Middleby Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Middleby Bundle

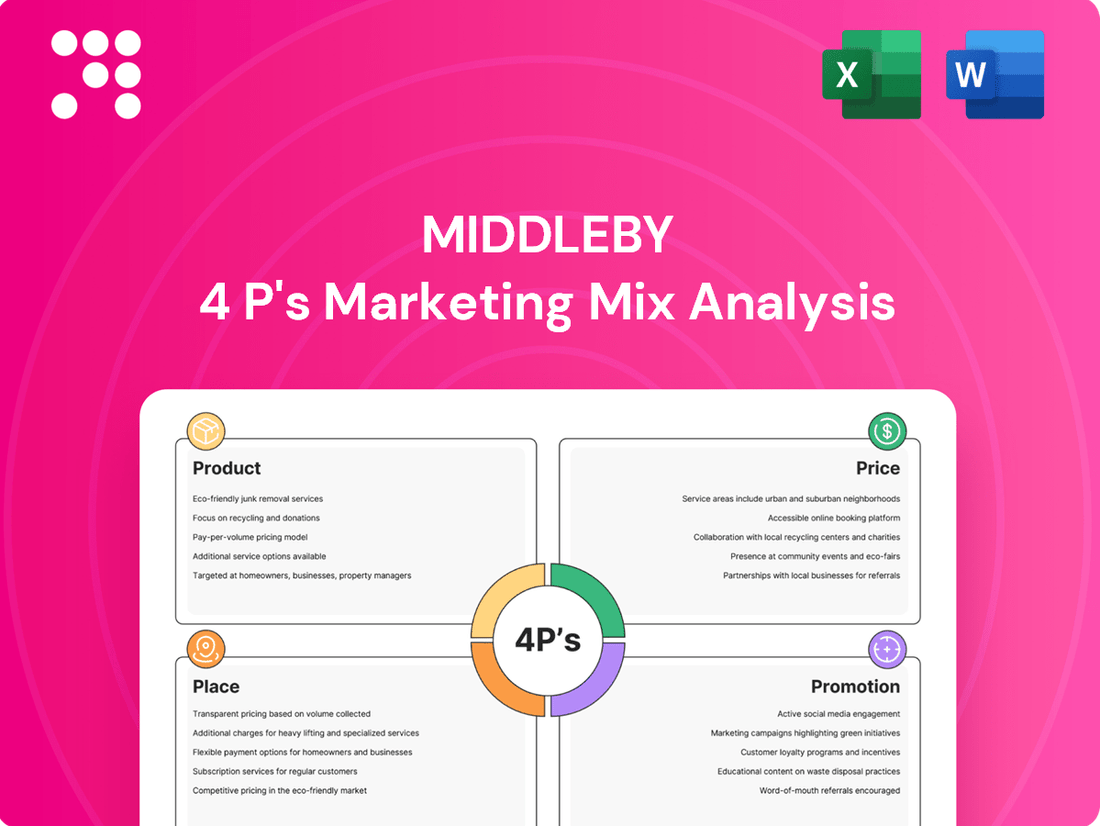

Middleby's success is built on a strategic foundation, but understanding the nuances of their Product, Price, Place, and Promotion is key to unlocking true market insight. Our comprehensive analysis goes beyond the surface, revealing how these elements synergize to create their competitive edge.

Dive deep into Middleby's product innovation, pricing strategies, distribution networks, and promotional campaigns. This ready-to-use, editable report provides actionable insights and real-world examples, perfect for business professionals and students alike.

Save valuable time and gain a competitive advantage. Access the full 4Ps Marketing Mix Analysis for Middleby and discover how to apply these powerful strategies to your own business or academic pursuits.

Product

Middleby's product strategy for commercial foodservice equipment is robust, encompassing cooking, refrigeration, and ventilation. Their offerings are engineered for efficiency and automation, catering to a wide array of food service operations. For instance, in 2024, the company highlighted advancements in automated cooking technologies aimed at reducing labor dependency, a significant industry concern.

Innovation is central to Middleby's product development, with a keen focus on addressing key market demands. This includes a strong emphasis on energy-efficient solutions, a trend that gained further traction in 2024 as sustainability regulations tightened. Their equipment is designed to meet the evolving needs of restaurants and institutional kitchens, integrating advanced technology for enhanced performance.

Middleby's Food Processing segment offers comprehensive equipment solutions for industrial protein, bakery, and snack manufacturers, enabling the production of diverse items like bacon, tortillas, and cookies. Their strategy centers on providing technologies that boost efficiency and reduce operational costs for these businesses.

This segment's growth is often fueled by strategic acquisitions, allowing Middleby to broaden its product portfolio and technological capabilities. For instance, in 2023, Middleby continued to integrate acquired businesses, aiming to offer more end-to-end processing lines, which is crucial for processors seeking streamlined operations and faster time-to-market.

Middleby's residential kitchen appliances, including premium ranges, ovens, and refrigerators, are positioned for the discerning home chef and luxury market. This strategy targets consumers willing to invest in high-performance, aesthetically pleasing kitchen equipment, a segment that aligns with the growing emphasis on home-based culinary experiences.

Despite a challenging economic climate in 2024, Middleby's residential segment has demonstrated resilience and operational enhancements. The company reported that its residential business saw a notable increase in profitability, driven by strategic pricing and improved supply chain efficiencies, even as overall consumer spending faced headwinds.

The company is actively leveraging the sustained trend of increased home cooking and the demand for sophisticated, high-end appliances. This focus is supported by market data from late 2024 indicating a continued preference for durable, feature-rich appliances, with sales in the premium segment outperforming the broader market.

Innovation and Technology Integration

Middleby places a strong emphasis on innovation and the integration of cutting-edge technology. This commitment is evident in their development of IoT-enabled equipment, automation solutions, and digital platforms designed to streamline operations for their customers. For instance, their digital robotic kitchens and systems that optimize oil consumption in fryers represent tangible advancements showcased at major industry events.

This strategic focus on technology directly addresses key customer needs by boosting operational efficiency, lowering labor expenses, and ensuring a higher degree of product consistency. Middleby's investment in technology is a core driver for enhancing the value proposition across their diverse product portfolio, aiming to solidify their market leadership.

Looking at recent performance, Middleby's dedication to technological advancement is reflected in their ongoing product development pipeline. While specific figures for the impact of new technology integration on revenue are proprietary, the company’s consistent investment in R&D, which stood at approximately $150 million in 2023, underscores this commitment. This investment fuels the creation of smarter, more efficient kitchen solutions, contributing to their competitive edge in the market.

- IoT Connectivity: Enabling remote monitoring and control of kitchen equipment.

- Automation: Reducing manual labor and increasing throughput in commercial kitchens.

- Digital Solutions: Offering software and platforms for data analytics and operational optimization.

- Sustainability Tech: Developing innovations like oil management systems to reduce waste and costs.

Acquisition-Driven Expansion

Middleby's product strategy heavily leans on acquisition-driven expansion, a key component of its marketing mix. This approach allows the company to quickly broaden its product portfolio and market reach. For instance, recent acquisitions have bolstered their offerings in areas like frozen dessert equipment, tortilla production systems, and industrial baking lines, directly enhancing their product breadth.

These strategic acquisitions aren't just about adding more products; they're about synergistic growth. By integrating companies with specialized expertise, Middleby strengthens its position in diverse market segments. This integration is designed to facilitate rapid scaling of both revenue and EBITDA, as seen in the company's consistent performance trends.

- Acquisition Integration: Middleby has a track record of successfully integrating acquired businesses, enhancing their existing product lines and market penetration.

- Portfolio Diversification: Acquisitions in areas like frozen dessert and tortilla production expand Middleby’s product offerings, catering to a wider range of customer needs.

- Revenue and EBITDA Growth: The strategy of acquiring complementary businesses directly contributes to accelerated revenue growth and improved EBITDA margins for Middleby.

- Market Segment Strengthening: By acquiring specialized companies, Middleby solidifies its competitive advantage across various industry segments.

Middleby's product strategy is characterized by a dual focus on innovation in commercial foodservice and strategic acquisitions to expand its portfolio. They engineer equipment for efficiency and automation, with advancements in automated cooking and energy-efficient solutions being key priorities, as highlighted throughout 2024.

The company's Food Processing segment offers comprehensive solutions for industries like protein and bakery, aiming to boost efficiency and reduce costs, often through integrating acquired businesses to provide end-to-end processing lines.

In the residential sector, Middleby targets the premium market with high-performance, aesthetically pleasing appliances, demonstrating resilience in 2024 with improved profitability driven by strategic pricing and supply chain enhancements.

Overall, Middleby leverages technological integration, including IoT and automation, alongside a robust acquisition strategy to diversify its offerings and strengthen its market position across various segments.

| Product Segment | Key Focus Areas | 2023 R&D Investment (Approx.) | Notable Trend/Initiative |

|---|---|---|---|

| Commercial Foodservice | Automation, Energy Efficiency, IoT | $150 Million | Automated cooking advancements in 2024 |

| Food Processing | Efficiency, Cost Reduction, End-to-End Solutions | Included in overall R&D | Integration of acquisitions for expanded processing lines |

| Residential Appliances | Premium Quality, Aesthetics, Performance | Included in overall R&D | Resilience and profitability growth in 2024 |

What is included in the product

This analysis provides a comprehensive breakdown of Middleby's marketing strategies, examining its Product offerings, Pricing structures, Place (distribution) channels, and Promotion tactics.

Simplifies complex marketing strategies into actionable insights, alleviating the burden of deciphering intricate plans for busy executives.

Place

Middleby's global distribution network is a cornerstone of its market presence, enabling sales and service across North America, Asia, Europe, the Middle East, and Latin America. This extensive reach ensures their equipment is accessible to a wide array of clients in commercial, industrial, and consumer sectors worldwide.

In fiscal year 2023, Middleby reported net sales of $4.03 billion, a testament to the effectiveness of this broad distribution strategy in penetrating diverse international markets and serving a global customer base.

Middleby employs a dual strategy for product distribution, leveraging both direct sales teams and an extensive network of dealers, designers, and home builder partners. This multi-channel approach ensures wide market penetration and caters to diverse customer segments.

In 2023, Middleby's residential kitchen equipment segment, which heavily relies on these channels, saw significant revenue generation, reflecting the effectiveness of their distribution strategy. For instance, the company's focus on building strong relationships with home builders in key markets like North America continues to drive sales volume.

Middleby leverages its Innovation Kitchens and Showrooms to bring its advanced solutions to life for customers. These dedicated facilities, including commercial foodservice innovation kitchens and industrial baking and protein centers, offer interactive demonstrations. For the residential market, award-winning showrooms allow customers to experience products firsthand, driving engagement and understanding of Middleby's offerings.

Strategic Regional Expansion

Middleby is actively pursuing strategic regional expansion to enhance its market penetration and customer relationships. A prime example is its focus on Europe, where investments like the Middleby Innovation Kitchen in Munich are designed to bolster sales and showcase its cutting-edge foodservice solutions.

These regional centers are crucial for driving sales and fostering direct engagement with foodservice professionals. They serve as platforms for customers to interact with Middleby's technologies and innovations firsthand, facilitating a deeper understanding of their value proposition.

- European Focus: Middleby's commitment to Europe is evident through strategic investments aimed at increasing market share and customer engagement.

- Innovation Hubs: Facilities like the Munich Innovation Kitchen act as central points for sales activities and product demonstrations, driving adoption of Middleby solutions.

- Customer Experience: These regional hubs provide foodservice professionals with direct access to experience and evaluate Middleby's comprehensive range of innovations.

Spin-off for Focused Distribution

Middleby's strategic move to spin off its Food Processing division into a separate public entity by early 2026 is a significant step in refining its distribution approach. This separation will allow the commercial and residential kitchen equipment business to concentrate on its distinct distribution channels, while the industrial food processing segment can develop strategies specifically suited to its B2B market.

This focused approach is expected to unlock greater value by enabling each company to tailor its distribution networks more effectively. For instance, the kitchen equipment segment might leverage a broader dealer network and direct-to-consumer online sales, whereas the food processing division could focus on specialized industrial distributors and direct sales to large food manufacturers.

The company's recent performance highlights the potential for such strategic realignments. In the first quarter of 2024, Middleby reported revenue growth, with its Residential Kitchen Equipment segment showing particular strength, suggesting that dedicated focus can indeed yield positive results.

- Spin-off Timing: Planned for early 2026.

- Strategic Goal: To create two more focused, independently managed companies.

- Distribution Impact: Enables tailored strategies for distinct market segments (kitchen equipment vs. food processing).

- Potential Benefit: Enhanced market penetration and operational efficiency through specialization.

Middleby's "Place" strategy centers on a robust, multi-channel global distribution network, encompassing direct sales, dealers, and strategic partnerships. This broad reach is crucial for serving diverse sectors worldwide, as evidenced by their $4.03 billion in net sales for fiscal year 2023. Their approach includes physical touchpoints like innovation kitchens and showrooms, facilitating direct customer engagement and product experience. This strategy is further refined by the planned spin-off of the Food Processing division by early 2026, allowing for more specialized distribution approaches for distinct business segments.

| Distribution Channel | Market Segment | Key Strategy Element |

|---|---|---|

| Direct Sales Teams | Commercial Foodservice, Industrial | Direct customer engagement, technical support |

| Dealers, Designers, Home Builders | Residential Kitchen Equipment | Wide market penetration, localized support |

| Innovation Kitchens & Showrooms | Commercial & Residential | Product demonstration, customer experience |

| Regional Expansion (e.g., Europe) | Commercial Foodservice | Increased market share, tailored solutions |

Same Document Delivered

Middleby 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This Middleby 4P's Marketing Mix Analysis is complete and ready for your immediate use.

You're viewing the exact version of the analysis you'll receive—fully complete, ready to use. This means you can confidently assess the depth and quality of the Middleby 4P's Marketing Mix before making your purchase.

Promotion

Middleby leverages trade shows and industry events, like NAFEM 2025, as a key promotional tool. These platforms are vital for showcasing cutting-edge products and technologies, such as their advancements in digital robotic kitchens.

Participation in events like NAFEM 2025 allows Middleby to directly engage with a targeted audience of commercial and industrial clients. This direct interaction is instrumental in generating leads and understanding market needs firsthand, fostering stronger client relationships.

In 2024, the commercial foodservice equipment market was valued at approximately $45 billion globally, with trade shows serving as a significant driver for new product adoption and sales within this competitive landscape.

Middleby effectively uses its corporate website and dedicated investor relations sections to disseminate crucial information. This includes timely financial results, significant strategic announcements, and detailed product catalogs, ensuring transparency and accessibility for stakeholders.

This robust digital presence is indispensable for engaging a wide spectrum of audiences, from individual and institutional investors to financial professionals and prospective customers globally. It serves as a primary channel for building brand awareness and communicating value propositions.

For instance, as of the first quarter of 2024, Middleby's investor relations portal provided direct access to earnings calls and presentations, facilitating informed decision-making for its shareholder base. The company's website also showcases its diverse product portfolio, driving interest and potential sales leads.

Middleby leverages investor presentations and earnings calls as crucial communication tools, offering detailed insights into financial performance and strategic direction. These events are vital for fostering transparency and building trust with investors and financial professionals.

During their Q4 2023 earnings call in February 2024, Middleby reported a 12% increase in net sales to $1.1 billion, highlighting strong operational execution. Management also provided an optimistic outlook for 2024, projecting continued growth driven by new product introductions and market expansion.

Strategic Communications on Corporate Actions

Middleby utilizes strategic communications, like press releases and investor calls, to proactively inform stakeholders about major corporate actions. For instance, their planned spin-off of the Food Processing segment is being communicated to highlight the strategic rationale and anticipated value creation for shareholders. This approach aims to ensure transparency and manage market expectations effectively.

These communications are critical for the Promotion aspect of their marketing mix, as they shape public perception and investor confidence during significant transitions. By detailing the expected benefits, such as enhanced focus and potential for improved financial performance in both entities, Middleby seeks to garner support and understanding. For example, in the lead-up to the spin-off, detailed financial projections and strategic roadmaps are shared.

- Spin-off Announcement: Middleby announced its intention to spin off its Food Processing equipment business in late 2023, aiming for completion in 2024.

- Shareholder Value Focus: Communications emphasize the strategic benefits, including increased operational focus and tailored capital allocation for each independent entity.

- Investor Relations: Investor presentations and webcasts provide detailed financial data and outlooks for both the remaining Middleby and the new, independent Food Processing company.

Targeted Marketing to Key Segments

Middleby's promotional strategy is finely tuned to resonate with its varied clientele, which spans from commercial kitchens in restaurants and large institutions to food production plants and even the residential market. This targeted approach ensures marketing messages are relevant and impactful for each specific segment.

To amplify its reach, Middleby offers robust marketing support to its network of dealers and sales partners. This collaboration is crucial for synchronizing promotional activities and effectively connecting with end-user customers, driving brand awareness and product adoption across all channels.

For instance, in 2024, Middleby's digital marketing spend saw a notable increase, with a significant portion allocated to highly targeted campaigns on professional platforms like LinkedIn and industry-specific trade publication websites. This strategic investment aims to capture the attention of decision-makers in their target sectors.

- Targeted Digital Campaigns: Focused ad placements on industry-specific websites and professional networks.

- Dealer Co-op Marketing Funds: Financial assistance for partners to run localized promotional activities.

- Trade Show Presence: Active participation in key industry events like the National Restaurant Association Show and Pack Expo.

- Content Marketing Initiatives: Development of case studies and white papers showcasing product solutions for specific industry challenges.

Middleby's promotional efforts are multifaceted, aiming to reach a diverse customer base from commercial kitchens to food processing plants. They actively participate in major industry trade shows like NAFEM 2025 and the National Restaurant Association Show, which are critical for demonstrating new technologies, such as their digital robotic kitchens, and generating direct leads within the approximately $45 billion global commercial foodservice equipment market in 2024.

The company also maintains a strong digital presence through its corporate website and investor relations portal, providing easy access to financial results, strategic announcements, and product information. This digital strategy is essential for engaging a broad audience, including investors and potential customers, and was evident in Q1 2024 when their investor portal offered direct access to earnings calls.

Furthermore, Middleby utilizes investor presentations and earnings calls, like the one in February 2024 where they reported a 12% net sales increase to $1.1 billion for Q4 2023, to communicate financial performance and strategic direction, fostering transparency and trust. Their proactive communication regarding the planned spin-off of the Food Processing segment in 2024 also highlights their commitment to informing stakeholders about value creation initiatives.

Middleby supports its dealer network with marketing assistance, including co-op funds and targeted digital campaigns on professional platforms, which saw increased investment in 2024. This collaborative approach, combined with content marketing like case studies, ensures their promotional messages are effectively delivered across all market segments.

| Promotional Tactic | Key Focus Areas | 2024/2025 Relevance |

| Trade Shows (e.g., NAFEM 2025) | Product Innovation Showcase, Lead Generation, Direct Client Engagement | Crucial for demonstrating advancements like digital robotic kitchens in a $45B market. |

| Digital Presence (Website, Investor Relations) | Information Dissemination, Brand Awareness, Stakeholder Engagement | Essential for reaching global investors and customers; Q1 2024 saw direct access to earnings calls. |

| Investor Communications (Calls, Presentations) | Financial Performance, Strategic Direction, Transparency | Builds trust; Q4 2023 sales were $1.1B, up 12% YoY, with positive 2024 outlook. |

| Dealer Support & Digital Marketing | Co-Marketing, Targeted Campaigns, Brand Amplification | Increased digital spend in 2024 focused on professional platforms; supports end-user reach. |

Price

Middleby's value-based pricing for commercial solutions centers on the tangible benefits its advanced equipment provides. This means customers are paying for enhanced efficiency, automation, and significant labor savings, which directly translate to improved profitability and reduced operational costs. For instance, equipment designed to address critical labor shortages in 2024 allows operators to justify the upfront investment by demonstrating clear long-term cost reductions.

Middleby navigates the competitive residential kitchen appliance market by focusing on premium brands, where pricing reflects the high-end segment. Their strategy balances the perceived value of luxury and advanced features against consumer willingness to pay. For instance, in 2024, the average price for a premium built-in refrigerator could range from $4,000 to $10,000, a segment Middleby actively competes within.

Middleby is planning strategic price adjustments, with a focus on the latter half of 2025, to counteract the financial strain caused by rising tariff costs. This move is designed to protect their profit margins from these external economic headwinds.

Pricing for Food Processing Efficiency

Middleby's pricing for food processing equipment is strategically set to reflect the substantial value it offers clients through enhanced efficiency, accelerated production, and significant cost reductions. This approach is supported by the robust margins observed within the food processing sector, indicating a pricing model that effectively captures the economic advantages derived from Middleby's advanced solutions for large-scale food manufacturers.

The company's pricing strategy is designed to align with the return on investment (ROI) that industrial clients can expect. For instance, Middleby's automated cooking systems have been shown to reduce labor costs by up to 20% and increase throughput by 15% in large commercial kitchens, directly translating into cost savings that justify the premium pricing of such equipment.

- Value-Based Pricing: Prices are determined by the economic benefits delivered, such as improved yield and reduced waste.

- Premium Positioning: Reflects the high quality, advanced technology, and long-term reliability of Middleby's equipment.

- Segmented Pricing: Different product lines may have varied pricing structures based on complexity, capacity, and customization.

- Total Cost of Ownership: While upfront costs can be high, pricing considers the overall operational savings and longevity of the equipment.

Flexible Pricing and Incentive Programs

Middleby's pricing strategy often incorporates flexibility, particularly within the residential sector. This approach aims to stimulate demand and foster stronger relationships with sales partners and end-users. For instance, incentive programs can be structured to reward partners for achieving specific sales targets or for undertaking localized marketing initiatives, thereby enhancing product visibility and market penetration.

These financial incentives can make Middleby's offerings more competitive and accessible. By providing discounts or tailored financing options, the company can effectively lower the barrier to entry for customers, encouraging purchases and driving sales volume. This strategy is crucial for maintaining market share and encouraging broader adoption of their product lines.

- Flexible Pricing Models: Middleby may offer tiered pricing or volume discounts to cater to different customer segments and purchase sizes.

- Sales Partner Incentives: Programs could include rebates, co-op advertising funds, or performance bonuses for distributors and dealers.

- Customer Promotions: Seasonal discounts, bundled offers, or financing plans can be deployed to attract new customers and encourage repeat business.

- Competitive Benchmarking: Pricing is likely adjusted based on competitor offerings and perceived value in the market, especially in the highly competitive residential appliance space.

Middleby's pricing strategy emphasizes the total value delivered, moving beyond simple cost-plus. For commercial clients, this means pricing is directly tied to the efficiency gains, labor savings, and increased throughput their equipment provides, justifying higher upfront costs with clear ROI. In the premium residential market, prices reflect advanced features and brand prestige, with products like high-end refrigerators often falling between $4,000 and $10,000 in 2024.

The company plans price adjustments in late 2025 to offset rising tariff costs and protect profit margins. This proactive approach highlights their focus on maintaining profitability amidst economic pressures. Flexible pricing models, including incentives for sales partners and customer promotions like discounts or financing, are also employed to stimulate demand and enhance market penetration, particularly in the competitive residential sector.

4P's Marketing Mix Analysis Data Sources

Our Middleby 4P's Marketing Mix Analysis draws from a comprehensive suite of data sources, including official company filings, investor relations materials, and detailed industry reports. We also incorporate insights from competitor analysis, market research databases, and direct observation of Middleby's product offerings, pricing strategies, distribution channels, and promotional activities.