gas production, showcasing their immense contribution.

These mature, highly productive assets boast low operating expenses and yield premium-quality crude, translating into a consistent and robust inflow of cash. This reliable revenue stream is crucial for Petrobras, enabling it to comfortably fund its ambitious growth projects and maintain a healthy balance sheet.

Petrobras' domestic refining system hit a remarkable 93% utilization factor in 2024, the highest since 2014. This operational prowess, coupled with record-breaking annual production of gasoline and S-10 diesel, underscores its position as a Cash Cow.

This high capacity utilization translates directly into consistent, strong cash flow by ensuring a steady supply of refined products to meet Brazil's substantial energy demand. The efficiency of its refining network is a key driver of profitability.

Petrobras' integrated logistics and distribution network functions as a robust cash cow. This extensive infrastructure, covering Brazil, ensures efficient movement and sales of oil products and natural gas, contributing a steady revenue stream.

The network’s maturity means it demands less capital for aggressive expansion, allowing it to consistently generate substantial cash flow from its widespread operations. For instance, in 2023, Petrobras reported record net income of R$180 billion, with its refining and marketing segment, heavily reliant on this network, being a key contributor.

Conventional Oil and Gas Assets

While Petrobras is heavily investing in pre-salt exploration, its conventional oil and gas assets remain significant cash cows. These mature fields, despite natural production declines, are crucial for consistent revenue. In 2023, Petrobras produced an average of 2.8 million barrels of oil equivalent per day (boed), with conventional fields contributing a substantial portion. Revitalization efforts are key to sustaining output from these established areas.

These conventional assets offer a stable cash flow with lower capital expenditure requirements compared to new frontier projects. This stability is vital for funding Petrobras' ambitious growth strategies, particularly in the pre-salt region. The company's focus on optimizing recovery factors in these fields ensures they continue to be reliable profit centers.

- Consistent Revenue Stream: Conventional fields provide a steady income, supporting overall financial health.

- Lower CAPEX Needs: Compared to pre-salt, these mature assets require less new investment to maintain production.

- Production Stability: They contribute significant, predictable production volumes to Petrobras' output.

- Profitability Driver: These fields remain core to the company's profitability and cash generation.

Strategic Gas Supply in Brazil

Petrobras' strategic gas supply in Brazil, despite market liberalization, demonstrates its position as a Cash Cow. The company continues to hold a substantial share in the natural gas market, serving key distributors and industrial clients across the nation.

While its market share has experienced some decline, Petrobras benefits from long-standing contracts and extensive infrastructure, which guarantee a consistent and reliable demand for its natural gas products. This stability is crucial for its cash-generating capabilities.

- Market Share: Petrobras holds a significant, though slightly reduced, market share in Brazil's natural gas sector.

- Demand Stability: Established contracts and robust infrastructure ensure consistent demand for its gas supply.

- Cash Flow Generation: This segment is a reliable source of steady cash flow for the company.

- Optimization Efforts: Petrobras actively works to optimize its gas portfolio, further solidifying its Cash Cow status.

Petrobras' pre-salt operations stand as a dominant cash cow, contributing approximately 80% of its total oil and gas production in 2024. These mature, high-quality crude producing fields boast low operating costs, ensuring a consistent and substantial cash inflow. This reliable revenue stream is vital for funding the company's ambitious growth initiatives and maintaining financial stability.

The company's domestic refining segment is another significant cash cow, achieving a 93% utilization rate in 2024, its highest since 2014. This operational efficiency, coupled with record gasoline and diesel production, highlights its role in generating steady cash flow by meeting Brazil's substantial energy needs.

Petrobras' integrated logistics and distribution network functions as a mature cash cow, requiring less capital for expansion while consistently generating strong cash flow. This network ensures efficient movement and sales of oil products and natural gas across Brazil, contributing to its robust financial performance. For instance, in 2023, Petrobras reported a record net income of R$180 billion, with the refining and marketing segment playing a pivotal role.

Conventional oil and gas assets, despite natural declines, remain crucial cash cows for Petrobras. In 2023, these fields contributed a substantial portion to the company's average daily production of 2.8 million barrels of oil equivalent. Revitalization efforts are key to sustaining their stable cash generation and supporting new investments.

| Segment | BCG Category | 2024 Production Contribution | Key Characteristics | Financial Impact |

|---|---|---|---|---|

| Pre-Salt Operations | Cash Cow | ~80% of total oil & gas production | Low operating costs, high-quality crude | Consistent, robust cash inflow |

| Domestic Refining | Cash Cow | 93% utilization (highest since 2014) | Record gasoline & S-10 diesel production | Steady cash flow, meets domestic demand |

| Logistics & Distribution | Cash Cow | Extensive network across Brazil | Mature infrastructure, low CAPEX needs | Consistent revenue stream |

| Conventional Oil & Gas | Cash Cow | Substantial portion of 2.8 MMboed (2023 avg.) | Stable cash flow, lower CAPEX requirements | Reliable profit centers, supports growth |

Preview = Final Product

Petrobras BCG Matrix

The Petrobras BCG Matrix you are previewing is the complete, unwatermarked document you will receive immediately after purchase. This comprehensive analysis is ready for immediate integration into your strategic planning, offering clear insights into Petrobras' business units and their market positions.

Dogs

Petrobras has strategically identified its older onshore and shallow water fields for divestment, signaling their low growth potential and shrinking market share. These mature assets often come with higher operating expenses compared to their production levels, making them less profitable than the company's high-performing deepwater ventures.

This divestment strategy is a move to streamline Petrobras' asset base and concentrate resources on more promising and competitive operations. For instance, in 2023, Petrobras completed the sale of its onshore fields in the Recôncavo basin, a move aimed at improving capital allocation and reducing operational complexity.

Petrobras has actively divested non-strategic assets as part of its portfolio optimization. This included selling off international holdings and stakes in various ventures that no longer aligned with its core business. For instance, in 2023, Petrobras completed the sale of its stake in the Tartaruga Verde field for approximately $1.1 billion, a move to focus on more promising exploration and production areas.

These divested units were characterized by their limited contribution to Petrobras' long-term strategic objectives or by their low market share and growth potential within the company's broader portfolio. The disposal of these assets is designed to streamline operations and enhance financial efficiency, allowing Petrobras to concentrate resources on its most valuable and strategic endeavors.

Certain legacy petrochemical and fertilizer operations within Petrobras might be classified as Dogs. These units often struggle with low market share in highly competitive global markets, coupled with limited prospects for significant growth. For instance, if specific fertilizer segments faced intensified competition from new entrants with lower production costs in 2024, their growth rate could have been significantly hampered, placing them in this category.

While Petrobras' broader strategy involves some diversification into petrochemicals, units that persistently underperform or deviate from the company's focus on higher-value products could be candidates for divestment. For example, if a particular petrochemical plant reported declining profit margins throughout 2024 due to feedstock price volatility and weak demand, it would strongly suggest a need for strategic review.

Segments with Significant Market Share Loss Post-Liberalization

Following Brazil's natural gas market liberalization, Petrobras experienced a notable decline in its market share, falling below 70% in 2024. This shift indicates a significant competitive challenge, particularly in areas where private players have swiftly established a stronger presence.

Specific segments within the natural gas market have seen Petrobras' market share erode substantially. These areas, where competitors have rapidly gained traction and Petrobras faces sustained low market share, could be identified as potential 'dogs' if they lack a clear strategy for recovery.

- Market Share Decline: Petrobras' natural gas market share dropped below 70% in 2024 post-liberalization.

- Competitive Gains: Private competitors have rapidly gained ground in specific sub-segments and regions.

- Strategic Adaptation: Petrobras is adjusting its commercial strategy to navigate the intensified competition.

Mature Fields with Limited Economic Recovery Potential

Mature fields with limited economic recovery potential, often categorized as Dogs in the BCG matrix, represent a segment of Petrobras' portfolio where further investment is unlikely to yield significant growth or long-term profitability. Despite revitalization efforts, these fields have reached a stage where returns on additional capital expenditure are diminishing.

These assets contribute a small fraction to Petrobras' future production and are primarily managed to maximize immediate cash flow rather than to pursue expansion. For instance, as of early 2024, Petrobras continued to focus on optimizing production from established fields like Marlim and Roncador, which, while still significant producers, are in later stages of their lifecycle.

The strategy for these fields is often to extract remaining value efficiently. This can involve cost optimization and a focus on operational efficiency. As of the first quarter of 2024, Petrobras reported that its production from mature onshore and shallow water fields, while stable, did not show the same growth trajectory as its pre-salt assets.

- Low Growth: These fields typically exhibit very low or negative market growth rates due to natural decline.

- Limited Profitability: While they can generate cash, their long-term profit potential is constrained by declining production and increasing operational costs.

- Cash Extraction Focus: Management prioritizes extracting maximum cash with minimal reinvestment to fund more promising ventures.

- Decommissioning Potential: Eventually, these assets may be candidates for decommissioning if the cost of extraction exceeds the market value of the produced hydrocarbons.

Petrobras' older onshore and shallow water fields, along with certain legacy petrochemical and fertilizer operations, can be classified as Dogs in the BCG matrix. These segments are characterized by low market share and limited growth prospects, often facing declining production or intense competition. For example, Petrobras' natural gas market share fell below 70% in 2024 following market liberalization, with private players rapidly gaining traction in specific areas, indicating a potential 'Dog' status for those segments if recovery strategies are not implemented.

| Asset Category | BCG Classification | Key Characteristics | 2024 Data/Observation |

|---|---|---|---|

| Mature Onshore/Shallow Water Fields | Dogs | Low growth, diminishing returns on investment, focus on cash extraction. | Continued optimization of production, but no significant growth trajectory compared to pre-salt assets. |

| Legacy Petrochemicals/Fertilizers | Dogs | Low market share in competitive markets, limited growth potential, potential for declining profit margins. | Some fertilizer segments faced intensified competition from lower-cost producers, potentially hampering growth. |

| Certain Natural Gas Segments | Potential Dogs | Eroding market share, strong competition from private players, lack of clear recovery strategy. | Market share dropped below 70% in 2024, with competitors swiftly establishing stronger presences in sub-segments. |

Question Marks

Petrobras plans to invest US$5.2 billion in wind and solar projects between 2024 and 2028, targeting 5 GW of onshore renewable capacity. This significant allocation reflects the high-growth potential of the wind energy sector globally and for Brazil.

Despite this substantial investment, Petrobras currently holds a modest market share in renewable energy generation. The company's onshore wind projects, while promising, represent a strategic push into a competitive landscape that demands considerable capital and robust partnerships to gain significant traction.

Petrobras is actively exploring green and sustainable hydrogen, a move that positions it within the question mark quadrant of the BCG matrix. The company has signed Memorandums of Understanding (MOUs) to assess opportunities in this burgeoning sector, signaling recognition of its high-growth potential.

While the market for sustainable hydrogen is expanding rapidly, Petrobras's current engagement is in its nascent stages. This translates to a low market share, necessitating significant investment and technological development to achieve scale and capture a meaningful position in this emerging energy landscape.

Petrobras is strategically positioning itself in the burgeoning sustainable aviation fuel (SAF) and 100% renewable diesel markets. These initiatives represent a forward-looking approach to capitalize on global decarbonization trends, moving beyond its existing R5 diesel production.

The company's commitment includes building dedicated plants for SAF and 100% renewable diesel, signaling a significant investment in future-oriented, high-growth segments. These advanced biofuels are expected to drive substantial revenue as environmental regulations tighten and demand for cleaner transportation fuels escalates.

Currently, Petrobras's market share in these advanced biofuel categories is minimal as the specialized facilities are still in development or slated for completion after 2028. For instance, the company announced plans for a SAF unit at its Abreu e Lima Refinery (Rnest) with a projected capacity of 12,000 barrels per day, aiming for operation around 2029.

New Exploratory Frontiers (beyond current focus areas)

Petrobras is actively expanding its exploration efforts into new territories, venturing beyond its core pre-salt and Equatorial Margin focus. This strategic pivot includes investments in blocks within the Pelotas Basin and acquiring international stakes, signaling a pursuit of untapped resources.

These new exploratory frontiers hold significant growth potential, capable of unlocking entirely new production zones for Petrobras if discoveries prove commercially viable. For instance, in 2024, Petrobras secured exploration rights for several blocks in the Pelotas Basin, marking a significant expansion of its exploration portfolio.

However, these ventures are inherently speculative. They begin with a low or even zero market share and face considerable uncertainty regarding their commercial viability, fitting the profile of Petrobras's 'Question Marks' in the BCG matrix.

- New Exploration Areas: Pelotas Basin blocks and international stakes.

- High Growth Potential: Opportunity to open new production zones.

- Speculative Nature: Initial low/zero market share and uncertain commercial viability.

- 2024 Activity: Petrobras secured new exploration blocks in the Pelotas Basin.

Subsea Gas Separation (Hisep 2) for Market Sales

Petrobras' Hisep 2 project targets subsea CO2 separation, aiming to unlock significant market sales for natural gas. This initiative directly addresses the substantial volume of gas currently reinjected, with over 60% of Brazil's gas production facing this fate, representing a substantial growth avenue.

The Hisep 2 system, designed for subsea CO2 removal, positions Petrobras to convert previously unusable gas into marketable product. This technological advancement is crucial for maximizing the value of Brazil's vast offshore gas reserves.

- Market Sales Potential: Hisep 2 aims to increase marketable gas volumes by enabling the sale of gas previously reinjected due to CO2 content.

- Growth Opportunity: With over 60% of Brazil's gas production currently reinjected, this technology presents a high-growth opportunity.

- Technological Novelty: The Hisep 2 system is a new technology, with its first deployment slated for 2028, indicating a nascent market share for this specific gas recovery method.

- Strategic Importance: This development is key for Petrobras to enhance its gas monetization strategy and capitalize on the growing demand for natural gas.

Petrobras's ventures into sustainable hydrogen and advanced biofuels like SAF and 100% renewable diesel represent significant strategic bets. These areas are characterized by high growth potential but currently have minimal market share due to their nascent development stages and the need for substantial capital investment and technological advancement.

Similarly, new exploration territories such as the Pelotas Basin and international ventures are classified as question marks. While they offer the promise of unlocking new production zones, their commercial viability remains uncertain, placing them in a high-risk, high-reward category within Petrobras's portfolio.

The Hisep 2 project, focused on subsea CO2 separation for natural gas, is another key question mark. This innovative technology aims to monetize gas previously reinjected due to CO2 content, tapping into a significant growth opportunity given that over 60% of Brazil's gas production faces this challenge.

Petrobras's investment in renewable energy, targeting 5 GW of onshore capacity by 2028, also falls into the question mark category. Despite the substantial US$5.2 billion allocation, the company's current market share in renewables is modest, requiring significant effort to establish a strong foothold in this competitive sector.

BCG Matrix Data Sources

Our Petrobras BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.