Laurus Labs Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Laurus Labs Bundle

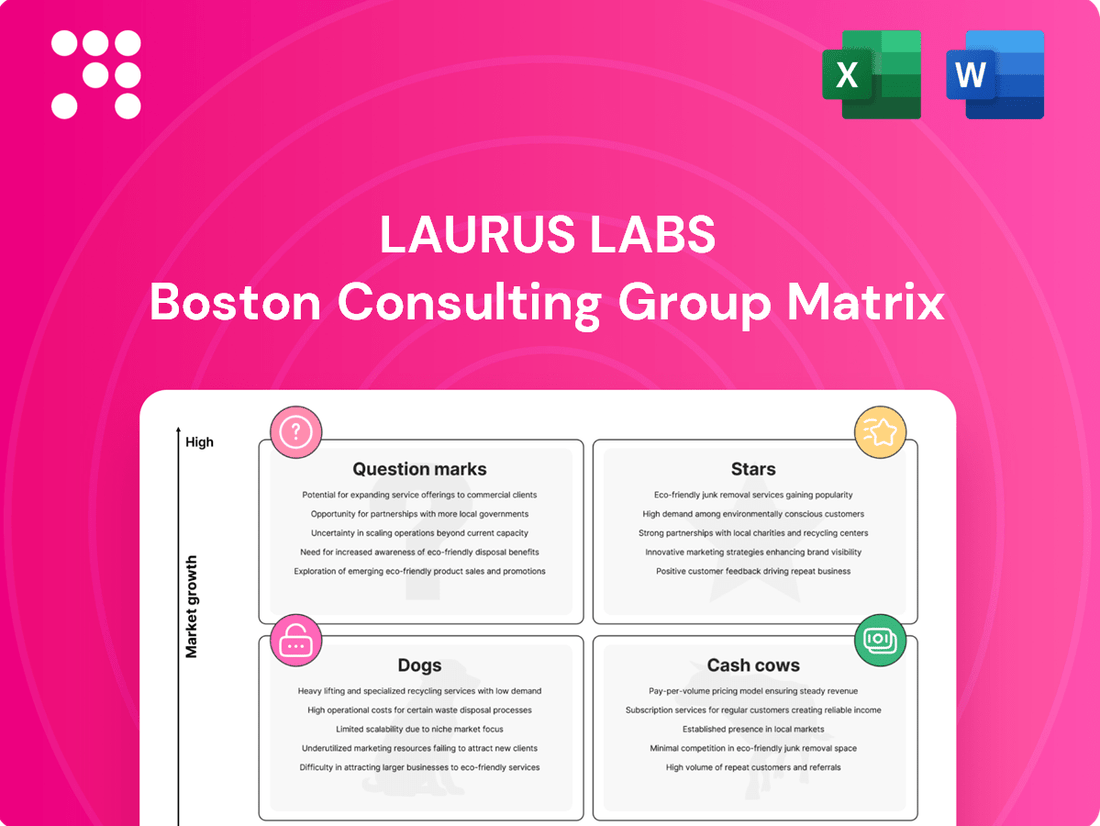

Curious about Laurus Labs' strategic positioning? Our BCG Matrix preview highlights key product categories, offering a glimpse into their market share and growth potential. Understand where their "Stars" shine and where their "Cash Cows" are generating revenue.

Ready to transform this insight into action? Purchase the full Laurus Labs BCG Matrix report for a comprehensive quadrant-by-quadrant analysis, including detailed data, actionable recommendations, and a clear roadmap for optimizing your investment and product portfolio.

Stars

Laurus Labs' Contract Development and Manufacturing Organization (CDMO) for small molecules is a significant growth driver. In fiscal year 2025, this segment experienced a remarkable 42% revenue increase, now representing 28% of the company's total revenue. This expansion highlights Laurus Labs' growing presence in the rapidly expanding CDMO market, particularly for complex active pharmaceutical ingredients (APIs).

The strong performance is fueled by robust demand for intricate API development and manufacturing services, especially for projects in late-stage clinical trials and commercial production. Laurus Labs is actively bolstering its capabilities in this area, evidenced by the September 2024 inauguration of a new research and development facility. This investment is geared towards enhancing expertise in cutting-edge areas like flow chemistry, high-potency API development, and continuous manufacturing processes.

Laurus Labs' integrated CDMO services, covering everything from initial research and development to full-scale commercial manufacturing, make it a comprehensive solution provider in the growing small molecule CDMO sector. This end-to-end capability allows Laurus to meet intricate client demands and secure enduring partnerships with significant players, indicating a strong presence in this niche market.

Laurus Labs is significantly bolstering its high-potency API (HiPotent API) development capabilities, evidenced by its new R&D facility and sustained capital expenditure. This strategic focus targets a rapidly expanding segment of the pharmaceutical market, demanding specialized infrastructure and expertise. Laurus is positioned to capture a substantial share of this niche, leveraging its advanced technological platforms.

The company boasts one of India's largest manufacturing capacities dedicated to HiPotent APIs, a critical differentiator in this specialized field. This scale, combined with stringent quality control and advanced containment technologies, provides a strong competitive edge. For instance, by 2024, Laurus has invested heavily in expanding its HiPotent API manufacturing lines, aiming to meet the growing global demand for complex oncology and other specialized therapeutics.

Flow Chemistry and Biocatalysis

Laurus Labs is making significant strides in flow chemistry and biocatalysis, setting itself apart from many Indian competitors. This investment in advanced manufacturing technologies positions them as a key partner for innovator companies seeking alternatives to traditional production methods.

These areas, flow chemistry and biocatalysis, are experiencing rapid growth within the pharmaceutical manufacturing sector. Laurus Labs is actively cultivating a strong market presence and technical expertise in these high-potential fields.

- Flow Chemistry: Laurus Labs has successfully developed and scaled its intellectual property in flow chemistry, offering a more efficient and controlled manufacturing process.

- Biocatalysis Investment: The company is actively investing in biocatalysis, leveraging enzymes for chemical synthesis, which can lead to greener and more selective reactions.

- Market Differentiation: These advanced technologies differentiate Laurus Labs from its Indian peers, attracting innovator partners looking for cutting-edge manufacturing solutions.

- Strategic Focus: The company's strategic emphasis on these platforms is designed to secure significant market share leadership in the evolving pharmaceutical manufacturing landscape.

Late-Phase and Commercial CDMO Projects

Laurus Labs is seeing robust growth from its late-phase and commercial Contract Development and Manufacturing Organization (CDMO) projects. These initiatives are a key driver for faster revenue growth and improved profit margins.

The company’s strong performance in these advanced stages of drug development and manufacturing reflects its significant capacity expansion over recent years. This positions Laurus Labs as a major player with a substantial market share in these critical areas.

The consistent demand and the tendency for clients to remain with Laurus Labs for ongoing projects highlight its leading role in meeting complex client requirements.

- Revenue Contribution: Late-phase and commercial CDMO projects are significantly boosting Laurus Labs' overall revenue.

- Margin Expansion: These projects are directly contributing to an increase in the company's profit margins.

- Market Share: The strong performance indicates a high market share in the crucial late stages of drug development and manufacturing.

- Capacity Utilization: Laurus Labs is effectively leveraging its substantial investments in manufacturing capacity made in previous years.

The small molecule CDMO segment of Laurus Labs, a key growth engine, saw a 42% revenue surge in fiscal year 2025, now accounting for 28% of total revenue. This expansion is driven by strong demand for complex API development and manufacturing, particularly for late-stage clinical trials and commercial production. Laurus Labs is enhancing its capabilities through investments like its September 2024 R&D facility inauguration, focusing on flow chemistry and high-potency APIs.

Laurus Labs' small molecule CDMO operations are positioned as Stars in the BCG Matrix due to their high growth and strong market position. The segment's substantial revenue contribution and rapid growth rate, evidenced by a 42% increase in FY25, clearly indicate its Star status. This performance is underpinned by significant investments in advanced technologies like flow chemistry and biocatalysis, alongside expanded high-potency API manufacturing capacity.

| Segment | FY25 Revenue Growth | Contribution to Total Revenue | BCG Matrix Classification |

| Small Molecule CDMO | 42% | 28% | Star |

What is included in the product

This BCG Matrix analysis categorizes Laurus Labs' business units to guide strategic decisions on investment and resource allocation.

A clear BCG Matrix visualizes Laurus Labs' portfolio, relieving the pain of uncertainty by highlighting growth opportunities and areas needing strategic focus.

Cash Cows

Laurus Labs is a global leader in supplying antiretroviral (ARV) active pharmaceutical ingredients (APIs). This segment represents a mature market where the company enjoys a substantial market share.

Although ARVs contribute a smaller percentage to Laurus Labs' overall revenue as the company diversifies, pricing has remained steady. This stability ensures a reliable and consistent generation of cash flow.

In 2023, Laurus Labs reported that its ARV business continued to be a strong performer, contributing significantly to its overall financial health. This established business is crucial for funding investments in new, high-growth opportunities within the company's portfolio.

Laurus Labs' established generic API portfolio, extending beyond antiretrovirals (ARVs) into cardiovascular and gastrointestinal therapeutics, represents a significant cash cow. These products thrive in mature generic markets where Laurus Labs holds a strong, established presence.

The company's deep market penetration in these segments translates into consistent, high-profit margins. For instance, in the fiscal year ending March 31, 2024, Laurus Labs reported a robust performance in its Generic APIs business, contributing significantly to overall revenue and profitability, demonstrating the stability and cash-generating power of this segment.

The Finished Dosage Form (FDF) segment, primarily driven by Antiretroviral (ARV) FDFs, is a cornerstone of Laurus Labs' Cash Cows. This segment benefits from Laurus's established high market share in a mature product category. The company's operational prowess here translates into robust profit margins and a reliable stream of cash, even with subdued growth in the broader ARV market.

Well-Utilized Manufacturing Facilities

Laurus Labs' well-utilized manufacturing facilities are true cash cows. These sites, boasting approvals from stringent bodies like the USFDA, WHO-Geneva, and EMA, operate at peak efficiency. This high level of regulatory compliance and operational capacity means they are consistently generating significant cash flow.

The core API and FDF production facilities, in particular, are mature operations. Their optimized processes and high asset utilization rates directly translate into robust operating profit margins, making them reliable income generators for the company. For instance, in the fiscal year ending March 31, 2024, Laurus Labs reported a consolidated revenue of INR 5,527 crore, with a significant portion stemming from these established manufacturing strengths.

- High Regulatory Approvals: Facilities approved by USFDA, WHO-Geneva, EMA.

- Mature Operations: Core API and FDF production sites are established cash generators.

- Optimized Processes: High asset utilization leads to improved operating profit margins.

- Financial Contribution: These facilities underpin substantial revenue generation, contributing to the company's overall financial health.

Long-Standing Client Relationships

Laurus Labs' established API and FDF businesses benefit from long-standing relationships with over 1,800 global clients, including major pharmaceutical firms. This extensive network translates to a significant market share within stable, mature segments, ensuring predictable revenue and consistent cash flow. The inherent stickiness of these contracts minimizes the necessity for intensive new business development, reinforcing their position as cash cows.

These enduring client partnerships are a testament to Laurus Labs' reliability and quality in established product lines. For instance, in fiscal year 2024, the company reported strong performance in its Generic Finished Dosage Forms (FDF) segment, driven by its established product portfolio and client base. This stability allows for efficient capital allocation towards growth initiatives in other business areas.

- 1,800+ Global Clients: A broad and stable customer base across the pharmaceutical industry.

- Predictable Revenue Streams: Consistent cash flow generated from mature, established businesses.

- High Market Share in Stable Segments: Dominance in established API and FDF markets.

- Reduced Business Development Costs: Client retention in mature segments lowers the need for extensive new client acquisition.

Laurus Labs' established generic API and FDF businesses are prime examples of cash cows. These segments operate in mature markets where the company holds significant market share, ensuring consistent revenue and profit margins. For instance, in the fiscal year ending March 31, 2024, the company's Generic APIs business demonstrated strong performance, contributing substantially to overall profitability.

The company's manufacturing facilities, boasting approvals from stringent regulatory bodies like the USFDA and EMA, are also key cash cows. Their high operational efficiency and asset utilization lead to robust profit margins, translating into reliable cash flow generation. This financial stability from established segments allows Laurus Labs to fund investments in newer, high-growth areas.

| Business Segment | Market Maturity | Laurus Labs' Market Share | Cash Flow Generation |

| Generic APIs | Mature | Substantial | Consistent and High |

| Finished Dosage Forms (FDF) - ARVs | Mature | High | Reliable |

| Manufacturing Facilities | N/A (Operational Strength) | N/A | Significant |

Delivered as Shown

Laurus Labs BCG Matrix

The Laurus Labs BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after your purchase. This comprehensive report, meticulously crafted with industry-standard analysis, will be delivered without any watermarks or sample content, ensuring you get a professional-grade tool ready for strategic decision-making. You can trust that the insights and visualizations presented here are precisely what you will download, allowing for immediate integration into your business planning and presentations. This is the complete, unedited BCG Matrix analysis, designed to provide actionable intelligence on Laurus Labs' product portfolio.

Dogs

Laurus Labs has strategically exited its low-margin, non-core nutrition businesses within the Bio segment. This move is consistent with the BCG matrix's guidance for 'Dogs,' which are businesses with low market share and low growth, often recommended for divestment or liquidation to reallocate resources.

These discontinued operations likely represented areas where Laurus Labs lacked a competitive advantage or saw limited future potential, thereby freeing up capital and management focus for more promising ventures. For instance, in fiscal year 2023, Laurus Labs reported a significant restructuring effort, which included the rationalization of certain product lines, aligning with this divestment strategy.

Within Laurus Labs' portfolio, oncology APIs represent a segment that has recently faced headwinds. Specifically, sales for oncology APIs saw a substantial decrease of 58% year-on-year in the second quarter of fiscal year 2025. This sharp decline was attributed to the rescheduling of supplies, suggesting potential issues with demand or production timelines for certain products in this category.

This performance indicates that some oncology API products may indeed be classified as Dogs in the BCG matrix. Such products typically possess a low market share and operate in a slow-growing or declining market. The significant sales drop in Q2 FY25 points to challenges in market penetration or competitive pressures, making these products candidates for a strategic review to determine their future viability.

Legacy API products, especially those experiencing significant price declines, might be categorized as Dogs in the BCG matrix. These could represent older or commoditized offerings with a small market share in markets that aren't growing much. For instance, if Laurus Labs had a specific older antibiotic API with declining demand and multiple competitors, it might fit this profile.

The company's stated strategy to shift its antiretroviral (ARV) capacity towards more profitable opportunities hints at a move away from less attractive business segments. This suggests that some of their legacy API products might be barely covering their costs, diverting valuable resources and management focus from areas with greater growth potential.

Initial Ventures with Poor Market Adoption

Laurus Labs, like many innovative companies, has likely experienced ventures with poor market adoption, which would be categorized as Dogs in the BCG Matrix. These are often early-stage projects or product launches that, despite initial investment, fail to capture significant market share or demonstrate robust growth. While specific past failures aren't detailed in recent public disclosures, the nature of continuous R&D means some initiatives will inevitably underperform.

These underperforming ventures typically consume resources without generating substantial returns, acting as cash traps. For instance, a hypothetical scenario could involve a new chemical intermediate that faced intense competition or unexpected regulatory hurdles, leading to its discontinuation. Such outcomes are a natural part of a diversified portfolio, especially in the dynamic pharmaceutical and chemical sectors.

- Low Market Share: Ventures in this category struggle to gain traction, often holding a minimal percentage of their target market.

- Low Growth Rate: The markets for these products or services are typically stagnant or declining, offering little potential for expansion.

- Resource Consumption: They can become cash traps, requiring ongoing investment for maintenance or minimal operations without generating profits.

- Strategic Re-evaluation: Companies often re-evaluate these ventures, leading to divestment, scaling down, or complete abandonment to reallocate capital to more promising areas.

Inefficiently Utilized Older Capacities

Inefficiently utilized older capacities within Laurus Labs could be classified as Dogs in the BCG Matrix. These are manufacturing lines or older assets that are not running at their best efficiency, perhaps because the products they make are less in demand now, or the market has shifted.

While Laurus is actively working to make sure all its assets are used better, any older, less efficient ones would be seen as investments that don't bring in much profit and don't have much chance to grow.

These assets might need a lot of upkeep relative to the money they actually make, making them a drain on resources.

- Low Utilization Rates: Older facilities might be operating at significantly lower capacity utilization than newer, more advanced plants. For instance, if a facility built for a specific older product line now only produces at 40% capacity due to reduced market demand.

- High Maintenance Costs: Older equipment often requires more frequent and costly maintenance. If maintenance expenses for an older production line exceed 15% of its revenue contribution, it could be indicative of inefficiency.

- Limited Future Growth Potential: These capacities are unlikely to be upgraded or expanded due to technological obsolescence or lack of market foresight, suggesting minimal to no future revenue growth prospects.

Laurus Labs' strategic exit from its nutrition business within the Bio segment aligns with the BCG matrix's classification of 'Dogs.' These are businesses with low market share and low growth, typically recommended for divestment. This move frees up capital and management focus for more promising ventures, as seen in their fiscal year 2023 restructuring efforts that rationalized product lines.

The significant 58% year-on-year sales decline in oncology APIs during Q2 FY25, attributed to supply rescheduling, suggests these products may also be classified as Dogs. This sharp drop indicates challenges in market penetration or competitive pressures, making them candidates for a strategic review.

Legacy API products facing significant price declines and low demand, such as a hypothetical older antibiotic API with multiple competitors, would also fit the Dog profile. These products consume resources without substantial returns, acting as cash traps.

Inefficiently utilized older manufacturing capacities can also be considered Dogs. These assets might have low utilization rates and high maintenance costs relative to their revenue, with limited future growth potential, requiring ongoing investment without significant profit generation.

Question Marks

Laurus Bio, a segment focused on precision fermentation and other biotech ventures, is positioned as a potential Star in Laurus Labs' BCG matrix. While it currently represents a modest 3% of Laurus Labs' revenue as of Q2 FY24, its high-growth potential is undeniable.

Significant equity infusions are fueling Laurus Bio's expansion, with new facilities slated for commercialization by the close of 2026. This substantial investment phase is crucial for establishing a strong market presence and capturing future revenue streams.

The success of these investments will determine if Laurus Bio can transition from a question mark to a Star, commanding a larger market share and becoming a significant revenue driver for the parent company.

Laurus Labs is strategically expanding its Finished Dosage Forms (FDFs) presence in developed markets, particularly the US, with several recent launches demonstrating positive early momentum. These new products are entering established, competitive landscapes, necessitating substantial investment in marketing and distribution to secure market penetration and build brand recognition.

The company's focus on these high-potential, albeit competitive, developed markets is crucial for its growth trajectory. For example, in 2024, Laurus Labs has targeted specific therapeutic areas in the US where it aims to capture market share, a move that requires robust financial backing for sales force expansion and promotional activities.

The successful adoption and growth of these new FDF launches are pivotal for Laurus Labs' portfolio evolution. Their performance will directly influence their classification, ideally moving them from a question mark status to becoming stars within the company's strategic matrix, indicating strong market growth and a solid competitive position.

Laurus Labs' strategic move with KRKA Pharma positions its Finished Dosage Formulations (FDF) business in the 'Question Marks' quadrant of the BCG Matrix. This joint venture targets new, high-growth markets, including India, with a new manufacturing facility slated for June 2025.

This venture represents a significant investment in expanding Laurus Labs' geographical and product reach. While these new markets offer substantial growth potential, Laurus is currently in the early stages of establishing its presence and building market share, necessitating careful resource allocation to foster growth.

Animal Health and Crop Protection Intermediates

Laurus Labs is strategically expanding into the animal health and crop protection sectors, areas identified as potential high-growth markets. The company is actively enhancing its animal health manufacturing capabilities and aims to secure qualification for its crop protection intermediate facility by the close of fiscal year 2025.

These ventures represent new market entries where Laurus Labs is currently establishing its presence, implying a low initial market share. Significant capital investment will be crucial for building a robust market position and achieving substantial growth in these segments.

- Animal Health Expansion: Laurus Labs is investing in its animal health facilities to cater to a growing global demand.

- Crop Protection Focus: Targeting qualification for crop protection intermediates by end of FY25, indicating a move into a new, potentially lucrative market.

- Market Entry Strategy: These are new forays with high growth potential but require substantial investment to gain market share, positioning them as potential future 'Stars' in the BCG matrix.

- Investment Requirement: Success hinges on significant capital deployment to establish a strong competitive footing and capture market share.

Emerging Technologies (e.g., CAR-T Cell Therapy, Gene Therapy)

Laurus Labs is strategically positioning itself in emerging technologies like CAR-T cell therapy and gene therapy, viewing them as potential game-changers. These areas, while currently representing a small portion of their market presence, are characterized by high innovation and significant growth potential.

The company's investment in CAR-T cell therapy via ImmunoAct and its in-licensing of gene therapy assets from IIT Kanpur underscore a commitment to pioneering biotechnology. These ventures require substantial research and development funding, reflecting their status as question marks in the BCG matrix – high risk, high reward investments.

- Investment in ImmunoAct: Laurus Labs has invested in ImmunoAct, a company focused on CAR-T cell therapy, signaling a move into advanced oncology treatments.

- Gene Therapy In-licensing: The acquisition of gene therapy assets from IIT Kanpur demonstrates an interest in genetic disease treatment modalities.

- Nascent Market Share: Despite the strategic importance, these technologies currently hold a very small market share for Laurus Labs.

- High R&D Expenditure: These initiatives are capital-intensive, demanding significant R&D investment with the expectation of future revenue transformation.

Laurus Bio, Laurus Labs' foray into precision fermentation and biotech, is currently a question mark. While it represented a modest 3% of revenue in Q2 FY24, significant investments are being made, with new facilities expected by the close of 2026. Its success will determine if it can evolve into a Star.

The company's expansion into developed markets with its Finished Dosage Forms (FDFs) also places it in the question mark category. For instance, in 2024, Laurus Labs launched several products in the US, a competitive landscape requiring substantial marketing investment to gain traction.

The joint venture with KRKA Pharma for FDFs targets new markets like India, with a new facility planned for June 2025. This venture is in its nascent stages, necessitating careful resource allocation to build market share.

Laurus Labs' ventures into animal health and crop protection are also question marks. The company is enhancing animal health manufacturing and aims for crop protection intermediate facility qualification by FY25, requiring significant capital to establish a market presence.

Emerging technologies like CAR-T cell therapy (via ImmunoAct) and gene therapy (in-licensed from IIT Kanpur) are high-risk, high-reward question marks. These capital-intensive initiatives demand substantial R&D funding for future revenue transformation.

| Business Segment | BCG Category | Key Developments/Status | Investment Focus | Market Share Potential |

| Laurus Bio | Question Mark | Modest 3% revenue (Q2 FY24), new facilities by end of 2026 | Precision fermentation, biotech ventures | High growth potential, transitioning to Star |

| Finished Dosage Forms (US Market) | Question Mark | Recent launches in 2024, competitive landscape | Marketing, distribution expansion | Securing market penetration |

| FDFs (KRKA JV) | Question Mark | New facility in India by June 2025 | Geographical and product reach expansion | Building market share in new territories |

| Animal Health & Crop Protection | Question Mark | Animal health manufacturing enhancement, crop protection facility qualification by FY25 | Capital investment for market establishment | Entering new, high-growth sectors |

| CAR-T & Gene Therapy | Question Mark | Investment in ImmunoAct, in-licensing from IIT Kanpur | High R&D expenditure, pioneering biotechnology | Nascent market share, significant future potential |

BCG Matrix Data Sources

Our Laurus Labs BCG Matrix leverages comprehensive data from financial reports, market research, and internal performance metrics. This ensures a robust analysis of product portfolio strength and market dynamics.