Orix Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Orix Bundle

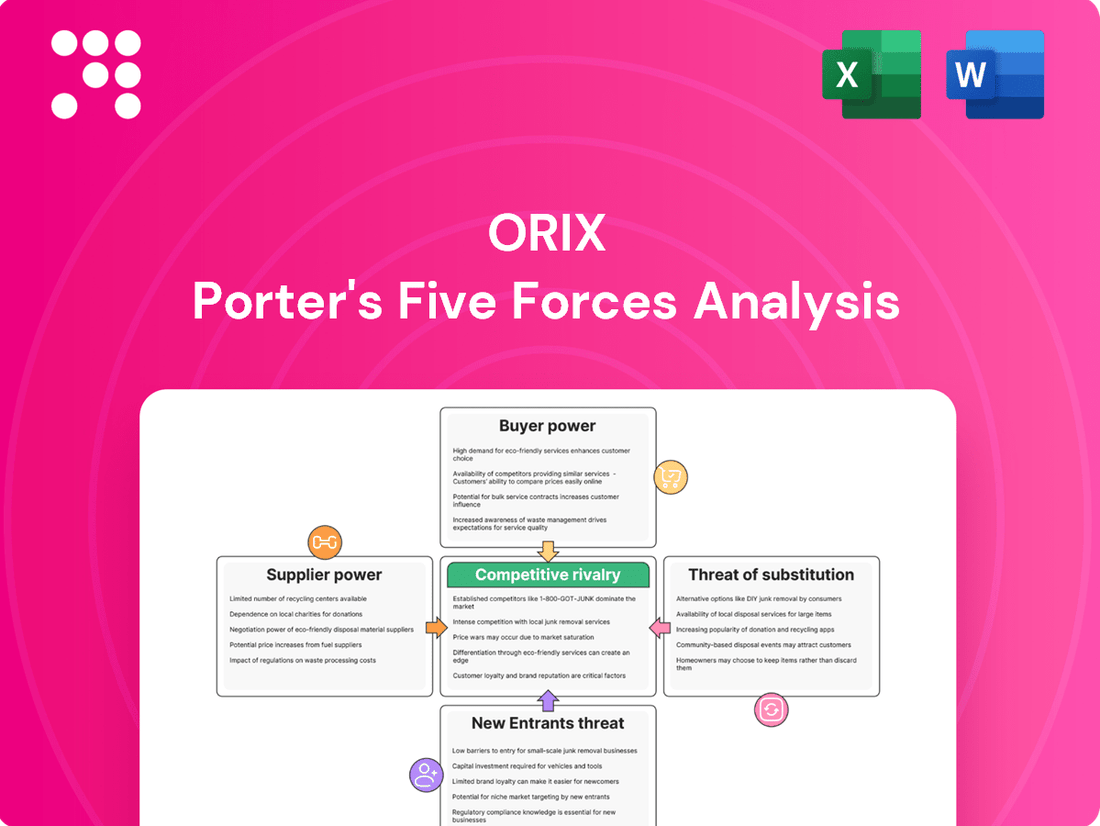

Orix's competitive landscape is shaped by powerful forces, including the bargaining power of its customers and suppliers, and the intense rivalry among existing players. Understanding these dynamics is crucial for navigating its market effectively.

The complete Porter's Five Forces Analysis reveals the real forces shaping Orix’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

ORIX, a global financial services group, engages with numerous suppliers across its diverse operations, from technology vendors to real estate developers and energy project financiers. In sectors where suppliers are few and dominant, such as specialized financial software or unique energy components, these concentrated suppliers can wield considerable influence. For instance, if ORIX relies on a single or very limited number of providers for critical IT infrastructure, those providers could dictate higher prices or unfavorable contract terms, directly impacting ORIX's operational costs and flexibility.

The uniqueness of inputs ORIX relies on significantly impacts supplier bargaining power. If ORIX requires highly specialized software for its complex financial modeling, or particularly unique components for its renewable energy installations, the suppliers of these niche offerings gain considerable leverage. This is because the limited availability of comparable alternatives for ORIX means suppliers can dictate terms more effectively.

Switching costs represent a significant factor in the bargaining power of suppliers for ORIX. These costs encompass the financial outlays and operational disruptions ORIX would face if it were to transition from one supplier to another. This can include expenses related to adapting IT infrastructure, re-educating employees on new systems or processes, and potential penalties for terminating existing agreements.

For instance, if ORIX relies on a specialized software provider for its core financial operations, the cost of migrating data, implementing a new platform, and training personnel could be substantial. In 2024, many companies experienced increased IT integration costs due to the rapid adoption of cloud-based solutions, highlighting the potential for high switching costs in this area.

When switching costs are high, suppliers gain considerable leverage. ORIX would be more hesitant to seek alternative suppliers, even if current terms become less favorable, due to the significant investment required for a change. This can lead to suppliers dictating terms more effectively, thereby increasing their bargaining power.

Threat of Forward Integration

The threat of forward integration by suppliers significantly bolsters their bargaining power against ORIX. If a key supplier, for instance, a technology vendor crucial to ORIX's operations, were to develop its own financial services or directly offer solutions to ORIX's customer base, it would create a formidable competitive challenge. This potential shift could force ORIX to concede to less advantageous contract terms to mitigate the risk of losing clients to its own supplier.

Consider a scenario where a specialized data analytics firm, currently supplying ORIX with market insights, decides to launch its own consulting arm directly targeting ORIX's clientele. Such a move, if credible, would directly challenge ORIX's market position. For example, if this data firm has a strong existing relationship with ORIX's top 10 clients, representing a substantial portion of ORIX's revenue, their ability to integrate forward becomes a potent threat.

- Supplier Integration Risk: ORIX must continuously assess the likelihood of its key suppliers moving into its core business areas.

- Competitive Landscape Shift: A supplier's forward integration can transform a partner into a direct competitor, impacting market share.

- Contractual Safeguards: ORIX may need to negotiate clauses that restrict suppliers from directly competing with its services for a defined period.

- Client Dependency: The impact is amplified if suppliers have deep relationships with ORIX's most valuable clients.

Importance of Supplier to ORIX's Business

The bargaining power of suppliers is a key consideration for ORIX Corporation. If ORIX relies heavily on specific suppliers for critical components or services essential to its core business operations, those suppliers gain significant leverage. This dependence can directly impact ORIX's ability to deliver its own products and services effectively to its customer base.

For instance, in ORIX's diverse financial services and leasing segments, the availability and cost of capital are paramount. Suppliers of funding, whether through debt markets or institutional investors, can exert considerable influence if ORIX's access to capital is constrained. In 2024, global interest rate environments and liquidity conditions continued to shape the cost and availability of funding for financial institutions, directly affecting ORIX's operational capacity and strategic flexibility.

- Dependence on Capital Providers: ORIX's reliance on various funding sources, including banks and bondholders, gives these entities bargaining power, especially in tight credit markets.

- Critical Technology/Software: Suppliers of specialized financial technology or software crucial for ORIX's trading platforms or risk management systems can hold sway if alternatives are limited.

- Outsourcing Partners: For outsourced services like IT infrastructure or back-office operations, the importance of reliable and secure providers means ORIX must consider their terms carefully.

- Regulatory Compliance Tools: Suppliers of software or services that ensure ORIX's compliance with complex financial regulations can also possess significant bargaining power.

When suppliers are concentrated or offer unique inputs, their bargaining power increases significantly for ORIX. High switching costs, such as those associated with integrating new IT systems, further empower suppliers, as ORIX faces substantial expenses and disruptions to change providers. The threat of suppliers integrating forward into ORIX's business lines also amplifies their leverage, potentially turning partners into competitors.

In 2024, the financial services sector continued to navigate evolving technology landscapes and regulatory demands, influencing supplier relationships. For instance, the increasing reliance on specialized AI-driven analytics platforms means providers of these advanced solutions can command stronger terms if ORIX's adoption is critical and alternatives are scarce.

| Factor | Impact on ORIX | 2024 Context |

| Supplier Concentration | High leverage for few dominant suppliers | Continued consolidation in fintech may reduce options for specialized software. |

| Uniqueness of Inputs | Stronger terms for niche providers | Demand for specialized ESG data platforms could increase supplier power. |

| Switching Costs | Deters ORIX from changing suppliers | High implementation costs for new cybersecurity solutions in 2024. |

| Forward Integration Threat | Suppliers becoming competitors | Data analytics firms expanding into advisory services pose a risk. |

What is included in the product

This analysis dissects the competitive landscape for Orix by examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes.

Quickly identify and address competitive threats by visualizing each force's impact, allowing for targeted strategic adjustments.

Customers Bargaining Power

ORIX's diverse customer base, spanning individual investors to major corporations across sectors like finance, leasing, real estate, and renewable energy, significantly tempers customer bargaining power. This broad reach means ORIX isn't beholden to any single client or small group of clients, reducing the leverage any one customer can exert.

The price sensitivity of ORIX's customers is a key factor in their bargaining power. For instance, corporate clients engaging ORIX for intricate financial engineering solutions or large-scale leasing might exhibit lower price sensitivity due to the strategic importance and complexity of these services. Conversely, individual consumers seeking more standardized retail finance products, like auto loans or personal credit, are likely to be more attuned to pricing differences, especially in markets with numerous alternative providers.

Customers wield greater bargaining power when readily available substitutes exist for financial services. In 2024, the financial services sector, particularly in areas like wealth management and lending, continued to see a proliferation of fintech solutions and neobanks, offering consumers a wider array of choices than ever before.

This abundance of alternatives means customers can easily switch providers if ORIX's terms, pricing, or service levels are not competitive. For instance, a customer seeking investment advice might find numerous robo-advisors or specialized digital platforms offering similar services at lower fees, directly impacting ORIX's ability to dictate terms.

Customer Information and Transparency

Customers today have unprecedented access to information, especially regarding financial services. This increased transparency allows them to easily compare ORIX's offerings with those of its competitors in terms of pricing, service quality, and contract terms. For instance, in 2024, online financial comparison platforms have become highly sophisticated, enabling consumers to scrutinize details that were previously opaque.

When customers can readily see how ORIX stacks up against others, their leverage in negotiations significantly grows. They can use this knowledge to demand better rates, more favorable terms, or enhanced service levels. This heightened customer awareness directly translates into a stronger bargaining position, forcing ORIX to be more competitive to retain and attract business.

- Informed Decisions: Customers in 2024 can access detailed product reviews and performance data, empowering them to make informed choices.

- Price Sensitivity: The ease of price comparison means customers are more sensitive to ORIX's pricing strategies compared to previous years.

- Service Expectations: Transparency in service level agreements (SLAs) across the industry sets higher expectations for ORIX's customer support and delivery.

- Negotiating Power: Armed with comparative data, customers are better equipped to negotiate discounts and customized solutions with ORIX.

Threat of Backward Integration by Customers

The threat of customers integrating backward, meaning they start providing the service themselves, is a significant factor in assessing their bargaining power. While less prevalent in the broad financial services sector, it can emerge in specific niches. For instance, a major corporation could explore setting up its own internal leasing or financing division, thereby reducing its reliance on external providers like ORIX. This move would directly enhance their leverage.

This potential for backward integration directly impacts ORIX's pricing power and customer retention strategies. If a substantial client, such as a large manufacturing firm with significant capital needs, decides to build its own fleet management or equipment financing unit, it directly removes revenue from ORIX's books. For example, if a Fortune 500 company annually spends $50 million on equipment leasing, bringing that in-house represents a direct loss of that revenue stream for ORIX.

The feasibility of backward integration for customers depends heavily on the complexity and capital intensity of the services offered. For ORIX, whose services range from equipment leasing and automotive rentals to real estate and energy solutions, the barriers to entry for a customer looking to replicate these operations vary. Establishing a sophisticated leasing operation, for example, requires significant capital investment, expertise in asset management, and regulatory compliance, which can deter many potential integrators.

- Customer Bargaining Power: Threat of backward integration by customers can increase their leverage.

- Example Scenario: A large corporation establishing its own in-house leasing arm instead of using ORIX.

- Impact on ORIX: Reduced revenue and increased pressure on pricing and service offerings.

- Feasibility Factors: Capital investment, expertise, and regulatory hurdles influence a customer's ability to integrate backward.

The bargaining power of ORIX's customers is influenced by the availability of substitutes and the ease with which they can switch providers. In 2024, the financial services landscape, particularly in areas like lending and wealth management, saw a significant influx of fintech solutions and neobanks, offering consumers a broader selection of alternatives. This increased competition means customers can readily shift to other providers if ORIX's pricing or service terms are not competitive.

Customers are also empowered by unprecedented access to information, allowing them to easily compare ORIX's offerings against competitors. Sophisticated online comparison platforms in 2024 enable consumers to scrutinize pricing, service quality, and contract terms, enhancing their negotiating leverage. This transparency compels ORIX to maintain competitive pricing and service levels to retain business.

The threat of customers integrating backward, meaning they start providing the service themselves, can also elevate their bargaining power. While complex for many financial services, a large corporation could establish its own internal leasing or financing division, reducing reliance on ORIX and increasing its leverage. For example, if a major client annually spends $50 million on equipment leasing, bringing this in-house represents a direct loss of that revenue stream for ORIX.

| Factor | Impact on Customer Bargaining Power | ORIX's Position (2024 Outlook) | Key Data/Observation |

| Availability of Substitutes | Increases Power | Moderate to High, due to fintech competition | Proliferation of neobanks and digital wealth platforms |

| Customer Information Access | Increases Power | Moderate, due to online comparison tools | Sophistication of financial comparison websites |

| Threat of Backward Integration | Increases Power | Low to Moderate, depends on customer scale and service complexity | Feasibility varies; large corporations may consider in-house solutions |

Preview Before You Purchase

Orix Porter's Five Forces Analysis

This preview shows the exact Orix Porter's Five Forces Analysis document you'll receive immediately after purchase, providing a comprehensive overview of competitive and industry forces. You'll gain insights into Orix's strategic positioning and potential threats and opportunities without any surprises or placeholders. This professionally formatted analysis is ready for your immediate use and decision-making.

Rivalry Among Competitors

ORIX navigates a crowded marketplace teeming with a wide array of competitors. These include established traditional banks, other large diversified financial services conglomerates, niche leasing specialists, dedicated real estate developers, and even energy sector players venturing into financing. This broad spectrum of rivals, each with its own strengths and market focus, significantly amplifies the competitive intensity across ORIX's diverse business lines.

The industries ORIX operates in, such as financial services and infrastructure, exhibit varied growth rates. For instance, the global financial services market was projected to grow at a compound annual growth rate (CAGR) of around 6% to 8% leading up to 2024, indicating a moderately competitive environment. In segments with slower growth, like certain established lending markets, competition for market share intensifies as companies fight for existing customers and opportunities.

ORIX's involvement in sectors like real estate investment and large-scale renewable energy projects means many of its operations carry significant fixed costs. These high initial investments create substantial exit barriers, making it difficult and costly for companies to leave the market even when facing profitability challenges.

This situation often fuels intense price competition. When demand falters, particularly during economic downturns, businesses are less likely to cease operations due to the unrecoverable sunk costs. For instance, in the renewable energy sector, projects often involve long-term capital commitments, meaning companies may continue to operate at lower margins to recoup investments rather than abandoning them entirely.

Product and Service Differentiation

The degree to which ORIX can make its products and services stand out from what competitors offer directly impacts the intensity of rivalry. When offerings are very similar, like in commoditized markets, price often becomes the main battleground. ORIX's approach to building a diverse portfolio and crafting specialized solutions is designed to lessen this pressure to compete solely on price.

For instance, in the leasing sector, ORIX's ability to bundle financing, maintenance, and remarketing services provides a more comprehensive package than a simple equipment lease. This integrated approach makes it harder for competitors to match ORIX's value proposition on a price-only basis. As of fiscal year 2024, ORIX reported total assets of approximately ¥22.4 trillion, showcasing its significant scale and capacity to invest in service differentiation across its various business segments.

- Diversified Offerings: ORIX's broad range of financial services, including leasing, lending, and investment banking, reduces reliance on any single, easily replicated product.

- Tailored Solutions: The company focuses on creating customized financial packages for specific client needs, moving beyond standardized offerings.

- Service Integration: By combining financial products with related services, ORIX enhances its value proposition and creates switching costs for customers.

Strategic Stakes and Aggressiveness of Competitors

The strategic importance of the markets ORIX operates in significantly fuels competitive rivalry. For instance, in the burgeoning renewable energy sector, where ORIX has substantial investments, major global players like Brookfield Renewable Partners and NextEra Energy are aggressively expanding. Their commitment to achieving net-zero targets by 2050 or earlier means they view renewable energy infrastructure as a cornerstone of future profitability, driving intense competition for projects and talent.

This strategic imperative translates into aggressive tactics. Competitors might engage in price wars for power purchase agreements or invest heavily in securing land for new solar and wind farms. For example, as of early 2024, the global renewable energy market saw record investment levels, with companies vying for market share through both organic growth and strategic acquisitions, directly impacting ORIX’s operational landscape.

- Strategic Importance: Key markets for ORIX, such as infrastructure and financial services, are vital for competitors' long-term growth and market positioning.

- Aggressive Tactics: Competitors may employ aggressive pricing, increased marketing spend, and substantial capital investments to capture or defend market share.

- Market Dynamics: In 2024, the global infrastructure sector, a core area for ORIX, experienced robust M&A activity, indicating high strategic stakes and competitive intensity.

- Competitor Focus: Rivals often target segments crucial for future revenue streams, leading to heightened rivalry for ORIX in those specific areas.

Competitive rivalry is a significant factor for ORIX due to the diverse nature of its operations, spanning financial services, leasing, and infrastructure. The presence of numerous competitors, from traditional banks to specialized firms, intensifies this rivalry. For instance, in the global financial services market, which was projected to grow around 6-8% leading up to 2024, competition is robust. High exit barriers in sectors like renewable energy, where ORIX invests heavily, mean companies often continue operations even with lower margins, fueling price competition.

| Industry Segment | Key Competitors | Competitive Intensity Driver |

|---|---|---|

| Financial Services | Major global banks, diversified financial groups | Market share battles in a moderately growing sector |

| Leasing | Specialized leasing companies, equipment manufacturers | Differentiation through bundled services vs. price |

| Infrastructure/Renewable Energy | Large energy companies, infrastructure funds | Strategic importance, high fixed costs, aggressive expansion |

SSubstitutes Threaten

Customers seeking corporate finance and leasing solutions have numerous alternatives to ORIX's offerings. Direct financing from commercial banks, for instance, remains a primary substitute, with global bank lending expected to see continued growth in 2024 as economic conditions stabilize. Many corporations also opt to issue bonds, a market that has shown resilience, with global bond issuance reaching significant figures in early 2024, providing a direct capital-raising avenue.

The ability for companies to self-finance through retained earnings or equity offerings further reduces reliance on external financial service providers like ORIX. This internal financing capability is particularly strong for well-established companies with healthy cash flows, directly challenging ORIX's traditional lending and leasing models. The availability of these diverse funding mechanisms means ORIX must continually innovate and offer competitive terms to retain its market share.

The threat of substitutes for ORIX's investments, particularly in renewable energy and infrastructure, is amplified by shifting investor preferences. For instance, in 2024, global investment in clean energy reached an estimated $1.7 trillion, a figure that could easily redirect capital towards emerging technologies or more favored sectors if ORIX's current portfolios become less appealing due to market shifts or regulatory changes.

New technological advancements, such as breakthroughs in battery storage or advanced geothermal systems, could present attractive alternatives to ORIX's existing renewable energy assets. Similarly, evolving infrastructure models, perhaps driven by smart city initiatives or decentralized utility networks, might draw investment away from traditional infrastructure projects that ORIX currently supports.

Technological advancements, particularly in fintech, are rapidly introducing new substitutes for ORIX's core financial services. Digital lending platforms, for instance, are offering streamlined access to capital, bypassing traditional banking channels. In 2024, the global fintech market was valued at over $1.1 trillion, indicating significant customer adoption of these alternative solutions.

Peer-to-peer financing and blockchain-based asset management provide further avenues for customers to secure funding or manage their investments outside of conventional financial institutions. These innovations directly challenge ORIX's established market position by offering potentially more efficient or cost-effective alternatives.

DIY (Do-It-Yourself) Options

For certain retail finance or small-scale investment needs, individuals and even smaller businesses might opt for 'do-it-yourself' solutions. These DIY options, utilizing online tools, direct investment platforms, or consulting non-traditional advisors, can substitute ORIX's more comprehensive offerings. For instance, the rise of robo-advisors, which saw significant growth with assets under management projected to reach over $2.5 trillion globally by 2027, presents a direct alternative for simpler portfolio management.

The increasing accessibility of sophisticated financial management software and educational resources empowers individuals to handle their own financial planning and investments. This trend is further fueled by platforms offering commission-free trading, making direct market access more appealing. In 2024, the number of retail investors actively managing their portfolios directly continued to climb, indicating a sustained shift towards self-service models for wealth management.

- DIY platforms offer lower cost structures compared to traditional financial advisory services.

- The proliferation of user-friendly investment apps and online financial education resources lowers the barrier to entry for DIY investors.

- Robo-advisors, a key DIY substitute, are expected to manage a substantial portion of global investable assets in the coming years.

- For basic financial needs, individuals may find DIY solutions perfectly adequate, reducing the perceived need for ORIX's more integrated services.

Regulatory Changes and New Market Structures

Changes in regulations can indeed introduce compelling substitutes for ORIX's offerings. For example, in 2024, governments worldwide continued to explore and implement new incentives aimed at promoting sustainable investments and renewable energy projects. These incentives can make alternative investment vehicles or business models significantly more attractive than traditional ones, thereby diminishing the demand for ORIX's established financial services in those sectors.

Furthermore, the emergence of new market structures, particularly in dynamic sectors like energy and real estate, can create substitute threats. Consider the growing trend of decentralized energy grids or innovative fractional ownership models in real estate. These innovations, often spurred by regulatory shifts or technological advancements, offer alternative ways for capital to be deployed and managed, potentially bypassing ORIX's existing service frameworks. For instance, by mid-2024, several countries saw increased activity in peer-to-peer energy trading platforms, directly competing with traditional utility financing models.

- Regulatory shifts can foster new investment avenues, directly impacting ORIX's market share.

- Emerging market structures, such as P2P energy trading, present viable alternatives to ORIX's traditional financing.

- Government incentives for green investments in 2024 made alternative energy financing more competitive.

Customers have many other ways to get the financing and leasing they need besides ORIX. For example, commercial banks are a big substitute, and global bank lending was expected to keep growing in 2024. Companies can also raise money by issuing bonds, a market that remained strong, with significant global bond issuance in early 2024.

Companies that can fund themselves through their own profits or by selling stock are less reliant on outside financial companies like ORIX. This is especially true for established businesses with good cash flow, directly challenging ORIX's lending and leasing business. The availability of these different funding options means ORIX needs to keep offering competitive deals.

The threat of substitutes for ORIX's investments, especially in areas like renewable energy, is growing as investor interests change. In 2024, global investment in clean energy was estimated to be around $1.7 trillion, which could easily shift to newer technologies or more popular sectors if ORIX's current investments become less attractive.

| Substitute Area | Example | 2024 Relevance/Data |

|---|---|---|

| Direct Financing | Commercial Bank Loans | Continued growth in global bank lending |

| Capital Markets | Corporate Bonds | Resilient market with significant issuance |

| Internal Funding | Retained Earnings/Equity | Strong for established companies with healthy cash flow |

| Alternative Investments | Clean Energy Projects | Global investment estimated at $1.7 trillion in 2024 |

| Fintech Solutions | Digital Lending Platforms | Global fintech market valued over $1.1 trillion in 2024 |

Entrants Threaten

Entering many of ORIX's core businesses, like major real estate projects, infrastructure financing, and specific financial services, demands immense amounts of capital. For instance, a large-scale urban development project could easily require billions of dollars in upfront investment.

These significant capital requirements act as a formidable barrier, deterring many potential new players from even attempting to enter these markets. Companies without access to substantial funding simply cannot compete with established entities like ORIX.

In 2023, ORIX Corporation reported total assets exceeding ¥20 trillion, highlighting the sheer scale of financial resources necessary to operate in its key sectors. This financial muscle is a critical element in maintaining its competitive position.

The financial services, insurance, and energy sectors are particularly challenging for new players due to stringent regulatory frameworks. For instance, in 2024, the European Union continued to implement and enforce directives like MiFID II, which impose substantial compliance burdens and capital requirements on financial institutions. These extensive licensing procedures and ongoing compliance costs, often running into millions of dollars, act as a significant barrier, effectively deterring many potential entrants from even attempting to enter these markets.

ORIX's extensive global reach and diverse business lines create significant economies of scale and scope. This means they can spread their fixed costs across a larger volume of operations and offer a wider array of integrated services more efficiently than smaller, specialized competitors. For instance, in 2024, ORIX's total revenue reached approximately $21.6 billion, a testament to its broad operational footprint.

New entrants face a substantial barrier in replicating ORIX's cost advantages. Achieving similar production efficiencies or offering a comparable breadth of financial and business services would require immense capital investment. This makes it challenging for newcomers to compete effectively on price or provide the same level of comprehensive, bundled solutions that ORIX offers to its clients.

Brand Loyalty and Reputation

Established players like ORIX have cultivated deep brand loyalty and a robust reputation over many years. For instance, ORIX Corporation reported a net income of ¥387.3 billion (approximately $2.6 billion USD based on average 2024 exchange rates) in the fiscal year ending March 2024, reflecting the trust and stability customers associate with their services.

New entrants face a significant hurdle in replicating this level of customer trust, especially in financial services where reliability is paramount. They would need substantial marketing expenditure to build brand awareness and convince consumers to switch from established, reputable providers.

- Brand Loyalty: ORIX's long-standing presence fosters strong customer retention.

- Reputation Capital: Decades of reliable service build significant trust.

- Marketing Investment: New entrants require substantial funds to build credibility.

- Financial Sector Sensitivity: Trust is a critical differentiator in finance and insurance.

Access to Distribution Channels and Expertise

New entrants into ORIX's markets face a significant hurdle in replicating its established distribution channels and deep-seated expertise. Building comparable networks, especially in specialized sectors like renewable energy financing where ORIX has demonstrated substantial project management capabilities, requires immense capital and time. Furthermore, acquiring the specialized talent needed to navigate complex corporate finance transactions or manage large-scale infrastructure projects is a formidable barrier.

Consider the competitive landscape in the Japanese renewable energy sector. As of early 2024, while investment is growing, the number of players with ORIX's proven track record in originating, structuring, and managing complex renewable energy projects remains limited. New entrants would need to overcome not only the initial capital outlay for infrastructure but also the challenge of attracting and retaining seasoned professionals with a deep understanding of regulatory frameworks, technology integration, and financial modeling specific to these niche areas.

- Distribution Network Barrier: ORIX's extensive global and domestic networks provide a significant advantage in reaching diverse client segments and sourcing opportunities.

- Expertise Gap: New entrants would struggle to match ORIX's decades-long accumulated expertise in areas such as corporate finance, leasing, and renewable energy project development.

- Talent Acquisition Challenge: Attracting and retaining specialized talent, crucial for complex financial services and project management, presents a high barrier for newcomers.

- Niche Market Entry Difficulty: Entering niche segments where ORIX holds strong positions, like specialized asset financing or renewable energy infrastructure, requires specialized knowledge that is not easily acquired.

The threat of new entrants for ORIX is generally low due to several substantial barriers. High capital requirements, stringent regulations, established brand loyalty, and the need for specialized expertise all make it difficult for new companies to enter ORIX's core markets. These factors create a protective moat around ORIX's business operations.

For instance, ORIX's total assets exceeded ¥20 trillion in 2023, underscoring the immense financial resources required to compete. Furthermore, in 2024, regulatory compliance costs in the financial sector, such as those stemming from EU directives like MiFID II, can easily run into millions of dollars, deterring many potential new entrants.

ORIX's 2024 revenue of approximately $21.6 billion and a net income of ¥387.3 billion (about $2.6 billion USD) in the fiscal year ending March 2024 highlight its scale and profitability, built on years of customer trust and operational efficiency. This financial strength and established reputation are difficult for newcomers to replicate.

| Barrier Type | Description | ORIX's Advantage (as of 2023-2024 data) | Impact on New Entrants |

|---|---|---|---|

| Capital Requirements | Massive upfront investment needed for core businesses like real estate and infrastructure financing. | Total Assets: > ¥20 trillion (2023) | High barrier; requires significant funding access. |

| Regulatory Hurdles | Strict licensing and compliance in financial services, insurance, and energy sectors. | Navigates complex global regulations effectively. | High barrier; substantial compliance costs and time for licensing. |

| Brand Loyalty & Reputation | Long-standing trust and customer retention in financial services. | Net Income: ¥387.3 billion (FY ending March 2024) | High barrier; requires extensive marketing and time to build credibility. |

| Expertise & Distribution | Deep knowledge in niche areas like renewable energy financing and established global networks. | Proven track record in complex project management and financing. | High barrier; difficult to acquire specialized talent and replicate distribution channels. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, drawing from industry-specific market research reports, company financial statements, and expert interviews with industry professionals to provide a comprehensive view of competitive dynamics.