Middleby Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Middleby Bundle

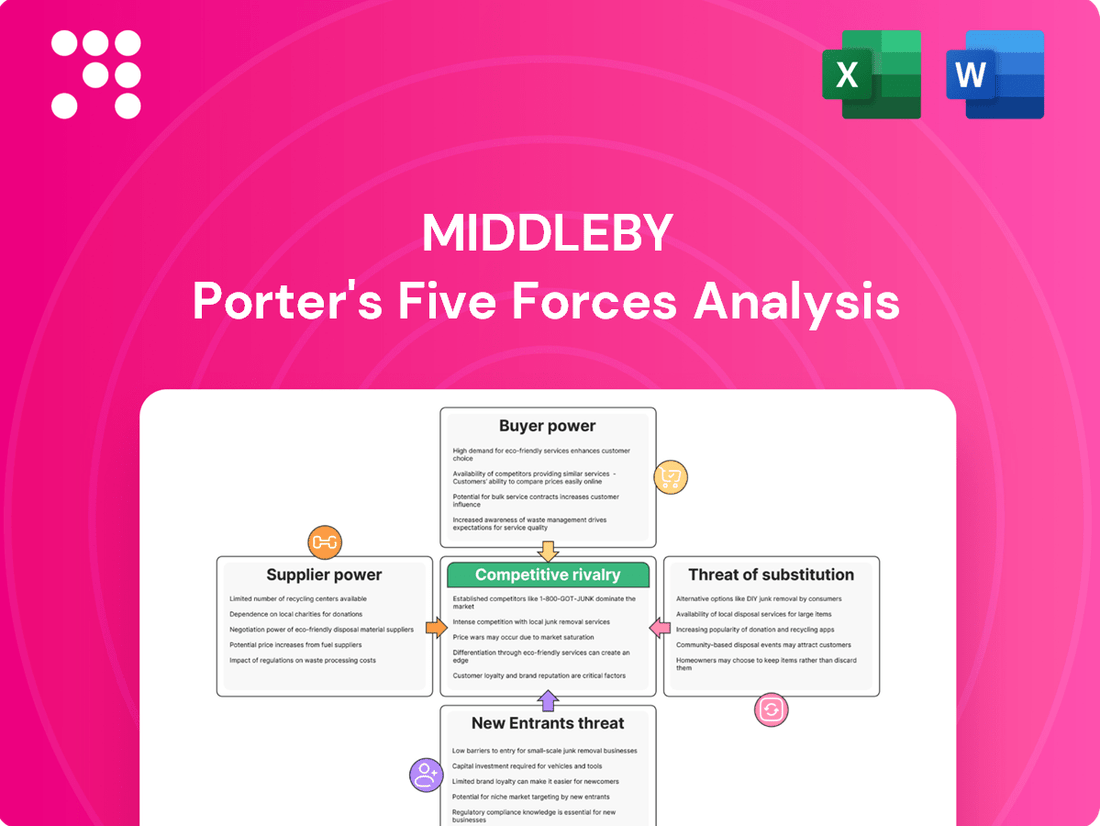

Middleby’s competitive landscape is shaped by powerful forces, from the intense rivalry among existing players to the significant bargaining power of their buyers. Understanding these dynamics is crucial for anyone looking to navigate the commercial kitchen equipment industry.

The complete report reveals the real forces shaping Middleby’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Supplier concentration significantly impacts Middleby's bargaining power. If Middleby relies on a few specialized suppliers for critical components in its commercial foodservice or food processing equipment, those suppliers gain leverage. For instance, if a unique sensor technology is only available from one or two manufacturers, Middleby has less room to negotiate prices or terms.

Conversely, for more commoditized parts, such as standard stainless steel or basic electrical components, Middleby likely benefits from a broader supplier base. This wider availability allows Middleby to solicit bids from multiple vendors, driving down costs and increasing its own bargaining power. The sheer volume Middleby purchases also strengthens its position with many suppliers.

The bargaining power of suppliers for Middleby is significantly influenced by switching costs. If Middleby relies on highly specialized components or has deeply integrated its supply chain with particular vendors, the expense and effort required to change suppliers would be substantial. This would naturally give those suppliers more leverage.

Conversely, if Middleby can easily source compatible components from multiple readily available vendors, the switching costs are low. This scenario diminishes supplier power, as Middleby has more options and less dependence on any single supplier.

For instance, in 2023, Middleby's cost of goods sold was $2.1 billion, indicating a significant reliance on its supply chain. The complexity of integrating new suppliers for specialized food service equipment components, which often require specific certifications and performance standards, suggests that switching costs can be a considerable factor in their supplier relationships.

The uniqueness of supplier offerings significantly impacts Middleby's bargaining power. If suppliers provide highly differentiated or critical components, such as advanced IoT modules for their smart kitchen appliances, their leverage increases. For instance, a specialized sensor supplier for a new line of connected ovens would hold more sway than a provider of standard stainless steel.

Threat of Forward Integration by Suppliers

If suppliers can credibly threaten to integrate forward and start manufacturing the equipment themselves, their bargaining power over companies like Middleby significantly increases. This means they could potentially capture more of the value chain and profit margins.

However, for highly specialized manufacturing industries, such as those Middleby operates within, this threat is generally considered less likely. The capital investment, technical expertise, and established distribution networks required to produce complex commercial kitchen equipment are substantial barriers.

Despite being a theoretical consideration, the potential for forward integration by suppliers remains a factor in strategic planning. Companies must continuously assess the capabilities and intentions of their key suppliers, especially for critical components where supplier power could be more pronounced.

- Supplier Forward Integration Threat: Suppliers integrating into manufacturing increases their bargaining power.

- Industry Specialization: Less likely in specialized sectors like Middleby's due to high barriers to entry.

- Strategic Consideration: Remains a theoretical but important factor for companies to monitor.

Importance of Middleby to Supplier

The relative importance of Middleby as a customer significantly influences supplier bargaining power. If Middleby constitutes a substantial portion of a supplier's revenue, that supplier's leverage diminishes due to their reliance on Middleby's business. Conversely, if Middleby is a minor client for a large supplier, the supplier holds greater power.

For instance, in 2023, Middleby's Cost of Goods Sold (COGS) was approximately $2.6 billion. The distribution of this spending across various suppliers dictates how much influence Middleby can exert. Suppliers for whom Middleby represents a significant percentage of their sales will likely offer more favorable terms to retain this crucial business.

- Supplier Dependence: When Middleby is a key client, suppliers are incentivized to be more accommodating.

- Customer Size: Smaller suppliers may have less bargaining power against Middleby compared to larger, more diversified suppliers.

- Revenue Impact: A supplier's dependence on Middleby's revenue directly correlates to Middleby's ability to negotiate better pricing and terms.

Suppliers' bargaining power over Middleby is influenced by the concentration of their customer base. If Middleby represents a significant portion of a supplier's revenue, the supplier has less leverage and is more likely to offer favorable terms. Conversely, if Middleby is a small customer for a supplier, the supplier has more power to dictate terms and pricing.

The cost of goods sold for Middleby in 2023 was approximately $2.6 billion. This substantial figure means that even if Middleby is a small customer for some suppliers, its overall purchasing volume can still provide some negotiating leverage, especially when aggregated across its diverse supplier network.

The threat of suppliers integrating forward, meaning they start manufacturing the end products themselves, can increase their bargaining power. However, for highly specialized sectors like commercial foodservice and food processing equipment, the significant capital investment and technical expertise required make this threat less probable for most suppliers to Middleby.

| Factor | Impact on Middleby's Supplier Bargaining Power | Supporting Data/Reasoning |

| Supplier Concentration | High concentration of suppliers for critical components increases their power. | Reliance on few specialized manufacturers for unique technologies grants suppliers leverage. |

| Switching Costs | High switching costs empower suppliers. | Deep integration of specialized components or supply chains makes changing vendors costly and difficult for Middleby. |

| Supplier Revenue Dependence | When Middleby is a major customer, supplier power diminishes. | Middleby's 2023 COGS of $2.6 billion indicates significant purchasing power, especially with suppliers who rely heavily on its business. |

| Uniqueness of Offerings | Differentiated or critical supplier inputs increase supplier power. | Suppliers of advanced IoT modules for smart appliances have more leverage than providers of standard materials. |

| Forward Integration Threat | Potential for suppliers to manufacture Middleby's products increases their power. | Generally less likely in Middleby's specialized industry due to high barriers to entry. |

What is included in the product

This analysis unpacks the competitive forces impacting Middleby, detailing threats from new entrants, substitutes, buyer and supplier power, and the intensity of rivalry.

Effortlessly identify and mitigate competitive threats with a visual breakdown of industry power dynamics, enabling proactive strategic adjustments.

Customers Bargaining Power

Middleby's customer base is quite varied, spanning from individual restaurants to large food processing plants and even everyday households. This diversity generally mitigates the bargaining power of the customer as a whole.

However, in the commercial and food processing sectors, a few major clients could represent a significant chunk of Middleby's revenue. If such large customers were to demand lower prices or better terms, their substantial purchasing volume would give them considerable leverage, potentially allowing them to switch to competitors if their demands aren't met.

For instance, if a single large restaurant chain or a major food manufacturer accounted for over 10% of Middleby's sales, their ability to negotiate would be amplified. Conversely, the residential market is so spread out that no single homeowner can exert meaningful pressure on Middleby's pricing or product development.

The bargaining power of customers for Middleby is significantly influenced by switching costs, which differ across their diverse customer segments. For major commercial clients and large-scale food processing operations, the expenses associated with transitioning to a competitor's equipment can be substantial. These costs often include the need for retraining personnel, integrating new systems with existing infrastructure, and accounting for potential downtime during the switchover. These elevated switching costs effectively diminish the leverage customers hold.

Conversely, for residential consumers who purchase Middleby appliances, the barriers to switching are generally much lower. This ease of transition empowers these customers with greater bargaining power, as they can more readily opt for alternative brands if unsatisfied with Middleby's offerings or pricing. This disparity highlights a key dynamic in Middleby's market positioning.

Customer price sensitivity is a significant driver of their bargaining power. In markets where Middleby operates, such as commercial foodservice equipment and residential appliances, customers often weigh price heavily in their purchasing decisions. This is particularly true in 2024, with ongoing economic considerations influencing consumer and business spending habits.

The degree to which customers are sensitive to price can fluctuate based on broader economic conditions. For instance, during periods of economic uncertainty, customers may become more inclined to seek out lower-priced alternatives, thereby amplifying their bargaining leverage. Conversely, if Middleby's products are perceived as offering superior value or unique benefits, this sensitivity might be somewhat mitigated.

Middleby's advanced features, such as enhanced energy efficiency, automation capabilities, and IoT integration, play a crucial role in shaping customer price sensitivity. If these features are perceived as delivering substantial long-term cost savings or operational improvements, customers may be willing to accept a higher initial price. For example, a commercial kitchen operator might prioritize the energy savings from a more efficient oven, reducing their overall operating expenses despite a higher upfront cost.

Threat of Backward Integration by Customers

The threat of backward integration by Middleby's customers is generally low. This is because most of their customer segments, which include restaurants and food processing facilities, lack the specialized knowledge, manufacturing infrastructure, and significant capital investment required to produce complex commercial kitchen and food processing equipment themselves. For instance, the cost of setting up a facility to manufacture ovens or specialized food processing machinery would be prohibitive for the vast majority of Middleby's clientele.

While some very large, vertically integrated food conglomerates might theoretically consider in-house production, the economic feasibility and the core competencies required often make this an unattractive option. Middleby's customers benefit from economies of scale and specialized manufacturing expertise that are difficult and costly to replicate. This limits their ability to credibly threaten backward integration, thereby reducing their bargaining power.

- Low Likelihood of Backward Integration: Most Middleby customers are focused on their core business of food service or processing, not equipment manufacturing.

- Capital and Expertise Barriers: The high cost and specialized knowledge needed to produce commercial kitchen equipment deter most customers from attempting backward integration.

- Reduced Customer Bargaining Power: The inability of customers to credibly threaten to produce their own equipment limits their leverage in price negotiations with Middleby.

Information Availability

The sheer volume of information now available to consumers significantly amplifies their bargaining power. With easy access to online reviews, detailed product comparisons, and transparent pricing across numerous vendors, customers can make highly informed decisions.

This increased transparency is particularly potent in segments like residential kitchen appliances and smaller commercial food service operations. For instance, in 2024, platforms like Consumer Reports and dedicated review sites offer extensive data on appliance performance, durability, and cost of ownership, allowing buyers to easily benchmark Middleby’s offerings against competitors.

- Informed Decisions: Customers can readily compare features, prices, and user experiences for commercial ovens or residential dishwashers.

- Price Sensitivity: Online price comparison tools empower buyers to identify the lowest available prices, pressuring sellers to remain competitive.

- Brand Loyalty Impact: Easily accessible information can erode brand loyalty if competitors offer superior value or better perceived quality.

- Transparency Expectations: The digital age has fostered an expectation of readily available product and pricing data, shifting power towards the informed consumer.

The bargaining power of Middleby's customers is a mixed bag, largely depending on the segment. While large commercial clients can wield significant influence due to volume and switching costs, the fragmented residential market offers less leverage. Overall, increased transparency and readily available information in 2024 empower buyers, making price sensitivity a key factor.

The threat of backward integration by Middleby's customers remains minimal. The substantial capital, specialized expertise, and manufacturing infrastructure required to produce complex commercial kitchen equipment are prohibitive for most of Middleby's diverse customer base, from restaurants to food processors.

In 2023, Middleby reported total revenue of $4.4 billion, with a significant portion coming from its Commercial Foodservice segment. While specific customer concentration data isn't publicly detailed, the nature of large-scale food service operations suggests that major chains could represent substantial individual client revenue streams, thereby increasing their bargaining power.

| Customer Segment | Bargaining Power Factors | Impact on Middleby |

|---|---|---|

| Large Commercial Foodservice Chains | High volume purchases, potential switching costs (training, integration), price sensitivity | Moderate to High leverage, can negotiate pricing and terms |

| Food Processing Plants | Significant capital investment in equipment, specialized needs, potential for long-term contracts | Moderate leverage, influenced by scale and integration needs |

| Residential Consumers | Low switching costs, high price transparency (online), brand perception | Low to Moderate leverage, influenced by brand loyalty and perceived value |

Same Document Delivered

Middleby Porter's Five Forces Analysis

This preview showcases the complete Middleby Porter's Five Forces Analysis, offering a comprehensive examination of competitive forces within the commercial kitchen equipment industry. The document you see here is precisely what you will receive, fully formatted and ready for immediate use upon purchase. This ensures you gain instant access to a professionally prepared analysis without any discrepancies or placeholder content.

Rivalry Among Competitors

The competitive landscape for Middleby is intensely crowded across its core segments. In commercial foodservice equipment, for example, the market is fragmented with many global and local players vying for market share. This high degree of competition is a constant pressure point for Middleby.

Middleby faces formidable rivals such as Illinois Tool Works, which boasts brands like Hobart and Vulcan-Hart, and Ali Group, a significant international competitor. Additionally, Electrolux and Rational AG are major players in the commercial foodservice arena. This broad spectrum of competitors, each with its own strengths and market focus, amplifies the rivalry.

The residential kitchen appliance sector is similarly competitive, with giants like Whirlpool, LG, and Samsung presenting substantial challenges. These companies often have extensive brand recognition and distribution networks, making it difficult for any single player to dominate. The sheer number and diversity of these competitors underscore the dynamic and challenging nature of the markets Middleby operates within.

The commercial foodservice equipment market is projected for growth, which generally eases competitive pressures by offering opportunities for all participants. However, this dynamic can shift. For instance, if certain segments, like residential kitchen equipment, experience a sales downturn, as seen with a notable decrease in Q4 2024, the overall rivalry among companies can sharpen as they vie for market share in a more constrained environment.

Middleby Corporation actively pursues product differentiation as a core strategy to mitigate competitive rivalry. They focus on integrating advanced technologies, such as the Internet of Things (IoT) for connected kitchen solutions and sophisticated automation features, into their extensive product lines. This innovation-driven approach, encompassing over 120 brands, aims to create unique value propositions for customers.

The emphasis on features like enhanced energy efficiency and intelligent operational capabilities serves to lessen the reliance on price as the primary competitive factor. For instance, their advanced cooking equipment often boasts significant energy savings compared to older models, a tangible benefit that justifies a premium price and fosters customer loyalty, thereby reducing direct price wars with competitors.

Exit Barriers

Middleby Corporation operates in industries characterized by significant capital requirements and specialized assets, contributing to high exit barriers. This means that companies, even those struggling financially, may find it difficult or prohibitively expensive to leave the market. For instance, the specialized nature of commercial kitchen equipment manufacturing involves substantial investments in machinery and tooling that have limited resale value outside the industry.

These elevated exit barriers can intensify competitive rivalry. When unprofitable competitors are effectively trapped in the market due to these barriers, they may continue to operate, potentially engaging in aggressive pricing or other strategies to survive. This sustained presence of weaker players can depress overall industry profitability and put pressure on more efficient firms like Middleby.

Consider the capital expenditures reported by Middleby. In 2023, the company invested approximately $160 million in capital expenditures, a significant sum underscoring the asset-heavy nature of its operations. This level of investment, replicated across the industry, reinforces the idea that exiting is not a simple decision, thereby perpetuating rivalry among existing participants.

- Specialized Assets: Manufacturing facilities and equipment are often highly specific to the production of commercial cooking and refrigeration units, limiting their utility elsewhere.

- Capital Intensity: The need for substantial upfront investment in plant, property, and equipment creates a high financial hurdle for new entrants and a significant cost for exiting firms.

- Long-Term Contracts: Some segments may involve long-term supply or service agreements that bind companies to ongoing operations, even if profitability wanes.

- Brand Value and Reputation: The established reputation and brand loyalty built over years represent intangible assets that are difficult to divest or transfer, encouraging continued operation to preserve this value.

Strategic Stakes

The strategic importance of the market significantly fuels competitive rivalry. Middleby's planned spin-off of its food processing division by early 2026 underscores a strategic move to unlock value and foster growth in distinct business segments, potentially intensifying competition as each entity sharpens its focus. This strategic realignment suggests that competitors will face more concentrated efforts from both Middleby's core kitchen equipment business and the newly independent food processing company.

The market's appeal to rivals is amplified by the potential for specialized growth strategies. For instance, in the commercial kitchen equipment sector, where Middleby is a dominant player, competitors are likely to react to Middleby's increased focus by innovating and targeting specific market niches. Similarly, the newly formed food processing entity will likely face aggressive competition from established players and emerging companies vying for market share in that specific industry.

- Strategic Focus: Middleby's spin-off aims to create distinct entities, each with a clearer strategic mandate, potentially leading to more aggressive competitive plays in their respective markets.

- Market Value: The perceived value and growth potential within both the kitchen equipment and food processing sectors will attract and sustain high levels of rivalry as companies strive to capture market share.

- Competitive Response: Competitors are expected to adapt their strategies, possibly through increased R&D, mergers, or acquisitions, to counter Middleby's focused approach in each of its business segments.

Middleby operates in highly competitive markets, facing rivals like Illinois Tool Works and Ali Group in commercial foodservice, and giants such as Whirlpool and Samsung in residential appliances. This intense rivalry is further fueled by significant capital requirements and specialized assets, creating high exit barriers that keep less profitable competitors in the market. For instance, Middleby's 2023 capital expenditures of approximately $160 million highlight the asset-heavy nature of its operations, reinforcing these barriers.

The strategic importance of Middleby's markets, coupled with its planned spin-off of the food processing division by early 2026, is expected to intensify competition as each business unit sharpens its focus. Competitors will likely respond with increased innovation and niche targeting to counter Middleby's concentrated efforts, potentially leading to aggressive pricing or strategic realignments across the industry.

| Competitor | Key Brands | Market Segment |

|---|---|---|

| Illinois Tool Works | Hobart, Vulcan-Hart | Commercial Foodservice Equipment |

| Ali Group | Various (international) | Commercial Foodservice Equipment |

| Whirlpool Corporation | Whirlpool, KitchenAid, Maytag | Residential Kitchen Appliances |

| Samsung | Samsung | Residential Kitchen Appliances |

SSubstitutes Threaten

The threat of substitutes for Middleby's products is generally low, particularly in the commercial sector where specialized cooking and food processing equipment is often essential for efficiency and quality. For instance, in high-volume commercial kitchens, alternatives like manual preparation or less sophisticated tools simply cannot match the speed and consistency offered by Middleby's automated systems.

While simpler, manual kitchen tools might serve as substitutes for some residential cooking needs, they don't directly compete with Middleby's core commercial offerings. For specialized food processing, such as in the bakery or meat industries, finding direct substitutes that replicate the precision and output of Middleby's machinery is exceptionally difficult.

The capital investment required for Middleby's advanced equipment also acts as a barrier to entry for potential substitutes, as developing comparable technology is costly. This means that for many of its target markets, Middleby's advanced, integrated solutions are often the most viable, if not the only, option to meet specific operational demands.

The attractiveness of substitutes for Middleby's commercial kitchen equipment hinges significantly on their price-performance trade-off. If alternative, lower-cost solutions can deliver comparable output or quality, the threat posed by these substitutes escalates.

For instance, smaller, independent restaurants, often operating with tighter budgets, might choose less sophisticated, more economical equipment. This decision, even if it leads to lower operational efficiency, allows them to conserve capital expenditure, a critical factor for many businesses in 2024. This segment of the market is particularly sensitive to the upfront cost of equipment.

Customer propensity to substitute is a key factor in assessing competitive pressure. This tendency is driven by a mix of convenience, potential cost savings, and shifting consumer tastes. For example, in the residential kitchen appliance market, consumers increasingly favor versatile, compact gadgets that can perform multiple functions, directly substituting for bulkier, single-purpose machines.

In 2024, the market for smart kitchen appliances saw significant growth, with many consumers adopting multi-functional devices like air fryer-toaster ovens. This trend highlights a growing willingness to substitute specialized equipment with more adaptable solutions, especially when they offer convenience and space-saving benefits. This directly impacts brands that rely on single-function, high-end equipment.

Technological Advancements in Substitutes

Technological advancements are continuously introducing new substitutes that can impact Middleby's core business. For instance, innovations in ready-to-eat meal preparation and the rise of outsourced food preparation services offer consumers alternatives to traditional cooking, potentially lessening the demand for certain commercial and residential kitchen equipment.

The growing consumer preference for convenience, fueled by increasingly busy lifestyles, is a significant driver behind the demand for processed and packaged foods. This trend directly influences the market for food processing equipment, a key segment for Middleby, as it shifts demand towards more automated and efficient processing solutions.

Consider these specific impacts:

- Growth in Meal Kit Services: Services like HelloFresh and Blue Apron, which saw significant growth, offer pre-portioned ingredients and recipes, reducing the need for extensive home kitchen equipment.

- Advancements in Food Preservation: Technologies like advanced packaging and flash-freezing allow for longer shelf lives of processed foods, making them more attractive substitutes for fresh ingredients and potentially impacting demand for certain cooking appliances.

- Rise of Ghost Kitchens: These delivery-only food preparation facilities can utilize specialized, high-volume equipment, potentially reducing the need for traditional restaurant kitchen setups that Middleby often serves.

Regulatory and Health Trends

Shifting regulatory landscapes and growing consumer awareness about food safety and healthy eating present a significant threat of substitutes for Middleby's equipment. For instance, a stronger emphasis on fresh, minimally processed foods could diminish the need for certain food preparation machinery. Conversely, heightened concerns regarding food safety might boost demand for advanced, sanitary equipment, potentially substituting older or less compliant technologies.

The increasing consumer preference for plant-based diets, driven by health and environmental concerns, could also impact the demand for specific cooking equipment traditionally used for meat preparation. This trend, gaining significant traction in 2024, forces manufacturers to adapt their product lines or risk losing market share to companies offering specialized equipment for alternative food preparation methods.

- Regulatory shifts: Evolving food safety standards, such as HACCP implementation mandates, can pressure existing users to upgrade, but also make it easier for new, compliant technologies to enter the market.

- Consumer health trends: The rise of "clean eating" and demand for transparency in food sourcing directly influences the types of appliances consumers and commercial kitchens seek, potentially favoring simpler, less energy-intensive equipment.

- Substitution impact: A move towards smaller, more localized food production or direct-to-consumer models might reduce the need for large-scale commercial kitchen equipment, favoring modular or specialized units.

The threat of substitutes for Middleby's commercial kitchen equipment remains relatively low due to the specialized nature and high performance required in professional settings. While simpler, manual tools exist, they cannot match the efficiency and consistency of Middleby's automated systems, particularly in high-volume operations. The significant capital investment needed for advanced technology also deters many potential substitute innovations.

However, in 2024, the residential market shows a greater propensity for substitution, with consumers increasingly favoring versatile, multi-functional appliances like air fryer-toaster ovens over single-purpose machines. This trend, driven by convenience and space-saving needs, highlights a potential shift that could influence broader market expectations, even impacting commercial applications if cost-effective, adaptable solutions emerge.

Technological advancements in food preparation and delivery services, such as ready-to-eat meals and ghost kitchens, also present indirect substitutes. These services reduce the reliance on traditional kitchen setups, potentially impacting demand for certain types of commercial equipment. Furthermore, evolving consumer preferences towards plant-based diets may necessitate specialized equipment for alternative food preparation, creating opportunities for new entrants or shifts in product focus.

Entrants Threaten

The capital needed to break into Middleby's core markets – commercial foodservice, food processing, and luxury residential kitchens – is immense. This includes substantial upfront costs for research and development, building and equipping manufacturing plants, establishing robust distribution channels, and launching effective marketing campaigns.

For instance, setting up a state-of-the-art commercial oven manufacturing facility can easily run into tens of millions of dollars, not to mention the ongoing investment in innovation and brand building. This high financial hurdle significantly deters potential new competitors from entering the fray.

Established players in the commercial kitchen equipment industry, such as Middleby, leverage significant economies of scale in their manufacturing processes, bulk purchasing of raw materials, and extensive distribution networks. For instance, Middleby's global manufacturing footprint allows for optimized production runs and reduced per-unit costs.

New entrants face a substantial hurdle in replicating these cost efficiencies. Without the same production volume and purchasing power, they would likely incur higher per-unit manufacturing and procurement costs, making it challenging to compete on price with established giants like Middleby. This cost disadvantage acts as a significant barrier to entry.

Middleby's extensive portfolio, boasting over 120 brands, coupled with a strong reputation for innovation and quality, presents a formidable barrier to new entrants. Establishing comparable brand recognition and cultivating customer loyalty in these mature markets demands substantial financial and temporal investment, making it difficult for newcomers to gain a foothold.

Access to Distribution Channels

Middleby's established global distribution and service networks present a significant barrier for new entrants in the commercial foodservice equipment, food processing machinery, and residential appliance sectors. Building comparable infrastructure requires substantial capital investment and time, making it difficult for newcomers to compete effectively.

New entrants might attempt to leverage existing distribution channels, but these often favor established players like Middleby, limiting access and favorable terms. For example, in 2023, Middleby reported a robust global presence with operations spanning numerous countries, underscoring the scale of their distribution advantage.

- Established Global Reach: Middleby possesses extensive worldwide distribution and service networks, a critical asset in the foodservice and food processing industries.

- Capital Intensity: The cost and time required for new entrants to replicate Middleby's distribution infrastructure are substantial, acting as a significant deterrent.

- Channel Access: New companies may struggle to gain access to prime distribution channels, which are often dominated by incumbents and offer preferential treatment to established brands.

- Service Network Importance: The ability to provide reliable after-sales service and support is paramount, and building a comparable service network is a considerable hurdle for any new competitor.

Regulatory Hurdles and Intellectual Property

The industries where Middleby operates, particularly commercial foodservice equipment, are often characterized by rigorous health, safety, and environmental regulations. For instance, NSF International certifications are critical for food equipment, and navigating these standards requires significant investment and expertise, acting as a substantial barrier for newcomers. The cost and complexity of ensuring compliance with these evolving regulations can be prohibitive for potential entrants.

Furthermore, Middleby possesses a robust portfolio of intellectual property, including numerous patents on its innovative cooking, refrigeration, and warewashing technologies. This strong patent protection makes it difficult and expensive for new companies to develop competing products without infringing on existing intellectual property rights. For example, Middleby's focus on energy efficiency and smart kitchen technology is often protected by patents, creating a technological moat.

- Regulatory Compliance Costs: New entrants face substantial upfront costs in meeting stringent safety and environmental standards, such as those mandated by UL, CE, and NSF certifications.

- Intellectual Property Barriers: Middleby's extensive patent portfolio, covering areas like advanced cooking methods and connected kitchen solutions, presents a significant hurdle for competitors seeking to introduce similar innovations.

- Capital Investment: Establishing manufacturing facilities that adhere to these regulations and developing proprietary technology requires considerable capital, deterring smaller or less-funded new entrants.

The threat of new entrants for Middleby is considered low due to several significant barriers. The substantial capital required to establish manufacturing facilities, develop innovative products, and build robust distribution and service networks deters most potential newcomers. For instance, Middleby's 2023 revenue of $4.3 billion reflects the scale of operations required to compete effectively, a level difficult for new entities to match without considerable investment.

Moreover, established brand loyalty and the need for regulatory compliance, such as NSF certifications for commercial kitchen equipment, add further complexity and cost for any aspiring competitor. Middleby's extensive patent portfolio, protecting its technological advancements, also creates a significant hurdle, making it challenging for new entrants to offer comparable products without substantial R&D or licensing agreements.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High costs for manufacturing, R&D, distribution, and marketing. | Significant deterrent due to the immense financial commitment needed. |

| Brand Loyalty & Reputation | Middleby's strong reputation for quality and innovation. | New entrants struggle to build comparable trust and recognition. |

| Regulatory Compliance | Meeting stringent health, safety, and environmental standards. | Adds substantial cost and complexity, requiring specialized expertise. |

| Intellectual Property | Middleby's extensive patent portfolio. | Limits ability to develop similar technologies without infringement. |

Porter's Five Forces Analysis Data Sources

Our Middleby Porter's Five Forces analysis is built upon a robust foundation of data, incorporating information from industry-specific market research reports, financial filings of key players, and publicly available company statements. This comprehensive approach ensures a thorough understanding of the competitive landscape.