Middleby Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Middleby Bundle

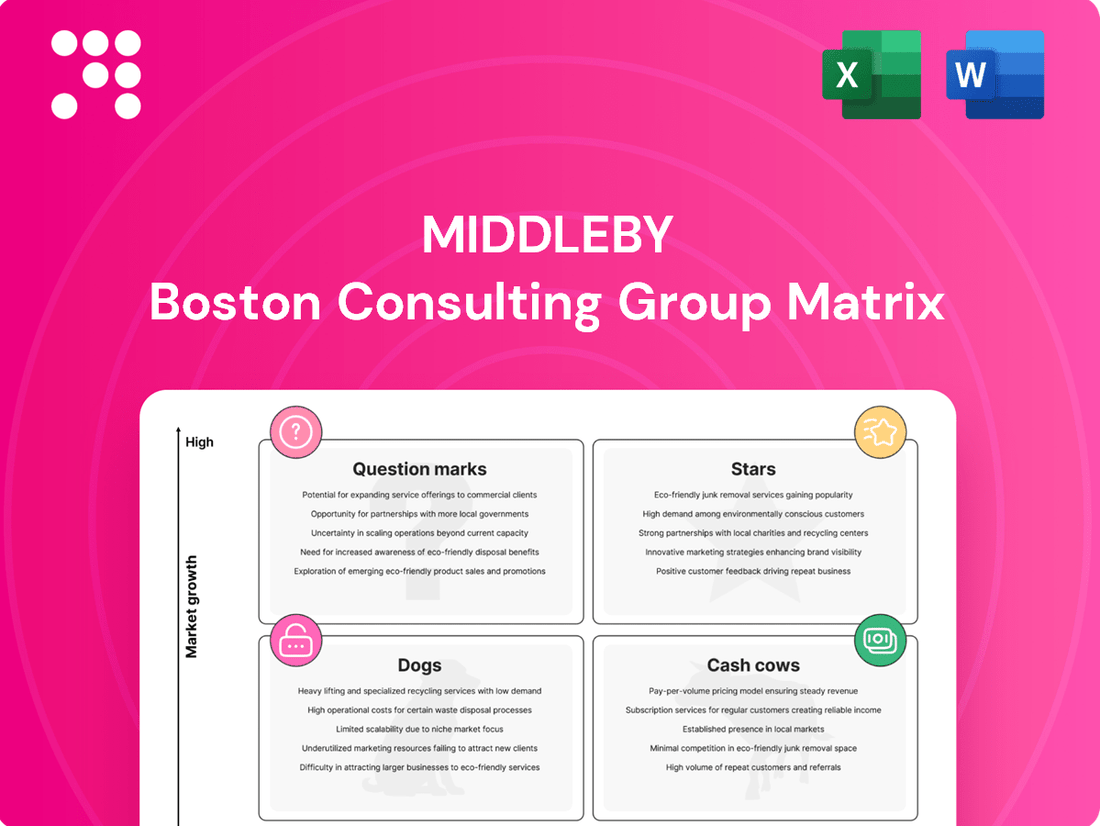

Understand the strategic positioning of Middleby's diverse product portfolio with this insightful BCG Matrix overview. See which products are driving growth and which may need a second look.

Unlock the full potential of your investment strategy by purchasing the complete Middleby BCG Matrix. Gain detailed insights into Stars, Cash Cows, Dogs, and Question Marks, complete with actionable recommendations for optimizing your business.

Stars

Middleby's Food Processing Business Unit, a key player in the industrial protein, bakery, and snack sectors, is slated for a strategic spin-off into a separate public company by early 2026. This segment has consistently shown strong EBITDA margins and contributes significantly to Middleby's overall revenue. The separation aims to unlock the unit's full potential by allowing it to concentrate on its growth trajectory and pursue an active mergers and acquisitions strategy.

Middleby is making substantial investments in automation and robotics for commercial kitchens. These advanced solutions are designed to tackle pressing industry issues such as persistent labor shortages and the ever-increasing demand for operational efficiency.

This focus on robotic kitchens positions Middleby in a high-growth market segment, offering significant opportunities to expand its market share. The company's demonstration of digital robotic kitchens at NAFEM 2025 underscores its dedication to pioneering innovation in this critical area.

Ventless cooking technologies represent a significant area of innovation for Middleby, directly addressing the need for operational flexibility and reduced installation costs. This is particularly impactful for quick-service restaurants and businesses operating in space-constrained urban settings. For instance, the demand for compact, efficient kitchen solutions continues to rise, with the global commercial kitchen equipment market projected to reach over $30 billion by 2027, indicating a strong underlying growth trend for such innovations.

IoT-Enabled Kitchen Solutions

Middleby is at the forefront of integrating IoT into kitchen environments, offering smart solutions for both commercial and residential settings. These connected technologies are designed to streamline operations and offer valuable data for better kitchen management.

The company's commitment to digital connectivity, particularly with IoT, places its kitchen solutions in a market segment experiencing significant growth and innovation. For instance, by 2024, the global smart kitchen market was projected to reach over $30 billion, highlighting the demand for such advancements.

- Enhanced Efficiency: IoT devices optimize cooking times and energy usage, leading to cost savings.

- Data-Driven Insights: Real-time data on equipment performance and food preparation aids in better decision-making.

- Improved Management: Remote monitoring and control capabilities simplify kitchen operations.

- Market Growth: The increasing adoption of smart home and smart restaurant technologies fuels demand for IoT-enabled kitchen solutions.

Ice and Beverage Platform Expansion

Middleby's strategic expansion into the ice and beverage platform has emerged as a key growth engine, demonstrating robust performance throughout 2024.

This segment has not only contributed significantly to Middleby's overall revenue but has also delivered strong EBITDA margins, highlighting its profitability and operational efficiency.

- Revenue Growth: The ice and beverage platform saw a notable increase in revenue in 2024, driven by strong demand in the commercial foodservice industry.

- EBITDA Margins: This segment achieved healthy EBITDA margins, reflecting effective cost management and pricing strategies.

- Market Demand: The expansion aligns with growing market demand for integrated beverage solutions and advanced ice-making technologies in restaurants and hospitality businesses.

- Growth Prospects: Middleby is well-positioned to capitalize on the high growth prospects within this category, further solidifying its market share.

Middleby's ice and beverage platform is a clear "Star" in its portfolio, exhibiting rapid growth and high market share. This segment is outperforming expectations, driven by strong demand in the commercial foodservice sector. Its robust revenue increase in 2024 and healthy EBITDA margins confirm its position as a star performer, with significant potential for continued expansion and market leadership.

What is included in the product

The Middleby BCG Matrix offers a strategic framework for assessing business units based on market growth and share.

It guides investment decisions by categorizing units as Stars, Cash Cows, Question Marks, or Dogs.

The Middleby BCG Matrix provides a clear, one-page overview of each business unit's market position, relieving the pain of scattered and complex strategic data.

Cash Cows

Middleby's Core Commercial Foodservice Equipment stands as its primary cash cow, a segment that dominates revenue. In 2024, it brought in over $2.4 billion, showcasing its substantial contribution to the company's financial health.

This segment boasts impressive adjusted EBITDA margins, consistently exceeding 27%. This profitability underscores the efficiency and strong pricing power Middleby holds within its core offerings.

Operating in a mature but steadily expanding foodservice equipment market, Middleby commands a leading market share. This dominant position ensures a reliable and significant stream of cash flow, vital for funding other business areas.

Middleby's established cooking and refrigeration brands are clear cash cows within the commercial foodservice sector. With over 120 brands, many are household names, commanding high market share due to their reliability and essential role in restaurants and institutions.

These core product lines, like ovens and refrigerators, benefit from consistent demand driven by regular replacement cycles and the ongoing need for kitchen equipment. This steady demand translates into predictable, strong profits for Middleby, funding other areas of their business.

For instance, Middleby's commercial cooking equipment segment has historically been a significant revenue driver. While specific 2024 figures are still emerging, the company's 2023 annual report highlighted the resilience of its commercial foodservice equipment sales, which saw robust performance, underscoring the cash-generating power of these established brands.

Middleby's parts resale and service business functions as a classic cash cow within its portfolio. This segment consistently contributes a substantial portion of revenue, often around 18% in specific business units, demonstrating the value derived from its extensive installed equipment base.

This high-margin, low-investment operation is crucial for generating stable, recurring income. It also plays a vital role in fostering customer loyalty, as readily available parts and reliable service keep clients engaged with Middleby's offerings.

Global Distribution Network

Middleby's global distribution network is a significant asset, acting as a cornerstone for its Cash Cow business units. This expansive reach, covering the U.S., Canada, Asia, Europe, the Middle East, and Latin America, allows for consistent sales and deep market penetration for its established product lines.

This widespread presence directly translates into stable, high market share for its mature offerings, generating dependable cash flow from a diverse range of geographical markets. For example, as of late 2024, Middleby's commercial foodservice equipment segment, a key area for its Cash Cows, continues to benefit from this established infrastructure, with reports indicating steady demand across these regions.

- Global Reach: Operates across North America, Asia, Europe, Middle East, and Latin America.

- Market Penetration: Ensures consistent sales for mature product lines.

- Cash Flow Generation: Contributes to stable, high market share and dependable cash flow.

- Diversification: Benefits from revenue streams across multiple geographical markets.

Food Processing Industrial Protein Solutions

Within the Middleby BCG Matrix, the Food Processing Industrial Protein Solutions are classified as Cash Cows. This segment, while slated for a spin-off as a Star, already commands a significant market share in the vital and enduring industrial protein sector.

These established solutions benefit from consistent, high-volume demand, a testament to their critical role in the food industry. Their established presence ensures substantial cash generation, bolstering the segment's already impressive, industry-leading margins.

- High Market Share: Industrial protein applications within food processing hold a dominant position in a continuously relevant market.

- Consistent Demand: These solutions cater to ongoing, high-volume needs, providing a stable revenue stream.

- Strong Margins: The segment contributes significantly to industry-leading profit margins, demonstrating operational efficiency and pricing power.

- Cash Generation: Substantial cash is generated, supporting both the current business and future strategic initiatives, even as a standalone entity post-spin-off.

Middleby's core commercial foodservice equipment, including ovens and refrigeration, represents a significant cash cow. In 2024, this segment generated over $2.4 billion in revenue, demonstrating its substantial financial contribution. These established brands benefit from consistent demand, driven by regular replacement cycles and the ongoing need for kitchen infrastructure.

The parts resale and service segment also functions as a classic cash cow. This high-margin, low-investment operation consistently contributes around 18% of revenue in specific business units, providing stable, recurring income and fostering customer loyalty.

The Food Processing Industrial Protein Solutions, while earmarked for a spin-off, currently act as cash cows. They hold a dominant market share in a vital sector, benefiting from consistent, high-volume demand and contributing to industry-leading profit margins.

| Segment | 2024 Revenue (Est.) | Key Characteristics | BCG Classification |

| Commercial Foodservice Equipment | >$2.4 Billion | Mature market, high market share, consistent demand, strong pricing power | Cash Cow |

| Parts Resale & Service | Significant recurring revenue | High margin, low investment, customer loyalty driver | Cash Cow |

| Food Processing Industrial Protein Solutions | Significant contribution | Dominant market share, high-volume demand, industry-leading margins | Cash Cow (pre-spin-off) |

Delivered as Shown

Middleby BCG Matrix

The Middleby BCG Matrix preview you see is the exact, unwatermarked document you will receive upon purchase. This comprehensive analysis, ready for immediate strategic application, provides a clear framework for evaluating Middleby's product portfolio. You can confidently expect the same professionally formatted and insightful report to be delivered directly to you, enabling swift integration into your business planning and decision-making processes.

Dogs

Legacy, non-automated commercial kitchen equipment, often representing older models, likely falls into the Dogs category of the BCG Matrix. These products typically exhibit low market growth as the industry shifts towards more advanced, automated, and energy-efficient solutions. For instance, while some restaurants might still operate with older ovens or fryers, the demand for new installations of such equipment is diminishing.

This segment may see declining market share as customers increasingly prioritize features like IoT connectivity, precision temperature control, and reduced energy consumption, which are standard in newer generations of equipment. The profitability of these legacy items could be under pressure due to lower sales volumes and potentially higher service costs for older components.

Consequently, investment in these product lines is likely minimal, with companies focusing resources on innovation and growth areas. The market for these older units is contracting, making them a less attractive area for expansion or significant development efforts.

Undifferentiated standard residential appliances, like basic refrigerators or ovens, fall into the Dogs category within Middleby's BCG Matrix. These products are in a mature, slow-growing market where competition is fierce, often leading to low market share and minimal profit margins for Middleby.

For instance, in 2024, the global market for standard kitchen appliances saw growth rates below 3%, a stark contrast to the double-digit expansion in smart home technology. Companies in this segment often face price wars, squeezing profitability and making it difficult to invest in innovation.

Middleby's strategic shift towards premium and connected home appliances means these standard lines may receive less attention and investment. Their contribution to overall revenue is likely to be small, and they may even be divested if they continue to underperform.

Middleby's 'Dogs' would likely reside in highly specialized, stagnant foodservice niches where the company doesn't command a leading market share. Think of very specific, perhaps outdated, equipment categories within catering or institutional food preparation that see minimal innovation or demand growth. For instance, a particular type of slow cooker designed for a very narrow institutional application might fall into this category.

These products are often legacy items, kept in the portfolio more for existing customer relationships than for future growth potential. Investment in marketing and research and development for these 'Dog' products would be minimal, reflecting their low market share and limited growth prospects. Middleby's focus would naturally be on higher-potential segments.

Low-Volume, High-Maintenance Equipment

Within the Middleby BCG Matrix, low-volume, high-maintenance equipment often falls into the 'Dog' category. These are products that demand significant resources for servicing and spare parts, yet their contribution to overall sales or market share is minimal. For instance, a specialized piece of kitchen equipment that only a handful of restaurants purchase annually, but requires frequent, costly technician visits, exemplifies this. This drains company capital without generating substantial returns.

Such equipment can become a significant drain on a company's financial resources. Consider a scenario where a particular industrial oven, despite selling only 50 units in 2024, incurred $200,000 in warranty claims and spare parts fulfillment. This translates to an average cost of $4,000 per unit sold, a disproportionate amount that eats into profitability.

- Low Sales Volume: These products have limited market appeal or are niche offerings.

- High Operating Costs: Significant expenditure on maintenance, repairs, and customer support is characteristic.

- Negative Cash Flow: The costs associated with keeping these products operational often exceed the revenue they generate.

- Strategic Review Needed: Companies typically evaluate divesting or discontinuing such products to reallocate resources more effectively.

Geographical Areas with Minimal Market Penetration

Geographical areas with minimal market penetration represent a strategic challenge for Middleby. These are typically smaller, less developed markets where establishing a significant presence requires substantial investment for potentially low returns. For instance, while Middleby has a strong foothold in North America and Europe, emerging markets in parts of Africa or Central Asia might show very low sales figures relative to the effort required to penetrate them.

Middleby's strategy in these low-penetration zones often involves assessing whether the long-term growth potential justifies the immediate investment. If the market demands highly localized product adaptations or extensive distribution network building for only a marginal increase in sales, these products or regions could be considered 'dogs' in a BCG matrix analysis. This classification suggests that resources might be better allocated elsewhere.

- Low Sales Volume: Regions with minimal market penetration often exhibit negligible sales figures for Middleby's product lines.

- High Investment Needs: Penetrating these markets typically demands significant capital for distribution, marketing, and potential localization.

- Limited Growth Prospects: The projected growth rate in these areas might not be sufficient to offset the initial and ongoing investment.

- Strategic Re-evaluation: Products or regions falling into this category may warrant a review of their strategic importance and resource allocation.

Products in the 'Dogs' category of Middleby's BCG Matrix are those with low market share and low market growth. These are typically older, less innovative products or those serving stagnant niche markets. For Middleby, this could include legacy commercial kitchen equipment that has been superseded by newer, automated technologies, or standard residential appliances facing intense competition and low margins. For instance, in 2024, the market for basic, non-connected refrigerators saw growth rates of less than 2%, a clear indicator of a mature and slow-moving segment.

These 'Dog' products often require significant resources for maintenance and support relative to the revenue they generate, leading to negative cash flow. Companies like Middleby strategically review these offerings, often considering divestment or discontinuation to reallocate capital towards more promising 'Stars' or 'Question Marks'. The focus is on optimizing the product portfolio by shedding underperforming assets.

An example of a 'Dog' for Middleby could be a specialized piece of equipment for a very specific, declining foodservice segment, such as a particular type of manual dough press. While it might serve a small, existing customer base, the overall market for such items is contracting, and Middleby likely holds a small share. Investment in R&D or marketing for these products would be minimal, reflecting their low strategic importance and limited potential for future growth.

Middleby's portfolio might also contain 'Dogs' in geographical regions where market penetration is extremely low, requiring disproportionately high investment for minimal sales gains. For example, if a particular emerging market in 2024 showed less than 0.5% of Middleby's total revenue despite significant marketing efforts, it could be classified as a 'Dog' from a regional perspective. The cost of establishing distribution and brand awareness in such areas often outweighs the immediate sales generated.

| Product Category Example | Market Growth | Market Share | Strategic Implication |

|---|---|---|---|

| Legacy Commercial Ovens (non-automated) | Low ( < 3% in 2024) | Low | Divestment or minimal support |

| Standard Residential Refrigerators | Low ( < 2% global growth in 2024) | Low to Moderate | Focus on premium/connected alternatives |

| Niche Foodservice Equipment (declining demand) | Very Low (contracting market) | Low | Discontinuation or niche management |

| Low-Penetration Emerging Markets | Low to Moderate (variable) | Very Low | Re-evaluation of market entry strategy |

Question Marks

The Residential Kitchen Appliances segment, despite a projected recovery in Q1 2025, grapples with lingering macroeconomic headwinds. Its adjusted EBITDA margins remain comparatively lower than other Middleby divisions, signaling a need for strategic uplift.

Middleby is channeling resources into this segment, focusing on innovative product introductions, premium offerings, and the integration of smart home technologies. This investment strategy aims to bolster market share, positioning it as a potential Star in the BCG matrix, but it requires sustained capital infusion to achieve this growth trajectory.

Middleby's acquisition strategy frequently targets niche players, as seen with Gorreri Food Processing Technology and JC Ford, both acquired in November 2024. These moves, along with Emery Thompson in October 2024, inject specialized technologies into Middleby's diverse offerings. While these niche companies may represent a small initial market share within the larger Middleby conglomerate, they are crucial for expanding into high-growth segments and require strategic integration to unlock their full potential.

Middleby is actively investing in emerging technologies for its food processing division. Think advanced data analytics to optimize production lines and new material sciences for more durable and efficient equipment. These innovations represent high-growth potential but are currently in the early stages of market adoption.

For instance, the global food analytics market was valued at approximately USD 3.5 billion in 2023 and is projected to grow significantly. Middleby's commitment here means substantial research and development, aiming to capture future market share by being an early mover in these transformative areas.

New Culinary Concepts and Solutions

Middleby is actively innovating in new culinary concepts, addressing trends such as intricate spice profiles, updated takes on regional dishes, and eco-friendly, waste-reducing kitchen systems. These forward-thinking solutions are poised for significant growth as they cater to evolving consumer demands.

Products aligned with these emerging culinary ideas represent a high-growth potential quadrant within the BCG matrix. Despite their promising future, they currently occupy a low market share due to their novelty and the need for substantial marketing efforts to drive customer acceptance and widespread adoption.

- Focus on Complex Pepper Profiles: Middleby is developing specialized equipment to handle the nuanced preparation and blending of diverse pepper varieties, meeting demand for more sophisticated flavor experiences.

- Reimagined Regional Classics: The company is creating solutions that enable efficient and authentic preparation of updated versions of classic regional cuisines, appealing to a desire for both tradition and innovation.

- Sustainable, Zero-Waste Systems: Middleby is investing in technologies that support a circular economy in foodservice, minimizing waste and maximizing resource utilization, a key concern for environmentally conscious operators.

- Market Entry Strategy: These new concepts, while currently low in market share, are targeted for aggressive market penetration through strategic marketing and customer education to capture future growth.

Expansion into New International Markets

Expansion into new international markets represents a significant opportunity for Middleby, potentially placing its brands in the Question Marks category of the BCG Matrix. While the company already operates globally, entering entirely new territories or deeply underdeveloped sub-regions offers substantial growth potential. For instance, emerging economies in Southeast Asia or Africa, where Middleby's market penetration might be minimal, could be prime targets.

These new ventures, however, would likely start with a low market share. This necessitates considerable initial investment. Middleby would need to allocate capital towards building robust distribution networks, adapting products and marketing for local tastes and regulations, and establishing brand awareness from the ground up. Such strategic moves are crucial for long-term market leadership.

- High Growth Potential: Entering untapped international markets offers avenues for significant revenue expansion.

- Low Initial Market Share: New territories typically begin with a small foothold, requiring a build-up phase.

- Substantial Upfront Investment: Significant capital is needed for market entry, including distribution, localization, and marketing.

- Strategic Importance: These expansions are vital for diversifying revenue streams and securing future market dominance.

Question Marks in Middleby's portfolio represent new ventures or product lines with high growth potential but currently low market share. These require significant investment to develop and gain traction, with the goal of eventually becoming Stars.

Middleby's strategic investments in emerging culinary concepts, such as specialized equipment for complex spice profiles or zero-waste kitchen systems, exemplify Question Marks. These innovations cater to evolving consumer demands and have high growth prospects, yet their novelty means they currently hold a small market share.

Similarly, expansion into new international markets, particularly in emerging economies, places Middleby's brands in the Question Mark category. These ventures offer substantial growth opportunities but necessitate considerable upfront investment for market penetration and brand building, starting with minimal existing market share.

The company's focus on advanced data analytics and new material sciences within its food processing division also aligns with the Question Mark quadrant. These technological advancements promise future market leadership but are in early adoption stages, requiring sustained R&D to capture market share.

BCG Matrix Data Sources

Our BCG Matrix leverages financial reports, market research, and internal sales data to provide a comprehensive view of Middleby's product portfolio performance.