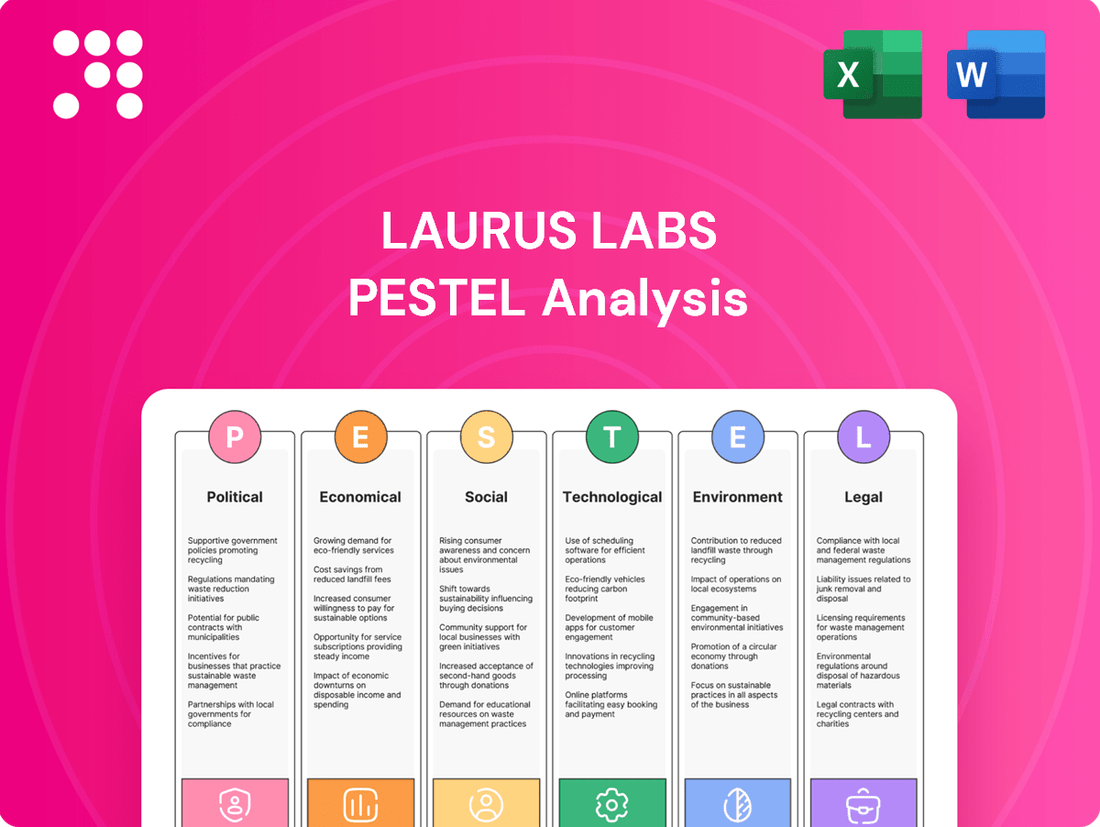

Laurus Labs PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Laurus Labs Bundle

Navigate the complex external forces impacting Laurus Labs with our comprehensive PESTLE analysis. Understand how political stability, economic shifts, and technological advancements are shaping the pharmaceutical landscape. Equip yourself with critical insights to anticipate challenges and capitalize on emerging opportunities.

Unlock the full potential of your strategic planning with our detailed PESTLE analysis of Laurus Labs. Discover how social trends, environmental regulations, and legal frameworks create both risks and rewards. Download the complete report to gain actionable intelligence and make informed decisions.

Political factors

Government healthcare policies significantly shape Laurus Labs' financial performance. For instance, shifts in government healthcare spending and drug pricing regulations in major markets such as India, the US, and Europe directly influence the company's revenue streams and profit margins.

The focus on generic medicines within national health programs, a trend observed globally, presents both opportunities and challenges. In 2023, India's pharmaceutical market, a key region for Laurus Labs, saw continued government emphasis on affordable medicines, impacting pricing dynamics for generic drugs.

Laurus Labs' international trade relations are crucial, especially with India's significant role in global pharmaceutical exports. Changes in trade agreements or the imposition of tariffs by major importing nations like the United States or European Union countries can directly impact the cost and accessibility of Laurus Labs' Active Pharmaceutical Ingredients (APIs) and Finished Dosage Forms (FDFs).

For instance, the US International Trade Commission's actions on certain pharmaceutical imports or retaliatory tariffs imposed by India could disrupt supply chains. In 2023, India's pharmaceutical exports reached an estimated USD 25.4 billion, highlighting the sensitivity of the sector to global trade policies.

The political stability of India, where Laurus Labs is headquartered and has significant operations, is a key factor. As of early 2024, India's political landscape has remained relatively stable, with the current government continuing its reform agenda, which generally supports business growth. However, any significant shifts or unexpected elections could introduce uncertainty.

Geopolitical risks, particularly concerning global supply chains for active pharmaceutical ingredients (APIs) and intermediates, remain a concern for Laurus Labs. For instance, ongoing trade tensions and regional conflicts in areas from which raw materials are sourced could lead to price volatility and potential disruptions. Laurus Labs' reliance on China for certain key starting materials means that any escalation in Sino-Indian relations or broader geopolitical instability in Asia could impact its cost of goods sold and production schedules.

Drug Approval Processes and Regulatory Harmonization

Laurus Labs' product launch timelines are directly impacted by the evolving drug approval processes of major regulatory bodies. For instance, the US Food and Drug Administration (FDA) and the European Medicines Agency (EMA) continually update their guidelines, which can lead to variations in the time it takes to secure market authorization for new pharmaceutical products. In 2023, the FDA continued to streamline certain pathways, but complex biologics still faced rigorous review periods, potentially extending market entry by several months.

The ongoing global trend toward regulatory harmonization, or conversely, divergence, significantly shapes Laurus Labs' research and development investments and market entry strategies. While efforts like the International Council for Harmonisation of Technical Requirements for Pharmaceuticals for Human Use (ICH) aim to create common standards, regional differences persist. For example, the Central Drugs Standard Control Organisation (CDSCO) in India has its own specific requirements that may differ from Western counterparts, necessitating tailored approaches for each market.

- US FDA Approval Timelines: In 2024, the FDA's PDUFA (Prescription Drug User Fee Act) reauthorization aims to maintain efficient review cycles, but the complexity of new drug applications means some approvals can still take over a year.

- EMA Review Process: The EMA's centralized procedure, while offering single market access, can involve lengthy scientific evaluations, with average review times for new active substances often exceeding 200 days in 2024.

- CDSCO Harmonization Efforts: India's CDSCO is increasingly aligning with international standards, but localized clinical data requirements can still present unique challenges for global pharmaceutical companies like Laurus Labs.

- Impact on R&D: Divergent regulations necessitate parallel submission strategies and can increase the cost of R&D by requiring region-specific testing and documentation, a factor Laurus Labs must strategically manage.

Intellectual Property Rights Enforcement

The strength of intellectual property (IP) rights enforcement significantly impacts Laurus Labs' ability to protect its innovations. Strong IP laws in key markets like the United States and Europe, where Laurus Labs has substantial operations and sales, are crucial for safeguarding its patented processes and drug formulations. For instance, the U.S. Patent and Trademark Office (USPTO) grants patents that are generally well-enforced, providing a strong deterrent against infringement.

Conversely, jurisdictions with weaker IP enforcement pose a risk. If Laurus Labs' proprietary manufacturing techniques or novel drug compounds are not adequately protected in certain regions, it could face competition from unauthorized generic manufacturers. This is particularly relevant in emerging markets where patent litigation can be complex and outcomes uncertain. The global landscape of IP enforcement varies, with some countries demonstrating more robust legal frameworks and faster resolution of disputes than others, directly affecting Laurus Labs' competitive advantage and R&D investment recovery.

Laurus Labs' strategy likely involves careful consideration of the IP enforcement landscape when planning market entry and R&D investments. The company's 2023 annual report highlighted ongoing efforts to secure and defend its IP portfolio across various geographies. The effectiveness of patent litigation and the speed of regulatory approvals for new products are directly tied to the strength of IP rights enforcement in each target market.

Key considerations for Laurus Labs regarding IP enforcement include:

- Patent protection strength: The robustness of patent laws and their application in major markets where Laurus Labs operates.

- Enforcement mechanisms: The availability and efficiency of legal recourse against IP infringement in different jurisdictions.

- Generic competition risk: The potential for unauthorized generic versions of Laurus Labs' products to emerge in markets with weaker IP protection.

- R&D investment security: The degree to which strong IP enforcement safeguards the substantial investments made in research and development.

Government policies on drug pricing and healthcare access directly influence Laurus Labs' revenue. For instance, India's National Pharmaceutical Pricing Authority (NPPA) caps prices for essential medicines, impacting Laurus Labs' domestic sales. Furthermore, the company's significant export markets, like the US and Europe, are subject to their respective healthcare reforms and reimbursement policies, which can affect demand and profitability for its APIs and formulations.

Trade policies and geopolitical stability are critical for Laurus Labs, given its global supply chain for raw materials and its substantial export business. For example, in 2023, India's pharmaceutical exports, valued at approximately USD 25.4 billion, demonstrated the sector's sensitivity to international trade agreements and tariffs. Any disruptions in sourcing key starting materials, often from China, due to trade tensions or regional instability, can directly impact Laurus Labs' production costs and delivery schedules.

The political stability in India, Laurus Labs' home base, underpins its operational continuity. As of early 2024, India's stable political environment has supported its economic reforms, generally fostering business growth. However, potential shifts in government or policy changes can introduce market uncertainties, affecting investor confidence and strategic planning for companies like Laurus Labs.

What is included in the product

This PESTLE analysis examines the external macro-environmental factors influencing Laurus Labs across Political, Economic, Social, Technological, Environmental, and Legal dimensions, offering a comprehensive view of market dynamics and potential strategic implications.

A concise Laurus Labs PESTLE analysis that distills complex external factors into actionable insights, easing the burden of comprehensive market research for strategic decision-making.

Economic factors

Global economic growth directly impacts healthcare spending, as a robust economy generally translates to higher disposable incomes and increased investment in health services and products. For Laurus Labs, this means that periods of strong global economic expansion, such as the projected 2.7% GDP growth for 2024 by the IMF, typically support higher demand for their pharmaceutical offerings, particularly in emerging markets.

Conversely, economic slowdowns or recessions can significantly dampen healthcare expenditure. For instance, if a major market experiences a contraction, governments and individuals may reduce their healthcare budgets, leading to lower sales volumes and potentially pressuring Laurus Labs' pricing power. The IMF's forecast for global growth to slow to 2.3% in 2025, down from 3.2% in 2023, highlights the sensitivity of the sector to these macroeconomic shifts.

Currency exchange rate fluctuations significantly impact Laurus Labs, given its substantial international business. For instance, a stronger US dollar against the Indian rupee generally boosts the rupee value of its dollar-denominated export revenues, potentially increasing profitability. Conversely, a weaker dollar could have the opposite effect.

The company's reliance on imported raw materials and intermediates also makes it vulnerable to exchange rate movements. If the INR weakens against currencies like the USD or EUR, the cost of these essential inputs rises, directly impacting Laurus Labs' cost of goods sold and potentially squeezing profit margins. For example, in the fiscal year ending March 31, 2024, Laurus Labs reported that approximately 60% of its revenue came from exports, highlighting the critical nature of currency stability.

Rising inflation, a persistent global concern through 2024 and into 2025, directly impacts Laurus Labs by escalating the cost of essential inputs. This includes everything from the chemicals needed for drug synthesis to the energy powering their manufacturing facilities and the wages paid to their skilled workforce. For instance, global inflation rates hovered around 5-6% in many key economies during 2024, translating into higher procurement costs for Laurus Labs.

The company's profitability hinges on its capacity to manage these increased operational expenses. Laurus Labs must strategically decide whether to absorb these higher raw material and energy costs, which would squeeze profit margins, or pass them onto customers through price adjustments. The competitive landscape and the price sensitivity of their pharmaceutical products will heavily influence this decision, with a delicate balance required to maintain market share while safeguarding earnings.

R&D Investment and Funding Environment

The R&D investment and funding environment significantly impacts Laurus Labs' ability to innovate and bring new products to market. A robust economic climate generally translates to greater availability of capital for research and development initiatives, fostering a more aggressive approach to pipeline expansion. For instance, in 2023, the global pharmaceutical R&D spending was projected to reach over $240 billion, indicating a strong commitment to innovation across the sector.

Conversely, economic downturns can create headwinds for R&D funding. During periods of economic uncertainty, investors may become more risk-averse, potentially leading to reduced capital availability or a more selective approach to funding early-stage drug development. This can force companies like Laurus Labs to prioritize projects with a clearer path to commercialization or seek alternative funding sources.

Key considerations for Laurus Labs regarding the R&D funding environment include:

- Government Grants and Incentives: Access to government funding programs, such as those offered by national health institutes or innovation agencies, can significantly de-risk early-stage R&D.

- Venture Capital and Private Equity: The appetite of venture capital and private equity firms for investing in life sciences and pharmaceutical innovation directly influences the availability of non-dilutive or equity-based funding.

- Corporate Partnerships and Licensing Deals: Strategic collaborations with larger pharmaceutical companies or licensing agreements for promising drug candidates can provide crucial funding and validation for Laurus Labs' R&D efforts.

Generic Drug Market Competition and Pricing Pressure

The generic drug market is intensely competitive, leading to considerable pricing pressure. This is driven by a growing number of manufacturers and the increasing bargaining power of large buyers like pharmacy benefit managers and hospital groups. Laurus Labs, a key player in Active Pharmaceutical Ingredients (APIs) and formulations, must actively manage these dynamics to protect its market share and ensure profitable pricing for its products.

In 2024, the global generics market is projected to continue its growth trajectory, but with persistent pricing challenges. For instance, the US generics market, a significant revenue driver for many Indian companies, saw average prices decline by approximately 10-15% annually in recent years, a trend expected to persist. This environment necessitates a focus on operational efficiency and product differentiation for companies like Laurus Labs.

- Intense Competition: The market features numerous players, both established and emerging, vying for market share, which inherently drives down prices.

- Buyer Consolidation: Large pharmacy chains and distributors are consolidating, increasing their purchasing power and ability to negotiate lower prices.

- Regulatory Landscape: Favorable regulatory pathways for generic approvals can accelerate market entry for new competitors, further intensifying price wars.

- Pricing Erosion: Expect continued price erosion on older, off-patent drugs, requiring Laurus Labs to focus on newer generics and complex formulations for sustained profitability.

Global economic growth directly influences healthcare spending, with stronger economies typically leading to increased demand for pharmaceuticals like those produced by Laurus Labs. For example, the IMF projected global GDP growth of 2.7% for 2024, a figure that generally supports robust demand in the healthcare sector.

Conversely, economic slowdowns, such as the IMF's forecast of global growth easing to 2.3% in 2025, can dampen healthcare expenditure, impacting Laurus Labs' sales volumes and pricing power. Currency fluctuations also play a crucial role; with approximately 60% of Laurus Labs' revenue derived from exports in FY24, a stronger USD against the INR positively impacts its rupee-denominated earnings, while a weaker INR increases the cost of imported raw materials.

Inflationary pressures, evident globally in 2024 with rates around 5-6% in key economies, directly raise Laurus Labs' operational costs, from raw materials to energy and wages. The company must balance absorbing these costs against passing them on to customers, a decision influenced by market competition and product price sensitivity.

What You See Is What You Get

Laurus Labs PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Laurus Labs PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the market dynamics and strategic considerations that shape Laurus Labs' operations and future growth.

Sociological factors

Global demographic shifts, like the aging population in developed nations and a growing middle class in emerging markets, directly impact Laurus Labs. For instance, by 2050, the World Health Organization projects the global population aged 60 and over will nearly double to 2.1 billion, increasing demand for treatments addressing age-related conditions that Laurus Labs targets.

The rising prevalence of chronic diseases such as diabetes, cardiovascular issues, and cancer, further shapes market needs. In 2024, the International Diabetes Federation estimated over 500 million adults globally live with diabetes, a key area for Laurus Labs' API and formulations business, highlighting the direct correlation between disease burden and product demand.

Growing health awareness is a significant driver for Laurus Labs. In 2024, global healthcare spending is projected to reach over $10 trillion, reflecting increased consumer focus on well-being and preventive measures. This trend directly boosts demand for pharmaceuticals, particularly those related to chronic disease management and general wellness, areas where Laurus Labs has a strong presence.

Laurus Labs must also navigate evolving lifestyle patterns and disease prevalence. For instance, the rising incidence of lifestyle diseases like diabetes and cardiovascular conditions, a trend observed globally through 2024, necessitates continuous adaptation of their research and development pipeline. By aligning their product portfolio with these emerging health needs, Laurus Labs can capitalize on these sociological shifts.

Patient adherence and access to healthcare significantly impact medication consumption. Factors like patient education on treatment regimens, the affordability of drugs, and the availability of healthcare services directly influence how consistently patients take their prescribed medicines. For instance, in India, a substantial portion of the population still faces barriers to accessing quality healthcare, which can hinder adherence to treatments for chronic conditions that Laurus Labs addresses.

Laurus Labs must strategically consider these sociological elements when formulating and marketing its products. Enhancing patient education programs and ensuring affordability through various pricing models can broaden the reach of their formulations. In 2023, global out-of-pocket healthcare spending remained a critical concern, highlighting the need for accessible pharmaceutical solutions.

Societal Expectations for Corporate Social Responsibility (CSR)

Societal expectations for corporate social responsibility (CSR) are increasingly shaping how businesses like Laurus Labs operate. Consumers and investors alike are scrutinizing companies for their ethical conduct, environmental impact, and commitment to community well-being. A strong stance on CSR can significantly boost a company's reputation and foster deeper connections with stakeholders.

Laurus Labs, like many in the pharmaceutical sector, faces heightened expectations regarding its social and environmental footprint. Demonstrating robust CSR initiatives can translate into enhanced brand loyalty and a stronger ability to attract and retain top talent, which is crucial in a competitive industry. For instance, in 2023, Laurus Labs reported significant investments in its sustainability initiatives, including a focus on reducing its carbon emissions and improving water management across its manufacturing facilities.

- Growing Demand for Ethical Practices: Stakeholders expect transparency and fair labor practices throughout the supply chain.

- Environmental Stewardship: Pressure is mounting for pharmaceutical companies to minimize waste and pollution, with Laurus Labs actively pursuing green chemistry principles.

- Community Engagement: Local communities anticipate positive contributions, such as healthcare access programs and educational support, which Laurus Labs has been expanding.

- Impact on Brand Perception: A strong CSR record, evidenced by initiatives like their 2024 commitment to invest 2% of their CSR budget in rural healthcare infrastructure, directly influences public and investor confidence.

Workforce Demographics and Talent Availability

The availability of skilled scientific, technical, and manufacturing talent is a crucial sociological factor for Laurus Labs. India's growing young population, with an increasing number of graduates in STEM fields, presents a substantial talent pool. For instance, in 2023, over 1.5 million engineering graduates were produced in India, many of whom possess the foundational skills sought by pharmaceutical companies like Laurus Labs.

Demographic shifts and the quality of educational systems directly influence the depth and breadth of this talent. While India has a large workforce, the specific skills required for advanced pharmaceutical research, development, and complex manufacturing might face localized shortages. This necessitates continuous investment in training and development to bridge any skill gaps and maintain a competitive edge in innovation.

Competition for this specialized talent is intensifying, not only within the pharmaceutical sector but also from adjacent industries like biotechnology and IT. Laurus Labs, like its peers, must contend with this competition, potentially impacting recruitment costs and retention strategies. By 2025, it's projected that the global pharmaceutical market will see continued growth, further amplifying the demand for skilled professionals.

- Talent Pool Growth: India's annual output of STEM graduates, exceeding 1.5 million in 2023, provides a significant base for Laurus Labs.

- Skill Specialization: The demand for highly specialized skills in areas like biopharmaceutical manufacturing and drug discovery remains a critical consideration.

- Competitive Landscape: Increased competition for skilled professionals from various sectors can influence recruitment and retention efforts for Laurus Labs.

- Educational System Impact: The alignment of educational curricula with industry needs is vital for ensuring a steady supply of relevantly skilled talent.

Societal attitudes towards health and wellness are increasingly driving demand for Laurus Labs' products. As global health awareness rises, evidenced by over $10 trillion in projected global healthcare spending for 2024, consumers are proactively seeking solutions for chronic conditions like diabetes, a market segment Laurus Labs actively serves. This heightened focus on well-being directly translates into greater demand for pharmaceuticals and healthcare interventions.

The aging global population, projected to reach 2.1 billion individuals aged 60 and over by 2050 according to the WHO, presents a significant growth opportunity for Laurus Labs. This demographic shift fuels demand for treatments addressing age-related diseases, a core area of focus for the company's API and formulations business. Laurus Labs is well-positioned to meet the needs of this expanding elderly demographic.

Patient adherence to medication regimens is a critical factor influencing market success. Barriers to access, such as affordability and healthcare infrastructure, can impact consistent treatment uptake, particularly in regions like India where out-of-pocket healthcare spending remains a concern. Laurus Labs' efforts to enhance patient education and product affordability are therefore vital for maximizing market penetration and patient outcomes.

The pharmaceutical industry, including Laurus Labs, is under increasing scrutiny regarding its corporate social responsibility (CSR). Stakeholders expect ethical practices, environmental stewardship, and community engagement. Laurus Labs' investments in sustainability, such as its 2023 focus on reducing carbon emissions and water usage, alongside its 2024 commitment to invest 2% of its CSR budget in rural healthcare, are crucial for building brand reputation and stakeholder trust.

Technological factors

Technological leaps in genomics, proteomics, and AI are revolutionizing how drugs are found and developed. These innovations are significantly speeding up the entire process, from initial research to clinical trials.

Laurus Labs' strategic adoption of these advanced technologies is crucial for enhancing its research and development efficiency. By integrating AI-driven platforms, for instance, the company can analyze vast datasets to identify potential drug candidates more rapidly, aiming to shorten development timelines and reduce costs.

In 2024, the pharmaceutical industry saw AI contribute to identifying novel drug targets and predicting compound efficacy, with some AI-discovered drugs entering early-stage clinical trials. Laurus Labs' investment in such capabilities positions it to capitalize on these trends, potentially bringing innovative therapies to market faster and gaining a competitive edge in the evolving healthcare landscape.

Laurus Labs is actively integrating advanced manufacturing technologies to boost efficiency. The company's focus on continuous manufacturing and automation is designed to streamline production, lower operational expenses, and elevate product quality. This strategic move is vital for Laurus Labs to remain competitive in the dynamic pharmaceutical landscape.

In 2023, Laurus Labs reported a capital expenditure of ₹629 crore, with a significant portion allocated to capacity expansion and technological upgrades, including automation. The company aims to leverage Industry 4.0 principles to achieve greater precision and scalability in its manufacturing operations, anticipating a positive impact on its cost structure and market responsiveness.

The biotechnology sector is experiencing robust expansion, with the global biologics market projected to reach approximately $790 billion by 2027, showcasing significant growth potential. Laurus Labs is strategically positioning itself within this domain by investing in biosimilars and novel biologics, aiming to capture a share of this high-value market. Their focus on developing and manufacturing these complex products, including investments in specialized facilities, is crucial for future revenue streams.

Data Analytics and Digitalization in Pharma

The pharmaceutical industry is rapidly embracing big data analytics and digitalization. This trend is transforming everything from drug discovery to how patients are engaged. For Laurus Labs, this presents significant opportunities to streamline operations, enhance decision-making, and develop more personalized treatments. For instance, in 2024, the global healthcare analytics market was projected to reach over $60 billion, highlighting the scale of this digital shift.

Laurus Labs can leverage these technological advancements across its entire value chain. In research and development, AI-powered analytics can accelerate the identification of drug candidates. In manufacturing and supply chain, digitalization enables better inventory management and predictive maintenance, potentially reducing costs and improving efficiency. Patient engagement platforms, driven by data, can lead to improved adherence and better health outcomes.

The strategic integration of these technologies is becoming a competitive imperative. Companies that effectively harness data analytics and digitalization are better positioned to innovate and respond to market demands. Laurus Labs' ability to adopt and implement these tools will be crucial for its continued growth and success in the evolving pharmaceutical landscape.

Intellectual Property and Patent Expiries

Technological advancements in drug synthesis and formulation are directly influenced by intellectual property rights. Laurus Labs benefits from patent expiries of major drugs, enabling them to enter the market with generic alternatives. This also pushes Laurus Labs to continuously innovate and secure its own patents to maintain a competitive edge.

For instance, the pharmaceutical industry saw significant patent cliffs approaching in the 2024-2025 period for several blockbuster drugs, creating a substantial market for generic manufacturers like Laurus Labs. The company's strategic focus on developing complex generics and biosimilars, supported by its robust R&D capabilities, positions it to capitalize on these opportunities. Laurus Labs' investment in advanced manufacturing technologies further supports its ability to produce high-quality, cost-effective generic medicines.

- Patent Expiries: The period 2024-2025 is marked by the expiry of patents for several high-revenue drugs, opening avenues for generic competition.

- Laurus Labs' Strategy: The company is actively pursuing opportunities in generic and biosimilar development, leveraging its technological expertise.

- Innovation Drive: To counter generic competition for its own products, Laurus Labs invests heavily in R&D to develop new patented molecules and formulations.

- Technological Integration: The company's use of advanced synthesis and formulation technologies is crucial for developing complex generics efficiently and cost-effectively.

The rapid evolution of AI in drug discovery is a significant technological factor, with AI-driven platforms in 2024 identifying novel drug targets and predicting compound efficacy, leading to some AI-discovered drugs entering early clinical trials. Laurus Labs' investment in these capabilities allows for faster identification of drug candidates, potentially shortening development timelines and reducing costs.

Advanced manufacturing technologies, such as automation and continuous manufacturing, are enhancing efficiency. Laurus Labs' capital expenditure in 2023, amounting to ₹629 crore, included significant allocations for technological upgrades and capacity expansion, embracing Industry 4.0 principles for precision and scalability.

The biotechnology sector's robust expansion, with the global biologics market projected to reach approximately $790 billion by 2027, presents a high-value opportunity. Laurus Labs is strategically investing in biosimilars and novel biologics, requiring specialized facilities to capture a share of this growing market.

Digitalization and big data analytics are transforming the pharmaceutical value chain. In 2024, the global healthcare analytics market was projected to exceed $60 billion, indicating a substantial digital shift that Laurus Labs can leverage for operational streamlining and enhanced decision-making.

Legal factors

Laurus Labs operates within a stringent regulatory environment, necessitating strict adherence to Good Manufacturing Practices (GMP) and rigorous quality control standards. Failure to comply with these regulations, which are constantly evolving, can result in significant financial penalties and product recalls, impacting market access. For instance, in 2023, regulatory actions by agencies like the US FDA led to import alerts for several pharmaceutical manufacturers, highlighting the critical nature of compliance.

Intellectual property protection is a cornerstone for Laurus Labs, particularly safeguarding its innovations in Active Pharmaceutical Ingredients (APIs) and Contract Research and Manufacturing Services (CRAMS). This legal framework is crucial for maintaining competitive advantage and revenue streams derived from proprietary formulations and manufacturing processes.

The company actively engages with patent law, which involves both defending its own patents against infringement and strategically challenging those of competitors. For instance, in 2023, Laurus Labs reported ongoing legal activities related to intellectual property, reflecting the dynamic nature of patent landscapes in the pharmaceutical sector.

Governments globally are stepping up efforts to regulate drug prices and shape reimbursement decisions, a trend that significantly affects Laurus Labs. For instance, in 2024, the US Inflation Reduction Act continues to empower Medicare to negotiate prices for certain high-cost drugs, potentially impacting the revenue streams for companies with products in those categories. This necessitates robust strategies for market access and pricing to navigate these evolving legal landscapes.

Environmental, Health, and Safety (EHS) Regulations

Laurus Labs' manufacturing facilities must adhere to rigorous Environmental, Health, and Safety (EHS) regulations. These laws cover crucial areas such as the proper disposal of industrial waste, control of air emissions, and ensuring a safe working environment for all employees. For instance, India's Ministry of Environment, Forest and Climate Change continuously updates its environmental standards, impacting chemical and pharmaceutical manufacturing.

Failure to comply with these mandatory EHS requirements can lead to severe consequences. Laurus Labs could face significant legal liabilities, substantial fines, and even temporary or permanent operational shutdowns, disrupting its supply chain and market presence. In 2023, the Central Pollution Control Board reported that numerous industrial units across India faced penalties for non-compliance with environmental norms.

- Waste Management: Strict adherence to hazardous waste management rules, including segregation, treatment, and disposal, is paramount.

- Emission Controls: Regulations on air and water emissions necessitate investment in advanced pollution control technologies.

- Workplace Safety: Compliance with occupational safety and health standards is critical to prevent accidents and ensure employee well-being.

- Regulatory Audits: Regular audits by environmental agencies ensure ongoing adherence to EHS legislation.

Anti-Trust and Competition Law

Laurus Labs, operating in the highly regulated pharmaceutical sector, must navigate stringent anti-trust and competition laws across its global markets. These regulations are designed to foster fair competition and prevent monopolistic practices, impacting everything from pricing strategies to potential collaborations.

Compliance is crucial, especially concerning mergers, acquisitions, and maintaining fair trade practices. For instance, in 2024, regulatory bodies worldwide continue to scrutinize pharmaceutical sector consolidation, potentially affecting Laurus Labs' growth strategies. The company must ensure its market share and business dealings do not stifle competition or lead to unfair pricing.

- Mergers & Acquisitions Scrutiny: Regulatory bodies like the Federal Trade Commission (FTC) in the US and the European Commission closely examine pharmaceutical M&A deals to prevent market concentration.

- Pricing Regulations: Laws preventing price gouging and ensuring fair access to medicines are paramount, especially in markets with price controls.

- Anti-Competitive Agreements: Laurus Labs must avoid any agreements that could restrict competition, such as price-fixing or market allocation.

Laurus Labs faces significant legal and regulatory hurdles, particularly concerning GMP and evolving environmental standards, which can lead to import alerts and penalties. Intellectual property laws are critical for protecting its API and CRAMS innovations, with ongoing patent litigation being a common occurrence. Furthermore, global drug pricing regulations, like those influenced by the US Inflation Reduction Act of 2024, directly impact revenue streams and necessitate adaptive market access strategies.

Environmental factors

The pharmaceutical sector, including companies like Laurus Labs, is under growing scrutiny to implement sustainable manufacturing. This means using resources like water, energy, and raw materials much more efficiently. For instance, a 2024 report highlighted that pharmaceutical manufacturing can be highly resource-intensive, with water usage often exceeding 100 liters per kilogram of active pharmaceutical ingredient (API) produced in some processes.

Laurus Labs must therefore prioritize reducing its environmental impact. This involves optimizing its operations to minimize waste and lower energy consumption across its manufacturing facilities. In 2023, Laurus Labs reported a focus on improving energy efficiency, aiming to reduce its per-unit energy consumption by 5% by 2025.

Laurus Labs faces significant environmental responsibilities, particularly concerning the proper disposal of chemical waste and the control of air and water pollution emanating from its manufacturing operations. In 2023, the pharmaceutical industry, including companies like Laurus Labs, was under increasing scrutiny for its environmental footprint, with regulatory bodies globally tightening emission standards.

To navigate these challenges and ensure compliance, Laurus Labs is compelled to invest in advanced waste treatment technologies. For instance, companies in this sector are increasingly adopting Zero Liquid Discharge (ZLD) systems, which can significantly reduce water pollution. Adherence to strict emission standards, such as those set by the Central Pollution Control Board (CPCB) in India, is paramount to mitigating environmental impact and maintaining operational licenses.

Climate change poses significant risks to Laurus Labs' operations. Extreme weather events, such as floods or droughts, could disrupt the supply of key raw materials, impacting production schedules and increasing costs. For instance, a severe monsoon in India, a major supplier region for many pharmaceutical ingredients, could lead to shortages.

Furthermore, the increasing global focus on carbon emissions means Laurus Labs may face higher operational expenses due to carbon taxes or stricter environmental regulations. In 2024, many countries are implementing or strengthening carbon pricing mechanisms, which could add to the cost of energy and transportation.

Adapting to these environmental shifts is crucial for Laurus Labs. This involves developing more resilient supply chains, exploring alternative energy sources, and investing in greener manufacturing processes to mitigate potential financial and operational impacts. The company's ability to navigate these challenges will be a key determinant of its long-term sustainability and profitability.

Water Scarcity and Water Stewardship

Laurus Labs' pharmaceutical manufacturing is significantly reliant on water, a critical input for various processes. This dependence becomes a key environmental concern, especially in areas experiencing water stress.

The company must actively engage in robust water stewardship. This includes implementing advanced water recycling technologies and conservation measures to ensure operational continuity and minimize its environmental footprint. For instance, by 2024, many industrial sectors are facing increased scrutiny on water usage, with some regions implementing stricter regulations on water withdrawal and discharge.

Key aspects of Laurus Labs' water stewardship could include:

- Water Consumption Reduction: Implementing closed-loop systems and optimizing process efficiency to lower overall water intake.

- Wastewater Treatment and Reuse: Investing in advanced treatment facilities to enable the safe reuse of treated wastewater in non-critical applications.

- Supply Chain Water Risk Assessment: Evaluating water-related risks within its raw material sourcing and manufacturing network.

- Community Engagement: Collaborating with local communities on water management initiatives to ensure shared access and responsible use.

Biodiversity Protection and Ecosystem Impact

While Laurus Labs' primary focus is pharmaceuticals, the broader impact of industrial activities on local biodiversity and ecosystems is an increasing environmental consideration. The company's land use practices, potential for chemical runoff, and overall ecological footprint are becoming more scrutinized by regulators and stakeholders. For instance, in 2023, the Indian government strengthened regulations around industrial effluent discharge, requiring stricter monitoring and treatment protocols to protect aquatic life and surrounding habitats.

Laurus Labs, like other players in the chemical and pharmaceutical sectors, must proactively manage its environmental impact. This includes assessing the biodiversity of the land it occupies and implementing measures to mitigate any negative effects from its operations. For example, companies are increasingly investing in reforestation projects and developing advanced wastewater treatment technologies to minimize ecological disruption. A 2024 report by the Confederation of Indian Industry highlighted that pharmaceutical companies are dedicating significant resources to improve their environmental, social, and governance (ESG) performance, with biodiversity protection being a key area of focus.

Key considerations for Laurus Labs include:

- Land Use Assessment: Evaluating the ecological value of land acquired for new facilities and implementing biodiversity-friendly construction and operational practices.

- Chemical Runoff Mitigation: Enhancing wastewater treatment processes to prevent the release of harmful chemicals into local water bodies, thereby protecting aquatic ecosystems.

- Ecological Footprint Management: Quantifying and reducing the company's overall environmental impact, including carbon emissions and waste generation, which indirectly affect biodiversity.

- Supply Chain Scrutiny: Ensuring that raw material sourcing and manufacturing partners also adhere to stringent environmental standards to protect ecosystems throughout the value chain.

Laurus Labs faces increasing pressure to adopt sustainable manufacturing practices, focusing on efficient resource utilization like water and energy. For instance, by 2024, many industrial sectors are seeing stricter regulations on water withdrawal and discharge, pushing companies towards advanced water recycling. The company is also prioritizing waste reduction and energy efficiency, with a stated goal to reduce per-unit energy consumption by 5% by 2025.

Environmental responsibilities, particularly concerning chemical waste disposal and pollution control, are paramount. Global emission standards are tightening, making adherence to regulations like those from India's Central Pollution Control Board crucial for operational licenses. Laurus Labs is investing in technologies like Zero Liquid Discharge (ZLD) systems to manage wastewater effectively.

Climate change presents operational risks, including potential supply chain disruptions from extreme weather events affecting raw material availability. Furthermore, rising carbon taxes and stricter environmental regulations in various countries, as seen in 2024, could increase operational costs for energy and transportation.

The company's land use and potential for chemical runoff are under scrutiny, impacting local biodiversity. Laurus Labs is implementing measures to mitigate ecological effects, such as improving wastewater treatment and assessing land use for ecological value, aligning with a broader industry trend towards enhanced ESG performance as highlighted in a 2024 industry report.

PESTLE Analysis Data Sources

Our Laurus Labs PESTLE Analysis is meticulously constructed using data from reputable sources including government regulatory bodies, international financial institutions, and leading pharmaceutical industry reports. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.