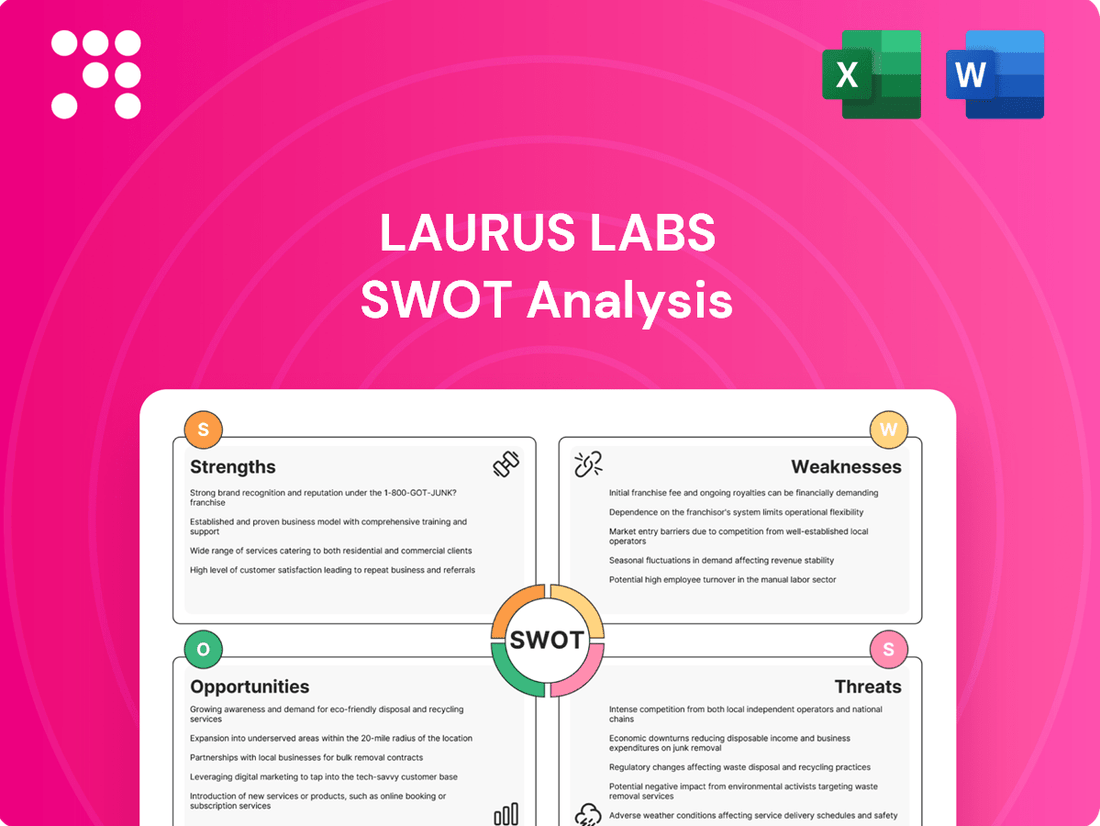

Laurus Labs SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Laurus Labs Bundle

Laurus Labs demonstrates impressive strengths in its robust R&D capabilities and diversified product portfolio, particularly in APIs and generics. However, potential threats from regulatory changes and intense competition warrant careful consideration. Understanding these dynamics is crucial for anyone looking to invest or strategize within the pharmaceutical sector.

Want the full story behind Laurus Labs' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Laurus Labs boasts a significant strength in its diversified portfolio, encompassing Active Pharmaceutical Ingredients (APIs), Finished Dosage Forms (FDFs), and Contract Research and Manufacturing Services (CRAMS). This broad offering covers critical therapeutic areas like anti-retroviral, oncology, and cardiovascular treatments, providing a robust revenue base.

The company's integrated service model, stretching from initial research and development to large-scale commercial manufacturing, creates a strong value proposition. This end-to-end capability allows Laurus Labs to cater to the complex needs of global pharmaceutical clients, fostering deeper partnerships and securing repeat business.

For the fiscal year 2024, Laurus Labs reported strong performance across its segments, with APIs continuing to be a major revenue driver. The company's strategic expansion into FDFs and CRAMS in recent years has proven successful, contributing to a more stable and diversified financial profile.

Laurus Labs demonstrates exceptional R&D capabilities, a cornerstone of its innovation strategy. The company inaugurated a substantial 200,000 sq ft R&D center in Hyderabad's Genome Valley in September 2024, significantly enhancing its research infrastructure.

This advanced facility is purpose-built to support cutting-edge technologies, including flow chemistry, biocatalysis, and the development of high-potency APIs, positioning Laurus Labs at the forefront of pharmaceutical innovation.

The company's active management of over 110 CDMO projects further highlights its dedication to driving innovation and delivering novel solutions for its clients.

Laurus Labs possesses a formidable manufacturing backbone, operating 12 plants with substantial capacity, including 10 billion drug products and 240 kiloliters of fermentation. This extensive infrastructure is a key strength, enabling efficient and large-scale production.

The company's manufacturing facilities are globally recognized, holding approvals from major regulatory bodies like the USFDA, WHO-Geneva, Japan-PDMA, UK-MHRA, EMA, and TGA. This broad regulatory acceptance is crucial for market access and underscores the high quality of their operations.

Reinforcing its commitment to quality, Laurus Labs' Hyderabad API manufacturing facility successfully passed a USFDA audit in September 2024 with zero Form 483 observations. This achievement is a testament to their robust compliance systems and operational excellence.

Growing CDMO Segment & Strategic Partnerships

Laurus Labs' Contract Development and Manufacturing Organization (CDMO) segment is a significant growth driver, with revenues surging by 85% in Q4 FY25. This expansion is fueled by a strategic focus on high-value services and an increasing global footprint.

The company is actively cultivating strategic partnerships to bolster its CDMO capabilities. Notable collaborations include a joint venture with KrKa Pharma and an equity investment from Eight Roads Ventures in Laurus Bio, both aimed at enhancing its market position and project pipeline.

- CDMO Revenue Growth: 85% increase in Q4 FY25.

- Key Partnerships: Joint venture with KrKa Pharma, Eight Roads Ventures investment in Laurus Bio.

- Strategic Focus: Expansion in high-value CDMO services and global presence.

- Future Outlook: Robust pipeline of complex projects supports long-term growth.

Positive Future Outlook & Capacity Expansion

Laurus Labs anticipates a significant turnaround following a demanding FY24. The company projects impressive compound annual growth rates (CAGR) for revenue at 23.2%, EBITDA at 51.1%, and profit after tax (PAT) at a remarkable 118.2% between FY24 and FY26E. This optimistic outlook is supported by a robust pipeline of new project deliveries and the successful expansion of its existing manufacturing capabilities.

The company's strategic investments are geared towards sustained growth and market leadership. Laurus Labs is actively expanding its operational footprint through substantial capital expenditures. These investments are focused on enhancing its capacity in key areas, including a new fermentation site and additional finished dosage form (FDF) manufacturing lines, demonstrating a clear commitment to capturing future market opportunities.

- Projected FY24-FY26E CAGRs: Revenue 23.2%, EBITDA 51.1%, PAT 118.2%.

- Growth Drivers: New project execution and scaling of existing capacities.

- Capacity Expansion: Investments in fermentation site and FDF manufacturing.

- Strategic Focus: Commitment to long-term growth and market penetration.

Laurus Labs' diversified business model, spanning APIs, FDFs, and CRAMS, provides a stable revenue foundation across various therapeutic areas. The company's integrated R&D and manufacturing capabilities, supported by a strong regulatory track record and recent USFDA audit success with zero observations in September 2024, are significant competitive advantages.

The CDMO segment is a key growth engine, evidenced by an 85% revenue increase in Q4 FY25, bolstered by strategic partnerships like the KrKa Pharma joint venture. Projections for FY24-FY26E show robust CAGRs: 23.2% for revenue, 51.1% for EBITDA, and 118.2% for PAT, driven by new project execution and capacity expansions.

| Metric | FY24 (Actual) | FY26E (Projected) | CAGR (FY24-FY26E) |

|---|---|---|---|

| Revenue | INR 5,137 Cr | INR 8,000 Cr (Est.) | 23.2% |

| EBITDA | INR 1,100 Cr (Est.) | INR 2,500 Cr (Est.) | 51.1% |

| PAT | INR 300 Cr (Est.) | INR 1,000 Cr (Est.) | 118.2% |

What is included in the product

This analysis details Laurus Labs's core competencies, areas for improvement, market expansion prospects, and potential industry headwinds.

Highlights Laurus Labs' competitive advantages and areas for improvement, enabling targeted strategic interventions.

Weaknesses

Laurus Labs faced a significant financial setback in fiscal year 2024, reporting a 16.6% year-on-year drop in revenue and an alarming 80% reduction in net profit. This performance was largely due to the cessation of a substantial one-time order for Paxlovid within its Contract Development and Manufacturing Organization (CDMO) segment, alongside challenging pricing conditions for other Active Pharmaceutical Ingredients (APIs).

Although the fourth quarter of fiscal year 2025 indicated a robust recovery, the overall results for FY24 underscored the company's susceptibility to the cyclical nature of major contracts and the volatility of market pricing dynamics in the API sector. This highlights a key weakness in its revenue stream predictability and profitability margins.

Laurus Labs faces significant weaknesses due to its exposure to regulatory scrutiny. In May 2024, the company received an untitled letter from the USFDA concerning its Laurus Synthesis API facility, highlighting potential compliance issues. This was followed by a Form 483 observation issued in January 2025 to its subsidiary, Laurus Generics Inc., indicating deviations from Current Good Manufacturing Practices (cGMP) and adverse drug experience (PADE) compliance.

These regulatory challenges can directly impact Laurus Labs' operational efficiency and market access. Such observations often lead to delays in the approval of new products and can even result in import bans, severely disrupting supply chains and revenue streams. The need to address these cGMP and PADE compliance issues also incurs substantial remediation costs, impacting the company's profitability and financial performance.

Laurus Labs' historical reliance on anti-retroviral (ARV) APIs presents a significant weakness. As of the first nine months of fiscal year 2024, ARV products accounted for over 40% of the company's revenue.

This substantial dependence on a single therapeutic area exposes Laurus Labs to considerable market risks. Fluctuations in ARV pricing, shifts in global health funding for HIV/AIDS initiatives like PEPFAR, or changes in treatment protocols could disproportionately impact the company's financial performance.

While Laurus Labs is actively pursuing diversification strategies, the ARV segment continues to represent a major portion of its business, underscoring the ongoing vulnerability to factors affecting this specific market.

Increased Debt Levels and Deteriorated Coverage Metrics

Laurus Labs' ambitious capital expenditure plans, particularly in expanding its manufacturing capabilities, have been partly financed through increased borrowing. This has led to a noticeable rise in its total debt, climbing from ₹976.20 crore in FY23 to ₹1117.76 crore by the end of FY24. This higher debt load directly translates into increased interest expenses, putting pressure on the company's bottom line.

Consequently, key debt coverage metrics have seen a deterioration. The interest coverage ratio, a crucial indicator of a company's ability to meet its interest obligations, experienced a significant decline in FY24. While the overall gearing levels are still considered manageable, this upward trend in debt and the associated weakening of coverage ratios can impact future profitability and limit financial maneuverability.

- Increased Debt: Total debt rose from ₹976.20 crore (FY23) to ₹1117.76 crore (FY24).

- Higher Interest Costs: The expanded debt burden directly results in increased interest payments.

- Deteriorated Coverage: The interest coverage ratio saw a notable decline in FY24.

- Financial Flexibility Impact: While gearing remains manageable, the debt increase affects profitability and future financial options.

Underutilized Manufacturing Capacity

A significant portion of Laurus Labs' manufacturing infrastructure remains underutilized. As of the first quarter of fiscal year 2025 (ending June 2024), roughly 40% of its total manufacturing capacity across all business segments was not yet operating at full potential. This presents a challenge as it means substantial capital investments are not yet generating optimal returns.

The current underutilization of these facilities directly impacts the company's operating leverage. Until these capacities are scaled up and contribute meaningfully to revenue generation, they can exert downward pressure on gross profit margins. This situation highlights a key area for operational improvement and strategic focus to enhance profitability.

- Underutilization: Approximately 40% of Laurus Labs' manufacturing capacity was not fully utilized as of June 2024.

- Capital Investment: Significant capital has been deployed into these capacities, which are currently not yielding their full potential return.

- Margin Impact: Underutilization can negatively affect operating leverage and gross profit margins until capacity utilization improves.

Laurus Labs' financial performance in FY24 was significantly impacted by the cessation of a large Paxlovid order and challenging API pricing, leading to a 16.6% revenue drop and an 80% net profit decline. Despite a Q4 FY25 recovery, this highlights revenue predictability and margin volatility weaknesses.

Regulatory issues, including a USFDA untitled letter in May 2024 and a Form 483 in January 2025 for its subsidiary, point to potential cGMP and PADE compliance weaknesses. These can delay product approvals and disrupt supply chains, necessitating costly remediation efforts.

The company's heavy reliance on ARV APIs, which constituted over 40% of revenue in the first nine months of FY24, exposes it to significant market risks from pricing shifts and funding changes in global health initiatives.

Laurus Labs' debt increased to ₹1117.76 crore in FY24 from ₹976.20 crore in FY23, raising interest expenses and weakening its interest coverage ratio, impacting profitability and financial flexibility.

As of June 2024, approximately 40% of Laurus Labs' manufacturing capacity remained underutilized, meaning substantial capital investments were not generating optimal returns, potentially pressuring gross profit margins.

| Metric | FY23 | FY24 | Change |

| Total Revenue | ₹5,817.50 crore | ₹4,856.50 crore | -16.6% |

| Net Profit | ₹656.70 crore | ₹131.30 crore | -80.0% |

| Total Debt | ₹976.20 crore | ₹1117.76 crore | +14.5% |

Same Document Delivered

Laurus Labs SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering a comprehensive look at Laurus Labs' Strengths, Weaknesses, Opportunities, and Threats. This ensures you receive exactly what you see, with all strategic insights intact.

Opportunities

The Contract Development and Manufacturing Organization (CDMO) market in India is set for significant expansion, with projections indicating it could double by 2029. This presents a considerable avenue for Laurus Labs to increase its market presence and revenue streams.

A key driver for this growth is the global trend of major pharmaceutical companies, often referred to as Big Pharma, actively outsourcing their manufacturing and development needs. This strategic shift is partly fueled by a desire to diversify supply chains, moving away from over-reliance on single regions like China.

Laurus Labs is well-positioned to capitalize on this opportunity. Its comprehensive, integrated service offerings, coupled with ongoing investments in expanding its capabilities, allow it to meet the evolving demands of global pharmaceutical clients and secure a more substantial share of the burgeoning CDMO market.

Laurus Labs is making significant strides in diversifying its business. Beyond its established presence in antiretroviral (ARV) Active Pharmaceutical Ingredients (APIs), the company is actively expanding into lucrative areas like oncology, animal health, and crop protection. This strategic move is designed to tap into higher-margin markets and create more resilient revenue streams.

The company is also investing heavily in cutting-edge therapeutic areas. With a Good Manufacturing Practice (GMP) facility currently under construction, Laurus Labs is positioning itself for growth in biologics, gene therapy (focusing on plasmid, vector, and antibody-drug conjugation development), and cell therapy. This forward-looking approach, including its stake in associate ImmunoACT, signals a commitment to advanced medical solutions and future revenue growth.

Laurus Labs is actively pursuing market penetration in key emerging economies, aiming to broaden its customer base and diversify revenue streams. This strategic move is designed to mitigate risks associated with over-reliance on existing markets, fostering a more resilient global presence.

The company's Generic Finished Dosage Form (FDF) division is a primary focus for expansion, with a particular emphasis on the North American market. This targeted approach leverages established demand and regulatory pathways to drive growth.

By forming strategic alliances and introducing innovative products, Laurus Labs can significantly enhance its ability to reach new geographies and customer segments. For instance, in the fiscal year 2023, Laurus Labs reported a substantial increase in its FDF revenues, signaling positive traction in its expansion efforts.

Strategic Investments in R&D and Capacity

Laurus Labs has a significant opportunity to leverage its ongoing investments in research and development (R&D) and manufacturing capacity. The company's commitment to continuous innovation is evident in its strategic expansion plans.

The recent opening of a new R&D center, alongside planned expansions including a fermentation facility and additional Finished Dosage Form (FDF) manufacturing lines, positions Laurus Labs to tackle more complex chemistries and emerging advanced modalities. These investments are critical for building a strong product pipeline and securing lucrative, long-term contracts with leading global pharmaceutical innovators.

- R&D Investment: Continued allocation of resources to R&D fuels the development of novel products and processes.

- Capacity Expansion: The new fermentation facility and additional FDF lines will boost production capabilities for complex molecules.

- Pipeline Growth: These investments are essential for developing a robust pipeline of new chemical entities (NCEs) and generic drugs.

- Strategic Partnerships: Enhanced capabilities will attract and secure long-term contracts with global pharmaceutical companies.

Strong Order Book and Project Pipeline

Laurus Labs is experiencing significant growth in its Contract Development and Manufacturing Organization (CDMO) business, boasting a robust pipeline of projects. Many of these are in late-stage clinical development, indicating strong potential for near-term revenue generation.

The company has secured several integrated Contract Manufacturing Organization (CMO) agreements. Furthermore, Laurus Labs is observing heightened interest from both new and existing major pharmaceutical clients for early-stage development projects. This strong order book is a key driver for future revenue growth and sustained expansion.

- Project Pipeline Strength: A healthy and expanding CDMO project pipeline, with a notable number of late-phase clinical projects.

- Monetization Potential: High near-term monetization potential from these late-phase projects.

- CMO Contracts: Multiple integrated CMO contracts have been signed, demonstrating client confidence.

- Customer Interest: Strong interest from big pharma for early-stage projects, signaling future business.

The burgeoning CDMO market in India, projected to double by 2029, offers Laurus Labs a substantial opportunity for growth, driven by global pharmaceutical companies increasingly outsourcing manufacturing and development to diversify supply chains away from single regions.

Laurus Labs is strategically expanding into higher-margin markets such as oncology, animal health, and crop protection, while also investing in advanced therapeutic areas like biologics and gene therapy, including its stake in ImmunoACT, to build future revenue streams.

The company's Generic Finished Dosage Form (FDF) division is targeting expansion, particularly in North America, with fiscal year 2023 showing positive revenue traction, bolstered by strategic alliances and product innovation to reach new geographies.

Significant investments in R&D and manufacturing capacity, including a new R&D center and planned fermentation and FDF facilities, position Laurus Labs to handle complex chemistries and advanced modalities, securing long-term contracts with global pharmaceutical innovators.

Laurus Labs' CDMO business shows strong momentum with a robust pipeline of late-stage clinical projects, alongside multiple integrated CMO agreements and growing interest from major pharmaceutical clients for early-stage development, indicating strong near-term revenue potential.

Threats

Laurus Labs faces significant pressure in its Contract Development and Manufacturing Organization (CDMO) business due to increasing competition. Both established global pharmaceutical companies and emerging domestic players are vying for market share, creating a more crowded and challenging environment.

This intensified competition can trigger price wars, potentially impacting Laurus Labs' profitability by squeezing its net margins. For instance, in FY23, the CDMO segment revenue grew by 28% to INR 1,496 crore, but maintaining such growth amidst price pressures requires strategic maneuvering.

To navigate this threat, Laurus Labs must focus on differentiating its services and upholding cost efficiencies. Continuous innovation and a strong value proposition are crucial for sustaining its competitive edge and profitability in the dynamic CDMO market.

Laurus Labs navigates a landscape of evolving regulatory demands, with heightened global scrutiny posing a consistent threat. For instance, the USFDA's recent issuance of warning letters and Form 483 observations underscores the critical need for stringent quality compliance, which can directly translate into increased operational costs and potential disruptions to manufacturing if not addressed promptly.

These compliance challenges can have significant financial repercussions, ranging from delayed product approvals to outright market access restrictions, thereby impacting Laurus Labs' revenue streams and overall profitability. The company's ability to maintain high standards in its manufacturing processes is paramount to mitigating these risks.

Furthermore, the increasing trend of global protectionism and the imposition of unpredictable trade barriers present another substantial challenge. Such policies could impede Laurus Labs' access to crucial international markets, thereby hindering its projected volume growth and casting a shadow over its future revenue prospects.

The generic API segment, a key area for Laurus Labs, has already seen pricing weakness, which directly impacted their revenue in FY24. For instance, the company reported a revenue of INR 5,124 crore for FY24, a notable decrease from INR 5,524 crore in FY23, partly attributed to these pricing pressures.

Continued intense competition and shifts in demand within the generic API market are likely to sustain this pricing pressure. This could further erode Laurus Labs' profit margins if not effectively managed.

To counter this, Laurus Labs must focus on optimizing its cost structure and strategically target generic APIs that offer higher value or possess unique market advantages. This approach is vital for safeguarding profitability against ongoing market challenges.

Changes in Global Funding for ARV

Laurus Labs' substantial historical reliance on Anti-Retroviral (ARV) APIs and formulations makes it vulnerable to shifts in global funding for HIV/AIDS initiatives. Programs like the President's Emergency Plan for AIDS Relief (PEPFAR) are critical, and any significant reduction in their funding could directly impact Laurus Labs' core business segment. While the company has expressed confidence in its ability to navigate procurement without major funding disruptions, a drastic cut in these vital global health budgets presents a tangible threat to demand and revenue streams.

For instance, PEPFAR has been a cornerstone in global HIV/AIDS response, and its funding levels are subject to political and economic considerations in donor countries. Changes in these commitments, even if not directly impacting Laurus Labs' procurement in the short term, could signal a broader slowdown in the market. The company's revenue from ARV formulations, which historically formed a significant portion of its sales, could see a direct impact if global demand softens due to reduced funding. In 2023, Laurus Labs reported its ARV segment contributed a substantial part of its revenue, highlighting the sensitivity to external funding environments.

- Global health funding shifts: Changes in major donor commitments to HIV/AIDS relief programs, like PEPFAR, directly influence the market for ARVs.

- Impact on demand: Reduced funding can lead to decreased procurement of ARV APIs and finished formulations, affecting sales volumes for Laurus Labs.

- Revenue vulnerability: A significant portion of Laurus Labs' revenue is historically tied to its ARV business, making it susceptible to funding fluctuations.

Industry Shifts to Advanced Modalities

The pharmaceutical landscape is rapidly advancing, with a growing emphasis on sophisticated treatments such as next-generation biologics and cell and gene therapies. While Laurus Labs is actively investing in these emerging fields, a swift and substantial pivot away from small-molecule Active Pharmaceutical Ingredients (APIs), which represent its primary strength, could pose a risk. This is particularly true if the company's diversification and expansion initiatives do not align with the accelerating pace of market evolution.

For instance, the global biologics market was valued at approximately USD 372.7 billion in 2023 and is projected to reach USD 671.5 billion by 2030, indicating a significant shift in investment and R&D focus within the industry. Laurus Labs' current revenue heavily relies on its small molecule API business, which contributed a substantial portion of its sales in recent years. However, if the industry's demand for advanced modalities outpaces Laurus Labs' ability to scale its own capabilities in these areas, it could face competitive disadvantages.

- Market Shift: The pharmaceutical industry's increasing focus on biologics, cell, and gene therapies represents a significant industry shift.

- Laurus Labs' Position: While Laurus Labs is investing in these advanced areas, its core competency remains in small-molecule APIs.

- Potential Exposure: A rapid industry-wide move away from small molecules could leave Laurus Labs vulnerable if its diversification efforts lag behind market demand.

Intensified competition within the CDMO segment, marked by aggressive pricing strategies from both global and domestic players, poses a significant threat to Laurus Labs' profitability. This pressure was evident in FY24, where despite revenue growth in certain segments, overall revenue saw a dip, signaling the impact of market dynamics.

The company also faces the persistent threat of evolving regulatory requirements, with stringent compliance demands from bodies like the USFDA potentially increasing operational costs and risking production disruptions. Furthermore, global protectionist policies and trade barriers could restrict market access, impacting volume growth and future revenue projections.

Laurus Labs' reliance on ARV APIs makes it susceptible to shifts in global health funding for HIV/AIDS programs, such as PEPFAR. Any reduction in these critical budgets could directly affect demand and revenue streams, especially given that ARVs historically represent a substantial portion of the company's sales.

The rapid advancement of the pharmaceutical industry towards biologics and gene therapies presents a challenge to Laurus Labs' core strength in small-molecule APIs. If the company's diversification into these advanced modalities does not keep pace with market evolution, it could face competitive disadvantages.

SWOT Analysis Data Sources

This Laurus Labs SWOT analysis is built upon a foundation of credible data, including their official financial statements, comprehensive market research reports, and insights from industry experts. This multi-faceted approach ensures a robust and accurate assessment of the company's strategic position.