Middleby PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Middleby Bundle

Navigate the complex external forces shaping Middleby's trajectory with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and technological advancements are impacting the foodservice equipment giant. Equip yourself with actionable intelligence to anticipate challenges and capitalize on emerging opportunities. Download the full PESTLE analysis now and gain a critical competitive advantage.

Political factors

Global trade policies significantly influence Middleby Corporation's extensive international operations. For instance, the imposition of tariffs, such as those seen in US-China trade disputes, can directly increase the cost of imported components for Middleby's manufacturing facilities or raise prices for its exported equipment. In 2023, the World Trade Organization reported that global trade growth slowed considerably, highlighting the sensitivity of companies like Middleby to these shifts.

Middleby, a significant player in commercial foodservice and food processing equipment, navigates a complex landscape of global food safety and health regulations. These rules, which differ across nations and territories, set specific requirements for equipment design, the materials used, and how they operate. For instance, the U.S. Food and Drug Administration (FDA) and European Union directives continuously update standards, impacting everything from sanitation protocols to energy efficiency.

Staying compliant is crucial for Middleby to avoid costly penalties, prevent product recalls, and maintain its strong brand reputation. This necessitates ongoing investment in research and development to adapt its product lines to emerging standards. In 2024, the global food safety market was valued at approximately $18.5 billion and is projected to grow, underscoring the increasing importance and complexity of these regulatory environments for manufacturers like Middleby.

Government spending significantly impacts Middleby's performance. For instance, in the United States, the Infrastructure Investment and Jobs Act, enacted in late 2021, allocated substantial funds towards infrastructure improvements, which can indirectly benefit sectors Middleby serves, such as food service in transportation hubs. Furthermore, government initiatives aimed at boosting the hospitality sector, like grants or tax incentives for businesses recovering from economic downturns, directly translate into increased demand for commercial kitchen equipment.

Economic stimulus measures, particularly those focused on public sector investments, play a crucial role. In 2024, many governments globally are continuing to invest in public health infrastructure and educational facilities. These investments often involve upgrades or new builds of kitchens and food service areas within hospitals, schools, and universities, creating direct sales opportunities for Middleby's product lines. Conversely, fiscal austerity measures or significant reductions in public project funding can dampen demand, as seen in periods of government budget tightening that slow down capital expenditure by public institutions.

Geopolitical Stability in Key Markets

The political stability of countries where Middleby operates or sources materials is a critical factor, impacting everything from raw material availability to consumer spending. For instance, ongoing geopolitical tensions in Eastern Europe, which began in early 2022, have continued to influence global energy prices and supply chain logistics throughout 2024 and into early 2025, potentially affecting Middleby's operational costs and the economic health of its key markets.

Unrest, conflicts, or significant political shifts can disrupt supply chains, impact manufacturing operations, and reduce market demand due to economic uncertainty. The ongoing trade disputes and tariff changes between major economic blocs, observed in 2024, highlight the vulnerability of global manufacturing to political decisions, directly affecting companies like Middleby that rely on international sourcing and sales.

Middleby's strategy to mitigate these risks involves diversifying its manufacturing locations and customer bases. As of their latest reports, Middleby has a significant presence across North America, Europe, and Asia, a geographical spread that helps buffer against localized political instability. This diversification is crucial as political events, such as upcoming elections in major economies in late 2024 and early 2025, could lead to unforeseen policy changes impacting international trade and investment.

- Geopolitical Risk Impact: Political instability can lead to supply chain disruptions and reduced market demand, as seen with the ongoing effects of regional conflicts on global trade in 2024.

- Operational Vulnerability: Regions experiencing unrest or significant political shifts pose direct risks to manufacturing continuity and profitability for companies with concentrated operations.

- Diversification Strategy: Middleby's global manufacturing footprint and diverse customer base are key to managing risks associated with regional political volatility, a strategy reinforced by economic uncertainty in 2024-2025.

- Trade Policy Sensitivity: Changes in trade policies and tariffs, often driven by political factors, can significantly impact the cost of goods and market access for international businesses.

Taxation Policies and Incentives

Changes in corporate tax rates, import/export duties, and the availability of manufacturing incentives across different countries directly impact Middleby's bottom line. For instance, a reduction in corporate tax rates, like the decrease in the U.S. federal corporate tax rate from 35% to 21% in 2018, can boost net income, while increased tariffs on imported components could raise production costs.

Favorable tax policies can act as a significant catalyst for Middleby's investment and expansion plans. For example, many countries offer tax credits or deductions for research and development, which could encourage Middleby to invest more in innovation. Conversely, a higher overall tax burden can diminish profitability, necessitating careful financial planning.

Middleby must continuously monitor and adapt to the evolving global tax landscape to optimize its operational structure and strategic investment decisions. This includes evaluating the financial implications of differing tax regimes when considering acquisitions or establishing new manufacturing facilities.

Key considerations for Middleby include:

- Impact of U.S. Corporate Tax Rate: The Tax Cuts and Jobs Act of 2017, which lowered the U.S. corporate tax rate, provided a benefit to U.S.-based multinational corporations like Middleby.

- Global Tax Reforms: Ongoing international efforts, such as those by the OECD on base erosion and profit shifting (BEPS), could lead to changes in how multinational companies are taxed, affecting Middleby's effective tax rate.

- Manufacturing Incentives: The availability of investment tax credits or accelerated depreciation allowances in regions where Middleby operates or plans to expand can influence site selection and capital expenditure decisions.

- Trade Duties: Fluctuations in import duties on raw materials or finished goods, such as those seen in trade disputes between major economies, can directly affect the cost of goods sold and pricing strategies.

Government stability and policy continuity are paramount for Middleby's long-term planning and investment. Political shifts can introduce uncertainty, impacting regulatory environments and economic conditions. For instance, the 2024 election cycles in several major economies could lead to significant policy changes affecting international trade and investment, influencing Middleby's global strategy.

Government support, such as infrastructure spending or incentives for specific industries, can directly boost demand for Middleby's products. In 2024, many nations continue to invest in public sector upgrades, including food service facilities in schools and hospitals, creating direct sales opportunities. Conversely, fiscal austerity measures can curtail such spending, dampening market growth.

Trade policies and geopolitical stability remain critical. Ongoing trade disputes and tariff adjustments, as observed through 2024, directly affect Middleby's international operations by altering costs and market access. The company's diversified manufacturing base helps mitigate risks from localized political instability, a strategy that remains vital given the dynamic global political landscape.

What is included in the product

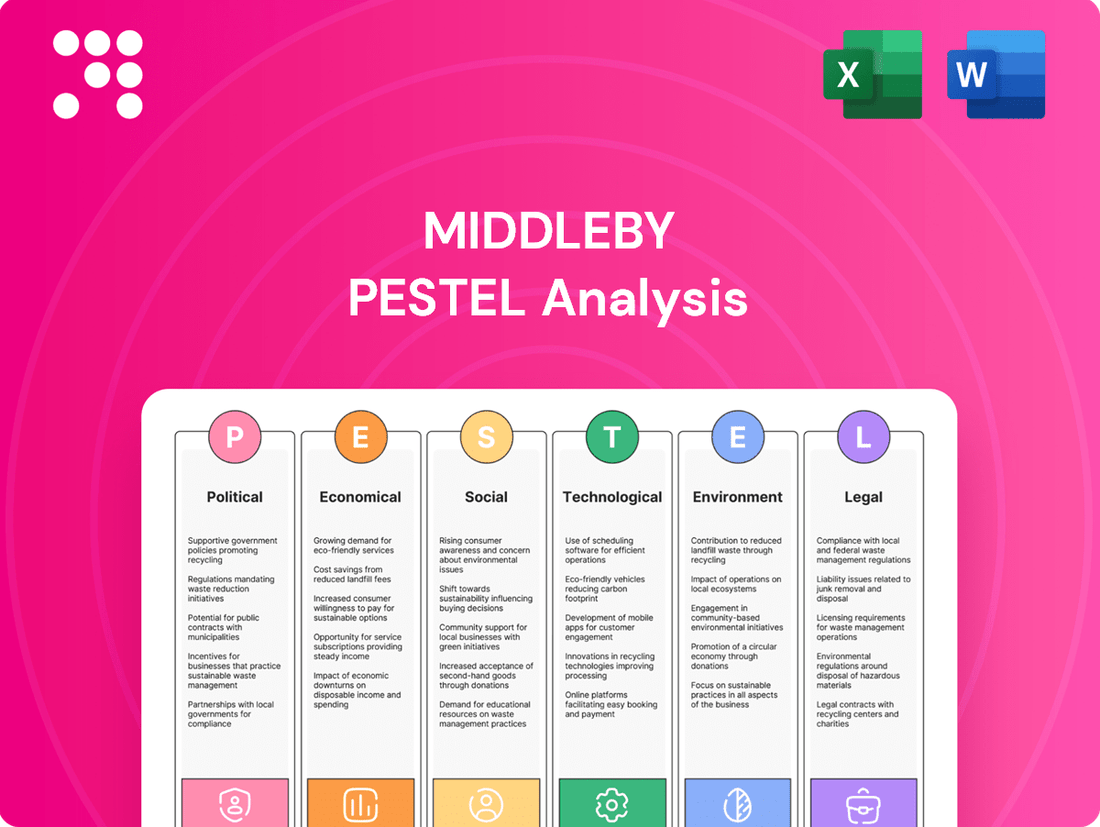

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Middleby, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

A clear and actionable PESTLE analysis for Middleby, transforming complex external factors into manageable insights that guide strategic decision-making and mitigate potential risks.

Economic factors

Middleby's fortunes are directly linked to the health of the global economy. When economies are strong, restaurants and institutions tend to invest more in new equipment, and consumers feel more confident spending on dining out and home upgrades, which benefits Middleby's commercial and residential product lines. For instance, global GDP growth was projected to be around 2.7% in 2024, a modest but positive figure that supports continued business investment.

Consumer spending is a key driver for Middleby. Higher disposable incomes and a positive economic outlook encourage people to dine out more frequently and undertake home improvement projects, both of which increase demand for Middleby's ovens, refrigeration, and other kitchen and home appliances. In 2024, consumer confidence surveys indicated a gradual improvement in many developed markets, suggesting a supportive environment for discretionary spending.

Conversely, economic slowdowns or recessions pose a significant challenge. During such periods, businesses cut back on capital expenditures, and consumers reduce their discretionary spending, leading to softer demand for Middleby's products. A slowdown in global growth, perhaps to 2.0% or lower, could lead to delayed purchasing decisions and impact Middleby's sales performance.

Rising inflation significantly impacts Middleby's expenses, especially for key materials like steel and copper. For instance, the Producer Price Index for manufactured goods saw substantial increases throughout 2024, directly affecting Middleby's cost of goods sold.

These higher input costs can squeeze profit margins if not passed on through pricing strategies or offset by efficiency gains. Middleby's ability to manage its supply chain and explore hedging options for commodities will be crucial in navigating these inflationary pressures and protecting profitability.

Interest rate fluctuations directly impact Middleby's cost of borrowing for crucial activities like expanding operations, making acquisitions, and managing working capital. For instance, if the Federal Reserve maintains its target range for the federal funds rate at 5.25%-5.50% as seen in early 2024, Middleby's borrowing expenses will reflect these prevailing rates.

Higher interest rates can also dampen demand from Middleby's commercial customers. When financing new equipment or facility upgrades becomes more expensive for restaurants and food service businesses, their purchasing decisions may be delayed, potentially lengthening sales cycles for Middleby's products.

The company's financial health and growth trajectory are significantly influenced by its capacity to secure capital on favorable terms. In 2023, Middleby maintained a solid balance sheet, and its ability to access capital at competitive rates remains paramount for executing its strategic growth initiatives and ensuring overall financial resilience.

Supply Chain Disruptions and Logistics Costs

Global supply chain vulnerabilities, such as port congestion and labor shortages, continue to impact industries like foodservice equipment manufacturing. For Middleby, these disruptions can translate into production delays and higher logistics costs. For instance, in early 2024, shipping costs from Asia to the US remained elevated compared to pre-pandemic levels due to ongoing capacity constraints and increased demand.

Efficiently managing its intricate global supply chain is paramount for Middleby to ensure on-time product delivery and manage transportation expenses. Strategies to bolster resilience are crucial.

- Supplier Diversification: Reducing reliance on single-source suppliers mitigates risk.

- Inventory Optimization: Balancing stock levels prevents both stockouts and excessive holding costs.

- Logistics Network Review: Continuously assessing and adapting transportation routes and methods is key.

- Geopolitical Risk Assessment: Monitoring global events that could impact trade routes and material availability.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant economic factor for Middleby, a global enterprise operating across numerous countries. For instance, in the first quarter of 2024, the U.S. dollar experienced a strengthening trend against several major currencies, potentially impacting the international competitiveness of Middleby's offerings. Conversely, a weaker dollar in late 2023 had previously increased the cost of sourcing components from overseas markets.

Middleby actively manages these risks through various financial strategies. As of their 2023 annual report, the company utilized forward contracts and currency options to hedge a portion of its foreign currency exposures, aiming to mitigate volatility in its reported earnings and operational costs. This proactive approach is crucial for maintaining predictable financial performance amidst global economic shifts.

- Global Operations Exposure: Middleby's sales and purchases occur in multiple currencies, directly exposing it to exchange rate volatility.

- Impact on Pricing and Costs: A strong USD can make Middleby's products more expensive for international buyers, while a weak USD raises the cost of imported raw materials and components.

- Hedging Strategies: The company employs financial instruments like forward contracts and options to manage foreign exchange risk and stabilize international revenues and expenses.

- 2023 Performance Context: While specific hedging figures for 2024 are still emerging, Middleby's 2023 financial statements indicated ongoing efforts to manage currency impacts on its global business.

Economic factors significantly shape Middleby's operating environment, influencing both demand for its products and the cost of doing business. Global economic growth, consumer spending habits, inflation, interest rates, and currency fluctuations all play a critical role in the company's performance.

For instance, the projected 2.7% global GDP growth for 2024 offers a baseline of economic support, while improvements in consumer confidence in developed markets in early 2024 suggest a favorable climate for discretionary spending on dining and home improvements. However, rising inflation, as evidenced by increases in the Producer Price Index for manufactured goods throughout 2024, directly impacts Middleby's material costs, necessitating careful management of pricing and operational efficiencies.

Interest rate levels, such as the Federal Reserve's target range of 5.25%-5.50% in early 2024, affect Middleby's borrowing costs and can influence its commercial customers' investment decisions. Furthermore, currency exchange rate volatility, with the U.S. dollar strengthening in Q1 2024, requires ongoing hedging strategies to mitigate impacts on international sales and procurement costs.

| Economic Factor | 2024/2025 Data/Projection | Impact on Middleby |

|---|---|---|

| Global GDP Growth | Projected 2.7% for 2024 | Supports business investment and demand for commercial equipment. |

| Consumer Confidence | Gradual improvement in developed markets (early 2024) | Boosts discretionary spending on dining out and home appliances. |

| Inflation (PPI for Manufactured Goods) | Substantial increases throughout 2024 | Raises input costs for raw materials, potentially squeezing margins. |

| Federal Funds Rate | Target range 5.25%-5.50% (early 2024) | Influences borrowing costs and can dampen customer investment in new equipment. |

| USD Exchange Rate | Strengthening trend in Q1 2024 | Impacts international competitiveness and cost of imported components. |

What You See Is What You Get

Middleby PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Middleby PESTLE Analysis provides a comprehensive overview of the external factors impacting the company, covering Political, Economic, Social, Technological, Legal, and Environmental influences. You'll gain valuable insights into the strategic landscape in which Middleby operates.

Sociological factors

Consumers are increasingly seeking out plant-based and healthier food options, a trend that significantly impacts the foodservice industry. This shift necessitates commercial kitchens to adopt new equipment for preparing these specialized diets. For instance, the global plant-based food market was valued at approximately $29.7 billion in 2023 and is projected to reach $162 billion by 2030, highlighting a substantial demand for innovative cooking solutions.

Middleby Corporation must continue to innovate its product portfolio to cater to these evolving dietary preferences. This includes developing advanced ovens, fryers, and preparation tools that can efficiently handle ingredients for plant-based meals and other health-conscious offerings. By staying ahead of these culinary trends, Middleby ensures its equipment remains indispensable for restaurants and food manufacturers adapting to changing consumer tastes.

Persistent labor shortages continue to plague the hospitality industry, a trend that significantly boosts the demand for automated and labor-saving equipment. As of early 2024, many U.S. restaurants reported struggling to fill open positions, with some operating at reduced hours due to insufficient staff. This environment makes Middleby's offerings, particularly those that reduce reliance on manual labor and enhance operational efficiency, increasingly attractive to commercial customers seeking to mitigate these staffing challenges.

The post-pandemic world has significantly amplified consumer and business expectations around health, safety, and hygiene, particularly in food service. This translates into a strong demand for equipment that actively supports these concerns. For instance, a 2024 survey indicated that over 70% of restaurant patrons consider sanitation protocols a primary factor when choosing where to dine.

Middleby can capitalize on this trend by integrating features such as touchless controls, advanced self-sanitizing mechanisms, and enhanced air filtration into its diverse product lines. This focus on hygiene not only meets current regulatory pressures but also directly addresses evolving customer preferences, potentially boosting market share and brand loyalty in a competitive landscape.

Urbanization and Restaurant Density

Urbanization continues to be a significant driver, concentrating populations and, consequently, restaurants in city centers. This heightened density fuels demand for commercial kitchen equipment as new eateries, ghost kitchens, and institutional food services emerge to cater to these growing urban populations. For instance, by 2023, over 57% of the global population resided in urban areas, a figure projected to reach 60% by 2030, underscoring the expanding market for foodservice infrastructure.

Middleby can capitalize on this trend by focusing its product development and marketing efforts on urban markets. The company's portfolio, which includes space-saving and energy-efficient equipment, is particularly well-suited for the often-constrained environments of city-based kitchens.

- Growing Urban Demand: As urbanization accelerates, so does the need for commercial kitchen equipment in densely populated urban centers.

- Ghost Kitchens and Efficiency: The rise of ghost kitchens, often located in urban hubs, creates a specific demand for efficient, high-throughput equipment.

- Middleby's Strategic Advantage: Middleby's range of space-efficient and high-performance solutions aligns perfectly with the needs of these expanding urban foodservice markets.

Demand for Sustainable and Energy-Efficient Lifestyles

Consumers and businesses are increasingly prioritizing sustainability and energy efficiency, directly impacting demand for appliances. For instance, the U.S. Environmental Protection Agency reported that Energy Star certified products are widely sought after, with sales reaching over $65 billion in 2023, highlighting a significant market shift towards eco-conscious purchasing. This trend is evident in both residential and commercial sectors, where utility cost savings and reduced environmental footprints are key drivers.

Middleby's focus on developing innovative, eco-friendly solutions, such as advanced refrigeration systems and energy-saving cooking equipment, directly addresses this growing societal demand. The company's commitment to reducing energy consumption in its product lines, like the continued development of their high-efficiency commercial ovens, positions them favorably within this evolving market landscape. This strategic alignment with consumer values is crucial for long-term growth and market relevance.

- Growing Consumer Preference: Consumers are actively seeking Energy Star certified appliances, with sales of these products exceeding $65 billion in the US in 2023.

- Commercial Operator Focus: Businesses are prioritizing kitchen equipment that lowers operational utility costs and minimizes their environmental impact.

- Middleby's Strategic Alignment: The company's investment in developing energy-efficient cooking and refrigeration technologies directly caters to these societal demands.

- Market Trend: The demand for sustainable lifestyles is a significant sociological factor influencing purchasing decisions across both residential and commercial markets.

Sociological factors highlight shifting consumer preferences and workforce dynamics that directly influence the foodservice equipment market. The increasing demand for healthier, plant-based meals, coupled with persistent labor shortages in the hospitality sector, necessitates innovative and efficient kitchen solutions. Furthermore, heightened consumer and business expectations around hygiene and sustainability are reshaping product development priorities.

Middleby Corporation is well-positioned to address these sociological shifts. By innovating equipment that supports specialized diets, reduces labor dependency, and enhances hygiene and energy efficiency, the company can effectively meet evolving market demands. For example, the plant-based food market's projected growth to $162 billion by 2030 underscores the need for adaptable culinary technology.

The emphasis on health and safety, with over 70% of patrons considering sanitation crucial, drives demand for advanced features like touchless controls. Similarly, the growing preference for Energy Star certified appliances, with sales exceeding $65 billion in 2023, demonstrates a clear market trend towards sustainability that Middleby's eco-friendly solutions can leverage.

| Sociological Factor | Impact on Foodservice | Middleby's Opportunity |

| Healthier Eating Trends | Increased demand for plant-based and specialized diet preparation equipment. | Develop advanced ovens and preparation tools for diverse dietary needs. |

| Labor Shortages | Growing need for automated and labor-saving kitchen equipment. | Offer high-efficiency, automated solutions to reduce reliance on manual labor. |

| Hygiene and Safety Concerns | Heightened demand for equipment with enhanced sanitation features. | Integrate touchless controls and self-sanitizing mechanisms. |

| Sustainability Focus | Preference for energy-efficient and eco-friendly appliances. | Invest in developing energy-saving refrigeration and cooking technologies. |

Technological factors

The foodservice industry is seeing a surge in automation and robotics, a trend that directly benefits Middleby. Think about robotic arms prepping ingredients or automated fryers ensuring perfect results every time. This technology is key to tackling labor shortages and boosting operational consistency.

Middleby is well-positioned to capitalize on this by developing equipment with advanced robotic features and AI-powered cooking. For example, their acquisition of H.M.M. (Hygienic Manufacturing Machines) in late 2023 signaled a commitment to enhancing automated solutions. This focus on innovation is vital for staying ahead in a rapidly changing market.

Investment in research and development for these cutting-edge technologies is paramount. Middleby's ongoing commitment to R&D, evidenced by their consistent capital allocation towards innovation, ensures they can meet the evolving demands of commercial kitchens and food processing. This proactive approach is essential for maintaining their competitive edge.

The integration of the Internet of Things (IoT) into kitchen equipment is transforming how commercial and residential kitchens operate. For Middleby, this means appliances can be remotely monitored, allowing for predictive maintenance to minimize costly downtime. For instance, in 2024, the global IoT in Foodservice market was valued at approximately $10.5 billion, with projections indicating significant growth.

Middleby can capitalize on this trend by offering smart appliances that provide valuable data analytics to commercial operators, helping them optimize energy consumption and operational efficiency. This connectivity also opens doors for new service models, such as subscription-based maintenance or performance-based contracts, enhancing customer experience and loyalty. By 2025, it's estimated that over 75% of new commercial kitchen equipment will feature some level of connectivity.

Technological progress in energy efficiency is a cornerstone for Middleby's product innovation, spurred by increasingly stringent environmental regulations and a growing customer desire to cut operational expenses. For instance, advancements in areas like improved insulation materials and more efficient heating elements directly translate to lower energy bills for users of commercial kitchen equipment.

Innovations in refrigeration systems and ventilation technology are also key, allowing Middleby to develop products that consume less power without sacrificing performance. This focus on efficiency not only benefits end-users but also aligns with broader sustainability mandates, a trend that is expected to accelerate through 2025.

By offering products that demonstrably reduce energy consumption, Middleby empowers its customers to meet their own sustainability targets and navigate a landscape of evolving environmental compliance. This commitment to efficiency is a significant competitive advantage in the current market.

Digitalization of Sales and Service

Middleby is increasingly leveraging digital platforms to connect with customers for sales, support, and post-purchase services. This shift means that how they engage with clients is fundamentally changing, moving towards online interactions. For example, in 2023, the global e-commerce market for industrial equipment saw significant growth, with many B2B sectors reporting double-digit percentage increases in online sales channels, a trend expected to continue through 2025.

By adopting advanced e-commerce solutions, Middleby can expand its market reach and streamline operations. Implementing virtual product demonstrations, for instance, allows for wider accessibility and can reduce the need for physical travel, potentially saving costs and time. AI-powered customer service tools are also becoming crucial; by mid-2024, businesses utilizing AI in customer service reported an average improvement of 15% in response times and customer satisfaction scores.

Furthermore, this digital transformation is invaluable for data collection. Middleby can gather richer insights into customer behavior and product performance through online interactions. This data is critical for refining product development strategies and conducting more precise market analysis, enabling more informed business decisions. By 2025, it's projected that over 60% of B2B purchasing decisions will be influenced by digital content and online research.

- Enhanced Market Reach: Digital platforms expand Middleby's customer base beyond geographical limitations.

- Operational Efficiency: Virtual demonstrations and AI support reduce costs and improve service speed.

- Data-Driven Insights: Digital interactions provide valuable data for product innovation and market understanding.

- Customer Engagement: Modernizing sales and service through digital means improves overall customer experience.

Advanced Materials and Manufacturing Processes

Innovation in materials science and manufacturing is a significant technological driver for Middleby. Advances in areas like new alloys, composites, and especially additive manufacturing, or 3D printing, are making equipment more durable, lighter, and potentially more cost-effective. For instance, the aerospace industry, a key sector for advanced materials, saw its market grow to an estimated $900 billion in 2024, indicating the widespread adoption and impact of these material innovations.

These technological advancements directly translate into improved product performance and faster new product development cycles for Middleby. By embracing techniques like 3D printing for prototyping and even some production components, Middleby can reduce lead times and costs associated with traditional manufacturing methods. This agility allows them to respond more quickly to market demands and introduce cutting-edge solutions to their broad customer base, from commercial kitchens to food processing plants.

The integration of advanced materials and manufacturing processes supports Middleby's strategy of offering high-performance, efficient, and reliable equipment. For example, the global additive manufacturing market is projected to reach over $100 billion by 2030, highlighting the growing importance and investment in these technologies across various industries, including those Middleby serves.

- Material Innovation: Development of lighter, stronger alloys and composites enhances equipment durability and energy efficiency.

- Additive Manufacturing: 3D printing enables rapid prototyping and customized component production, reducing development costs and time.

- Cost-Effectiveness: New manufacturing techniques can streamline production, leading to more competitive pricing and improved margins.

- Performance Enhancement: Advanced materials and processes allow for the creation of equipment with superior functionality and longevity.

Technological advancements are reshaping the foodservice industry, with automation and AI becoming central to operational efficiency and addressing labor challenges. Middleby's strategic acquisitions, like H.M.M. in late 2023, underscore its commitment to integrating these innovations into its product lines. The company's sustained investment in R&D ensures it remains at the forefront of developing smart, connected kitchen equipment.

The increasing adoption of IoT in foodservice, with the market valued at approximately $10.5 billion in 2024, allows for remote monitoring and predictive maintenance, crucial for minimizing downtime. By 2025, over 75% of new commercial kitchen equipment is expected to feature connectivity, enabling Middleby to offer data analytics for optimized energy use and new service models.

Energy efficiency is a key technological focus, driven by regulations and cost-saving demands. Innovations in materials and ventilation are leading to lower power consumption without performance compromise. Furthermore, digital platforms are transforming customer engagement, with AI in customer service improving response times by an average of 15% by mid-2024.

Material science and additive manufacturing are also critical, enabling Middleby to create more durable, lighter, and cost-effective equipment. The global additive manufacturing market's projected growth to over $100 billion by 2030 highlights the industry's increasing reliance on these advanced production techniques.

| Key Technological Trend | Market Impact (2024/2025 Estimates) | Middleby's Strategic Response |

| Automation & Robotics | Addressing labor shortages, improving consistency. | Acquisition of H.M.M. (late 2023), developing AI-powered cooking. |

| Internet of Things (IoT) | IoT in Foodservice Market: ~$10.5 billion (2024), growing significantly. Over 75% of new commercial kitchen equipment to be connected by 2025. | Offering smart appliances with data analytics, predictive maintenance, and new service models. |

| Energy Efficiency | Driven by regulations and cost reduction. | Focus on advanced insulation, efficient heating elements, and improved refrigeration/ventilation. |

| Digital Platforms & E-commerce | B2B industrial equipment e-commerce saw double-digit growth in 2023. Over 60% of B2B purchasing decisions influenced by digital content by 2025. | Expanding market reach, streamlining operations via virtual demos, AI customer service (improving response times by ~15% by mid-2024). |

| Materials Science & Additive Manufacturing | Global additive manufacturing market projected to exceed $100 billion by 2030. | Utilizing 3D printing for rapid prototyping and component production, enhancing durability and cost-effectiveness. |

Legal factors

Middleby operates under a stringent global framework of food safety and hygiene regulations. This includes adherence to Hazard Analysis and Critical Control Points (HACCP) principles, NSF International standards, and various regional health codes. For instance, in 2024, the U.S. Food and Drug Administration (FDA) continued its focus on preventive controls, impacting food processing equipment manufacturers like Middleby.

Failure to comply with these regulations can result in significant consequences. These can range from hefty fines and product recalls, which can cost millions in lost revenue and remediation, to severe damage to Middleby's brand reputation. In 2023, the global food recall market was valued at billions, highlighting the financial impact of safety breaches.

Consequently, Middleby must maintain constant vigilance over evolving regulatory landscapes and ensure its product lines consistently meet or surpass these demanding standards. This commitment is crucial not only for maintaining market access but also for fostering enduring customer trust and loyalty in the competitive food service industry.

Middleby, as a manufacturer, operates under product liability laws that assign responsibility for harm caused by product defects. Stringent quality assurance, thorough testing protocols, and explicit user guidance are crucial for minimizing legal exposure. For instance, in 2023, the U.S. Consumer Product Safety Commission (CPSC) reported over 500,000 product-related injuries treated in emergency rooms, highlighting the importance of robust safety measures.

Furthermore, warranty laws govern the guarantees provided for Middleby's products. This necessitates well-established after-sales support and service infrastructure to meet these obligations. Failure to comply can lead to costly recalls and litigation, impacting brand reputation and financial performance.

Middleby operates under stringent environmental protection regulations that dictate manufacturing processes, waste management, and the lifecycle of its products. These laws, covering emissions, water quality, and hazardous materials handling, directly influence operational expenses and the very design of Middleby's equipment.

For instance, the European Union's Waste Electrical and Electronic Equipment (WEEE) directive mandates specific recycling and disposal procedures, adding complexity and cost to product management. In 2024, companies globally are facing increased scrutiny on their carbon footprints, with many governments implementing stricter emissions standards, potentially impacting Middleby's supply chain and manufacturing locations.

Compliance necessitates continuous investment in greener technologies and sustainable operational strategies. This commitment is crucial not only for regulatory adherence but also for maintaining brand reputation and meeting the growing demand for environmentally responsible products from consumers and business partners alike.

Labor and Employment Laws

Middleby's global operations mean it must navigate a complex web of labor and employment laws across different countries. These regulations cover everything from minimum wages and working hours to anti-discrimination policies and the right to unionize. Staying compliant is vital to prevent costly legal battles, hefty fines, and damage to the company's reputation. For instance, in 2024, the International Labour Organization reported that over 50% of countries had updated their labor laws to address new forms of work, highlighting the dynamic regulatory landscape Middleby must manage.

Ensuring fair employment practices and adhering to international labor standards are paramount for Middleby. This involves managing a diverse workforce with varying cultural expectations and legal frameworks. Failure to do so can lead to significant operational disruptions and financial penalties. For example, a major multinational in 2023 faced a significant lawsuit for non-compliance with labor laws in one of its key markets, resulting in millions in damages and a substantial hit to its stock price.

- Global Compliance: Middleby must comply with labor laws in all operating regions, affecting wages, working conditions, and employee rights.

- Risk Mitigation: Adherence to labor laws prevents legal disputes, fines, and reputational harm, crucial for maintaining investor confidence.

- International Standards: Managing diverse international labor standards requires robust internal policies and continuous monitoring.

- Fair Employment: Upholding fair employment practices across all facilities is essential for employee morale and operational stability.

Intellectual Property Rights

Protecting its intellectual property, including patents, trademarks, and trade secrets for innovative equipment and technologies, is crucial for Middleby’s competitive edge. For instance, in 2023, the company continued to file new patents, reflecting ongoing investment in R&D to safeguard its technological advancements.

Conversely, Middleby must diligently ensure its product offerings do not infringe upon the intellectual property rights of competitors or other entities. This involves thorough legal review and due diligence during product development to mitigate potential litigation risks.

Navigating the intricate landscape of global intellectual property laws and actively defending its innovations are paramount for Middleby to maintain its market leadership and technological superiority. Failure to do so could lead to costly legal battles and erosion of its competitive advantage.

- Patent Filings: Middleby’s commitment to innovation is underscored by its consistent patent filings, which are essential for protecting its proprietary technologies.

- Infringement Avoidance: Proactive measures to avoid infringing on others' IP are critical to prevent legal challenges and associated financial penalties.

- Competitive Advantage: Robust IP protection and careful navigation of legal frameworks are vital for sustaining Middleby's market position and profitability.

Middleby must navigate a complex web of global legal and regulatory requirements, impacting everything from food safety to environmental standards and labor practices. Compliance is not merely a legal obligation but a critical factor in operational efficiency, brand reputation, and market access. For instance, in 2024, the ongoing focus on supply chain transparency and sustainability by regulatory bodies worldwide means Middleby must ensure its entire value chain adheres to increasingly stringent standards, potentially affecting sourcing and manufacturing costs.

The company's product liability and intellectual property protection are also significant legal considerations. Ensuring product safety and avoiding patent infringement are paramount to prevent costly litigation and maintain its competitive edge. With the global product recall market valued in the billions, as seen in 2023, robust quality control and legal due diligence are essential risk mitigation strategies for Middleby.

Furthermore, evolving labor laws and international employment standards demand constant vigilance. In 2024, the International Labour Organization highlighted that over 50% of countries have updated labor laws, requiring Middleby to maintain adaptable and compliant HR practices across its diverse workforce to avoid disputes and maintain operational stability.

Environmental factors

The energy efficiency of Middleby's equipment is a key environmental consideration, influenced by evolving regulations and customer desire for reduced operating costs. For instance, the U.S. Department of Energy's Energy Star program continues to set benchmarks for energy consumption in appliances, impacting both commercial and residential markets. Middleby's commitment to developing Energy Star certified products, like their advanced commercial cooking equipment, directly addresses this by lowering utility bills for users and shrinking the carbon footprint of their product lifecycle.

Middleby's manufacturing operations, which include producing commercial kitchen equipment, inevitably generate waste streams such as scrap metal, plastics, and electronic components. In 2023, the company reported a focus on reducing its environmental footprint, with initiatives aimed at diverting a significant portion of manufacturing waste from landfills through enhanced recycling programs.

Robust waste management and recycling are not just about environmental stewardship but also critical for regulatory compliance and enhancing corporate social responsibility. Middleby is increasingly evaluating the end-of-life recyclability of its products, a factor that influences design and material sourcing decisions as part of its sustainability strategy.

The carbon footprint stemming from Middleby's manufacturing, logistics, and global supply chain is a significant environmental factor. In 2023, the company reported a reduction in Scope 1 and 2 greenhouse gas emissions intensity by 15% compared to a 2020 baseline, demonstrating progress in operational efficiency.

Middleby is actively pursuing emission reductions through strategies like optimizing transportation routes, which can cut fuel consumption and associated emissions by up to 10% per route. Furthermore, investments in renewable energy sources for their facilities, such as solar installations at their Elgin, Illinois campus, are contributing to a cleaner energy mix.

Collaboration with suppliers who prioritize sustainable practices is also crucial. Many of Middleby's key suppliers have committed to science-based targets for emissions reduction, aligning with the company's broader environmental goals. Transparently measuring and reporting these emissions is becoming a standard expectation for investors and customers alike.

Water Usage in Food Processing Equipment

Water efficiency is a critical environmental consideration for Middleby's food processing equipment, especially in areas grappling with water scarcity. Many regions, including parts of California and the Southwestern United States, are experiencing prolonged drought conditions, making water conservation a paramount concern for businesses. Middleby is focused on engineering equipment that significantly reduces water usage during cleaning, cooling, and processing operations.

This focus on water conservation offers dual benefits: it helps Middleby's customers lower their environmental footprint and also reduces their operational expenses. For instance, by 2024, the food processing industry in the US was already seeing increased scrutiny on water usage, with some facilities reporting water costs rising by 5-10% year-over-year in drought-affected areas. Middleby's commitment is to innovate water-saving solutions that maintain high performance and stringent hygiene standards.

- Water Scarcity Impact: Regions like the American Southwest are facing critical water shortages, increasing the importance of efficient water use in industrial processes.

- Customer Cost Savings: By minimizing water consumption, Middleby's equipment helps food processors reduce utility bills, a growing concern with rising water prices.

- Performance and Hygiene: Middleby strives to achieve water reduction without compromising the essential functions of cleaning and processing in food production.

- Industry Trend: The food processing sector is increasingly prioritizing sustainability, with water efficiency being a key metric for environmental responsibility.

Sustainable Sourcing of Materials

Middleby's dedication to environmental stewardship is evident in its approach to sourcing materials. The company actively partners with suppliers who demonstrate strong ethical and environmental practices, ensuring that the raw materials and components used in their products meet rigorous standards. This focus includes minimizing the use of hazardous substances and evaluating the overall environmental footprint of materials throughout their lifecycle.

This commitment to sustainable sourcing not only bolsters Middleby's brand image but also serves as a crucial risk management strategy. By prioritizing environmentally responsible suppliers, Middleby mitigates potential disruptions arising from resource scarcity and the increasing impact of environmental regulations. For instance, in 2024, the demand for recycled content in manufacturing saw a significant rise, with many industries aiming for over 30% recycled material integration. Middleby's proactive stance positions it favorably to meet these evolving market expectations.

Key aspects of Middleby's sustainable sourcing initiatives include:

- Supplier Audits: Regularly assessing suppliers for compliance with environmental and ethical guidelines.

- Material Lifecycle Assessment: Evaluating the environmental impact of materials from extraction to disposal.

- Hazardous Substance Reduction: Actively seeking alternatives to chemicals that pose environmental or health risks.

- Promoting Circular Economy Principles: Encouraging the use of materials that can be reused or recycled.

Environmental factors significantly shape Middleby's operational landscape and product development. Growing regulatory pressures and consumer demand for sustainability are driving innovation in energy and water efficiency. For example, the U.S. Environmental Protection Agency's ENERGY STAR program continues to influence appliance design, with Middleby actively developing certified products to meet these standards.

Middleby's manufacturing processes generate waste, prompting a strategic focus on waste reduction and recycling. Initiatives to divert manufacturing waste from landfills are crucial for compliance and corporate responsibility, with an increasing emphasis on product end-of-life recyclability influencing design and material choices.

The company is actively working to reduce its carbon footprint across its supply chain and operations. In 2023, Middleby reported a 15% reduction in Scope 1 and 2 greenhouse gas emissions intensity against a 2020 baseline, achieved through operational efficiencies and investments in renewable energy sources like solar installations.

Water scarcity in regions like the Southwestern U.S. highlights the importance of water efficiency in Middleby's food processing equipment. The company is engineering solutions that reduce water usage during critical operations, offering customers cost savings and environmental benefits, especially as water costs rise.

| Environmental Factor | Impact on Middleby | Key Initiatives/Data (2023-2024) |

|---|---|---|

| Energy Efficiency | Regulatory compliance, customer cost savings, reduced carbon footprint | Development of ENERGY STAR certified products; focus on efficient commercial cooking equipment. |

| Waste Management | Regulatory compliance, corporate social responsibility, resource optimization | Enhanced recycling programs to divert manufacturing waste; evaluation of product recyclability. |

| Carbon Emissions | Operational efficiency, supply chain sustainability, investor expectations | 15% reduction in Scope 1 & 2 GHG emissions intensity (vs. 2020 baseline); optimization of logistics routes; solar installations. |

| Water Scarcity | Operational costs for customers, environmental stewardship, product innovation | Engineering water-saving solutions for food processing equipment; addressing drought-impacted regions. |

| Sustainable Sourcing | Risk management, brand reputation, regulatory compliance | Partnering with suppliers on environmental practices; increasing use of recycled content (aiming for >30% integration in some industries). |

PESTLE Analysis Data Sources

Our Middleby PESTLE Analysis is meticulously constructed using a blend of public and proprietary data, ensuring relevance to real business conditions within the food service equipment industry and its global markets. This approach allows us to capture nuanced market dynamics and regulatory landscapes.