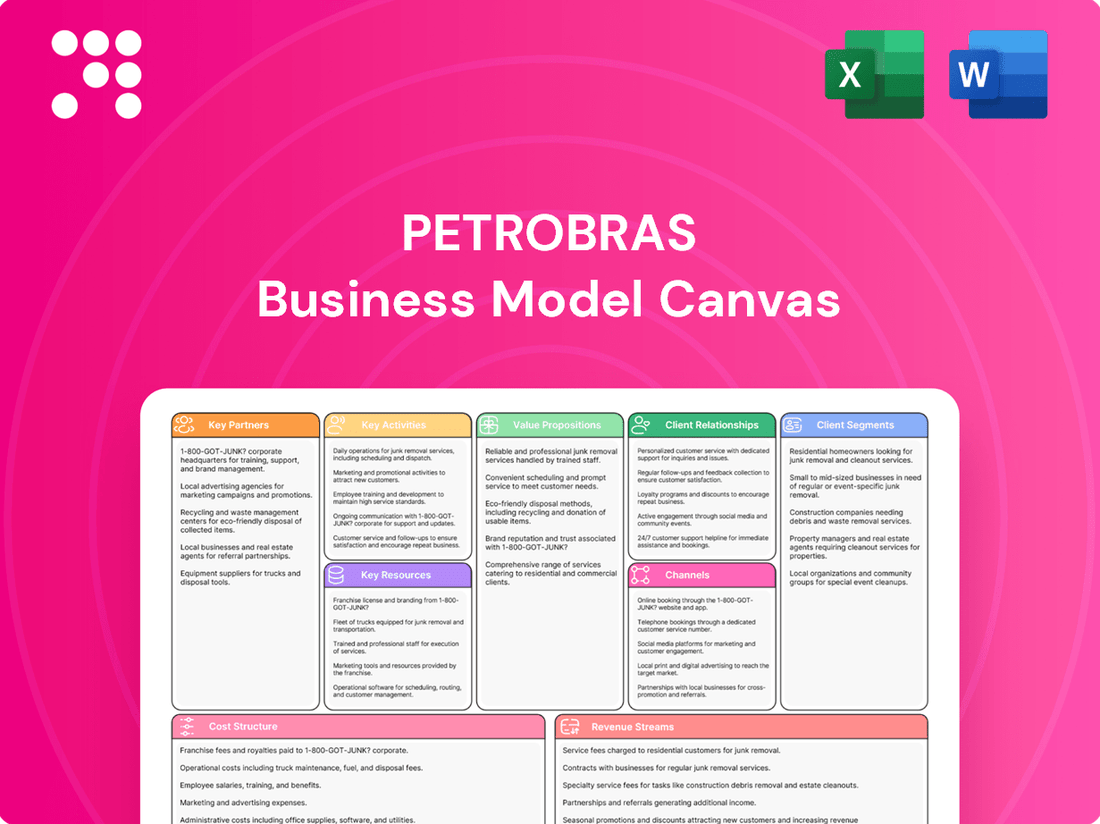

Petrobras Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Petrobras Bundle

Unlock the strategic blueprint behind Petrobras's complex business model. This comprehensive Business Model Canvas details their key partners, value propositions, and revenue streams, offering a clear view of their operational success.

Dive into the core of Petrobras's operations with our full Business Model Canvas. Understand how they manage customer relationships, key resources, and cost structures to maintain their global standing. This is your chance to learn from a titan of the energy sector.

See how Petrobras builds and delivers value across the entire energy chain. Our downloadable Business Model Canvas provides an in-depth look at their customer segments, channels, and competitive advantages, perfect for strategic analysis.

Partnerships

Petrobras actively forms joint ventures and alliances with both international and domestic energy players. These collaborations are vital for distributing the substantial financial burdens and gaining access to cutting-edge technologies needed for intricate operations, particularly in deepwater exploration. For instance, Petrobras's 2024-2028+ Strategic Plan emphasizes these partnerships for risk mitigation and knowledge sharing, especially in emerging energy sectors and challenging deepwater environments.

Petrobras relies on a vast network of suppliers and service providers for its complex operations, from exploration to production and maintenance. These partnerships are crucial for securing specialized equipment, advanced technologies, and essential services like offshore vessel operations and subsea system deployment.

In 2024, Petrobras's significant investment in goods and services, projected to be around $20 billion, highlights the vital role these key partners play. This substantial expenditure directly supports the company's ability to bring new production platforms online and ensure the ongoing efficiency of its existing infrastructure.

Petrobras actively collaborates with technology companies and research institutions to foster innovation across its operations, from exploration and production to refining and the development of low-carbon solutions.

These strategic alliances are crucial for advancing cutting-edge technologies, including seabed CO2 separation and reinjection, flexible deepwater pipelines, and all-electric well completion systems. In 2023, Petrobras allocated $960 million to research and development initiatives aimed at enhancing operational efficiency.

Furthermore, the company is actively pursuing partnerships focused on green hydrogen production and Carbon Capture, Utilization, and Storage (CCUS) projects, signaling a commitment to evolving energy landscapes.

Government Agencies and Regulators

As a state-controlled entity, Petrobras's key partnerships include crucial relationships with Brazilian government agencies and regulators. These collaborations are essential for securing necessary operating licenses and ensuring compliance with stringent environmental and safety standards. For example, the National Agency of Petroleum, Natural Gas and Biofuels (ANP) plays a vital role in regulating the sector.

These governmental partnerships are fundamental for Petrobras to align its strategic objectives with national energy policies and development plans. This alignment ensures that the company's activities contribute to broader economic and social goals. The ongoing dialogue with these bodies is critical for navigating the evolving regulatory landscape.

Recent legislative developments underscore the significance of these partnerships. For instance, Law 15,075/2024, which addresses local content surpluses and the extension of Production Sharing Agreements, demonstrates the direct impact of governmental decisions on Petrobras's operational framework and future investments. Such laws often stem from close consultation between the company and regulatory bodies.

- Regulatory Compliance: Adherence to environmental, safety, and operational standards set by agencies like IBAMA and ANP.

- Policy Alignment: Ensuring Petrobras's strategy supports national energy security and economic development goals.

- Licensing and Approvals: Obtaining permits for exploration, production, and infrastructure projects.

- Legislative Influence: Engaging with government on new regulations, such as those impacting local content or production sharing agreements, as seen with Law 15,075/2024.

Local Communities and Socio-Environmental Organizations

Petrobras recognizes that strong relationships with local communities and socio-environmental organizations are fundamental to its social license to operate. These partnerships are crucial for effectively managing the company's environmental impacts and fostering positive social outcomes.

The company actively invests in voluntary socio-environmental projects, focusing on areas such as biodiversity conservation and sustainable economic development. These initiatives are designed to create shared value and address the specific needs of the regions where Petrobras operates. For instance, the 2024 Sustainability Report highlights Petrobras' dedication to people and the environment, underscoring its commitment to responsible operations.

A key example of this commitment is the ProFloresta+ program, which aims to restore forests in the Amazon region. Such programs demonstrate Petrobras' proactive approach to environmental stewardship and its engagement with organizations dedicated to conservation and sustainable practices.

- Community Engagement: Petrobras collaborates with local communities to ensure its operations align with social expectations and to mitigate potential negative impacts.

- Environmental Stewardship: Investments in biodiversity conservation and forest restoration, such as the ProFloresta+ program, showcase a commitment to environmental protection.

- Sustainable Development: Programs focused on economic development and education in local areas aim to create long-term benefits for the communities.

- Social License: Maintaining open dialogue and partnerships with socio-environmental organizations is vital for securing and maintaining Petrobras' social license to operate.

Petrobras's strategic partnerships are a cornerstone of its operational model, enabling risk sharing and technological advancement in complex energy projects.

These collaborations extend to a wide array of suppliers and service providers, crucial for securing specialized equipment and advanced technologies, with Petrobras projecting approximately $20 billion in goods and services spending in 2024.

Furthermore, alliances with technology firms and research institutions are vital for innovation, particularly in areas like Carbon Capture, Utilization, and Storage (CCUS), with $960 million invested in R&D in 2023.

Crucially, Petrobras maintains essential partnerships with Brazilian government agencies, ensuring regulatory compliance and alignment with national energy policies, as exemplified by its engagement with ANP and the impact of laws like 15,075/2024.

What is included in the product

Petrobras's Business Model Canvas focuses on integrated oil and gas operations, serving diverse customer segments from industrial to retail, with value propositions centered on energy supply and technological innovation, all supported by extensive infrastructure and strategic partnerships.

The Petrobras Business Model Canvas offers a structured approach to dissecting complex operational challenges, streamlining strategic planning and resource allocation to alleviate pain points in the energy sector.

Activities

Petrobras's core activity revolves around exploring for and producing oil and natural gas, with a strong emphasis on Brazil's pre-salt reserves. This segment is crucial for the company's operations and future growth.

The company has outlined significant capital expenditures for exploration and production, projecting around $77 billion for its 2025-2029 Business Plan. A substantial portion of these investments is earmarked for pre-salt assets, recognizing their economic viability and environmental benefits.

Petrobras targets a production level of 3.2 million barrels of oil and gas equivalent per day by 2029. New platforms, such as FPSO Maria Quitéria and FPSO Marechal Duque de Caxias, are key to achieving this ambitious production target.

Petrobras's Refining, Transportation, and Marketing (RTM) activities are central to its business model, transforming crude oil into essential products. The company's commitment to this segment is evident in its Strategic Plan 2024-2028+ and Business Plan 2025-2029, which earmark substantial investments. These investments aim to boost refining capacity and enhance the availability of premium fuels like S10 Diesel and lubricants, meeting evolving market demands.

Key to optimizing RTM operations is the Reftop Program, a strategic initiative focused on improving the efficiency and reliability of Petrobras's refining infrastructure. This program directly supports the company's overarching goals, ensuring a steady and high-quality supply of petroleum products to the market. By modernizing its refining park, Petrobras solidifies its position in the downstream sector.

Petrobras actively engages in the processing, transportation, and sale of natural gas, alongside electricity generation. The company is focused on integrated and competitive operations within the gas and energy trade.

Enhancing its energy portfolio, Petrobras is incorporating renewable sources, signaling a strategic shift. Planned investments aim to expand infrastructure and broaden the company's natural gas offerings, with projects like the Rota 3 gas pipeline set to boost capacity.

Low Carbon and Energy Transition Initiatives

Petrobras is actively investing in low-carbon initiatives to reshape its energy future. This includes significant capital allocation towards biofuels, wind, and solar power generation. The company's 2025-2029 Business Plan earmarks a substantial $16.3 billion for these low-carbon projects, reflecting a strategic pivot to diversify its energy sources and shrink its environmental impact.

Key activities involve developing and commercializing marine fuels with reduced carbon intensity, making them more appealing for maritime clients. Furthermore, Petrobras is exploring strategic collaborations to advance the production of green hydrogen, a crucial element in decarbonizing various industrial sectors.

- Investment in Low-Carbon Projects: Petrobras has allocated $16.3 billion for low-carbon initiatives within its 2025-2029 Business Plan.

- Diversification of Energy Portfolio: The company is expanding into biofuels, wind energy, solar energy, CCUS, and hydrogen.

- Reduced Carbon Intensity Fuels: Petrobras is developing and marketing marine fuels with lower carbon intensity.

- Green Hydrogen Exploration: The company is actively exploring partnerships for green hydrogen production.

Research, Development, and Innovation (RD&I)

Petrobras's commitment to Research, Development, and Innovation (RD&I) is central to its strategy for staying competitive and advancing its energy transition. This involves creating new technologies that improve how they operate and reduce environmental impact.

Key areas of focus for Petrobras's RD&I include developing advanced solutions for CO2 capture and storage, creating more adaptable pipeline systems, implementing subsea electrification to power offshore operations, and automating drilling rigs. These efforts are designed to boost efficiency and production.

In 2023, Petrobras invested R$ 3.6 billion in research and development. This significant allocation underscores the company's dedication to technological advancement, aiming to enhance operational performance and support its sustainability objectives. For instance, their work on CO2 capture technologies is crucial for reducing greenhouse gas emissions from their operations.

- Technological Advancement: Developing proprietary technologies like CO2 separation and reinjection systems.

- Operational Efficiency: Implementing innovations such as flexible pipelines and rig automation to streamline operations.

- Energy Transition: Investing in subsea electrification to support cleaner offshore energy production.

- Investment in the Future: Petrobras allocated R$ 3.6 billion to RD&I in 2023, highlighting its strategic focus on innovation.

Petrobras's key activities encompass the entire oil and gas value chain, from exploration and production, particularly in Brazil's pre-salt region, to refining, transportation, and marketing of petroleum products. The company is also actively expanding into natural gas and increasingly investing in low-carbon energy sources like biofuels, wind, and solar power, alongside exploring green hydrogen potential.

Significant investments are being made to achieve production targets and enhance refining capabilities. For instance, the 2025-2029 Business Plan allocates approximately $77 billion to exploration and production, with a focus on pre-salt assets. Additionally, R$ 3.6 billion was invested in research and development in 2023 to drive technological advancements and operational efficiency.

| Activity | Focus Area | Key Data/Initiative |

| Exploration & Production | Pre-salt reserves | $77 billion CAPEX for 2025-2029; Target 3.2 million boe/d by 2029 |

| Refining, Transportation & Marketing | Premium fuels, efficiency | Reftop Program for refining infrastructure optimization |

| Gas & Energy Trade | Natural gas, electricity | Rota 3 gas pipeline to boost capacity |

| Low-Carbon Initiatives | Renewables, decarbonization | $16.3 billion for low-carbon projects (2025-2029); Green hydrogen exploration |

| Research & Development | Innovation, efficiency | R$ 3.6 billion invested in 2023; CO2 capture and storage technologies |

Full Document Unlocks After Purchase

Business Model Canvas

The Petrobras Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This comprehensive analysis, detailing Petrobras's strategic framework, is not a sample but a direct representation of the final deliverable. You'll gain immediate access to this complete, ready-to-use document, allowing you to fully understand and leverage Petrobras's business model.

Resources

Petrobras's most critical resource is its extensive proven and probable oil and natural gas reserves, especially within Brazil's pre-salt offshore regions. These reserves are the bedrock of its exploration and production operations, providing a substantial competitive edge due to their high quality and comparatively lower emissions intensity.

In 2024, Petrobras continued to highlight its significant reserve base. The company's strategic direction is firmly centered on maximizing the value and output from these substantial hydrocarbon assets, ensuring long-term production capabilities and financial strength.

Petrobras's key resources include its advanced technology and extensive infrastructure, particularly for deepwater and ultra-deepwater operations. This encompasses a significant fleet of Floating Production Storage and Offloading (FPSO) vessels, sophisticated subsea systems, and specialized drilling equipment, enabling efficient hydrocarbon extraction in challenging environments.

The company continues to invest in upgrading its technological capabilities, with ongoing efforts to deploy new, more modern, and efficient platforms. For instance, in 2024, Petrobras continued its strategic investments in pre-salt exploration and production, a testament to its commitment to leveraging advanced technology.

Petrobras's skilled workforce, encompassing geologists, engineers, and researchers, is a cornerstone of its operations. This expertise is vital for navigating the complexities of oil and gas exploration, production, and refining, as well as for advancing low-carbon initiatives.

In 2023, Petrobras invested R$3.8 billion in training and development, underscoring its commitment to maintaining a high level of technical proficiency across its diverse operations. This focus on human capital directly supports the company's ability to innovate and execute its strategic objectives.

Refining and Processing Facilities

Petrobras operates an extensive network of refineries and natural gas processing plants, crucial for converting raw hydrocarbons into valuable marketable products. This integrated infrastructure ensures a consistent supply of fuels, lubricants, and petrochemical feedstocks to both domestic and international customers. In 2024, Petrobras continued its strategic investments in upgrading and expanding these facilities, aiming to boost processing capacity and enhance the quality of its refined products, aligning with evolving market demands and environmental standards.

These refining and processing facilities represent a core physical asset for Petrobras, enabling the company to capture value across the entire oil and gas chain. The modernization efforts are focused on improving energy efficiency and reducing the environmental footprint of operations. For instance, investments are directed towards advanced refining technologies that can process heavier crude oils and produce cleaner fuels, such as ultra-low sulfur diesel.

- Integrated Operations: Petrobras’s refineries and processing plants are strategically located and interconnected, optimizing logistics and operational synergies.

- Product Diversification: These facilities produce a wide array of products, including gasoline, diesel, jet fuel, LPG, lubricants, and various petrochemicals.

- Capacity and Efficiency: Ongoing investments in 2024 aim to increase the overall processing capacity and improve the energy efficiency of the company's refining assets.

- Market Responsiveness: The company’s ability to adapt its processing capabilities allows it to respond effectively to shifts in demand for different fuel types and petrochemical products.

Strong Brand and Market Presence

Petrobras leverages its robust brand and significant market presence in Brazil, a key resource within its business model. This allows it to command a substantial share in the distribution of oil products, natural gas, and biofuels across the nation.

The company's established history and integrated operational structure foster deep trust and recognition among both individual consumers and large industrial clients. This strong brand equity directly translates into customer loyalty and a competitive advantage.

- Dominant Market Share: Petrobras holds a commanding position in Brazil's energy market, particularly in refined products and natural gas distribution.

- Brand Recognition: Its long-standing presence and consistent operations have cultivated widespread brand awareness and trust.

- Integrated Operations: From exploration to distribution, Petrobras's integrated model reinforces its market strength and reliability.

- Customer Loyalty: The combination of brand strength and reliable supply fosters significant customer loyalty across all segments.

Petrobras's intellectual property, including patents and proprietary technologies for deepwater exploration and production, is a critical resource. This expertise allows the company to operate efficiently in challenging environments, maintaining a technological lead.

In 2024, Petrobras continued to emphasize its commitment to technological innovation, particularly in areas like carbon capture and storage, and advanced seismic imaging techniques. This focus on R&D ensures its ability to adapt to future energy demands and environmental regulations.

Financial resources, including access to capital markets and strong credit ratings, are fundamental to Petrobras's ability to fund its extensive exploration, development, and production projects. This financial strength underpins its long-term strategic planning and investment capacity.

In the first quarter of 2024, Petrobras reported a net income of R$23.7 billion, demonstrating its robust financial performance and capacity for continued investment in its operations and strategic initiatives.

| Key Resource | Description | 2024 Relevance |

|---|---|---|

| Intellectual Property | Patents and proprietary technologies for deepwater exploration and production. | Enables efficient operations and technological leadership. |

| Financial Resources | Access to capital markets and strong credit ratings. | Funds extensive exploration, development, and production projects. |

| Brand and Market Presence | Dominant market share and established brand recognition in Brazil. | Drives customer loyalty and competitive advantage in product distribution. |

Value Propositions

Petrobras provides a dependable and connected flow of crucial energy items, spanning crude oil, natural gas, and refined fuels like gasoline and diesel. This integrated approach also extends to biofuels and electricity, catering to a broad spectrum of energy needs.

The company's control over its entire operational cycle, from initial exploration to final distribution, guarantees steady product availability. This robust system helps satisfy a substantial portion of Brazil's energy requirements.

Demonstrating this reliability, Petrobras maintained impressive production figures in 2024, reaching approximately 2.6 million barrels of oil daily, a testament to its capacity to meet demand consistently.

Petrobras is dedicated to delivering superior energy products while actively working to lower its environmental impact. This commitment is evident in their production of higher-quality oil from pre-salt reserves, which inherently generate fewer greenhouse gas emissions.

The company is also expanding its portfolio of more sustainable offerings. Examples include S10 Diesel, marine fuels with reduced sulfur content, and gasoline formulated for a carbon-neutral profile. These initiatives reflect a strategic shift towards cleaner energy solutions.

Petrobras's investments in biorefining technologies and other low-carbon projects directly bolster this value proposition. For instance, by 2023, Petrobras had already advanced its biorefining capabilities, aiming to integrate renewable feedstocks into fuel production to further reduce the carbon intensity of its products.

Petrobras's commitment to technological innovation is central to its deepwater and pre-salt operations, enabling efficient and responsible resource extraction. In 2024, the company continued to advance its pioneering solutions, such as CO2 separation and reinjection, which are crucial for reducing environmental impact.

The development of all-electric platforms and advanced enhanced oil recovery (EOR) techniques further bolsters operational efficiency. These innovations directly contribute to Petrobras's ability to maximize production while adhering to stringent environmental standards, a key value proposition in today's energy landscape.

Contribution to Brazilian Socio-Economic Development

Petrobras's role as a major state-controlled entity significantly bolsters Brazil's socio-economic landscape. Its substantial investments directly fuel national development.

The company is projected to create approximately 315,000 jobs over the next five years, a testament to its impact on employment. Furthermore, Petrobras is a major contributor to government coffers through taxes and royalties, underpinning public services and infrastructure.

- Job Creation: Estimated 315,000 jobs over the next five years.

- Fiscal Contribution: Significant revenue generation through taxes and royalties.

- Economic Multiplier: Investments stimulate broader economic activity and development.

Commitment to Sustainability and Responsible Practices

Petrobras deeply integrates sustainability, safety, and environmental stewardship into its core operations. This commitment is evident in their ambitious goal to achieve net-zero emissions by 2050, a significant undertaking for an energy company. They are also actively investing in biodiversity conservation initiatives, demonstrating a broader environmental focus.

The company's latest Sustainability Reports, which are readily available, provide a comprehensive overview of their Environmental, Social, and Governance (ESG) practices. These reports highlight their strategic efforts to balance their traditional oil and gas operations with a growing diversification into lower-carbon business ventures, reflecting a forward-looking approach to energy transition.

- Net-Zero Target: Aiming for net-zero greenhouse gas emissions by 2050.

- Biodiversity Investment: Allocating resources towards the conservation of biodiversity.

- ESG Reporting: Detailed disclosure of Environmental, Social, and Governance practices.

- Low-Carbon Diversification: Strategic investments in businesses with reduced carbon footprints.

Petrobras offers a reliable supply of essential energy products, from crude oil and natural gas to gasoline and diesel, alongside biofuels and electricity. This comprehensive energy provision ensures consistent availability, meeting a substantial portion of Brazil's energy demands. In 2024, Petrobras maintained robust production, averaging around 2.6 million barrels of oil daily, underscoring its capacity to meet market needs.

Customer Relationships

Petrobras cultivates deep connections with its major industrial clients, distributors, and international purchasers through specialized sales teams and dedicated account managers. This approach is designed to nurture enduring partnerships.

These relationships are solidified by ensuring a reliable supply of products, tailoring offerings to meet specific client requirements, and providing robust technical assistance. For instance, in 2024, Petrobras continued its focus on strengthening these ties, aiming for enhanced client retention and satisfaction across its diverse customer base.

Direct interaction allows Petrobras to gain a nuanced understanding of each client's unique needs and the ever-changing market landscapes they operate within. This proactive engagement is crucial for adapting its strategies and product development.

Petrobras is enhancing customer engagement through its digital platforms, offering robust self-service options. These online portals allow customers to easily place orders, track shipments, and access detailed product specifications, streamlining interactions and improving overall convenience.

In 2024, Petrobras continued to invest in its digital infrastructure, aiming to provide a more seamless experience for its diverse customer base. This focus on digital transformation is designed to boost efficiency and customer satisfaction across all segments, from individual consumers to large industrial clients.

Petrobras offers extensive technical support and advisory services, particularly vital for sophisticated offerings like specialized fuels and lubricants, and for its strategic joint venture partners. This expertise covers optimal product application, performance enhancement, and stringent safety protocols, fostering deeper engagement and ensuring clients maximize the value derived from Petrobras's solutions.

Public Relations and Corporate Communications

Petrobras prioritizes robust public relations and transparent corporate communications to foster trust with its diverse stakeholders. This commitment is crucial due to its status as a publicly owned entity with substantial societal influence.

The company regularly disseminates information regarding its financial performance, sustainability efforts, and strategic direction. This includes detailed annual and sustainability reports, which serve as primary channels for engaging with investors, media, and the general public.

- Financial Transparency: Petrobras aims to provide clear and accessible financial reporting, ensuring stakeholders have a comprehensive understanding of its economic health and operational results.

- Sustainability Reporting: The company actively communicates its progress and commitments in environmental, social, and governance (ESG) areas, highlighting its dedication to sustainable practices. For instance, in 2023, Petrobras reported a reduction in its Scope 1 and 2 greenhouse gas emissions intensity compared to 2022.

- Strategic Communications: Regular updates on strategic plans, such as investments in new energy sources and operational efficiency improvements, are shared to maintain stakeholder alignment and confidence.

Community Engagement and Social Programs

Petrobras actively engages with local communities through a variety of social programs and initiatives. These efforts are designed to address socio-environmental impacts and foster positive relationships, thereby strengthening the company's social license to operate.

These programs often concentrate on key areas crucial for sustainable development, including education, environmental protection, and the promotion of sustainable economic activities. For instance, in 2023, Petrobras invested R$ 1.1 billion in social, environmental, and governance (ESG) initiatives, demonstrating a tangible commitment to these principles.

- Community Investment: Petrobras's social programs aim to create shared value, contributing to the well-being of communities where it operates.

- Socio-Environmental Focus: Initiatives prioritize education, environmental conservation, and economic development to mitigate impacts and foster growth.

- Strengthening Social License: By addressing community needs and environmental concerns, Petrobras builds trust and maintains its operational legitimacy.

- 2023 ESG Investment: The company's significant investment in ESG in 2023 underscores its dedication to these community-focused relationships.

Petrobras maintains strong ties with key industrial clients and distributors through dedicated sales teams and account managers, ensuring reliable supply and tailored solutions. In 2024, the company continued to enhance these relationships, focusing on client retention and satisfaction.

Digital platforms offer customers self-service options for orders and tracking, streamlining interactions. Petrobras's 2024 digital investments aim for a more seamless customer experience, boosting efficiency and satisfaction across all segments.

Extensive technical support is provided for specialized products and partners, enhancing product application and safety. Petrobras also prioritizes public relations and transparent communication, including detailed financial and sustainability reports, to build trust.

Community engagement through social programs in education and environmental protection strengthens Petrobras's social license to operate. In 2023, the company invested R$ 1.1 billion in ESG initiatives, demonstrating a commitment to these principles.

Channels

Petrobras leverages its vast pipeline network to transport crude oil, natural gas, and refined products efficiently across Brazil, connecting production sites to refineries and distribution points. This vital infrastructure underpins the cost-effective and continuous flow of hydrocarbons.

In 2024, Petrobras continued to invest in expanding this critical channel. The Rota 3 project, for instance, is a significant development aimed at increasing natural gas transportation capacity, further strengthening the company's logistical capabilities and market reach.

Petrobras' refineries and natural gas processing plants are crucial channels, transforming crude oil and natural gas into a wide array of marketable products like gasoline, diesel, and petrochemicals. These facilities are the backbone of the company's value chain, ensuring the efficient conversion of raw resources.

These processing hubs also act as vital distribution points, supplying refined fuels and natural gas to domestic and international markets. In 2024, Petrobras continued its focus on optimizing these operations, aiming to boost production and enhance overall efficiency to meet growing energy demands.

Petrobras manages an extensive network of terminals and storage facilities throughout Brazil. This infrastructure is crucial for the effective storage and distribution of crude oil, natural gas, and refined products, ensuring a steady supply chain.

These strategically located facilities are vital for reaching diverse markets, both domestically and internationally. They provide the logistical flexibility needed to meet demand and manage inventory efficiently.

As of the first quarter of 2024, Petrobras reported a total oil and gas production of approximately 2.8 million barrels of oil equivalent per day, underscoring the scale of operations supported by its storage and terminal network.

Distribution Subsidiaries and Partnerships

Petrobras leverages its own distribution subsidiaries, such as Petrobras Distribuidora (BR), to manage a significant portion of its refined product sales. This integrated approach allows for direct control over the supply chain and customer relationships, ensuring consistent product quality and service delivery across its extensive network.

Beyond its captive network, Petrobras also relies on a broad array of third-party distributors and retailers. This strategy is crucial for achieving widespread market penetration, reaching diverse customer segments from large industrial clients to individual consumers at the pump. In 2024, BR alone served over 11,000 service stations and a vast industrial client base.

- Own Subsidiaries: Petrobras Distribuidora (BR) is a primary channel, managing a substantial part of the refined product distribution.

- Third-Party Network: A wide range of independent distributors and retailers ensures broad market reach.

- Customer Segments: Distribution caters to industrial, commercial, and individual consumer markets.

- Market Penetration: The multi-tiered system facilitates deep penetration across Brazil's diverse economic landscape.

International Sales and Export Operations

Petrobras actively engages in international sales and export operations, primarily for its crude oil and select refined products. This strategic channel allows the company to reach a global customer base, including major international refiners and trading houses. In 2024, Petrobras continued to be a significant exporter, with its international sales forming a crucial component of its overall revenue generation, underscoring its role as a key player in the global energy market.

Leveraging its extensive production capacity and access to critical shipping lanes, Petrobras' export strategy is designed to maximize market reach and profitability. The company's global presence facilitates direct engagement with international buyers, ensuring efficient distribution of its products. This outward-looking approach is vital for managing supply and demand dynamics and capitalizing on international market opportunities.

The contribution of international sales to Petrobras' financial performance is substantial. For instance, in the first quarter of 2024, Petrobras reported significant export volumes, contributing to its robust financial results. These operations are supported by a sophisticated logistics network and a deep understanding of international trade regulations and market trends.

- Global Reach: Direct sales to international refiners and traders.

- Revenue Contribution: Exports are a significant driver of Petrobras' overall revenue.

- Market Access: Leveraging global shipping routes for efficient product distribution.

- 2024 Performance: Continued strong export volumes contributing to financial results.

Petrobras utilizes its extensive pipeline network, refineries, terminals, and storage facilities as core channels for product movement and transformation. These physical assets are complemented by its distribution subsidiary, BR, and a broad network of third-party distributors, ensuring wide market access. International sales represent another key channel, allowing Petrobras to engage with global markets and diversify its revenue streams.

In 2024, Petrobras continued to invest in its infrastructure, notably through projects like Rota 3 to enhance natural gas transport. The company's production of approximately 2.8 million barrels of oil equivalent per day in Q1 2024 highlights the scale of operations managed through these channels.

| Channel Type | Key Components | 2024 Focus/Data |

| Infrastructure | Pipelines, Refineries, Terminals, Storage | Rota 3 expansion for gas capacity; Q1 2024 production ~2.8 million boe/day |

| Domestic Distribution | BR (own subsidiary), Third-party distributors | BR served >11,000 stations and industrial clients in 2024 |

| International Sales | Direct exports of crude oil and refined products | Significant export volumes in Q1 2024 contributing to revenue |

Customer Segments

Downstream companies, including other refineries and petrochemical producers, rely on Petrobras for essential feedstocks like crude oil and naphtha. In 2024, Petrobras continued to be a significant supplier to these sectors, facilitating their production of fuels and chemical derivatives.

Large industrial clients, such as power generation facilities and manufacturing plants, are also key customers, purchasing natural gas and refined products for their operational energy needs. Petrobras's commitment to reliable, high-volume supply in 2024 ensured these clients could maintain consistent operations.

Petrobras's fuel distributors and retailers form a critical customer segment, encompassing a vast network of branded and unbranded service stations throughout Brazil. This segment directly serves the nation's extensive consumer base reliant on transportation fuels like gasoline and diesel.

In 2024, Petrobras continued to be a dominant supplier, with its fuels powering a significant portion of Brazil's estimated 50 million vehicles. The company's strategy involves maintaining strong relationships with these downstream partners, ensuring consistent product availability and supporting their retail operations.

Electricity generation companies represent a crucial customer segment for Petrobras, primarily relying on its natural gas and, at times, fuel oil. These fuels serve as essential feedstock for thermal power plants, powering a significant portion of the grid.

As Petrobras strategically broadens its natural gas and broader energy offerings, the importance of this customer base is set to grow. For instance, in 2024, Petrobras continued to be a major supplier of natural gas to Brazil's thermal power sector, a vital component in ensuring energy security and meeting peak demand.

International Oil and Gas Buyers

Petrobras serves a crucial role in the global energy landscape by exporting crude oil and a select range of refined products. This segment is comprised of major international refiners who require consistent crude oil supplies for their operations, as well as sophisticated trading houses that manage the global flow of energy commodities. Other energy companies, looking to secure feedstock or diversify their supply chains, also form a significant part of this buyer base.

In 2024, Petrobras continued to be a significant supplier of crude oil to international markets. For instance, the company's pre-salt production, a key export driver, remained robust. In the first quarter of 2024, Petrobras' total oil and gas production reached an average of 2.8 million barrels of oil equivalent per day (boed), with a substantial portion designated for export.

- Global Refiners: Companies operating large-scale refineries that process crude oil into gasoline, diesel, jet fuel, and other petroleum products.

- Trading Houses: Intermediaries that buy, sell, and transport oil and gas globally, managing price risks and logistics.

- Energy Companies: Other oil and gas producers or distributors that may purchase Petrobras' crude for their own refining or to meet contractual obligations.

- Market Focus: Key export destinations historically include North America, Europe, and Asia, reflecting the global demand for Brazil's high-quality crude.

Biofuel Consumers and Developers

Petrobras is increasingly engaging with biofuel consumers, such as the transportation sector seeking sustainable fuel alternatives and industrial clients looking to reduce their carbon footprint. This segment is crucial as demand for lower-emission fuels grows. For instance, Brazil's sugarcane ethanol production reached an estimated 35.7 billion liters in the 2023-2024 harvest season, highlighting a significant market for Petrobras's biofuel offerings.

Furthermore, companies actively involved in biofuel development, from feedstock cultivation to advanced processing technologies, are emerging as key partners and customers for Petrobras. These developers are vital for expanding the supply chain and innovation in biofuels like biodiesel and biomethane. Petrobras's strategy includes not only supplying these fuels but also collaborating on new production methods and market penetration strategies.

- Biofuel Consumers: Transportation sector (trucking, aviation), industrial users seeking to decarbonize operations.

- Biofuel Developers: Companies involved in ethanol, biodiesel, and biomethane production and technology.

- Market Growth: Brazil's ethanol production highlights the scale of the biofuel market.

- Strategic Importance: These segments are key to Petrobras's low-carbon transition and market expansion.

Petrobras's customer segments are diverse, ranging from large industrial entities to individual consumers via its extensive retail network. The company's reach extends globally, supplying crude oil to international refiners and trading houses. Domestically, it fuels Brazil's transportation sector and provides natural gas for power generation and industrial use.

The company's strategy in 2024 focused on maintaining robust supply chains for its core products while also expanding into emerging areas like biofuels. This dual approach ensures it meets the immediate energy demands of its established customer base while positioning itself for future market shifts.

Key customer segments include downstream companies, industrial clients, fuel distributors, electricity generators, and international buyers of crude oil and refined products. Additionally, Petrobras is actively engaging with the growing biofuel market, serving both consumers and developers in this sector.

In 2024, Petrobras's total oil and gas production averaged approximately 2.8 million barrels of oil equivalent per day, with a significant portion allocated to exports and domestic distribution. Brazil's ethanol production for the 2023-2024 season reached an estimated 35.7 billion liters, underscoring the scale of the biofuel market Petrobras is increasingly targeting.

| Customer Segment | Key Products/Services | 2024 Relevance/Data Point |

| Downstream Companies (Refineries, Petrochemicals) | Crude Oil, Naphtha | Essential feedstock supplier, facilitating fuel and chemical derivative production. |

| Industrial Clients (Power Generation, Manufacturing) | Natural Gas, Refined Products | Ensured consistent operational energy supply for large-scale users. |

| Fuel Distributors & Retailers | Gasoline, Diesel | Supplied fuels for a significant portion of Brazil's ~50 million vehicles. |

| Electricity Generation Companies | Natural Gas, Fuel Oil | Major supplier for thermal power plants, crucial for grid energy security. |

| Global Refiners & Trading Houses | Crude Oil, Refined Products | Robust pre-salt production contributed to significant exports; Q1 2024 production averaged 2.8 million boed. |

| Biofuel Consumers & Developers | Ethanol, Biodiesel, Biomethane | Targeting growth in lower-emission fuels; Brazil's ethanol production estimated at 35.7 billion liters (2023-2024). |

Cost Structure

Petrobras's cost structure heavily features exploration, development, and production (E&P) expenses. These include the significant outlays for drilling, completing wells, and maintaining offshore platform operations, reflecting the capital-intensive nature of the industry.

The company's 2024-2028 Strategic Plan underscores this commitment, earmarking a substantial US$ 73 billion specifically for E&P activities. This demonstrates a clear prioritization of expanding and optimizing its upstream operations.

While pre-salt ventures are a key profit driver, they also necessitate considerable upfront capital investment. This means that the initial stages of these projects represent a significant cost component within Petrobras's overall expense base.

Refining and processing costs are a significant part of Petrobras's expenses. These include the day-to-day operations of their refineries, keeping everything running smoothly, and the energy needed to transform crude oil and natural gas into usable products. For instance, in 2024, Petrobras continued its focus on optimizing refinery operations to improve efficiency and reduce costs.

Maintenance is another key expense, ensuring that these complex facilities operate safely and reliably. Petrobras allocates substantial resources to scheduled maintenance and unexpected repairs to prevent costly downtime. Capital expenditures are also a factor, as the company invests in modernizing its refineries and expanding processing capacity to meet market demands and improve product quality.

Petrobras' extensive network of pipelines, terminals, and transportation fleets represents a significant cost center. In 2023, the company reported R$ 33.6 billion in sales expenses, which includes transportation and logistics. Maintaining and operating this vast infrastructure, from offshore platforms to onshore distribution points, requires substantial capital and operational expenditure.

Efficiently managing these assets is paramount to controlling costs and ensuring product delivery. For instance, optimizing fleet utilization and pipeline maintenance schedules directly impacts the bottom line. Petrobras' commitment to modernizing its logistics infrastructure aims to reduce these expenses and improve overall operational efficiency, a key factor in its competitive strategy.

Personnel and Labor Costs

Petrobras, as a massive integrated energy company, carries significant personnel and labor costs. These expenses encompass salaries, comprehensive benefits packages, and ongoing training programs for its vast workforce. For instance, in 2023, Petrobras reported total personnel expenses of R$ 35.9 billion.

The company's unwavering dedication to maintaining stringent safety standards and ensuring the well-being of its employees also plays a role in these costs. This commitment translates into investments in specialized safety equipment, health programs, and rigorous training protocols.

- Salaries and Wages: The fundamental cost of employing its extensive workforce.

- Employee Benefits: Includes health insurance, retirement plans, and other social contributions.

- Training and Development: Essential for maintaining a skilled workforce, especially in a complex industry.

- Safety and Health Programs: Investments to ensure employee well-being and operational safety.

Environmental and Regulatory Compliance Costs

Petrobras faces substantial costs to meet environmental and regulatory mandates. These expenses cover implementing advanced emissions reduction technologies, robust waste management systems, and rigorous safety protocols across its operations.

A significant portion of these costs is allocated to decommissioning older platforms and infrastructure. For instance, Petrobras has set aside nearly US$8 billion specifically for green decommissioning projects in the Campos Basin, with a target completion by 2028.

- Environmental Management Systems: Investment in systems to monitor and manage environmental impact.

- Emissions Reduction Technologies: Capital expenditure on technologies to lower greenhouse gas and pollutant emissions.

- Waste Management and Disposal: Costs associated with the safe and compliant handling of operational waste.

- Decommissioning Liabilities: Funds reserved for the safe removal and disposal of retired offshore platforms and facilities.

Petrobras's cost structure is dominated by exploration, development, and production (E&P) expenses, including significant outlays for drilling and platform operations. The company's 2024-2028 Strategic Plan allocates US$ 73 billion to E&P, highlighting the capital-intensive nature of its upstream activities, particularly pre-salt ventures.

Refining, processing, and maintenance costs are also substantial, covering refinery operations, energy consumption, and upkeep of complex facilities. Petrobras's extensive logistics network, including pipelines and terminals, incurs significant operational and capital expenditures, with sales expenses in 2023, including transportation, totaling R$ 33.6 billion.

Personnel and labor costs, encompassing salaries, benefits, and training, represent another major expense, with total personnel expenses in 2023 amounting to R$ 35.9 billion. Additionally, environmental compliance and decommissioning liabilities are significant, with nearly US$8 billion earmarked for green decommissioning projects in the Campos Basin by 2028.

| Cost Category | Key Components | 2023 Figures (R$ billion) | 2024-2028 Strategic Plan (E&P) |

|---|---|---|---|

| Exploration, Development & Production (E&P) | Drilling, well completion, platform operations | N/A (Strategic Plan Focus) | US$ 73 billion |

| Refining & Processing | Refinery operations, energy, maintenance | N/A (Operational Focus) | N/A |

| Logistics & Transportation | Pipeline, terminal, fleet operation | 33.6 (Sales Expenses) | N/A |

| Personnel & Labor | Salaries, benefits, training | 35.9 | N/A |

| Environmental & Decommissioning | Emissions reduction, waste management, decommissioning | N/A (Specific Project Allocation) | US$ 8 billion (Campos Basin Decommissioning) |

Revenue Streams

Petrobras's most significant revenue source is the sale of crude oil. This encompasses both domestic sales within Brazil and exports to international markets, with a particular emphasis on the high-quality crude extracted from its prolific pre-salt reserves.

The financial performance of this stream is inherently tied to global oil price volatility. For instance, in 2024, Petrobras maintained an average daily oil production of approximately 2.6 million barrels, directly feeding into this crucial revenue generator.

Petrobras generates significant revenue from selling refined petroleum products like gasoline, diesel, jet fuel, and lubricants. These sales cater to a wide range of customers, from large distributors and industrial users to individual consumers at the pump.

This segment is a cornerstone of Petrobras's financial performance. For instance, in the first quarter of 2024, Petrobras reported a net income of R$23.7 billion, with its refining, marketing, and transportation segment being a major contributor to this profitability.

Petrobras generates significant revenue from selling natural gas to a diverse customer base, including industrial users, power plants, and distribution networks. This core revenue stream is bolstered by its expanding gas infrastructure and increasing integration of renewable energy sources.

In 2024, Petrobras continued to be a major supplier of natural gas in Brazil, with its gas sales contributing substantially to its overall financial performance. The company's strategic investments in gas infrastructure are designed to enhance delivery capabilities and unlock new market opportunities, thereby supporting future revenue growth from both gas and electricity sales.

Sales of Petrochemicals and Biofuels

Petrobras generates revenue not only from oil and gas but also from petrochemical products and biofuels. This diversification is a key part of its strategy to adapt to evolving energy markets.

The company is actively re-entering the fertilizer market, aiming to bolster this segment. Furthermore, Petrobras is committed to significantly increasing its biofuel production capacity, aligning with global energy transition trends and creating new income streams.

- Petrochemical Sales: Petrobras sells a range of petrochemical products derived from its refining operations, contributing to its overall revenue.

- Biofuel Expansion: The company is investing in expanding its biofuel production, particularly ethanol and biodiesel, to meet growing demand and sustainability targets. For instance, in 2024, Petrobras announced plans to increase its biofuel output significantly.

- Fertilizer Re-entry: Petrobras is strategically re-entering the fertilizer market, with initial investments focusing on key production facilities to capture market share and diversify revenue.

Joint Venture and Partnership Income

Petrobras generates revenue through its involvement in numerous joint ventures and strategic partnerships. This income stream encompasses its proportional share of profits from co-owned and operated projects, as well as dividends or service fees derived from equity investments in other companies. These collaborative efforts are instrumental in distributing project risks and amplifying Petrobras's overall revenue-generating capacity.

- Joint Venture Profits: Petrobras's share of profits from projects like the pre-salt exploration and production, where it partners with companies such as TotalEnergies and CNPC. For instance, in the fiscal year 2023, Petrobras reported significant operational results from its joint ventures, contributing positively to its overall financial performance.

- Partnership Dividends and Fees: Income received from equity stakes in entities like Braskem, where Petrobras holds a substantial ownership. These dividends, declared based on Braskem's profitability, represent a direct financial benefit to Petrobras.

- Risk Sharing and Enhanced Revenue: Collaborations allow Petrobras to access new technologies, markets, and capital, thereby reducing individual risk exposure and increasing the potential for larger revenue streams than it could achieve alone.

Petrobras's revenue streams are diverse, extending beyond crude oil sales to include refined products, natural gas, and petrochemicals. The company also actively pursues growth in biofuels and is re-entering the fertilizer market. Strategic joint ventures and partnerships further contribute to its income, sharing risks and amplifying revenue potential.

| Revenue Stream | Description | Key Data Point (2024 unless specified) |

| Crude Oil Sales | Domestic and international sales of crude oil, especially from pre-salt reserves. | Average daily production ~2.6 million barrels. |

| Refined Products | Sales of gasoline, diesel, jet fuel, lubricants, etc. | Q1 2024 net income R$23.7 billion, with refining a major contributor. |

| Natural Gas | Sales to industrial users, power plants, and distribution networks. | Continued major supplier in Brazil, supporting overall financial performance. |

| Petrochemicals & Biofuels | Sales of petrochemical products and expansion in ethanol/biodiesel. | Plans to significantly increase biofuel output in 2024. |

| Fertilizers | Re-entry into the fertilizer market with initial facility investments. | Focus on key production facilities to capture market share. |

| Joint Ventures | Share of profits and dividends from co-owned projects. | Significant operational results from joint ventures in FY 2023. |

Business Model Canvas Data Sources

The Petrobras Business Model Canvas is informed by extensive internal financial disclosures, comprehensive market research on global energy trends, and strategic analysis of operational performance. These data sources ensure each component of the canvas accurately reflects the company's current market position and strategic direction.