Orix Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Orix Bundle

Discover the core of Orix's marketing strategy by exploring their product offerings, pricing models, distribution channels, and promotional activities. This analysis provides a foundational understanding of how these elements contribute to their market presence.

Ready to move beyond the overview? Unlock the full, in-depth 4Ps Marketing Mix Analysis for Orix, complete with actionable insights and strategic examples. Get a comprehensive, editable report designed for professionals and students alike.

Product

ORIX Corporation's diversified financial services encompass a broad spectrum, including corporate finance, leasing, loans, and investment banking, catering to a global clientele of businesses and individuals. This expansive portfolio is central to their strategy, showcasing deep expertise across various financial instruments and solutions. For instance, as of the fiscal year ending March 31, 2024, ORIX reported total revenue of ¥2,437.8 billion, with its financial services segments forming a significant portion of this figure, demonstrating the scale and reach of its offerings.

ORIX's Product strategy in real estate is broad, covering development, rental, and management across urban projects, offices, logistics, and housing. This comprehensive approach aims to establish ORIX as a full-service real estate group.

The company's involvement spans diverse property types, from large-scale urban developments to specialized logistics facilities and residential condominiums. This wide reach demonstrates a commitment to capturing various segments of the real estate market.

Leveraging its core financial expertise, ORIX strategically integrates financial solutions within its real estate operations. This synergy allows for innovative financing structures and a deeper understanding of market dynamics, as seen in their robust condominium development and brokerage services.

For the fiscal year ending March 2024, ORIX reported significant contributions from its real estate segment, reflecting the company's active engagement and success in the property market.

ORIX is actively investing in renewable energy, with a notable focus on solar and wind power projects. As of early 2024, their commitment extends to developing and financing substantial solar farms and wind power plants, contributing to a cleaner energy future.

The company is also broadening its reach into energy storage solutions, recognizing the critical role of battery systems in grid stability. This expansion into battery energy storage systems (BESS) is a key part of their strategy to support the integration of renewable sources.

Furthermore, ORIX is facilitating corporate power purchase agreements (PPAs), enabling businesses to procure renewable energy directly. This approach underscores their dedication to sustainable development and meeting the evolving global energy demands through innovative financial solutions.

Investment and Operation (Private Equity & Concession)

ORIX’s Investment and Operation segment is a core component of its strategy, encompassing private equity investments, M&A brokerage, and concession businesses. This multifaceted approach allows ORIX to actively participate in and shape the growth of various industries.

The company’s expertise extends to operating businesses, particularly in infrastructure. For instance, ORIX has been a significant player in airport concessions, demonstrating its ability to manage and enhance large-scale projects. This hands-on operational involvement is key to their value creation model.

A central theme in this segment is strategic investment and capital recycling. ORIX aims to identify promising businesses, inject capital, improve operations, and then strategically divest or restructure to redeploy capital into new opportunities. This dynamic approach fuels continuous growth and returns.

Key highlights of ORIX’s Investment and Operation activities include:

- Private Equity Investments: ORIX actively manages private equity funds, targeting companies with strong growth potential across diverse sectors.

- M&A Brokerage: The company provides advisory services for mergers and acquisitions, facilitating strategic transactions for its clients and portfolio companies.

- Concession Businesses: ORIX invests in and operates infrastructure concessions, such as airports and toll roads, generating stable, long-term revenue streams.

- Capital Recycling: A core strategy involves the efficient recycling of capital from mature investments into new ventures, optimizing portfolio performance.

Automobile and Mobility Services

ORIX's automobile and mobility services offer a broad spectrum of solutions, encompassing car leasing, car rental, and specialized business transportation. This includes their self-drive rental service, MyChoize, which provides flexibility for individual travelers. For businesses, ORIX delivers comprehensive fleet management and mobility solutions, demonstrating their capability in serving diverse client needs within the automotive sector.

The company's commitment to the automotive and mobility sector is evident in its diverse offerings, catering to both individual and corporate clients. For instance, ORIX India's car leasing and rental services are a significant part of their business, aiming to provide seamless transportation experiences. In fiscal year 2023, ORIX India reported substantial growth in its leasing and rental segments, reflecting increasing demand for flexible mobility solutions.

- Car Leasing: ORIX provides tailored leasing solutions for corporate fleets and individual customers, optimizing vehicle acquisition and management.

- Car Rental: Services like MyChoize offer convenient self-drive rental options across various Indian cities, catering to short-term and long-term needs.

- Business Transportation: ORIX manages and operates fleets for corporate clients, ensuring efficient and reliable employee transportation and logistics.

- Fleet Management: The company leverages its expertise to manage vehicle maintenance, insurance, and lifecycle for corporate partners, reducing operational burdens.

ORIX's product strategy is characterized by its diversification across financial services, real estate, renewable energy, investment and operation, and automotive/mobility. This broad product portfolio allows ORIX to cater to a wide array of customer needs, from corporate finance and leasing to real estate development and sustainable energy solutions. The company strategically integrates its financial expertise with these diverse offerings, creating synergistic value and innovative solutions for its global clientele.

| Segment | Key Products/Services | Fiscal Year Ending March 2024 Data/Context |

|---|---|---|

| Financial Services | Corporate Finance, Leasing, Loans, Investment Banking | Total Revenue ¥2,437.8 billion; Financial Services a significant portion. |

| Real Estate | Development, Rental, Management (Urban, Offices, Logistics, Housing) | Significant contributions from the real estate segment, demonstrating active engagement. |

| Renewable Energy | Solar Power, Wind Power, Energy Storage (BESS), PPAs | Active investment in solar and wind projects, expansion into BESS, facilitating PPAs. |

| Investment & Operation | Private Equity, M&A Brokerage, Concessions (Airports, Roads) | Active participation in infrastructure concessions and strategic capital recycling. |

| Automotive & Mobility | Car Leasing, Car Rental (MyChoize), Fleet Management, Business Transportation | ORIX India's leasing and rental segments reported substantial growth in FY2023. |

What is included in the product

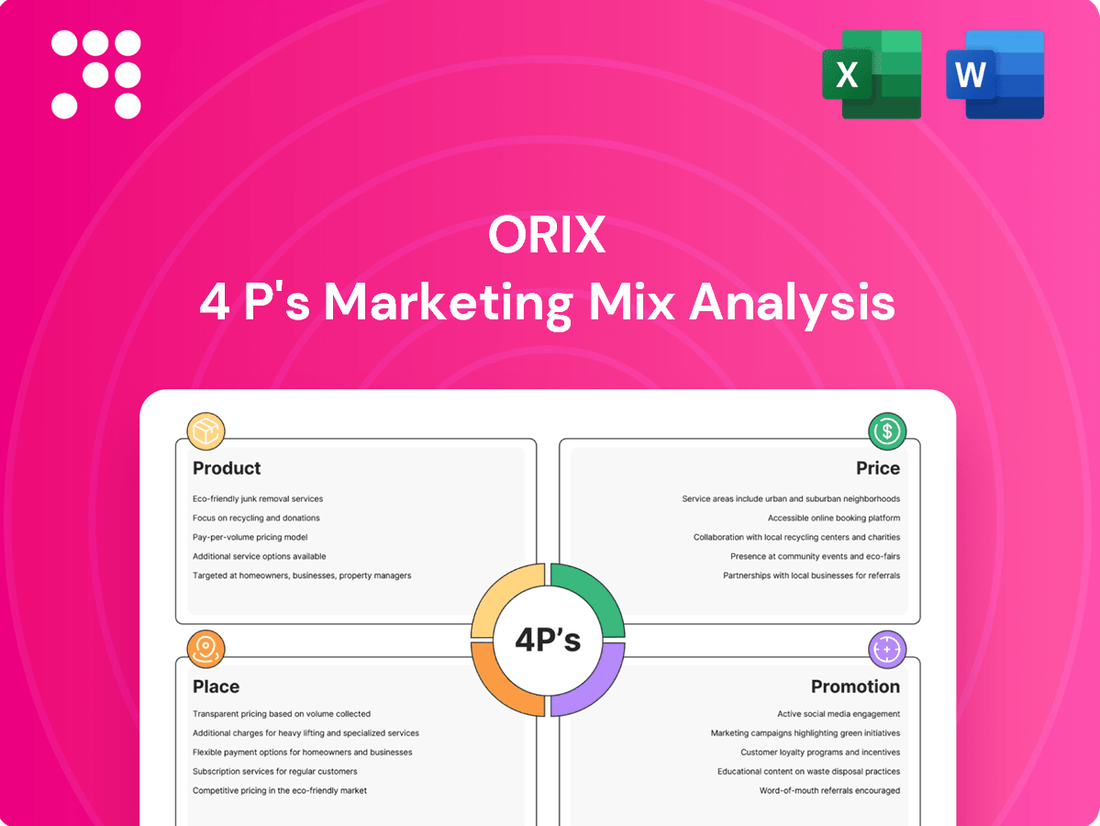

This analysis provides a comprehensive breakdown of Orix's marketing strategies, examining its Product, Price, Place, and Promotion tactics with real-world examples and strategic implications.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of overwhelming data for clearer decision-making.

Place

ORIX's global network, spanning approximately 30 countries and regions with a workforce of around 34,000 dedicated employees, forms a crucial pillar of its marketing mix. This expansive international presence, bolstered by significant subsidiaries like ORIX USA and ORIX Europe, ensures they can effectively cater to a diverse client base, ranging from individual consumers to major multinational corporations. This widespread operational capability directly supports their ability to offer tailored financial solutions and services across varied markets.

ORIX leverages direct sales for many of its financial and leasing products, especially those catering to corporate finance and maintenance leasing needs. This direct approach enables the creation of customized solutions and fosters close relationships with business clients.

The company's corporate financial services segment is strategically focused on serving both small and medium-sized enterprises (SMEs) and larger corporations, indicating a broad market penetration strategy. For instance, in fiscal year 2024, ORIX's Corporate Financial Services segment reported a significant contribution to the company's overall performance, with revenues reflecting strong demand for tailored financial solutions.

ORIX leverages its investor relations website as a crucial digital touchpoint, offering timely financial results and corporate disclosures. This platform is essential for transparent communication with stakeholders, reflecting a commitment to digital engagement in financial reporting.

While specific digital strategies vary across its diverse portfolio, ORIX likely employs online channels for customer acquisition and service in its retail finance segments. This digital presence is key to reaching a broader audience and providing accessible financial solutions.

In 2024, companies across sectors saw increased reliance on digital platforms for customer interaction and sales, with many reporting significant growth in online engagement metrics. ORIX's digital strategy would likely align with this trend to enhance customer experience and operational efficiency.

Strategic Partnerships and Joint Ventures

ORIX actively utilizes strategic partnerships and joint ventures to broaden its market presence and enhance its diverse service portfolio. These collaborations are crucial for accessing new markets and customer segments, thereby driving growth and innovation.

Notable examples include ORIX's involvement in renewable energy projects, where partnerships are key to scaling operations and developing sustainable energy solutions. Furthermore, a significant joint venture with NTT Docomo, Inc. in the retail finance sector demonstrates ORIX's strategy to integrate its financial expertise with established consumer platforms.

These strategic alliances bolster ORIX's distribution networks and provide invaluable access to new customer bases, particularly in areas like digital finance and consumer lending. For instance, ORIX's commitment to expanding its financial services through collaborations reflects a dynamic approach to market penetration.

- Renewable Energy Collaborations: ORIX's strategic partnerships in renewable energy projects aim to leverage combined expertise and capital for large-scale developments, contributing to global sustainability goals.

- NTT Docomo Joint Venture: The collaboration in retail finance with NTT Docomo, a major telecommunications company, allows ORIX to tap into a vast customer base and offer integrated financial products.

- Market Reach Expansion: These ventures are designed to significantly enhance ORIX's distribution capabilities, enabling them to reach a wider audience and offer a more comprehensive suite of financial services.

Physical Branches and Offices (Selective)

For specific services, especially in markets like India, ORIX strategically operates a network of physical branches and offices. This physical presence is crucial for delivering localized services and providing a direct customer touchpoint for offerings such as car rental and leasing.

These locations facilitate face-to-face interactions, which are particularly valued in certain regions for building trust and addressing customer needs for financial solutions. For instance, ORIX India's operations in 2024 continue to leverage these branches to serve a diverse clientele seeking flexible mobility and financing options.

- Localized Service Delivery: Physical branches enable ORIX to tailor its car rental and leasing services to the specific needs and regulations of different regions, such as India.

- Direct Customer Engagement: These offices serve as vital touchpoints for customers, fostering direct interaction and relationship building for financial solutions.

- Market Penetration: Maintaining a physical footprint supports deeper market penetration and brand visibility in key operating areas.

- Operational Hubs: Branches function as operational centers for managing fleets, customer support, and administrative tasks, ensuring efficient service delivery.

ORIX's physical presence, particularly through its network of branches and offices in markets like India, serves as a critical component of its Place strategy. This localized approach ensures direct customer engagement and tailored service delivery for offerings such as car rental and leasing, fostering trust and accessibility.

These physical touchpoints are essential for building strong customer relationships and addressing specific regional needs, a strategy that continues to be vital for ORIX India's operations in 2024. The branches act as operational hubs, supporting efficient service management and administrative functions, thereby enhancing overall customer experience.

ORIX's strategic use of physical locations complements its digital and partnership-driven approaches, creating a multi-faceted distribution network. This combination allows them to effectively reach diverse customer segments and solidify their market presence across various financial service domains.

Same Document Delivered

Orix 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Orix 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion in detail. You'll gain valuable insights into Orix's strategic approach to each element, enabling you to benchmark and adapt for your own business.

Promotion

ORIX leverages robust investor relations and financial reporting as a key promotional element. This includes detailed annual reports, earnings call presentations, and SEC filings like Form 20-F, all designed to attract and inform sophisticated investors.

For instance, ORIX's fiscal year 2024 (ending March 31, 2024) reported consolidated net income attributable to stockholders of ¥330.8 billion, showcasing strong financial performance that underpins investor confidence and attracts capital.

These transparent disclosures are crucial for demonstrating ORIX's financial health and strategic direction, directly appealing to individual investors, financial professionals, and business strategists seeking data-driven insights.

ORIX's corporate website and the 'ORIX IN ACTION' platform serve as vital digital touchpoints, effectively showcasing their extensive business portfolio, commitment to sustainability, and overarching corporate mission. This digital strategy is key to fostering brand recognition and clearly articulating their value to a wide audience.

In 2024, ORIX reported a consolidated net income of ¥377.7 billion, with a significant portion of their business operations supported by robust digital communication channels. The 'ORIX IN ACTION' content, in particular, highlights their environmental, social, and governance (ESG) efforts, aligning with global trends and investor expectations for transparency.

ORIX actively manages its public image through strategic public relations, highlighting key developments like its significant investment in the renewable energy sector. For instance, in early 2024, ORIX announced a substantial commitment to solar and wind power projects, aiming to bolster its ESG profile and attract investor interest.

The company regularly disseminates crucial information via press releases and news articles distributed through major business wires and financial news platforms. This consistent media engagement ensures ORIX's financial performance and strategic acquisitions, such as its 2024 acquisition of a controlling stake in a European infrastructure fund, are widely communicated, enhancing market visibility.

Targeted Communication for Business Segments

ORIX's targeted communication strategy is a cornerstone of its marketing mix, ensuring each business segment receives relevant messaging. This approach is crucial given ORIX's broad operational scope, which spans finance, real estate, and renewable energy, among others.

For example, ORIX's communication in the renewable energy sector, a key growth area, focuses on their ambitious development pipelines and commitment to environmental, social, and governance (ESG) goals. In 2024, the company continued to invest heavily in solar and wind projects, aiming to contribute significantly to decarbonization efforts. Their real estate segment, conversely, highlights ongoing development projects and robust asset management capabilities, showcasing ORIX's tangible impact on urban landscapes and infrastructure.

- Renewable Energy Focus: ORIX emphasizes growth plans and decarbonization contributions, aligning with global sustainability trends.

- Real Estate Expertise: Communication highlights development projects and asset management prowess, demonstrating tangible value creation.

- Segment-Specific Messaging: Tailored communication ensures relevance and resonance with diverse stakeholder groups across ORIX's portfolio.

Industry Events and Conferences

ORIX, as a global financial services group, actively engages in industry events and conferences to foster connections and highlight its capabilities. These gatherings provide crucial platforms for networking with potential clients and partners across its diverse business segments, including finance, real estate, and energy. For instance, ORIX Corporation USA's participation in the 2024 ABS East conference in September provided an opportunity to discuss market trends and showcase their securitization expertise.

Such events are vital for ORIX to demonstrate thought leadership and gain insights into emerging market dynamics. By presenting at or sponsoring key industry forums, ORIX reinforces its brand presence and its commitment to innovation within sectors like infrastructure and renewable energy. For example, ORIX Infrastructure's involvement in events like the Inframation Global Summit allows them to connect with project developers and investors.

These strategic engagements are instrumental in building relationships and identifying new business opportunities. ORIX's presence at events such as the Global Alternative Investment Management (GAIM) conferences, which often feature discussions on private credit and real estate investments, directly supports its strategic objectives in these areas. In 2024, ORIX's commitment to these forums underscores their strategy of active market participation.

ORIX's promotional strategy is multifaceted, emphasizing transparent financial reporting and robust digital engagement. Their approach is designed to resonate with a sophisticated audience, including investors and business strategists, by clearly articulating their financial strength and strategic vision.

The company actively cultivates its public image through strategic public relations and consistent media engagement, highlighting key investments and acquisitions. This consistent communication ensures ORIX's financial performance and strategic moves are widely recognized, boosting market visibility.

ORIX also prioritizes participation in industry events and conferences, fostering crucial connections with potential clients and partners across its diverse business segments. These engagements are vital for demonstrating thought leadership and identifying new business opportunities.

| Promotional Activity | Key Focus Areas | Data/Example (2024/2025) |

|---|---|---|

| Financial Reporting & Investor Relations | Transparency, Financial Health, Strategic Direction | Consolidated Net Income: ¥377.7 billion (FY2024) |

| Digital Engagement | Portfolio Showcase, ESG Commitment, Corporate Mission | ORIX IN ACTION platform highlighting ESG efforts |

| Public Relations & Media | Key Developments, Strategic Acquisitions, ESG Profile | Investment in renewable energy projects (early 2024) |

| Industry Events & Conferences | Networking, Thought Leadership, Business Opportunities | Participation in ABS East (Sept 2024) and Global Alternative Investment Management conferences |

Price

ORIX's pricing strategy for corporate finance and leasing services centers on value-based principles. This means their fees are directly tied to the specific benefits and solutions delivered to clients, rather than a one-size-fits-all approach. For instance, a complex restructuring deal for a large corporation might command a higher fee than a standard equipment lease, reflecting the intricate advisory and risk management involved.

Key determinants of ORIX's pricing include the client's financial health and credit rating, as this directly impacts the risk associated with the financial arrangement. Market interest rates also play a crucial role, influencing the cost of capital for ORIX and thus the pricing of their services. As of early 2024, benchmark lending rates, such as the Federal Funds Rate, have remained elevated, suggesting that ORIX's pricing for new deals would incorporate these higher borrowing costs to ensure competitive yet profitable terms.

ORIX's pricing in its maintenance leasing and automobile rental segments is strategically competitive. They carefully consider prevailing market rates, the expected depreciation of their assets, and the comprehensive services included, ensuring their offerings remain appealing to a broad client base, from individuals to large corporations.

This competitive pricing approach is crucial for attracting and retaining customers in both the individual and corporate sectors. By balancing cost-effectiveness with value-added services, ORIX aims to be the preferred choice for clients needing reliable mobility and equipment solutions, a strategy that has seen them maintain a strong market presence.

Orix's pricing strategy for its private equity and strategic investments hinges on sophisticated valuation models and targeted return expectations. These are often structured around anticipated asset sales and the efficient recycling of capital, aiming for optimal profit realization.

For instance, in the fiscal year ending March 2024, Orix reported significant gains from its investment portfolio, with a notable contribution from its private equity segment. The company's ability to identify and execute profitable exits directly fuels its overall profitability and reinvestment capacity.

Concession-Based Revenue Models

Concession-based revenue models are a cornerstone for businesses like airport operators, where pricing is frequently governed by regulatory bodies or established through lengthy contracts. This structure emphasizes generating predictable, ongoing income through various fees and charges.

These models are specifically engineered to deliver stable, recurring revenue streams, crucial for long-term financial planning and investment. For instance, airport concessions often include landing fees, terminal usage charges, and revenue sharing from retail operations, all contributing to a consistent income flow.

- Airport Concession Revenue: Global airport concession revenue was projected to reach over $40 billion in 2024, driven by increased passenger traffic and diverse retail offerings.

- Fee Structures: Common fees include passenger facility charges, aircraft landing fees, and rental income from retail and food service outlets within terminals.

- Long-term Agreements: Many concessions are awarded through 10-20 year contracts, providing operators with revenue visibility and stability.

- Regulatory Influence: Pricing for essential services like air traffic control or runway access is often set by aviation authorities, ensuring a regulated yet consistent revenue base.

Dynamic Pricing and Market Conditions

ORIX's pricing strategies are deeply intertwined with the ever-shifting market. For instance, in its leasing and financing segments, interest rate movements directly impact the cost of capital, necessitating adjustments to pricing to maintain profitability and competitiveness. The prevailing economic outlook also plays a crucial role, influencing demand for ORIX's services and the perceived risk associated with lending.

The company actively monitors its competitive landscape, ensuring its pricing remains attractive without compromising its financial objectives. This dynamic approach allows ORIX to navigate economic uncertainties and capitalize on market opportunities. For example, during periods of economic expansion, ORIX might adjust pricing to capture greater market share, while in more cautious economic climates, pricing may be recalibrated to emphasize risk-adjusted returns.

- Interest Rate Sensitivity: Fluctuations in benchmark interest rates, such as the LIBOR or SOFR transition impacting global finance, directly influence ORIX's cost of funding and thus its pricing for loans and leases.

- Economic Outlook Impact: ORIX's pricing models incorporate forecasts for GDP growth and inflation, as these macro factors affect borrower capacity and the value of assets financed. For 2024-2025, analysts are closely watching inflation trends and their potential impact on central bank policy rates.

- Competitive Benchmarking: ORIX continuously analyzes competitor pricing in key markets like Japan, the US, and Asia, adjusting its own rates to remain competitive in sectors such as corporate finance and real estate.

- Risk Mitigation Pricing: The company factors in credit risk assessments and geopolitical stability when setting prices, particularly for international operations, ensuring that pricing adequately compensates for potential downside risks.

ORIX's pricing across its diverse business segments reflects a strategic blend of value-based, competitive, and risk-adjusted methodologies. For corporate finance and leasing, pricing is tied to delivered client benefits, considering factors like creditworthiness and prevailing interest rates, which in early 2024 were influenced by elevated benchmark rates. In maintenance leasing and auto rentals, ORIX employs competitive pricing, factoring in market rates and asset depreciation to attract both individual and corporate clients.

The company's private equity and strategic investment pricing relies on sophisticated valuation models and targeted returns, often structured around anticipated asset sales and capital recycling. This approach contributed to significant gains in ORIX's private equity segment for the fiscal year ending March 2024. Furthermore, ORIX leverages concession-based revenue models, particularly in infrastructure like airports, where pricing is often dictated by regulatory bodies or long-term contracts, ensuring stable, recurring income streams.

| Segment/Service | Pricing Strategy Focus | Key Influencing Factors | 2024/2025 Data/Trends |

|---|---|---|---|

| Corporate Finance & Leasing | Value-Based, Risk-Adjusted | Client financial health, credit rating, market interest rates (e.g., elevated benchmark rates in early 2024) | Pricing reflects higher capital costs; focus on complex deal structures. |

| Maintenance Leasing & Auto Rental | Competitive, Value-Driven | Market rates, asset depreciation, included services, customer retention | Strategic pricing to maintain broad appeal; balancing cost-effectiveness with service. |

| Private Equity & Strategic Investments | Sophisticated Valuation, Targeted Returns | Asset sale anticipation, capital recycling efficiency, profit realization | Fiscal year ending March 2024 saw significant portfolio gains, especially from private equity. |

| Concession-Based Revenue (e.g., Airports) | Contractual, Regulatory, Fee-Based | Regulatory bodies, long-term agreements (10-20 years), passenger traffic, retail revenue share | Global airport concession revenue projected over $40 billion in 2024; stable, recurring income focus. |

4P's Marketing Mix Analysis Data Sources

Our 4P's Marketing Mix Analysis leverages a blend of primary and secondary data sources. We meticulously review official company reports, press releases, and product documentation for insights into Product and Price strategies. Distribution and Promotion are informed by market research, industry publications, and competitive analysis.