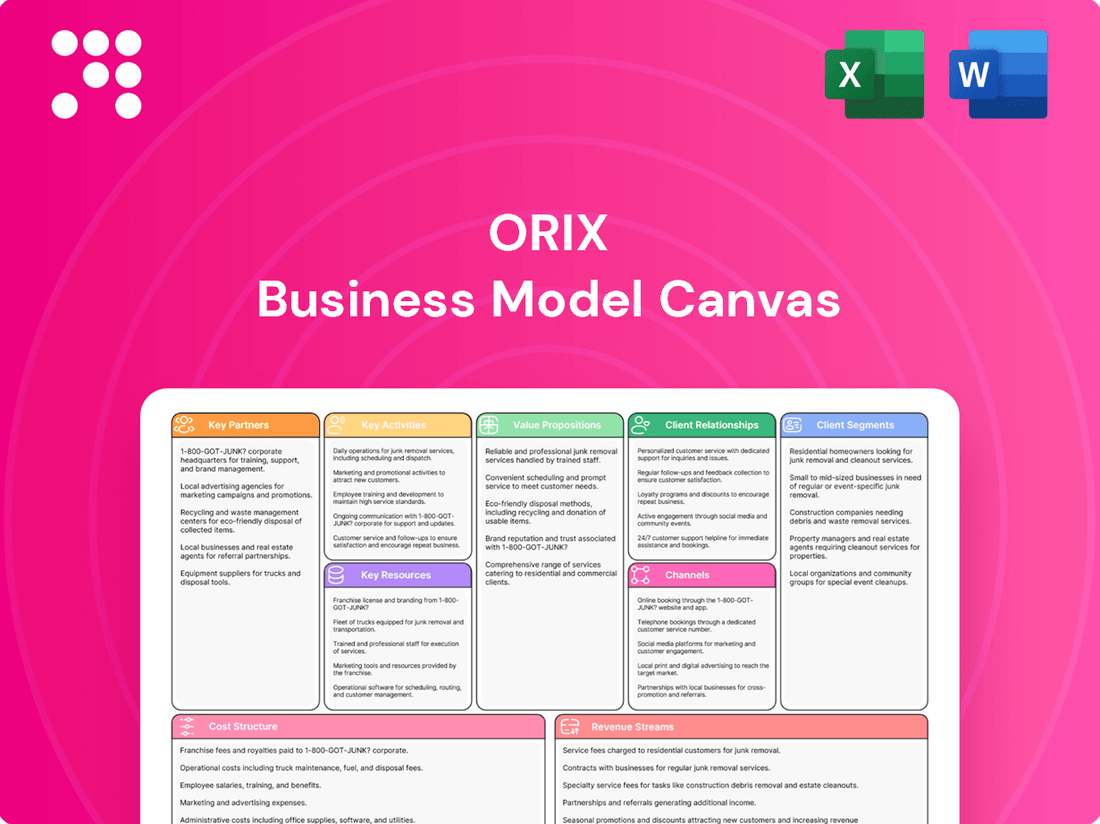

Orix Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Orix Bundle

Curious about Orix's winning formula? Our comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success. Download the full version to gain actionable insights and elevate your own strategic planning.

Partnerships

ORIX actively collaborates with a wide array of financial institutions and lenders, including major global banks and specialized credit providers. These relationships are fundamental to ORIX's ability to secure the necessary capital for its extensive operations, spanning corporate finance, asset-based lending, and real estate development.

These strategic alliances are vital for maintaining ORIX's robust liquidity and strong capital position, which in turn allows the company to offer a comprehensive suite of financial solutions to its clients worldwide. For instance, in 2023, ORIX announced a significant ¥1 trillion (approximately $7 billion USD at the time) syndicated loan facility, underscoring the scale of its partnerships with leading financial entities.

Through these collaborations, ORIX can undertake and support large-scale infrastructure projects and strategic growth initiatives across various industries. Such partnerships are not merely about funding; they often involve co-investment opportunities and knowledge sharing, enhancing ORIX's market reach and operational capabilities.

ORIX actively cultivates strategic investment partnerships, often through joint ventures and co-investments, especially in high-growth areas like renewable energy, private equity, and infrastructure. This approach allows ORIX to share risks and leverage the specialized knowledge and capital of its partners.

A prime example is ORIX's capital partnership with Panasonic Connect. This collaboration focuses on carving out and jointly operating businesses, showcasing a commitment to enhancing global business value by combining complementary strengths and resources. Such alliances are crucial for ORIX's expansion and diversification strategies.

ORIX collaborates with leading technology and equipment manufacturers to secure a consistent supply of assets for its extensive leasing operations. This is crucial for its industrial equipment, ICT, and automotive leasing segments, ensuring clients receive modern and reliable solutions.

These partnerships are vital for ORIX's maintenance leasing services, guaranteeing access to up-to-date machinery and vehicles. For instance, in 2024, ORIX continued to strengthen its ties with major automotive manufacturers, reflecting the industry's rapid technological advancements and the demand for electric vehicle fleets.

Real Estate Developers and Operators

ORIX actively partners with real estate developers and operators across its diverse portfolio. These collaborations are fundamental to sourcing, developing, and managing properties, ensuring efficient operations and maximizing asset value. For instance, in 2024, ORIX's real estate segment continued to leverage these relationships to expand its footprint in key urban centers.

These partnerships are crucial for ORIX's success in the real estate sector. They provide access to expertise in project execution, property management, and facility operations, which are essential for the long-term success and profitability of its real estate investments. This strategy allows ORIX to effectively manage its extensive real estate holdings.

- Development Synergy: ORIX collaborates with developers to identify and execute new real estate projects, benefiting from their market knowledge and construction capabilities.

- Operational Excellence: Partnerships with property and facility managers ensure efficient day-to-day operations, tenant satisfaction, and optimal property maintenance.

- Value Enhancement: These alliances help ORIX enhance the value of its real estate portfolio through strategic upgrades and effective management practices.

- Market Access: Collaborations provide ORIX with access to diverse markets and project types, broadening its investment opportunities.

Government and Public Sector Entities

ORIX actively partners with government and public sector entities to finance and develop critical infrastructure. These collaborations are vital for projects like transportation networks and utilities, often involving long-term concessions. For instance, in 2024, ORIX continued its involvement in airport operations and renewable energy projects, leveraging these public-private partnerships for stable, long-term returns and contributing to national development goals.

These governmental partnerships are characterized by complex regulatory environments and substantial capital requirements. ORIX's expertise in navigating these frameworks allows it to participate in projects that offer predictable revenue streams. The company's 2024 activities underscored its commitment to sectors aligned with sustainable development and public welfare.

- Infrastructure Financing: ORIX provides crucial capital for large-scale public infrastructure projects, ensuring their timely execution and long-term viability.

- Concession Agreements: The company secures and manages concessions, such as airport operations, generating revenue through long-term operational rights.

- Renewable Energy Initiatives: ORIX invests in and supports renewable energy projects, aligning with government mandates for sustainable energy production.

- Public-Private Partnerships (PPPs): These collaborations allow ORIX to engage in significant projects, benefiting from government backing and contributing to societal progress.

ORIX's key partnerships extend to specialized financial service providers and fintech companies to enhance its offerings and operational efficiency. These collaborations are crucial for integrating innovative technologies and expanding into new financial product areas. For example, in 2024, ORIX continued to explore partnerships with companies specializing in digital asset management and blockchain technology to streamline transactions and improve customer experience.

These alliances allow ORIX to offer more sophisticated financial solutions and gain a competitive edge in rapidly evolving markets. By working with these partners, ORIX can better serve its diverse client base and adapt to changing industry trends. The company’s strategic focus in 2024 included leveraging these partnerships to bolster its digital transformation initiatives and expand its global reach.

What is included in the product

A structured framework detailing Orix's diverse financial services, encompassing customer segments, value propositions, and revenue streams across leasing, banking, and insurance.

Organized into key business model components, it illustrates Orix's integrated approach to financial solutions and strategic growth.

The Orix Business Model Canvas acts as a pain point reliever by providing a structured, visual framework that simplifies complex business strategies, making them easier to understand and manage.

It alleviates the pain of fragmented thinking by consolidating all essential business elements onto a single, digestible page, fostering clarity and alignment.

Activities

ORIX's key activities revolve around providing comprehensive corporate finance and leasing solutions. This includes offering diverse lending options and extensive leasing services for a broad range of assets, from automobiles to sophisticated electronic measuring instruments and ICT equipment.

These core activities are vital for ORIX, as they form the backbone of its revenue generation, providing businesses with crucial capital and necessary equipment. For instance, ORIX Corporation USA reported significant growth in its leasing segments, contributing substantially to its overall financial performance in the fiscal year ending March 2024.

ORIX actively pursues real estate development, investment, rental, and property management across diverse asset classes including commercial, residential, and hospitality. This multifaceted approach aims to capture value throughout the real estate lifecycle.

In 2024, ORIX's real estate segment continued to be a significant contributor, with a focus on acquiring and developing properties in key global markets. The company's strategy involves identifying undervalued assets and implementing value-add initiatives to enhance rental income and capital appreciation.

The company's management of rental properties and hospitality assets is geared towards optimizing occupancy rates and guest satisfaction, thereby driving consistent revenue streams. ORIX leverages its expertise to provide end-to-end real estate solutions, from initial acquisition to ongoing operational management.

ORIX's strategic investments and operations are a core engine for growth, spanning a wide array of industries. For instance, in 2024, ORIX continued its aggressive push into renewable energy, announcing a significant investment in a solar power project in Japan, aiming to expand its clean energy portfolio. This strategic focus allows them to capitalize on global trends towards sustainability and energy transition.

The company actively engages in private equity, identifying and acquiring stakes in businesses with strong growth prospects. Their infrastructure investments, such as their involvement in airport concessions, demonstrate a long-term vision for stable returns. ORIX's approach involves not just capital allocation but also active management to drive operational improvements and ultimately achieve profitable exits.

In 2024, ORIX's infrastructure segment reported robust performance, with airport concessions contributing significantly to its earnings, reflecting successful operational management and increased travel demand. This diversified approach to investments and operations, from high-growth tech to essential infrastructure, underpins their resilient business model and ability to generate consistent value.

Retail Finance and Insurance Services

ORIX's retail finance and insurance services are a crucial component, focusing on delivering a wide array of financial products and insurance solutions directly to individual consumers and small businesses. This strategic move broadens their market reach significantly.

This segment is dedicated to crafting personalized financial solutions, catering to the unique needs of individuals and small enterprises. By doing so, ORIX effectively expands its customer base beyond its traditional corporate clientele, leading to a more diversified and resilient revenue structure.

In 2024, ORIX's commitment to retail finance was evident. For instance, their consumer finance operations continued to support personal loans and credit services, contributing to overall group revenue. In the insurance sector, ORIX Life Insurance maintained its market presence, offering various life and non-life insurance products designed for individual protection and savings.

- Consumer Finance: Offering personal loans, credit cards, and other lending products to individuals and small businesses.

- Life Insurance: Providing life insurance policies, including term life, whole life, and savings-oriented products.

- Non-Life Insurance: Offering various insurance coverages such as auto, property, and casualty insurance for individuals.

- Customer Acquisition: Implementing targeted marketing campaigns and digital platforms to attract and serve a broader retail customer base.

Asset Management

ORIX's asset management activities are a cornerstone of its business, focusing on generating consistent fee-based income by managing global portfolios. Through subsidiaries like ROBECO Group, ORIX provides expertise in both equity and fixed income strategies, catering to a diverse client base.

These operations involve the careful management of both ORIX's own capital and significant third-party assets. The goal is to leverage deep investment knowledge to achieve robust returns, thereby enhancing the company's overall profitability and expanding its recurring revenue streams.

- Global Reach: Manages assets across various geographies, including significant operations in Europe via ROBECO Group.

- Diverse Strategies: Offers expertise in both equity and fixed income investment management.

- Dual Capital Management: Oversees both proprietary capital and third-party funds.

- Fee-Based Revenue: Focuses on generating stable income through management fees.

ORIX’s key activities encompass a broad spectrum of financial services, including corporate finance and leasing, real estate development and management, strategic investments across diverse industries, and retail finance and insurance. These activities are supported by robust asset management operations, providing diversified revenue streams and global market reach.

In fiscal year 2024, ORIX Corporation USA’s leasing segments demonstrated strong performance, contributing significantly to overall financial results. Furthermore, ORIX’s strategic investments in renewable energy, such as a solar power project in Japan, highlight its commitment to sustainable growth and capitalizing on global energy transition trends.

The company’s infrastructure segment, particularly airport concessions, reported robust earnings in 2024, driven by increased travel demand and effective operational management. Simultaneously, ORIX’s retail finance operations, including consumer loans and credit services, along with ORIX Life Insurance’s offerings, continued to expand its customer base and diversify revenue.

ORIX’s asset management arm, including ROBECO Group, managed substantial global portfolios in fiscal year 2024, generating significant fee-based income through diverse equity and fixed income strategies, managing both proprietary and third-party assets.

| Key Activity Segment | Focus Area | 2024 Performance Highlight |

|---|---|---|

| Corporate Finance & Leasing | Lending, diverse asset leasing | Strong growth in leasing segments (ORIX USA) |

| Real Estate | Development, investment, rental, management | Acquisition and development in key global markets |

| Strategic Investments | Renewable energy, private equity, infrastructure | Significant investment in Japanese solar power project; robust performance in airport concessions |

| Retail Finance & Insurance | Consumer loans, credit, life & non-life insurance | Continued expansion of customer base; stable market presence for life insurance |

| Asset Management | Global portfolio management (equity, fixed income) | Generated significant fee-based income via ROBECO Group |

Preview Before You Purchase

Business Model Canvas

The Orix Business Model Canvas preview you are viewing is the exact, complete document you will receive after purchase. This means all sections, formatting, and content are identical to the final deliverable, ensuring no surprises. You can trust that what you see is precisely what you will get, ready for immediate use and customization.

Resources

ORIX's financial capital is a cornerstone, built on substantial equity and robust access to global debt markets. This allows them to fund a wide array of lending, leasing, and investment ventures effectively.

As of the fiscal year ending March 2024, ORIX Corporation reported total equity of approximately ¥5.1 trillion (around $33 billion USD at current exchange rates), underscoring its strong financial foundation. This robust capital base is crucial for supporting its expansive global operations and strategic growth initiatives, including potential acquisitions.

ORIX's diversified asset portfolio is a cornerstone of its business model, encompassing financial services, real estate, aircraft, ships, and renewable energy. This broad spectrum of holdings, as of early 2024, allows ORIX to tap into various economic cycles and mitigate sector-specific downturns.

This strategic diversification is evident in ORIX's financial performance. For the fiscal year ending March 2024, ORIX Corporation reported consolidated net income attributable to common shareholders of approximately ¥527.5 billion (around $3.5 billion USD at prevailing exchange rates), demonstrating the resilience and profitability generated across its diverse business segments.

By holding assets in areas like aircraft leasing and renewable energy projects, ORIX not only generates stable income streams but also positions itself for future growth in sectors with strong long-term demand. This multi-faceted approach to asset management is key to its sustained value creation.

ORIX's profound expertise in financial structuring and risk management forms a cornerstone of its operations. This intellectual capital is crucial for navigating complex financial landscapes and identifying lucrative ventures.

This deep understanding enables ORIX to adeptly assess credit risk and manage a wide array of investments, a critical capability in today's volatile markets. For instance, as of March 31, 2024, ORIX Corporation reported total assets of approximately ¥22.7 trillion, underscoring the scale of its managed portfolio.

By leveraging this specialized knowledge, ORIX can effectively pinpoint profitable opportunities while simultaneously safeguarding against potential financial downturns across its diverse business segments, from corporate financial services to real estate and energy.

Global Network and Market Presence

ORIX leverages its extensive global network, spanning approximately 30 countries and regions, to tap into diverse markets and identify a wide array of investment opportunities. This broad international footprint is fundamental to its ability to execute cross-border transactions efficiently and source assets globally.

This widespread presence significantly enhances ORIX's client servicing capabilities by allowing it to cater to a global clientele and offer tailored solutions across different geographies. For instance, in fiscal year 2024, ORIX reported significant contributions from its international operations, underscoring the strategic importance of its global network.

- Global Reach: Operations in approximately 30 countries and regions.

- Market Access: Facilitates access to diverse international markets.

- Transaction Capabilities: Crucial for cross-border deal execution and asset sourcing.

- Client Servicing: Enables comprehensive support for a global customer base.

Skilled Human Capital

ORIX's skilled human capital, encompassing financial analysts, investment professionals, real estate specialists, and operational managers, is a cornerstone of its business model. This deep pool of expertise allows ORIX to navigate complex financial landscapes and execute diverse strategies across its various segments.

The collective knowledge and adaptability of its workforce are critical for ORIX's success in dynamic market conditions. For instance, as of fiscal year 2024, ORIX reported approximately 33,000 employees globally, a testament to the scale of its human capital investment.

- Financial Acumen: Expertise in financial analysis and investment management drives profitability and strategic decision-making.

- Real Estate Insight: Specialized knowledge in real estate markets enables effective property development and management.

- Operational Excellence: Experienced operational managers ensure efficient execution across ORIX's diverse businesses.

- Adaptability: The workforce's ability to respond to evolving market trends is key to sustaining competitive advantage.

ORIX's key resources are its strong financial capital, diversified asset portfolio, deep expertise in financial structuring and risk management, extensive global network, and skilled human capital. These elements collectively enable ORIX to pursue a wide range of investment and business opportunities across various sectors and geographies.

| Key Resource | Description | Fiscal Year 2024 Data/Context |

|---|---|---|

| Financial Capital | Equity and debt market access for funding operations. | Total equity: ¥5.1 trillion (approx. $33 billion USD) |

| Diversified Asset Portfolio | Holdings in financial services, real estate, aircraft, ships, and energy. | Net income: ¥527.5 billion (approx. $3.5 billion USD) |

| Expertise | Financial structuring and risk management capabilities. | Total assets: ¥22.7 trillion |

| Global Network | Operations in approximately 30 countries and regions. | Facilitates cross-border transactions and market access. |

| Human Capital | Skilled workforce in finance, real estate, and operations. | Global employees: Approx. 33,000 |

Value Propositions

ORIX provides a wide range of financial services, encompassing corporate finance, leasing, and investment products. This allows them to cater to a broad client base, from individuals to major corporations, offering a one-stop shop for diverse financial needs.

In fiscal year 2024, ORIX reported consolidated net income attributable to shareholders of approximately $3.1 billion, demonstrating the scale and success of their diversified financial solutions across various segments.

ORIX actively pursues strategic investment opportunities in burgeoning sectors like renewable energy, private equity, and infrastructure. This provides clients and partners with entry into distinct asset classes, aiming for substantial returns.

For instance, in 2024, ORIX Corporation USA completed a significant investment in a solar energy project, highlighting its commitment to the renewable energy space and its strategy to capitalize on the global energy transition.

The company's proficiency in pinpointing and nurturing these high-potential ventures adds value that extends beyond conventional financial services, leveraging its deep market knowledge.

ORIX's core strength lies in its profound expertise in asset management and value creation. This isn't just about holding assets; it's about actively growing their worth through sophisticated valuation, strategic management, and efficient capital recycling. For instance, ORIX's real estate division has consistently demonstrated its ability to identify undervalued properties, implement improvement strategies, and achieve profitable dispositions.

This deep understanding of asset lifecycles is crucial for generating superior returns. ORIX applies this acumen across diverse sectors, including aircraft leasing and private equity. By meticulously managing these investments, ORIX ensures they perform optimally throughout their holding period, paving the way for successful and strategic exits that maximize shareholder value.

Global Reach and Local Presence

ORIX leverages its extensive network across more than 30 countries to offer a truly global financial perspective. This expansive reach allows the company to tap into diverse markets and provide clients with a broad spectrum of financial solutions. By understanding the nuances of each local market, ORIX ensures its services are not only globally competitive but also locally relevant.

This strategic blend of global expertise and local understanding is a cornerstone of ORIX's value proposition. It means clients receive the benefit of international best practices, informed by on-the-ground knowledge of specific regional economic conditions and regulatory environments. For instance, ORIX's operations in Asia, a key growth region, demonstrate this by tailoring services to meet the unique demands of markets like Japan, China, and Southeast Asia.

The company's commitment to a dual approach is reflected in its financial performance and client engagement. In the fiscal year ending March 2024, ORIX reported consolidated net income of ¥390.6 billion, underscoring its ability to generate value across its diverse international operations. This financial strength supports its capacity to deliver sophisticated, localized solutions.

- Global Network: Operations in over 30 countries.

- Market Insight: Deep understanding of local economic and regulatory landscapes.

- Client Benefit: Access to global best practices combined with tailored local solutions.

- Financial Strength: Consolidated net income of ¥390.6 billion for FY2024 supports service delivery.

Commitment to Sustainability and Responsible Investment

ORIX's dedication to sustainability is a core value proposition, resonating strongly with a growing segment of investors and clients. This commitment is particularly evident in their significant investments within the renewable energy and environmental sectors, demonstrating a tangible effort to align financial growth with positive environmental impact.

This focus on ESG (Environmental, Social, and Governance) factors directly appeals to those who seek to integrate their financial aspirations with broader societal and environmental betterment. For instance, ORIX Corporation's fiscal year 2024 results highlighted robust performance in their environmental infrastructure business, contributing to a substantial portion of their overall revenue growth.

- Focus on Renewable Energy: ORIX actively invests in solar, wind, and other clean energy projects, a sector projected to see continued expansion through 2024 and beyond.

- ESG Integration: The company's strategy incorporates ESG principles, attracting capital from a client base increasingly prioritizing responsible investment.

- Environmental Solutions: ORIX provides solutions for environmental protection and resource management, meeting market demand for sustainable business practices.

- Long-Term Value Creation: By prioritizing sustainability, ORIX aims to create enduring value for stakeholders while contributing to a more sustainable future.

ORIX's value proposition centers on its comprehensive financial solutions, spanning corporate finance, leasing, and investment products, serving a diverse clientele from individuals to large corporations. This integrated approach offers clients a single point of access for a wide array of financial needs.

The company's strategic focus on high-growth sectors like renewable energy and private equity provides clients with access to distinct asset classes, aiming for significant returns. This is exemplified by ORIX Corporation USA's 2024 investment in a solar energy project, underscoring its commitment to capitalizing on the global energy transition.

ORIX's core strength lies in its deep expertise in asset management and value creation, actively enhancing asset worth through sophisticated valuation and strategic management. This acumen is applied across diverse sectors, including aircraft leasing and private equity, ensuring optimal performance and maximizing shareholder value through strategic exits.

Furthermore, ORIX leverages its extensive global network, operating in over 30 countries, to offer localized financial solutions informed by deep market understanding. This blend of global best practices and local insight is a key differentiator, as demonstrated by its tailored services in key Asian markets.

The company's commitment to sustainability, particularly in renewable energy and environmental sectors, appeals to investors prioritizing ESG principles. ORIX's fiscal year 2024 results showed strong performance in its environmental infrastructure business, contributing significantly to revenue growth.

| Value Proposition | Description | Supporting Data/Examples |

| Comprehensive Financial Solutions | One-stop shop for diverse financial needs. | Services include corporate finance, leasing, investment products. |

| Strategic Investment Focus | Access to high-growth sectors for substantial returns. | 2024 investment in solar energy project by ORIX Corporation USA. |

| Expert Asset Management | Active value creation through sophisticated management. | Proficiency demonstrated across real estate, aircraft leasing, and private equity. |

| Global Network & Local Insight | Tailored solutions combining global best practices with local market understanding. | Operations in over 30 countries; tailored services in Asian markets. FY2024 net income: ¥390.6 billion. |

| Commitment to Sustainability | Focus on ESG and renewable energy investments. | Strong performance in environmental infrastructure business in FY2024. |

Customer Relationships

ORIX cultivates robust customer relationships by assigning dedicated account managers. These professionals offer personalized service and craft bespoke financial solutions for corporate clients and large institutions, ensuring a deep understanding of their unique needs.

This dedicated approach fosters enduring partnerships, providing clients with consistent support and strategic financial guidance. For instance, ORIX’s commitment to client success is reflected in its ability to structure complex financing arrangements, such as the ¥100 billion ($670 million USD as of July 2024) sustainability-linked loan facility provided to a major Japanese utility in early 2024.

ORIX cultivates deep client relationships through an advisory and consultative approach, particularly for its investment and corporate finance clientele. This means offering expert guidance on intricate financial structures and strategic investment planning.

This goes beyond simple transactions; ORIX aims to build lasting trust by providing insightful solutions that optimize client assets and demonstrate tangible value. For instance, in 2024, ORIX Capital Markets advised on several significant cross-border M&A deals, showcasing their ability to navigate complex financial landscapes.

ORIX leverages digital platforms and self-service options to efficiently serve individual and smaller business clients. Online portals facilitate applications for retail finance and insurance, boosting convenience and remote access.

These digital channels allow clients to easily manage their accounts and access a range of services. For instance, in fiscal year 2024, ORIX reported a significant increase in digital transaction volumes across its various business segments, reflecting the growing reliance on these platforms.

Community Engagement and CSR Initiatives

ORIX actively participates in Corporate Social Responsibility (CSR) and community engagement, especially around its renewable energy and infrastructure sites. These efforts foster positive relationships with local populations and stakeholders, demonstrating a commitment to social impact alongside business objectives.

For example, in 2024, ORIX Japan supported local environmental clean-up drives and educational programs focused on sustainability. Such initiatives not only build goodwill but also enhance ORIX's reputation as a responsible corporate citizen.

- Community Programs: ORIX's commitment extends to supporting local educational institutions and cultural events in areas where it has significant operations.

- Environmental Stewardship: The company invests in and promotes environmental conservation efforts, particularly in regions impacted by its infrastructure development.

- Stakeholder Relations: These activities are crucial for building trust and long-term partnerships with communities, contributing to the social license to operate.

Partnerships with Intermediaries

ORIX actively cultivates partnerships with financial intermediaries, including brokers and agents, to expand its market penetration for leasing, insurance, and retail finance offerings. These collaborations are crucial for accessing a wider customer base by tapping into established networks.

These indirect relationships allow ORIX to significantly extend its market reach and streamline customer acquisition processes. For instance, in 2023, ORIX Corporation USA reported that its indirect financing channels contributed to a substantial portion of its new business originations, demonstrating the efficacy of these partnerships in driving growth.

- Expanded Market Reach: Partnerships with intermediaries allow ORIX to access customer segments it might not reach directly.

- Cost-Effective Acquisition: Leveraging partner networks often proves more cost-effective for customer acquisition than direct marketing efforts.

- Product Diversification: Intermediaries can offer a range of ORIX products, increasing cross-selling opportunities.

- 2023 Performance: ORIX Corporation USA saw a notable increase in new business volume through its intermediary channels in 2023, underscoring the strategic importance of these relationships.

ORIX builds strong customer relationships through dedicated account managers for corporate clients, offering personalized service and tailored financial solutions. For individual and smaller businesses, digital platforms provide convenient self-service options for managing accounts and accessing services. Furthermore, ORIX engages in community programs and environmental stewardship to foster positive stakeholder relations, enhancing its reputation as a responsible corporate citizen.

These varied approaches ensure deep engagement, from complex financial advisory for large institutions to accessible digital tools for retail customers. ORIX’s strategy emphasizes building trust and delivering tangible value, as seen in its 2024 advisory roles in significant M&A deals and increased digital transaction volumes.

| Relationship Type | Key Activities | Examples/Data |

|---|---|---|

| Dedicated Account Management | Personalized service, bespoke financial solutions | ¥100 billion sustainability-linked loan to Japanese utility (early 2024) |

| Advisory & Consultative | Expert guidance on financial structures, strategic planning | Advised on cross-border M&A deals (2024) |

| Digital Platforms | Online portals, self-service options | Significant increase in digital transaction volumes (FY 2024) |

| Community Engagement | CSR, local support, environmental initiatives | Supported local environmental clean-ups and sustainability education (2024) |

| Intermediary Partnerships | Collaborations with brokers and agents | Notable increase in new business volume via indirect channels (2023) |

Channels

ORIX leverages a direct sales force and dedicated relationship managers to cultivate deep connections with key client segments, including large corporations, institutional investors, and high-net-worth individuals. This approach is crucial for its corporate finance, private equity, and asset management divisions, where tailored advice and complex solutions are paramount.

These direct channels facilitate highly personalized interactions, enabling ORIX to understand intricate client needs and develop bespoke financial strategies. For instance, in fiscal year 2024, ORIX’s financial advisory services saw significant growth driven by these relationship-centric engagements, with new mandates secured from major industrial and technology firms.

ORIX leverages a robust branch network and regional offices, especially in Japan, to serve its retail finance, banking, and certain corporate financial services. These physical touchpoints offer crucial in-person interaction for clients needing consultations and direct service delivery. As of March 2024, ORIX Corporation’s consolidated net revenue was approximately ¥2.1 trillion, with its domestic operations forming a significant portion of this, underscoring the importance of its physical presence in key Japanese markets.

Orix increasingly utilizes its corporate website and dedicated digital portals to share vital company information, including investor relations updates and details on financial product applications. These online channels significantly boost accessibility and transparency for investors and customers alike.

In 2024, Orix reported a substantial increase in website traffic, indicating a growing reliance on digital channels for engagement. This digital push streamlines operations, allowing for more efficient communication and interaction with a broad spectrum of stakeholders.

Strategic Partnerships and Affiliates

ORIX leverages a robust network of consolidated subsidiaries and affiliates to significantly broaden its market presence and service offerings. This structure allows for the delivery of specialized financial and business solutions across diverse industries and international markets, acting as a key channel to reach customers indirectly.

These strategic alliances and the internal group structure are crucial for ORIX's business model, enabling access to new customer segments and the provision of tailored services that might otherwise be inaccessible. For instance, in 2023, ORIX’s consolidated group revenue reached approximately ¥2,158 billion, reflecting the scale and impact of its integrated operations and partnerships.

- Subsidiary Network: ORIX operates through a vast array of subsidiaries, each often specializing in specific financial services or industries, such as leasing, banking, and asset management.

- Geographic Reach: The company's global footprint, supported by these affiliates, allows it to serve clients in over 30 countries and regions.

- Service Diversification: Partnerships and subsidiaries enable ORIX to offer a comprehensive suite of services, from corporate finance and investment banking to real estate and energy solutions.

- Synergistic Growth: By integrating the capabilities of its diverse group companies, ORIX fosters internal synergies that drive innovation and enhance competitive positioning.

Industry Events and Conferences

ORIX actively participates in key industry events and financial conferences. This engagement allows them to demonstrate their specialized knowledge and build relationships with potential clients and collaborators. For instance, their presence at major financial summits in 2024 provided valuable opportunities for direct interaction and market intelligence gathering.

These gatherings are vital for ORIX's business development strategy, enhancing brand recognition within specific investment and financial markets. By showcasing their capabilities, they attract new business and reinforce their position as industry leaders.

- Showcasing Expertise: ORIX leverages these events to present case studies and insights, highlighting their success in complex financial transactions.

- Networking Opportunities: Participation facilitates direct engagement with a diverse range of stakeholders, from institutional investors to corporate executives.

- Market Trend Analysis: Attending industry conferences in 2024 provided ORIX with real-time data on emerging financial technologies and regulatory shifts.

- Brand Visibility: Strategic sponsorship and speaking engagements at these events significantly boost ORIX's profile in the competitive financial landscape.

ORIX utilizes a multi-channel approach, blending direct client engagement with broad digital and indirect outreach. This strategy ensures comprehensive market coverage and caters to diverse client needs, from personalized advisory to accessible online services.

The company's investment in digital platforms and its extensive subsidiary network are key enablers for reaching a wide customer base and offering specialized solutions. ORIX's consolidated net revenue of ¥2.1 trillion in fiscal year 2024 highlights the effectiveness of its diverse channel strategy.

Through direct sales, a strong branch network, digital portals, and its subsidiary ecosystem, ORIX effectively serves both retail and institutional clients across various financial sectors. Industry event participation further bolsters its market presence and relationship-building efforts.

| Channel Type | Primary Use | Key Benefits | 2024 Impact/Data |

|---|---|---|---|

| Direct Sales Force & Relationship Managers | Corporate Finance, Private Equity, Asset Management | Personalized advice, deep client understanding | Drove growth in financial advisory services |

| Branch Network & Regional Offices | Retail Finance, Banking, some Corporate Services | In-person consultation, direct service | Supported significant portion of domestic revenue |

| Corporate Website & Digital Portals | Information sharing, investor relations, product applications | Accessibility, transparency, efficient communication | Increased website traffic, streamlined stakeholder interaction |

| Subsidiary Network & Affiliates | Broad market presence, specialized solutions | Access to new segments, diverse service offerings | Contributed to ¥2.16 trillion consolidated revenue (2023) |

| Industry Events & Conferences | Demonstrate expertise, build relationships, market intelligence | Brand visibility, networking, trend analysis | Provided opportunities for direct interaction and market insights |

Customer Segments

ORIX provides tailored corporate finance, leasing, and strategic investment solutions to large corporations and multinational enterprises. These clients, often with complex capital requirements and global operations, benefit from ORIX's ability to structure customized financial arrangements. For instance, ORIX USA's acquisition of Royal Bank of Canada's U.S. equipment finance business in 2024, valued at approximately $1.6 billion, demonstrates its commitment to serving large-scale corporate needs in the leasing sector.

Small and Medium-sized Enterprises (SMEs) are a cornerstone of ORIX's customer base, especially benefiting from their leasing and corporate lending divisions. These businesses often require tailored financial products to manage equipment acquisition and operational capital, areas where ORIX excels.

In 2024, SMEs continued to be a vital engine for economic growth, and ORIX's financial solutions played a key role in their expansion. For instance, ORIX’s leasing services provide SMEs with access to essential assets like vehicles and machinery without the upfront capital expenditure, freeing up cash flow for other critical business functions.

ORIX's corporate lending arm offers flexible financing options that cater to the diverse needs of SMEs, from working capital to expansion loans. This support is crucial as many SMEs navigate economic shifts and seek to invest in new technologies or markets, contributing to their overall resilience and growth trajectory.

Orix serves individual investors and retail clients by offering a range of accessible financial products. These include vital life insurance policies designed for personal wealth protection and consumer loans that support everyday financial needs.

This segment actively seeks dependable and straightforward financial solutions to manage their personal finances effectively. For instance, in 2024, the demand for digitalized insurance offerings saw significant growth, with many retail clients preferring online platforms for policy management and claims processing.

Institutional Investors and Funds

ORIX actively partners with institutional investors, including pension funds and various investment funds, offering them specialized asset management services. These collaborations often involve co-investment opportunities, particularly within ORIX's private equity and real asset portfolios. Clients in this segment are primarily seeking sophisticated investment strategies and broad diversification across their holdings.

In 2024, the global institutional investor market continued to seek alpha generation through alternative investments. For instance, pension funds globally allocated an average of 22% to private markets by the end of 2023, a figure expected to grow. ORIX's ability to provide access to these less liquid, potentially higher-yielding assets directly addresses this demand.

- Specialized Strategies: ORIX offers tailored investment approaches designed to meet the specific risk and return profiles of institutional clients.

- Co-Investment Opportunities: These investors can participate alongside ORIX in significant private equity and real asset deals, leveraging ORIX's expertise and deal sourcing capabilities.

- Diversification Needs: ORIX's diverse asset management platform allows institutional investors to enhance their portfolio diversification, reducing overall risk.

- Demand for Alternatives: Institutional capital is increasingly flowing into alternatives, with ORIX well-positioned to capture this trend through its established track record and global reach.

Public Sector and Government Entities

Public sector and government entities represent a significant customer segment for ORIX, particularly within its infrastructure and concession businesses. These organizations rely on ORIX for crucial public utility projects, such as airport operations and the development of renewable energy infrastructure. For instance, ORIX's involvement in airport management often entails long-term agreements with national or regional governments, ensuring stable revenue streams and a focus on public service delivery.

These relationships are characterized by their long-term nature, often spanning decades, and a shared commitment to public welfare and sustainable development. Government bodies are keen on partners who can deliver reliable infrastructure and contribute to economic growth. ORIX’s expertise in managing complex projects aligns with these governmental objectives, making them a preferred partner for public-private partnerships.

ORIX's infrastructure investments in the public sector are substantial. For example, in 2024, ORIX continued to expand its portfolio in renewable energy, with projects contributing to national decarbonization targets. These ventures often involve significant upfront capital and a commitment to operational excellence over extended periods, reflecting the strategic importance of these assets to the public good.

- Airport Operations: ORIX manages key airport facilities, partnering with governments for infrastructure development and operational efficiency.

- Renewable Energy Projects: Government entities contract ORIX for the development and management of solar, wind, and other renewable energy sources.

- Long-Term Concessions: Contracts with public sector clients are typically long-term, ensuring predictable revenue and a focus on sustainable public services.

- Public-Private Partnerships: ORIX actively engages in PPPs, leveraging private sector expertise for public infrastructure needs.

ORIX strategically serves a diverse customer base, from multinational corporations requiring complex financial structuring to SMEs seeking accessible leasing and lending solutions. The company also caters to individual investors with life insurance and consumer loans, and partners with institutional investors for asset management and co-investment opportunities.

Cost Structure

ORIX's funding costs are a substantial part of its expenses, primarily driven by interest paid on its significant borrowings. These borrowings fuel its diverse operations, including lending, leasing, and various investment ventures.

For instance, as of the fiscal year ending March 31, 2024, ORIX Corporation reported interest expenses of approximately ¥370.3 billion. This figure underscores the direct impact of interest rate fluctuations on the company's bottom line and profitability.

Orix's operating expenses are a significant component of its cost structure, encompassing employee salaries and benefits, administrative costs, and general overheads. These expenses are crucial for managing its vast global operations and supporting a diverse workforce across its various business segments.

In fiscal year 2024, Orix reported operating income of ¥1,161,143 million, reflecting the substantial investments made in its operational infrastructure and personnel to drive its diversified business activities.

Orix's cost structure includes significant depreciation and amortization expenses due to its extensive asset base. In its fiscal year ending March 2024, Orix reported depreciation and amortization of ¥221.9 billion, reflecting the wear and tear on its considerable leasing assets like aircraft and ships, as well as its real estate holdings. These non-cash charges are a key component of its operational costs, representing the gradual reduction in value of its tangible and intangible assets over their useful lives.

Investment-Related Expenses

Investment-related expenses are a significant component of ORIX's cost structure, directly supporting its value creation strategy through strategic investments. These costs encompass the entire lifecycle of an investment, from initial identification and acquisition to ongoing management.

Key expenses include due diligence fees, which are critical for thoroughly evaluating potential investments, and transaction costs associated with the actual purchase or sale of assets. For instance, in 2024, the private equity sector saw average deal advisory fees range from 1% to 3% of transaction value, highlighting the substantial nature of these costs for a firm like ORIX.

Furthermore, ORIX incurs ongoing management fees for its private equity and real asset portfolios. These fees are essential for covering the operational costs of managing these investments effectively and driving long-term value. In 2023, management fees for private equity funds typically fell between 1.5% and 2% of committed capital annually, reflecting the industry standard that ORIX would likely align with.

- Due Diligence Fees: Costs incurred for evaluating potential investment opportunities, ensuring thorough risk assessment and financial viability.

- Transaction Costs: Expenses related to the execution of investment deals, including legal, advisory, and brokerage fees.

- Management Fees: Ongoing charges for the professional management of private equity and real asset portfolios, crucial for active value creation.

- Portfolio Monitoring Expenses: Costs associated with the continuous oversight and performance tracking of existing investments to identify opportunities and mitigate risks.

Risk Management and Compliance Costs

ORIX invests significantly in risk management and compliance. These expenses cover the development and maintenance of robust frameworks to identify, assess, and mitigate financial and operational risks across its diverse global operations. In 2024, ORIX continued to prioritize these areas to navigate complex regulatory landscapes.

Compliance costs are substantial, reflecting adherence to financial regulations in numerous countries where ORIX operates. This includes expenses for legal counsel, regulatory reporting systems, and dedicated compliance personnel to ensure adherence to evolving legal requirements.

Furthermore, internal audit functions represent a key cost component, providing independent assurance on the effectiveness of internal controls and risk management processes. These investments are crucial for maintaining ORIX's strong credit ratings and investor confidence.

- Risk Management Frameworks: Costs associated with sophisticated systems and expert personnel for identifying and mitigating financial and operational risks.

- Regulatory Compliance: Expenses for legal, technology, and staffing to ensure adherence to diverse international financial regulations.

- Internal Audit Functions: Investment in independent review processes to guarantee operational integrity and control effectiveness.

ORIX's cost structure is heavily influenced by its funding strategy, with interest expenses on borrowings forming a significant portion. Operating expenses, including personnel and administration, are also substantial due to its global reach. Furthermore, depreciation and amortization reflect the value of its extensive leasing and real estate assets.

| Cost Category | FY 2024 (¥ billions) | Description |

|---|---|---|

| Interest Expenses | 370.3 | Cost of borrowing to fund operations and investments. |

| Depreciation & Amortization | 221.9 | Non-cash expense reflecting the wear and tear on ORIX's asset base. |

| Operating Expenses | (Included in overall financial reporting, not separately itemized for this context) | Covers salaries, benefits, and administrative costs for global operations. |

Revenue Streams

ORIX generates significant revenue through interest income earned on its diverse portfolio of financial products. This includes interest from corporate finance activities, loans extended to businesses, and income from various financial instruments it holds.

The company's banking and credit segments are central to this revenue stream, demonstrating its core function as a financial services provider. For the fiscal year ending March 31, 2024, ORIX reported total interest income of approximately ¥460 billion, highlighting the substantial contribution of this segment to its overall financial performance.

ORIX generates substantial revenue through leasing and renting out a diverse portfolio of assets. This includes everything from cars and industrial machinery to aircraft and commercial real estate.

This leasing and rental income is a predictable and consistent revenue stream, forming a vital part of ORIX's overall business strategy. For instance, in the fiscal year ending March 31, 2024, ORIX Corporation reported total revenues of ¥2,106.9 billion, with leasing and other businesses contributing significantly to this figure.

ORIX actively realizes gains through the divestment of its portfolio companies and other assets, a key component of its capital management strategy. This includes profits derived from selling stakes in private equity investments and real estate holdings, which are crucial for replenishing capital for new ventures.

In the fiscal year ending March 31, 2024, ORIX reported significant income from gains on sales of investments and other assets. For instance, the company's consolidated financial results highlighted substantial contributions from such activities, underscoring their importance in overall financial performance.

Fees and Commissions

ORIX generates income through a variety of fee-based services, enhancing its revenue diversification. These include asset management fees, advisory services, and commissions earned from insurance product sales. This segment is characterized by being less capital-intensive compared to other revenue streams.

For the fiscal year ending March 31, 2024, ORIX reported significant contributions from its fee and commission-based businesses. For instance, its Financial Services segment, which heavily relies on such income, demonstrated robust performance, reflecting the ongoing demand for its diverse offerings.

- Asset Management Fees: ORIX earns fees for managing investment portfolios across various asset classes.

- Advisory Fees: Income is generated from providing financial and strategic advice to corporate and individual clients.

- Commissions: Revenue is derived from commissions on the sale of insurance and other financial products.

- Transaction Fees: Fees associated with specific financial transactions, such as loan origination or securitization, also contribute.

Concession and Operation Income

Orix generates revenue through concession and operation income, primarily from managing public infrastructure like airports. These long-term contracts offer predictable and stable cash flows, a key element for consistent earnings. For instance, airport concessions often involve fees from retail, parking, and airline services, contributing significantly to operational income.

Beyond airports, Orix's operational businesses, such as those in the renewable energy sector, also bolster this revenue stream. These ventures are typically underpinned by long-term power purchase agreements, ensuring a steady and reliable income for extended periods. This stability is a hallmark of Orix's approach to infrastructure and operational investments.

- Airport Concessions: Revenue derived from retail, parking, and airline services at managed airports.

- Renewable Energy Operations: Income from operating solar, wind, and other green energy facilities under long-term agreements.

- Infrastructure Management: Fees and income generated from the ongoing operation and maintenance of various public infrastructure assets.

- Long-Term Contracts: The foundation of this revenue stream, providing predictable and stable cash flows over many years.

ORIX's revenue streams are multifaceted, encompassing core financial services, asset-based income, capital gains, fee-based services, and operational income from concessions and infrastructure management.

The company's financial services, including banking and credit, generated substantial interest income. Leasing and rental activities provide a steady income from a diverse asset base, while gains from asset divestments offer opportunistic profit realization.

Fee-based services, such as asset management and advisory, contribute to revenue diversification with lower capital intensity. Concessions and infrastructure operations, particularly in airports and renewable energy, ensure predictable, long-term cash flows.

| Revenue Stream | Description | FY2024 Contribution (Approximate) |

|---|---|---|

| Interest Income | From corporate finance, loans, and financial instruments. | ¥460 billion (Interest Income) |

| Leasing & Rental Income | From diverse assets like vehicles, machinery, and real estate. | Significant portion of ¥2,106.9 billion total revenue. |

| Gains on Sales of Assets | Profits from divesting portfolio companies and real estate. | Substantial contributions noted in financial results. |

| Fee-Based Services | Asset management, advisory, and commissions. | Robust performance in Financial Services segment. |

| Concessions & Operations | Airport fees, renewable energy income, infrastructure management. | Stable, predictable cash flows from long-term contracts. |

Business Model Canvas Data Sources

The Orix Business Model Canvas is constructed using a blend of internal financial statements, customer feedback surveys, and competitive landscape analysis. This multi-faceted approach ensures a comprehensive and data-driven representation of Orix's strategic framework.