Middleby SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Middleby Bundle

Middleby's robust brand portfolio and diversified product offerings present significant strengths in a dynamic foodservice equipment market. However, understanding the nuances of their competitive landscape and potential regulatory shifts is crucial for navigating future growth.

Want the full story behind Middleby's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Middleby Corporation truly shines with its incredibly diverse product portfolio. They offer everything from commercial foodservice equipment, essential for restaurants and hotels, to advanced food processing machinery used in large-scale food production. Adding to this breadth, they also cater to the luxury market with high-end residential kitchen appliances. This wide reach means they’re not putting all their eggs in one basket, serving many different customers and industries around the world.

Middleby boasts an impressive portfolio of over 100 respected brands, many of which are household names and trusted by professionals in their respective sectors. This extensive brand recognition provides a significant competitive advantage and broad market penetration.

The company is a recognized leader in innovation, consistently earning industry awards for its patented cooking technologies and forward-thinking solutions. Examples include IoT-enabled equipment, ventless kitchen systems, and automation advancements, showcasing their commitment to research and development and staying ahead of market trends.

Middleby demonstrates robust financial health, underscored by its consistent ability to generate strong operating cash flows. This financial resilience is crucial for navigating market fluctuations and funding future growth initiatives. For instance, in the first quarter of 2025, the company reported substantial operating cash flow, a testament to efficient management and operational prowess.

This healthy cash generation not only supports day-to-day operations but also provides significant strategic flexibility. Middleby can leverage this financial strength to pursue value-enhancing acquisitions, reduce existing debt burdens, and importantly, return capital to its shareholders through dividends or share buybacks, thereby enhancing shareholder value.

Proven Strategic Acquisition Capability

Middleby has a strong track record of successfully acquiring and integrating complementary businesses and technologies. This strategy has been a consistent driver of growth, allowing the company to expand its brand portfolio and market reach across its key segments. For instance, in 2023, Middleby completed several strategic acquisitions, further solidifying its market leadership and technological advancements.

These acquisitions are not merely about scale; they are carefully chosen to enhance Middleby's capabilities and market position. By integrating new brands and technologies, the company consistently strengthens its competitive advantage and broadens its offerings to customers.

- Consistent Acquisition Strategy: Middleby actively pursues and successfully integrates complementary businesses.

- Portfolio Expansion: Acquisitions have broadened its brand portfolio and market presence.

- Technological Enhancement: The company leverages acquisitions to bolster its technological capabilities.

- Market Leadership: This strategic approach reinforces its position as a leader in its core segments.

Extensive Global Footprint and Service Network

Middleby boasts an impressive global reach, with its products available in over 100 countries, underpinned by a significant U.S. manufacturing foundation. This extensive market penetration is crucial for capturing diverse customer demands and mitigating regional economic downturns.

The company's strength lies in its vast network of independent dealers, distributors, consultants, sales representatives, and certified technicians. This robust infrastructure ensures not only widespread product availability but also exceptional after-sales support, which is a key differentiator in the competitive commercial kitchen equipment market.

- Global Market Access: Products marketed in over 100 countries.

- Extensive Distribution: Supported by a broad network of independent partners.

- Service Excellence: Certified technicians ensure comprehensive after-sales support.

- Customer Loyalty: Strong infrastructure fosters repeat business and brand advocacy.

Middleby's diversified product lines, spanning commercial foodservice, food processing, and residential appliances, provide significant stability and reduce reliance on any single market. This broad market penetration is further amplified by its ownership of over 100 well-established brands, many of which are industry leaders, ensuring strong brand equity and customer trust across various segments.

Innovation is a core strength, evidenced by continuous investment in R&D and the development of advanced technologies like IoT integration and automation. The company's robust financial health, characterized by strong operating cash flow generation, as seen in Q1 2025, provides the flexibility for strategic acquisitions and shareholder returns.

Middleby’s proven acquisition strategy has consistently expanded its brand portfolio and technological capabilities, reinforcing its market leadership. Coupled with an extensive global distribution network and strong after-sales support, these factors collectively position Middleby for sustained growth and market resilience.

What is included in the product

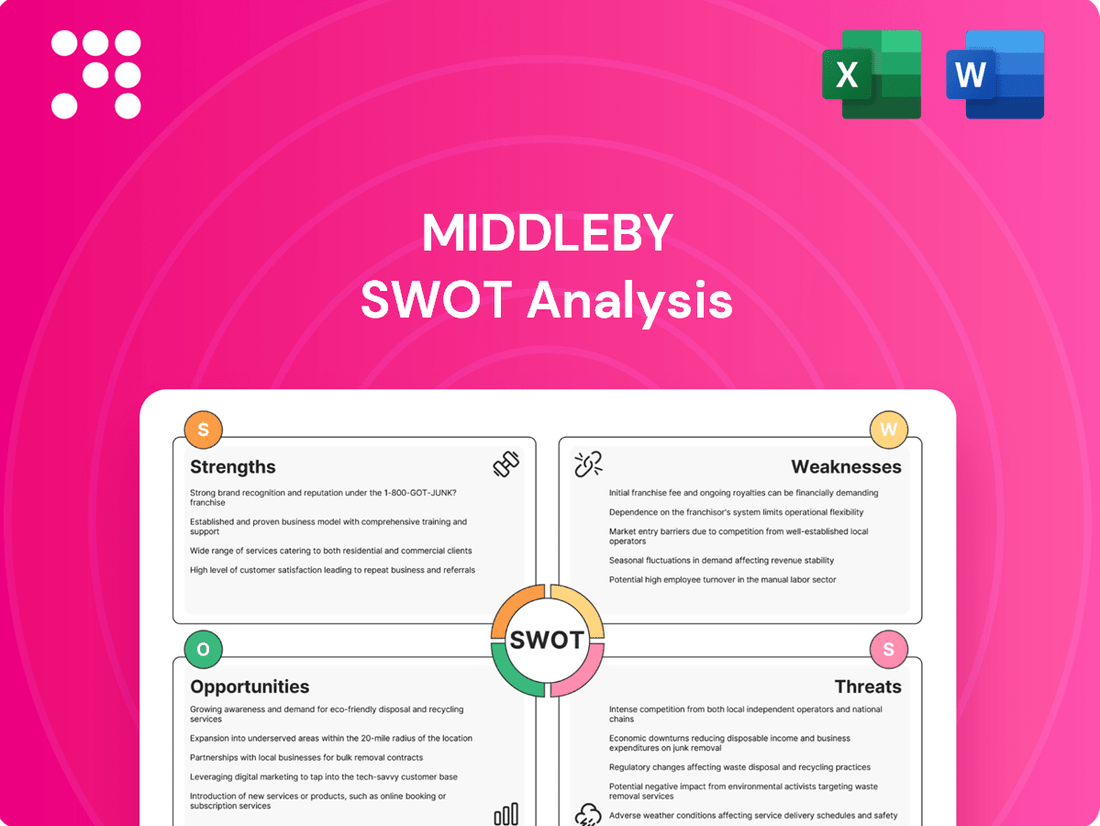

Analyzes Middleby’s competitive position through key internal and external factors, detailing its strengths in innovation and market leadership alongside potential weaknesses in integration and opportunities in emerging markets, while also considering threats from competition and economic shifts.

Middleby's SWOT analysis offers a clear framework to identify and address operational inefficiencies, turning potential weaknesses into strategic advantages.

Weaknesses

Middleby has recently experienced revenue underperformance, with net sales declining by 2.2% in the first quarter of 2025 compared to the prior year. This trend was further underscored by a decrease in organic sales, signaling potential challenges in market demand or prevailing economic conditions impacting the company's ability to grow its top line.

Middleby faces considerable risk from tariffs, with an estimated annual cost impact of $150 million to $200 million, largely stemming from trade with China. This exposure presents a persistent financial challenge.

While the company is actively implementing mitigation strategies, including operational adjustments and price hikes, tariffs remain a significant headwind that could compress profit margins.

The Residential Kitchen Equipment Group at Middleby has been navigating significant macroeconomic headwinds. Factors like inventory overhang and a general reluctance among consumers to spend have directly impacted this segment, leading to revenue declines.

While there are positive signals suggesting stabilization and a slight rebound in margins, the segment's past struggles, including impairments of intangible assets, underscore its vulnerability to economic downturns. For instance, in the first quarter of 2024, the company reported a net sales decrease of 1.4% for its Residential segment, reflecting these persistent challenges.

Mixed Performance in Food Processing Segment (pre-spin-off)

Prior to its planned spin-off, Middleby's Food Processing segment faced a challenging period. In the first quarter of 2025, this segment reported a decline in net sales and adjusted EBITDA. For instance, net sales for the segment were down 5.2% year-over-year, and adjusted EBITDA saw a 10.5% decrease compared to the same period in 2024.

These disappointing financial results were primarily attributed to customer delivery delays and the timing of large project completions. These factors suggest underlying operational or market-specific headwinds that impacted the segment's performance before its separation from the larger Middleby corporation.

- Declining Sales: Q1 2025 saw a year-over-year decrease in net sales for the Food Processing segment.

- EBITDA Pressure: Adjusted EBITDA for the segment also experienced a notable decline in the same quarter.

- Operational Headwinds: Customer delivery delays were cited as a key reason for the underperformance.

- Project Timing: The timing of large project completions also contributed to the mixed financial results.

Highly Competitive and Fragmented Markets

Middleby navigates intensely competitive and fragmented markets across commercial foodservice, food processing, and residential kitchen equipment. The company contends with a multitude of rivals, including larger global corporations possessing superior financial strength and personnel. This fierce competition often translates into significant pressure on pricing strategies, the ability to secure and maintain market share, and the crucial need for effective product differentiation.

For instance, in the commercial foodservice equipment sector, Middleby faces established players and numerous smaller, specialized manufacturers. This fragmentation means that while Middleby holds leading positions in certain segments, the overall market is not dominated by a single entity. The ongoing need to innovate and maintain cost-effectiveness is paramount to retaining its competitive edge.

- Intense Competition: Middleby operates in markets with numerous competitors, including larger, well-resourced global companies.

- Pricing Pressure: High competition directly impacts Middleby's ability to set prices and maintain profit margins.

- Market Share Challenges: Fragmented markets require continuous effort to gain and defend market share against a wide array of rivals.

- Differentiation Imperative: Success hinges on Middleby's capacity to distinguish its products and services in a crowded marketplace.

Middleby's performance is hampered by declining sales across key segments, exemplified by a 5.2% year-over-year net sales decrease in its Food Processing segment in Q1 2025. This underperformance extends to its Residential Kitchen Equipment Group, which saw a 1.4% net sales decrease in Q1 2024 due to inventory overhang and reduced consumer spending. The company also faces significant pressure from intense competition, with larger global players possessing greater financial resources, impacting pricing power and market share retention.

| Segment | Q1 2025 Net Sales Change (YoY) | Q1 2025 Adj. EBITDA Change (YoY) | Key Weakness |

|---|---|---|---|

| Food Processing | -5.2% | -10.5% | Customer delivery delays, project timing |

| Residential Kitchen Equipment | -1.4% (Q1 2024) | N/A | Macroeconomic headwinds, consumer spending reluctance |

| Overall | -2.2% (Q1 2025) | N/A | Intense competition, pricing pressure |

Preview Before You Purchase

Middleby SWOT Analysis

The preview you see is the same document the customer will receive after purchasing. This ensures transparency and allows you to assess the quality and depth of our Middleby SWOT analysis before committing. You're getting a genuine look at the comprehensive report you'll download.

Opportunities

Middleby's planned spin-off of its Food Processing segment into a separate publicly traded company by early 2026 is a prime opportunity to enhance shareholder value. This strategic separation is designed to create two more focused businesses, each capable of pursuing distinct growth paths and attracting specialized investor interest. For instance, in 2023, Middleby's Food Processing segment generated approximately $1.5 billion in revenue, highlighting its substantial scale and potential as a standalone entity.

The foodservice and food processing sectors are increasingly prioritizing automation, digital solutions, and IoT connectivity, creating a significant growth opportunity for Middleby. This trend is driven by a need for greater efficiency and the ongoing challenge of labor shortages.

Middleby is well-positioned to capitalize on this by developing innovative products such as digital robotic kitchens, ventless cooking systems, and smart equipment. These advancements directly address customer needs for improved operational performance and data-driven insights.

For instance, the company's investment in smart kitchen technology, which saw significant development through 2024, allows for remote monitoring and diagnostics, reducing downtime and enhancing overall productivity for clients. This focus on connected solutions is a key differentiator in a market hungry for technological integration.

Middleby is strategically expanding its global footprint, with significant efforts underway to bolster its presence in key international markets including Europe, India, and Brazil. This geographical diversification is a core component of its growth strategy.

Beyond geographic expansion, Middleby is actively broadening its product portfolio by entering promising new categories such as ice and beverage solutions. This move aims to capture new revenue streams and reduce reliance on existing product lines.

These combined initiatives in market and product category expansion present substantial opportunities for Middleby to achieve organic growth and enhance its overall business diversification, moving beyond its established core competencies.

Growing Demand for Sustainable and Energy-Efficient Solutions

The global push for sustainability is a significant tailwind for Middleby. Their focus on energy-efficient kitchen equipment, like ventless systems and ENERGY STAR® certified refrigeration, directly addresses this growing market need. This aligns with increasing consumer and regulatory pressure for greener operations.

Middleby's innovations in yield improvement for food processing also contribute to reduced waste, further enhancing their appeal in a sustainability-conscious market. For example, in 2023, the global market for sustainable food technology was valued at over $15 billion and is projected to grow substantially in the coming years.

- Reduced Environmental Footprint: Middleby's products help customers lower their carbon emissions and operational waste.

- Regulatory Compliance: Energy efficiency standards are tightening globally, making Middleby's offerings increasingly attractive for compliance.

- Cost Savings for Customers: Energy-efficient equipment translates to lower utility bills, a key selling point.

- Market Differentiation: A strong sustainability portfolio sets Middleby apart from competitors.

Enhanced Shareholder Value through Share Repurchases

Middleby's strategic focus on share repurchases, with a goal to reduce outstanding shares by 6-8% annually, underscores management's belief in the company's underlying worth. This proactive capital allocation aims to boost shareholder returns by increasing earnings per share and reinforcing a dedication to shareholder value maximization.

This strategy is particularly impactful as it directly addresses the supply of shares, potentially driving up per-share metrics. For instance, if Middleby successfully executes its repurchase program, it can lead to a more favorable earnings per share (EPS) calculation, even if net income remains flat.

- Management Confidence: An annual target of 6-8% share reduction signals strong belief in Middleby's intrinsic value.

- EPS Improvement: Reducing the number of outstanding shares directly increases Earnings Per Share (EPS), a key metric for investors.

- Shareholder Returns: This capital allocation strategy prioritizes returning value to shareholders.

Middleby's planned spin-off of its Food Processing segment by early 2026 offers a significant opportunity to unlock shareholder value and allow each business to pursue tailored growth strategies. The increasing demand for automation and digital solutions in the foodservice and food processing industries presents a strong tailwind, with Middleby well-positioned to benefit through its innovative product development. Furthermore, the company's strategic global expansion and diversification into new product categories like ice and beverage solutions are set to drive organic growth and enhance business resilience.

Threats

Middleby faces significant pressure from ongoing macroeconomic headwinds. Rising labor costs and increased energy expenses directly impact the company's operational efficiency and profit margins. Furthermore, general economic uncertainty can lead to cautious consumer spending and delayed purchasing decisions from key large chain customers, affecting sales across its diverse product segments.

Middleby operates in highly competitive and fragmented markets, facing numerous established companies and emerging players. For instance, the commercial foodservice equipment sector, a core area for Middleby, saw significant activity with companies like Ali Group making strategic acquisitions in 2024, further consolidating the competitive landscape.

Some competitors boast superior financial and human resources, enabling them to engage in aggressive pricing strategies or outspend Middleby on research and development. This can lead to pressure on market share and necessitate continuous innovation to maintain differentiation. The global commercial kitchen equipment market, valued at approximately $35 billion in 2023, is expected to grow, but this growth will be fiercely contested.

Middleby faces significant risks from disruptions in its worldwide supply chain and unpredictable shifts in commodity prices. These issues can drive up manufacturing expenses and squeeze profit margins. For instance, in 2023, the company navigated challenges related to component availability and rising raw material costs, impacting its operational efficiency.

Tariffs, especially those imposed by China, have directly affected Middleby's bottom line, as seen in previous years where increased import duties necessitated costly adjustments to sourcing and pricing strategies. The company's ability to manage these external economic pressures is crucial for maintaining profitability and competitive pricing in its diverse markets.

Integration Risks Associated with Acquisitions

Middleby's reliance on acquisitions as a growth engine introduces significant integration risks. Successfully merging new companies, their technologies, and workforces is complex and can be a major hurdle. For instance, the integration of Welbilt, acquired in 2023 for $2.9 billion, will be a key test of Middleby's ability to manage such large-scale integrations efficiently.

Furthermore, the projected synergies and financial advantages from these deals may not materialize as expected. This could lead to disappointing financial results or even necessitate impairment charges, impacting profitability. The challenge lies in realizing the full value of acquired assets and operations, a common pitfall in the M&A landscape.

- Integration Complexity: Merging diverse business units, IT systems, and corporate cultures can lead to operational disruptions and increased costs.

- Synergy Realization: Failure to achieve anticipated cost savings or revenue enhancements from acquisitions can undermine the strategic rationale.

- Financial Underperformance: If integration issues persist or synergies fall short, acquired businesses might underperform, potentially requiring write-downs.

Evolving Industry Trends and Consumer Preferences

Middleby faces a significant threat from the rapid evolution of consumer preferences and dining habits, impacting both residential and commercial foodservice sectors. For instance, the growing demand for plant-based options and sustainable packaging, as highlighted in a 2024 industry report, requires swift adaptation in product offerings and manufacturing processes.

Failure to quickly integrate these shifts could lead to a loss of market share. The company must maintain a keen eye on emerging kitchen design trends, such as smart kitchen technology integration, which is projected to grow by 15% annually through 2027, to ensure its products remain desirable.

The imperative for continuous product innovation is paramount. Competitors are increasingly leveraging AI-powered kitchen equipment and advanced automation, a trend that saw a 20% increase in venture capital funding for food tech startups in 2024. Middleby's ability to respond to these technological advancements and evolving market demands will be critical for its sustained relevance and competitive edge.

- Rapidly changing consumer tastes in food preparation and dining experiences.

- Emerging kitchen design trends, including smart technology integration, impacting appliance demand.

- Increased competition from agile players introducing innovative and automated foodservice solutions.

- The need for significant R&D investment to keep pace with technological advancements and sustainability demands.

Middleby contends with intense competition, including agile players like Ali Group, which made strategic acquisitions in 2024, intensifying market fragmentation. Competitors with greater financial and human resources can leverage aggressive pricing and R&D, potentially eroding Middleby's market share in the roughly $35 billion global commercial kitchen equipment market. Staying ahead requires constant innovation to differentiate its product lines.

SWOT Analysis Data Sources

This Middleby SWOT analysis is built upon a foundation of comprehensive data, including the company's official financial filings, extensive market research reports, and insights from industry experts. This multi-faceted approach ensures a robust and accurate assessment of Middleby's strategic position.