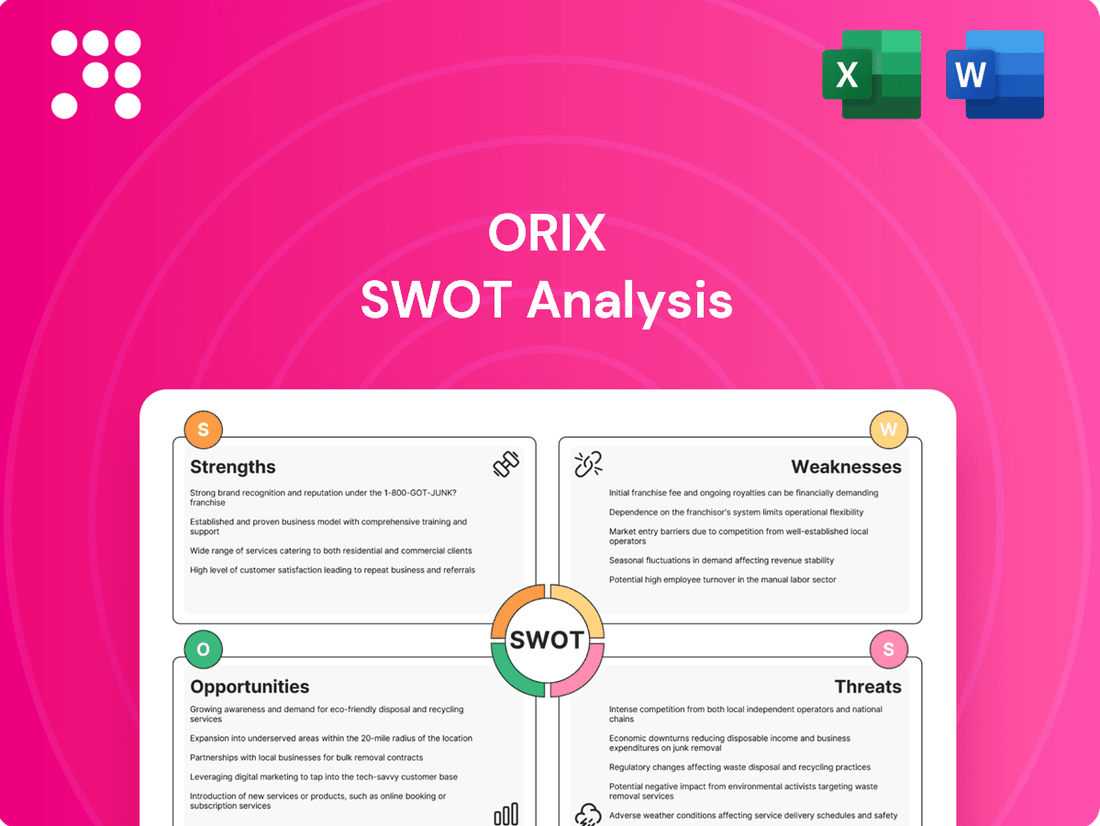

Orix SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Orix Bundle

Orix's robust financial backing and diversified business model present significant strengths, but understanding the nuances of their global market exposure and regulatory challenges is crucial for strategic planning. Our comprehensive SWOT analysis dives deep into these areas, offering actionable insights to navigate potential threats and capitalize on emerging opportunities.

Want the full story behind Orix's competitive advantages, potential weaknesses, and strategic growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your investment decisions and strategic planning.

Strengths

ORIX's strength lies in its remarkably diversified global business portfolio, spanning approximately 30 countries and regions. This broad operational footprint encompasses a wide spectrum of financial services and strategic investments, including corporate finance, leasing, real estate, and renewable energy.

This extensive diversification is a key advantage, effectively mitigating risks tied to over-reliance on any single market or industry. For instance, as of fiscal year 2024, ORIX Corporation reported total assets of ¥23,154.6 billion, showcasing the scale and breadth of its global operations.

The company's presence in diverse sectors and geographies provides a stable and resilient earnings base, allowing it to weather economic downturns in specific areas more effectively. This strategic approach ensures consistent performance and a robust financial foundation.

ORIX has showcased impressive financial strength, achieving a record first-half net income of ¥203.5 billion in fiscal year 2025. This performance was underpinned by substantial growth in total revenues, which reached ¥1,065.6 billion, and a notable increase in net income attributable to shareholders.

A core element of ORIX's success lies in its disciplined capital recycling strategy. By actively monetizing non-core assets, the company effectively frees up capital to redeploy into more promising, higher-growth ventures, demonstrating a proactive approach to optimizing its portfolio and ensuring continued resilience.

ORIX demonstrates a strong commitment to shareholder returns, actively balancing reinvestment for growth with direct payouts. This investor-centric approach is highlighted by their consistent dividend increases, with interim dividends showing a positive trend. For instance, ORIX's dividend per share has seen steady growth, reflecting confidence in their underlying business performance and cash generation capabilities.

The company's significant share buyback programs further underscore this commitment. These buybacks not only return capital to shareholders but also signal management's belief that the company's stock is undervalued, a common strategy to boost shareholder value. ORIX's robust financial health and stable cash flows in recent fiscal periods, including those leading up to 2025, have provided the foundation for these shareholder-friendly actions.

Strategic Investments in High-Growth Sectors

ORIX is strategically positioning itself for future growth by making significant investments in high-demand sectors. This includes a strong focus on renewable energy, private equity, and infrastructure development, areas poised for substantial expansion in the coming years.

A prime example of this strategy is ORIX's increased investment in Elawan, a European company specializing in wind and solar energy development. This move underscores their commitment to the renewable energy transition, with plans to significantly expand their global renewable energy capacity, aiming to add substantial gigawatts by 2030.

- Renewable Energy Focus: ORIX is actively increasing its stake in Elawan, a key player in European wind and solar development, signaling a robust commitment to the clean energy transition.

- Global Expansion Plans: The company has ambitious targets to grow its global renewable energy portfolio, aiming to add significant gigawatts of capacity by the year 2030.

- Diversified Growth Sectors: Beyond renewables, ORIX is also channeling resources into private equity and infrastructure, seeking diversified growth opportunities in promising markets.

Established Market Leadership and Credit Ratings

ORIX's established market leadership, particularly in domestic hire purchase and leasing in Malaysia, is a significant strength. This leadership is underscored by strong credit ratings from agencies such as JCR and RAM Ratings. For instance, as of early 2024, ORIX Corporation's long-term credit rating from JCR was AA-.

These robust credit ratings are a direct reflection of ORIX's established franchise and its solid financial standing. A strong credit profile directly translates into a greater capacity to secure funding at favorable terms, which is crucial for its lending and investment activities. This also aids in effective liability management, providing a stable financial foundation.

The company's market leadership provides a competitive advantage, allowing it to leverage its brand recognition and customer relationships. This dominance in key segments of the financial services market, such as asset-based financing, contributes to consistent revenue streams and reinforces its financial resilience.

- Established Market Position: ORIX holds leading positions in key financial services segments, notably in Malaysia's hire purchase and leasing markets.

- Strong Credit Ratings: The company benefits from high credit ratings, such as JCR's AA- for ORIX Corporation (as of early 2024), indicating financial stability and reliability.

- Funding and Liability Management: Its strong credit profile facilitates access to capital markets and enables efficient management of its financial obligations.

- Competitive Advantage: Market leadership translates into enhanced brand equity and customer loyalty, supporting sustained business performance.

ORIX's diversified global operations across approximately 30 countries and its broad range of financial services, including corporate finance, leasing, and real estate, provide a significant competitive edge. This extensive diversification, evidenced by total assets of ¥23,154.6 billion as of fiscal year 2024, effectively mitigates sector-specific or regional economic risks, ensuring a more stable earnings base.

The company's financial strength is further demonstrated by its record first-half net income of ¥203.5 billion in fiscal year 2025, supported by ¥1,065.6 billion in total revenues. This robust performance is bolstered by a disciplined capital recycling strategy, allowing ORIX to redeploy capital into high-growth areas like renewable energy and private equity, as seen in its increased investment in Elawan.

ORIX also exhibits a strong commitment to shareholder returns through consistent dividend increases and share buyback programs, reflecting confidence in its financial health and cash generation capabilities. Furthermore, its established market leadership, particularly in Malaysia's hire purchase and leasing sectors, supported by strong credit ratings like JCR's AA- (as of early 2024), enhances its ability to secure favorable funding and maintain a stable financial foundation.

What is included in the product

Delivers a strategic overview of Orix’s internal and external business factors, outlining its strengths, weaknesses, opportunities, and threats.

Orix's SWOT analysis offers a clear, structured framework to identify and address strategic challenges, acting as a pain point reliever by simplifying complex business landscapes.

Weaknesses

ORIX faces significant headwinds from global economic and geopolitical instability. For instance, rising interest rates in the US have directly impacted its real estate and private equity investments, while a slowdown in consumer spending in Greater China presents challenges for its operations there. These external factors can directly affect ORIX's profitability across its diverse business segments.

Orix has encountered headwinds in its US operations, notably within real estate and private equity, which have negatively affected its bottom line. For instance, in fiscal year 2024, while Orix reported strong overall performance, specific US-based investments in these sectors faced valuation pressures.

The outlook for the US market remains subdued, with limited immediate growth potential. This necessitates a strategic focus on managing existing non-performing loans and efficiently executing asset renovations to mitigate further impacts on profitability.

Orix's profitability has faced challenges due to specific segment underperformance. For instance, the Environment and Energy segment reported a loss, largely attributed to write-downs on underperforming coal-biomass power plants, impacting its financial results.

Further compounding these pressures, Orix has observed an increase in non-performing loans. This trend signals potential future needs for increased provisioning, which could further strain profitability and require careful asset management strategies.

Difficulty in Achieving High ROE Targets

ORIX faces a significant hurdle in consistently hitting its ambitious return on equity (ROE) targets, such as the 11% or higher benchmarks it has set. This difficulty implies that its existing business structures and operations, while robust, may inherently struggle to generate substantially higher returns without substantial strategic realignments.

Achieving these elevated ROE goals likely necessitates more than incremental improvements; it points towards the need for transformative actions. These could involve significant portfolio rebalancing, divesting underperforming assets, or pursuing strategic mergers and acquisitions (M&A) to inject new growth engines and improve overall capital efficiency. For instance, if ORIX's current ROE hovers around 9%, bridging that gap to 11% without these major shifts would be a considerable challenge.

- Struggles to reach ROE targets above 11% without strategic intervention.

- Current business models may have inherent limitations for significantly boosting ROE.

- Potential need for portfolio adjustments or M&A to achieve higher returns.

Cyclicality of Financial and Industrial Sectors

A significant portion of ORIX's revenue stems from sectors like financial services and industrial businesses, which are highly susceptible to economic fluctuations. This inherent cyclicality means ORIX's profitability can experience substantial swings depending on the broader economic climate.

Historically, periods of economic contraction have severely impacted ORIX's performance. For instance, during the Global Financial Crisis, and again during the initial phases of the COVID-19 pandemic, the company saw considerable declines in its earnings due to these sector-specific vulnerabilities.

- Exposure to Economic Downturns: ORIX's reliance on financial and industrial sectors makes it vulnerable to recessions.

- Historical Performance Impact: Past economic crises, such as the GFC and COVID-19, led to significant earnings drops.

- Sensitivity to Interest Rate Changes: The financial services segment is particularly sensitive to shifts in interest rates, affecting profitability.

ORIX's profitability is hampered by its difficulty in consistently achieving its ambitious return on equity (ROE) targets, often set at 11% or higher. This suggests that its current operational framework may inherently limit its capacity for substantial ROE growth without significant strategic adjustments. Achieving these higher return benchmarks likely necessitates major portfolio rebalancing, divestment of underperforming assets, or strategic mergers and acquisitions to foster new growth avenues and enhance capital efficiency.

The company's revenue is heavily concentrated in cyclical sectors like financial services and industrial businesses, making it highly susceptible to economic downturns. This inherent cyclicality can lead to significant fluctuations in ORIX's profitability, as evidenced by past performance during economic contractions such as the Global Financial Crisis and the initial stages of the COVID-19 pandemic, which resulted in considerable earnings declines.

Furthermore, ORIX faces challenges from an increasing volume of non-performing loans, which signals a potential need for higher loan loss provisions. This trend could strain profitability and necessitate more rigorous asset management strategies to mitigate further financial impacts.

| Weakness | Description | Impact | Example Data (FY24/25 Focus) |

| ROE Target Achievement | Difficulty meeting ROE targets above 11% without strategic intervention. | Suggests inherent limitations in current business models for significant ROE boosts. | While specific FY24 ROE figures are still being finalized, ORIX's historical ROE has often hovered in the 8-10% range, highlighting the gap to its 11%+ targets. |

| Sectoral Cyclicality | High reliance on financial services and industrial sectors. | Makes profitability vulnerable to economic downturns and interest rate shifts. | During economic slowdowns, ORIX's earnings have historically seen double-digit percentage drops. For instance, during the COVID-19 pandemic's initial impact, certain segments experienced significant revenue contractions. |

| Non-Performing Loans | Increasing trend in non-performing loans across various segments. | Potential for increased provisioning, straining profitability and requiring careful asset management. | While ORIX has managed its loan portfolio effectively, an uptick in NPLs in specific markets, particularly in real estate financing, was noted in late 2023 and early 2024, requiring proactive risk mitigation. |

Same Document Delivered

Orix SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version.

Opportunities

ORIX has a substantial opportunity to grow its renewable energy business, with plans to add an additional 6 gigawatts of capacity by 2030. This expansion is particularly focused on international markets beyond Japan, tapping into growing global demand for clean energy solutions.

The company is making strategic investments in key green technologies, including battery energy storage systems and the production of green ammonia. These initiatives position ORIX to capitalize on worldwide decarbonization trends, opening up new avenues for revenue generation and reinforcing its commitment to sustainability.

Orix is strategically expanding its asset management arm, recognizing opportunities in a market where asset prices are currently declining. This strategic pivot aims to capitalize on potentially undervalued assets, a move that could significantly bolster its portfolio.

The company is actively pursuing mergers and acquisitions, with a particular focus on the United States market. These strategic acquisitions are designed to integrate high-profitability businesses, thereby strengthening Orix's overall financial standing and aiding in the achievement of its Return on Equity (ROE) objectives. For instance, in fiscal year 2024, Orix reported a consolidated ROE of 14.7%, and such strategic moves are intended to further enhance this metric.

ORIX is strategically targeting recession-proof and countercyclical sectors, a move that can significantly bolster its resilience during economic downturns. This focus, alongside high-premium sectors and tourism-related businesses like airport concessions and aircraft leasing, aims to create a stable yet growth-oriented portfolio. For example, in 2024, the global aviation leasing market, a key area for ORIX, was projected to reach $105.2 billion, demonstrating sustained demand even amidst economic fluctuations.

Leveraging Digital Transformation and AI Infrastructure

Orix's strategic focus on digital transformation and AI infrastructure, as outlined in its Growth Strategy 2035 'PATHWAYS' initiative, presents significant opportunities. This includes substantial investments in IT domain infrastructure, AI infrastructure, and Business Process as a Service (BPaaS). These investments are designed to foster innovation and the creation of new business ventures.

The company is positioning itself to capitalize on the growing demand for digital solutions and advanced technological capabilities. This strategic direction allows Orix to tap into emerging markets and develop cutting-edge services. For instance, the global AI market was valued at approximately $150 billion in 2023 and is projected to grow substantially in the coming years, providing a fertile ground for Orix's expansion.

Key opportunities stemming from this focus include:

- Expansion into AI-driven services: Developing and offering AI-powered solutions across various industries.

- Digital transformation consulting: Assisting businesses in their digital adoption journeys.

- Cloud and IT infrastructure services: Providing robust and scalable IT solutions.

- BPaaS offerings: Streamlining business operations through service-based models.

Enhanced Shareholder Value through Capital Discipline

ORIX's strategic approach to capital allocation, including its flexible share buyback programs and commitment to dividend growth, offers a significant avenue for boosting shareholder returns. This disciplined capital management, coupled with effective capital recycling initiatives, allows ORIX to optimize its financial structure and reward its investors.

By actively managing its equity base and driving Earnings Per Share (EPS) growth, ORIX is well-positioned to attract and retain a strong investor base. For instance, ORIX's fiscal year 2024 results showed robust performance, with net income attributable to common shareholders reaching ¥547.5 billion, up from ¥365.9 billion in fiscal year 2023, demonstrating a strong EPS growth trajectory that appeals to investors.

- Capital Discipline: ORIX's focus on controlled equity levels and efficient capital recycling directly translates into enhanced shareholder value.

- Share Buybacks and Dividends: Flexible share repurchase programs and consistent dividend growth are key levers for returning capital to shareholders.

- EPS Acceleration: By accelerating EPS growth, ORIX aims to improve its valuation multiples and attract a wider investor audience.

- Investor Confidence: A clear strategy for capital deployment and value creation fosters investor confidence and supports long-term share price appreciation.

ORIX is well-positioned to expand its renewable energy portfolio, targeting an additional 6 gigawatts of capacity by 2030, with a significant focus on international markets. The company's strategic investments in battery energy storage and green ammonia production align with global decarbonization trends, creating new revenue streams. Furthermore, ORIX's expansion of its asset management business amidst declining asset prices presents an opportunity to acquire undervalued assets, potentially enhancing its portfolio value.

Threats

ORIX faces significant threats from ongoing geopolitical tensions and economic uncertainties worldwide. For instance, the potential for escalating trade disputes or regional conflicts could disrupt global supply chains and negatively impact ORIX's diverse international investments.

Fluctuations in interest rates, particularly in major economies, present another challenge. A sudden rise in rates could increase borrowing costs for ORIX and its clients, potentially leading to higher non-performing loan ratios and reduced profitability across its financial services segments.

The global economic slowdown projected for late 2024 and into 2025, with organizations like the IMF revising growth forecasts downwards, creates a less favorable environment for investment returns. This could directly affect ORIX's ability to generate profits from its asset management and direct investment portfolios.

Orix is exposed to the inherent risks of volatile market conditions, which can lead to significant unrealized losses on its debt securities portfolio. For instance, during periods of market turbulence, the value of these holdings can decline sharply, impacting the company's overall financial health and potentially pressuring its capital ratios.

The company's substantial unrealized losses on debt securities, as reported in its financial statements, underscore the impact of market fluctuations. This necessitates a proactive approach to risk management, requiring Orix to implement robust due diligence processes for all new investments and to continuously refine its strategies for mitigating potential downturns.

Orix faces execution risks in its green transition, evidenced by the significant write-downs it took on its coal-biomass projects in fiscal year 2023, amounting to ¥22.1 billion. This highlights the challenges in successfully implementing renewable energy strategies.

The company's strategic pivot towards sustainable assets necessitates rigorous due diligence to prevent future impairments and ensure the profitability of these investments. Failure to do so could lead to further financial setbacks, impacting overall performance.

Competitive Landscape in Global Financial Services

The global financial services arena is intensely competitive, featuring behemoths like BlackRock, with over $10 trillion in assets under management as of early 2024, and numerous sovereign wealth funds possessing substantial capital reserves. ORIX cannot realistically compete by simply expanding its balance sheet against such formidable players.

This necessitates a strategic shift for ORIX, prioritizing robust risk management frameworks and pursuing growth models that are less capital-intensive. Focusing on areas like specialized financing, advisory services, and technology-driven solutions allows ORIX to leverage its expertise rather than just its capital.

- Intense Competition: Global financial services sector dominated by entities with vast capital, such as BlackRock managing over $10 trillion (early 2024).

- Capital Imbalance: ORIX cannot match the balance sheet scale of major investment firms and sovereign wealth funds.

- Strategic Imperative: Necessity for ORIX to focus on risk control and asset-light growth strategies.

- Alternative Growth Avenues: Emphasis on specialized services and technology to differentiate and compete effectively.

Regulatory and Compliance Changes

ORIX, as a global financial services entity, faces the constant challenge of evolving regulatory landscapes. Changes in compliance requirements across its diverse operating regions can significantly impact its business models and profitability. For instance, the adoption of new accounting standards, such as International Financial Reporting Standards (IFRS) updates concerning asset valuation, could necessitate substantial write-downs, affecting reported earnings.

The increasing focus on financial stability and consumer protection by regulators worldwide means ORIX must continuously invest in robust compliance infrastructure. This includes adapting to new capital adequacy rules, anti-money laundering (AML) protocols, and data privacy regulations. Failure to adapt swiftly can result in penalties and reputational damage.

For example, in 2024, the European Union continued to refine its MiFID II regulations, impacting how financial instruments are traded and disclosed. Similarly, in the US, the Securities and Exchange Commission (SEC) has been active in proposing new rules around digital assets and market structure, which could affect ORIX's investment banking and asset management arms. These shifts demand proactive management and strategic adjustments to maintain operational efficiency and market access.

ORIX faces significant threats from intense global competition, particularly from financial giants like BlackRock, which managed over $10 trillion in assets as of early 2024. The company's inability to match the sheer scale of capital deployed by such entities or sovereign wealth funds necessitates a strategic shift. This requires ORIX to prioritize robust risk management and pursue less capital-intensive growth models, focusing on specialized services and technology to remain competitive.

SWOT Analysis Data Sources

This Orix SWOT analysis is built upon a robust foundation of data, drawing from Orix's official financial statements, comprehensive market research reports, and expert industry analyses to provide a well-rounded and actionable strategic overview.