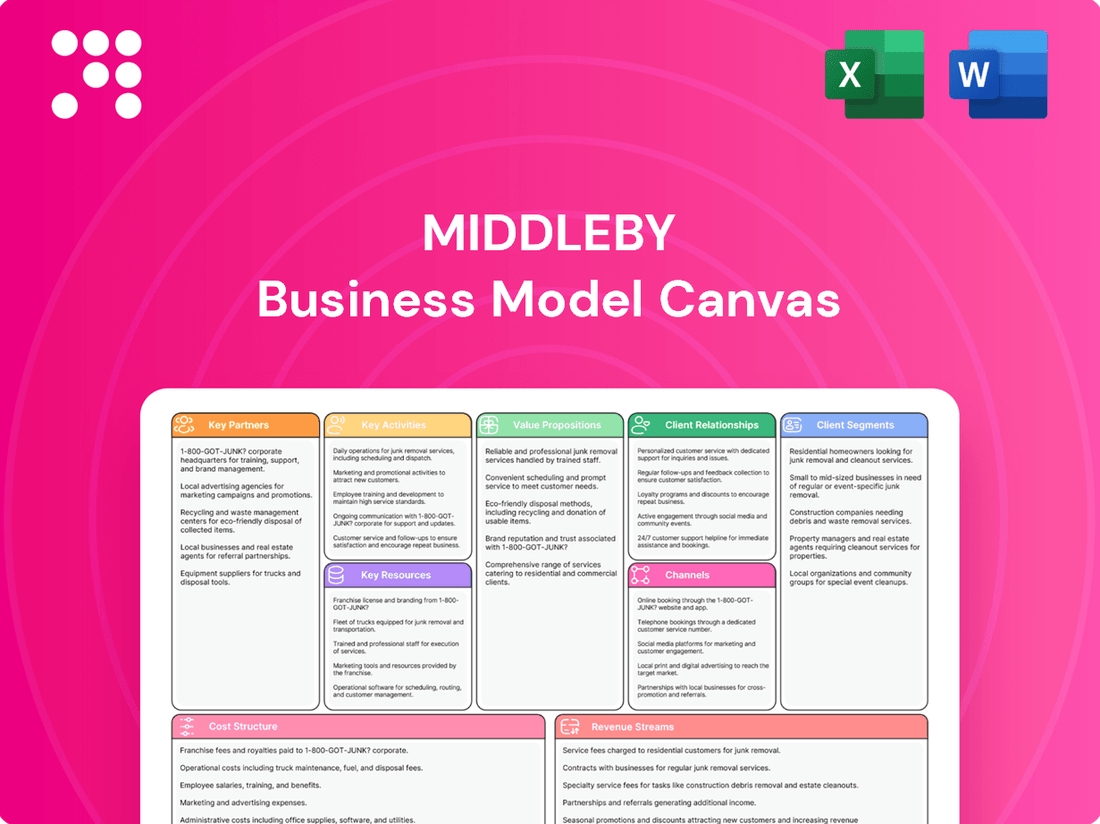

Middleby Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Middleby Bundle

Unlock the core components of Middleby's innovative business model with our comprehensive Business Model Canvas. Discover how they effectively deliver value, cultivate customer relationships, and manage key resources to maintain their industry dominance. This detailed breakdown is essential for anyone looking to understand the strategic engine behind their success.

Partnerships

Middleby actively pursues strategic acquisitions as a cornerstone of its growth strategy, aiming to broaden its product offerings, extend its market presence, and enhance its technological expertise. This approach to inorganic growth has been instrumental in solidifying its leadership across various industry segments, integrating a multitude of brands and innovative technologies.

In 2024 alone, Middleby bolstered its portfolio with key acquisitions such as JBT Morrell, a significant player in food processing equipment, Gorreri, known for its advanced portioning and processing solutions, JC Ford, a specialist in extrusion technology, and Emery Thompson, a leader in ice cream batch freezers. These moves underscore Middleby's commitment to expanding its capabilities in specialized areas of food preparation and processing.

Middleby relies heavily on a global network of distributors and dealers to effectively reach its diverse customer base, spanning both commercial foodservice and residential kitchen sectors. These partners are vital for driving sales and ensuring widespread market penetration.

These crucial intermediaries provide essential local support, including sales, service, and installation, which is fundamental to Middleby's customer engagement strategy. Their established relationships and market knowledge are invaluable for navigating regional complexities and expanding reach.

For instance, in 2023, Middleby's strategic partnerships with its extensive dealer network were a significant factor in its ability to maintain strong sales performance across various international markets, reinforcing the importance of this distribution channel.

Middleby actively collaborates with technology firms and innovators to embed cutting-edge solutions, such as the Internet of Things (IoT), automation, and digital connectivity, into their diverse range of equipment. These strategic partnerships are crucial for the development of next-generation products designed to meet the evolving demands of modern kitchens and food processing operations.

For instance, Middleby’s focus on IoT-driven kitchen solutions enhances operational efficiency and data insights for their clients. Their investment in ventless cooking technologies, often developed in partnership with specialized innovators, addresses space and ventilation constraints in commercial kitchens, a growing trend particularly noted in urban environments.

The company’s beverage division also benefits from these collaborations, pushing forward innovations in connected beverage systems. These partnerships ensure Middleby remains at the forefront of technological advancement, offering solutions that are not only functional but also intelligent and adaptable to the dynamic needs of the food service industry.

Raw Material and Component Suppliers

Middleby relies heavily on a diverse network of raw material and component suppliers to maintain its manufacturing efficiency. These partnerships are critical for securing a consistent flow of high-quality inputs. For instance, in 2024, Middleby continued to emphasize strengthening these relationships to ensure supply chain stability.

Ensuring a stable and high-quality supply chain is paramount for Middleby's production. This focus directly impacts cost management and the ability to meet customer demand reliably. The company actively works with suppliers to uphold quality standards across all components.

Supply chain resilience is a significant focus for Middleby, particularly in navigating potential disruptions. By fostering strong relationships and potentially diversifying its supplier base, Middleby aims to mitigate risks and ensure uninterrupted product availability for its customers.

- Supplier Diversification: Middleby actively seeks to broaden its supplier base to reduce dependency on any single source.

- Quality Assurance: Robust quality control measures are implemented with suppliers to guarantee the integrity of raw materials and components.

- Risk Mitigation: Strategies are in place to address potential supply chain disruptions, ensuring business continuity.

- Long-Term Relationships: Middleby cultivates enduring partnerships with key suppliers, fostering collaboration and mutual benefit.

Service and Installation Providers

Middleby relies on a robust network of authorized service and installation providers to ensure its commercial kitchen equipment performs optimally after purchase. These partnerships are critical for delivering professional setup, routine maintenance, and timely repairs, directly impacting equipment lifespan and customer satisfaction. For instance, in 2024, Middleby continued to expand its global service footprint, aiming to reduce response times for critical equipment issues.

These collaborations are fundamental to maintaining Middleby's reputation for dependable and high-quality products. A well-trained and geographically dispersed service team ensures that customers, from large restaurant chains to independent eateries, receive consistent support, minimizing operational downtime. This focus on post-sale support is a key differentiator in the competitive commercial kitchen equipment market.

The strategic importance of these partnerships is underscored by Middleby's ongoing investment in training and certification programs for its service partners. This ensures that technicians possess the specialized knowledge required for Middleby's diverse product portfolio, from advanced cooking technologies to sophisticated refrigeration systems.

- Authorized Service Network: Essential for post-sale support and customer satisfaction.

- Equipment Longevity: Proper installation and maintenance by partners extend product life.

- Reputation for Reliability: A strong service network reinforces Middleby's brand promise.

- Global Reach: Partnerships enable consistent support across various international markets.

Middleby's key partnerships are multifaceted, encompassing strategic acquisitions, a robust global distributor network, technology collaborators, and essential suppliers. These alliances are critical for expanding its product portfolio, ensuring market reach, driving innovation, and maintaining operational efficiency. The company actively integrates new brands and technologies through acquisitions, like JBT Morrell and Gorreri in 2024, to enhance its specialized capabilities.

Its extensive dealer network provides vital local sales and service support, crucial for penetrating diverse markets and maintaining customer satisfaction. Furthermore, collaborations with technology firms are key to embedding advanced features like IoT into their equipment, as seen in their connected beverage systems and ventless cooking solutions.

Strong relationships with raw material and component suppliers are fundamental for supply chain stability and quality control, a focus reinforced in 2024. Finally, a network of authorized service and installation providers ensures optimal equipment performance and customer support, with Middleby expanding its global service footprint in 2024 to improve response times.

What is included in the product

A detailed, structured overview of Middleby's business model, presented across the nine classic Business Model Canvas blocks, offering a clear understanding of their strategy.

This model meticulously outlines Middleby's customer segments, value propositions, and revenue streams, providing a comprehensive view of their operational framework.

The Middleby Business Model Canvas provides a structured framework to identify and address operational inefficiencies, acting as a pain point reliever by offering clarity on customer segments and value propositions.

By visually mapping out key resources and activities, the Middleby Business Model Canvas helps businesses pinpoint and resolve pain points related to cost structures and revenue streams.

Activities

Middleby’s commitment to Research and Development (R&D) is a cornerstone of its business model, fueling continuous innovation across its diverse segments. The company dedicates significant resources to developing cutting-edge cooking technologies, advanced automation, and smart IoT solutions, aiming to enhance efficiency and performance for its customers. This focus on innovation extends to creating more energy-efficient equipment, a critical factor in today's market.

Key to this R&D effort are Middleby’s specialized innovation centers, like the Middleby Innovation Kitchens (MIK). These facilities serve as hubs for showcasing advanced product solutions and actively involve customers in the testing and refinement process, ensuring that new developments meet real-world demands. For instance, in 2023, Middleby continued to integrate advanced digital technologies into its product lines, reflecting a growing trend towards connected and data-driven kitchen environments.

Middleby's core activities revolve around the meticulous design, manufacturing, and assembly of a diverse portfolio of commercial foodservice, food processing, and residential kitchen appliances. This encompasses everything from ovens and fryers to specialized food preparation equipment, all built to exacting standards.

The company boasts an extensive network of manufacturing facilities strategically located across the globe. This global footprint allows for efficient production cycles, robust quality control, and proximity to key markets, optimizing their supply chain and reducing lead times. In 2024, Middleby continued to invest in its manufacturing capabilities, including the expansion of its Palmetto, Florida facility, which is crucial for its innovative filling and depositing brands.

Middleby's sales and marketing are crucial for reaching its global clientele across more than 120 brands. Key activities include showcasing innovations at industry events such as NAFEM and the Bar & Restaurant Expo, alongside direct sales outreach and cultivating a strong distribution network.

In 2024, Middleby continued its strategic presence at major trade shows, directly engaging with customers and partners to highlight the efficiency, profitability, and technological advancements of its product lines. This approach is vital for maintaining market leadership and driving revenue growth.

Post-Sales Service and Support

Middleby's post-sales service and support are vital for maintaining customer satisfaction and ensuring their equipment performs reliably over time. This includes offering comprehensive after-sales service, routine maintenance, and readily accessible technical support.

A robust global service network and efficient parts availability are cornerstones of this strategy. For instance, in 2023, Middleby continued to invest in expanding its service technician base and parts distribution centers to minimize downtime for its customers worldwide.

- Global Service Network: Middleby operates a vast network of trained technicians and authorized service partners across continents, ensuring prompt assistance regardless of customer location.

- Parts Availability: Ensuring a high fill rate for spare parts is critical. Middleby maintains strategically located distribution hubs to deliver necessary components quickly, supporting the longevity of their equipment.

- Technical Support: Customers have access to expert technical support through various channels, including phone, email, and online resources, to troubleshoot issues and optimize equipment performance.

- Customer Loyalty: By providing exceptional post-sales support, Middleby fosters strong customer relationships, driving repeat business and reinforcing its brand as a provider of durable, high-quality commercial kitchen and industrial processing equipment.

Strategic Portfolio Management and Acquisitions

Middleby's strategic portfolio management is crucial, involving a continuous assessment of its diverse business units. This includes actively seeking and integrating new acquisitions to bolster capabilities and market presence.

A core activity is identifying synergistic companies aligned with market trends, facilitating mergers and acquisitions to drive growth. This proactive approach ensures Middleby remains competitive and expands its reach.

- Portfolio Review: Middleby consistently evaluates its business segments to optimize performance and strategic alignment.

- Acquisition Strategy: The company actively pursues acquisitions that offer synergistic benefits and market expansion opportunities.

- Divestiture: The planned spin-off of its Food Processing business in 2024 exemplifies strategic portfolio management, allowing for focused growth in core areas.

- Market Adaptation: This ongoing management ensures Middleby adapts to evolving market dynamics and capitalizes on emerging opportunities.

Middleby's key activities center on innovation, manufacturing, and sales. The company invests heavily in R&D to create advanced foodservice and food processing equipment, exemplified by its innovation centers. Its global manufacturing footprint ensures efficient production, with ongoing investments in facilities like the Palmetto expansion in 2024.

Sales and marketing efforts are vital, featuring participation in industry events like NAFEM in 2024 to showcase product advancements. Post-sales support, including a global service network and parts availability, is crucial for customer retention. Strategic portfolio management, including acquisitions and the planned 2024 Food Processing spin-off, drives growth and market adaptation.

| Key Activity | Description | 2024 Focus/Data |

| Research & Development | Developing innovative cooking, automation, and IoT solutions. | Continued integration of digital technologies. |

| Manufacturing | Designing, manufacturing, and assembling diverse appliance portfolios. | Investment in facilities like Palmetto expansion. |

| Sales & Marketing | Showcasing innovations and cultivating distribution networks. | Presence at NAFEM and Bar & Restaurant Expo. |

| Service & Support | Providing after-sales service, maintenance, and technical assistance. | Expanding service technician base and parts distribution. |

| Portfolio Management | Assessing business units and pursuing synergistic acquisitions. | Planned spin-off of Food Processing business. |

Full Version Awaits

Business Model Canvas

The Business Model Canvas you are previewing is precisely the document you will receive upon purchase. This is not a mockup or a sample; it's a direct snapshot of the actual, complete file you'll download. You'll gain full access to this professionally structured and ready-to-use Business Model Canvas, identical to what you see here.

Resources

Middleby’s strength lies in its vast portfolio of over 120 well-regarded brands spanning commercial, residential, and food processing sectors. This extensive collection represents a significant intangible asset, fostering strong market recognition and deep customer loyalty.

These established brands are not just names; they are trusted by consumers and businesses alike, a testament to years of consistent quality and performance. This brand equity directly translates into pricing power and market penetration.

Furthermore, Middleby actively invests in research and development, leading to proprietary technologies, patents, and a robust intellectual property portfolio. This innovation pipeline is crucial for maintaining a competitive edge in its diverse markets.

Middleby operates an extensive network of manufacturing facilities across the globe. This vast physical infrastructure is a cornerstone of their business, allowing for efficient, large-scale production and the ability to tailor offerings to specific regional market demands. For instance, their operations span North America, Europe, and Asia, ensuring proximity to key customer bases and supply chains.

Crucial to their competitive edge are dedicated innovation centers like the Middleby Innovation Kitchens (MIK). With locations such as the prominent MIK in Dallas, Texas, and others strategically placed worldwide, these facilities are vital for pioneering new product development. They also serve as dynamic spaces for showcasing existing technologies, demonstrating their capabilities to potential clients, and fostering collaborative partnerships that drive future innovation.

Middleby's highly skilled workforce is a cornerstone of its success, encompassing engineers, designers, manufacturing specialists, sales professionals, and culinary experts. This diverse talent pool is crucial for developing and supporting its complex product lines.

The company actively cultivates top talent, especially within its Research and Development (R&D) divisions, to foster ongoing innovation. In 2023, Middleby continued to invest in its people, recognizing that specialized expertise is vital for creating cutting-edge equipment and delivering exceptional customer service.

Financial Capital and Liquidity

Middleby's financial capital and liquidity are foundational to its business model. A robust financial position, characterized by strong cash flow and ample borrowing power, enables the company to invest in critical areas like research and development and pursue strategic acquisitions.

This financial strength directly supports Middleby's operational capacity and growth initiatives. For instance, the company's ability to generate substantial free cash flow is a key enabler for reinvesting in the business and providing returns to shareholders.

As of the first quarter of 2025, Middleby demonstrated this financial health with:

- $745 million in cash reserves.

- Approximately $3.0 billion in available borrowing capacity.

Extensive Distribution and Service Network

Middleby's extensive distribution and service network is a cornerstone of its business model, ensuring products reach customers worldwide and receive robust support. This global infrastructure includes a vast array of distributors, dealers, and certified service technicians.

This network is vital for Middleby's ability to provide efficient product delivery and comprehensive after-sales service, catering to a broad and geographically diverse clientele. In 2023, Middleby reported a significant portion of its revenue was generated internationally, underscoring the importance of this global reach.

- Global Reach: A network spanning over 100 countries ensures product availability and service accessibility.

- Customer Support: Authorized service partners provide crucial after-sales support, enhancing customer satisfaction and product longevity.

- Market Penetration: The established network facilitates deep penetration into various market segments, from commercial kitchens to residential appliances.

- Operational Efficiency: This infrastructure streamlines logistics and support, contributing to Middleby's operational effectiveness.

Middleby's key resources are multifaceted, encompassing a vast brand portfolio, proprietary intellectual property, global manufacturing capabilities, dedicated innovation centers, a skilled workforce, substantial financial capital, and an extensive distribution and service network. These elements collectively enable Middleby to design, produce, market, and service a wide array of high-quality products across diverse sectors.

The company's intellectual property, including patents and proprietary technologies, is a critical resource that fuels innovation and provides a competitive advantage. This is complemented by their global manufacturing footprint, which ensures efficient production and market responsiveness. Furthermore, Middleby's financial strength, demonstrated by significant cash reserves and borrowing capacity as of Q1 2025, underpins its ability to invest in R&D and strategic growth.

| Resource Category | Key Components | Significance |

|---|---|---|

| Brand Portfolio | Over 120 brands (commercial, residential, food processing) | Market recognition, customer loyalty, pricing power |

| Intellectual Property | Proprietary technologies, patents | Competitive edge, innovation pipeline |

| Physical Infrastructure | Global manufacturing facilities | Efficient production, regional customization |

| Innovation Centers | Middleby Innovation Kitchens (MIK) | New product development, technology showcase |

| Human Capital | Skilled workforce (engineers, designers, sales, culinary experts) | Product development, customer support, innovation |

| Financial Capital | Cash reserves ($745M Q1 2025), borrowing capacity ($3.0B Q1 2025) | Investment in R&D, acquisitions, operational capacity |

| Distribution & Service Network | Distributors, dealers, certified service technicians (100+ countries) | Global reach, efficient delivery, after-sales support |

Value Propositions

Middleby's high-performance and innovative equipment is a cornerstone of its value proposition, offering customers advanced cooking, refrigeration, ventilation, and food processing solutions. These aren't just standard appliances; they are designed with cutting-edge technology to boost operational efficiency and profitability.

The inclusion of IoT-enabled features and automation in their 2024 product lines, for instance, allows businesses to remotely monitor and control equipment, optimize energy usage, and streamline workflows. This focus on smart technology directly addresses the growing demand for digitalization within the food service and processing industries.

Furthermore, Middleby prioritizes energy-efficient designs, a critical factor for businesses looking to reduce operating costs and meet sustainability goals. As of early 2024, many of their new models boast significantly improved energy consumption ratings compared to previous generations, directly translating into cost savings for their clientele.

Middleby offers comprehensive, end-to-end solutions, providing a full spectrum of equipment for commercial kitchens, food processing plants, and even residential settings. This integrated approach simplifies sourcing for customers, ensuring all their needs are met by one reliable partner.

This 'full-line' strategy is a significant value proposition, allowing clients to procure compatible, integrated systems seamlessly. For instance, in their food processing division, Middleby delivers complete solutions tailored for protein, bakery, and snack manufacturers, streamlining operations from start to finish.

Middleby's commitment to reliability and durability is a cornerstone of its value proposition. Their products are engineered to meet rigorous professional standards, featuring robust construction designed for the demanding conditions of commercial kitchens and industrial settings. This focus on quality translates directly into minimal operational downtime for their clients, a critical factor for businesses where every minute of lost productivity impacts revenue. For instance, in 2023, Middleby's Commercial Foodservice segment, a primary beneficiary of this durability, reported strong performance, underscoring the market's appreciation for dependable equipment.

The long-term reliability of Middleby equipment significantly lowers the total cost of ownership for customers. Businesses can depend on these machines to perform consistently over extended periods, reducing the need for frequent repairs or premature replacements. This inherent durability fosters strong customer trust and loyalty, as clients recognize the tangible financial benefits and operational stability that Middleby products provide. This reputation for quality is a key differentiator in a competitive market, reinforcing Middleby's market position.

Enhanced Efficiency and Cost Savings

Middleby's innovative equipment, such as ventless cooking solutions and automated systems, directly translates into significant operational advantages for its customers. These advancements are designed to tackle key cost centers in the food service and food manufacturing industries.

By reducing the need for extensive ventilation systems and streamlining cooking processes, Middleby's offerings help lower both initial installation expenses and ongoing utility bills. For example, the Blodgett INVOQ oven demonstrates a commitment to sustainability and cost reduction, achieving an impressive 70% reduction in water and energy consumption compared to traditional models.

- Reduced Labor: Automation and efficient design minimize the need for manual intervention, lowering labor costs.

- Lower Energy Bills: Energy-saving technologies directly decrease electricity and gas consumption.

- Minimized Food Waste: Precise cooking controls and improved food preservation capabilities reduce spoilage.

- Improved Profitability: These combined savings contribute to a stronger bottom line for businesses relying on Middleby equipment.

Premium Quality and Culinary Excellence (Residential)

For discerning homeowners, Middleby delivers premium residential kitchen appliances, exemplified by brands like Viking. These products are engineered for professional-grade performance, transforming home kitchens into culinary hubs.

- Superior Cooking and Refrigeration: Middleby's residential offerings provide exceptional cooking results and advanced refrigeration, meeting the demands of passionate home chefs.

- Aesthetic Appeal: Beyond functionality, these appliances enhance the visual design of high-end kitchens, blending performance with sophisticated style.

- Elevated Culinary Experience: The focus is on empowering users with tools that elevate their home cooking and entertaining experiences to a professional level.

Middleby's value proposition centers on providing high-performance, innovative, and reliable equipment that drives efficiency and profitability for its customers across commercial foodservice and food manufacturing. Their solutions are designed to reduce operational costs through energy efficiency and automation, while their commitment to durability ensures a lower total cost of ownership. For residential clients, they offer premium, professional-grade appliances that enhance the home culinary experience.

| Value Proposition Element | Key Benefit | Supporting Fact/Example (2024 Focus) |

|---|---|---|

| High-Performance & Innovative Equipment | Boosts operational efficiency and profitability | IoT-enabled features and automation in 2024 product lines for remote monitoring and workflow optimization. |

| Energy Efficiency | Reduces operating costs and supports sustainability goals | New models in early 2024 show significantly improved energy consumption ratings. |

| End-to-End Solutions | Simplifies sourcing and ensures integrated systems | Complete solutions for protein, bakery, and snack manufacturers in the food processing division. |

| Reliability & Durability | Minimizes operational downtime and lowers total cost of ownership | Strong performance in the Commercial Foodservice segment in 2023, reflecting market appreciation for dependable equipment. |

| Cost Reduction (Ventless/Automation) | Lowers installation and utility expenses | Blodgett INVOQ oven achieves a 70% reduction in water and energy consumption compared to traditional models. |

| Premium Residential Appliances | Elevates home culinary experience with professional-grade performance | Brands like Viking offer advanced cooking and refrigeration, enhancing kitchen aesthetics and functionality. |

Customer Relationships

Middleby cultivates direct connections with major commercial and industrial clients via specialized sales forces and account managers. This personalized approach ensures a deep understanding of individual customer requirements, nurturing enduring partnerships vital for substantial equipment transactions and ongoing revenue streams.

Middleby's commitment to customer relationships shines through its comprehensive customer support and technical service. This network is designed to help clients with everything from initial installation and routine maintenance to troubleshooting unexpected issues and sourcing necessary parts. In 2024, a strong service infrastructure is crucial, as demonstrated by industry reports indicating that over 70% of B2B customers expect a response to their support inquiries within 24 hours.

Ensuring operational continuity and minimizing equipment downtime are paramount for Middleby's customers. This focus on proactive and reactive technical service directly contributes to customer satisfaction and fosters long-term loyalty. For instance, companies with highly responsive technical support often see a significant increase in customer retention rates, sometimes by as much as 15% compared to those with less robust systems.

Middleby's Innovation Kitchens and Food Processing Innovation Centers are key to customer engagement. These spaces offer live demonstrations, hands-on product testing, and collaborative development, allowing clients to experience Middleby's advanced equipment directly. This approach builds stronger customer ties and highlights the company's technological edge.

In 2024, Middleby continued to leverage these centers to showcase their latest advancements in commercial cooking and food processing technology. For instance, their MIK facilities facilitate customized recipe development and operational efficiency testing, directly addressing customer pain points and demonstrating tangible value. This direct engagement is crucial for solidifying partnerships and driving sales by allowing clients to witness the performance and benefits of Middleby's solutions firsthand.

Training and Educational Programs

Middleby invests in its customers by offering comprehensive training and educational programs designed to maximize equipment performance and longevity. These programs cater to various user groups, including culinary teams, maintenance staff, and operational personnel.

By equipping customers with in-depth knowledge on optimal usage and maintenance, Middleby ensures they fully leverage the capabilities of their advanced kitchen solutions. This focus on customer empowerment translates to increased efficiency and better outcomes in commercial kitchens.

- Culinary Training: Programs focus on techniques and best practices for utilizing Middleby equipment to achieve superior food quality and consistency.

- Maintenance Workshops: Hands-on sessions teach essential maintenance procedures to minimize downtime and extend equipment lifespan.

- Operator Education: Training covers efficient operation, safety protocols, and troubleshooting for frontline staff.

- Digital Learning Resources: Middleby also provides online modules and documentation for flexible, on-demand learning.

Strategic Partnerships with Large Chains/Institutions

Middleby cultivates strategic, long-term partnerships with major commercial foodservice chains and institutions. These collaborations focus on deeply understanding unique operational challenges and co-developing tailored equipment solutions to meet specific needs.

While certain buying levels from these large chains experienced a slight moderation in Q1 2025, these foundational relationships continue to be a paramount strategic focus for Middleby. This commitment underscores the enduring value placed on these key accounts.

- Focus on Customized Solutions: Middleby works closely with large chains to engineer equipment that addresses their precise workflow and efficiency requirements.

- Long-Term Value Proposition: These partnerships are built on a foundation of ongoing support and innovation, ensuring continued relevance and performance.

- Strategic Importance Despite Market Fluctuations: Even with a reported muted buying activity from some large chains in Q1 2025, Middleby maintains these relationships as a core element of its customer strategy.

Middleby prioritizes strong customer relationships through dedicated sales teams and robust after-sales support, aiming for long-term partnerships. Their Innovation Kitchens and training programs further enhance engagement by allowing direct experience and skill development with their advanced equipment. In 2024, a significant portion of B2B customers expected swift support responses, highlighting the importance of Middleby's service infrastructure.

| Customer Relationship Strategy | Key Activities | Customer Benefits | 2024 Data/Observation |

| Direct Client Engagement | Specialized Sales Forces, Account Management | Personalized solutions, deep understanding of needs | Over 70% of B2B customers expect support response within 24 hours. |

| Comprehensive Support | Technical Service, Parts Sourcing, Installation Assistance | Minimized downtime, operational continuity, increased customer retention | Companies with responsive support can see up to 15% higher customer retention. |

| Innovation & Collaboration | Innovation Kitchens, Food Processing Centers, Product Demonstrations | Hands-on experience, co-development, showcasing technological edge | Facilitates customized recipe development and efficiency testing. |

| Customer Education | Training Programs (Culinary, Maintenance, Operator), Digital Resources | Maximized equipment performance, longevity, and efficient operation | Focus on empowering users for better kitchen outcomes. |

| Strategic Partnerships | Co-development with major chains, tailored equipment solutions | Addressing unique operational challenges, long-term value | Core strategic focus despite some Q1 2025 muted buying from large chains. |

Channels

Middleby utilizes its dedicated direct sales force to directly engage with substantial commercial, industrial, and institutional clients. This direct channel facilitates in-depth consultations, the creation of tailored solutions, and the negotiation of high-value contracts, ensuring a deep understanding of client needs.

Key account teams are specifically tasked with nurturing and managing relationships with Middleby's most significant customers. These major clients often include prominent restaurant chains and large-scale food manufacturers, underscoring the strategic importance of these dedicated teams in securing and growing business.

In 2023, Middleby's commercial foodservice equipment segment, a primary area for direct sales and key account engagement, saw robust performance, contributing significantly to the company's overall revenue. The company's focus on these high-impact relationships continues to be a cornerstone of its market strategy.

Middleby's extensive network of authorized distributors and dealers is a cornerstone of its go-to-market strategy, especially for reaching smaller commercial clients and residential customers globally. These partners are vital for providing localized sales expertise, installation services, and ongoing support, ensuring broad product accessibility across diverse markets.

In 2024, this channel remained critical, with Middleby's brands leveraging these relationships to penetrate new regions and strengthen existing market positions. The company reported that a significant portion of its commercial equipment sales were facilitated through this distributor network, highlighting its efficiency in reaching a wide customer base.

Middleby leverages company showrooms and innovation centers, like the Middleby Innovation Kitchens (MIK), as a crucial part of its business model. These spaces allow potential clients to directly interact with and experience Middleby's extensive product lines, fostering deeper understanding and trust. For instance, the MIK facilities are designed for hands-on demonstrations and expert consultations, showcasing the practical application and benefits of their commercial kitchen equipment.

Trade Shows and Industry Events

Middleby actively participates in key industry trade shows, such as NAFEM and the Bar & Restaurant Expo. These events serve as crucial channels for showcasing new product lines and technological advancements directly to a targeted audience of food service professionals and buyers.

These industry gatherings are vital for lead generation and nurturing customer relationships. For instance, NAFEM, a major exhibition for foodservice equipment, typically attracts thousands of attendees, providing Middleby with significant opportunities for direct engagement and sales pipeline development. In 2024, the Bar & Restaurant Expo in Las Vegas saw over 10,000 attendees, offering a prime venue for Middleby to demonstrate its solutions.

- Showcasing Innovation: Demonstrating new equipment and technologies to industry professionals.

- Lead Generation: Capturing contact information and interest from potential new customers.

- Client Relationship Building: Strengthening ties with existing clients and partners.

- Market Visibility: Enhancing brand recognition and positioning within the competitive landscape.

Online Presence and Digital Platforms

Middleby leverages its corporate website and numerous individual brand sites to showcase product details, specifications, and support. These digital platforms are vital for sharing information and generating leads, even if direct online sales of major equipment are less common.

The company's online presence acts as a primary touchpoint for customers seeking information and engaging with the Middleby brands. In 2023, Middleby's websites saw significant traffic, with over 5 million unique visitors across its brand portfolio, underscoring their importance in the customer journey.

- Corporate and Brand Websites: Central hubs for product information, specifications, and support resources.

- Lead Generation: Digital platforms are key for capturing customer interest and initiating sales conversations.

- Customer Engagement: Online channels facilitate communication and build relationships with existing and potential clients.

- Information Dissemination: Websites serve as the primary source for company news, product launches, and industry insights.

Middleby employs a multi-faceted channel strategy, blending direct engagement with extensive partner networks to reach a diverse customer base. This approach ensures both deep client relationships for large deals and broad market penetration for wider product adoption.

The company prioritizes direct sales and key account management for its most significant clients, ensuring tailored solutions and strong partnerships. Simultaneously, a robust distributor and dealer network extends Middleby's reach to smaller businesses and global markets, supported by digital platforms and physical showrooms for enhanced customer experience.

Trade shows and innovation centers serve as crucial touchpoints for showcasing new technologies and fostering direct engagement, driving lead generation and brand visibility. In 2024, Middleby continued to invest in these channels, recognizing their impact on sales and customer relationships.

| Channel | Target Audience | Key Function | 2023/2024 Impact |

|---|---|---|---|

| Direct Sales Force | Large Commercial/Industrial Clients | Tailored Solutions, High-Value Contracts | Robust performance in foodservice equipment segment. |

| Distributors & Dealers | Smaller Commercial, Residential Clients Globally | Localized Sales, Installation, Support | Critical for regional penetration and market share growth. |

| Showrooms & Innovation Centers | Potential Clients | Product Experience, Demonstrations, Consultations | Fostering understanding and trust in product capabilities. |

| Trade Shows (e.g., NAFEM, Bar & Restaurant Expo) | Food Service Professionals, Buyers | New Product Showcase, Lead Generation, Relationship Building | Significant engagement opportunities; Bar & Restaurant Expo had >10,000 attendees in 2024. |

| Corporate & Brand Websites | All Customer Segments | Information Dissemination, Lead Capture, Customer Engagement | Over 5 million unique visitors in 2023, vital for customer journey. |

Customer Segments

Commercial foodservice establishments, encompassing everything from bustling restaurants and hotels to catering services and large institutional kitchens worldwide, represent Middleby's most significant customer base. These businesses are actively looking for cooking, refrigeration, and ventilation equipment that is not only efficient and dependable but also incorporates innovative features to streamline their daily operations.

In 2024, this vital segment was a powerhouse for Middleby, bringing in $2.4 billion in revenue. This figure highlights its crucial role, making up a substantial 62% of the company's overall earnings and underscoring the deep reliance of the foodservice industry on Middleby's solutions.

Industrial Food Processing Facilities are a key customer segment for Middleby, encompassing major food manufacturers, large bakeries, and protein processors. These clients demand specialized, high-volume equipment for critical production stages like cooking, baking, frying, slicing, and packaging.

Middleby's dedicated Food Processing business unit provides these industrial clients with comprehensive, end-to-end solutions tailored to their specific needs. This segment is crucial to Middleby's strategy, with plans for a spin-off highlighting its significant value and focus.

Middleby caters to a discerning clientele of affluent homeowners and passionate cooks who seek professional-level kitchen equipment for their homes. This group prioritizes luxury branding, exceptional performance, and elegant aesthetics in their appliances.

In 2024, the Residential Kitchen segment, which includes these high-end consumers, achieved a substantial revenue of $725 million, underscoring the significant market demand for premium residential kitchen solutions.

Chain Restaurants and Franchises

Chain restaurants and franchises are a significant customer segment for Middleby, demanding reliable, standardized equipment for consistent operations across numerous outlets. These businesses often leverage bulk purchasing power and require comprehensive service and maintenance contracts to ensure uptime and operational efficiency. Middleby's ability to deliver uniform quality and support is paramount for these clients.

For example, in 2023, the US quick-service restaurant (QSR) market, a major sector for chain restaurants, generated over $300 billion in sales. Middleby's portfolio, including brands like Blodgett and Viking, caters to the high-volume, durability needs of these establishments, offering solutions that can be deployed uniformly across hundreds or even thousands of locations.

- Standardized Solutions: Franchisees require equipment that meets brand specifications, ensuring consistency in food preparation and presentation across all units.

- Bulk Purchasing Power: Large chains negotiate favorable terms for volume orders, benefiting from Middleby's scale and manufacturing capabilities.

- Service and Support Network: Reliable after-sales service and maintenance are critical for minimizing downtime in multi-unit operations, a key Middleby offering.

- Efficiency and Throughput: Equipment must be designed for speed and high-volume output to meet the demands of busy chain restaurant environments.

Specialty Food Producers (e.g., Snack, Beverage)

Middleby actively serves specialty food producers, including those in the dynamic snack and beverage sectors. This strategic expansion allows them to cater to growing markets with specialized equipment requirements, drawing upon their established expertise in food processing and commercial solutions.

- Snack Food Producers: Require specialized processing equipment for items like baked goods, extruded snacks, and confectionery.

- Beverage Producers: Need advanced solutions for carbonation, filling, packaging, and pasteurization, from craft breweries to large-scale soft drink manufacturers.

- Market Growth: The global snack food market is projected to reach over $200 billion by 2027, indicating significant demand for efficient production technologies.

- Revenue Impact: Middleby's strategic focus on the ice and beverage category contributed $750 million in revenue in 2024, underscoring the financial significance of this customer segment.

Middleby's customer base is diverse, primarily serving commercial foodservice establishments globally, which accounted for $2.4 billion in revenue in 2024, representing 62% of total earnings. This segment includes restaurants, hotels, and institutional kitchens seeking efficient and innovative equipment.

Another key group is industrial food processing facilities, requiring specialized high-volume equipment for cooking, baking, and packaging. Middleby also targets affluent homeowners with professional-grade residential kitchen appliances, generating $725 million in 2024.

Chain restaurants and franchises rely on Middleby for standardized, durable equipment and robust service networks. Additionally, specialty food producers in the snack and beverage sectors are a growing focus, with the beverage category contributing $750 million in 2024 revenue.

| Customer Segment | 2024 Revenue Contribution | Key Needs/Characteristics |

|---|---|---|

| Commercial Foodservice | $2.4 billion (62%) | Efficiency, dependability, innovation, streamlined operations |

| Industrial Food Processing | N/A (Spin-off focus) | High-volume, specialized processing equipment |

| Residential Kitchen | $725 million | Luxury branding, exceptional performance, elegant aesthetics |

| Chain Restaurants/Franchises | Integral to Commercial Foodservice | Standardization, bulk purchasing, service network, efficiency |

| Specialty Food Producers (Snack & Beverage) | Beverage category: $750 million | Specialized processing, advanced solutions for production |

Cost Structure

Middleby's manufacturing and production costs are substantial, encompassing raw materials, components, labor, and overhead across its worldwide facilities. For instance, in 2023, the company reported cost of sales of $3.6 billion, reflecting these significant production expenditures. Fluctuations in commodity prices and labor rates directly impact these figures.

The company actively manages these costs, aiming to mitigate impacts like tariffs through operational efficiencies and strategic pricing adjustments. This proactive approach is crucial for maintaining profitability in a dynamic global manufacturing environment.

Middleby's commitment to innovation is reflected in its significant Research and Development (R&D) expenses. This ongoing investment fuels the creation of new cooking technologies and enhancements to their existing product lines, ensuring they remain at the forefront of the commercial kitchen equipment industry.

These costs encompass salaries for a dedicated team of engineers and scientists, the operational expenses of innovation centers, and the significant outlay for prototyping and testing new designs. For instance, in 2023, Middleby reported R&D expenses of $125.7 million, a testament to their focus on future product development and technological advancements.

This strategic allocation of resources to R&D is not merely an expense but a critical driver for Middleby's competitive advantage and long-term growth trajectory. It allows them to anticipate market needs and deliver cutting-edge solutions to their global customer base.

Middleby's cost structure is heavily influenced by its Sales, Marketing, and Distribution Expenses. These include the salaries and commissions paid to its global sales force, which are crucial for reaching a wide array of customer segments. For example, in 2023, Middleby's selling, general, and administrative expenses, which encompass these costs, were $920.7 million, reflecting the investment in its sales infrastructure.

Significant outlays are also allocated to marketing campaigns designed to promote its diverse brand portfolio across various channels. Furthermore, participation in key industry trade shows and the ongoing management of a complex global distribution network represent substantial operational costs. These investments are vital for maintaining brand visibility and ensuring efficient product delivery worldwide.

Acquisition and Integration Costs

Middleby's growth strategy heavily relies on acquisitions, which naturally brings about significant costs. These include the expenses tied to thoroughly investigating potential targets, covering legal processes, and the complex task of merging acquired companies into Middleby's existing operations. There's also the possibility of goodwill impairment, which can arise if an acquired company doesn't perform as expected post-acquisition.

While these acquisitions are crucial for expanding revenue streams, they demand substantial financial resources both at the outset and over time. For instance, Middleby committed $224.6 million to acquisitions between the start of 2023 and the middle of 2024, highlighting the scale of these investments.

- Due Diligence and Legal Fees: Costs incurred to vet acquisition targets and handle legal documentation.

- Integration Expenses: Costs associated with merging systems, operations, and cultures of acquired businesses.

- Goodwill Impairment Risk: Potential write-downs if acquired assets do not perform to valuation expectations.

- Capital Outlay for Acquisitions: Direct purchase prices for acquired companies, totaling $224.6 million from early 2023 to mid-2024.

General, Administrative, and Corporate Overhead

General, Administrative, and Corporate Overhead encompasses the essential costs of running Middleby’s corporate operations. This includes everything from executive and administrative staff salaries to vital functions like IT, finance, and legal departments. These are the shared services that support the entire organization.

Furthermore, these costs also cover crucial activities such as ensuring compliance with industry regulations, managing necessary regulatory filings, and maintaining effective investor relations. These functions are critical for the company's long-term stability and communication with stakeholders.

For fiscal year 2024, Middleby reported a positive trend in its operational expenses. The combined selling, general, and administrative expenses saw a reduction, totaling $762.5 million. This indicates improved efficiency in managing these overhead costs.

Key components of this cost structure include:

- Executive and Administrative Salaries: Compensation for leadership and support staff.

- Shared Corporate Services: Costs for IT, finance, legal, and human resources.

- Compliance and Regulatory Costs: Expenses for adhering to laws and filing requirements.

- Investor Relations: Costs associated with communicating with shareholders and the market.

Middleby's cost structure is built upon significant manufacturing expenditures, R&D investments, sales and marketing efforts, acquisition-related expenses, and corporate overhead. These elements collectively shape the company's financial foundation and operational efficiency. For instance, in 2023, cost of sales was $3.6 billion, R&D was $125.7 million, and SG&A was $920.7 million, demonstrating the scale of these commitments.

| Cost Category | 2023 Expense (Millions USD) | Key Components |

|---|---|---|

| Cost of Sales | 3,600 | Raw materials, labor, manufacturing overhead |

| Research & Development | 125.7 | Engineering salaries, innovation centers, prototyping |

| Selling, General & Administrative (SG&A) | 920.7 | Sales force, marketing campaigns, distribution management |

| Acquisitions | 224.6 (Early 2023 - Mid 2024) | Due diligence, legal fees, integration, capital outlay |

Revenue Streams

Commercial Foodservice Equipment Sales represent Middleby's primary revenue engine, bringing in $2.4 billion in 2024. This income stems from selling a broad spectrum of cooking, refrigeration, and ventilation gear to various clients like restaurants, hotels, and institutional kitchens.

The demand for this equipment is closely tied to the industry's growth, fueled by new establishments opening, existing ones undergoing renovations, and the continuous need for technology upgrades to enhance efficiency and meet evolving culinary demands.

Revenue is generated from selling specialized equipment to industrial food processors, focusing on protein, bakery, and snack production. This segment is slated for a spin-off into its own company. In 2024, this revenue stream brought in $731 million.

This revenue stream is bolstered by the growing need for automation and enhanced efficiency in large-scale food manufacturing operations.

Middleby generates income by selling premium kitchen appliances like ranges, ovens, and refrigerators directly to homeowners. This segment is a significant contributor to their overall business.

In 2024, the Residential Kitchen segment brought in $725 million in revenue. Despite current economic headwinds, Middleby anticipates continued expansion in this market over the long term.

Parts and Aftermarket Sales

Middleby generates revenue through the sale of replacement parts and consumables, supporting its extensive installed equipment base. This stream is crucial for maintaining equipment performance and customer satisfaction, often yielding high-margin, recurring income.

- Parts and Aftermarket Sales: This segment includes revenue from selling spare parts, filters, and other consumables necessary for the ongoing operation of Middleby's commercial kitchen and food processing equipment.

- Service Contracts and Maintenance: Revenue is also derived from service contracts and maintenance agreements, ensuring equipment reliability and providing customers with ongoing support.

- Customer Support: These sales are intrinsically linked to providing essential support to customers, enhancing the longevity and operational efficiency of their Middleby investments.

- Recurring Revenue: This revenue stream offers a predictable and often profitable income source, contributing significantly to Middleby's overall financial stability.

Service and Installation Fees

Middleby generates revenue through service and installation fees, covering the setup, ongoing maintenance, and repair of its commercial kitchen equipment. These fees are crucial for ensuring equipment longevity and customer satisfaction.

This revenue stream reinforces Middleby's value proposition by providing a complete solution, from initial purchase to operational support. For instance, in 2023, Middleby's service and parts segment demonstrated robust performance, contributing significantly to overall profitability.

- Equipment Installation: Fees for professional setup and integration of new appliances.

- Maintenance Contracts: Recurring revenue from scheduled servicing to prevent breakdowns.

- Repair Services: Charges for diagnosing and fixing equipment issues, ensuring uptime.

- Parts Sales: Revenue from selling replacement components for ongoing repairs.

Middleby's revenue streams are diversified, encompassing equipment sales, parts, and aftermarket services. The company generated substantial income from selling a wide array of commercial foodservice equipment, with sales reaching $2.4 billion in 2024. Additionally, the industrial food processing equipment segment contributed $731 million in 2024, highlighting a focus on automation in large-scale food manufacturing.

| Revenue Stream | 2024 Revenue (in billions) | Key Drivers |

|---|---|---|

| Commercial Foodservice Equipment Sales | $2.4 | New establishments, renovations, technology upgrades |

| Industrial Food Processing Equipment Sales | $0.731 | Automation and efficiency in food manufacturing |

| Residential Kitchen Appliances | $0.725 | Homeowner demand for premium appliances |

| Parts and Aftermarket Services | (Not specified separately, but significant contributor) | Equipment maintenance, consumables, service contracts |

Business Model Canvas Data Sources

The Middleby Business Model Canvas is built using a combination of internal financial data, extensive market research reports, and strategic insights derived from industry analysis. These diverse data sources ensure each block of the canvas is populated with accurate and relevant information to reflect Middleby's current and future strategic direction.