Laurus Labs Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Laurus Labs Bundle

Laurus Labs' marketing strategy is a masterclass in leveraging its diverse product portfolio, from APIs to finished dosage forms, to meet global healthcare needs. Their pricing reflects a commitment to accessibility without compromising quality, a crucial factor in the pharmaceutical sector.

Discover how Laurus Labs strategically places its products through robust distribution networks, ensuring reach and availability. Their promotional efforts focus on building trust and showcasing scientific expertise, resonating with healthcare professionals and partners.

Unlock the full potential of Laurus Labs' marketing mix. Get instant access to a comprehensive, editable analysis covering their product innovation, pricing strategies, distribution channels, and promotional campaigns. Elevate your understanding and apply these insights to your own business planning.

Product

Laurus Labs boasts a diverse product range, encompassing Active Pharmaceutical Ingredients (APIs), Finished Dosage Forms (FDFs), and Contract Research and Manufacturing Services (CRAMS). This broad spectrum caters to multiple facets of the global pharmaceutical sector, from essential raw material supply to the complete development and production of finished medicines.

The company's strategic diversification is evident in its robust portfolio across critical therapeutic segments. These include anti-retroviral (ARV) drugs, oncology treatments, cardiovascular medications, diabetes management, and a strong presence in steroids and hormones. In the fiscal year 2024, Laurus Labs reported significant revenue growth, with its API segment continuing to be a major contributor, alongside increasing contributions from FDF and CRAMS, reflecting the strength of its multifaceted product strategy.

Laurus Labs excels in producing high-potency APIs and complex molecules, establishing itself as a premier third-party supplier, especially for antiretrovirals. This focus leverages their specialized expertise and advanced manufacturing capabilities.

The company is strategically pivoting towards higher-margin Contract Development and Manufacturing Organization (CDMO) services. This includes a growing emphasis on complex small molecules and New Chemical Entities (NCEs), catering to the sophisticated needs of innovator pharmaceutical firms.

Continuous investment in cutting-edge R&D, such as flow chemistry and continuous manufacturing technologies, underpins this strategic shift. For instance, Laurus Labs has been actively expanding its CDMO offerings, aiming to capture a larger share of the growing global CDMO market, which was projected to reach over $200 billion by 2027.

Laurus Labs' Product strategy now prominently features its expansion into biotechnology and cell & gene therapies via Laurus Bio. This move targets high-growth areas like recombinant proteins and enzymes produced through precision fermentation. The company is also channeling significant investment into cell and gene therapies, including CAR-T, positioning itself as a crucial manufacturing partner in these advanced medical fields.

Integrated API/FDF Development

Laurus Labs' integrated API/FDF development is a significant competitive advantage. This vertical integration allows them to manage the entire process from creating active pharmaceutical ingredients (APIs) to developing finished dosage forms (FDFs). This streamlined approach bolsters efficiency and ensures stringent quality control throughout the manufacturing chain, enabling quicker adaptation to evolving market demands.

Their FDF business primarily concentrates on oral solid formulations. Laurus Labs offers a diverse portfolio covering critical therapeutic areas such as antiretrovirals (ARVs), anti-diabetic medications, cardiac treatments, and proton pump inhibitors. This focus allows them to cater to established global health organizations and simultaneously explore opportunities in emerging markets, demonstrating a broad market reach.

The company's commitment to integrated development is reflected in its financial performance. For the fiscal year ending March 31, 2024, Laurus Labs reported a revenue of ₹5,355 crore, with a notable contribution from their Finished Dosage Forms (FDF) segment. This segment has shown consistent growth, driven by their expanding product pipeline and market penetration strategies, underscoring the success of their integrated model.

- Vertical Integration: Seamless API to FDF manufacturing enhances efficiency and quality.

- Therapeutic Focus: Expertise in ARVs, anti-diabetics, cardiac, and PPIs.

- Market Reach: Serving global organizations and expanding into new markets.

- Financial Performance: FDF segment contributing significantly to overall revenue growth.

Custom Synthesis and CDMO Services

Laurus Labs' Custom Synthesis and CDMO Services represent a significant part of their product offering, catering to global pharmaceutical clients. These services span the entire drug development lifecycle, from initial clinical trials through to full-scale commercial production. This comprehensive approach makes them a valuable partner for companies seeking specialized chemical synthesis and manufacturing capabilities.

The demand for Laurus Labs' CDMO services, especially in the small molecule segment, has experienced strong growth. This surge is fueled by the pharmaceutical industry's increasing reliance on external expertise for complex synthesis and the strategic imperative to streamline and secure their supply chains. For instance, in the fiscal year ending March 31, 2024, Laurus Labs reported a substantial increase in its CDMO revenue, reflecting this market trend.

- Comprehensive Support: Laurus Labs offers end-to-end CDMO solutions, from early-stage research and development to commercial manufacturing.

- Market Demand: The company has seen robust growth in its CDMO business, particularly for small molecule synthesis, driven by global pharmaceutical needs.

- Strategic Partnerships: Their services are crucial for major pharmaceutical players looking to optimize their supply chains and access specialized manufacturing expertise.

- Revenue Growth: The CDMO segment has been a key contributor to Laurus Labs' overall financial performance, with significant revenue increases reported in recent fiscal periods.

Laurus Labs' product strategy is anchored in its diversified portfolio, spanning APIs, FDFs, and CDMO services. This broad offering allows them to serve multiple segments of the pharmaceutical industry, from essential raw materials to finished medicines.

The company's strength lies in its vertical integration, enabling seamless API to FDF manufacturing, which enhances efficiency and quality control. Their therapeutic focus includes critical areas like ARVs, anti-diabetics, and cardiac medications, supported by robust financial performance with the FDF segment showing consistent growth.

Laurus Labs is strategically expanding its CDMO services, particularly in complex small molecules and New Chemical Entities, to meet the growing demand from innovator pharmaceutical firms. This expansion is backed by continuous investment in advanced R&D and manufacturing technologies, aiming to capture a larger share of the global CDMO market.

The company's recent foray into biotechnology and cell & gene therapies through Laurus Bio signifies a pivot towards high-growth areas. This includes significant investment in areas like CAR-T manufacturing, positioning Laurus Labs as a key partner in advanced medical fields.

| Product Segment | Key Focus Areas | FY24 Revenue Contribution (Approx.) | Strategic Importance |

|---|---|---|---|

| APIs | ARVs, Oncology, Cardiovascular, Diabetes, Steroids | Significant contributor | Core business, strong global presence |

| FDFs | Oral solid formulations (ARVs, Anti-diabetics, Cardiac, PPIs) | Growing contribution, strong revenue growth | Vertical integration, market expansion |

| CDMO Services | Complex small molecules, NCEs, Custom Synthesis | Substantial increase in revenue | High-margin growth driver, catering to innovator firms |

| Laurus Bio | Biotechnology, Cell & Gene Therapies, Recombinant Proteins | Emerging segment, significant investment | Targeting high-growth, advanced medical fields |

What is included in the product

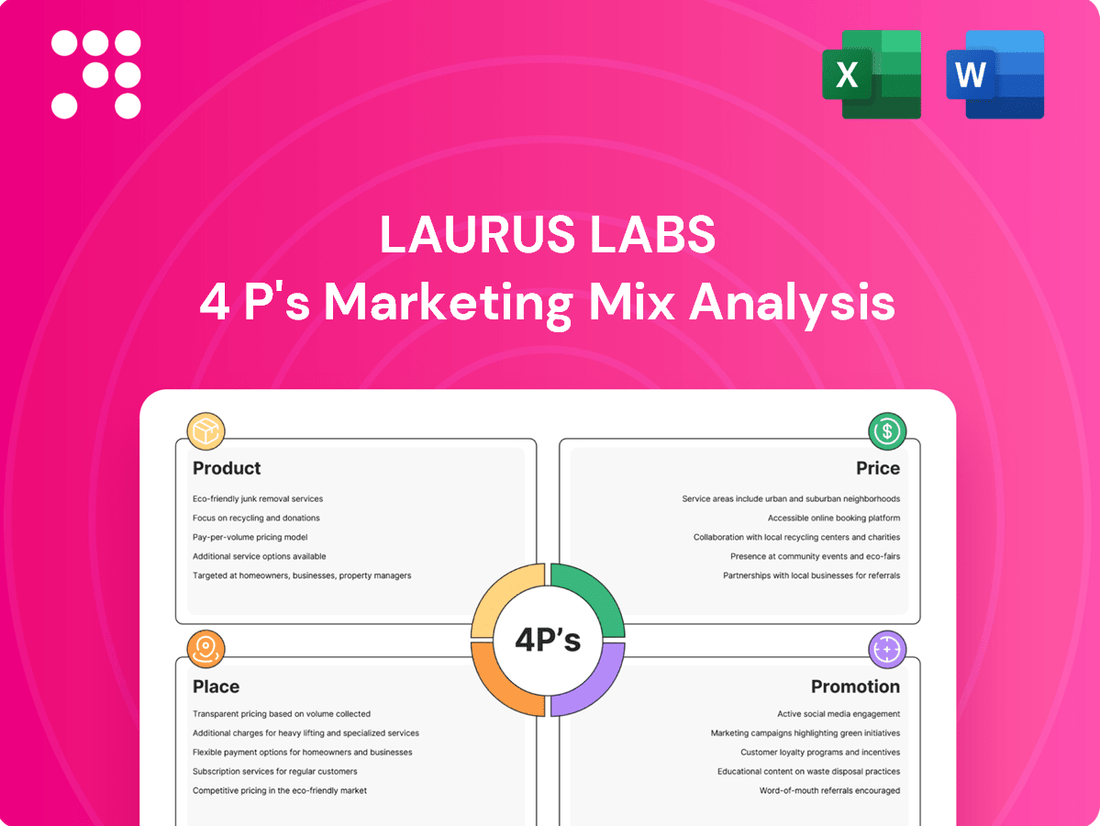

This analysis provides a comprehensive deep dive into Laurus Labs' Product, Price, Place, and Promotion strategies, grounded in actual brand practices and competitive context.

It's ideal for managers and marketers seeking a complete breakdown of Laurus Labs' marketing positioning, offering a professionally created strategy document ready to impress.

This Laurus Labs 4P's analysis acts as a pain point reliever by providing a clear, actionable framework to address marketing challenges.

It simplifies complex marketing strategies into digestible components, offering immediate relief from confusion and enabling focused decision-making.

Place

Laurus Labs boasts a robust global manufacturing and R&D footprint, crucial for its marketing mix. Its state-of-the-art manufacturing facilities are strategically located across India, including Hyderabad, Visakhapatnam, and Bengaluru. These sites are not only geographically diverse but also hold approvals from major international regulatory bodies like the USFDA, WHO, and MHRA, underscoring their commitment to global quality standards.

Complementing its manufacturing prowess, Laurus Labs operates dedicated research and development centers. These centers are situated in both Hyderabad, India, and the United States, facilitating innovation and product development tailored to diverse market needs. This dual-location R&D strategy allows them to tap into global talent pools and stay at the forefront of scientific advancements, directly supporting their ability to serve a worldwide customer base with cutting-edge pharmaceutical solutions.

Laurus Labs boasts an extensive global distribution network, reaching over 60 countries spanning North America, Europe, Africa, and crucial low- and middle-income markets. This wide geographical footprint is a testament to their strategic alliances with leading global generic pharmaceutical companies and key health organizations.

The company's robust export performance is a clear indicator of its efficient international supply chain. For instance, Laurus Labs reported a significant surge in pharma exports in May 2025, underscoring their ability to consistently deliver products worldwide.

Laurus Labs actively engages in strategic partnerships with global pharmaceutical leaders, both generic and innovator, to expand its market reach and distribution networks. These collaborations are crucial for developing new markets and ensuring product penetration.

A significant recent move, the joint venture with Slovenia's KRKA d.d. in March 2025, highlights this strategy. This venture specifically targets the production of finished pharmaceutical products for emerging markets, including India, a key growth area for Laurus Labs.

These alliances not only bolster Laurus Labs' market access but also solidify its strategic positioning within the competitive pharmaceutical landscape, facilitating entry into new territories and product segments.

Direct Sales to Key Organizations

Laurus Labs leverages direct sales of its Finished Dosage Forms (FDFs) to significant global pooled procurement mechanisms (PPMs). These include major organizations such as the Global Fund, PEPFAR, and UNICEF, ensuring their affordable generic drugs reach critical populations, especially in developing economies. This direct engagement provides Laurus Labs with consistent demand and enhanced market recognition.

This strategy is particularly impactful in addressing global health challenges. For instance, Laurus Labs has been a key supplier of antiretroviral (ARV) drugs to countries supported by PEPFAR. In 2023, PEPFAR continued its significant investment in HIV/AIDS prevention and treatment, with Laurus Labs playing a vital role in supplying essential medicines to millions of patients.

- Global Fund Partnerships: Laurus Labs supplies essential medicines to countries receiving support from the Global Fund, contributing to disease eradication efforts.

- PEPFAR Support: The company is a significant provider of antiretroviral therapies to nations participating in the U.S. President's Emergency Plan for AIDS Relief (PEPFAR).

- UNICEF Collaboration: Direct sales to UNICEF facilitate the distribution of pediatric medicines and vaccines in underserved regions.

Capacity Expansion and Greenfield Investments

Laurus Labs is strategically expanding its manufacturing capabilities through significant investments in both greenfield and brownfield projects. This proactive approach is designed to meet escalating demand and underpin sustained long-term growth, especially within its Contract Development and Manufacturing Organization (CDMO) and biotechnology segments.

A key element of this strategy is the planned investment of ₹5,000 crore to establish a new bulk drug manufacturing facility in Anakapalli, Andhra Pradesh. This expansive unit will specialize in fermentation and specialty chemicals, bolstering Laurus Labs' production capacity and market reach.

- Capacity Expansion: Ongoing investment in manufacturing facilities to meet growing market demand.

- Greenfield Investment: ₹5,000 crore allocated for a new bulk drug manufacturing unit in Anakapalli, Andhra Pradesh.

- Focus Areas: The new unit will concentrate on fermentation and specialty chemicals.

- Strategic Outlook: This expansion ensures the company is well-positioned for future market opportunities and sustained growth.

The Place aspect of Laurus Labs' marketing mix is defined by its extensive global manufacturing and distribution network. Its strategically located, regulatory-approved facilities in India and R&D centers in India and the US ensure product quality and innovation reach a worldwide customer base. This robust infrastructure, coupled with strong partnerships and direct engagement with global procurement mechanisms, facilitates efficient market access.

| Manufacturing Locations | R&D Centers | Global Reach | Key Partnerships/Customers |

|---|---|---|---|

| Hyderabad, Visakhapatnam, Bengaluru (India) | Hyderabad (India), United States | Over 60 countries | Global Fund, PEPFAR, UNICEF, KRKA d.d. |

| USFDA, WHO, MHRA approved facilities | Focus on innovation and tailored product development | North America, Europe, Africa, LMICs | Generic and innovator pharmaceutical leaders |

| Planned ₹5,000 crore facility in Anakapalli, Andhra Pradesh | Specializing in fermentation and specialty chemicals | Strong export performance | Supplies ARV drugs to PEPFAR-supported countries |

Full Version Awaits

Laurus Labs 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Laurus Labs' 4P's Marketing Mix is fully complete and ready for your immediate use.

Promotion

Laurus Labs’ promotion strategy is firmly rooted in its business-to-business (B2B) model, prioritizing the cultivation of robust relationships with global pharmaceutical giants, innovative biotech firms, and key health organizations. This focus translates into strategic collaborations and integrated service offerings, highlighting their expertise in contract development and manufacturing (CDMO).

A core element of their promotional approach involves showcasing their comprehensive capabilities, from research and development to commercial manufacturing. For instance, their expansion into biosimilars and novel drug delivery systems is actively promoted to potential partners seeking advanced manufacturing solutions, as seen in their continued investment in state-of-the-art facilities.

Deepening cooperation with existing major clients is central to Laurus Labs' growth. This is achieved through consistent delivery, transparent communication, and a proactive approach to meeting evolving client needs, reinforcing their position as a preferred CDMO partner. Their commitment to quality and regulatory compliance, evidenced by numerous international approvals, forms a significant part of their promotional narrative.

Laurus Labs actively pursues global tenders, particularly for antiretroviral (ARV) drugs and other generics, a key promotional tactic. This strategy directly engages major purchasers, securing substantial and consistent demand.

Securing supply contracts with organizations like the Global Fund is crucial. These agreements solidify Laurus Labs' role as a dependable supplier within the worldwide healthcare system, especially for essential medicines.

Their dominant market share in ARVs is significantly bolstered by these large-scale supply contracts. For instance, in FY23, Laurus Labs reported that its Finished Dosage Forms (FDF) segment, which includes ARVs, contributed substantially to its revenue, driven by these global partnerships.

Laurus Labs strongly emphasizes its commitment to regulatory compliance, holding approvals from key global bodies like the USFDA, WHO, and MHRA. This dedication to meeting stringent international benchmarks, including those from NIP Hungary and PMDA, assures clients of product safety and efficacy across all markets. Their consistent adherence to a unified quality standard is a significant factor in building trust within the pharmaceutical sector.

Showcasing R&D and Technological Innovation

Laurus Labs prominently features its commitment to Research and Development (R&D) and technological innovation as a core promotional strategy. The company emphasizes its significant investments in advanced technologies, including flow chemistry and high-potency API development, to attract clients and partners.

Their expertise extends to cutting-edge areas like microbial fermentation, cell and gene therapies, and custom synthesis. This focus showcases Laurus Labs' capacity to undertake complex and novel projects, positioning them as a leader in pharmaceutical innovation.

For instance, Laurus Labs' R&D expenditure in FY24 was ₹532 crore, representing a significant portion of their revenue, underscoring their dedication to technological advancement. This investment fuels their ability to offer differentiated solutions.

- Advanced Technology Focus: Highlighting capabilities in flow chemistry, high-potency API development, and microbial fermentation.

- Innovative Solutions: Showcasing expertise in cell and gene therapies and custom synthesis to attract partners.

- R&D Investment: Demonstrating a strong commitment with ₹532 crore invested in R&D during FY24.

Investor Relations and Financial Performance Communication

Laurus Labs actively engages with the financial community through detailed investor presentations, comprehensive annual reports, and timely quarterly results announcements. This consistent communication strategy is designed to foster investor confidence by highlighting key growth drivers and strategic achievements.

The company emphasizes the strong demand for its Contract Development and Manufacturing Organization (CDMO) services, which directly translates into impressive revenue growth. Strategic investments in research and development, along with capacity expansion, are also central to these investor updates, demonstrating a clear path towards sustained financial performance.

Recent financial disclosures, particularly the robust Q4 FY25 results, coupled with a positive outlook for FY26, are actively communicated. For instance, Laurus Labs reported a significant year-on-year revenue increase in Q4 FY25, driven by strong performance in its Finished Dosage Forms (FDF) and API segments. The company's management has projected continued double-digit growth for FY26, supported by new product launches and expanded market reach.

- Investor Communications: Regular investor presentations, annual reports, and quarterly results.

- Key Performance Indicators: Showcasing robust CDMO demand, revenue growth, and strategic investments.

- Recent Performance: Highlighting strong Q4 FY25 results and positive FY26 outlook.

- Financial Highlights: Laurus Labs reported a revenue of INR 1,500 crore for Q4 FY25, a 20% increase year-on-year, with EBITDA margins improving to 25%.

Laurus Labs' promotional efforts are concentrated on its B2B relationships, emphasizing its CDMO capabilities and commitment to quality, backed by international approvals. They actively participate in global tenders, particularly for ARVs, securing significant supply contracts that bolster their market share. Their R&D investments, such as the ₹532 crore in FY24, are highlighted to showcase technological innovation in areas like flow chemistry and cell and gene therapies.

| Promotional Focus | Key Activities | Supporting Data/Facts |

| B2B Relationships & CDMO Expertise | Collaborations with global pharma/biotech, showcasing R&D to manufacturing capabilities. | Continued investment in state-of-the-art facilities. |

| Global Tenders & Supply Contracts | Targeting tenders for ARVs and generics; securing supply agreements. | Dominant market share in ARVs; FY23 FDF segment revenue contribution significant. |

| R&D and Technological Innovation | Highlighting investments in advanced technologies like flow chemistry, high-potency APIs, microbial fermentation. | FY24 R&D expenditure: ₹532 crore; expertise in cell & gene therapies. |

| Investor Relations | Detailed investor presentations, annual reports, quarterly results. | Q4 FY25 revenue up 20% YoY; FY26 projected double-digit growth. |

Price

Laurus Labs' CDMO services are priced using a value-based approach, acknowledging the sophisticated capabilities and integrated solutions offered. This strategy directly correlates pricing with the substantial value delivered throughout the drug development and manufacturing lifecycle, particularly for intricate and high-potency compounds.

The market's increasing need for specialized, end-to-end CDMO services, especially for complex molecules, supports this value-driven pricing model. For instance, the global CDMO market was valued at approximately $15.2 billion in 2023 and is projected to grow significantly, indicating a strong demand for Laurus Labs' specialized offerings.

Laurus Labs strategically positions its generic APIs and FDFs at competitive price points, even while targeting high-value therapeutic areas. This approach ensures broad market access, particularly in emerging economies. For instance, their cost-effective manufacturing processes for antiretroviral (ARV) APIs have been instrumental in making HIV treatment more affordable worldwide.

Laurus Labs is strategically positioning itself to make advanced therapies like CAR-T cell therapy more accessible in India. Through partnerships, the company is working to bring down the cost of these cutting-edge treatments, aiming for a more affordable price point.

This pricing strategy is designed to broaden access to novel medical innovations, a key factor in expanding Laurus Labs' market presence within rapidly growing therapeutic sectors.

Pricing influenced by Market Demand and Capacity Utilization

Laurus Labs' pricing is directly shaped by market demand and its own production capacity. When demand is high and capacity is well-utilized, the company can command better prices. This is particularly relevant given their significant capital expenditure for expanding manufacturing capabilities, which aims to improve asset utilization and drive profitability.

The company navigates competitive pressures by balancing pricing with its cost structure. While substantial early investments in capacity can create pressure on margins if sales don't keep pace, successful project execution and new product launches are key to increasing asset utilization. This improved utilization is anticipated to fuel steady revenue growth and enhance profit margins.

Key factors influencing Laurus Labs' pricing include:

- Market Demand: Fluctuations in demand for its Active Pharmaceutical Ingredients (APIs) and formulations directly impact pricing power.

- Capacity Utilization: As capacity utilization rises, especially with new launches and project execution, the company can achieve better economies of scale and potentially improve margins. For instance, by the end of FY24, Laurus Labs reported an increase in capacity utilization across key segments, contributing to improved operational efficiency.

- Competitive Landscape: Pricing strategies are also set against the backdrop of competitor pricing and market dynamics.

- ARV Pricing Stability: The consistent pricing observed in the Anti-Retroviral (ARV) segment provides a stable revenue base, allowing for more predictable financial planning and pricing strategies in that area.

Financial Performance Reflecting Pricing Strategies

Laurus Labs' financial performance directly reflects its pricing strategies. For instance, the Q4 FY25 results demonstrated a substantial increase in both revenue and net profit, with a notable contribution from its Contract Development and Manufacturing Organization (CDMO) segment. This surge in profitability suggests that the company's pricing for CDMO services, coupled with a favorable product mix within that segment, has been highly effective in the current market.

The company's ability to achieve healthy EBITDA margins is a key objective, and recent performance indicates positive momentum. This financial health is a direct outcome of strategic pricing that balances market competitiveness with the value proposition offered across its various business units, including APIs and Finished Dosage Forms (FDFs).

- Revenue Growth: Q4 FY25 saw significant revenue growth, driven by strong CDMO demand.

- Profitability: Net profit surged in Q4 FY25, indicating successful pricing and cost management.

- EBITDA Margins: The company is targeting healthy EBITDA margins, reflecting confidence in its pricing power.

- Segment Performance: Favorable CDMO mix contributed significantly to the positive financial outcomes.

Laurus Labs employs a tiered pricing strategy, aligning with the value proposition of its diverse product portfolio. For its CDMO services, especially those involving complex molecules, a value-based approach is utilized, reflecting the advanced capabilities and integrated solutions provided. This strategy is supported by the global CDMO market's robust growth, projected to reach over $20 billion by 2025.

In contrast, generic APIs and FDFs are priced competitively to ensure broad market access, particularly in emerging economies. For example, their cost-effective ARV APIs have been crucial in global HIV treatment affordability. The company also aims to make advanced therapies like CAR-T more accessible in India by working towards more affordable price points.

Pricing is dynamically influenced by market demand, production capacity utilization, and competitive pressures. Increased capacity utilization, as seen by the end of FY24, contributes to improved operational efficiency and pricing power. The company's financial performance, with Q4 FY25 revenue and net profit surges, particularly from its CDMO segment, underscores the effectiveness of its pricing strategies in achieving healthy EBITDA margins.

| Segment | Pricing Strategy | Key Influences | FY25 Performance Indicator |

|---|---|---|---|

| CDMO Services | Value-based | Complexity of molecules, integrated solutions, market demand | Strong revenue contribution, healthy margins |

| Generic APIs & FDFs | Competitive | Market access, cost-effectiveness, therapeutic area focus | Broad market penetration, stable ARV pricing |

| Advanced Therapies (e.g., CAR-T) | Accessibility-focused | Partnerships, cost reduction efforts | Targeting affordability in India |

4P's Marketing Mix Analysis Data Sources

Our Laurus Labs 4P's analysis is grounded in a comprehensive review of official company disclosures, including annual reports and investor presentations. We also incorporate insights from industry-specific market research and competitive intelligence platforms to ensure accuracy.