Petrobras PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Petrobras Bundle

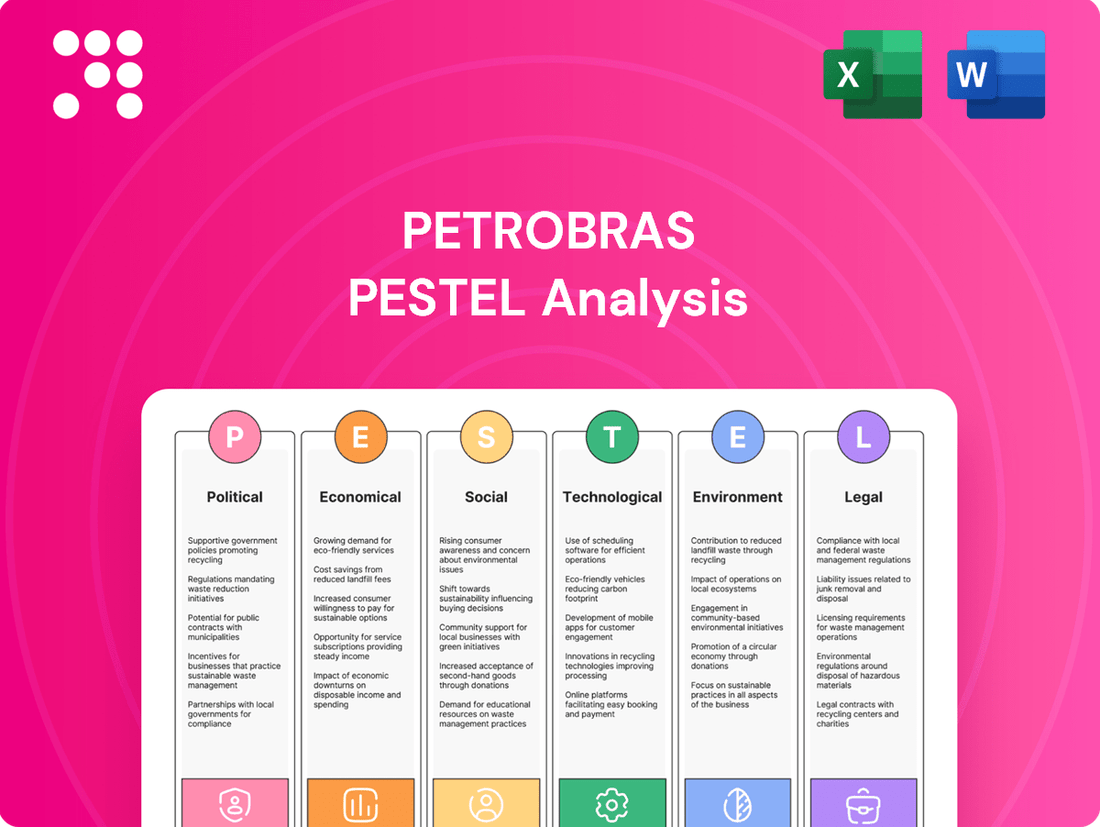

Navigating the complex global energy landscape requires a deep understanding of Petrobras's external environment. Our PESTLE analysis delves into the political, economic, social, technological, legal, and environmental factors that are profoundly shaping its trajectory. Gain a critical edge by understanding these forces and how they present both challenges and opportunities for the oil giant.

Unlock actionable intelligence with our comprehensive PESTLE Analysis of Petrobras. We've meticulously researched the external forces impacting its operations, from shifting government policies to emerging environmental regulations. Equip yourself with the insights needed to make informed strategic decisions and outperform the competition. Download the full version now and get the complete picture.

Political factors

As a state-controlled entity, Petrobras's strategic path is heavily shaped by Brazilian government policies and political priorities. For instance, shifts in presidential administrations can alter the company's focus, potentially moving from a push for domestic energy security to a greater emphasis on maximizing shareholder returns or investing in the energy transition. This government influence is a critical factor in understanding Petrobras's operational and investment decisions.

The stability of Brazil's regulatory environment is a critical factor for Petrobras. For instance, the Brazilian government's approach to local content rules, which mandate a certain percentage of goods and services be sourced domestically, directly influences project costs and operational efficiency. Changes in these requirements, as seen in past adjustments, can significantly alter the financial viability of new exploration and production ventures.

The shadow of Operation Car Wash continues to shape Petrobras, impacting its governance and how the public and investors view it. While the company has significantly upgraded its compliance efforts, the possibility of renewed investigations or increased public attention presents an ongoing political risk.

Despite implementing enhanced compliance and transparency measures, the market remains sensitive to any new allegations. For instance, in early 2024, Petrobras's stock experienced volatility following reports of potential irregularities in certain contracts, underscoring the persistent impact of past governance issues on investor sentiment.

National Energy Security Priorities

Brazil's government often sees Petrobras as a crucial tool for safeguarding national energy security. This perspective can translate into policies that favor domestic supply and stable energy prices, sometimes at the expense of purely profit-driven strategies or market-aligned decisions.

For instance, in 2024, the Brazilian government's influence on Petrobras's pricing policies remained a significant factor. While Petrobras aimed to align with international market trends, political considerations regarding fuel affordability for consumers often played a role in dividend distribution and investment decisions. This delicate balance aims to ensure energy availability while managing economic impacts.

- Prioritization of Domestic Supply: Government directives can push Petrobras to invest in projects that boost internal production, even if less profitable than international exploration.

- Price Stability Mandate: Political pressure can influence fuel pricing, potentially leading Petrobras to absorb some market volatility to protect consumers.

- Strategic Investment Direction: National energy security goals can steer Petrobras's capital allocation towards infrastructure that guarantees supply, such as refineries and pipelines, over potentially higher-return but less secure overseas ventures.

International Relations and Trade Policies

Brazil's foreign policy and its relationships with key oil players, like the United States and China, can significantly influence Petrobras. For instance, as of early 2024, Brazil's trade surplus with China reached US$11.9 billion in the first two months, highlighting the importance of these bilateral ties for economic stability, which in turn supports Petrobras's operational environment.

International trade agreements and geopolitical shifts directly impact global oil markets. Sanctions on major oil producers or trade disputes can lead to price volatility, affecting Petrobras's export revenues. For example, ongoing geopolitical tensions in the Middle East continue to create uncertainty in global oil supply, a factor Petrobras monitors closely.

- Global Oil Price Sensitivity: Petrobras's profitability is closely tied to international crude oil prices, which are heavily influenced by geopolitical events and trade policies.

- Export Market Access: Trade agreements and diplomatic relations determine Petrobras's access to key international markets for its oil and refined products.

- Supply Chain Disruptions: Geopolitical instability can disrupt global shipping routes and the supply of essential equipment and services for Petrobras's operations.

- Energy Transition Policies: International agreements on climate change and energy transition can shape the long-term demand for fossil fuels, impacting Petrobras's strategic planning.

The Brazilian government's direct influence on Petrobras is significant, impacting strategic decisions, pricing, and investment priorities. For instance, in 2024, the government's stance on fuel affordability influenced dividend payouts and capital allocation, balancing market dynamics with national economic concerns.

Political stability and regulatory frameworks are crucial. Changes in local content rules, a recurring theme in Brazilian policy, directly affect operational costs and project feasibility, as seen in past adjustments impacting exploration ventures.

Past governance issues, notably Operation Car Wash, continue to cast a shadow, influencing investor sentiment and requiring ongoing vigilance in compliance. Even in early 2024, reports of potential irregularities caused stock market volatility, highlighting persistent sensitivity.

| Political Factor | Impact on Petrobras | 2024/2025 Relevance |

|---|---|---|

| Government Control | Shapes strategic direction and investment priorities. | Continued government influence on pricing and dividend policy. |

| Regulatory Environment | Affects operational costs and project viability (e.g., local content). | Potential for policy shifts impacting exploration and production costs. |

| Governance & Compliance | Influences investor confidence and market perception. | Ongoing market sensitivity to compliance issues and past scandals. |

What is included in the product

This Petrobras PESTLE analysis provides a comprehensive examination of how political, economic, social, technological, environmental, and legal factors influence the company's operations and strategic direction.

It offers actionable insights for stakeholders to navigate the complex external landscape and identify key opportunities and threats.

Provides a concise version of Petrobras' PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, streamlining strategic discussions.

Helps support discussions on external risk and market positioning during planning sessions by clearly outlining the political, economic, social, technological, environmental, and legal factors affecting Petrobras.

Economic factors

Petrobras's financial health is intrinsically tied to the unpredictable swings in global oil and gas prices. For instance, in 2024, Brent crude oil prices have fluctuated, averaging around $83 per barrel in the first half, impacting the company's revenue streams. These price movements directly influence the scale of Petrobras's exploration and production (E&P) capital expenditure decisions, with lower prices potentially curtailing investment and higher prices bolstering earnings and cash generation.

Brazil's economic performance is a critical driver for Petrobras. In 2023, the country's GDP growth was a strong 2.9%, indicating a healthy expansion. Inflation, while a concern globally, stood at 4.62% for 2023, a manageable figure that supports consumer purchasing power and, consequently, domestic demand for Petrobras's fuels.

This economic environment directly influences Petrobras's sales volumes. With a growing economy and stable inflation, consumer spending on transportation and energy remains robust. For instance, the demand for gasoline and diesel, key products for Petrobras, is closely tied to overall economic activity and the mobility of the population.

Petrobras's financial performance is highly sensitive to exchange rate fluctuations. A substantial portion of its revenue, derived from international oil sales, is denominated in U.S. dollars. Conversely, many operational expenses are incurred in Brazilian Reais (BRL).

This mismatch means that a weaker Real against the dollar directly boosts Petrobras's reported revenues and profits when translated back into BRL. For instance, during 2023, the average BRL/USD exchange rate hovered around 5.00 BRL to 1 USD, a level that generally favored the company's dollar-denominated earnings.

However, the volatility of this rate also impacts debt servicing and the cost of imported goods. A significant depreciation of the Real can increase the burden of dollar-denominated debt and make essential imported equipment and services more expensive, as seen in periods of rapid BRL depreciation.

Access to Capital and Investment Climate

Petrobras needs significant capital for its extensive operations, from deepwater exploration to refining upgrades. The global interest rate environment and Brazil's overall investment climate directly impact the cost and availability of this crucial financing, affecting both expansion projects and the company's ability to manage its debt. For instance, in early 2024, Brazil's Selic rate stood at 11.75%, a key benchmark influencing borrowing costs.

Investor confidence is paramount for Petrobras to secure the funds needed for its ambitious growth strategies. Positive sentiment can lower the cost of capital, while uncertainty can lead to higher interest rates and reduced investment appetite. In 2023, Petrobras reported a net profit of R$124.6 billion, demonstrating strong operational performance that can bolster investor confidence, though market sentiment can fluctuate based on political and economic developments.

- Capital Needs: Petrobras requires billions of dollars annually for exploration, production, and infrastructure development.

- Financing Costs: Global interest rates and Brazil's economic stability directly influence the cost of borrowing for Petrobras.

- Investor Confidence: Market sentiment and perceived political risk in Brazil significantly impact Petrobras's ability to attract equity and debt financing.

- 2023 Performance: The company's R$124.6 billion net profit in 2023 highlights its earning potential, a key factor for investors.

Domestic Fuel Price Controls

Historically, Petrobras has experienced significant government influence over its domestic fuel pricing policies. For instance, in the past, the Brazilian government has directed Petrobras to keep prices below international market benchmarks to manage inflation. While direct price controls have lessened, the potential for renewed intervention remains a key consideration.

Any resurgence of domestic fuel price controls could directly affect Petrobras's financial performance by capping its ability to adjust prices in line with global crude oil costs. This can compress refining margins and reduce overall profitability, impacting investor returns. For example, in 2022, Petrobras reported a net profit of R$124.6 billion, but significant price adjustments were often debated and influenced by government policy.

- Government Intervention Risk: Past instances show the government dictating fuel prices, potentially below market rates.

- Margin Compression: Price controls can limit Petrobras's ability to pass on rising crude oil costs, squeezing profit margins.

- Profitability Impact: Reduced margins directly translate to lower overall profitability and potentially reduced shareholder value.

Economic factors significantly shape Petrobras's operational and financial landscape. Global oil price volatility directly impacts revenue, with Brent crude averaging around $83 per barrel in early 2024, influencing capital expenditure. Brazil's economic health, evidenced by a 2.9% GDP growth in 2023 and a manageable 4.62% inflation rate, underpins domestic demand for Petrobras's products. Exchange rate fluctuations, particularly the BRL/USD rate averaging around 5.00 in 2023, create a complex dynamic, boosting dollar-denominated earnings but also impacting debt servicing and import costs.

| Economic Factor | Key Data Point (2023-2024) | Impact on Petrobras |

| Global Oil Prices | Brent Crude: ~$83/barrel (H1 2024 average) | Directly affects revenue, profitability, and investment decisions. |

| Brazilian GDP Growth | 2.9% (2023) | Supports domestic demand for fuels and energy products. |

| Brazilian Inflation Rate | 4.62% (2023) | Influences consumer spending power and operational costs. |

| BRL/USD Exchange Rate | ~5.00 BRL/USD (2023 average) | Favors dollar-denominated earnings but increases costs for dollar-denominated debt and imports. |

Preview the Actual Deliverable

Petrobras PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Petrobras delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic direction.

What you’re previewing here is the actual file—fully formatted and professionally structured. You'll gain immediate access to a detailed breakdown of how external forces shape Petrobras's business landscape, including insights into regulatory changes, market trends, and societal expectations.

The content and structure shown in the preview is the same document you’ll download after payment. This PESTLE analysis provides a robust framework for understanding the multifaceted challenges and opportunities facing Petrobras in the global energy sector.

Sociological factors

Petrobras's brand image and public perception in Brazil are deeply intertwined with its state-controlled status and historical events, significantly impacting its operations. Negative public sentiment, often fueled by past corruption scandals, can lead to increased regulatory pressure and affect its social license to operate.

Public opinion on Petrobras's environmental stewardship and social responsibility is a key factor. For instance, in early 2024, surveys indicated mixed public views, with a significant portion of Brazilians expressing concern over the company's environmental impact, particularly regarding offshore oil spills and deforestation allegations in the Amazon region, while others acknowledge its role in national energy security.

Petrobras's role as a major employer in Brazil means its labor relations are a critical sociological element. The company's engagement with powerful labor unions, representing thousands of workers across its vast operations, directly influences operational stability. For instance, in 2023, Petrobras faced several labor-related challenges, including negotiations over collective bargaining agreements and potential strike actions, which can lead to significant production disruptions and financial losses if not managed effectively.

Managing a workforce that spans diverse skill sets, from offshore oil rig technicians to administrative staff, presents ongoing sociological challenges. Ensuring fair labor practices, competitive compensation, and safe working conditions across these varied segments is paramount to maintaining employee morale and productivity. Petrobras's commitment to diversity and inclusion initiatives also plays a role in shaping its workforce dynamics and public perception.

Petrobras's extensive exploration and production activities, especially in sensitive offshore environments and onshore areas, directly influence local communities. For instance, the company's investments in the pre-salt region of Brazil have created significant economic opportunities but also necessitate careful management of social and environmental externalities.

Maintaining social license to operate hinges on robust community engagement. Petrobras's commitment to addressing local concerns, such as potential environmental impacts from seismic surveys or oil spills, and fostering local development through job creation and infrastructure projects, is crucial. In 2023, Petrobras reported investing R$ 2.5 billion in social and environmental programs across its operational areas, aiming to foster positive local impact.

Energy Transition and Consumer Preferences

Societal awareness of climate change is profoundly reshaping consumer preferences, even within Brazil's historically fossil fuel-centric market. This growing consciousness is driving a demand for more sustainable energy alternatives.

While oil and gas are still the primary energy sources, the market is witnessing a notable uptick in demand for biofuels and renewable electricity. For instance, Brazil's sugarcane-based ethanol production reached approximately 29.7 billion liters in the 2023-2024 harvest season, showcasing the strength of the biofuel sector. This trend directly impacts Petrobras's strategic planning, suggesting a need to diversify its product portfolio and investment focus towards these cleaner energy avenues to align with evolving consumer expectations and regulatory landscapes.

- Growing Climate Awareness: Increased public concern over environmental issues is a key driver.

- Biofuel Demand: Brazil's significant biofuel production, like ethanol, indicates a strong existing market.

- Renewable Electricity Growth: While not directly Petrobras's core, it influences the overall energy market and investment decisions.

Health and Safety Standards

Societal expectations for robust health and safety standards are a critical consideration for Petrobras. A lapse in these standards can trigger severe reputational damage, leading to significant financial penalties and a erosion of public trust, which directly affects operational continuity.

For instance, in 2023, Petrobras reported a reduction in its Lost Time Injury Frequency Rate (LTIFR) to 0.75 per million hours worked, a metric closely watched by stakeholders. However, any deviation from such benchmarks, or a major incident, could invite heightened regulatory scrutiny and increased fines, potentially impacting the company's social license to operate.

- Reputational Risk: Incidents can lead to negative media coverage and public outcry, impacting brand image.

- Regulatory Fines: Non-compliance with safety regulations can result in substantial financial penalties.

- Operational Disruptions: Accidents may lead to temporary or permanent shutdowns of facilities.

- Stakeholder Trust: Maintaining high safety standards is crucial for investor confidence and community relations.

Societal concerns about climate change are increasingly influencing energy consumption patterns in Brazil, pushing for a greater adoption of sustainable alternatives. This growing awareness is reflected in the robust market for biofuels, with Brazil's ethanol production reaching approximately 29.7 billion liters for the 2023-2024 harvest season, highlighting a significant shift in consumer preferences and a direct challenge to traditional fossil fuel dominance.

Public perception of Petrobras is heavily shaped by its history, including past corruption scandals that have eroded trust and led to increased regulatory scrutiny. Maintaining a positive brand image and social license to operate requires consistent efforts in transparency and ethical conduct, especially given the company's significant role as a national employer and its impact on local communities through extensive exploration activities.

Petrobras's commitment to health and safety standards is paramount, as any failure can result in severe reputational damage and financial penalties. For example, in 2023, the company reported a Lost Time Injury Frequency Rate (LTIFR) of 0.75 per million hours worked, a metric that reflects its ongoing efforts to maintain operational safety and stakeholder confidence.

| Sociological Factor | Impact on Petrobras | Supporting Data/Trend (2023-2024) |

| Public Perception & Brand Image | Affects social license to operate, regulatory pressure, and stakeholder trust. | Negative sentiment from past scandals persists; 2023 saw ongoing efforts to rebuild trust. |

| Environmental & Social Responsibility | Influences consumer choices and community relations. | Surveys in early 2024 showed mixed views on environmental impact; R$ 2.5 billion invested in social/environmental programs in 2023. |

| Labor Relations | Impacts operational stability and productivity. | 2023 experienced negotiations with powerful labor unions and potential strike actions. |

| Climate Change Awareness & Biofuel Demand | Drives demand for sustainable alternatives and portfolio diversification. | Brazil's ethanol production reached ~29.7 billion liters in 2023-2024 harvest. |

| Health & Safety Standards | Crucial for reputation, avoiding fines, and operational continuity. | 2023 LTIFR reported at 0.75 per million hours worked. |

Technological factors

Petrobras's operational success hinges on advanced exploration and production technologies, particularly for its deepwater and ultra-deepwater ventures in the pre-salt Santos Basin. The company is committed to ongoing investment in areas like seismic imaging, specialized drilling methods, and sophisticated subsea infrastructure to unlock the vast potential of these challenging reservoirs.

These technological advancements are crucial for maximizing oil recovery rates and driving down operational expenses. For instance, Petrobras has been a leader in deploying subsea processing and enhanced oil recovery (EOR) techniques, which are vital for efficiently extracting hydrocarbons from the complex geological formations found in the pre-salt fields.

Petrobras is leveraging technological advancements to refine its processes, aiming for higher yields and better product quality. For instance, investments in advanced catalysts and sophisticated automation systems are key to optimizing refinery operations. This focus on efficiency is crucial for maintaining competitiveness in the global downstream market.

Digitalization plays a significant role in Petrobras's strategy to enhance refinery performance. By integrating digital tools and data analytics, the company can better manage energy consumption and reduce its environmental footprint. For example, in 2023, Petrobras reported a 10% reduction in specific energy consumption across its refineries compared to 2022, directly attributable to process optimization initiatives.

Petrobras faces a dynamic landscape with the growing integration of renewable energy sources like wind and solar, alongside advanced biofuels. This shift presents a significant opportunity for Petrobras to diversify its energy portfolio beyond traditional oil and gas. In 2023, Brazil's renewable energy sources accounted for approximately 84% of its electricity generation, highlighting a strong national push towards cleaner alternatives.

Leveraging its existing expertise in biofuels, particularly ethanol, Petrobras can capitalize on this trend. The company has a substantial history in sugarcane-based ethanol production, a sector that saw Brazil produce around 33.1 billion liters in the 2023-2024 harvest. This established capability positions Petrobras to potentially expand into next-generation biofuels and other renewable energy ventures as the global energy transition accelerates.

Digitalization, AI, and Data Analytics

Petrobras is increasingly leveraging digitalization, AI, and data analytics to sharpen its operations. These advancements are key to boosting efficiency, enabling predictive maintenance, and improving overall decision-making across the company's extensive value chain. For instance, in 2024, the company continued to invest in digital transformation initiatives aimed at optimizing exploration and production processes.

The integration of these technologies allows for a more granular understanding and control of operations, from the initial stages of reservoir management to the complexities of logistics and the critical need for robust cybersecurity. By analyzing vast datasets, Petrobras can anticipate equipment failures, optimize production output, and streamline its supply chain, leading to significant cost savings and enhanced performance.

- Enhanced Operational Efficiency: Digital tools and AI algorithms are being deployed to optimize drilling, production, and refining processes, aiming for higher output and lower operational costs.

- Predictive Maintenance: By analyzing sensor data and historical performance, Petrobras can predict potential equipment failures, allowing for proactive maintenance and minimizing costly downtime.

- Improved Decision-Making: Advanced data analytics provide deeper insights into market trends, reservoir performance, and operational risks, empowering more informed strategic and tactical decisions.

- Cybersecurity Fortification: With increased digitalization, robust AI-driven cybersecurity measures are essential to protect sensitive operational data and infrastructure from threats.

Carbon Capture, Utilization, and Storage (CCUS)

As environmental pressures intensify, Carbon Capture, Utilization, and Storage (CCUS) technologies are becoming essential for Petrobras to reduce emissions from its oil and gas activities. The company's commitment to sustainability targets and maintaining its social license to operate hinges on the successful development and implementation of these solutions.

Petrobras is actively exploring CCUS projects, aiming to capture CO2 from its industrial processes. For instance, the company has been involved in pilot programs and studies to assess the feasibility of large-scale CCUS deployment, particularly in its offshore operations. These efforts are crucial for aligning with Brazil's climate commitments and global decarbonization trends.

- Investment in CCUS: Petrobras has allocated significant capital towards research and development in CCUS technologies, with projections indicating substantial future investments to meet emission reduction goals.

- Technological advancements: Ongoing innovation in capture methods, such as post-combustion and direct air capture, aims to improve efficiency and reduce the cost of CCUS, making it more viable for widespread adoption.

- Regulatory landscape: Evolving government policies and incentives for carbon capture and storage are influencing Petrobras's strategic decisions and the economic attractiveness of CCUS projects.

- Operational integration: Integrating CCUS infrastructure into existing oil and gas facilities presents both opportunities for emission reduction and challenges in terms of engineering and operational complexity.

Petrobras is heavily investing in digitalization, AI, and advanced analytics to boost operational efficiency and decision-making across its value chain. These technologies are vital for optimizing exploration, production, and refining, enabling predictive maintenance, and enhancing cybersecurity. For example, in 2024, the company continued its digital transformation initiatives, focusing on improving the precision of its pre-salt operations.

The company is also at the forefront of adopting Carbon Capture, Utilization, and Storage (CCUS) technologies to meet its environmental targets. These investments are critical for reducing emissions from its oil and gas activities and maintaining its social license to operate. Petrobras is actively involved in pilot programs and studies for large-scale CCUS deployment, particularly offshore.

Furthermore, Petrobras is exploring opportunities in renewable energy, including biofuels, to diversify its portfolio. Brazil's strong renewable energy sector, which accounted for approximately 84% of its electricity generation in 2023, presents a significant market. Petrobras's existing expertise in sugarcane-based ethanol, with Brazil producing around 33.1 billion liters in the 2023-2024 harvest, positions it well for expansion.

Technological innovation is key to Petrobras's strategy for maximizing oil recovery in challenging deepwater and ultra-deepwater pre-salt fields. This includes advanced seismic imaging, specialized drilling techniques, and sophisticated subsea infrastructure, all aimed at increasing efficiency and reducing costs in complex geological environments.

| Technology Area | Key Applications for Petrobras | Impact/Benefit | Recent Data/Context |

| Digitalization & AI | Predictive maintenance, process optimization, enhanced decision-making, cybersecurity | Reduced downtime, cost savings, improved safety, increased efficiency | Continued investment in digital transformation initiatives in 2024. |

| Carbon Capture, Utilization & Storage (CCUS) | Reducing emissions from industrial processes, particularly offshore operations | Meeting environmental targets, maintaining social license, aligning with climate commitments | Involvement in pilot programs and feasibility studies for large-scale deployment. |

| Renewable Energy & Biofuels | Diversification of energy portfolio, leveraging existing biofuel expertise | Market expansion, reduced carbon footprint, new revenue streams | Brazil's renewable electricity generation at ~84% in 2023; ~33.1 billion liters of ethanol produced in 2023-2024 harvest. |

| Deepwater Exploration & Production | Advanced seismic imaging, specialized drilling, subsea processing | Maximizing oil recovery, reducing operational costs, unlocking pre-salt potential | Focus on enhancing efficiency in complex geological formations. |

Legal factors

Petrobras navigates a stringent regulatory environment, adhering to national and international laws for oil and gas operations. This includes compliance with Brazil's National Agency of Petroleum, Natural Gas and Biofuels (ANP) regulations, which dictate licensing, production quotas, and environmental standards. For instance, in 2023, Petrobras invested R$25.9 billion in exploration and production, a significant portion of which is allocated to ensuring compliance with these rigorous operational and safety mandates.

Petrobras faces stringent anti-corruption and compliance regulations, including Brazil's Clean Company Act and international laws like the U.S. Foreign Corrupt Practices Act (FCPA) and the UK Bribery Act. Following the Lava Jato (Car Wash) scandal, which involved billions in fines and penalties for various companies, Petrobras has implemented enhanced compliance programs. In 2023, the company continued to invest in these areas, reinforcing its commitment to transparency and ethical business practices to mitigate legal risks and potential sanctions.

Petrobras navigates a complex web of environmental laws and permitting processes. Strict regulations in Brazil, such as those from IBAMA, mandate thorough environmental impact assessments for all new projects, from offshore exploration to refinery upgrades. Failure to secure necessary permits or comply with standards for pollution control, waste disposal, and biodiversity protection can lead to significant fines and operational halts. For instance, in 2023, Petrobras faced scrutiny and potential penalties related to emissions from its refineries, highlighting the ongoing need for robust environmental management systems.

Labor and Employment Legislation

Petrobras, as a significant employer in Brazil, must navigate a complex web of labor and employment legislation. These laws dictate everything from minimum wages and working hours to collective bargaining rights and social security obligations. Failure to adhere to these regulations can result in costly labor disputes, legal challenges, and substantial financial penalties, directly affecting the company's operational continuity and public image.

The Brazilian labor code is known for its protective stance towards employees. For instance, in 2023, Brazil's minimum wage was R$1,320 per month, a figure that Petrobras must ensure is met or exceeded for all its employees, alongside other legally mandated benefits and contributions. The company also faces scrutiny regarding working conditions, particularly in its high-risk operational environments, and must comply with specific safety and health regulations to prevent accidents and ensure employee well-being.

Furthermore, Petrobras's relationship with labor unions is a critical legal factor. Unions advocate for workers' rights, and collective bargaining agreements can significantly influence labor costs and operational flexibility. In 2024, ongoing negotiations and potential strikes stemming from wage disputes or working condition grievances remain a persistent risk that Petrobras must actively manage through compliance and dialogue.

- Compliance with Brazil's labor laws is mandatory for Petrobras, covering wages, working conditions, and union rights.

- Non-compliance can lead to costly labor disputes, lawsuits, and financial liabilities, impacting operations and reputation.

- In 2023, Brazil's minimum wage was R$1,320, a baseline for Petrobras's employee compensation.

- Managing relationships with powerful labor unions through collective bargaining is crucial for operational stability.

International Trade and Sanctions Laws

Petrobras's extensive international operations mean it must meticulously adhere to a web of international trade and sanctions laws. These regulations directly impact its ability to import necessary equipment and export its products, with tariffs potentially increasing costs. For instance, the ongoing geopolitical tensions in 2024 and 2025 continue to highlight the critical nature of sanctions regimes, which can abruptly alter market access or necessitate complex compliance procedures for any company with global reach.

Navigating these intricate legal landscapes is not merely a matter of compliance but a strategic imperative for Petrobras. Failure to do so can lead to severe penalties, supply chain disruptions, and reputational damage. The company's 2023 revenue from international operations, which constituted a significant portion of its total, underscores the financial impact of these legal factors.

- Tariff Impact: Increased tariffs on imported specialized drilling equipment can directly affect Petrobras's capital expenditure plans for deepwater exploration projects.

- Sanctions Compliance: Adherence to sanctions imposed by major economic blocs, such as those affecting certain countries or entities, is crucial to maintain access to international financial markets and key suppliers.

- Trade Agreements: Petrobras benefits from Brazil's participation in various trade agreements, which can reduce duties on its exports and facilitate smoother cross-border transactions.

- Regulatory Scrutiny: International trade bodies and national governments continuously update their trade and sanctions regulations, requiring ongoing monitoring and adaptation by Petrobras.

Petrobras operates under a robust legal framework, encompassing stringent environmental regulations enforced by bodies like IBAMA, which mandate detailed impact assessments for all projects. The company must also navigate complex labor laws, ensuring compliance with minimum wage standards, such as Brazil's R$1,320 minimum wage in 2023, and managing collective bargaining with influential labor unions.

Furthermore, Petrobras is subject to strict anti-corruption laws, including Brazil's Clean Company Act and international legislation like the FCPA, necessitating continuous investment in compliance programs to mitigate risks and avoid penalties, as seen in the aftermath of the Lava Jato investigations.

The company's global reach requires adherence to international trade laws and sanctions regimes, impacting its supply chain and market access, especially given the geopolitical shifts observed in 2024 and 2025.

Petrobras's significant investment in exploration and production, R$25.9 billion in 2023, is partly allocated to meeting these extensive legal and regulatory requirements across its operations.

Environmental factors

Global and national climate change policies, such as the Paris Agreement's aim to limit warming to 1.5°C, directly influence Petrobras's long-term strategy. Brazil's Nationally Determined Contribution (NDC) under the Paris Agreement targets a 37% reduction in greenhouse gas emissions below 2005 levels by 2025, and a 43% reduction by 2030, impacting Petrobras's operational planning.

Petrobras faces increasing pressure to align with these decarbonization goals, requiring significant investments in lower-carbon operations and a strategic pivot towards cleaner energy sources. For instance, the company has committed to reducing its absolute greenhouse gas emissions by 30% by 2030 compared to 2019 levels, a move that necessitates substantial capital allocation towards renewable energy projects and efficiency improvements.

Petrobras's extensive operations, from offshore exploration to onshore refining, inherently pose risks to delicate marine and terrestrial ecosystems. The company's commitment to biodiversity protection is paramount, as evidenced by its ongoing efforts to mitigate the environmental footprint of its activities, particularly in sensitive areas like the Brazilian coast.

In 2023, Petrobras reported investing R$1.7 billion in environmental programs, a significant portion of which is directed towards biodiversity conservation and impact reduction. Compliance with Brazil's robust environmental legislation, such as the National Policy on Biodiversity and the Forest Code, is a critical operational requirement, with potential for substantial fines and reputational damage for non-adherence.

The inherent risk of oil spills, especially from Petrobras' deepwater exploration activities, presents a substantial environmental challenge. In 2023, the company reported a 12% decrease in the volume of crude oil spilled compared to 2022, with a total of 6,442 barrels, underscoring ongoing efforts in prevention.

Maintaining advanced spill prevention systems and rapid emergency response mechanisms is crucial for Petrobras to minimize environmental harm and protect its reputation. The company invested approximately $2 billion in environmental protection and safety initiatives in 2024, a significant portion allocated to deepwater operational integrity.

Water Management and Resource Scarcity

Petrobras, like all major oil and gas companies, faces significant challenges in water management due to the substantial water volumes consumed across its operations, from exploration and drilling to refining and processing. In 2023, the company reported its commitment to improving water efficiency, aiming to reduce freshwater withdrawal by 20% by 2030 compared to a 2015 baseline. This focus is driven by increasing water scarcity in key operating regions, particularly in Brazil, and the growing stringency of environmental regulations concerning wastewater discharge.

To address these environmental factors, Petrobras is investing in advanced water management strategies. These include enhanced water recycling and reuse initiatives within its facilities and the implementation of sophisticated treatment technologies to minimize the environmental impact of its discharged water. For example, the company has been deploying membrane filtration and advanced oxidation processes to treat produced water, aiming for higher quality discharge or even reuse in industrial processes. These efforts are crucial not only for regulatory compliance but also for maintaining operational continuity in water-stressed areas and reducing overall operational costs.

- Water Consumption: Oil and gas extraction and refining are inherently water-intensive processes, crucial for operations like hydraulic fracturing and cooling.

- Scarcity and Regulation: Regions where Petrobras operates, such as parts of Brazil, are experiencing increasing water stress, leading to tighter regulations on water usage and discharge quality.

- Efficiency Measures: Petrobras is actively implementing water recycling and advanced treatment technologies to reduce its reliance on freshwater sources and minimize its environmental footprint.

- Targets: The company has set targets to reduce freshwater withdrawal, reflecting a commitment to more sustainable water management practices in its operations.

Waste Management and Pollution Control

Petrobras faces significant environmental scrutiny regarding its waste management and pollution control. The effective handling of industrial waste, hazardous materials, and air pollutants from its extensive refining and production operations is paramount. This includes a constant need for investment in advanced technologies and best practices to minimize emissions, prevent soil and water contamination, and ensure the responsible disposal of all operational byproducts.

In 2023, Petrobras reported significant investments in environmental protection, with a focus on reducing its carbon footprint and improving waste management systems. The company has been actively implementing programs to cut greenhouse gas emissions, aiming for a 30% reduction by 2030 compared to 2019 levels. This commitment extends to improving its water management practices, with targets to reduce water withdrawal and increase water recycling across its facilities.

- Emissions Reduction: Petrobras is investing in technologies to lower sulfur dioxide (SO2) and nitrogen oxide (NOx) emissions from its refineries, crucial for air quality compliance.

- Waste Handling: The company is enhancing its systems for managing drilling fluids, produced water, and other operational wastes, with a focus on circular economy principles.

- Water Pollution Control: Efforts are underway to prevent oil spills and minimize the discharge of contaminated water into marine and freshwater ecosystems.

- Biodiversity Protection: Petrobras also implements programs to protect biodiversity in areas surrounding its operations, particularly in sensitive ecosystems like the Amazon and coastal regions.

Environmental regulations are a significant factor for Petrobras, influencing everything from emissions standards to waste disposal. The company's adherence to Brazil's environmental laws, such as those concerning biodiversity and forest protection, is critical to avoid penalties and maintain its social license to operate. Petrobras's 2023 environmental investments, totaling R$1.7 billion, highlight its commitment to managing its ecological footprint.

The global push towards decarbonization, driven by agreements like the Paris Agreement, directly impacts Petrobras's strategic direction. Brazil's own emission reduction targets, aiming for a 43% cut by 2030, necessitate a shift in operational focus and investment towards cleaner energy solutions. Petrobras has responded by setting its own goal to reduce absolute greenhouse gas emissions by 30% by 2030 compared to 2019 levels.

Petrobras's operations inherently carry environmental risks, particularly concerning potential oil spills and the management of water resources. The company reported a 12% decrease in oil spills in 2023 compared to the previous year, with 6,442 barrels spilled, indicating ongoing efforts in prevention and response. Furthermore, a commitment to reduce freshwater withdrawal by 20% by 2030 underscores the challenges and strategies related to water scarcity and management.

The company's environmental performance is also measured by its waste management and pollution control efforts. Investments in advanced technologies are crucial for minimizing air pollutants like SO2 and NOx from refineries and for responsibly handling operational wastes, including drilling fluids and produced water. Petrobras's focus on biodiversity protection in its operational areas, especially in sensitive ecosystems, remains a key environmental consideration.

PESTLE Analysis Data Sources

Our Petrobras PESTLE Analysis is grounded in extensive data from official Brazilian government sources, international energy agencies, and leading economic research institutions. We incorporate regulatory updates, market performance data, and socio-economic indicators to ensure a comprehensive and accurate assessment.