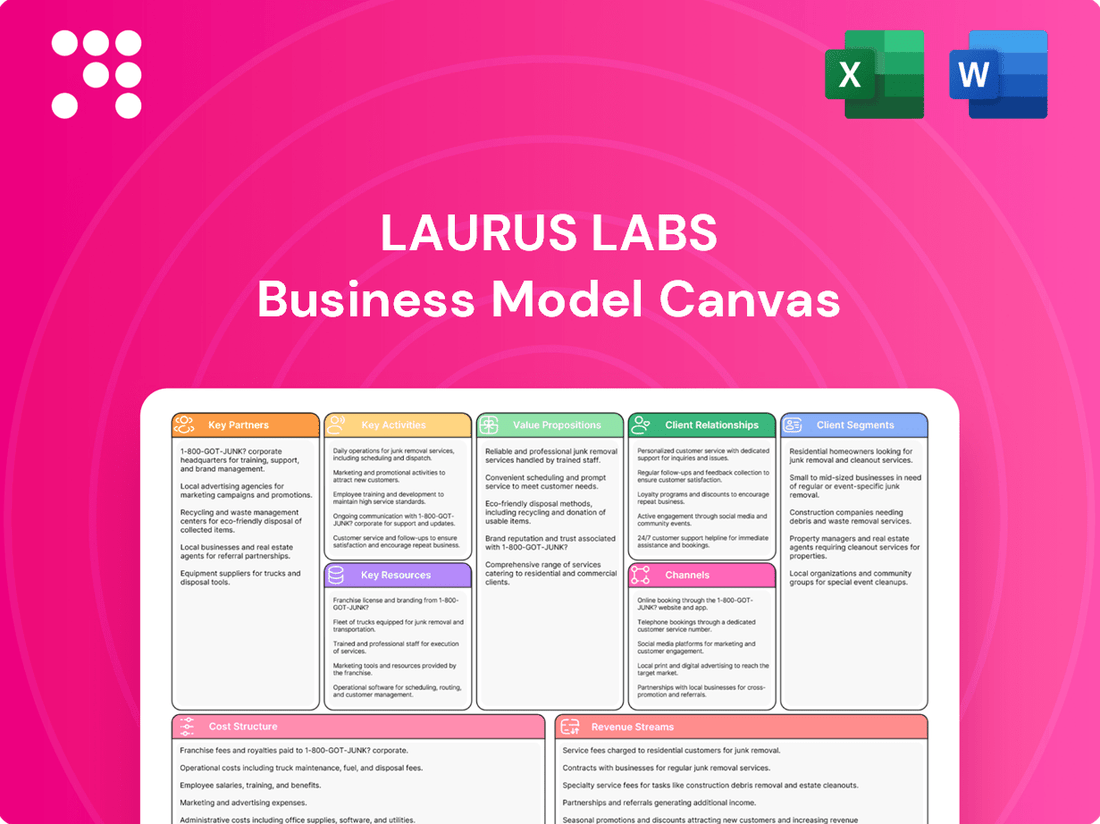

Laurus Labs Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Laurus Labs Bundle

Unlock the strategic blueprint of Laurus Labs's success with our comprehensive Business Model Canvas. This detailed analysis dissects their customer segments, value propositions, and revenue streams, offering a clear roadmap to their market dominance. Ideal for aspiring pharmaceutical leaders and strategic planners seeking to emulate proven growth tactics.

Partnerships

Laurus Labs cultivates key partnerships with major global pharmaceutical giants, acting as a crucial supplier of Active Pharmaceutical Ingredients (APIs) and Finished Dosage Forms (FDFs). These collaborations are often cemented by multi-year supply agreements, providing Laurus with predictable revenue streams and fostering joint development initiatives.

For instance, in fiscal year 2024, Laurus Labs reported significant revenue contributions from its long-standing relationships with these multinational corporations, underscoring the strategic importance of these alliances. The company’s commitment to stringent quality control and reliable delivery has been instrumental in solidifying these vital partnerships, ensuring sustained demand for its pharmaceutical components.

Laurus Labs actively partners with leading global pharmaceutical and biotechnology companies, offering comprehensive Contract Research and Manufacturing Services (CRAMS). These collaborations are built on providing specialized services like custom synthesis, intricate process development, and large-scale manufacturing, all powered by Laurus Labs' robust research and development expertise and advanced manufacturing infrastructure.

These strategic alliances are vital for Laurus Labs, particularly in nurturing early-stage drug development projects and consistently expanding its project pipeline. For instance, in the fiscal year 2024, the company continued to secure significant contracts within its CRAMS segment, contributing to its revenue diversification and solidifying its position as a preferred partner in the global pharmaceutical ecosystem.

Laurus Labs actively partners with technology firms and academic institutions to bolster its research and development efforts and integrate cutting-edge manufacturing processes. A notable collaboration involves Willow Biosciences, utilizing AI-driven bio-based methods for Active Pharmaceutical Ingredient (API) production, targeting improved sustainability and cost efficiency.

Further strengthening its innovation pipeline, Laurus Labs is engaged in a strategic alliance with IIT Kanpur, focusing on the development of gene therapy assets. These partnerships are crucial for Laurus Labs' commitment to advancing pharmaceutical manufacturing and therapeutic solutions.

Raw Material and Intermediate Suppliers

Laurus Labs cultivates strategic alliances with suppliers of essential raw materials and advanced intermediates to ensure a resilient supply chain. These collaborations are vital for controlling procurement expenses and maintaining consistent production of Active Pharmaceutical Ingredients (APIs) and Finished Dosage Forms (FDFs).

The company diversifies its supplier base, engaging both domestic and international vendors to mitigate risks and secure competitive pricing. For instance, in fiscal year 2023, Laurus Labs reported that its procurement strategies helped manage input costs effectively, contributing to its overall financial performance.

- Key raw material suppliers are crucial for Laurus Labs' API and FDF manufacturing operations.

- Partnerships focus on cost management and uninterrupted production flow.

- Sourcing strategies involve both Indian and global vendors.

- In FY23, the company emphasized strengthening supplier relationships to enhance supply chain stability.

Joint Ventures and Strategic Investments

Laurus Labs leverages joint ventures to broaden its market access and diversify its product offerings. A notable example is their collaboration with Slovenia's Krka, aimed at manufacturing finished dosage forms for untapped markets. This strategic alliance allows Laurus Labs to tap into Krka's established distribution networks.

Strategic investments are another cornerstone of Laurus Labs' partnership strategy. The company invested in ImmunoACT, a company specializing in cell and gene therapies. This move bolsters Laurus Labs' presence in cutting-edge therapeutic fields, reflecting a forward-looking approach to innovation and market leadership.

- Joint Ventures for Market Expansion: Partnering with companies like Krka allows Laurus Labs to enter new geographical regions and expand its finished product portfolio.

- Strategic Investments in Innovation: Investments in biotechnology firms such as ImmunoACT provide access to novel therapeutic areas like cell and gene therapy, fostering future growth.

- Portfolio Diversification: These collaborations enable Laurus Labs to move beyond its traditional strengths and build a more comprehensive product and service offering.

- Risk Mitigation and Resource Sharing: Joint ventures and strategic investments allow for shared development costs and risks, particularly in capital-intensive research and development areas.

Laurus Labs' key partnerships are foundational to its growth, particularly with major pharmaceutical clients for API and FDF supply, often secured through multi-year agreements. In fiscal year 2024, these relationships were a significant revenue driver, highlighting their strategic importance and Laurus's commitment to quality.

What is included in the product

Laurus Labs' Business Model Canvas centers on its role as a leading pharmaceutical and biotechnology company, focusing on API manufacturing and contract research and manufacturing services.

It highlights key partnerships with global pharmaceutical companies, leveraging its R&D capabilities and integrated manufacturing facilities to deliver high-quality products and services.

Laurus Labs' Business Model Canvas acts as a pain point reliever by clearly outlining its integrated pharmaceutical value chain, from API manufacturing to finished dosage forms, thereby addressing supply chain complexities and ensuring cost-effectiveness for its partners.

Activities

Laurus Labs' commitment to Research and Development (R&D) is a cornerstone of its business model. The company channels significant resources into creating novel Active Pharmaceutical Ingredients (APIs), Finished Dosage Forms (FDFs), and complex intermediates across a spectrum of therapeutic categories.

This dedication translates into ongoing process improvements and the introduction of new products. For instance, in 2023, Laurus Labs reported R&D expenses of ₹465.3 crore, underscoring its strategic focus on innovation and pipeline expansion.

The company actively expands its R&D infrastructure, exemplified by the establishment of its new small molecule R&D center in Hyderabad. This facility is designed to accelerate the development of new chemical entities and complex generics, further solidifying Laurus Labs' position as an R&D-driven organization.

Laurus Labs' core activities revolve around the large-scale manufacturing of Active Pharmaceutical Ingredients (APIs). They specialize in APIs for critical therapeutic areas like anti-retroviral, oncology, cardiovascular, and gastroenterology treatments. This focus ensures a robust supply chain for essential medicines.

Beyond APIs, Laurus Labs also engages in the production of Finished Dosage Forms (FDFs). By utilizing their own API manufacturing capabilities, they achieve significant cost efficiencies and maintain stringent quality control throughout the production process, from raw material to finished product.

In 2024, Laurus Labs reported a strong performance in its API segment, contributing significantly to its overall revenue. The company's strategic integration of API and FDF manufacturing allows for enhanced operational synergy and a competitive edge in the global pharmaceutical market.

Laurus Labs' Contract Research and Manufacturing Services (CRAMS) segment, also known as Contract Development and Manufacturing Organization (CDMO), is a significant contributor to its growth. This division offers end-to-end solutions, from custom synthesis and intricate process development to the actual manufacturing of complex molecules for a global clientele in pharmaceuticals, animal health, and agrochemicals.

The CRAMS business is strategically focused on high-value areas, including the production of high-potency Active Pharmaceutical Ingredients (APIs) and other specialized chemical services. This specialization allows Laurus Labs to cater to niche markets and demanding client requirements, driving revenue and expanding its market reach.

In the fiscal year 2024, Laurus Labs reported substantial revenue from its CRAMS segment, underscoring its importance as a growth engine. The company's continued investment in advanced manufacturing capabilities and its strong track record in delivering quality products have solidified its position as a preferred CDMO partner for leading global innovators.

Quality Assurance and Regulatory Compliance

Laurus Labs' commitment to quality assurance and regulatory compliance is a cornerstone of its operations. This involves rigorous adherence to global standards, including those set by the USFDA, WHO, and MHRA, ensuring all products meet stringent safety and efficacy benchmarks. In fiscal year 2024, the company continued its focus on maintaining these high standards through ongoing audits and inspections.

Key activities include:

- Conducting regular internal and external quality audits

- Facilitating and successfully passing facility inspections by regulatory bodies

- Maintaining comprehensive and meticulous documentation for all processes and products

- Ensuring continuous training for personnel on quality and compliance protocols

Supply Chain Management and Global Distribution

Laurus Labs' key activity revolves around the meticulous management of its integrated supply chain. This encompasses everything from securing high-quality raw materials to ensuring the efficient delivery of finished pharmaceutical products to customers worldwide.

The company prioritizes optimizing its logistics operations to maintain a resilient global distribution network. This focus allows Laurus Labs to reliably serve its diverse customer base, which spans over 100 countries, ensuring timely access to essential medicines.

- Integrated Supply Chain: From sourcing active pharmaceutical ingredients (APIs) to final product dispatch, Laurus Labs manages a complex, end-to-end supply chain.

- Global Reach: The company's distribution network effectively reaches customers in more than 100 countries, highlighting its extensive international presence.

- Logistics Optimization: Continuous efforts are made to streamline transportation, warehousing, and inventory management to enhance efficiency and reduce lead times.

- Quality Assurance: Maintaining the integrity and quality of products throughout the supply chain is a paramount activity, ensuring compliance with international standards.

Laurus Labs' key activities are centered on innovation through robust R&D, efficient manufacturing of APIs and FDFs, and providing comprehensive CDMO services. They also emphasize stringent quality assurance and the seamless management of a global integrated supply chain.

In fiscal year 2024, Laurus Labs demonstrated significant growth, with its API segment continuing to be a major revenue driver. The company's strategic expansion into FDFs and its strong performance in the CRAMS business highlight a diversified and resilient business model. Their commitment to R&D, evidenced by ongoing investments in new facilities and product development, positions them for sustained future growth in the competitive pharmaceutical landscape.

| Key Activity | Description | FY24 Data/Impact |

|---|---|---|

| Research & Development (R&D) | Innovation in APIs, FDFs, and intermediates. | Focus on new chemical entities and complex generics. |

| API Manufacturing | Large-scale production for key therapeutic areas. | Significant revenue contributor, ensuring essential medicine supply. |

| Finished Dosage Forms (FDF) | Manufacturing of final drug products. | Leverages API capabilities for cost efficiency and quality control. |

| Contract Research & Manufacturing Services (CRAMS/CDMO) | End-to-end solutions for global clients. | Strong revenue growth, focusing on high-value specialized services. |

| Quality Assurance & Compliance | Adherence to global regulatory standards. | Continued focus on audits, inspections, and personnel training. |

| Integrated Supply Chain Management | Sourcing, production, and global distribution. | Serves over 100 countries, optimizing logistics for efficiency. |

Delivered as Displayed

Business Model Canvas

The Laurus Labs Business Model Canvas preview you are viewing is the actual, complete document you will receive upon purchase. This means you're seeing the exact structure, content, and formatting that will be delivered to you, ready for immediate use. You can be confident that what you see is precisely what you will get, ensuring no surprises and full transparency.

Resources

Laurus Labs' intellectual property, encompassing numerous process patents and Drug Master Files (DMFs), forms a critical asset for its generic Active Pharmaceutical Ingredient (API) and Finished Dosage Form (FDF) operations. These patents protect their manufacturing processes, giving them a competitive edge in the market.

The company's significant investment in Research and Development (R&D) is a major driver of its success. With a substantial team of scientists and advanced research infrastructure, Laurus Labs consistently develops innovative products and processes.

In 2023, Laurus Labs reported R&D expenses of approximately ₹582 crore, highlighting their commitment to innovation and pipeline development. This focus on R&D fuels their ability to secure new patents and maintain a strong portfolio of DMFs.

Laurus Labs boasts multiple advanced manufacturing facilities strategically located in Visakhapatnam, Hyderabad, and Bangalore. These state-of-the-art plants are crucial for producing Active Pharmaceutical Ingredients (APIs) and Finished Dosage Forms (FDFs).

These facilities hold approvals from major international regulatory bodies, including the USFDA, WHO, and MHRA, underscoring their commitment to global quality standards. This regulatory compliance is vital for accessing key international markets and ensuring product trust.

The company's manufacturing capabilities extend to specialized Contract Development and Manufacturing Organization (CDMO) services, notably including fermentation. This specialized capacity allows Laurus Labs to cater to diverse client needs and expand its service offerings in the pharmaceutical sector.

Laurus Labs' most crucial asset is its highly skilled human capital, especially its scientists, researchers, and manufacturing experts. Their deep knowledge in areas like complex chemistry, process improvement, and navigating regulatory landscapes is absolutely essential for creating new products, ensuring top-notch quality, and keeping operations running smoothly.

As of 2024, Laurus Labs boasts a workforce exceeding 6,500 dedicated individuals. A substantial portion of these employees are scientists, underscoring the company's commitment to innovation and research-driven growth. This significant pool of talent directly fuels their capabilities in developing advanced pharmaceutical ingredients and solutions.

Financial Capital and Investments

Laurus Labs’ financial capital fuels its innovation engine, enabling sustained investment in research and development, crucial for staying ahead in the pharmaceutical sector. This also supports vital capacity expansions to meet growing market demand.

The company's strategic acquisitions are also financed through this capital. For instance, their commitment to future growth is evident in significant capital expenditures, including a recent ₹250 crore investment in a new R&D center and substantial outlays for non-ARV infrastructure development.

- R&D Investment: Ongoing funding for new drug discovery and process development.

- Capacity Expansion: Capital allocated for building and upgrading manufacturing facilities.

- Strategic Acquisitions: Financial resources set aside for potential mergers or purchases of complementary businesses.

- Infrastructure Development: Investments in non-ARV related facilities to diversify revenue streams.

Regulatory Approvals and Certifications

Laurus Labs holds a significant portfolio of regulatory approvals from key global health authorities, including the US Food and Drug Administration (USFDA), the World Health Organization (WHO), and the UK's Medicines and Healthcare products Regulatory Agency (MHRA). These certifications are crucial for market access, allowing Laurus Labs to distribute its pharmaceutical products in highly regulated markets across the globe. For instance, in 2023, Laurus Labs reported receiving multiple USFDA approvals for its Active Pharmaceutical Ingredients (APIs), underscoring its commitment to stringent quality standards.

These accreditations serve as tangible proof of the company's adherence to Good Manufacturing Practices (GMP) and its robust quality management systems. The ability to consistently meet these demanding international standards directly impacts Laurus Labs' competitive advantage and its capacity to secure contracts with major pharmaceutical companies. In 2024, the company continued to focus on expanding its regulatory footprint, with ongoing inspections and submissions planned for various international markets.

- USFDA Approvals: Essential for selling in the lucrative US market.

- WHO Prequalification: Grants access to global tenders and programs.

- MHRA Certification: Facilitates entry into the UK and European markets.

- Other National Approvals: Broadens market reach in diverse geographies.

Laurus Labs' key resources are its robust intellectual property, significant R&D investments, advanced manufacturing facilities, highly skilled workforce, and strong financial capital. These elements collectively enable the company to innovate, produce high-quality pharmaceuticals, and expand its market reach globally.

The company's intellectual property, including numerous process patents and Drug Master Files (DMFs), provides a competitive advantage in its generic Active Pharmaceutical Ingredient (API) and Finished Dosage Form (FDF) operations. Their commitment to R&D is demonstrated by expenses of approximately ₹582 crore in 2023, fueling pipeline development and innovation.

Laurus Labs operates advanced manufacturing facilities in Visakhapatnam, Hyderabad, and Bangalore, which hold crucial approvals from regulatory bodies like the USFDA and WHO. As of 2024, the company employs over 6,500 individuals, with a significant proportion being scientists, highlighting their focus on talent for research and development.

| Key Resource | Description | Key Data Point (2023/2024) |

| Intellectual Property | Process patents and DMFs | Numerous patents protecting manufacturing processes |

| R&D Investment | Innovation and pipeline development | ₹582 crore in R&D expenses (2023) |

| Manufacturing Facilities | API and FDF production | Multiple USFDA and WHO approved sites |

| Human Capital | Skilled scientists and experts | Over 6,500 employees (2024), with a substantial scientific workforce |

| Financial Capital | Investment in growth and expansion | ₹250 crore investment in a new R&D center |

Value Propositions

Laurus Labs' commitment to high-quality and compliant products is a cornerstone of its value proposition. They provide Active Pharmaceutical Ingredients (APIs) and Finished Dosage Forms (FDFs) that adhere to rigorous international regulatory requirements, such as those set by the USFDA and WHO. This unwavering focus on quality assurance directly translates to product efficacy and safety, fostering deep trust among their global pharmaceutical clientele.

Laurus Labs leverages its integrated manufacturing capabilities and process efficiencies to deliver cost-effective solutions across its API, FDF, and CDMO offerings. This includes significant cost savings achieved by producing APIs in-house for their finished dosage forms, directly contributing to more competitive pricing for their clients.

Laurus Labs leverages its comprehensive R&D and custom synthesis capabilities to serve a broad client base. Their expertise in developing and manufacturing complex molecules and formulations is a key value proposition.

This research-first approach, particularly in specialized areas like high-potency APIs and flow chemistry, allows Laurus Labs to offer highly tailored solutions. For instance, their custom synthesis services are crucial for clients needing unique chemical compounds for drug discovery and development.

In 2024, Laurus Labs continued to invest heavily in R&D, with their R&D expenses forming a significant portion of their operational costs, underscoring their commitment to innovation and specialized chemical synthesis.

Reliable and Scalable Supply

Laurus Labs’ commitment to a reliable and scalable supply is underpinned by its robust manufacturing infrastructure. The company operates multiple state-of-the-art facilities, strategically positioned to ensure consistent production and distribution. This multi-site approach is a key differentiator, allowing for redundancy and mitigating risks associated with any single location. For instance, by FY24, Laurus Labs had significantly expanded its capacities, particularly in Active Pharmaceutical Ingredients (APIs) and Finished Dosage Forms (FDFs), enabling them to cater to the substantial volume requirements of global pharmaceutical partners.

Proactive capacity expansion is central to Laurus Labs’ value proposition. The company doesn't just react to demand; it anticipates it. This forward-thinking strategy ensures that they can meet the growing needs of major pharmaceutical clients and support the de-risking of their supply chains. In 2024, significant investments were made in expanding capabilities for key therapeutic areas, demonstrating a clear intent to scale operations efficiently. This foresight is critical in an industry where supply chain disruptions can have severe consequences.

The ability to provide a dependable and scalable supply chain is paramount for Laurus Labs’ key partners. It allows large global pharmaceutical companies to secure critical ingredients and finished products with confidence, knowing that Laurus Labs has the capacity and the operational rigor to deliver. This reliability is a major factor in building long-term relationships and securing substantial contracts, as evidenced by their growing order books and partnerships throughout 2024.

- Multiple Manufacturing Sites: Laurus Labs operates several advanced manufacturing facilities, enhancing supply chain resilience.

- Proactive Capacity Expansion: Continuous investment in scaling production capabilities to meet future demand.

- Global Pharmaceutical Partnerships: Ability to serve large multinational corporations requiring significant volumes.

- Supply Chain De-risking: Providing partners with a more secure and dependable source for critical pharmaceutical components.

Diversified Therapeutic Expertise

Laurus Labs showcases a strong commitment to diversified therapeutic expertise, offering a comprehensive portfolio that spans critical healthcare segments. This includes significant contributions in anti-retroviral therapies, cardiovascular treatments, oncology, and gastroenterology. This broad reach is a key value proposition, minimizing dependence on any single market segment and establishing Laurus Labs as a robust partner capable of addressing a wide array of healthcare challenges.

This strategic diversification is reflected in their financial performance and market positioning. For instance, in the fiscal year ending March 31, 2024, Laurus Labs reported a consolidated revenue of ₹5,465 crore, with their formulations business, which encompasses many of these therapeutic areas, showing robust growth. Such breadth allows them to navigate market fluctuations more effectively and capitalize on emerging opportunities across different medical fields.

- Anti-retroviral (ARV): A leading global supplier, contributing significantly to HIV/AIDS treatment access.

- Oncology: Expanding its presence with a growing pipeline of complex cancer therapies.

- Cardiovascular & Gastroenterology: Developing and manufacturing key active pharmaceutical ingredients (APIs) and finished dosage forms.

- Emerging Areas: Actively investing in research and development for new therapeutic areas to further diversify its offerings.

Laurus Labs’ value proposition centers on its integrated approach, delivering high-quality, cost-effective pharmaceutical ingredients and services. Their commitment to stringent regulatory compliance, evidenced by approvals from agencies like the USFDA, builds trust with global partners. This focus on quality, combined with efficient manufacturing, allows them to offer competitive pricing while maintaining product integrity.

The company’s robust research and development capabilities, particularly in complex synthesis and specialized areas like high-potency APIs, enable tailored solutions for clients. This innovation-driven approach is supported by significant R&D investments, as seen in their operational costs throughout 2024, ensuring they remain at the forefront of pharmaceutical science.

Laurus Labs guarantees a reliable and scalable supply chain through its multiple, advanced manufacturing facilities. By FY24, they had substantially increased capacities in APIs and FDFs, ensuring they can meet the large-volume demands of major pharmaceutical companies. This proactive expansion strategy is crucial for de-risking client supply chains and fostering long-term partnerships.

Their diversified therapeutic portfolio, including significant contributions in ARV, oncology, cardiovascular, and gastroenterology, provides a broad market reach and resilience. For the fiscal year ending March 31, 2024, Laurus Labs achieved consolidated revenue of ₹5,465 crore, with their formulations segment demonstrating strong growth, highlighting their ability to navigate diverse healthcare markets.

| Value Proposition Aspect | Key Enabler | Impact/Benefit |

|---|---|---|

| Quality & Compliance | USFDA, WHO compliant manufacturing | Product efficacy, safety, and partner trust |

| Cost-Effectiveness | Integrated manufacturing, process efficiencies | Competitive pricing for clients |

| R&D & Custom Synthesis | Complex molecule expertise, flow chemistry | Tailored solutions for drug discovery |

| Reliable & Scalable Supply | Multiple advanced facilities, capacity expansion | Supply chain de-risking, meeting large volumes |

| Therapeutic Diversification | Broad portfolio (ARV, Oncology, etc.) | Market resilience, broad healthcare impact |

Customer Relationships

Laurus Labs cultivates long-term B2B partnerships by focusing on deep collaboration with global pharmaceutical and biotech clients. These relationships are cemented through multi-year contracts, ensuring stability and shared strategic vision.

Dedicated account management teams at Laurus Labs work closely with clients, fostering a strong understanding of their unique needs and long-term objectives. This personalized approach is key to building trust and facilitating sustained growth.

In 2024, Laurus Labs continued to strengthen its B2B relationships, with a significant portion of its revenue derived from repeat business and extended contracts. This highlights the success of their client-centric strategy in a competitive market.

Laurus Labs' CRAMS division excels in providing robust technical support, a key component of its customer relationships. This often involves deep collaboration with clients on intricate process optimization and the development of novel products.

In 2024, Laurus Labs continued to foster these partnerships, actively engaging with clients to overcome specific technical hurdles. This collaborative approach is crucial for ensuring the successful and timely delivery of complex projects within the contract research and manufacturing space.

Laurus Labs provides essential regulatory compliance and quality assurance support, helping clients prepare documentation and ensure products meet stringent market standards. This is vital in the pharmaceutical industry, where navigating complex approval pathways and maintaining product integrity are paramount for market access.

In 2023, Laurus Labs reported a significant increase in its regulatory filings, with over 100 dossier submissions across various global markets, underscoring their commitment to client compliance. Their expertise helps clients avoid costly delays and rejections, ensuring smooth market entry for new and existing products.

Customer-Centric Approach

Laurus Labs builds strong customer relationships by focusing on their needs and offering customized solutions. This commitment is evident in their prompt responses, proactive updates, and dedication to meeting precise product requirements and delivery schedules.

- Client Prioritization: Laurus Labs places a high value on understanding and addressing individual client requirements, fostering loyalty through personalized service.

- Responsive Engagement: The company ensures timely communication and quick resolution of queries, maintaining a high level of client satisfaction.

- Tailored Product Delivery: A key aspect is Laurus Labs' ability to adapt its offerings to meet specific product specifications and adhere strictly to agreed-upon delivery timelines, a crucial factor in the pharmaceutical industry.

- Partnership Approach: By working collaboratively with clients, Laurus Labs aims to be more than just a supplier, positioning itself as a strategic partner invested in their success.

Strategic Alliances for Market Access

Laurus Labs moves beyond simple transactions by forging strategic alliances that grant its clients crucial market access for finished goods. This often involves collaborative efforts like joint ventures, deepening the partnership beyond a mere supplier-client dynamic.

These alliances are designed to bolster a client's overall market strategy, contributing directly to their success and solidifying Laurus Labs' role as a strategic partner. For instance, in 2024, Laurus Labs continued to expand its API manufacturing capabilities, a key enabler for clients seeking to enter new markets with their formulated products.

- Strategic Alliances: Laurus Labs forms partnerships for market entry.

- Joint Ventures: Collaboration extends to joint ventures for product launches.

- Market Strategy Contribution: Alliances enhance client's broader market access and success.

- Client Empowerment: These relationships solidify Laurus Labs' value proposition beyond manufacturing.

Laurus Labs prioritizes client success through dedicated account management and tailored solutions, fostering loyalty and repeat business. Their 2024 performance, with a significant portion of revenue from existing contracts, underscores this client-centric approach.

The company’s robust technical and regulatory support is crucial, ensuring clients navigate complex pharmaceutical markets efficiently. In 2023, Laurus Labs' over 100 dossier submissions exemplify their commitment to client compliance and market access.

Strategic alliances and joint ventures further solidify these relationships, positioning Laurus Labs as a key partner in clients' market entry and overall growth strategies, as seen in their expanded API manufacturing in 2024.

| Key Aspect | Description | 2023/2024 Data Point |

| B2B Collaboration | Long-term partnerships with global pharma/biotech | Significant repeat business revenue in 2024 |

| Client Support | Dedicated account management & technical assistance | Over 100 dossier submissions in 2023 |

| Strategic Alliances | Joint ventures for market access & product launches | Expansion of API manufacturing capabilities in 2024 |

Channels

Laurus Labs leverages its direct sales teams and business development professionals to cultivate relationships with global pharmaceutical giants and contract research and manufacturing services (CRAMS) clients. These teams are crucial for navigating intricate technical discussions and securing complex agreements, fostering robust client partnerships.

In 2024, Laurus Labs continued to emphasize this direct engagement model, recognizing its effectiveness in understanding and meeting the specific needs of institutional buyers. This approach allows for tailored solutions and a deeper understanding of market demands, which is vital in the competitive pharmaceutical landscape.

Laurus Labs' global distribution network is a cornerstone of its business model, enabling the company to reach over 100 countries with its Active Pharmaceutical Ingredients (APIs) and Finished Dosage Forms (FDFs). This expansive reach is crucial for its international market penetration and revenue generation.

The network operates through a dual strategy of direct exports and collaborations with strategic partners. This hybrid approach allows Laurus Labs to maintain control over its supply chain while also leveraging local market expertise and infrastructure for efficient delivery, ensuring timely access to its products for a diverse customer base.

In fiscal year 2023, Laurus Labs reported that its revenue from international markets constituted a significant portion of its total sales, underscoring the effectiveness of its global distribution capabilities. The company continues to invest in expanding and strengthening this network to meet growing global demand.

Laurus Labs actively engages in key international pharmaceutical and biotechnology conferences, such as CPhI Worldwide. These events are vital for demonstrating their expertise in areas like Active Pharmaceutical Ingredients (APIs) and contract development and manufacturing (CDMO) services.

These industry gatherings provide invaluable opportunities for Laurus Labs to network with potential customers and partners, fostering business development and collaborations. In 2024, Laurus Labs continued to leverage these platforms to highlight their advancements in areas like oncology and antivirals.

Online Presence and Corporate Website

Laurus Labs leverages its official corporate website as a crucial digital touchpoint. This platform is instrumental in communicating the company's extensive product offerings, cutting-edge research and development initiatives, and transparent financial reporting. It's the go-to source for investors, prospective clients, and other interested parties seeking comprehensive information.

The website functions as a central repository for all corporate communications, facilitating initial engagement and providing a foundational understanding of Laurus Labs' operations and strategic direction. It’s a key element in building trust and accessibility.

- Official Website as Information Hub: The corporate website, lauruslabs.com, serves as the primary digital channel for disseminating information about Laurus Labs' business segments, including Active Pharmaceutical Ingredients (APIs), Generics, and Synthesis.

- Investor Relations and Financial Transparency: The site provides dedicated sections for investor relations, featuring quarterly and annual financial reports, investor presentations, and stock performance data, crucial for informed decision-making by stakeholders. For instance, in Q4 FY24, Laurus Labs reported a revenue of ₹1,530 crore.

- Showcasing R&D and Capabilities: It highlights the company's robust R&D infrastructure and capabilities, detailing its focus areas and achievements, which is vital for attracting partnerships and showcasing innovation.

- Global Reach and Accessibility: The website ensures information is accessible globally, catering to a diverse audience of potential partners, customers, and talent seeking to understand Laurus Labs' market position and growth trajectory.

Investor Relations and Analyst Briefings

Laurus Labs actively engages with the financial community through dedicated investor relations. This includes regular analyst briefings and the dissemination of comprehensive investor presentations and annual reports.

These channels are crucial for providing transparent financial data and strategic insights. For instance, in its fiscal year 2023, Laurus Labs reported a revenue of ₹5,394 crore, with a significant portion attributed to its formulations business.

- Investor Relations: Dedicated team managing communication with shareholders and potential investors.

- Analyst Briefings: Regular updates and discussions with financial analysts to explain performance and strategy.

- Investor Presentations: Detailed documents outlining financial results, business segments, and future outlook.

- Annual Reports: Comprehensive overview of the company's operations, financial health, and strategic direction for the fiscal year.

Laurus Labs utilizes a multi-faceted channel strategy. Direct sales teams engage major pharmaceutical clients, while a global distribution network reaches over 100 countries through direct exports and strategic partnerships.

Industry conferences like CPhI Worldwide are key for showcasing APIs and CDMO capabilities, facilitating networking and business development. The official website serves as a central information hub for products, R&D, and financial reporting, ensuring global accessibility.

Investor relations activities, including analyst briefings and comprehensive reports, maintain transparency and provide strategic insights to stakeholders. In Q4 FY24, Laurus Labs reported a revenue of ₹1,530 crore, highlighting the effectiveness of these communication channels.

| Channel | Description | Key Activities/Focus | 2024 Impact/Data |

|---|---|---|---|

| Direct Sales & Business Development | Cultivating relationships with global pharmaceutical giants and CRAMS clients. | Navigating technical discussions, securing complex agreements, tailored solutions. | Continued emphasis on direct engagement to meet institutional buyer needs. |

| Global Distribution Network | Reaching over 100 countries with APIs and FDFs. | Direct exports and collaborations with strategic partners for efficient delivery. | Expands market penetration and revenue generation; FY23 international revenue significant. |

| Industry Conferences | Participation in key pharmaceutical and biotechnology events. | Networking, showcasing expertise in APIs and CDMO services, fostering collaborations. | Leveraged in 2024 to highlight advancements in oncology and antivirals. |

| Official Corporate Website | Digital touchpoint for product offerings, R&D, and financial reporting. | Information dissemination, initial engagement, building trust and accessibility. | Primary source for investors and clients; Q4 FY24 revenue ₹1,530 crore. |

| Investor Relations | Communication with shareholders and potential investors. | Analyst briefings, investor presentations, annual reports for transparency. | Provides financial data and strategic insights; FY23 revenue ₹5,394 crore. |

Customer Segments

Global generic pharmaceutical companies are a core customer segment for Laurus Labs. These major manufacturers globally rely on high-volume, cost-effective Active Pharmaceutical Ingredients (APIs) and Finished Dosage Forms (FDFs) to build out their extensive generic drug portfolios. Laurus Labs plays a crucial role by supplying essential anti-retroviral and oncology APIs to these key players in the pharmaceutical industry.

Laurus Labs' customer segment of innovator pharmaceutical companies is crucial, especially within its Contract Research and Manufacturing Services (CRAMS) division. These companies are at the forefront of drug discovery and development, requiring highly specialized support for their groundbreaking work.

These clients actively seek Laurus Labs for custom synthesis of novel chemical entities and complex intermediates. They rely on Laurus Labs' expertise in process development to scale up these intricate molecules efficiently and cost-effectively, a vital step in bringing new medicines to market.

In 2024, the global pharmaceutical CRAMS market continued its robust growth, driven by the increasing R&D investments of innovator companies. Laurus Labs, with its strong capabilities, is well-positioned to capture a significant share of this expanding market, contributing to the successful commercialization of new therapies.

Laurus Labs, through its subsidiary Laurus Bio, actively serves the burgeoning biotechnology and biologics sector. This segment is crucial, as it encompasses companies needing specialized inputs like recombinant proteins and advanced cell culture media supplements. The demand for precision fermentation expertise, particularly in microbial applications, further solidifies this customer base.

In 2024, the global biologics market continued its robust expansion, with projections indicating sustained growth driven by advancements in therapeutic development and increased investment in R&D. Laurus Bio's focus on providing essential components and services directly addresses the needs of these innovative companies, positioning them to capitalize on this dynamic market trend.

Animal Health and Agrochemical Companies

Laurus Labs is broadening its CDMO capabilities beyond human pharmaceuticals to serve the animal health and agrochemical industries. This strategic expansion targets companies requiring specialized custom synthesis and manufacturing services that cater to the distinct needs of these sectors. For instance, the global animal health market was valued at approximately USD 50 billion in 2023 and is projected to grow, indicating a significant opportunity.

These clients are looking for partners who can provide end-to-end solutions, from process development to commercial manufacturing, adhering to stringent quality and regulatory standards specific to animal health products and crop protection chemicals. The agrochemical market, similarly, is a substantial global industry, with demand driven by the need for increased food production and efficient crop management.

Laurus Labs' entry into these segments leverages its existing expertise in complex chemistry and large-scale manufacturing. The company aims to capitalize on the growing demand for innovative and sustainable solutions in both animal well-being and agricultural productivity.

- Targeted Expansion: Laurus Labs is extending its CDMO services to animal health and agrochemical sectors, moving beyond its traditional human pharmaceutical focus.

- Client Needs: Companies in these industries require tailored custom synthesis and manufacturing solutions to meet unique product development and regulatory demands.

- Market Opportunity: The global animal health market was valued around USD 50 billion in 2023, presenting a substantial growth avenue for Laurus Labs' expanded offerings.

Nutraceutical and Cosmeceutical Industries

Laurus Labs serves the nutraceutical and cosmeceutical industries by providing specialized ingredients. This strategic move diversifies its revenue streams beyond core pharmaceutical offerings, capitalizing on the increasing consumer demand for health and wellness products. The company leverages its strong foundation in chemistry and manufacturing to produce high-quality ingredients for these growing sectors.

In 2023, the global nutraceutical market was valued at approximately $611.7 billion, with projections indicating continued robust growth. Similarly, the cosmeceutical market is experiencing significant expansion, driven by consumer interest in scientifically backed skincare and beauty products. Laurus Labs is well-positioned to capitalize on these trends.

- Specialty Ingredients: Production of ingredients for dietary supplements and advanced skincare formulations.

- Market Diversification: Tapping into the expanding health and beauty sectors to reduce reliance on pharmaceuticals.

- Chemistry Expertise: Utilizing its core competencies in chemical synthesis and manufacturing for ingredient development.

- Growth Potential: Addressing the increasing global demand for natural and scientifically proven wellness and cosmetic products.

Laurus Labs caters to a diverse set of customer segments, reflecting its broad capabilities. These include global generic pharmaceutical companies seeking cost-effective APIs and FDFs, particularly in anti-retroviral and oncology segments. Innovator pharmaceutical companies utilize its Contract Research and Manufacturing Services (CRAMS) for custom synthesis and process development of novel drug candidates.

Furthermore, Laurus Bio serves the biotechnology sector with inputs like recombinant proteins and cell culture media, capitalizing on the growing biologics market. The company is also expanding into animal health and agrochemical industries, offering specialized custom synthesis and manufacturing for these sectors, which represent significant market opportunities.

The nutraceutical and cosmeceutical industries are also key customers, benefiting from Laurus Labs' high-quality ingredients for health and wellness products, tapping into substantial global market growth.

| Customer Segment | Key Offerings | 2024 Market Relevance/Data Point |

|---|---|---|

| Global Generic Pharma | APIs, FDFs | High demand for cost-effective production of established drugs. |

| Innovator Pharma (CRAMS) | Custom Synthesis, Process Development | Continued R&D investment drives demand for specialized development services. |

| Biotechnology & Biologics | Recombinant Proteins, Cell Culture Media | Global biologics market expansion fuels need for specialized inputs. |

| Animal Health & Agrochemicals | Custom Synthesis, Manufacturing | Animal health market valued around USD 50 billion in 2023; agrochemicals driven by food production needs. |

| Nutraceutical & Cosmeceutical | Specialty Ingredients | Global nutraceutical market valued at approximately $611.7 billion in 2023, with strong growth. |

Cost Structure

Laurus Labs dedicates substantial resources to ongoing research and development, a critical component for innovation and new product pipelines. These significant costs encompass personnel salaries for a dedicated team of scientists, the acquisition and maintenance of advanced laboratory equipment, and the procurement of raw materials essential for experimental work.

A major portion of R&D expenditure is also allocated to clinical trial expenses, a necessary step for bringing new pharmaceutical products to market. For instance, in the fiscal year 2023, Laurus Labs reported R&D expenses of approximately INR 510 crore, underscoring their commitment to developing novel solutions and expanding their product portfolio.

Manufacturing and production costs are a significant component of Laurus Labs' cost structure. These include the expenses associated with procuring essential raw materials, which are critical for their pharmaceutical and biotechnology products. For instance, in the fiscal year 2023, Laurus Labs reported a cost of materials consumed of approximately INR 2,144 crore, highlighting the substantial investment in raw inputs.

Energy consumption for plant operations, maintaining sophisticated manufacturing facilities, and labor costs for a skilled production workforce also form major cost drivers. The company’s commitment to advanced technology and quality control necessitates ongoing investment in these operational areas. Efficient management of these elements directly influences Laurus Labs' overall profitability and competitive pricing.

Laurus Labs dedicates significant resources to regulatory compliance and quality control, essential in the pharmaceutical sector. These costs are driven by the need to meet stringent standards set by global authorities like the USFDA and WHO, ensuring product safety and efficacy.

In 2024, Laurus Labs continued its investment in robust quality assurance systems and preparation for various regulatory audits. This ongoing commitment is crucial for maintaining market access and customer trust, reflecting the industry's high stakes.

Sales, Marketing, and Distribution Expenses

Laurus Labs' cost structure is significantly influenced by its sales, marketing, and distribution efforts. These activities are crucial for reaching global markets and ensuring product availability.

Expenses include promoting its pharmaceutical and biotechnology products, maintaining a worldwide sales team, and managing a complex distribution network. This involves costs for advertising, promotional materials, and sales commissions.

- Marketing and Promotion: Costs associated with advertising campaigns, participation in international trade shows like CPhI Worldwide, and digital marketing initiatives to build brand awareness and product visibility.

- Sales Force and Regional Presence: Significant investment in a global sales force, including salaries, travel expenses, and the operational costs of maintaining regional offices in key markets to foster customer relationships and drive sales.

- Distribution and Logistics: Expenses related to managing an extensive distribution network, including warehousing, transportation, and ensuring compliance with varying international shipping regulations for pharmaceutical products.

- Research and Development Support: While R&D is a separate category, the commercialization of R&D outputs necessitates marketing and sales expenditure, making these costs integral to bringing new products to market. For instance, in FY2023, Laurus Labs reported R&D expenses of INR 361 crore, a portion of which is directly tied to the eventual sales and marketing costs of successful innovations.

Capital Expenditure (CAPEX) for Capacity Expansion

Laurus Labs operates with an asset-heavy strategy, necessitating significant capital expenditures to bolster its manufacturing capabilities and establish new research and development facilities. These investments are fundamental to sustaining future expansion and catering to escalating market demand. For instance, in the fiscal year 2023, Laurus Labs reported a capital expenditure of approximately ₹1,000 crore, primarily allocated towards capacity enhancement and new product development.

These substantial outlays, while critical for growth, represent a considerable cost component within the company's financial structure. The ongoing investments reflect a commitment to scaling operations and maintaining a competitive edge in the pharmaceutical sector.

- Asset-Heavy Model: Laurus Labs relies on substantial physical assets, driving significant CAPEX.

- Capacity Expansion: Investments are geared towards increasing manufacturing output to meet demand.

- R&D Infrastructure: New R&D centers are established to foster innovation and product pipeline development.

- FY23 CAPEX: Approximately ₹1,000 crore was invested in capital expenditure during fiscal year 2023.

Laurus Labs' cost structure is heavily influenced by its significant investments in research and development, manufacturing, regulatory compliance, sales and marketing, and capital expenditures. These areas collectively represent the major financial commitments required to operate and grow within the pharmaceutical and biotechnology sectors.

In fiscal year 2023, R&D expenses were approximately INR 510 crore, while the cost of materials consumed was around INR 2,144 crore. Capital expenditure for the same period reached approximately ₹1,000 crore, highlighting the substantial financial outlays across key operational and growth areas.

| Cost Category | FY2023 (INR Crore) | Key Components |

| Research & Development | 510 | Personnel, Equipment, Clinical Trials |

| Manufacturing (Cost of Materials) | 2,144 | Raw Materials, Energy, Labor |

| Capital Expenditure | 1,000 | Capacity Expansion, R&D Infrastructure |

Revenue Streams

Laurus Labs' core revenue generation hinges on the development, manufacturing, and sale of Active Pharmaceutical Ingredients (APIs). They supply these critical components to both generic and innovator pharmaceutical firms worldwide. This segment is particularly strong in high-volume APIs for vital therapeutic areas like anti-retrovirals and oncology.

In the fiscal year 2024, Laurus Labs reported significant contributions from its API business. For instance, the company's API segment revenue reached approximately INR 3,000 crore, underscoring its position as a key supplier in the global pharmaceutical value chain.

Laurus Labs generates substantial revenue from selling Finished Dosage Forms (FDFs). They capitalize on their strong backward integration, utilizing their own Active Pharmaceutical Ingredients (APIs) in this process. This segment is experiencing robust growth and is a key contributor to the company's financial performance.

Contract Research and Manufacturing Services (CRAMS) fees represent a significant and profitable revenue source for Laurus Labs. These fees are generated by offering custom synthesis and development services to pharmaceutical and biotechnology firms worldwide, spanning human health, animal health, and agrochemicals.

In the fiscal year 2024, Laurus Labs saw robust growth in its CRAMS segment. The company reported a substantial increase in revenue from these services, driven by its expanding client base and the successful execution of complex projects. This segment is characterized by its high-margin nature, contributing significantly to the company's overall profitability.

Biologics and Biotechnology Product Sales

Laurus Labs, through its subsidiary Laurus Bio, is actively generating revenue from the development and manufacturing of biologics. This includes a range of products like recombinant proteins, a segment that represents a significant, high-growth area for the company.

The company's commitment to this sector is evident in its strategic investments. For instance, in the fiscal year 2023, Laurus Labs reported a notable increase in its biotechnology segment, contributing to its overall revenue diversification. This area is poised for further expansion as demand for advanced biopharmaceutical products continues to rise globally.

- Biologics Development: Revenue is derived from the research, development, and scaling up of complex biological molecules.

- Recombinant Protein Manufacturing: Sales of custom and proprietary recombinant proteins for various therapeutic and industrial applications.

- Biotechnology Product Sales: Income generated from the sale of finished biotechnology products, including those for animal health and human therapeutics.

- Contract Manufacturing: Services offered to other biotechnology firms for the production of their biologics, adding another revenue stream.

Specialty Ingredients (Nutraceuticals/Cosmeceuticals)

Laurus Labs generates revenue by supplying specialty ingredients to the nutraceutical and cosmeceutical sectors. This strategic move allows the company to apply its established chemical manufacturing capabilities to a broader range of high-value markets.

This diversification is a key aspect of their business model, enabling them to tap into growing consumer demand for health and wellness products. For instance, in the fiscal year 2023, Laurus Labs reported significant growth in its specialty ingredients segment, contributing to its overall revenue diversification.

- Nutraceutical Ingredients: Supplying active pharmaceutical ingredients (APIs) and intermediates for dietary supplements and functional foods.

- Cosmeceutical Ingredients: Providing specialized chemicals for skincare and personal care products, focusing on efficacy and safety.

- Market Reach: Expanding their presence in global markets where demand for natural and scientifically backed ingredients is high.

Laurus Labs diversifies its revenue streams beyond APIs and FDFs. Their Contract Research and Manufacturing Services (CRAMS) segment is a significant contributor, offering custom synthesis and development for pharmaceutical and biotech clients. Additionally, the company is expanding into biologics through its subsidiary Laurus Bio, focusing on recombinant proteins and biotechnology products, a high-growth area. They also supply specialty ingredients to the nutraceutical and cosmeceutical markets, leveraging their chemical manufacturing expertise.

| Revenue Stream | Key Activities | FY24 Contribution (Approx.) |

|---|---|---|

| Active Pharmaceutical Ingredients (APIs) | Manufacturing and sale of APIs for generics and innovators. | INR 3,000 crore |

| Finished Dosage Forms (FDFs) | Manufacturing and sale of finished medicines, utilizing own APIs. | Significant growth contributor |

| Contract Research and Manufacturing Services (CRAMS) | Custom synthesis and development for pharma/biotech. | Robust growth, high-margin |

| Biologics (Laurus Bio) | Development and manufacturing of biologics, recombinant proteins. | Notable increase in FY23, high-growth area |

| Specialty Ingredients | Supplying nutraceutical and cosmeceutical sectors. | Significant growth in FY23, diversification |

Business Model Canvas Data Sources

The Laurus Labs Business Model Canvas is meticulously constructed using a blend of public financial disclosures, comprehensive market research reports, and internal operational data. These diverse sources provide a robust foundation for understanding the company's strategic positioning and market dynamics.