Orix PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Orix Bundle

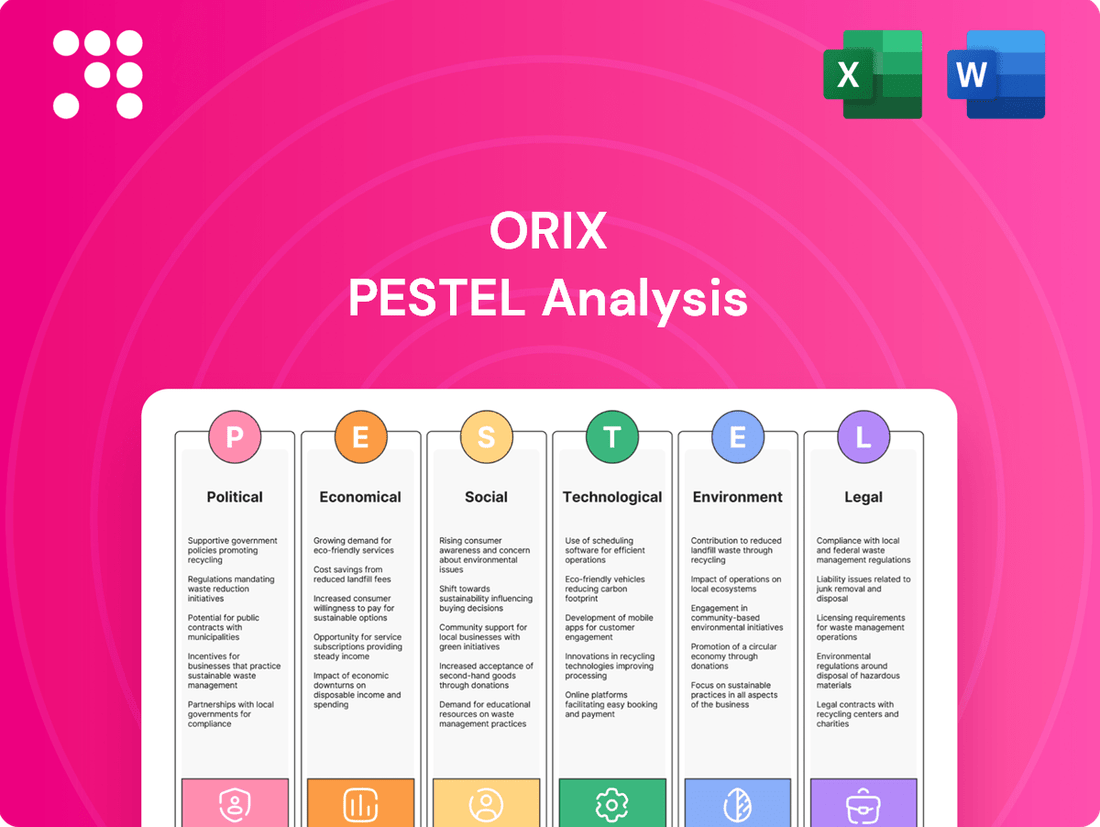

Unlock the strategic advantages Orix holds by understanding the political, economic, social, technological, legal, and environmental forces at play. Our PESTLE analysis provides a critical roadmap to navigating these external influences, empowering you to make informed decisions. Don't guess about Orix's future; know it. Download the full, expertly crafted PESTLE analysis now and gain the competitive edge.

Political factors

Changes in government financial regulations, including licensing requirements and capital adequacy rules, directly affect ORIX's diverse financial services operations. For instance, in 2024, many financial institutions globally faced increased scrutiny on their liquidity ratios, a trend likely to continue. Stricter oversight can elevate operational costs and necessitate adjustments to market entry strategies, impacting ORIX's profitability in lending and investment sectors.

ORIX's extensive global footprint, with significant operations in Asia, North America, and Europe, makes it vulnerable to geopolitical instability and evolving trade policies. For instance, the ongoing trade friction between the US and China, which intensified in recent years, can impact supply chains and investment flows relevant to ORIX's diverse business segments, including its real estate and infrastructure development arms.

Shifts in international relations and the imposition of sanctions, such as those seen in various global conflicts, can directly affect cross-border investment opportunities and the valuation of assets held by ORIX. In 2024, the global political landscape remains dynamic, with regional conflicts and trade disputes creating a complex operating environment that necessitates careful risk management for international businesses like ORIX.

ORIX, a major player in renewable energy, is significantly impacted by government backing for green projects. For instance, in 2024, many nations continued to offer tax credits and subsidies for solar and wind energy, with the US Inflation Reduction Act providing substantial long-term incentives that boost project viability.

These incentives directly influence ORIX's investment decisions by improving the financial returns on its sustainable infrastructure portfolio. Conversely, any rollback or reduction in these supportive policies, as seen in some European markets experiencing shifts in renewable energy subsidies in late 2023, could create uncertainty and potentially lower profitability for ORIX's green investments.

Taxation Policies

Taxation policies are a significant political factor for ORIX. Fluctuations in corporate tax rates, capital gains taxes, and other fiscal policies in its key operating jurisdictions directly impact ORIX's net income and investment returns. For instance, changes in corporate tax rates can alter the profitability of its various financial services and investment activities.

Recent fiscal reforms and international tax agreements also play a crucial role. For example, the US Tax Cuts and Jobs Act of 2017 significantly lowered the corporate tax rate, which would have had a material impact on companies with substantial US operations. While specific 2024/2025 data is still emerging, ORIX, with its global presence, is highly sensitive to such shifts. Changes in tax treaties or domestic tax reforms in countries like Japan, the US, and other major markets where ORIX operates can influence its financial structuring and overall profitability across its diverse business segments.

- Corporate Tax Rate Impact: Changes in corporate tax rates directly affect ORIX's bottom line. A higher rate reduces net income, while a lower rate can boost it.

- Capital Gains Tax Influence: Fluctuations in capital gains taxes can alter the attractiveness and returns of ORIX's investment portfolio.

- Global Tax Reforms: ORIX's international operations mean it's exposed to varying tax regimes and reforms, requiring constant adaptation of its financial strategies.

- Fiscal Policy Shifts: Broader fiscal policies, such as changes in tax incentives or deductions, can influence ORIX's investment decisions and the performance of its subsidiaries.

Public Policy on Infrastructure Development

Government spending and policy priorities significantly shape infrastructure development, directly impacting ORIX's investment strategies. For instance, the Japanese government's commitment to digital transformation and green infrastructure, as seen in its FY2024 budget allocating substantial funds to these areas, presents opportunities for ORIX's diverse portfolio. Public-private partnerships (PPPs) are a key mechanism, and ORIX's involvement in projects like the Kansai International Airport expansion highlights its engagement with these policy frameworks.

Increased government focus on modernizing infrastructure and developing smart cities, such as initiatives promoting renewable energy integration and resilient urban planning, creates new avenues for ORIX. Conversely, any slowdown in these government-driven initiatives or shifts in policy priorities could potentially constrain growth prospects for ORIX's infrastructure-related investments.

- Government Infrastructure Spending: Japan's FY2024 budget emphasizes digital and green infrastructure, with specific allocations supporting smart city development and renewable energy projects.

- Public-Private Partnerships (PPPs): ORIX actively participates in PPPs, leveraging government policy to drive large-scale infrastructure projects.

- Policy Impact on Growth: Favorable government policies can unlock new investment opportunities, while policy shifts or slowdowns can present headwinds for ORIX's infrastructure segment.

Government regulations, particularly in financial services, directly influence ORIX's operational landscape. Increased scrutiny on liquidity and capital adequacy, evident in global trends throughout 2024, can elevate compliance costs and necessitate strategic adjustments for ORIX's diverse financial operations. Geopolitical shifts and trade policies also pose risks, with ongoing US-China trade tensions impacting investment flows relevant to ORIX's global real estate and infrastructure ventures.

Government support for renewable energy, such as tax credits and subsidies, significantly boosts ORIX's investment in sustainable infrastructure. For example, the US Inflation Reduction Act of 2024 continues to provide substantial incentives for green projects. Conversely, changes in these supportive policies, like the adjustments to renewable energy subsidies observed in some European markets in late 2023, can introduce uncertainty and affect profitability.

Taxation policies remain a critical political factor for ORIX. Fluctuations in corporate tax rates and capital gains taxes in key operating jurisdictions directly impact net income and investment returns. For instance, while specific 2024/2025 data is still emerging, ORIX's sensitivity to changes in international tax agreements and domestic reforms in major markets like Japan and the US is substantial, influencing its financial structuring and overall profitability.

Government spending priorities, particularly in infrastructure, directly shape ORIX's investment strategies. Japan's FY2024 budget, with its emphasis on digital and green infrastructure, presents significant opportunities for ORIX's portfolio, especially through public-private partnerships. Initiatives promoting smart cities and renewable energy integration create new avenues, while any slowdown in these government-driven projects could constrain growth.

What is included in the product

This Orix PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to guide strategic decision-making and identify potential opportunities and threats.

Provides a clear, actionable framework for identifying and mitigating external threats, transforming potential business disruptions into manageable challenges.

Economic factors

ORIX's financial performance is intrinsically linked to the health of the global economy. Strong growth periods generally fuel demand for its diverse financial services, from corporate finance to leasing, and bolster asset values. For instance, in fiscal year 2024, ORIX reported robust growth in its core businesses, reflecting a generally positive economic environment in key markets.

Conversely, economic downturns and recessionary fears pose significant risks. Recessions can trigger a rise in loan defaults, dampen transaction volumes across its leasing and real estate segments, and lead to a depreciation of its asset portfolio. The International Monetary Fund (IMF) projected global growth to be around 3.2% in 2024, a slight slowdown from previous years, indicating a cautious outlook that ORIX must navigate.

The prevailing interest rate environment significantly impacts ORIX's financial operations. For instance, as of mid-2024, central banks in major economies like the United States and the Eurozone have maintained relatively high benchmark rates, reflecting ongoing efforts to combat inflation. This trend directly increases ORIX's cost of capital for its diverse lending and investment activities.

Higher interest rates can also compress ORIX's net interest margins, as the cost of borrowing for the company and its clients rises. This might lead to a slowdown in demand for ORIX's leasing and financing services, particularly for large-ticket items or long-term projects where financing costs are a critical consideration. For example, a 1% increase in borrowing costs could translate to millions in additional expenses for a company of ORIX's scale.

Conversely, a future pivot towards lower interest rates, which some analysts anticipate for late 2024 or 2025, could alleviate some of these pressures. While lower rates might squeeze margins on new lending, they could also stimulate economic activity and increase the volume of new business for ORIX, potentially boosting overall profitability through increased transaction volumes.

High inflation in 2024 and early 2025 directly impacts ORIX by diminishing the real value of its earnings and increasing operating expenses across its diverse business segments. For instance, persistent inflation can drive up borrowing costs for ORIX's lending operations and raise the cost of goods and services for its leasing and rental businesses.

Consumer spending, a key driver for ORIX's retail finance and automotive segments, is sensitive to inflation. As purchasing power declines, consumers may postpone discretionary purchases, leading to slower growth or even contraction in these areas. This was evident in late 2024, where rising consumer prices led to a noticeable slowdown in durable goods sales.

ORIX must actively manage its investment portfolio to counteract inflation's erosive effects. Strategies may include favoring assets with inflation-linked returns or those in sectors that can more easily pass on increased costs to customers, ensuring the preservation of real returns on its substantial asset base.

Currency Exchange Rate Volatility

Currency exchange rate volatility presents a significant challenge for ORIX, given its extensive global footprint. Fluctuations in major currencies like the US Dollar, Euro, and others against the Japanese Yen directly affect the translation of ORIX's foreign earnings and asset values into its reporting currency. This can lead to unpredictable swings in consolidated financial results, impacting profitability and overall financial stability.

For instance, if the Japanese Yen strengthens considerably against other currencies, ORIX's overseas profits, when converted back to Yen, will appear lower. Conversely, a weaker Yen would boost the reported value of foreign earnings. This dynamic is crucial for investors to understand, as it can mask underlying operational performance.

Consider the impact on ORIX's financial statements. In fiscal year 2024, ORIX reported that a 1% appreciation of the Japanese Yen against the US Dollar would have a ¥10 billion negative impact on its recurring profit. This highlights the sensitivity of its earnings to currency movements.

- Impact on Consolidated Earnings: Foreign currency translation adjustments can significantly alter reported profits.

- Global Competitiveness: A strong Yen can make ORIX's overseas investments and services more expensive for foreign customers.

- Hedging Strategies: ORIX likely employs hedging strategies to mitigate some of this risk, but complete elimination is often not feasible.

- Fiscal Year 2024 Sensitivity: A 1% JPY appreciation against USD impacts recurring profit by approximately ¥10 billion.

Credit Market Conditions and Liquidity

Credit market conditions directly impact ORIX's operational capacity and strategic expansion. The cost and availability of funds are crucial for its diverse portfolio, which spans leasing, corporate finance, and significant infrastructure investments. For instance, as of mid-2024, global credit spreads widened due to persistent inflation concerns and central bank tightening, potentially increasing ORIX's borrowing costs.

Reduced liquidity in financial markets can significantly hinder ORIX's growth trajectory. This tightening environment can limit its capacity to finance new projects or acquire assets, thereby impacting its overall market competitiveness.

- Interest Rate Environment: Rising benchmark interest rates, such as the US Federal Funds Rate, which saw its last hike in July 2023 and remained elevated through early 2024, directly influence ORIX's funding costs across its global operations.

- Credit Availability: In early 2024, many financial institutions adopted a more cautious lending approach due to economic uncertainties, potentially making it harder for ORIX to secure favorable terms for its financing activities.

- Liquidity Levels: Central bank policies, including quantitative tightening measures observed in 2023 and continuing into 2024, have generally reduced overall market liquidity, which can affect the ease and cost of ORIX accessing capital.

- Bond Market Performance: Corporate bond yields, a key indicator of credit market health, saw fluctuations in 2024. For example, investment-grade corporate bond yields remained higher than in previous years, reflecting a more expensive debt market for companies like ORIX.

Economic stability is paramount for ORIX's diverse financial services. In fiscal year 2024, ORIX demonstrated resilience amidst global economic uncertainties, with its performance reflecting the general health of key markets. However, potential economic slowdowns or recessions in 2024-2025 could increase loan defaults and reduce transaction volumes across its segments.

Interest rate environments directly influence ORIX's cost of capital and net interest margins. As of mid-2024, elevated benchmark rates in major economies increased borrowing costs, potentially impacting demand for financing services. Conversely, anticipated rate cuts in late 2024 or 2025 could stimulate activity, though potentially compress margins on new lending.

Inflation in 2024 and early 2025 erodes the real value of ORIX's earnings and increases operating expenses. This impacts borrowing costs and the cost of goods for its leasing businesses, while also dampening consumer spending on discretionary items, a key driver for its retail and automotive finance arms.

Currency fluctuations, particularly between the Japanese Yen and major global currencies, significantly affect ORIX's consolidated earnings and asset valuations. A stronger Yen, for instance, reduces the reported value of foreign profits. In fiscal year 2024, ORIX noted a ¥10 billion negative impact on recurring profit for every 1% appreciation of the Yen against the US Dollar.

Credit market conditions, including credit spreads and liquidity levels, directly impact ORIX's funding costs and ability to finance new ventures. Widening credit spreads in mid-2024, driven by inflation concerns, increased the cost of debt. Reduced market liquidity due to central bank policies also poses challenges to accessing capital.

| Economic Factor | 2024/2025 Impact on ORIX | Key Data/Observation |

|---|---|---|

| Global Economic Growth | Drives demand for financial services; downturns increase risk. | IMF projected 3.2% global growth in 2024. |

| Interest Rates | Affects cost of capital and net interest margins. | Elevated rates in mid-2024 increased borrowing costs; potential cuts anticipated late 2024/2025. |

| Inflation | Reduces real earnings value, increases operating costs, impacts consumer spending. | Persistent inflation in 2024/2025 led to slower durable goods sales. |

| Currency Exchange Rates | Impacts translation of foreign earnings and asset values. | 1% JPY appreciation vs. USD impacts ORIX's recurring profit by ~¥10 billion (FY2024). |

| Credit Market Conditions | Influences funding costs and liquidity for operations. | Widening credit spreads in mid-2024 increased debt costs; reduced market liquidity observed. |

Preview Before You Purchase

Orix PESTLE Analysis

The preview you see here is the exact Orix PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive look at Orix's external environment.

The content and structure shown in the preview is the same document you’ll download after payment, offering a complete PESTLE breakdown for strategic planning.

Sociological factors

Global demographic shifts, including aging populations in developed nations and rapid urbanization in emerging markets, directly impact ORIX's investment focus. For instance, by 2050, the proportion of people aged 65 and over is projected to reach 16% globally, up from 10% in 2022, according to the UN. This trend fuels demand for ORIX's healthcare and real estate ventures, particularly those catering to seniors, while urban growth in Asia and Africa creates opportunities in retail finance and infrastructure development.

Societal and investor focus on ESG is growing rapidly. By early 2025, global sustainable investment assets are projected to exceed $50 trillion, a significant jump from previous years, directly influencing how companies like ORIX are perceived and funded.

Stakeholders now demand more than just financial returns; they seek responsible business operations and transparent reporting on environmental and social impacts. This shift means ORIX must actively demonstrate its commitment to sustainability to attract capital from a growing pool of ESG-focused investment funds.

Consumers and businesses are increasingly favoring digital financial services, with global mobile payment transaction value projected to reach $2.5 trillion by 2024. This shift impacts demand for ORIX's traditional banking and leasing models, pushing for more integrated digital platforms.

There's a growing preference for sustainable products and services, with a significant portion of consumers willing to pay more for eco-friendly options. ORIX's engagement in green financing and renewable energy projects aligns with this trend, potentially boosting demand for its specialized financial solutions.

Flexible asset utilization, such as leasing over outright ownership, is gaining traction. This is evident in the automotive leasing market, which saw robust growth in 2023. ORIX's diverse leasing portfolios, from vehicles to industrial equipment, are well-positioned to capitalize on this preference for flexibility.

Workforce Trends and Talent Acquisition

Societal shifts are significantly reshaping how and where people work. The rise of remote and hybrid models, accelerated by events in recent years, has become a permanent fixture, impacting office real estate needs and employee expectations. This flexibility is now a key factor in attracting talent. For instance, a 2024 survey indicated that over 70% of financial professionals value flexible work arrangements when considering a new role.

The competition for skilled professionals, particularly in finance, technology, and specialized investment sectors, is intensifying globally. ORIX must navigate this landscape to secure the human capital necessary for innovation and sustained operational excellence across its varied business segments. In 2024, the demand for AI and data analytics specialists in financial services saw a reported 25% year-over-year increase in job postings.

Attracting and retaining top-tier talent is paramount for ORIX's continued success. This involves not only competitive compensation but also a compelling company culture, opportunities for professional development, and alignment with employee values. Companies that prioritize employee well-being and career growth are seeing higher retention rates, with some reporting a 15% improvement in retention when offering robust training programs.

The gig economy further complicates talent acquisition, offering alternative employment structures that ORIX can leverage or compete with.

- Remote Work Adoption: Over 70% of financial professionals prioritize flexible work arrangements in 2024.

- Talent Demand: AI and data analytics roles in finance experienced a 25% surge in job postings in 2024.

- Retention Strategies: Companies with strong development programs report a 15% increase in employee retention.

- Gig Economy Influence: The rise of freelance and contract work presents both opportunities and challenges for talent sourcing.

Social Equity and Inclusivity Demands

The growing societal emphasis on social equity, diversity, and inclusion significantly shapes ORIX's internal operations, from its corporate culture and hiring strategies to its community outreach. Companies are increasingly judged on their commitment to these values, making them crucial for a strong brand reputation and attracting a wider talent pool.

For ORIX, embracing diversity and inclusion isn't just about good corporate citizenship; it's a strategic imperative. Failing to meet these expectations can lead to reputational damage and hinder efforts to recruit top talent. For instance, in 2023, ORIX Corporation USA reported that 45% of its workforce identified as ethnically or racially diverse, reflecting ongoing efforts to build a more inclusive environment.

Key areas influenced by these demands include:

- Workforce Diversity: Implementing policies to ensure representation across gender, ethnicity, age, and other demographics in hiring and promotion.

- Inclusive Culture: Fostering an environment where all employees feel valued, respected, and have equal opportunities to contribute and advance.

- Community Engagement: Supporting initiatives that promote social equity and uplift underserved communities, aligning business practices with societal well-being.

- Supplier Diversity: Encouraging partnerships with businesses owned by underrepresented groups, thereby extending equity principles throughout the supply chain.

Societal expectations for corporate responsibility are evolving, with a strong emphasis on ESG principles. By early 2025, global sustainable investment assets are projected to surpass $50 trillion, directly influencing investor perception and funding for companies like ORIX. Stakeholders now demand transparency and demonstrable commitment to environmental and social impacts, making sustainability a critical factor for capital attraction.

The increasing preference for digital financial services, with global mobile payment transaction value expected to reach $2.5 trillion by 2024, is reshaping ORIX's traditional models. Consumers and businesses alike are favoring convenient, integrated digital platforms, pushing for innovation in service delivery.

Flexible asset utilization, such as leasing over outright ownership, is gaining traction across various sectors, including automotive. ORIX’s diverse leasing portfolios are well-positioned to capitalize on this trend, offering adaptable solutions to meet changing consumer and business needs.

The rise of remote and hybrid work models has become a permanent fixture, impacting real estate needs and talent attraction. A 2024 survey found over 70% of financial professionals value flexible work arrangements, highlighting its importance in securing skilled professionals amidst intensifying competition, especially for AI and data analytics specialists who saw a 25% increase in job postings in 2024.

| Societal Factor | Trend/Impact | ORIX Relevance/Opportunity |

|---|---|---|

| ESG Focus | Sustainable investment assets to exceed $50 trillion by early 2025. | Attracts capital for green financing and renewable energy projects. |

| Digitalization | Mobile payment transaction value to reach $2.5 trillion by 2024. | Drives demand for integrated digital financial platforms. |

| Flexible Work | 70%+ financial professionals value flexible work in 2024. | Impacts real estate needs and talent retention strategies. |

| Talent Demand | 25% surge in AI/data analytics roles in finance (2024). | Intensifies competition for specialized skills. |

Technological factors

The financial services sector is undergoing a significant digital transformation, often referred to as FinTech. This evolution is driven by technologies like artificial intelligence (AI), blockchain, and advanced data analytics. For ORIX, this presents a dual landscape of opportunities to innovate and challenges to adapt.

Embracing these FinTech advancements can unlock substantial benefits for ORIX. For instance, AI can streamline loan processing and customer service, while blockchain offers potential for more secure and efficient transaction settlements. Big data analytics allows for deeper insights into market trends and customer behavior, crucial for optimizing risk management in their diverse financial and leasing operations.

Globally, FinTech investment reached an estimated $150 billion in 2024, highlighting the rapid pace of adoption and innovation. Companies that effectively integrate these technologies are better positioned to enhance customer experiences, launch novel services, and gain a competitive edge. ORIX's strategic integration of AI, for example, could lead to a projected 15-20% improvement in operational efficiency in its core lending divisions by 2025.

As a financial services leader, ORIX's commitment to cybersecurity is paramount, especially given the escalating threat landscape. In 2024, global cybercrime costs are projected to reach $10.5 trillion annually, underscoring the immense risk. ORIX must continually invest in advanced security protocols and data protection strategies to shield its extensive client data from breaches and maintain regulatory compliance.

ORIX is increasingly leveraging automation, including Robotic Process Automation (RPA) and AI-driven analytics, to enhance its operational efficiency. This technological shift is crucial for streamlining its extensive leasing and administrative processes, aiming to reduce operational costs and improve service quality.

For instance, in 2023, ORIX Corporation USA reported significant improvements in processing times for its auto leasing operations through the implementation of RPA, with some tasks seeing a reduction of up to 40%. This focus on automation is expected to continue driving cost savings and productivity gains across its global subsidiaries in 2024 and beyond.

Renewable Energy Technology Advancements

Technological breakthroughs are significantly reshaping ORIX's clean energy investments. For instance, solar panel efficiency continues to climb, with advancements pushing commercial modules beyond 23% efficiency, making solar projects more attractive. Battery storage technology is also seeing rapid development, with lithium-ion costs dropping by over 85% in the last decade, enabling more reliable grid integration for renewables.

These innovations directly impact the viability and cost-effectiveness of ORIX's clean energy portfolio. Improved solar and wind turbine technologies, coupled with enhanced energy storage solutions, lower the levelized cost of electricity (LCOE), making renewable sources increasingly competitive with traditional energy. This trend opens new avenues for investment and expansion within the sector.

Key technological factors influencing ORIX's renewable energy investments include:

- Solar Panel Efficiency: Continued improvements in photovoltaic technology are increasing energy output per square meter, reducing land requirements and overall project costs.

- Battery Storage Advancements: Innovations in battery chemistry and management systems are lowering costs and increasing the lifespan and performance of energy storage, crucial for grid stability with intermittent renewables.

- Offshore Wind Technology: Larger, more efficient wind turbines and improved installation techniques are making offshore wind farms more productive and cost-effective, even in deeper waters.

- Smart Grid Solutions: Development in grid management software and hardware allows for better integration of distributed renewable energy sources, improving reliability and efficiency.

PropTech and Smart Infrastructure Development

The real estate technology (PropTech) sector is rapidly evolving, with significant investments pouring into smart infrastructure. In 2024, the global PropTech market was valued at approximately $25 billion and is projected to grow substantially. This trend directly impacts ORIX's real estate and infrastructure portfolios by enabling more efficient operations and asset management through technologies like the Internet of Things (IoT) and advanced data analytics.

ORIX can leverage these advancements to boost asset value and operational performance. For instance, smart building systems can optimize energy consumption, leading to cost savings and improved tenant experiences. Furthermore, the integration of AI and big data analytics in urban planning, a growing area of focus, can identify new investment opportunities and enhance the long-term viability of infrastructure projects.

The adoption of PropTech and smart infrastructure presents ORIX with opportunities to:

- Enhance property management efficiency through automated systems and predictive maintenance.

- Increase asset value by incorporating smart technologies that appeal to modern tenants and investors.

- Develop new revenue streams by offering data-driven services and smart solutions within their properties and infrastructure.

- Improve sustainability and reduce operational costs via intelligent energy and resource management.

Technological advancements are fundamentally reshaping the financial services landscape for ORIX, with FinTech innovations like AI and blockchain driving efficiency and new service offerings. Global FinTech investment reached an estimated $150 billion in 2024, underscoring the sector's rapid evolution. ORIX's strategic adoption of these technologies, such as AI for loan processing, can yield significant operational improvements, with potential efficiency gains of 15-20% in lending divisions by 2025.

Legal factors

ORIX navigates a complex global regulatory landscape, encompassing banking, securities, anti-money laundering (AML), and anti-terrorism financing (ATF). Failure to comply can result in significant penalties, with fines in the financial services sector often reaching millions or even billions of dollars for major breaches, as seen in various global institutions. For instance, in 2023, several major banks faced substantial AML fines, underscoring the critical importance of robust compliance frameworks for ORIX’s diverse operations.

ORIX faces increasing scrutiny under global data privacy laws like the EU's GDPR and California's CCPA. Failure to secure customer and corporate data can result in substantial fines; for instance, GDPR penalties can reach up to 4% of annual global turnover or €20 million, whichever is higher. Maintaining robust data protection practices is crucial for ORIX to avoid legal repercussions and preserve stakeholder confidence.

ORIX's real estate and infrastructure ventures navigate a complex web of legal requirements. These include stringent land use and zoning regulations, which dictate how properties can be developed and utilized. For instance, in 2024, many urban development projects faced delays due to evolving zoning laws aimed at increasing green spaces.

Compliance with construction standards and environmental impact assessments is paramount. These legal frameworks ensure projects are built safely and minimize ecological disruption. Failure to adhere can lead to significant fines and project cancellations, impacting ORIX's operational continuity and potentially creating long-term environmental liabilities.

Emissions regulations are also a key consideration, particularly for infrastructure projects. As of early 2025, many countries are tightening standards for carbon emissions from construction and operational phases, requiring ORIX to invest in cleaner technologies and sustainable practices to maintain legal standing and public approval.

Contract Law and Dispute Resolution

Contract law is the bedrock of ORIX's operations, especially in its leasing and corporate finance divisions. The company's reliance on legally sound agreements across diverse global markets, including Japan and the United States, means that the clarity and enforceability of these contracts are paramount. For instance, ORIX's commitment to international leasing standards underscores the importance of consistent contract interpretation and adherence.

Efficient dispute resolution mechanisms are equally critical for ORIX. Given its significant investments and complex financial arrangements, the ability to resolve disagreements swiftly and fairly through arbitration or litigation is essential for minimizing financial exposure and maintaining operational continuity. In 2023, global commercial litigation costs continued to rise, highlighting the need for proactive risk management and robust legal frameworks to protect ORIX's assets and profitability.

- Contract Enforceability: ORIX's global leasing and finance operations depend on the consistent enforceability of contracts in jurisdictions like Japan, where contract law is well-established, and the US, with its diverse state-level regulations.

- Dispute Resolution Efficiency: The speed and fairness of dispute resolution processes directly impact ORIX's ability to manage commercial risks and protect its substantial investments in various sectors.

- Regulatory Compliance: Adherence to evolving contract laws and dispute resolution practices is crucial for ORIX to avoid penalties and maintain its reputation as a reliable financial institution.

Competition and Antitrust Laws

ORIX's diverse market activities, from financial services to infrastructure development, are closely monitored under competition and antitrust regulations across its global operations. These laws are designed to foster a level playing field, preventing any single entity from gaining undue market power through mergers, acquisitions, or strategic alliances. For instance, in 2023, the European Union's antitrust authorities continued to scrutinize large-scale M&A deals, with a particular focus on sectors like technology and finance, areas where ORIX has significant interests.

Compliance with these regulations is crucial for ORIX to avoid costly legal battles and potential disruptions to its growth strategies. Failure to adhere to antitrust frameworks can result in substantial fines and mandated divestitures, directly impacting profitability and market position. In 2024, regulatory bodies worldwide are expected to maintain a robust stance on market concentration, making proactive legal counsel and thorough due diligence paramount for ORIX's expansion plans.

- Regulatory Scrutiny: ORIX's M&A activities are subject to antitrust reviews in key markets like the US, EU, and Japan.

- Fair Competition Mandate: Antitrust laws aim to prevent monopolistic practices and ensure fair market access for competitors.

- Financial Impact of Non-Compliance: Fines for antitrust violations can reach billions of dollars, as seen in past cases involving major financial institutions.

- Strategic Partnerships: Even strategic partnerships may require regulatory approval to ensure they do not stifle competition.

ORIX must navigate evolving labor laws across its international operations, impacting hiring, compensation, and employee relations. For instance, in 2024, several countries introduced new regulations concerning remote work and worker classification, requiring adjustments to employment contracts and HR policies. Adherence to these laws is vital to prevent disputes and maintain a stable workforce, which is critical for ORIX's service-oriented businesses.

Environmental factors

Global commitments like the Paris Agreement, aiming to limit warming to well below 2 degrees Celsius, directly shape ORIX's investment focus. Many nations, including Japan, have set ambitious carbon neutrality targets for 2050. This drives significant capital allocation towards renewable energy projects, such as ORIX's investments in offshore wind farms, and sustainable infrastructure development.

These decarbonization policies present both opportunities and challenges for ORIX. While fostering growth in green sectors, they also introduce risks for ORIX's existing holdings in carbon-intensive industries, potentially requiring divestment or significant adaptation strategies to align with evolving environmental regulations and market expectations.

Government and industry targets for renewable energy penetration are key drivers for ORIX's growth in the clean energy sector. For instance, the US aims for 100% clean electricity by 2035, and the EU targets 42.5% renewables in its energy mix by 2030, with a push towards 45%.

These ambitious goals translate directly into increased demand for ORIX's investments in solar, wind, and other sustainable energy projects. Policy support, such as tax credits and feed-in tariffs, are critical for ensuring the profitability and scalability of ORIX's renewable energy portfolio.

ORIX faces environmental risks across its diverse portfolio, from potential pollution at industrial sites to resource depletion in infrastructure projects. For instance, in 2023, the company's real estate division had to address remediation costs for a former industrial property, highlighting the need for thorough environmental due diligence. This proactive approach is crucial for maintaining regulatory compliance and safeguarding asset values.

Resource Scarcity and Circular Economy Trends

Growing global awareness of resource scarcity is directly influencing ORIX's leasing and asset management operations. The shift towards a circular economy model, where resources are reused and recycled, presents both challenges and opportunities. For instance, ORIX could see increased demand for financing solutions that support businesses adopting circular practices, like equipment leasing for remanufacturing or recycling facilities.

Conversely, traditional linear business models, which rely on a take-make-dispose approach, might face escalating costs associated with raw materials or declining market demand as consumers and businesses prioritize sustainability. This evolving landscape necessitates ORIX's strategic adaptation to remain competitive and capitalize on emerging green finance trends.

- Circular Economy Market Growth: The global circular economy market was valued at approximately $2.5 trillion in 2023 and is projected to reach over $4.7 trillion by 2030, indicating significant investment potential.

- Resource Price Volatility: Key commodity prices, such as those for metals and rare earth elements essential for many manufactured goods, have experienced significant fluctuations, impacting the cost of capital for asset-intensive businesses.

- Regulatory Push: Governments worldwide are implementing policies to encourage circularity, including extended producer responsibility schemes and bans on single-use plastics, creating a more favorable environment for circular business models.

Sustainable Finance and Green Bond Markets

The sustainable finance sector, encompassing green bonds and sustainability-linked loans, presents ORIX with significant opportunities to secure funding for its green initiatives at potentially reduced borrowing costs. This trend is underscored by the global green bond market, which saw issuance exceed $700 billion in 2023 and is projected to continue its upward trajectory in 2024.

Conversely, the escalating investor preference for portfolios aligned with environmental, social, and governance (ESG) principles compels ORIX to proactively showcase its dedication to environmental responsibility. For instance, as of early 2024, over 70% of institutional investors globally consider ESG factors in their investment decisions, a figure that directly influences ORIX's stakeholder relations and access to capital.

- Growth in Green Finance: The global green bond market is projected to reach $1 trillion in annual issuance by 2025, offering ORIX expanded access to capital for its sustainability projects.

- Investor Demand for ESG: A significant majority of institutional investors, upwards of 70% in 2024, integrate ESG criteria, creating a strong incentive for ORIX to enhance its environmental disclosures and performance.

- Cost of Capital: Companies with strong ESG credentials, including those issuing green bonds, can benefit from a lower cost of capital, a trend observed across various industries in recent years.

- Regulatory Tailwinds: Evolving environmental regulations and reporting standards globally are further encouraging sustainable finance practices, benefiting companies like ORIX that are positioned to meet these requirements.

ORIX's environmental strategy is significantly shaped by global climate accords and national decarbonization targets, such as Japan's 2050 carbon neutrality goal. These policies are driving substantial investment into renewable energy, including ORIX's ventures in offshore wind, and sustainable infrastructure, creating a favorable market for clean energy solutions.

The increasing focus on a circular economy presents both opportunities for ORIX in financing reuse and recycling initiatives and challenges for traditional linear business models facing rising resource costs and declining demand. This shift necessitates ORIX's adaptation to capitalize on green finance trends and evolving consumer preferences for sustainable practices.

ORIX navigates environmental risks, from pollution liabilities at industrial sites to resource depletion in infrastructure, requiring rigorous due diligence to maintain compliance and asset value. The company's real estate division, for example, addressed remediation costs for a former industrial property in 2023, underscoring the importance of proactive environmental management.

The growth in sustainable finance, evidenced by the projected $1 trillion annual issuance in green bonds by 2025, offers ORIX enhanced access to capital for its green projects. Simultaneously, the strong investor demand for ESG-aligned portfolios, with over 70% of institutional investors considering ESG factors in 2024, incentivizes ORIX to bolster its environmental disclosures and performance.

| Environmental Factor | Key Data Point/Trend | Implication for ORIX |

|---|---|---|

| Climate Targets | Global commitment to limit warming below 2°C; Japan's 2050 carbon neutrality goal. | Drives investment in renewables and sustainable infrastructure; potential risk for carbon-intensive assets. |

| Circular Economy | Global market valued at ~$2.5 trillion in 2023, projected to exceed $4.7 trillion by 2030. | Opportunities in financing reuse/recycling; challenges for linear models due to resource costs. |

| Sustainable Finance | Green bond market issuance exceeded $700 billion in 2023; projected to reach $1 trillion by 2025. | Enhanced access to capital for green initiatives; potential for lower borrowing costs. |

| Investor ESG Focus | Over 70% of institutional investors consider ESG factors in 2024. | Incentive to improve environmental disclosures and performance for stakeholder relations and capital access. |

PESTLE Analysis Data Sources

Our Orix PESTLE Analysis is meticulously constructed using a blend of official government publications, reports from international organizations like the World Bank and IMF, and insights from reputable market research firms. This ensures a comprehensive and accurate understanding of the political, economic, social, technological, legal, and environmental factors impacting Orix.