Orix Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Orix Bundle

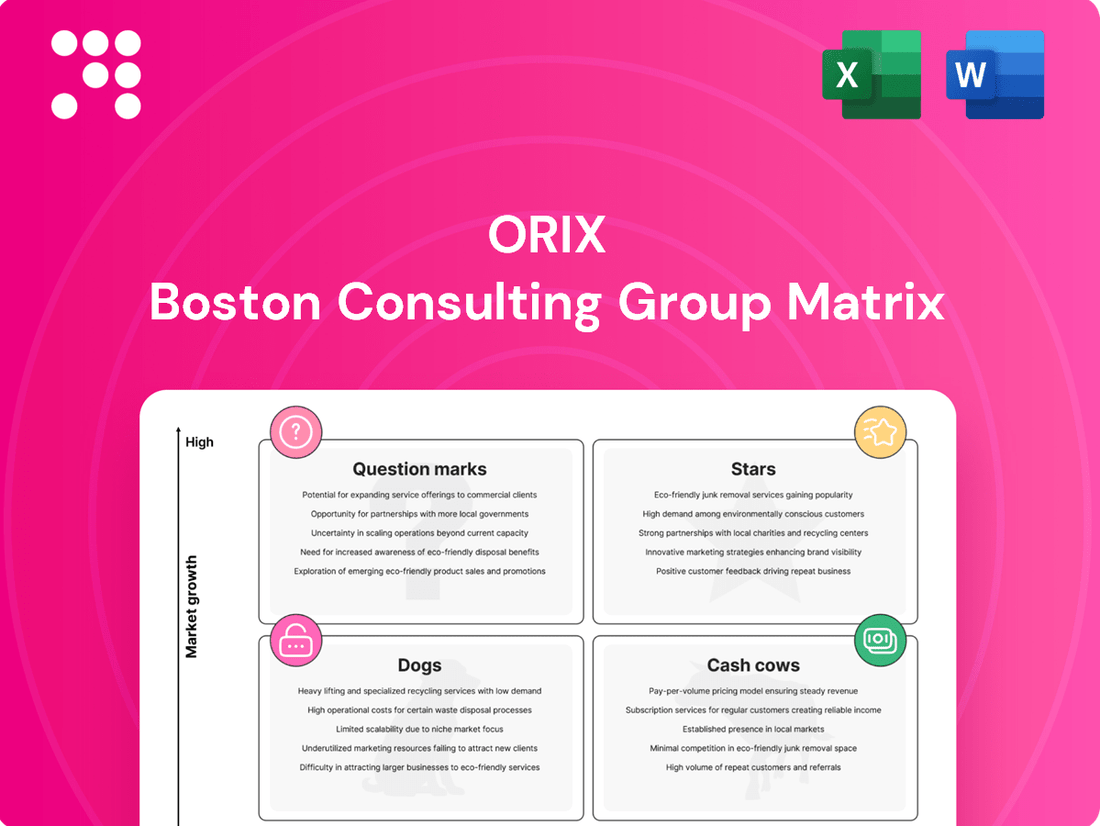

The Orix BCG Matrix offers a powerful framework to understand your company's product portfolio, categorizing them as Stars, Cash Cows, Dogs, or Question Marks. This initial glimpse highlights key areas for strategic focus, but imagine unlocking the full potential by seeing precisely where each product fits and what actions to take. Purchase the complete BCG Matrix for a detailed breakdown and actionable insights to optimize your investments and drive growth.

Stars

ORIX's Private Equity and Concession segment experienced robust expansion, posting a 125% profit increase to ¥98.9 billion in fiscal year 2025.

This impressive performance was driven by strategic divestitures of assets and substantial equity income generated from its concession portfolio, notably Kansai Airports.

This segment underscores ORIX's adeptness in identifying and capitalizing on opportunities within the infrastructure investment landscape.

The Aircraft and Ships Leasing segment is a strong performer, showing significant growth. In fiscal year 2025, this sector saw a remarkable 52% surge in profits, reaching ¥67.4 billion.

This impressive financial uptick is largely attributed to increased operating lease revenues generated by newly acquired subsidiaries. Furthermore, robust global demand for transportation equipment has significantly boosted the segment's performance.

ORIX is actively expanding its renewable energy portfolio, with a significant focus on hydropower in Spain. This strategic acquisition aligns with the company's commitment to clean energy solutions and addresses the increasing global need for sustainable power sources.

In 2024, Spain continued its strong push towards renewable energy, with solar and wind power leading the charge. Hydropower, while a more established source, remains crucial for grid stability and energy security, making ORIX's investment in Spanish hydropower assets particularly timely.

The Spanish government has set ambitious targets for renewable energy generation, aiming for a substantial increase in the share of renewables in its energy mix by 2030. ORIX's investments are well-positioned to benefit from these supportive policies and the overall growth trajectory of the Spanish renewable energy market.

Asset Management Expansion

ORIX is strategically targeting significant growth in its asset management segment, a move that positions it as a potential star in the BCG matrix. The company has set ambitious targets for fiscal year 2025, aiming to more than double its assets under management (AUM) to ¥100 trillion. This aggressive expansion plan signals a strong belief in the future profitability and market share potential of this business line.

The financial projections underscore this confidence, with ORIX targeting a pretax profit of ¥553.7 billion from its asset management operations in fiscal year 2025. Such a substantial profit target, coupled with the AUM goal, suggests that ORIX views asset management as a key engine for future revenue and earnings growth. This focus is crucial for a company looking to diversify and strengthen its overall financial performance.

Key aspects of ORIX's asset management expansion include:

- Target AUM: Aiming for ¥100 trillion in assets under management by fiscal year 2025.

- Profit Goal: Targeting a pretax profit of ¥553.7 billion for the asset management segment in fiscal year 2025.

- Strategic Focus: Identifying asset management as a high-growth area requiring significant investment and strategic attention.

- Market Opportunity: Leveraging market trends and opportunities to capture a larger share of the asset management industry.

Infrastructure and Public Finance (USA)

ORIX USA's Infrastructure and Public Finance group is a significant player in providing essential capital. They focus on critical sectors like infrastructure, education, and affordable housing within the United States, offering tailored financial solutions.

This segment has demonstrated robust growth, evidenced by over $11 billion in total commitments since its inception in 2009. Their strategy encompasses both tax-exempt and taxable financing avenues, highlighting a comprehensive approach to market needs.

- Capital Deployment: Over $11 billion in total commitments since 2009.

- Sector Focus: Infrastructure, education, and affordable housing.

- Financing Approach: Expertise in both tax-exempt and taxable opportunities.

- Market Position: Demonstrates strong growth potential within the U.S. public finance landscape.

ORIX's asset management segment is positioned as a potential Star in the BCG Matrix, exhibiting high growth potential and a strong market outlook.

The company aims to more than double its assets under management (AUM) to ¥100 trillion by fiscal year 2025, indicating aggressive expansion plans.

This segment is projected to generate a pretax profit of ¥553.7 billion in fiscal year 2025, underscoring its anticipated contribution to ORIX's overall earnings.

This strategic focus on asset management signifies ORIX's commitment to capturing a larger share of a growing industry.

| Segment | FY2025 Profit (¥ billion) | Growth Driver | BCG Classification |

|---|---|---|---|

| Private Equity and Concession | 98.9 (+125%) | Divestitures, Kansai Airports income | Question Mark/Star |

| Aircraft and Ships Leasing | 67.4 (+52%) | New subsidiaries, global demand | Star |

| Asset Management | 553.7 (Target) | AUM growth to ¥100T | Star |

What is included in the product

Strategic allocation of resources by categorizing business units into Stars, Cash Cows, Question Marks, and Dogs.

Visualizes portfolio health, easing strategic decision-making by identifying areas needing investment or divestment.

Cash Cows

Corporate Financial Services and Maintenance Leasing represent ORIX's Cash Cows, consistently delivering robust profits and a reliable earnings foundation. This segment thrives on its diverse offerings, including financing, fee-based services, and extensive leasing and rental operations for automobiles and vital ICT equipment.

ORIX's real estate operations, encompassing development, rentals, management, and facility services, consistently demonstrate robust profitability. This segment acts as a significant cash cow for the company, generating substantial returns from established and well-managed assets.

In fiscal year 2024, ORIX's real estate segment reported a segment profit of ¥194.3 billion, marking a notable increase and underscoring its role as a stable income generator. This growth reflects the maturity and consistent performance of its real estate portfolio.

ORIX's life insurance business is a prime example of a Cash Cow within its portfolio. In fiscal year 2024, this segment demonstrated robust financial health, with segment profits showing a notable increase. This consistent profitability underscores the mature and stable nature of the life insurance market where ORIX has established a strong and enduring presence.

Established Lending and Investment Portfolios

ORIX's established lending and investment portfolios function as its Cash Cows within the BCG Matrix framework. These segments represent mature businesses with significant market share and low growth prospects, generating substantial and consistent profits.

The company's strategy involves leveraging these stable income streams to fund investments in higher-growth areas. For instance, ORIX's real estate lending portfolio, a significant contributor, has demonstrated resilience. As of the fiscal year ending March 31, 2024, ORIX reported robust performance in its Financial Services segment, which encompasses many of these established lending activities, contributing significantly to overall profitability.

- Diversified Assets: ORIX's portfolio includes a mix of lending, investment banking, and asset management, providing stable cash flows.

- Profit Accretion: Many assets are immediately accretive to profits, ensuring consistent earnings.

- Long-Term Holdings: Other assets are held for long-term capital appreciation, contributing to future growth.

- 2024 Performance: The Financial Services segment, a core Cash Cow area, showed strong financial results in the fiscal year ending March 2024, underscoring its reliable profit generation.

Banking and Credit Services

The Banking and Credit Services segment for ORIX has shown robust performance, with segment profits increasing. This growth highlights a strong market position and a consistent ability to generate substantial cash flow for the company.

This segment is crucial as it offers fundamental financial services that contribute significantly to ORIX's overall stable earnings. For instance, in the fiscal year ending March 2024, ORIX reported a consolidated net profit attributable to owners of the parent of ¥320.7 billion, with its banking and credit businesses playing a vital role in this achievement.

- Increased Segment Profits: Demonstrates a healthy financial performance and market competitiveness.

- Strong Market Position: Indicates ORIX's established presence and influence within the banking and credit sectors.

- Consistent Cash Generation: Reflects the reliable income stream from these core financial operations.

- Essential Financial Services: Underpins ORIX's diversified business model and contributes to stable earnings.

ORIX's established lending and investment portfolios, alongside its banking and credit services, act as its primary Cash Cows. These mature businesses, characterized by significant market share and lower growth prospects, consistently generate substantial and reliable profits.

In fiscal year 2024, ORIX's Financial Services segment, which encompasses many of these lending activities, demonstrated robust performance. This segment's strong financial results, contributing significantly to the company's overall profitability, underscore its role as a dependable income generator.

The company strategically utilizes these stable cash flows to fuel investments in higher-growth ventures. For instance, the real estate segment, another key Cash Cow, reported a segment profit of ¥194.3 billion in fiscal year 2024, reflecting its mature and consistent income-generating capabilities.

| Segment | FY2024 Profit (¥ billion) | Contribution to Stability |

|---|---|---|

| Real Estate | 194.3 | Mature assets, consistent rental income |

| Financial Services (Lending & Investment) | Significant contributor | Established portfolios, reliable earnings |

| Banking & Credit Services | Increased segment profits | Strong market position, consistent cash generation |

What You See Is What You Get

Orix BCG Matrix

The Orix BCG Matrix document you are currently previewing is the exact, fully formatted report you will receive immediately after purchase. This comprehensive analysis tool, designed for strategic decision-making, will be delivered to you without any watermarks or demo content, ready for immediate application in your business planning.

Dogs

Underperforming coal-biomass power plants in the Environment and Energy segment are a significant drag on profitability, as evidenced by the ¥4.9 billion loss recorded in fiscal year 2025. This loss was largely driven by ¥25.9 billion in write-downs specifically allocated to these struggling assets.

These plants represent a classic 'dog' in the BCG matrix, characterized by low market share and low growth prospects. Their continued underperformance suggests they are unlikely to generate substantial future returns, making them prime candidates for divestiture or a complete overhaul.

ORIX USA and ORIX Europe operations, while generally performing well, experienced a dip in segment profits during fiscal year 2024. This decline, though not indicative of a fundamental weakness, suggests areas for strategic review within the ORIX BCG Matrix framework.

Specifically, ORIX USA's real estate and private equity sectors encountered headwinds in the second quarter of fiscal year 2025. These challenges directly impacted the segment's overall profitability, highlighting the need for a closer examination of these specific business units' market positioning and performance metrics.

Non-performing installment loans, a critical component within the ORIX BCG Matrix, highlight areas of concern for the company. ORIX saw a significant 132% increase in these problematic loans, totaling ¥79.1 billion. This substantial rise directly impacts future provisioning requirements and signals potential challenges in capital deployment.

These non-performing loans represent capital that is effectively frozen, generating little to no return for ORIX. Such a situation strongly suggests that the company needs to implement more stringent credit assessment processes. Tightening credit criteria is essential to mitigate future risks and improve the overall quality of ORIX's loan portfolio.

Sluggish Investments in Greater China

ORIX is adopting a cautious stance on new investments within Greater China, primarily driven by concerns over a subdued consumer spending environment and significant headwinds in the real estate sector. These factors contribute to a landscape characterized by limited growth prospects.

The current economic climate in Greater China suggests that investments in this region may face challenges, potentially leading to cash traps where capital is tied up without generating substantial returns. This cautious outlook is informed by recent economic indicators.

- Sluggish Consumer Spending: Retail sales growth in China has shown signs of deceleration, with year-on-year growth rates fluctuating. For instance, in early 2024, retail sales growth experienced a noticeable slowdown compared to previous periods, impacting demand for various goods and services.

- Real Estate Market Woes: The property sector continues to grapple with significant issues, including developer defaults and declining property sales. In 2024, the volume of commercial property transactions in major Chinese cities remained depressed, signaling a challenging environment for real estate-related investments.

- Low Growth Prospects: The International Monetary Fund (IMF) projected China's GDP growth to be around 4.6% for 2024, a figure that, while positive, reflects a moderating growth trajectory compared to historical highs, particularly in light of domestic economic pressures.

- Potential Cash Traps: Investments in sectors heavily reliant on consumer discretionary spending or the real estate market may experience prolonged periods of low returns, making it difficult to divest or realize capital efficiently.

Legacy Low-Growth Leasing Assets

Within ORIX's diverse portfolio, certain legacy leasing assets situated in markets experiencing sluggish growth could be classified as dogs if they haven't been modernized or broadened. These might represent older equipment leasing or less dynamic regional operations that haven't kept pace with evolving market demands.

For instance, while ORIX has seen significant success with its automotive leasing segment in India, reporting substantial year-over-year revenue growth in 2024, older, less adaptable leasing portfolios in mature or declining industries might struggle to generate competitive returns.

- Legacy Assets: Older, established leasing contracts in slow-growth sectors.

- Market Stagnation: Operations in regions with limited economic expansion or declining demand for specific leased assets.

- Diversification Need: Portfolios that lack exposure to newer, high-growth leasing areas like electric vehicle leasing or specialized industrial equipment.

- Strategic Shift: ORIX's ongoing efforts to reallocate resources towards more promising segments, potentially divesting or restructuring underperforming legacy operations.

Dogs in ORIX's portfolio are business units with low market share and low growth potential, demanding careful management to avoid becoming a drain on resources. The underperforming coal-biomass power plants, which incurred a ¥4.9 billion loss in fiscal year 2025 due to ¥25.9 billion in write-downs, exemplify this category. Similarly, non-performing installment loans, which surged by 132% to ¥79.1 billion in 2024, represent frozen capital with minimal returns, necessitating stricter credit assessments.

The cautious investment stance in Greater China, driven by subdued consumer spending and real estate headwinds, also points to potential dog-like characteristics in related ventures, with limited growth prospects and a risk of cash traps. ORIX's strategy involves identifying and addressing these underperformers, whether through divestiture, restructuring, or improved operational efficiency, to optimize its overall business matrix.

Question Marks

The Indian automotive leasing market is poised for substantial expansion, with ORIX Corporation India Ltd. projecting a jump from its current 2% to 7-8% of total vehicle sales within the next 5 to 7 years. This indicates a strong growth trajectory for the segment.

While the potential is high, the current low market share means significant investment will be necessary for companies like ORIX to establish a dominant position. This scenario aligns with the characteristics of a question mark in the BCG matrix, demanding strategic decisions regarding resource allocation.

ORIX is strategically increasing its focus on new greenfield investment initiatives, recognizing their potential for long-term growth. These ventures involve building operations from the ground up in emerging, high-growth sectors, demanding significant initial capital outlay before profitability is achieved.

For instance, in 2024, ORIX's commitment to greenfield projects is evident in its substantial investments in renewable energy infrastructure and advanced technology manufacturing. These sectors, while requiring patience for returns, are projected to offer substantial upside as global demand accelerates.

ORIX's investment in Space One's October 2024 Series A funding round, reportedly reaching $100 million, signals a strategic move into the emerging space technology sector. This aligns with the BCG matrix's concept of 'question marks,' representing high-growth potential but uncertain market positions.

Companies like Space One, focused on areas such as satellite launch services, demand substantial capital for research, development, and infrastructure. ORIX's commitment reflects a belief in the long-term disruptive capabilities of such technologies, even if immediate profitability is not guaranteed.

The challenge for ORIX is to nurture these 'question mark' investments, aiming to transform them into market leaders or 'stars.' This requires careful management and further capital injections to overcome the inherent risks and capitalize on the significant growth opportunities within the burgeoning space economy.

Strategic Acquisitions for High ROE

ORIX is strategically targeting mergers and acquisitions (M&A) to boost its Return on Equity (ROE) above its 11% goal. This involves acquiring companies with strong profitability and divesting underperforming assets. These potential acquisitions are classified as question marks, meaning their future success and integration into ORIX's portfolio are uncertain but promising.

The rationale behind this strategy is to actively manage the business portfolio, similar to how the BCG matrix analyzes products. Companies with high growth potential, but currently low market share or unproven integration, are the focus. ORIX aims to turn these question marks into stars or cash cows through effective management and strategic alignment.

For instance, if ORIX were to acquire a tech startup with innovative intellectual property but a nascent market presence, this would represent a question mark. The success hinges on ORIX's ability to scale the technology and capture market share. In 2024, many companies are exploring similar M&A strategies to navigate evolving market dynamics and achieve financial objectives.

- Strategic M&A: ORIX aims to acquire high-ROE businesses and divest low-ROE ones to meet its 11%+ ROE target.

- Question Mark Classification: Potential acquisitions are question marks due to unproven integration and performance, despite high growth prospects.

- Portfolio Management: This approach mirrors BCG matrix principles, focusing on nurturing high-potential but uncertain ventures.

- 2024 Context: M&A activity in 2024 reflects a broader trend of companies seeking strategic growth and portfolio optimization.

Early-Stage Private Equity Ventures

ORIX's early-stage private equity ventures, often targeting high-growth sectors like enterprise applications and infrastructure, are positioned as question marks in the BCG matrix. These investments demand substantial capital outlay for development and market penetration, mirroring the high cash consumption characteristic of this quadrant.

The success of these early-stage companies is uncertain; they require significant ongoing investment to achieve market traction and competitive advantage. For instance, ORIX Corporation USA's private equity arm actively seeks opportunities in technology and business services, areas known for their rapid evolution and high initial capital needs.

- High Cash Consumption: Early-stage ventures require significant funding for research, development, marketing, and scaling operations.

- Uncertain Future Growth: Their potential to become market leaders (stars) is not guaranteed and depends on market acceptance and competitive dynamics.

- Strategic Importance: These investments represent ORIX's commitment to fostering innovation and capturing future market share in emerging industries.

Question marks represent business units or investments with low market share but high growth potential. These ventures require significant investment to grow, and their future success is uncertain, making them a critical area for strategic evaluation.

ORIX's investments in emerging sectors like space technology and early-stage private equity exemplify question marks. These areas demand substantial capital for development and market entry, with the ultimate outcome of becoming market leaders or failing remaining unclear.

The challenge lies in deciding whether to invest more capital to try and turn these question marks into stars or to divest them before further resources are depleted. This strategic decision-making is crucial for portfolio optimization.

For instance, ORIX's $100 million investment in Space One's Series A funding in October 2024 highlights this dynamic. While the space sector offers high growth prospects, the market position and long-term viability of such ventures are still developing.

| BCG Matrix Quadrant | Characteristics | ORIX Examples | Strategic Consideration | 2024 Relevance |

|---|---|---|---|---|

| Question Marks | Low Market Share, High Market Growth | Space One (Space Tech), Early-Stage PE Ventures, Potential M&A Targets | Invest to gain market share or divest | Continued focus on high-growth, nascent industries |

| High Cash Consumption, Uncertain Future | Greenfield Investments in Renewable Energy | Requires careful monitoring and strategic capital allocation | Significant capital deployment in new initiatives | |

| Potential to become Stars or Dogs | Acquisition of tech startups with unproven market presence | Nurturing these ventures is key to future success | M&A activity driven by portfolio optimization |

BCG Matrix Data Sources

Our Orix BCG Matrix leverages comprehensive market data, including financial statements, industry growth rates, and competitor analysis, to accurately position business units.