Petrobras Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Petrobras Bundle

Uncover the strategic brilliance behind Petrobras's marketing efforts by examining its Product, Price, Place, and Promotion. This analysis delves into how their diverse product portfolio, dynamic pricing, extensive distribution network, and impactful promotional campaigns contribute to their market dominance.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Petrobras's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Petrobras' core product is crude oil and natural gas, with a strong emphasis on its deep and ultra-deep water pre-salt reserves in Brazil. This strategic focus is central to their product offering.

The company is heavily investing in exploration and production (E&P) to boost output and replenish reserves. This includes developing new wells and offshore platforms, demonstrating a commitment to future production capacity.

For the 2025-2029 period, Petrobras' Strategic Plan earmarks significant capital for E&P, targeting a daily production of 3.2 million barrels of oil and gas equivalent. This aggressive investment underscores the importance of this segment to their overall business.

Petrobras offers a diverse portfolio of refined petroleum products, including gasoline, diesel, jet fuel, and LPG, catering to critical sectors like transportation and industry. The company is strategically boosting its refining capabilities, aiming for a substantial increase in S10 diesel output by 2029 to better serve Brazil's energy needs.

Petrobras is actively broadening its product range to encompass more sustainable and low-carbon options as a core element of its energy transition. This strategic pivot includes significant investments in biorefining capabilities to produce next-generation biofuels, such as Diesel R and sustainable aviation fuel (SAF).

The company’s commitment to this diversification is clearly demonstrated by its 2025-2029 Business Plan, which earmarks an impressive US$16.3 billion specifically for low-carbon initiatives. This substantial allocation underscores Petrobras's dedication to developing a more environmentally conscious energy portfolio.

Electricity Generation and Natural Gas

Petrobras plays a significant role in Brazil's energy landscape beyond oil and gas, actively participating in electricity generation and natural gas marketing. This dual focus is crucial for the nation's energy security, with natural gas being a vital element in Brazil's energy mix.

The company is committed to enhancing its thermoelectric generation capabilities and strengthening its natural gas supply network. A prime example of this commitment is the development of the Gas Treatment Unit at the Boaventura Energy Complex, underscoring Petrobras's investment in expanding natural gas infrastructure.

In 2023, Petrobras's thermoelectric power plants contributed significantly to the national grid. For instance, its thermoelectric generation reached approximately 14,000 GWh, representing a notable portion of Brazil's overall electricity production. This highlights the company's dedication to optimizing its thermoelectric assets.

- Thermoelectric Generation: Petrobras's thermoelectric plants generated around 14,000 GWh in 2023, contributing to Brazil's energy supply.

- Natural Gas Infrastructure: Projects like the Gas Treatment Unit at Boaventura Energy Complex are key to expanding the company's natural gas supply capabilities.

- Energy Security: The company's involvement in electricity generation and natural gas marketing directly supports Brazil's national energy security objectives.

- Market Position: Petrobras is a key player in the marketing of natural gas, a critical component of Brazil's energy matrix, ensuring reliable supply to various sectors.

Lubricants and Asphalt s

Beyond its core fuel offerings, Petrobras plays a significant role in specialized petrochemical markets, notably with its lubricants and asphalt products. These segments are crucial for industrial applications and infrastructure development, demonstrating the company's diversified product portfolio.

Petrobras is committed to sustaining its market position in the lubricants sector, focusing on product quality and technological advancements. This dedication ensures that its base oils meet the stringent demands of various lubricant manufacturers. In parallel, the company continues to innovate its asphalt products, emphasizing durability and superior performance for critical road construction and civil engineering projects.

These specialized products, lubricants and asphalt, directly address the needs of industrial clients and the civil construction sector. For instance, Petrobras's asphalt sales are a key component in Brazil's extensive road network maintenance and expansion efforts. In 2024, the demand for high-performance asphalt remained robust, driven by government infrastructure spending and private sector development projects.

- Lubricants: Petrobras supplies base oils, essential components for lubricant manufacturing, serving diverse industrial and automotive needs.

- Asphalt: The company provides asphalt products vital for road construction and maintenance, contributing to Brazil's infrastructure development.

- Market Focus: Petrobras aims to maintain a strong market share in lubricants and invests in asphalt quality for enhanced durability and performance.

- Demand Drivers: The demand for these specialized products is closely tied to industrial activity and government investments in infrastructure projects.

Petrobras' product strategy centers on its substantial pre-salt oil and gas reserves, with a forward-looking plan to increase production to 3.2 million barrels of oil and gas equivalent daily by 2025-2029. This core offering is complemented by a diverse range of refined products, including gasoline and diesel, with a specific aim to boost S10 diesel output by 2029. Furthermore, the company is actively expanding into low-carbon alternatives, allocating US$16.3 billion to biofuels and sustainable aviation fuel by 2029, showcasing a commitment to a broader energy portfolio.

| Product Category | Key Offerings | Strategic Focus (2025-2029) | Notable Data/Targets |

|---|---|---|---|

| Crude Oil & Natural Gas | Deep and ultra-deep water pre-salt reserves | Exploration and Production (E&P) enhancement | Targeting 3.2 million boepd production |

| Refined Products | Gasoline, Diesel (including S10), Jet Fuel, LPG | Boosting refining capabilities, increasing S10 diesel output | Increased S10 diesel production by 2029 |

| Low-Carbon Energy | Biofuels (Diesel R), Sustainable Aviation Fuel (SAF) | Investment in biorefining and low-carbon initiatives | US$16.3 billion allocated to low-carbon projects |

| Electricity & Gas Marketing | Thermoelectric generation, natural gas supply | Enhancing thermoelectric generation, expanding gas network | 14,000 GWh thermoelectric generation in 2023 |

| Specialty Products | Lubricants (base oils), Asphalt | Maintaining market share, improving asphalt performance | Robust demand for asphalt in infrastructure projects |

What is included in the product

This analysis offers a comprehensive breakdown of Petrobras's marketing strategies across Product, Price, Place, and Promotion, grounded in actual brand practices and competitive context.

It's designed for professionals needing a deep dive into Petrobras's marketing positioning, providing real data and strategic implications for benchmarking and planning.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of understanding Petrobras' market position.

Provides a clear, concise overview of Petrobras' 4Ps, easing the burden of detailed market analysis for busy executives.

Place

Petrobras boasts an extensive domestic distribution network, ensuring its products reach a wide array of consumers throughout Brazil. This network is anchored by over 7,000 branded service stations, a crucial touchpoint for retail fuel sales.

Beyond retail, Petrobras utilizes direct sales channels to serve industrial clients and large consumers, demonstrating its capacity to cater to diverse market segments. This dual approach, combining widespread retail presence with targeted industrial supply, underscores the company's logistical prowess.

The company's logistical infrastructure is a significant asset, facilitating the broad availability of petroleum derivatives and natural gas. In 2024, Petrobras continued to invest in optimizing its supply chain, aiming to enhance efficiency and reach in a geographically challenging market.

Petrobras's refining and processing hubs are the backbone of its operations, transforming raw materials into valuable products. The company boasts a substantial network of refineries and natural gas processing units, with a strong concentration in Brazil's Southeast region, a key area for both production and consumption.

These strategically positioned facilities are essential for converting crude oil and natural gas into a wide array of marketable products, from gasoline and diesel to petrochemicals. They also act as crucial distribution centers, ensuring these products reach consumers across the country. For instance, the Abreu e Lima Refinery (RNEST) in Pernambuco, a significant asset, has seen substantial investment to enhance its processing capabilities.

Petrobras is actively investing in modernizing and expanding these vital hubs. These capital expenditures aim to boost production volumes, improve operational efficiency, and adapt to evolving market demands and environmental standards. For example, the company's 2024-2028 Strategic Plan outlines significant investments in refining, including projects focused on increasing the yield of lighter products and reducing the environmental footprint of its operations.

Petrobras leverages an expansive pipeline network, spanning thousands of kilometers, to transport crude oil, natural gas, and refined products efficiently throughout Brazil. This infrastructure is critical for linking its upstream production facilities to downstream refining centers and distribution points.

Maritime transportation, utilizing both Petrobras's owned fleet and chartered vessels, is equally significant. This segment handles coastal movements and international trade, ensuring products reach diverse markets. In 2024, Petrobras's logistics operations moved millions of barrels of oil and gas, underscoring the scale of its transportation capabilities.

International Operations and Partnerships

While Petrobras' core operations are firmly rooted in Brazil, its international footprint is significant, primarily in exploration and production (E&P). These ventures are often conducted through strategic partnerships, allowing Petrobras to tap into diverse geological basins and share the substantial financial and operational risks inherent in global energy exploration. For instance, in 2024, Petrobras continued its involvement in projects in regions like the Gulf of Mexico and South America, leveraging these alliances to gain access to new technologies and expertise.

These international collaborations are crucial for diversifying Petrobras' asset base and securing future production. By partnering with other national and international oil companies, Petrobras can optimize its capital allocation and enhance its learning curve in complex offshore environments. This global engagement not only bolsters its supply chain resilience but also broadens its market access and understanding of international energy dynamics.

- Global Exploration Ventures: Petrobras actively participates in E&P projects in several countries, often through joint ventures and production-sharing agreements.

- Risk Mitigation: Partnerships allow for the sharing of exploration risks, reducing Petrobras' individual exposure to the high costs and uncertainties of deepwater and frontier exploration.

- Technological and Knowledge Transfer: Collaborations facilitate the exchange of best practices, advanced technologies, and operational know-how, enhancing Petrobras' capabilities.

- Market Access and Supply Chain Integration: International operations expand Petrobras' reach, contributing to a more robust and diversified supply chain and providing access to different energy markets.

Inventory Management and Supply Chain Optimization

Petrobras's inventory management and supply chain optimization are vital for product availability and operational efficiency. This focus ensures crude oil, natural gas, and refined products reach consumers seamlessly, minimizing costly disruptions. The company's 2024-2028 Strategic Plan highlights significant investments aimed at removing logistical bottlenecks and improving the overall flow of operations.

Key initiatives include enhancing storage capacities and modernizing transportation networks. For instance, Petrobras is investing in upgrading its pipeline infrastructure and expanding its fleet of vessels to improve delivery times and reduce transit costs. These efforts are directly tied to ensuring product availability across its extensive distribution channels.

- Investment in logistics: Petrobras allocated approximately R$30 billion (around $6 billion USD) towards logistics and refining in its 2024-2028 Strategic Plan, a significant portion dedicated to supply chain improvements.

- Operational efficiency gains: By optimizing its supply chain, Petrobras aims to reduce inventory holding costs by an estimated 5-7% by 2027.

- Bottleneck removal: Projects like the enhancement of the Rota 3 gas pipeline are designed to increase natural gas throughput by 15 million cubic meters per day, directly addressing a key supply chain constraint.

- Digitalization of inventory: Implementing advanced tracking and forecasting systems is expected to improve inventory accuracy by over 95% by the end of 2025.

Petrobras's extensive physical presence in Brazil, encompassing over 7,000 branded service stations, ensures widespread product accessibility. This network is complemented by direct sales channels catering to industrial clients, showcasing a comprehensive distribution strategy. The company's logistical infrastructure, including a vast pipeline network and maritime transport capabilities, is crucial for product availability across the country.

The strategic placement of its refining and processing hubs, particularly in Brazil's Southeast, is key to converting raw materials into marketable products and serving as distribution centers. Investments in modernizing these facilities, as outlined in the 2024-2028 Strategic Plan, aim to boost production and adapt to market demands.

Petrobras's international exploration and production ventures, often through joint ventures, diversify its asset base and mitigate risks. These global collaborations enhance technological exchange and market access, contributing to supply chain resilience.

Supply chain optimization, with significant investments planned through 2028, focuses on enhancing storage and transportation networks to ensure seamless product delivery. Initiatives like the Rota 3 gas pipeline upgrade are designed to address key logistical constraints.

| Logistical Asset | Scale/Capacity | 2024/2025 Focus |

|---|---|---|

| Branded Service Stations | Over 7,000 | Maintaining widespread retail presence |

| Pipeline Network | Thousands of kilometers | Expansion and modernization for efficiency |

| Refining Hubs | Multiple major facilities | Capacity enhancement and environmental adaptation |

| Maritime Fleet | Owned and chartered vessels | Optimizing coastal and international movements |

| International E&P Ventures | Multiple countries | Risk sharing and technological advancement |

What You See Is What You Get

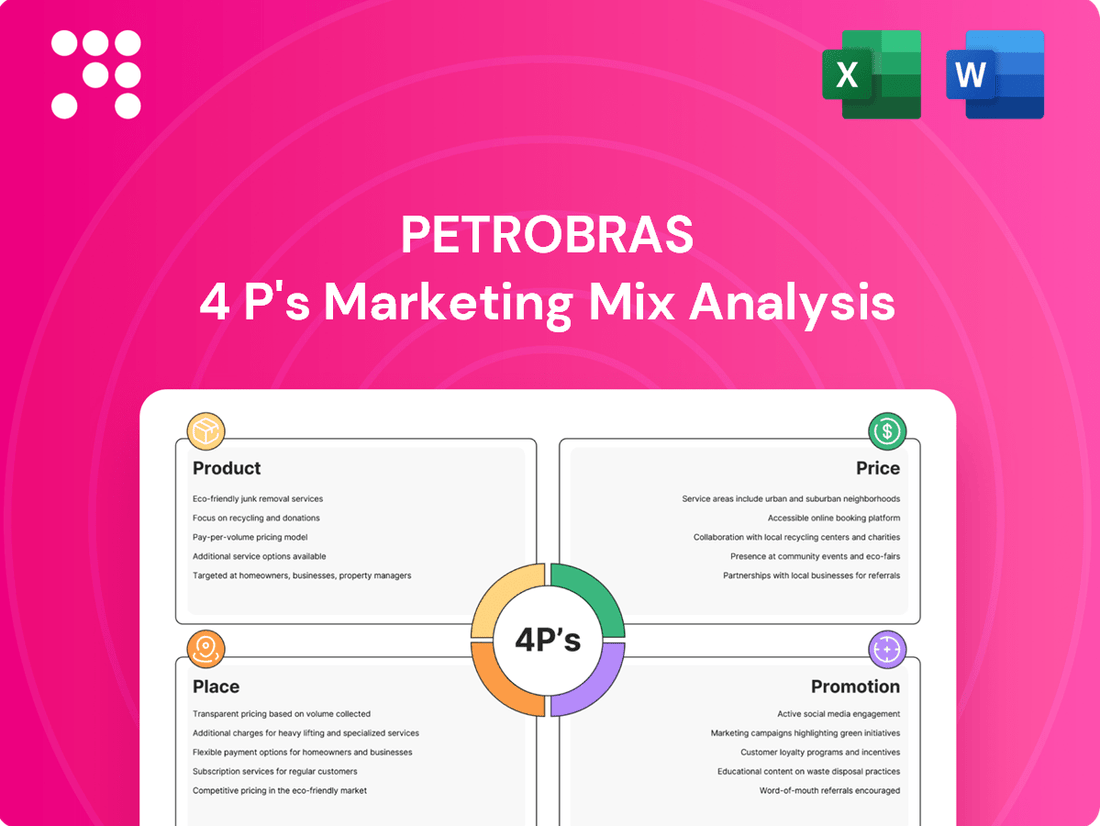

Petrobras 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Petrobras 4P's Marketing Mix Analysis details their Product, Price, Place, and Promotion strategies, offering a complete picture for your strategic planning.

Promotion

Petrobras actively cultivates its corporate brand, projecting an image as a premier integrated energy firm dedicated to Brazil's progress and the evolving energy landscape. This strategic branding effort involves transparently sharing its core purpose, values, and long-term vision with a broad array of stakeholders, with the ultimate goal of nurturing a favorable public image.

The company's brand equity is substantial, consistently ranking among Brazil's most valuable corporate identities. For instance, in 2023, Interbrand recognized Petrobras as one of the top brands in the country, underscoring its strong market presence and positive consumer perception.

Petrobras places a strong emphasis on investor relations and financial communications as a key promotional tool. This involves consistently sharing quarterly financial results, annual reports, and detailing their strategic direction with the investment community.

The company actively engages with stakeholders through webcasts and dedicated investor events, ensuring a platform for dialogue and information dissemination. For instance, in the first quarter of 2024, Petrobras reported a net income of R$23.7 billion, demonstrating its financial performance to investors.

These transparent and frequent communications are crucial for building and maintaining market confidence, providing financial decision-makers with the data needed to assess the company's value and future prospects.

Petrobras's commitment to sustainability is prominently showcased through its annual Sustainability Reports, detailing progress in crucial areas like decarbonization and biodiversity. In 2023, the company reported a reduction in its Scope 1 and 2 greenhouse gas emissions intensity, a key metric for its environmental performance.

These reports also highlight advancements in social responsibility, including initiatives for human rights and social inclusion, reflecting a dedication to broader ESG principles. This transparent communication fosters trust among stakeholders and positions Petrobras favorably within the growing global emphasis on sustainable business practices.

Public Awareness Campaigns and Social Media

Petrobras actively utilizes public awareness campaigns across traditional media like television and digital channels, including social media, to communicate its operations, products, and societal contributions. These initiatives are designed to boost brand recognition and educate the public on the company's integral role in everyday life.

The company's social media presence, particularly on platforms like Instagram and X (formerly Twitter), serves as a key avenue for direct engagement and information dissemination. For instance, in the first quarter of 2024, Petrobras reported significant engagement metrics across its digital platforms, reflecting a growing online audience interested in its sustainability efforts and energy production updates.

- Increased Brand Visibility: Campaigns aim to make Petrobras's brand more recognizable and accessible to a wider audience.

- Consumer Education: Information shared educates the public on the company's diverse operations, from exploration to refining.

- Reinforcing Societal Role: Efforts highlight Petrobras's contribution to Brazil's energy security and economic development.

- Digital Engagement: Social media platforms are used to foster dialogue and share timely updates, as seen in Q1 2024 engagement data.

Strategic Plan Communication

Petrobras actively shares its strategic blueprints, like the 2025-2029 Business Plan, to outline its investment focus and long-term goals. This transparency ensures stakeholders grasp the company's trajectory, which balances investment in lucrative oil and gas ventures with expansion into less carbon-intensive sectors.

The company's 2050 Strategic Plan further details its commitment to a diversified energy future. For instance, in its 2024 outlook, Petrobras highlighted significant capital expenditure plans, with a substantial portion allocated to exploration and production, demonstrating its continued reliance on its core business while also earmarking funds for renewable energy projects.

- Strategic Plan Communication: Petrobras communicates its 2025-2029 Business Plan and 2050 Strategic Plan to stakeholders.

- Investment Priorities: These plans articulate the company's long-term vision and capital allocation strategies.

- Diversified Focus: Communication highlights the balance between profitable oil and gas assets and investments in low-carbon businesses.

- Stakeholder Understanding: Proactive communication aims to foster clarity regarding Petrobras's future direction and operational strategy.

Petrobras utilizes a multi-faceted promotional strategy, emphasizing brand building, investor relations, and sustainability communications. Its consistent ranking among Brazil's top brands, as noted by Interbrand in 2023, highlights the effectiveness of its corporate image cultivation.

Financial transparency is a cornerstone, with detailed reporting of quarterly results, such as the R$23.7 billion net income in Q1 2024, fostering investor confidence. The company also actively promotes its commitment to ESG principles through annual Sustainability Reports, detailing progress in emissions reduction, with a reported intensity reduction in Scope 1 and 2 emissions in 2023.

Public awareness campaigns across traditional and digital media, including social media engagement that saw significant growth in Q1 2024, aim to educate the public and reinforce Petrobras's vital role in Brazil's energy sector and economy.

The communication of strategic plans, such as the 2025-2029 Business Plan and the 2050 Strategic Plan, provides clarity on investment priorities, balancing traditional energy with low-carbon initiatives, as evidenced by its 2024 outlook on capital expenditure.

| Promotional Area | Key Activities | 2023/2024 Data/Highlights |

|---|---|---|

| Brand Building | Corporate branding, public awareness campaigns | Ranked among Brazil's top brands (Interbrand, 2023) |

| Investor Relations | Financial reporting, investor events, webcasts | R$23.7 billion net income (Q1 2024) |

| Sustainability Communication | Sustainability Reports, ESG initiatives | Reduced Scope 1 & 2 GHG emissions intensity (2023) |

| Digital Engagement | Social media presence, online content | Significant engagement metrics across platforms (Q1 2024) |

| Strategic Communication | Business Plans, Strategic Plans | 2025-2029 Business Plan, 2050 Strategic Plan communicated |

Price

Petrobras' market-based fuel pricing policy navigates global crude oil prices and currency fluctuations, while also factoring in domestic market dynamics to foster stability. This strategy seeks to harmonize profit motives with broader national economic considerations, diverging from a rigid international parity pricing approach.

In 2024, Petrobras announced price adjustments that aimed to mitigate the impact of market volatility on consumers, demonstrating a commitment to managing price swings. For instance, diesel prices saw a notable adjustment in early 2024 following periods of international price escalation, reflecting this balancing act.

Petrobras is implementing new natural gas pricing strategies, including discounts for local distribution companies that commit to higher contract volumes with the company. This initiative aims to make Petrobras' offerings more competitive against imported liquefied natural gas (LNG) by lowering the average price for distributors.

These flexible commercial conditions are specifically designed to attract and retain clients in the Brazilian gas market. For instance, in early 2024, Petrobras announced a new gas sale and purchase agreement with a major distributor that includes these more attractive terms, reflecting a shift towards greater market responsiveness.

Petrobras strategically prices its refined products, including gasoline, diesel, and jet fuel, by closely monitoring market demand, competitor pricing strategies, and its own production expenses. This approach aims to maintain a competitive edge in the market while safeguarding the profitability of its refining operations and sales channels.

In 2024, Petrobras' pricing decisions are further informed by its ongoing efforts to enhance operational efficiency and the consistent quality of its refined output, ensuring its products meet market expectations and command favorable pricing.

Investment Returns and Shareholder Value

Petrobras' pricing is intrinsically tied to its shareholder value proposition, particularly concerning dividend payouts. The company's financial health and strategic investments directly reflect its capacity to price products competitively while ensuring robust profitability. For instance, Petrobras announced a significant dividend distribution of R$1.54 per share for the first half of 2024, underscoring the link between operational success and shareholder returns. This commitment means pricing decisions must balance market dynamics with the imperative to generate sufficient earnings to meet investor expectations.

The company’s ability to effectively price its oil and gas products is a cornerstone for maintaining profitability and, consequently, for its capacity to distribute dividends. Petrobras' financial results for Q1 2024 showed a net income of R$23.7 billion, a figure that directly influences its dividend-paying capacity. Effective pricing strategies are therefore not just about revenue generation but also about directly impacting investor confidence and the potential for future dividend payments, a key component of shareholder value.

- Dividend Payouts: Petrobras' commitment to returning capital to shareholders, as evidenced by its substantial dividend distributions in 2023 and early 2024, is a direct outcome of its pricing and profitability.

- Financial Performance Link: The company's net income, which was R$124.6 billion in 2023, directly dictates its capacity to pay dividends, highlighting how effective pricing translates into shareholder value.

- Investor Confidence: Consistent profitability, driven by strategic pricing, bolsters investor confidence and supports the company's share price, further enhancing shareholder value.

Regulatory and Tax Influences

Petrobras' fuel pricing is heavily influenced by government regulations and taxes, with the state tax on goods and services (ICMS) being a prime example. These fiscal impositions directly impact the final cost to consumers, often creating volatility. For instance, in early 2024, adjustments to ICMS rates in various Brazilian states led to fluctuations in gasoline and diesel prices, affecting household budgets and transportation costs.

The company navigates a complex regulatory environment where pricing decisions must align with public policy goals, potentially balancing market forces with socio-economic considerations. This can involve managing price adjustments to mitigate inflationary pressures, a recurring theme in Brazilian economic discussions. For example, discussions in late 2023 and early 2024 frequently centered on how Petrobras' pricing strategy for diesel could impact the broader inflation index, given its significance in the supply chain.

- ICMS Impact: State-level ICMS rates are a significant component of fuel prices, with variations across Brazil directly affecting consumer costs.

- Regulatory Framework: Petrobras operates under government oversight that shapes pricing policies, aiming to balance market dynamics with public interest objectives.

- Inflationary Concerns: Pricing decisions, particularly for essential fuels like diesel, are closely scrutinized for their potential impact on national inflation rates.

Petrobras' pricing strategy balances international market influences with domestic needs, aiming for stability rather than strict parity. This approach was evident in early 2024 with diesel price adjustments to cushion consumers from global price surges.

New natural gas pricing, including volume-based discounts for distributors, was introduced in early 2024 to compete with imported LNG, making Petrobras' offerings more attractive.

The company closely monitors market demand, competitor pricing, and its own costs for refined products like gasoline and diesel to maintain competitiveness and profitability.

Petrobras' pricing directly impacts shareholder value, as seen in its substantial dividend payouts, such as the R$1.54 per share announced for the first half of 2024, which are supported by strong financial performance, including a Q1 2024 net income of R$23.7 billion.

| Pricing Factor | 2024 Impact/Strategy | Financial Implication |

|---|---|---|

| Global Oil Prices | Adjustments to mitigate consumer impact (e.g., diesel in early 2024) | Influences revenue and profitability |

| Natural Gas Contracts | Volume discounts for distributors (early 2024) | Enhances market share and revenue stability |

| Refined Product Markets | Monitoring demand, competition, and costs | Ensures competitive edge and operational margins |

| Shareholder Returns | Dividend payouts linked to profitability | R$1.54/share (H1 2024) dividend reflects pricing success |

4P's Marketing Mix Analysis Data Sources

Our Petrobras 4P's Marketing Mix Analysis is meticulously constructed using a blend of official company disclosures, including annual reports and investor presentations, alongside industry-specific market research and competitive intelligence. This ensures a comprehensive understanding of Petrobras's product offerings, pricing strategies, distribution networks, and promotional activities.