Petrobras Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Petrobras Bundle

Petrobras operates in a dynamic energy sector where the threat of new entrants is moderate due to high capital requirements, while the bargaining power of buyers, particularly large industrial consumers, can exert significant price pressure.

The complete report reveals the real forces shaping Petrobras’s industry—from supplier influence to substitute threats. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Petrobras's reliance on specialized equipment for deepwater and pre-salt operations, such as FPSOs and subsea technology, is a key factor. The limited number of global suppliers for these critical components, like TechnipFMC and Baker Hughes, means they hold considerable sway.

This concentration of suppliers, coupled with the substantial costs and complexities involved in switching providers, significantly enhances their bargaining power. For instance, the lead time for a new FPSO can extend to several years and involve investments in the hundreds of millions of dollars, making Petrobras hesitant to disrupt existing relationships.

The oil and gas sector, particularly for intricate offshore endeavors, demands a workforce possessing advanced skills and specialized technical knowledge. A shortage of this talent directly elevates the negotiation leverage of labor providers, such as engineers, geologists, and seasoned rig personnel.

Petrobras's ongoing pursuit of innovation and operational efficiency in demanding settings underscores the critical role of these human capital providers. For instance, in 2024, the global demand for experienced petroleum engineers remained robust, with projections indicating continued growth in specialized roles needed for deepwater exploration.

Suppliers offering regulatory and environmental compliance services wield significant influence over Petrobras. Brazil's robust legal framework for the oil and gas industry, encompassing environmental impact assessments and safety certifications, makes adherence non-negotiable. Failure to comply can result in hefty fines and operational shutdowns, underscoring Petrobras' reliance on these specialized firms.

In 2024, Petrobras continued to navigate a complex regulatory landscape. The company reported significant investments in environmental, social, and governance (ESG) initiatives, reflecting the increasing importance of compliance. For instance, their commitment to reducing greenhouse gas emissions and ensuring safe operational practices directly ties them to service providers who can validate and facilitate these efforts.

Logistics and Infrastructure Providers

Logistics and infrastructure providers hold significant bargaining power over Petrobras due to the company's vast operational footprint across the entire oil and gas value chain. This includes everything from deep-sea extraction platforms to complex refinery operations and extensive distribution networks.

The leverage of these suppliers is amplified when there's a limited availability of essential services. For instance, specialized vessels for transporting crude oil or refined products, and specific pipeline operators in certain geographic areas, can command higher prices or dictate terms, especially for time-critical or high-volume shipments.

- Limited specialized transport: Petrobras often relies on a concentrated pool of specialized shipping companies for its offshore and international crude oil and product movements.

- Port infrastructure dependency: Access to and efficient use of key port facilities, particularly those equipped for large-scale oil and gas handling, can be concentrated among a few providers, granting them leverage.

- Pipeline network access: In regions where Petrobras's operations are integrated with existing pipeline infrastructure, the operators of these networks can exert influence over transportation costs and availability.

Raw Material and Chemical Suppliers for Refining

While crude oil is Petrobras's main input, its refining operations depend on a range of chemicals and catalysts. The influence of these suppliers hinges on how unique and readily available their offerings are. For highly specialized or proprietary chemicals, supplier power can be significant, as finding suitable replacements might affect how efficiently Petrobras refines products or the final quality.

- Supplier Dependence: Petrobras's refining segment requires specific chemicals and catalysts, making it reliant on specialized suppliers.

- Product Uniqueness: The bargaining power of these suppliers is amplified when their products are unique or proprietary, with few viable alternatives.

- Switching Costs: High switching costs, due to potential impacts on refining efficiency or product quality, further strengthen supplier leverage.

- Market Dynamics: In 2024, the global chemical supply chain experienced fluctuations due to geopolitical events and increased demand, potentially increasing the bargaining power of key chemical providers to Petrobras.

Suppliers of specialized equipment, such as FPSOs and subsea technology, hold significant bargaining power over Petrobras due to the limited number of global providers like TechnipFMC and Baker Hughes. The substantial costs and long lead times, potentially years and hundreds of millions of dollars for new FPSOs, make switching providers difficult for Petrobras.

The demand for skilled labor in complex offshore operations also empowers suppliers of human capital. In 2024, the robust global demand for experienced petroleum engineers and specialized rig personnel continued, giving these providers strong negotiation leverage.

Providers of regulatory and environmental compliance services also wield considerable influence. Petrobras's 2024 investments in ESG initiatives and adherence to Brazil's stringent legal framework highlight its dependence on these firms for operational continuity and avoiding penalties.

Logistics and infrastructure providers, especially those offering specialized transport for crude oil and access to key port facilities, can command higher prices. This leverage is particularly pronounced when there's limited availability of essential services, impacting Petrobras's extensive value chain.

The bargaining power of chemical and catalyst suppliers is amplified by product uniqueness and high switching costs in Petrobras's refining operations. Market dynamics in 2024, including supply chain fluctuations, further strengthened the position of key chemical providers.

What is included in the product

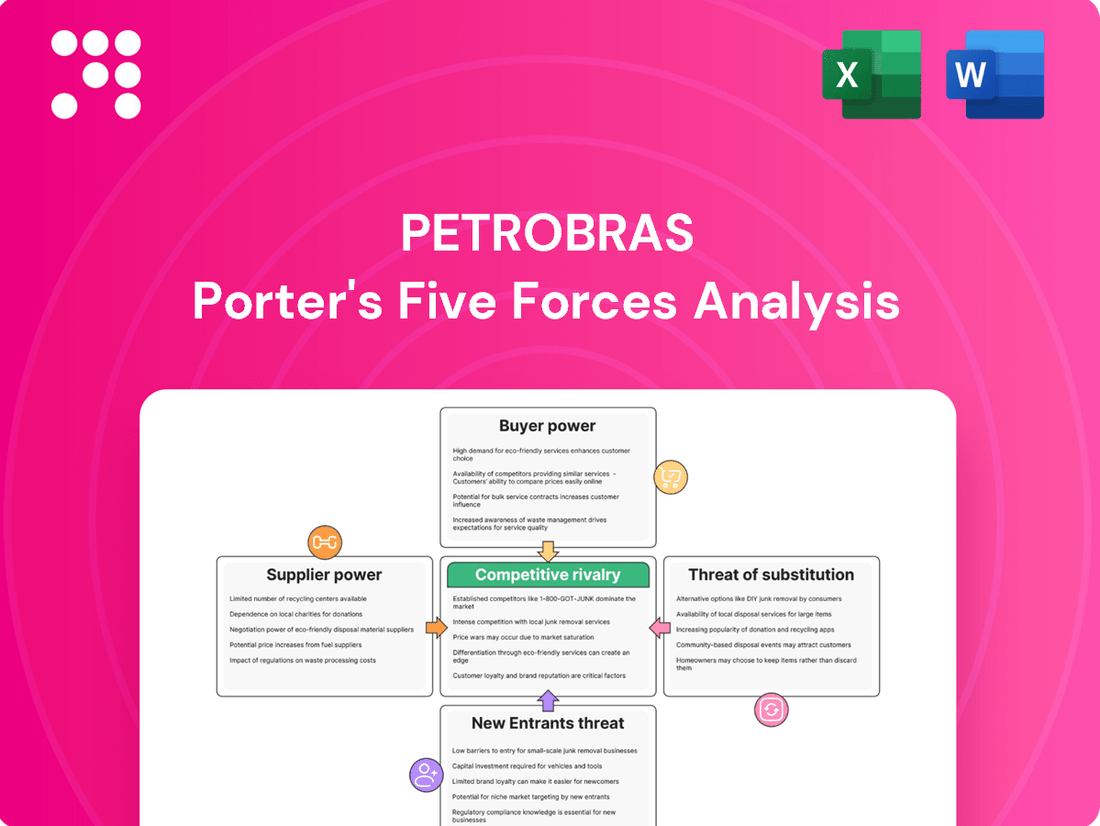

This Porter's Five Forces analysis for Petrobras dissects the competitive intensity within the oil and gas industry, examining buyer and supplier power, the threat of new entrants and substitutes, and the rivalry among existing players.

Instantly visualize Petrobras' competitive landscape with a dynamic five forces model, simplifying complex industry pressures for strategic clarity.

Customers Bargaining Power

Petrobras's significant control over Brazil's domestic energy market, encompassing exploration, production, refining, and distribution, inherently reduces the bargaining power of individual customers. With a substantial market share, especially in essential fuels like gasoline and diesel, Petrobras can dictate terms to a degree.

However, the Brazilian government's direct involvement in setting fuel prices introduces an indirect form of customer power. This governmental intervention, aimed at managing inflation and ensuring affordability for the broader population, can limit Petrobras's pricing flexibility, thereby influencing the effective bargaining power of the collective customer base.

Petrobras's strength lies in its broad customer reach, encompassing industrial, commercial, transportation, and residential sectors. This wide distribution means no single customer segment or buyer holds significant sway over the company's pricing or terms.

In 2023, Petrobras reported revenue from diverse segments, with refined products and biofuels accounting for a substantial portion, alongside oil and gas production. This spread across different end-markets dilutes the power of any one customer group, as their individual impact on overall revenue is limited.

The commodity nature of oil and gas means customers can easily switch suppliers if prices aren't competitive. Even with Petrobras's strong domestic position, global benchmarks for crude oil and refined products significantly impact local pricing, giving large buyers leverage, especially if they can explore import options.

Governmental Influence on Pricing and Supply

The Brazilian government, as Petrobras's majority shareholder, wields considerable influence over the company's pricing strategies for crucial commodities like fuel and natural gas. This governmental control becomes particularly pronounced during times of economic instability or elevated inflation.

Political interventions, often enacted to maintain social and economic equilibrium, can restrict Petrobras's autonomy in adjusting prices. Consequently, this indirectly bolsters the bargaining power of end consumers by shielding them from immediate price fluctuations, even though the direct interaction is with government policy rather than Petrobras itself.

- Government as Majority Shareholder: The Brazilian federal government holds approximately 50% of Petrobras's voting shares, giving it significant control over strategic decisions, including pricing.

- Price Interventions in 2024: In early 2024, Petrobras faced pressure to delay fuel price adjustments amidst concerns over inflation, demonstrating the ongoing government influence.

- Impact on Consumer Prices: While direct consumer bargaining is limited, government policies that cap or delay price increases effectively serve to manage consumer costs, thereby enhancing their indirect bargaining power.

Growing Demand for Low-Carbon Products

The increasing global and domestic focus on climate change is fueling a significant demand for low-carbon alternatives. This shift means that certain customer groups, particularly those prioritizing sustainability, are gaining leverage. For instance, by 2024, the demand for sustainable aviation fuel (SAF) is projected to reach 7.7 billion liters globally, highlighting a tangible market shift.

Petrobras is actively responding to this trend by investing in areas like biofuels, SAF, and renewable diesel. These initiatives are designed to meet the evolving preferences of environmentally conscious consumers. In 2023, Petrobras announced plans to invest approximately $1.5 billion in renewable energy projects through 2027, demonstrating a commitment to this growing market segment.

- Growing customer preference for sustainable options

- Petrobras's strategic investments in low-carbon fuels

- Potential for increased customer bargaining power driving energy transition

While individual customers have limited direct bargaining power due to Petrobras's dominant market position, the Brazilian government's role as majority shareholder significantly influences pricing, effectively acting on behalf of consumers. Government interventions in 2024 to manage inflation by delaying fuel price adjustments demonstrate this indirect power, benefiting the collective customer base by stabilizing costs.

The growing demand for sustainable energy alternatives is also a factor, empowering environmentally conscious consumers. As Petrobras invests in low-carbon fuels, such as biofuels, to meet this evolving preference, customers prioritizing these options gain leverage, potentially influencing future product development and pricing strategies.

| Factor | Impact on Customer Bargaining Power | Evidence/Data (as of July 2025, referencing 2024 data) |

|---|---|---|

| Government Majority Shareholding | Indirectly High | Brazilian Federal Government holds ~50% voting shares. Pressure in early 2024 to delay fuel price hikes due to inflation concerns. |

| Commodity Nature of Oil & Gas | Moderate | Global benchmarks influence local pricing. Large buyers may explore import options if prices are uncompetitive. |

| Demand for Sustainable Alternatives | Increasing | Global SAF demand projected to reach 7.7 billion liters by 2024. Petrobras investing ~$1.5 billion in renewables (2023-2027). |

What You See Is What You Get

Petrobras Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis of Petrobras, detailing the competitive landscape and strategic positioning of this major energy company. You're looking at the actual document; once your purchase is complete, you’ll gain instant access to this exact, fully formatted analysis, ready for immediate use.

Rivalry Among Competitors

While Petrobras is a giant in Brazil's oil and gas sector, the landscape is increasingly populated by international oil companies (IOCs). These global players, bringing cutting-edge technology and deep pockets, are actively vying for opportunities, especially in the lucrative pre-salt discoveries. For instance, in the 17th Bid Round in 2021, several IOCs secured significant exploration blocks, directly challenging Petrobras's traditional dominance in these high-potential areas.

Petrobras navigates a competitive downstream market where other fuel distributors and importers vie for market share. Despite its substantial refining capacity, which provides a distinct edge, the company encounters rivalry from private entities. This competition manifests in pricing strategies, the quality of customer service, and the reach of distribution networks for products like gasoline, diesel, and LPG.

In 2023, Brazil's gasoline consumption reached approximately 45 billion liters, with Petrobras historically holding a significant portion of this market. However, the increasing presence of private distributors, who accounted for around 30% of fuel sales by the end of 2023, intensifies this rivalry. This dynamic compels Petrobras to continuously enhance its operational efficiency and customer engagement within its commercialization segment to maintain its leading position.

The Brazilian government's policies heavily shape Petrobras's competitive environment. Market liberalization efforts, such as auction rounds for exploration blocks, directly invite new players, increasing rivalry. For instance, in 2023, Brazil held its 18th Bid Round, offering exploration blocks and attracting significant interest from both domestic and international companies, thereby intensifying competition for future production.

Regulatory oversight, including environmental and safety standards, also impacts operational costs and strategic decisions for all companies in the sector, including Petrobras. Changes in these regulations can alter the cost structure and competitive advantages of existing and potential new entrants, influencing the intensity of rivalry. The National Agency of Petroleum, Natural Gas and Biofuels (ANP) continuously updates these frameworks, affecting how companies operate and compete.

Energy Transition and Diversification

The global push towards an energy transition significantly heightens competitive rivalry for Petrobras. This isn't just about traditional oil and gas players anymore; it includes companies aggressively investing in renewable energy and low-carbon technologies. Petrobras's own diversification efforts into areas like biofuels, wind, and solar directly place it in competition with both established energy giants and newer, more specialized renewable energy firms, both within Brazil and on the international stage.

This intensified competition from a broader energy market landscape compels Petrobras to continuously innovate and adapt its strategic planning. For instance, by 2024, many global oil majors were significantly increasing their renewable energy investments; BP, for example, aimed for a 20% reduction in oil production by 2030, reinvesting heavily in low-carbon energy. Petrobras's move into these sectors means it must contend with rivals who may have a head start or a more focused commitment to these growth areas.

- Increased Competition: Petrobras faces rivals from traditional oil and gas companies and those focused on renewables.

- Diversification Pressure: The company's own diversification into biofuels, wind, and solar creates direct competition with specialized players.

- Strategic Adaptation: The evolving energy market necessitates continuous innovation and strategic adjustments for Petrobras to remain competitive.

- Global Trends: By 2024, major energy companies were channeling substantial capital into renewable projects, setting a high bar for Petrobras's transition strategy.

Focus on Pre-Salt and Deepwater Production

Petrobras's competitive edge is deeply rooted in its mastery of pre-salt and deepwater exploration and production. These challenging environments are where the company has built significant expertise and secured vast, highly productive reserves. This focus is a key differentiator in the global oil market.

The pre-salt fields, in particular, offer a compelling advantage due to their substantial output and, notably, a lower carbon intensity compared to many other oil-producing regions. For instance, in 2023, Petrobras reported that its pre-salt production reached an average of 2 million barrels of oil per day, showcasing the sheer scale of its operations in these areas. This efficiency contributes to its strong standing in crude oil output.

- Pre-salt Production Growth: Petrobras's average daily production from pre-salt fields in the first quarter of 2024 was 2.04 million barrels of oil and 95.6 million cubic meters of natural gas.

- Cost Efficiency: The company's pre-salt operations often boast competitive production costs, with lifting costs in some pre-salt fields as low as $4 per barrel, significantly below global averages for deepwater production.

- Technological Investment: Maintaining this advantage requires continuous, substantial investment in advanced technologies and robust risk management strategies, given the inherent complexities and capital demands of deepwater operations.

Petrobras faces intense rivalry from both established international oil companies (IOCs) and emerging players in Brazil's energy sector. These competitors, armed with advanced technology and significant capital, are increasingly targeting lucrative exploration blocks, particularly in the pre-salt region. For example, in the 18th Bid Round held in 2023, numerous domestic and international firms actively bid for exploration rights, directly challenging Petrobras's historical dominance.

The downstream market also presents a competitive landscape, with private distributors gaining market share. By the close of 2023, these private entities commanded approximately 30% of Brazil's fuel sales, a figure that underscores the pressure on Petrobras to maintain its competitive edge through operational efficiency and customer service. This dynamic is evident in the gasoline market, where consumption reached about 45 billion liters in 2023.

Furthermore, the global energy transition is amplifying competition. Petrobras's strategic diversification into renewable energy sources like biofuels, wind, and solar places it in direct competition with specialized renewable energy firms and global energy giants that are rapidly increasing their low-carbon investments. By 2024, major oil companies were channeling substantial capital into renewables, with some aiming for significant reductions in oil production by 2030, setting a high bar for Petrobras's transition strategy.

| Rivalry Factor | Description | 2023/2024 Data Point |

| IOC Presence | International oil companies actively seeking Brazilian exploration blocks. | Multiple IOCs secured blocks in the 17th Bid Round (2021) and showed strong interest in the 18th Bid Round (2023). |

| Downstream Competition | Private distributors increasing market share in fuel sales. | Private distributors held ~30% of fuel sales by end of 2023. |

| Renewable Energy Competition | Competition from specialized renewable energy firms and diversified oil majors. | Major oil companies increasing renewable investments by 2024; BP targeting 20% oil production reduction by 2030. |

SSubstitutes Threaten

The growing emphasis on climate change and decarbonization worldwide presents a substantial long-term threat from renewable energy sources like solar, wind, and hydropower. As these technologies advance and become more economically viable, they directly challenge the demand for fossil fuels, impacting sectors such as electricity generation and transportation.

Brazil, with its considerable renewable energy potential, is a prime example. By the end of 2023, renewable sources accounted for over 85% of Brazil's electricity generation, demonstrating a clear market shift away from fossil fuels. This trend is expected to accelerate as renewable energy costs continue to decline, potentially reducing Petrobras's market share in its traditional energy segments.

Brazil's strong position in biofuel production, especially sugarcane ethanol, presents a significant threat of substitutes for traditional gasoline. In 2023, Brazil produced approximately 35.4 billion liters of ethanol, a key component in its fuel mix, directly competing with gasoline sales.

Petrobras is proactively addressing this by investing heavily in biorefining capabilities and the development of advanced biofuels such as sustainable aviation kerosene (SAF) and renewable diesel. This strategic move aims to not only counter the threat from existing biofuels but also to capture market share in the growing low-carbon fuel sector.

The increasing global adoption of electric vehicles (EVs) presents a significant long-term threat to Petrobras by reducing demand for refined petroleum products like gasoline and diesel. While Brazil's EV penetration is still developing, the worldwide shift towards electrification in transportation, fueled by government support and technological progress, could steadily diminish Petrobras's primary market share. For instance, by the end of 2023, global EV sales surpassed 13.6 million units, a substantial increase from previous years, indicating a growing trend that will eventually impact traditional fuel consumption.

Natural Gas as a Transition Fuel

The increasing adoption of natural gas as a transition fuel presents a nuanced threat to Petrobras. While Petrobras is a significant natural gas producer, this very role means it also faces competition from natural gas itself when it displaces oil in sectors like industrial processes and power generation. This shift away from oil, even for a cleaner fossil fuel, can limit oil demand.

Petrobras's strategic focus on expanding its natural gas infrastructure and supply is a direct response to this trend. The company aims to benefit from the growing demand for natural gas as countries seek to reduce carbon emissions. For example, in 2023, Brazil's natural gas consumption saw notable growth, driven by industrial demand and thermoelectric power generation, areas where natural gas directly competes with oil-based fuels.

- Natural Gas as a Substitute: Natural gas can substitute for oil in power plants and industrial furnaces, impacting demand for oil products.

- Petrobras's Strategy: Petrobras is investing in natural gas infrastructure and production to capitalize on its role as a transition fuel.

- Market Dynamics: The global push for decarbonization favors natural gas over oil in certain applications, creating a substitute threat.

Energy Efficiency and Conservation

Improvements in energy efficiency and conservation directly threaten Petrobras by reducing the demand for its core products. For instance, the increasing adoption of electric vehicles (EVs) is a prime example. By 2024, global EV sales are projected to surpass 15 million units, a significant increase from previous years, directly impacting gasoline and diesel consumption.

Furthermore, advancements in industrial processes and building technologies contribute to lower energy intensity. This means industries require less fuel to produce the same output, and buildings consume less energy for heating, cooling, and lighting. These shifts collectively diminish the market size for traditional oil and gas, impacting Petrobras's revenue streams.

- Reduced Demand: Greater fuel efficiency in transportation, from cars to commercial fleets, directly cuts into the volume of gasoline and diesel sold.

- Industrial Efficiency: Modernized industrial operations use less energy, lessening the need for petrochemical feedstocks and fuel.

- Building Standards: Stricter building codes promoting energy-efficient designs and materials decrease reliance on fossil fuels for heating and cooling.

- Technological Advancements: Innovations in areas like smart grids and energy storage further enable a transition away from fossil fuel dependency.

The threat of substitutes for Petrobras is substantial, driven by the global shift towards cleaner and more efficient energy sources. Renewable energy, particularly solar and wind, directly competes with fossil fuels in electricity generation. Brazil's own energy landscape, where renewables dominated over 85% of electricity in 2023, highlights this trend.

Biofuels, like sugarcane ethanol, also pose a direct challenge. Brazil's production of approximately 35.4 billion liters of ethanol in 2023 underscores its role as a significant substitute for gasoline. Furthermore, the accelerating adoption of electric vehicles (EVs), with global sales surpassing 13.6 million units by the end of 2023, is steadily eroding demand for refined petroleum products.

Energy efficiency measures and the increasing use of natural gas as a transition fuel further amplify this threat. Even as Petrobras invests in natural gas, its growth in power generation and industrial use can displace oil. By 2024, global EV sales are projected to exceed 15 million units, a clear indicator of the evolving energy consumption patterns that Petrobras must navigate.

| Substitute Type | Impact on Petrobras | Key Data Point (2023/2024 Projections) |

|---|---|---|

| Renewable Energy (Solar, Wind) | Reduces demand for fossil fuels in power generation. | Over 85% of Brazil's electricity from renewables in 2023. |

| Biofuels (Ethanol) | Directly competes with gasoline sales. | Brazil produced ~35.4 billion liters of ethanol in 2023. |

| Electric Vehicles (EVs) | Decreases demand for gasoline and diesel. | Global EV sales projected to exceed 15 million units in 2024. |

| Natural Gas | Displaces oil in power generation and industrial sectors. | Notable growth in Brazil's natural gas consumption in 2023. |

Entrants Threaten

The oil and gas sector, particularly Brazil's deepwater exploration and production, demands colossal capital outlays. Acquiring exploration rights, building essential infrastructure such as Floating Production Storage and Offloading units (FPSOs), and undertaking intricate drilling operations present substantial hurdles for newcomers.

Petrobras's substantial investment plans, often running into billions of dollars, underscore the extreme capital intensity of this industry. For instance, in its 2024-2028 Strategic Plan, Petrobras announced investments of approximately $102 billion, with a significant portion allocated to exploration and production, demonstrating the scale of financial commitment required.

Petrobras's deepwater and pre-salt exploration and production capabilities present a significant barrier to new entrants. These operations require highly specialized technology and extensive technical expertise, areas where Petrobras has cultivated nearly 50 years of experience. For instance, the company's success in the pre-salt fields, which hold an estimated 50 billion barrels of oil equivalent, is a testament to its advanced technological prowess.

New companies looking to enter this segment would need to invest heavily in acquiring or developing similar advanced capabilities. This is a time-consuming and costly endeavor, potentially requiring billions of dollars in capital expenditure and years of research and development. This high upfront investment and the need for specialized knowledge significantly limit the pool of potential competitors capable of challenging Petrobras in these lucrative but technically demanding areas.

Brazil's oil and gas sector, while more open than in the past, still presents significant hurdles for newcomers due to its regulatory framework. For instance, while Brazil has actively sought foreign investment, companies must still contend with intricate environmental licensing processes and specific local content mandates, which can increase operational costs and complexity. This environment, coupled with the significant influence of the state-controlled Petrobras, creates a challenging entry barrier for firms not deeply familiar with the Brazilian market's nuances.

Control over Existing Infrastructure

Petrobras benefits from its vast existing infrastructure, encompassing a comprehensive network of pipelines, refineries, and offshore platforms. This extensive asset base represents a significant barrier to entry for potential competitors. For instance, in 2023, Petrobras operated approximately 15,000 kilometers of oil and gas pipelines across Brazil, a critical component for efficient transportation and market reach.

The sheer scale and cost associated with replicating Petrobras's integrated logistics and production infrastructure make it extremely challenging for new entrants. Establishing comparable facilities would require billions of dollars in capital investment and years of development, effectively deterring many aspiring players from entering the Brazilian oil and gas market.

- Existing Infrastructure: Petrobras operates a massive network of pipelines, refineries, and offshore production facilities.

- High Capital Investment: Replicating this infrastructure would demand billions in capital, a major deterrent for new entrants.

- Logistical Advantage: The existing network provides Petrobras with superior control over transportation and distribution, ensuring market access.

- Market Access Barrier: New companies would struggle to match Petrobras's established supply chain and distribution channels.

Brand Recognition and Market Dominance

Petrobras's status as Brazil's national oil company grants it immense brand recognition and a deeply entrenched market position. This makes it exceptionally difficult for new companies to gain a foothold.

For any potential new entrant, the challenge extends beyond simply offering products or services. They would need to invest heavily in building comparable brand awareness and cultivating customer loyalty, a significant hurdle against an integrated energy giant like Petrobras.

The sheer scale and operational integration of Petrobras present another barrier. New entrants would struggle to match its comprehensive infrastructure and market influence, especially in a sector as capital-intensive as oil and gas.

- Brand Recognition: Petrobras is a household name in Brazil, synonymous with the nation's energy sector.

- Market Dominance: As the national oil company, it holds a significant share of the Brazilian energy market, making it difficult for newcomers to compete on scale.

- Integrated Operations: Petrobras operates across the entire energy value chain, from exploration and production to refining and distribution, creating a formidable integrated advantage.

The threat of new entrants into Brazil's oil and gas sector, particularly for Petrobras, is significantly mitigated by the industry's extreme capital intensity and the specialized technological expertise required. The immense cost of exploration, infrastructure development like FPSOs, and complex drilling operations, often requiring billions of dollars in investment as highlighted by Petrobras's 2024-2028 Strategic Plan of approximately $102 billion, creates a formidable financial barrier.

Petrobras's established deepwater and pre-salt capabilities, built over decades, represent a substantial technological advantage. New entrants would need to invest heavily in acquiring similar advanced technologies and expertise to compete effectively, a process that is both time-consuming and prohibitively expensive, especially when considering the estimated 50 billion barrels of oil equivalent in Brazil's pre-salt fields.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | Colossal outlays for exploration, infrastructure (e.g., FPSOs), and operations. Petrobras's 2024-2028 plan alone is ~$102 billion. | Extremely high; deters most potential entrants. |

| Technological Expertise | Specialized knowledge for deepwater and pre-salt operations, where Petrobras has ~50 years of experience. | Significant; requires substantial R&D and acquisition of advanced capabilities. |

| Existing Infrastructure | Vast network of pipelines (~15,000 km in 2023), refineries, and platforms. | High; replication is costly and time-consuming, hindering market access. |

| Brand Recognition & Market Dominance | Petrobras's status as national oil company provides deep market entrenchment. | High; new entrants struggle to build comparable brand loyalty and market share. |

Porter's Five Forces Analysis Data Sources

Our Petrobras Porter's Five Forces analysis is built upon a foundation of robust data, including Petrobras' official annual reports, regulatory filings with agencies like the CVM and SEC, and industry-specific market research from reputable firms.